|

|

市場調査レポート

商品コード

1565779

銅箔の技術動向と市場見通し(~2035年)<2024> Copper Foil Technology Trend and Market Outlook (~2035) |

||||||

|

|||||||

| 銅箔の技術動向と市場見通し(~2035年) |

|

出版日: 2024年09月30日

発行: SNE Research

ページ情報: 英文 107 Pages

納期: お問合せ

|

全表示

- 概要

- 目次

エグゼクティブサマリー

電気自動車において、バッテリーは自動車の性能、コスト、安全性を左右するもっとも重要なコンポーネントの1つです。バッテリーの4つの主要コンポーネントは、正極、負極、電解液、セパレーターです。これら4つの主要コンポーネントが適切に機能するためには、正極と負極の両方に集電体を使用する必要があります。負極には集電体として一般的に銅箔が使用されます。

バッテリーは現在、電気自動車、エネルギー貯蔵システム(ESS)、IT用途に使用されています。EV市場を見ると、2021年~2035年にCAGRで19%の成長が予測され、バッテリー市場全体を牽引する見込みです。バッテリー市場の成長に伴い、銅箔市場も成長が見込まれます。2021年の銅箔需要は約21万トンで、2035年までに176万トンに達すると予測され、CAGRで15%の継続的な成長が見込まれます。2035年の電気自動車向け銅箔需要は約138万トンとなり、需要全体の約77%を占めると予測されます。これに伴い、ESSも今後より多くの銅箔を要求する可能性があります。

銅箔の場合、T値は販売価格から材料費(LMEに基づく銅の価格)を差し引いた値です。T値は需給によって絶えず変動します。2024年の6ミクロン広幅銅箔のT値は、産業関係者へのヒアリングから4.3ドル/kgと判明しました。市場競合の激しさから形成された価格です。2025年後半以降、需給バランスが整えば、T値は6ドル/kg前後で維持されると予測されます。この前提条件に基づけば、銅箔市場は2035年までに267億米ドルへ大きく成長すると予測されます。

地域ごとに異なる規制や地域ブロック形成のため、中国の電気自動車・ESS向け銅箔需要は、2021年の50%超から2035年までに44%に落ち込むと予測されます。一方、北米と欧州は自国のバッテリー生産能力を拡大することで銅箔需要を主導すると予測されます。

2021年現在、世界の銅箔生産の大部分(72%)を中国が占め、韓国、マレーシア、その他の地域が23%を占めています。しかし2025年以降は、継続的な生産能力増強が予測される欧州と米国からの銅箔へのニーズが見込まれます。

需給バランスの点では、北米は継続的に供給不足に陥るため、その他の地域からの供給を受けるか、現地投資を行う見通しです。韓国と日本の既存銅箔企業は、欧州、米国、マレーシアなどの他地域での生産能力拡張を計画しています。現在の市況によって、投資のタイミングは臨機応変に変わるとみられます。世界のバッテリーメーカーは現在、1~2社の銅箔パートナーと協力し、継続的にパートナーの数を増やそうとしています。銅箔メーカーは、低コストと技術の競合が激しい中国市場やサプライチェーンからの脱却のニーズを受け、世界のバッテリーメーカーと緊密に協力しようとしています。その協力は、現地の規制や品質要求によって異なる可能性があります。

銅箔はバッテリーセルのコストの約5%を占めています。銅箔製造の難易度は中程度ですが、かなりの投資と技術力を必要とするため、銅箔市場は売り手が買い手より優位に立つ市場と見なされています。

市場の銅箔は、硫酸銅水溶液に銅材料を溶かし、電解機で銅を電解析出させた電解銅箔が主流です。韓国と中国のバッテリーメーカーが要求する銅箔の購入仕様は似通っています。銅箔仕様の動向を見ると、より薄く、より広く、より長いロールが要求されています。銅箔のコスト構造から、銅箔ビジネスにおける競争力は人件費、電気代、減価償却費で決まる。マレーシアのような東南アジア地域は、人件費や電気代が他より安く、初期段階での歩留まり確保が比較的容易で、銅箔製造技術の標準化・安定化が進んでいるため、銅箔ビジネスへの投資が有利とされています。銅箔の製品グループは、機械的特性、厚さ、幅によって分類することができます。近年、バッテリーメーカーは引張強度が50kgf/mm2を超える銅箔を要求する傾向にあります。SiOx/SiCのような新しい負極活物質の採用が増えるにつれて、銅箔の物理的特性の変化や表面処理に対する要求も現れています。

