|

|

市場調査レポート

商品コード

1425441

エンコーダの世界市場レポート 2024年Encoder Global Market Report 2024 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| エンコーダの世界市場レポート 2024年 |

|

出版日: 受注後更新

発行: The Business Research Company

ページ情報: 英文 200 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 目次

エンコーダの市場規模は近年急速に拡大しています。2023年の24億4,000万米ドルから2024年には26億9,000万米ドルへと、CAGR10.2%で拡大します。これまでの成長の背景には、産業オートメーションの導入、自動車分野での需要の増加、インダストリー4.0の登場、製造業の世界の拡大、ロボット工学の重視などがあります。

アジア太平洋は、2023年のエンコーダ市場において最大の地域でした。エンコーダ市場レポートの対象地域は、アジア太平洋、西欧、中東欧、北米、南米、中東・アフリカです。

目次

第1章 エグゼクティブサマリー

第2章 市場の特徴

第3章 市場動向と戦略

第4章 マクロ経済シナリオ

- 高インフレが市場に与える影響

- ウクライナ・ロシア戦争が市場に与える影響

- COVID-19による市場への影響

第5章 世界市場規模と成長

- 世界のエンコーダ市場の促進要因と抑制要因

- 市場促進要因

- 市場抑制要因

- 世界のエンコーダ市場規模実績と成長、2018~2023年

- 世界のエンコーダ市場規模と成長予測、2023~2028年、2033年

第6章 市場セグメンテーション

- 世界のエンコーダ市場、タイプ別セグメンテーション、実績と予測、2018~2023年、2023~2028年、2033年

- リニアエンコーダ

- ロータリエンコーダ

- 世界のエンコーダ市場、位置信号別セグメンテーション、実績と予測、2018~2023年、2023~2028年、2033年

- アブソリュートエンコーダ

- インクリメンタルエンコーダ

- 世界のエンコーダ市場、センシング技術別セグメンテーション、実績と予測、2018~2023年、2023~2028年、2033年

- 光学式センシングエンコーダ

- 磁気式センシングエンコーダ

- 静電容量式エンコーダ

- 誘導型エンコーダ

- 世界のエンコーダ市場、用途別セグメンテーション、実績と予測、2018~2023年、2023~2028年、2033年

- 自動車

- 家電

- 航空宇宙と防衛

- 医療と医療機器

- 産業用

- その他

第7章 地域と国の分析

- 世界のエンコーダ市場、地域別、実績と予測、2018~2023年、2023~2028年、2033年

- 世界のエンコーダ市場、国別、実績と予測、2018~2023年、2023~2028年、2033年

第8章 アジア太平洋市場

第9章 中国市場

第10章 インド市場

第11章 日本市場

第12章 オーストラリア市場

第13章 インドネシア市場

第14章 韓国市場

第15章 西欧市場

第16章 英国市場

第17章 ドイツ市場

第18章 フランス市場

第19章 イタリア市場

第20章 スペイン市場

第21章 東欧市場

第22章 ロシア市場

第23章 北米市場

第24章 米国市場

第25章 カナダ市場

第26章 南米市場

第27章 ブラジル市場

第28章 中東市場

第29章 アフリカ市場

第30章 競合情勢と企業プロファイル

- エンコーダ市場の競合情勢

- エンコーダ市場の企業プロファイル

- Omron Corporation

- Honeywell International Inc.

- Schneider Electric SE

- Rockwell Automation Inc.

- Panasonic Corporation

第31章 競合ベンチマーキング

第32章 競合ダッシュボード

第33章 主要な合併と買収

第34章 将来の展望と潜在性分析

第35章 付録

Encoder Global Market Report 2024 from The Business Research Company provides strategists, marketers and senior management with the critical information they need to assess the market.

This report focuses on encoder market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the coronavirus and how it is responding as the impact of the virus abates.

- Assess the Russia - Ukraine war's impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you within 3-5 working days of order along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Where is the largest and fastest growing market for encoder? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The encoder market global report from the Business Research Company answers all these questions and many more.

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market's historic and forecast market growth by geography.

Scope

Markets Covered:

- 1) By Type: Linear Encoders; Rotary Encoders

- 2) By Position Signal: Absolute Encoders; Incremental Encoders

- 3) By Sensing Technology: Optical Sensing Encoders; Magnetic Sensing Encoders; Capacitive Encoders; Inductive Encoders

- 4) By Application: Automotive; Consumer Electronics; Aerospace And Defense; Healthcare And Medical Devices; Industrial; Other Applications

- Companies Mentioned: Omron Corporation; Honeywell International Inc.; Schneider Electric SE; Rockwell Automation Inc.; Panasonic Corporation

- Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita,

- Data segmentations: country and regional historic and forecast data, market share of competitors, market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

- Delivery format: PDF, Word and Excel Data Dashboard.

