|

|

市場調査レポート

商品コード

1565778

LIB向け乾電池電極プロセスの技術開発の動向と見通し<2024> Technology Development Trends and Prospects of Dry Battery Electrode Process for LIBs |

||||||

|

|||||||

| LIB向け乾電池電極プロセスの技術開発の動向と見通し |

|

出版日: 2024年10月04日

発行: SNE Research

ページ情報: 英文 277 Pages

納期: お問合せ

|

全表示

- 概要

- 目次

電気自動車そのものは温室効果ガスを排出しませんが、電気自動車の製造プロセスが炭素を排出し、環境を破壊しているという批判があります。その代表例がバッテリーで、電気自動車の製造コストの約40%を占めています。

バッテリー製造プロセスでは、特にNMPの乾燥・回収にかなりの電気エネルギーが消費され、温室効果ガス排出の原因となっています。ある調査結果によると、湿式製造プロセスでの溶剤乾燥により、1kWhあたり42kgのCO2が発生し、環境汚染物質である揮発性有機化合物(VOC)も大気中に排出されます。これに対し、乾式電極は溶媒の乾燥・回収プロセスがないため、消費電力が少なく、VOCの排出もない、環境にやさしいプロセスです。

エネルギー密度を高めるためには、100μm超の厚膜電極が必要となります。現在の湿式プロセスでは、溶媒と材料の層分離現象により、厚膜電極を作ることが困難です。活物質、導電材料、バインダーなどそれぞれの比重が異なるため、塗膜が厚いとバインダーや導電材料が電極表面に浮いてしまいます。湿式プロセスでは、電極に約100μm超の厚みで塗工することは難しいです。

乾式プロセスにすることで、この層分離現象を起こさずに活物質と導電材とバインダーを均一に分散させることができるため、厚膜の電極を作ることができ、バッテリーの容量とエネルギー密度を高めることができます。

2019年、Teslaは乾式電極技術を持つスーパーキャパシタ企業のMaxwell Technologiesを買収し、2020年9月のBattery Dayで乾式電極の導入を発表しました。Teslaは2年後の2021年にMaxwellをUCAPに売却しましたが、乾式電極技術を確保することができました。Tesla 4680バッテリーを直接入手して分析した専門家によると、このバッテリーは負極にのみ乾式電極を適用し、正極には既存の湿式電極を採用していました。

Teslaが正極に乾式電極プロセスをまだ適用していない理由は不明ですが、乾式電極プロセスの歩留まりが低く、量産できないという分析があります。また、4680バッテリーの歩留まりの低さがCybertruckの生産に影響しているという国外メディアの報道もあります。

乾式成膜プロセスの原理は単純ですが、実施するには各段階でかなりの課題があります。溶剤を使わずに活物質、導電材料、バインダーを均一に混合するのは容易ではありません。非粘性の粉末を集電体に均一に塗布するのはさらに困難です。歩留まりが悪ければ、生産コストも高くなります。乾式電極はコスト削減のために導入されましたが、実際にはコストアップ要因になりかねません。

