|

|

市場調査レポート

商品コード

1815660

栄養補助食品の世界市場レポート2025年Nutritional Supplements Global Market Report 2025 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 栄養補助食品の世界市場レポート2025年 |

|

出版日: 2025年09月09日

発行: The Business Research Company

ページ情報: 英文 250 Pages

納期: 2~10営業日

|

概要

栄養補助食品市場規模は、今後数年間で力強い成長が見込まれます。2029年の年間平均成長率(CAGR)は8.2%で、6,040億5,000万米ドルに成長します。予測期間の成長は、個別化栄養、遺伝子検査への関心の高まり、スマート包装、疫病への備え、持続可能性重視に起因すると考えられます。予測期間の主要動向には、CBDとヘンプベースサプリメント、植物性タンパク質、メンタルウェルビーイングサプリメント、コラーゲンサプリメント、脳の健康サプリメントが含まれます。

今後5年間の成長率8.2%という予測は、この市場の前回予測から0.3%の小幅な減少を反映しています。この減少は主に米国と他国との間の関税の影響によるものです。貿易摩擦により、スイスやインドから輸入される医療グレードのビタミンやミネラルの価格が高騰し、その結果、予防ケアの選択肢が減り、慢性疾患管理コストが上昇することで、米国のヘルスケアシステムが混乱する可能性があります。また、相互関税や、貿易の緊張と制限の高まりによる世界経済と貿易への悪影響により、その影響はより広範囲に及ぶと考えられます。

非伝染性疾患の有病率の上昇が栄養補助食品市場の需要を牽引しています。非伝染性疾患は、一般的に急性感染症によって引き起こされるものではなく、しばしば長期的な治療やケアを必要とする病状群です。糖尿病などの疾患は、糖尿病合併症に対処するのに役立つα-リポ酸を含む様々なサプリメントで管理することができます。例えば、2022年にベルギーに本部を置く非営利団体である国際糖尿病連合の統計によると、糖尿病患者の26%が診断時に十分な情報を受けておらず、20%が医療従事者からの定期的な教育を受けておらず、36%が糖尿病教育者に相談しておらず、20%の医療従事者が糖尿病の合併症としてうつ病を特定するのに苦労していることが明らかになりました。このように、非伝染性疾患の有病率の増加が栄養補助食品市場の成長を促進しています。

目次

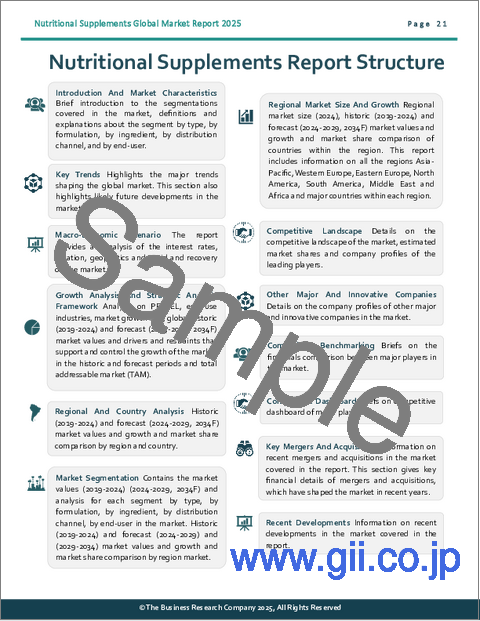

第1章 エグゼクティブサマリー

第2章 市場の特徴

第3章 市場動向と戦略

第4章 市場-マクロ経済シナリオ金利、インフレ、地政学、貿易戦争と関税、コロナ禍と回復が市場に与える影響を含むマクロ経済シナリオ

第5章 世界の成長分析と戦略分析フレームワーク

- 世界の栄養補助食品:PESTEL分析(政治、社会、技術、環境、法的要因、促進要因と抑制要因)

- 最終用途産業の分析

- 世界の栄養補助食品市場:成長率分析

- 世界の栄養補助食品市場の実績:規模と成長、2019~2024年

- 世界の栄養補助食品市場の予測:規模と成長、2024~2029年、2034年

- 世界の栄養補助食品:総潜在市場規模(TAM)

