|

|

市場調査レポート

商品コード

1217135

保険ブローカーの世界市場レポート 2023年Insurance Brokers Global Market Opportunities And Strategies To 2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 保険ブローカーの世界市場レポート 2023年 |

|

出版日: 2023年08月17日

発行: The Business Research Company

ページ情報: 英文 175 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 目次

世界の保険ブローカー市場は、2022年の988億2000万米ドルから2023年には年平均成長率(CAGR)6.6%で1053億3000万米ドルに拡大すると予想されます。ロシア・ウクライナ戦争は、少なくとも短期的には、COVID-19の大流行からの世界経済回復の可能性を混乱させました。この2国間の戦争は、複数の国に対する経済制裁、商品価格の高騰、サプライチェーンの混乱につながり、商品やサービス全体にインフレを引き起こし、世界中の多くの市場に影響を及ぼしています。保険ブローカー市場は、2027年にはCAGR5.5%で1303億5000万米ドルに成長すると予想されています。

2022年の保険ブローカー市場では、北米が最大の地域となりました。西欧は保険ブローカー市場で2番目に大きな市場でした。保険ブローカー市場レポートの対象地域は、アジア太平洋、西欧、東欧、北米、南米、中東・アフリカです。

目次

第1章 エグゼクティブサマリー

第2章 保険ブローカー市場の特徴

第3章 保険ブローカー市場の動向と戦略

第4章 保険ブローカー市場- マクロ経済シナリオ

第5章 保険ブローカーの市場規模と成長

- 世界の保険ブローカー市場の実績、2017年から2022年

- 市場の促進要因

- 市場の抑制要因

- 世界の保険ブローカー市場の予測、2022-2027F、2032F

- 市場の促進要因

- 市場の抑制要因

第6章 保険ブローカー市場セグメンテーション

- 世界の保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

- 生命保険

- 損害保険

- 健康保険

- その他のタイプ

- 世界の保険ブローカー市場、モード別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

- オフライン

- オンライン

- 世界の保険ブローカー市場、エンドユーザー別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

- コーポレート

- 個人

第7章 保険ブローカー市場の地域および国の分析

- 世界の保険ブローカー市場、地域別、実績と予測、2017-2022、2022-2027F、2032F

- 世界の保険ブローカー市場、国別、実績と予測、2017-2022、2022-2027F、2032F

第8章 アジア太平洋保険ブローカー市場

- アジア太平洋保険ブローカー市場概要

- 地域情報, COVID-19の影響,市場情報,背景情報,政府のイニシアチブ,規制,規制機関,主要団体,課税される税,法人税構造,投資,主要企業

- アジア太平洋保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第9章 中国の保険ブローカー市場

- 中国の保険ブローカー市場概要

- 中国の保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第10章 インドの保険ブローカー市場

- インドの保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第11章 日本の保険ブローカー市場

- 日本の保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第12章 オーストラリアの保険ブローカー市場

- オーストラリアの保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第13章 インドネシアの保険ブローカー市場