当レポートでは、世界の銅箔市場について調査分析し、銅箔技術、EV市場とバッテリー市場の見通し、需要、市場規模などの情報を提供しています。

目次

エグゼクティブサマリー

用語

第1部

- 銅箔技術

- LIB銅箔の理解

- バッテリー材料のコスト構造

- 銅箔の定義と分類

- 銅箔技術インデックス

- 銅箔の仕様

- 銅箔製造 - 溶解プロセス

- 銅箔製造 - めっきプロセス

- 銅箔製造 - 切断プロセス

- 銅箔製造 - 生産フロー

- 銅箔用語(生産能力、収率)

- 主要バッテリーメーカーのバッテリー技術ロードマップ(プレミアム/エントリーレベル)

- 銅箔製造 - ドラム、関連メーカー

- 銅箔製品 - 主な用途と分類

- 銅箔製品の変化と動向

- 銅箔の特許動向:国別/企業別

- 銅箔の特許動向:技術別

第2部

- EV市場

- 世界のEV市場の見通し(乗用車/商用車)

- 世界のEV市場の見通し(乗用車:地域別/年別)

- 地域別EV市場の成長率(乗用車、~2035年)

- 世界のEV市場の見通し(商用車:地域別/年別)

- バッテリー市場

- バッテリー市場:用途別(~2035年)

- バッテリー市場:地域別(~2035年)

- 見通し:乗用EVタイプ別(~2035年)

- バッテリー生産能力

- 生産能力:製造地域別(~2035年)

- 生産能力:主要企業別(~2035年)

- 世界のバッテリー需要/サポートバランス(~2035年)

第3部

- 銅箔市場

- 銅箔需要計算ロジック

- 銅箔使用:用途別(~2035年)

- 銅箔需要:用途別(~2035年)

- 世界の銅箔の市場規模

- 銅箔需要:地域別

- 銅箔生産能力

- 銅箔生産能力:企業別(~2035年)

- 銅箔生産能力:地域別(~2035年)

- 銅箔需給バランス:地域別(~2035年)

- 銅箔の価格の見通し

- 銅箔サプライチェーン(2024年時点の主要サプライヤー)

第4部

- 環境規制と代替材料の影響

- 複合銅箔

- 米国のIRAの影響

- CRMAの影響

- 投資サイト

- 次世代バッテリーの影響

- 1. 全固体電池

- 2. ナトリウムイオンバッテリー

第5部

- 主要企業

- *過去3年間の売上/営業利益

- 1. SK Nexilis

- 2. Doosan Solus

- 3. Lotte Energy Materials

- 4. Korea Zinc

- 5. Nippon Denkai

- 6. Wason

- 7. Nuo De

- 8. Jiayuan Technology

- 9. Zhajiang Defu

- 10. Chang Chun Group

- 11. Taesung

Executive Summary

In electric vehicles, battery is one of the most critical components which determine the performance, cost, and safety of vehicle. The 4 major components in battery is cathode, anode, electrolyte, and separator. In order for these 4 major components to properly do their jobs, the use of current collector for both cathode and anode is necessary. For anode, copper foil is generally used as a current collector.