Executive Summary

An encoder functions as a device that converts an analog signal into a digital one or translates active data signals into coded message formats. It operates as a combinational circuit, converting binary data from 2N input lines into N output lines, representing the N-bit code of the input.

The primary types of encoders include linear encoders and rotary encoders. Linear encoders are sensors or transducers that detect and measure linear movements of objects. They generate position signals through different encoder types, such as absolute encoders and incremental encoders. Various sensing technologies are employed, including optical, magnetic, capacitive, and inductive sensing for these encoders. Their applications span across automotive, consumer electronics, aerospace and defense, healthcare and medical devices, industrial, and numerous other sectors.

The encoder market research report is one of a series of new reports from The Business Research Company that provides encoder market statistics, including encoder industry global market size, regional shares, competitors with a encoder market share, detailed encoder market segments, market trends and opportunities, and any further data you may need to thrive in the encoder industry. This encoder market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The encoder market size has grown rapidly in recent years. It will grow from $2.44 billion in 2023 to $2.69 billion in 2024 at a compound annual growth rate (CAGR) of 10.2%. Historical growth can be attributed to the implementation of industrial automation, increased demand within the automotive sector, the advent of Industry 4.0, the global expansion of manufacturing operations, and a heightened emphasis on robotics.

The encoder market size is expected to see strong growth in the next few years. It will grow to $3.91 billion in 2028 at a compound annual growth rate (CAGR) of 9.8%. The anticipated growth in the forecast period is fueled by the increased adoption of artificial intelligence, the burgeoning significance of AI in healthcare applications, the expansion of electric vehicles, heightened precision demands, and the rapid growth of e-commerce. Major trends expected during this period encompass the amplified demand for high-resolution encoders, the integration of advanced technologies, the prominence of optical encoders, the trend towards miniaturization and compact designs, and the rising adoption of encoders driven by increased automation.

The surge in demand for industrial automation is poised to propel the growth of the encoder market. Industrial automation, using technology to control machinery and operations across sectors, relies on encoders as crucial components in high-speed systems. Encoders convert motion into electrical feedback signals, aiding in position, speed, count, direction, and linear distance detection. The rising integration of encoders in diverse industrial contexts, highlighted in the World Robotics 2021 Industrial Robots report by the International Federation of Robotics in October 2021, points to a substantial boost in automation. Despite pandemic challenges, manufacturers globally deployed a record 3 million industrial robots, signifying a 13% increase in installations, with China leading with a 20% rise to 168,400 units. This trend underscores the growing demand for industrial automation, driving the encoder market's growth.

The expanding automotive industry is anticipated to drive the encoder market. In this sector, encoders play a pivotal role in providing precise motion feedback and control, enhancing the performance, safety, and efficiency of vehicles. Notably, according to reports shared by the Society of Motor Manufacturers and Traders (SMMT) in June 2023, the UK witnessed a substantial 25.8% surge in passenger car sales, reaching 177,266 units compared to 140,958 units in 2022. This industry's growth and technological advancements necessitate high-quality encoder systems, thus propelling the encoder market's expansion.

Technological advancements stand as a significant trend shaping the encoder market landscape. Leading companies are innovating to solidify their positions, exemplified by Pepperl+Fuchs, a Germany-based industrial automation products manufacturer. In May 2022, they launched the ENI90 series of hollow shaft rotary encoders. These encoders, integrating BlueBeam technology and capable of withstanding rotational speeds of up to 6,000 rpm, cater to heavy-duty applications such as asynchronous motors or generators that require precise speed control. This advancement underscores the market's focus on high-performance, innovative encoder solutions.

Major players in the encoder market are concentrating on introducing cutting-edge solutions for medical video imaging applications, seeking a competitive advantage. Encoders are pivotal in medical imaging, converting motion into electrical signals for control devices in motion control systems. For example, Advantech, a Taiwan-based manufacturer of industrial computers, unveiled the VEGA-1200 in September 2023. This zero-latency 4K SDVoE hybrid encoder and decoder facilitate real-time video recording and broadcasting for medical video imaging applications. Featuring SDVoE capabilities, high-quality live HEVC and AVC encoding (up to 4Kp60), and an intuitive graphical user interface (GUI), the VEGA-1200 offers seamless integration, low power consumption, and robust support for all video input sources, contributing to simplified medical image and video recording processes.