- インドネシアの保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第14章 韓国の保険ブローカー市場

- 韓国の保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第15章 西欧の保険ブローカー市場

- 西欧の保険ブローカー市場概要

- 西欧の保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第16章 英国の保険ブローカー市場

- 英国の保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第17章 ドイツの保険ブローカー市場

- ドイツの保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第18章 フランスの保険ブローカー市場

- フランスの保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第19章 東欧の保険ブローカー市場

- 東欧の保険ブローカー市場概要

- 東欧の保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第20章 ロシアの保険ブローカー市場

- ロシアの保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第21章 北米の保険ブローカー市場

- 北米の保険ブローカー市場概要

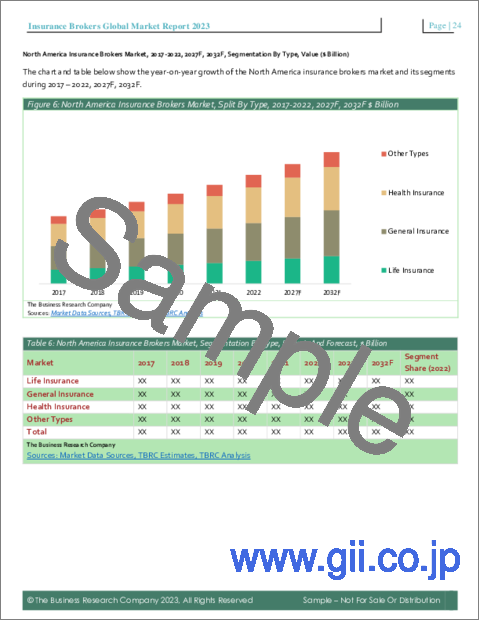

- 北米の保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第22章 米国の保険ブローカー市場

- 米国の保険ブローカー市場概要

- 米国の保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第23章 南米の保険ブローカー市場

- 南米の保険ブローカー市場概要

- 南米の保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第24章 ブラジルの保険ブローカー市場

- ブラジルの保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第25章 中東の保険ブローカー市場

- 中東の保険ブローカー市場概要

- 中東保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第26章 アフリカの保険ブローカー市場

- アフリカの保険ブローカー市場概要

- アフリカの保険ブローカー市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第27章 保険ブローカー市場の競合情勢と企業プロファイル

- 保険ブローカー市場の競合情勢

- 保険ブローカー市場の企業プロファイル

- Aon Plc

- Arthur J. Gallagher &Co

- BB&T Corp.

- Brown &Brown Insurance Inc

- HUB International Ltd.

第29章 保険ブローカー市場における主要な合併と買収

第29章 保険ブローカー市場の将来の見通しと潜在的な分析

第30章 付録

“Insurance Brokers Global Market Report 2023 ” from The Business Research Company provides strategists, marketers and senior management with the critical information they need to assess the market.

This report focuses on insurance brokers market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the coronavirus and how it is responding as the impact of the virus abates.

- Assess the Russia - Ukraine war's impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you within 3-5 working days of order along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Where is the largest and fastest growing market for insurance brokers ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? “The insurance brokers market global report ” from The Business Research Company answers all these questions and many more.

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market's historic and forecast market growth by geography.

Scope

Markets Covered:

1) By Type: Life Insurance; General Insurance; Health Insurance; Other Types

2) By Mode: Offline; Online

3) By End User: Corporate; Individual

Companies Mentioned: Aon Plc; Arthur J. Gallagher & Co; BB&T Corp.; Brown & Brown Insurance Inc.; HUB International Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita,

Data segmentations: country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery format: PDF, Word and Excel Data Dashboard.

Executive Summary

Major players in the market are: Aon Plc, Arthur J. Gallagher & Co, BB&T Corp., Brown & Brown Insurance Inc., HUB International Ltd., Marsh & McLennan Companies Inc., NFP Corp., Willis Towers Watson Plc, Wells Fargo Insurance Services, and Meadowbrook Insurance Group.

The global insurance brokers market will grow from $98.82 billion in 2022 to $105.33 billion in 2023 at a compound annual growth rate (CAGR) of 6.6%. The Russia-Ukraine war disrupted the chances of global economic recovery from the COVID-19 pandemic, at least in the short term. The war between these two countries has led to economic sanctions on multiple countries, surge in commodity prices, and supply chain disruptions, causing inflation across goods and services effecting many markets across the globe. The insurance brokers market is expected to grow to $130.35 billion in 2027 at a CAGR of 5.5%.

The insurance brokers market consists of sales of insurance products by entities that act as intermediaries (i.e., agents or brokers) in selling annuities and insurance policies. This market excludes the direct selling of insurance products by insurance companies. The value of the market is based on the fees or commissions paid to brokers by the insured, both commercial and personal. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included

An insurance broker is a person who is authorized to sell insurance and frequently collaborates with numerous insurance providers to provide customers with a range of products.

North America was the largest region in the insurance brokers market in 2022. Western Europe was the second largest market in the insurance brokers market. The regions covered in the insurance brokers market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

The main types of insurance brokers are life insurance, general insurance, health insurance, others. Life insurance in the insurance brokers market refers to the contract between the insurer and the insurance policyholder that promises to pay a total sum of money upon the death of an insured person. The services are offered in various modes, such as offline, and online mode. These are used by corporate, and individuals.