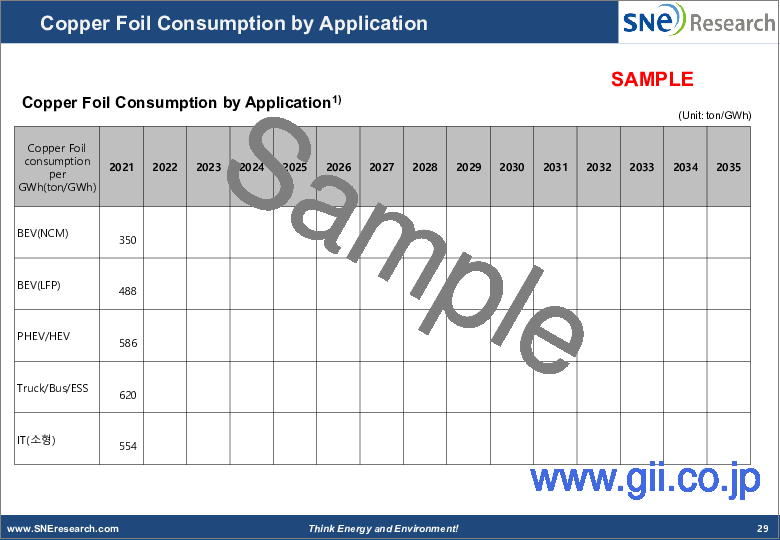

Battery is currently used for electric vehicles, energy storage system (ESS), and IT applications. If we look at the EV market, it is expected to grow at a CAGR of 19% from 2021 and 2035, leading the entire battery market. In accordance with the growth of battery market, the copper foil market is also expected to grow. Demand for copper foil in 2021 was approx. 210k ton and is expected to continuously grow at a CAGR of 15% to 1.76 million ton by 2035. Copper foil demand for electric vehicles in 2035 is expected to be around 1.38 million ton, taking up about 77% of the entire demand. Along with this, ESS would also demand more copper foil in future.

In case of copper foil, T value is defined a value by subtracting material costs (copper price, based on LME) from the selling price. T value continuously fluctuates depending on supply/demand. In 2024, the T value for 6 micron, wide-width copper foil was found to be 4.3 $/kg from our interviews with the industry players. It is the price formed from fierce competitions in the market. From the latter half of 2025, it is expected that T value would be maintained at around 6$/kg when supply/demand balance would be made. Based on this assumption, the copper foil market is expected to significantly grow to US$26.7 billion in 2035.

Due to different regulations in regions and regional block formation, China's copper foil demand for electric vehicles and ESS is expected to drop to 44% in 2035 from over 50% in 2021. On the other hand, North America and Europe are expected to lead copper foil demand by expanding their local battery capacity.

As of 2021, China took up a large portion (72%) of global copper foil production, while Korea, Malysia, and other regions accounted for 23%. However, after 2025, there would be needs for copper foil from Europe and the US where continuous capacity ramp-up is expected.

In terms of supply/demand balance, North America would continuously experience a shortage in the region, and in order to address the shortage, it is forecasted to receive supply from other regions or make local investment in the region. The existing copper foil companies in Korea and Japan have their capacity expansion plans in Europe, the US, and other regions such as Malaysia. Depending on the current market situations, their investment timing would change flexibly, though. Global battery makers are currently working on cooperation with 1 or 2 copper foil partners and trying to continuously increasing the number of partners they are working with. Following the needs to escape from the Chinese market and supply chain, where competitions for low cost and technology are fierce, copper foil makers have been trying to work closely with global battery manufacturers. Their cooperation may differ and vary depending on local regulations and quality requirements.

Copper foil takes up approx. 5% of battery cell cost. The level of difficulty in manufacturing copper foil is medium, but as it requires quite a lot of investment and technical prowess, the copper foil market is regarded as market where sellers have the whip hand over buyers.

