|

|

市場調査レポート

商品コード

1224457

防衛産業向け複合材料の世界市場 (2023-2028年):市場規模・シェア・動向・予測・競合分析・成長機会Defense Composites Market Size, Share, Trend, Forecast, Competitive Analysis, and Growth Opportunity: 2023-2028 |

||||||

| 防衛産業向け複合材料の世界市場 (2023-2028年):市場規模・シェア・動向・予測・競合分析・成長機会 |

|

出版日: 2023年02月12日

発行: Stratview Research

ページ情報: 英文 135 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

防衛産業向け複合材料の市場規模は、COVID-19の影響から2021年以降に回復し始め、今後5年間は4.7%のCAGRで成長し、2028年には8億米ドルの規模に達すると予測されています。

さまざまな防衛用途における複合材料の普及、軽量材料への需要の増加、大型用途における複合材料の好みの高まりなどの要因が、予測期間中の成長を促進すると予測されています。

樹脂別で見ると、熱可塑性複合材料の部門が予測期間中、もっとも高い成長を遂げると予想されています。高い耐衝撃性、強度、持続可能性、製造の容易さ、再成形性などが同部門の成長を促進する主な要因となっています。一方、熱硬化性複合材料の部門は、今後数年間、もっとも優勢の位置づけを維持すると予想されています。

当レポートでは、世界の防衛産業向け複合材料の市場を調査し、市場概要、COVID-19およびその他の市場影響因子の分析、市場規模の推移・予測、各種区分・地域別の内訳、競合環境、主要企業のプロファイル、成長機会の分析などをまとめています。

目次

第1章 エグゼクティブサマリー

第2章 防衛産業向け複合材料市場:環境分析

- サプライチェーン分析

- PEST分析

- 産業ライフサイクル分析

- 市場促進要因

- 市場の課題

第3章 防衛産業向け複合材料市場:市場評価

- 市場動向・予測

- 市場シナリオ分析:さまざまな市場環境における成長の軌跡

第4章 防衛産業向け複合材料市場:各種区分別の分析

- 地域別の動向・予測:強化タイプ別

- 炭素複合材料

- ガラス複合材料

- アラミド複合材料

- セラミック複合材料

- 地域別の動向・予測:樹脂タイプ別

- 熱硬化性複合材料

- 熱可塑性複合材料

- セラミックマトリックス複合材料

- 地域別の動向・予測:用途別

- 軍用機

- 海軍システム

- 陸上車両

- 個人防護

- 武器・弾薬

- その他

- 地域分析

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 競合分析

- 市場統合レベル

- 競合情勢

- 市場シェア分析

- 製品ポートフォリオ分析

- 地域的プレゼンス

- 戦略的提携

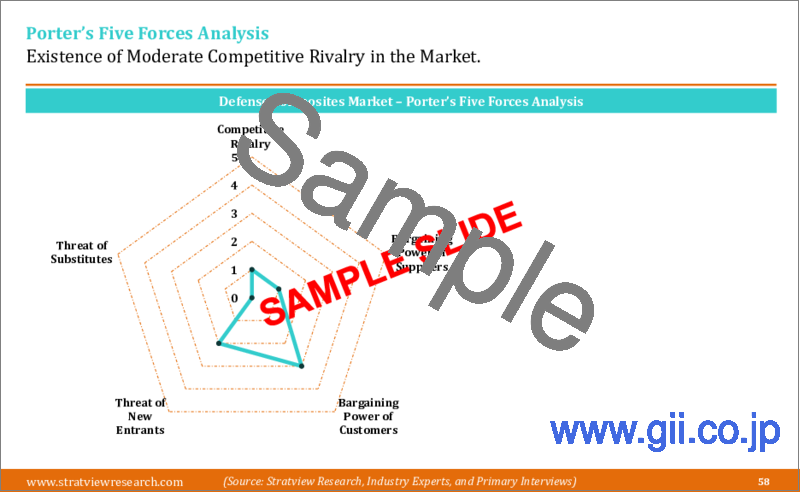

- ポーターのファイブフォース分析

第6章 戦略的成長機会

- 市場の魅力分析

- 新たな動向

- 戦略的影響

- 主な成功要因

第7章 主要企業のプロファイル

- DuPont de Nemours, Inc.

- Hexcel Corporation

- Lanxess AG

- Mitsubishi Chemical Group Corporation

- Owens Corning

- Sigmatex Limited

- SGL Carbon SE

- Solvay S.A.

- Teijin Limited

- Toray Industries Inc.