The increasing demand for insurance policies is expected to fuel the growth of the insurance brokers market over the coming years. The demand for insurance policies has risen due to the availability of security services and customized financial services to clients. According to the Insurance Regulatory and Development Authority (IRDAI) of India, the Life Insurance Corporation of India sold 2.17 crore insurance policies in the fiscal year 2021-2022 which was an 3.54% increase from previous year's 2.10 crore policies. Therefore, the increasing demand for insurance policies drives the growth of the insurance brokerage market.

The impact of COVID-19 is predicted to limit the growth of the insurance brokers market over the forecast period. The COVID-19 pandemic has taken the lives of millions of people, affected supply chains & business sectors, and disrupted economies worldwide. The coronavirus outbreak has several impacts on the insurance sector, from employee and business continuity concerns to customer care considerations to the financial outlook. For instance, the Indian insurance industry's productivity has been hit by 30% in March 2020. The pandemic has pushed the insurance industry to heavily depend on digitalization for selling new policies, setting up claims, and making other transactions. Therefore, the impact of COVID-19 restraints the growth of the insurance brokers market.

The integration of AI in the insurance sector is a key trend gaining popularity in the insurance brokers market. The combined power of AI and human creativity enables the Intelligent Broker, an automation programme for the insurance industry. Brokers will be able to resolve complicated obstacles, produce innovative products and services, and join or build new markets. In addition to this, AI in the insurance industry will improve customer service and prevent customers from fraud. In 2021, 60% of the insurance companies are targeting AI to be used in decision making and to reduce manual input, which has doubled in the last two years.

In March 2020, Aon, a UK-based global professional services firm that is engaged in selling a wide range of financial risk-mitigation products, including pension administration, insurance, and health-insurance plans, acquired Willis Towers Watson for $30 billion. The acquisition provided Aon with the ability to serve clients in areas including intellectual property, cyber, and climate risk to the company clients. Moreover, the deal will accelerate the innovations and strengthen the company's position in the insurance industry with more relevant solutions for clients. Willis Towers Watson is a British-American company engaged in providing risk management, insurance brokerage, and advisory services.

The countries covered in the insurance brokers market are: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, and USA.

The market value is defined as the revenues that enterprises gain from goods and/or services sold within the specified market and geography through sales, grants, or donations in terms of currency (in USD ($) unless otherwise specified).

The revenues for specified geography are consumption values - that is, they are revenues generated by organizations in the specified geography within the specified market, irrespective of where they are produced. It does not include revenues from resales either further along the supply chain or as part of other products.

The insurance brokers research report is one of a series of new reports from The Business Research Company that provides insurance brokers statistics, including insurance brokers industry global market size, regional shares, competitors with insurance brokers share, detailed insurance brokers segments, market trends and opportunities, and any further data you may need to thrive in the insurance brokers industry. This insurance brokers research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Table of Contents

1. Executive Summary

2. Insurance Brokers Market Characteristics

3. Insurance Brokers Market Trends And Strategies

4. Insurance Brokers Market - Macro Economic Scenario

4.1 COVID-19 Impact On Insurance Brokers Market

4.2 Ukraine-Russia War Impact On Insurance Brokers Market

4.3 Impact Of High Inflation On Insurance Brokers Market

5. Insurance Brokers Market Size And Growth

- 5.1. Global Insurance Brokers Historic Market, 2017-2022, $ Billion

- 5.1.1. Drivers Of The Market

- 5.1.2. Restraints On The Market

- 5.2. Global Insurance Brokers Forecast Market, 2022-2027F, 2032F, $ Billion

- 5.2.1. Drivers Of The Market

- 5.2.2. Restraints On the Market

6. Insurance Brokers Market Segmentation

- 6.1. Global Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

- Life Insurance

- General Insurance

- Health Insurance

- Other Types

- 6.2. Global Insurance Brokers Market, Segmentation By Mode, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