In May 2021, Computer Programs and Systems, Inc. (CPIS), a prominent US-based computer programming firm, completed the acquisition of TruCode LLC, with the financial details undisclosed. This strategic move aimed to integrate TruCode's offerings with CPIS's existing TruBridge services and solutions, specifically designed to streamline hospital revenue cycle processes by eliminating inefficiencies. TruCode, also based in the US, specializes in providing medical encoder solutions. CPIS's acquisition of TruCode aligns with its strategy to enhance TruBridge services, leveraging TruCode's expertise to further optimize and refine solutions aimed at improving efficiency within hospital revenue cycles.

Major companies operating in the encoder market report are Omron Corporation, Honeywell International Inc., Schneider Electric SE, Rockwell Automation Inc., Panasonic Corporation, ABB Ltd., Broadcom Inc., DR. JOHANNES HEIDENHAIN GmbH, Koyo Electronics Industries Co. Ltd., Renishaw PLC, Siemens AG, Sensata Technologies Holdings PLC, Fortive Corporation, Mitutoyo Corporation, FRABA B.V., ifm electronic GmbH, maxon motor AG, Alps Alpine Co. Ltd., Bourns Inc., CUI Devices, ELCO Holding AG, Grayhill Inc., TT Electronics PLC, Posital Fraba Inc., Hengstler GmbH, Sick AG, Baumer Group, Pepperl+Fuchs India Pvt. Ltd., Dynapar Corp., Heidenhain GmbH, Hans Turck GmbH & Co. KG

Asia-Pacific was the largest region in the encoder market in 2023. The regions covered in the encoder market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the encoder market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The encoder market consists of sales of the electromagnetic encoder, visual encoder, acoustic encoder, elaborative encoder, and semantic encoders. Values in this market are 'factory gate' values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

Table of Contents

1. Executive Summary

2. Encoder Market Characteristics

3. Encoder Market Trends And Strategies

4. Encoder Market - Macro Economic Scenario

- 4.1. Impact Of High Inflation On The Market

- 4.2. Ukraine-Russia War Impact On The Market

- 4.3. COVID-19 Impact On The Market

5. Global Encoder Market Size and Growth

- 5.1. Global Encoder Market Drivers and Restraints

- 5.1.1. Drivers Of The Market

- 5.1.2. Restraints Of The Market

- 5.2. Global Encoder Historic Market Size and Growth, 2018 - 2023, Value ($ Billion)

- 5.3. Global Encoder Forecast Market Size and Growth, 2023 - 2028, 2033F, Value ($ Billion)

6. Encoder Market Segmentation

- 6.1. Global Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- Linear Encoders

- Rotary Encoders

- 6.2. Global Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- Absolute Encoders

- Incremental Encoders

- 6.3. Global Encoder Market, Segmentation By Sensing Technology, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- Optical Sensing Encoders

- Magnetic Sensing Encoders

- Capacitive Encoders

- Inductive Encoders

- 6.4. Global Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- Automotive

- Consumer Electronics

- Aerospace And Defense

- Healthcare And Medical Devices

- Industrial

- Other Applications

7. Encoder Market Regional And Country Analysis

- 7.1. Global Encoder Market, Split By Region, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 7.2. Global Encoder Market, Split By Country, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

8. Asia-Pacific Encoder Market

- 8.1. Asia-Pacific Encoder Market Overview

- Region Information, Impact Of COVID-19, Market Information, Background Information, Government Initiatives, Regulations, Regulatory Bodies, Major Associations, Taxes Levied, Corporate Tax Structure, Investments, Major Companies

- 8.2. Asia-Pacific Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 8.3. Asia-Pacific Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 8.4. Asia-Pacific Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

9. China Encoder Market

- 9.1. China Encoder Market Overview

- 9.2. China Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F,$ Billion

- 9.3. China Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F,$ Billion

- 9.4. China Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F,$ Billion

10. India Encoder Market

- 10.1. India Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 10.2. India Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 10.3. India Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

11. Japan Encoder Market

- 11.1. Japan Encoder Market Overview

- 11.2. Japan Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 11.3. Japan Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 11.4. Japan Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

12. Australia Encoder Market

- 12.1. Australia Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 12.2. Australia Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 12.3. Australia Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

13. Indonesia Encoder Market

- 13.1. Indonesia Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 13.2. Indonesia Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 13.3. Indonesia Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

14. South Korea Encoder Market

- 14.1. South Korea Encoder Market Overview

- 14.2. South Korea Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 14.3. South Korea Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 14.4. South Korea Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

15. Western Europe Encoder Market

- 15.1. Western Europe Encoder Market Overview

- 15.2. Western Europe Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 15.3. Western Europe Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 15.4. Western Europe Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

16. UK Encoder Market

- 16.1. UK Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 16.2. UK Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 16.3. UK Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

17. Germany Encoder Market

- 17.1. Germany Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 17.2. Germany Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 17.3. Germany Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

18. France Encoder Market

- 18.1. France Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 18.2. France Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 18.3. France Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