第8章 付録

Market Insights

The defense industry is an early adopter of advanced composites. The lessons learnt from the incorporation of advanced composites in the crucial sections have lately been replicated in other aerospace platforms including commercial aircraft. Today, composite materials are used in building several crucial sections of military aircraft such as the fuselage and wings of military aircraft. Similarly, helmets, ballistic panels, missile fuselage, and bullet-proof jackets are other noticeable applications where the penetration of composites has been rising over the eons.

Unlike other aerospace platforms, such as general aviation and commercial aircraft, that recorded a colossal plunge amid the pandemic, the defense industry recorded a relatively low decline, thanks to the long-term contracts followed by continued focus on lading economies to further strengthen their defense capabilities. In the year 2020, the defense composites market witnessed a decline of -10.

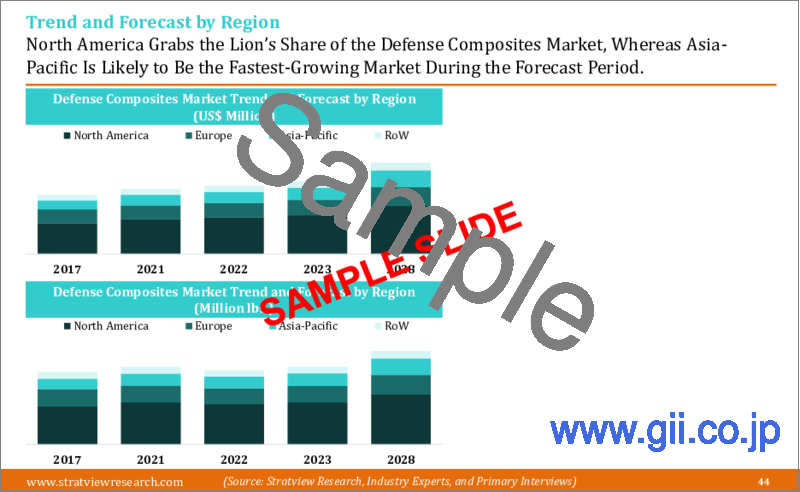

However, the defense composites market started rebounding from 2021 onwards and is likely to grow at a promising CAGR of 4.7% over the next five years to reach an annual market size of US$ 0.8 Billion in 2028. Major factors, such as increasing penetration of composites in various defense applications, greater demand for lightweight materials, and increasing preference for composites in large-sized applications, are expected to propel the growth of defense composites during the forecast period.

Recent Market JVs and Acquisitions:

- In 2018, Toray Industries, Inc. acquired Tencate Advanced Composites from Koninklijke Ten Cate B.V.

- In 2017, Hexcel Corporation acquired Structil SA, a French company that produces and supplies high-performance composites.

- Based on the reinforcement type, the defense composites market is segmented into carbon composites, glass composites, aramid composites, and ceramic composites. Carbon composite is anticipated to remain the most preferred material type in the market during the forecast period. The lightweight characteristic combined with high-tensile strength gives carbon fiber a clear advantage over its metal counterparts for many military and defense applications. In addition, an expected increase in production rates of the key military aircraft programs is expected to give additional impetus to the demand for carbon composites during the forecast period.

- Based on the resin type, the market is segmented into thermoset composites, thermoplastic composites, and ceramic matrix composites. Thermoplastic composite is expected to witness the highest growth in the market during the forecast period. High-impact resistance, strength, sustainability, ease of production, and re-formability are the major factors driving the growth of thermoplastic composites in the defense industry. On the other hand, thermoset composite is anticipated to remain the most dominant category in the years to come.

- In terms of regions, North America is expected to remain the largest market for defense composites during the forecast period. Major factors such as increasing focus on composite-rich military aircraft, lightweight defense vehicles, and weight reduction in personal protection equipment, such as body armor, tactical helmets, and shields, are fueling the growth of composites in the North American defense industry. Asia-Pacific and Europe are also likely to create sizeable opportunities in the coming five years.

- Key Players

- The market is highly populated with the presence of several local, regional, and global players. Most of the major players compete in some of the governing factors including price, product offerings, regional presence, etc. The following are the key players in the defense composites market.

- Hexcel Corporation

- Solvay S.A.

- Toray Industries, Inc.

- Teijin Limited

- Owens Corning

- Mitsubishi Chemical Group Corporation

- Sigmatex (UK) Limited

- SGL Carbon SE

- DuPont de Nemours, Inc.

- Lanxess AG

- Research Methodology

- This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today's defense composites market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research's internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 12 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

- Report Features

This report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter's five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Product portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

- The defense composites market is segmented into the following categories.