- Offline

- Online

- 6.3. Global Insurance Brokers Market, Segmentation By End User, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

- Corporate

- Individual

7. Insurance Brokers Market Regional And Country Analysis

- 7.1. Global Insurance Brokers Market, Split By Region, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

- 7.2. Global Insurance Brokers Market, Split By Country, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

8. Asia-Pacific Insurance Brokers Market

- 8.1. Asia-Pacific Insurance Brokers Market Overview

- Region Information, Impact Of COVID-19, Market Information, Background Information, Government Initiatives, Regulations, Regulatory Bodies, Major Associations, Taxes Levied, Corporate Tax Structure, Investments, Major Companies

- 8.2. Asia-Pacific Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

9. China Insurance Brokers Market

- 9.1. China Insurance Brokers Market Overview

- 9.2. China Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F,$ Billion

10. India Insurance Brokers Market

- 10.1. India Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

11. Japan Insurance Brokers Market

- 11.1. Japan Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

12. Australia Insurance Brokers Market

- 12.1. Australia Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

13. Indonesia Insurance Brokers Market

- 13.1. Indonesia Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

14. South Korea Insurance Brokers Market

- 14.1. South Korea Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

15. Western Europe Insurance Brokers Market

- 15.1. Western Europe Insurance Brokers Market Overview

- 15.2. Western Europe Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

16. UK Insurance Brokers Market

- 16.1. UK Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

17. Germany Insurance Brokers Market

- 17.1. Germany Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

18. France Insurance Brokers Market

- 18.1. France Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

19. Eastern Europe Insurance Brokers Market

- 19.1. Eastern Europe Insurance Brokers Market Overview

- 19.2. Eastern Europe Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

20. Russia Insurance Brokers Market

- 20.1. Russia Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

21. North America Insurance Brokers Market

- 21.1. North America Insurance Brokers Market Overview

- 21.2. North America Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

22. USA Insurance Brokers Market

- 22.1. USA Insurance Brokers Market Overview

- 22.2. USA Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

23. South America Insurance Brokers Market

- 23.1. South America Insurance Brokers Market Overview

- 23.2. South America Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

24. Brazil Insurance Brokers Market

- 24.1. Brazil Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

25. Middle East Insurance Brokers Market

- 25.1. Middle East Insurance Brokers Market Overview

- 25.2. Middle East Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

26. Africa Insurance Brokers Market

- 26.1. Africa Insurance Brokers Market Overview

- 26.2. Africa Insurance Brokers Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

27. Insurance Brokers Market Competitive Landscape And Company Profiles

- 27.1. Insurance Brokers Market Competitive Landscape

- 27.2. Insurance Brokers Market Company Profiles

- 27.2.1. Aon Plc

- 27.2.1.1. Overview

- 27.2.1.2. Products and Services

- 27.2.1.3. Strategy

- 27.2.1.4. Financial Performance

- 27.2.2. Arthur J. Gallagher & Co

- 27.2.2.1. Overview

- 27.2.2.2. Products and Services

- 27.2.2.3. Strategy

- 27.2.2.4. Financial Performance

- 27.2.3. BB&T Corp.

- 27.2.3.1. Overview

- 27.2.3.2. Products and Services

- 27.2.3.3. Strategy

- 27.2.3.4. Financial Performance

- 27.2.4. Brown & Brown Insurance Inc

- 27.2.4.1. Overview

- 27.2.4.2. Products and Services

- 27.2.4.3. Strategy

- 27.2.4.4. Financial Performance

- 27.2.5. HUB International Ltd.

- 27.2.5.1. Overview

- 27.2.5.2. Products and Services

- 27.2.5.3. Strategy

- 27.2.5.4. Financial Performance

- 27.2.1. Aon Plc

29. Key Mergers And Acquisitions In The Insurance Brokers Market

29. Insurance Brokers Market Future Outlook and Potential Analysis

30. Appendix

- 30.1. Abbreviations

- 30.2. Currencies

- 30.3. Historic And Forecast Inflation Rates

- 30.4. Research Inquiries

- 30.5. The Business Research Company

- 30.6. Copyright And Disclaimer