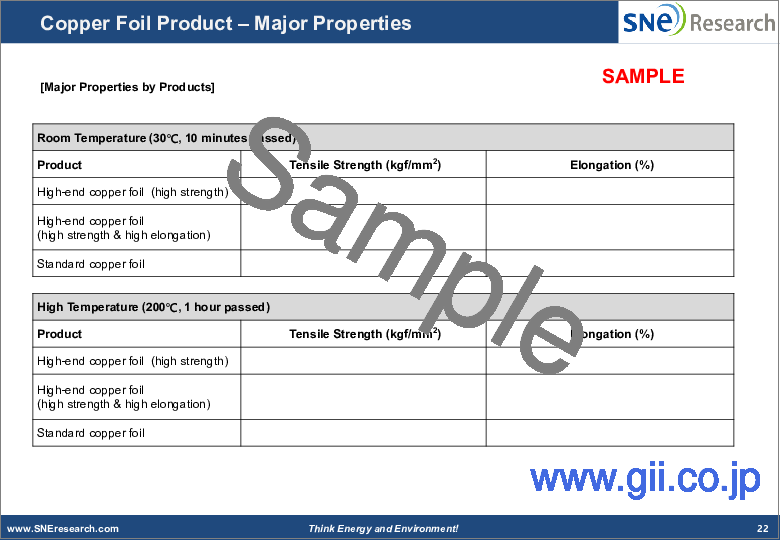

Copper foil in the market is mostly electrolytic copper foil made by dissolving copper materials into copper sulfate solution and electrodepositing copper in the solution by using electrolysis machine. The purchase specifications of copper foil required by Korean and Chinse battery makers are similar to each other. If we look at the trend in copper foil specifications, it is required to be thinner, wider, and longer in rolls. Based on the cost structure of copper foil, competitiveness in copper foil business can be determined by labor cost, electric charges, and depreciation cost. Countries in the Southeast Asian region such as Malaysia, of which labor cost and electricity charges are lower than others, are regarded as places where investment for copper foil business would be lucrative as it has become relatively easy to secure the yield at the initial stages and the copper foil manufacturing technology has gone through standardization and stabilization. The copper foil product group can be categorized by mechanical property, thickness and width. Recently, battery makers tend to require copper foil of which tensile strength is higher than 50 kgf/mm2. With the increasing adoption of new anode active materials such as SiOx/SiC, there have been requirements on changes in physical properties of copper foil and surface treatment.

Copper foil patents are mostly registered in China, followed by Japan, Taiwan, and the US. The Korean, Japanese, and Chinese companies take a leading role in patent application. If we look at the patents related to copper foil manufacturing, patents about adjusting physical properties of copper foil by changing additives or controlling the quantity of additives during the process are prevalent. Copper foil manufacturers are mostly Chinese, Korean, and Japanese. SK Nexilis and Lotter Energy Materials are increasing their production capacity in Malaysia first and considering possible capacity ramp-up in Europe and the US. Chinse copper foil companies are trying to secure their production capacity and customers in other regions than China based on their established competitiveness.

Table of Contents

Executive Summary

Terminology

Part-1

- Copper Foil Technology

- Understanding of LIB Copper Foil

- Cost Structure of Battery Materials

- Definition and Categorization of Copper Foil

- Copper Foil Technology Indexes

- Copper Foil Specifications

- Copper Foil Manufacturing - Dissolving process

- Copper Foil Manufacturing - Plating process

- Copper Foil Manufacturing -Slitting process

- Copper Foil Manufacturing - Production flow

- Copper Foil Terminology (Capacity, Yield)

- Major Battery Makers' Battery Technology Roadmap (Premium / Entry-level)

- Copper Foil Manufacturing - Drum and related manufacturers

- Copper Foil Products - Major Purposes and Categorization

- Changes and Trend in Copper Foil Products

- Copper Foil Patent Trend (By country / By Company)

- Copper Foil Patent Trend (By Technology)

Part-2

- EV Market

- Global EV Market Outlook (Passenger vehicle / Commercial vehicle)

- Global EV Market Outlook (Passenger vehicle - By Region / By year)

- Global EV Market Growth by Region (Passenger vehicle, ~'35)

- Global EV Market Outlook (Commercial vehicle - By Region / By year)

- Battery Market

- Battery Market by Application (~'35)

- Battery Market by Region (~'35)

- Outlook by Passenger EV Type (~'35)

- Batrery Capacity

- Capacity by Manufacturing Region (~'35)

- Capacity by Major Companies (~'35)

- Global Battery Demand / Support Balance (~'35)

Part-3

- Copper Foil Market

- Copper Foil Demand Calculation Logic

- Copper Foil Usage by Application (~'35, ton/GWh)

- Copper Foil Demand by Application (~'35, ton/GWh)

- Global Copper Foil Market Size (~'35, Bil. USD)

- Copper Foil Demand by Region (~'35, 10k ton)

- Copper Foil Capacity

- Copper Foil Capacity by Company (~'35, 10k ton)

- Copper Foil Capacity by Region (~'35, 10k ton)

- Copper Foil Demand / Supply Balance by Region (~'35)

- Copper Foil Price Outlook ('13~'35, $/kg, T-value-based)

- Copper Foil Supply Chain (Main Suppliers as of 2024)

Part-4

- Influences from Environmental Regulations and Alternative Materials

- Composite Copper Foil

- Influences from the US IRA

- Influences from the CRMA

- Investment Site

- Influences from Next-Gen Battery

- 1. All-Solid-State Battery

- 2. Na-ion Battery

Part-5

- Major Companies

- *Past 3-Year Salas / Operating Profits

- 1. SK Nexilis

- 2. Doosan Solus

- 3. Lotte Energy Materials

- 4. Korea Zinc

- 5. Nippon Denkai

- 6. Wason

- 7. Nuo De

- 8. Jiayuan Technology

- 9. Zhajiang Defu

- 10. Chang Chun Group

- 11. Taesung