19. Italy Encoder Market

- 19.1. Italy Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 19.2. Italy Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 19.3. Italy Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

20. Spain Encoder Market

- 20.1. Spain Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 20.2. Spain Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 20.3. Spain Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

21. Eastern Europe Encoder Market

- 21.1. Eastern Europe Encoder Market Overview

- 21.2. Eastern Europe Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 21.3. Eastern Europe Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 21.4. Eastern Europe Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

22. Russia Encoder Market

- 22.1. Russia Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 22.2. Russia Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 22.3. Russia Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

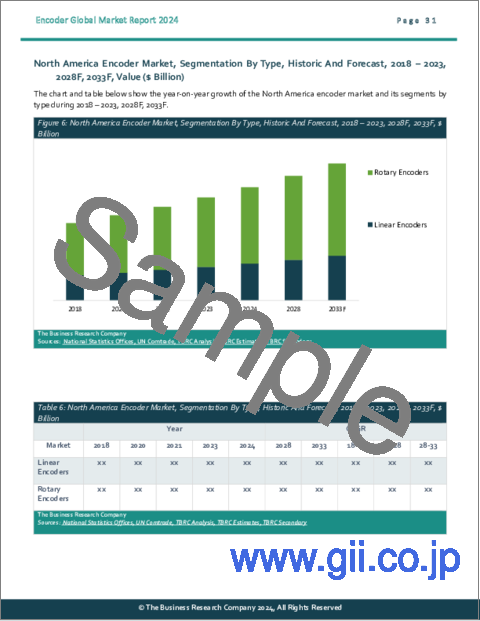

23. North America Encoder Market

- 23.1. North America Encoder Market Overview

- 23.2. North America Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 23.3. North America Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 23.4. North America Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

24. USA Encoder Market

- 24.1. USA Encoder Market Overview

- 24.2. USA Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 24.3. USA Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 24.4. USA Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

25. Canada Encoder Market

- 25.1. Canada Encoder Market Overview

- 25.2. Canada Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 25.3. Canada Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 25.4. Canada Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

26. South America Encoder Market

- 26.1. South America Encoder Market Overview

- 26.2. South America Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 26.3. South America Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 26.4. South America Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

27. Brazil Encoder Market

- 27.1. Brazil Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 27.2. Brazil Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 27.3. Brazil Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

28. Middle East Encoder Market

- 28.1. Middle East Encoder Market Overview

- 28.2. Middle East Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 28.3. Middle East Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 28.4. Middle East Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

29. Africa Encoder Market

- 29.1. Africa Encoder Market Overview

- 29.2. Africa Encoder Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 29.3. Africa Encoder Market, Segmentation By Position Signal, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- 29.4. Africa Encoder Market, Segmentation By Application, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

30. Encoder Market Competitive Landscape And Company Profiles

- 30.1. Encoder Market Competitive Landscape

- 30.2. Encoder Market Company Profiles

- 30.2.1. Omron Corporation

- 30.2.1.1. Overview

- 30.2.1.2. Products and Services

- 30.2.1.3. Strategy

- 30.2.1.4. Financial Performance

- 30.2.2. Honeywell International Inc.

- 30.2.2.1. Overview

- 30.2.2.2. Products and Services

- 30.2.2.3. Strategy

- 30.2.2.4. Financial Performance

- 30.2.3. Schneider Electric SE

- 30.2.3.1. Overview

- 30.2.3.2. Products and Services

- 30.2.3.3. Strategy

- 30.2.3.4. Financial Performance

- 30.2.4. Rockwell Automation Inc.

- 30.2.4.1. Overview

- 30.2.4.2. Products and Services

- 30.2.4.3. Strategy

- 30.2.4.4. Financial Performance

- 30.2.5. Panasonic Corporation

- 30.2.5.1. Overview

- 30.2.5.2. Products and Services

- 30.2.5.3. Strategy

- 30.2.5.4. Financial Performance

- 30.2.1. Omron Corporation

31. Global Encoder Market Competitive Benchmarking

32. Global Encoder Market Competitive Dashboard

33. Key Mergers And Acquisitions In The Encoder Market

34. Encoder Market Future Outlook and Potential Analysis

- 34.1 Encoder Market In 2028 - Countries Offering Most New Opportunities

- 34.2 Encoder Market In 2028 - Segments Offering Most New Opportunities

- 34.3 Encoder Market In 2028 - Growth Strategies

- 34.3.1 Market Trend Based Strategies

- 34.3.2 Competitor Strategies

35. Appendix

- 35.1. Abbreviations

- 35.2. Currencies

- 35.3. Historic And Forecast Inflation Rates

- 35.4. Research Inquiries

- 35.5. The Business Research Company

- 35.6. Copyright And Disclaimer