第6章 市場セグメンテーション

- 世界の栄養補助食品市場:タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- ヴィーガンスポーツ栄養

- 食事代替シェイク

- 栄養補助食品

- その他

- 世界の栄養補助食品市場配合別、実績と予測、2019~2024年、2024~2029年、2034年

- 錠剤

- カプセル

- 粉末

- ソフトジェル

- 液体

- その他

- 世界の栄養補助食品市場コンポーネント別、実績と予測、2019~2024年、2024~2029年、2034年

- 植物性

- ビタミン

- ミネラル

- タンパク質とアミノ酸

- 魚油

- 食物繊維と特殊炭水化物

- 酵素

- その他

- 世界の栄養補助食品市場:流通チャネル別、実績と予測、2019~2024年、2024~2029年、2034年

- スーパーマーケット/ハイパーマーケット

- 小売薬局

- 直接販売

- ドラッグストア

- eコマース

- 世界の栄養補助食品市場:エンドユーザー別、実績と予測、2019~2024年、2024~2029年、2034年

- 乳児

- 幼児

- 成人

- 妊婦

- 高齢者

- 世界の栄養補助食品市場:ヴィーガンスポーツ栄養のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- 植物性プロテインパウダー

- ヴィーガンプレワークアウトサプリメント

- ヴィーガンリカバリー

- 世界の栄養補助食品市場:食事代替シェイクのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- プロテインミールリプレイスメントシェイク

- 低カロリー食事代替シェイク

- 栄養豊富食事代替シェイク

- ヴィーガンミールリプレイスメントシェイク

- 世界の栄養補助食品市場:栄養補助食品のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- ビタミンとミネラル

- ハーブサプリメント

- オメガ3と脂肪酸サプリメント

- プロバイオティクスと消化促進剤

- 世界の栄養補助食品市場:その他のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- パフォーマンス向上剤

- 体重管理サプリメント

- 特殊サプリメント

- 食物繊維サプリメント

第7章 地域別・国別分析

- 世界の栄養補助食品市場:地域別、実績と予測、2019~2024年、2024~2029年、2034年

- 世界の栄養補助食品市場:国別、実績と予測、2019~2024年、2024~2029年、2034年

第8章 アジア太平洋市場

第9章 中国市場

第10章 インド市場

第11章 日本市場

第12章 オーストラリア市場

第13章 インドネシア市場

第14章 韓国市場

第15章 西欧市場

第16章 英国市場

第17章 ドイツ市場

第18章 フランス市場

第19章 イタリア市場

第20章 スペイン市場

第21章 東欧市場

第22章 ロシア市場

第23章 北米市場

第24章 米国市場

第25章 カナダ市場

第26章 南米市場

第27章 ブラジル市場

第28章 中東市場

第29章 アフリカ市場

第30章 競合情勢と企業プロファイル

- 栄養補助食品市場:競合情勢

- 栄養補助食品市場:企業プロファイル

- The Archer-Daniels-Midland Company

- Pfizer Inc.

- Bayer AG

- Abbott Laboratories

- GlaxoSmithKline plc

第31章 その他の大手企業と革新的企業

- Otsuka Pharmaceutical Co Ltd.

- DuPont de Nemours Inc.

- Koninklijke DSM NV

- Amway Corporation

- Nutrilite Products Inc.

- Nestle Health Science SA

- Glanbia plc

- Herbalife Nutrition Ltd.

- Carlyle Group Inc.

- Stepan Company

- GNC Holdings Inc.

- Nu Skin Enterprises Inc.

- USANA Health Sciences Inc.

- Arkopharma Laboratories Company Limited

- Iovate Health Sciences International Inc.

第32章 世界の市場競合ベンチマーキングとダッシュボード

第33章 主要な合併と買収

第34章 最近の市場動向

第35章 市場の潜在力が高い国、戦略

- 栄養補助食品市場、2029年:新たな機会を提供する国

- 栄養補助食品市場、2029年:新たな機会を提供するセグメント

- 栄養補助食品市場、2029年:成長戦略

- 市場動向による戦略

- 競合の戦略