- Defense Composites Market, by Reinforcement Type

- Carbon Composites (Regional Analysis: North America, Europe, Asia-Pacific, and the Rest of the World)

- Glass Composites (Regional Analysis: North America, Europe, Asia-Pacific, and the Rest of the World)

- Aramid Composites (Regional Analysis: North America, Europe, Asia-Pacific, and the Rest of the World)

- Ceramic Composites (Regional Analysis: North America, Europe, Asia-Pacific, and the Rest of the World)

- Defense Composites Market, by Resin Type

- Thermoset Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Thermoplastic Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Ceramic Matrix Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Defense Composites Market, by Application Type

- Military Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Naval Systems (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Land Vehicles (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Personal Protection (Regional Analysis: North America, Europe, Asia-Pacific, and the Rest of the World)

- Arms & Ammunition (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Defense Composites Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Table of Contents

- Report Scope

- Report Objectives

- Research Methodology

- Market Segmentation

- Secondary Research

- Key Information Gathered from Secondary Research

- Primary Research

- Key Information Gathered from Primary Research

- Breakdown of Primary Interviews by Region, Designation, and Value Chain Node

- Data Analysis and Triangulation

1. Executive Summary

2. Defense Composites Market Environment Analysis

- 2.1. Supply Chain Analysis

- 2.2. PEST Analysis

- 2.3. Industry Life Cycle Analysis

- 2.4. Market Drivers

- 2.5. Market Challenges

3. Defense Composites Market Assessment (2017-2028) (US$ Million and Million Lbs.)

- 3.1. Defense Composites Market Trend and Forecast (US$ Million and Million Lbs.)

- 3.2. Market Scenario Analysis: Growth Trajectories in Different Market Conditions

4. Defense Composites Market Segment Analysis (2017-2028) (US$ Million and Million Lbs.)

- 4.1. Reinforcement-Type Analysis

- 4.1.1. Carbon Composites: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.1.2. Glass Composites: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.1.3. Aramid Composites: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.1.4. Ceramic Composites: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.2. Resin-Type Analysis

- 4.2.1. Thermoset Composites: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.2.2. Thermoplastic Composites: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.2.3. Ceramic Matrix Composites: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.3. Application-Type Analysis

- 4.3.1. Military Aircraft: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.3.2. Naval Systems: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.3.3. Land Vehicles: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.3.4. Personal Protection: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.3.5. Arms & Ammunition: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.3.6. Others: Regional Trend and Forecast (US$ Million and Million Lbs.)

- 4.4. Regional Analysis

- 4.4.1. North American Defense Composites Market: Country Analysis

- 4.4.1.1. The USA's Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.1.2. Canadian Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.1.3. Mexican Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.2. European Defense Composites Market: Country Analysis

- 4.4.2.1. German Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.2.2. French Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.2.3. Russian Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.2.4. The UK's Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.2.5. Rest of the European Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.3. Asia-Pacific's Defense Composites Market: Country Analysis

- 4.4.3.1. Indian Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.3.2. Chinese Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.3.3. Japanese Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.3.4. Rest of the Asia-Pacific's Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.4. Rest of the World's (RoW) Defense Composites Market: Country Analysis

- 4.4.4.1. Brazilian Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.4.2. Saudi Arabian Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.4.3. Other Defense Composites Market T&F (US$ Million and Million Lbs.)

- 4.4.1. North American Defense Composites Market: Country Analysis

5. Competitive Analysis

- 5.1. Market Consolidation Level

- 5.2. Competitive Landscape

- 5.3. Market Share Analysis

- 5.4. Product Portfolio Analysis

- 5.5. Geographical Presence

- 5.6. Strategic Alliances

- 5.7. Porter's Five Forces Analysis

6. Strategic Growth Opportunities

- 6.1. Market Attractiveness Analysis

- 6.1.1. Market Attractiveness by Reinforcement Type

- 6.1.2. Market Attractiveness by Resin Type

- 6.1.3. Market Attractiveness by Application Type

- 6.1.4. Market Attractiveness by Region

- 6.1.5. Market Attractiveness by Country

- 6.2. Emerging Trends

- 6.3. Strategic Implications

- 6.4. Key Success Factors (KSFs)

7. Company Profile of Key Players (Alphabetically Arranged)

- 7.1. DuPont de Nemours, Inc.

- 7.2. Hexcel Corporation

- 7.3. Lanxess AG

- 7.4. Mitsubishi Chemical Group Corporation

- 7.5. Owens Corning

- 7.6. Sigmatex Limited

- 7.7. SGL Carbon SE

- 7.8. Solvay S.A.

- 7.9. Teijin Limited

- 7.10. Toray Industries Inc.

8. Appendix

- 8.1. Disclaimer

- 8.2. Copyright

- 8.3. Abbreviation

- 8.4. Currency Exchange

- 8.5. Market Numbers