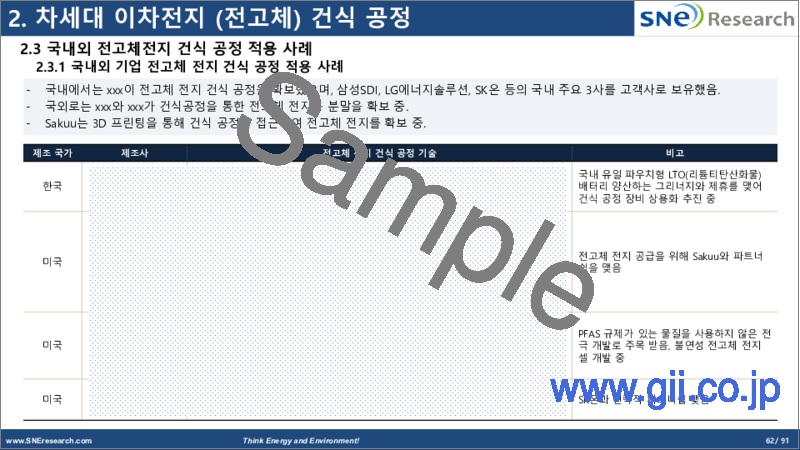

現在、Teslaのほか、国内外の企業がP/Pスケールの乾式プロセスを開発中と発表していますが、当初生産される直径46ミリの円筒型バッテリーはすべて湿式プロセスで生産される見通しです。LGESが2024年第4四半期にP/Pスケールで生産する4680バッテリーは、正極、負極ともに湿式プロセスを適用し、このバッテリーはTeslaに供給されます。近年LGESは、2024年第4四半期にOchang Energy Plantに乾式電極プロセスのP/Pラインを完成させ、2028年から適用すると発表しました。Samsung SDI、SK On、Panasonic、CATL、Kumyangも近年の乾式電極技術の開発を発表しています。

さらに、ドイツのVolkswagenは2023年6月、ドイツの印刷機器専門メーカーであるKoenig & Bauerと乾式電極プロセスを開発中であると発表しました。Volkswagenは2027年までに工業生産を開始する予定です。VolkswagenとKoenig & Bauerが乾式電極をどのように開発しているかは正確には分かっていません。

乾式プロセスは、乾燥プロセスが不要なためエネルギーコストを30%削減でき、乾燥に必要な面積も50%削減できます。乾式プロセスを用いた4680バッテリーは、理論的にはLFPバッテリーよりも安価にできますが、技術開発はまだ成功していません。

乾式プロセスの導入は、カーボンニュートラルなリチウム二次電池製造プロセスとして大きな可能性を秘めており、乾式電極技術の実用化は、性能向上と同時にバッテリー製造コストの削減に大きく寄与すると予測されています。今のところ量産化に成功した企業はありませんが、大手企業が技術開発に拍車をかけていることから、近い将来、乾式電極プロセスが動向となる可能性は高いです。また、乾式電極プロセスの開発は、次世代電池である全固体電池の製造プロセスにも応用できます。実際、国内外で全固体電池への関心は高まっており、量産化計画も立ち上がっています。

当レポートでは、二次電池産業にについて調査分析し、カーボンニュートラルプロセス開発の必要性、既存の湿式プロセスの問題点、現在の乾式プロセスの問題点などの技術情報に加え、近年の乾式電極プロセスの開発動向や各社の全固体電池開発状況などを紹介し、乾式プロセスの現状と近い将来を予測しています。

電極製造における乾式プロセスと湿式プロセスの違い

| 利点 | スーパーキャパシタ | コンパクト | ||

| 課題 | 偏析のリスク | 偏析のリスク | 偏析のリスク | 混合 |

| 主要企業 | Tesla (Maxwell Technologies) | Technical Univ. Dresden Fraunhofer IWS |

Technical Univ. Dresden Fraunhofer ISIT |

Technical Univ. Braunschweig Fraunhofer IPA |

| TRL | 6 | 5 | 4->6 | 4->6 |

| 参考文献 | US Patent US2006/0133012A1 10/817 590. Apr. 1. 2008. | Germany Patent DE102017208220A1. Nov. 22. 2018. | Proc. Fraunhofer ISIT - Achievements Results Annu. Rep., 2017.pp.32-33 | Energy Technol., vol. 8, no. 2. 2020. Art. no. 1900309 |

目次

第1章 LIBの厚膜電極向け乾式電極プロセス

- LIB産業におけるカーボンニュートラルプロセスの必要性

- リチウムイオンバッテリーにおける厚膜電極の必要性

- 湿式電極製造プロセスの問題

- 乾式プロセス採用の背景

- 乾式電極プロセスの種類

- 乾式電極プロセスの問題

- 乾式プロセスと湿式プロセスの比較

- PTFE繊維化

第2章 次世代二次電池(全固体電池)乾式電極プロセス

- 世界の全固体電池の開発動向

- 固体電池における乾式電極プロセス採用の必要性

- 固体電池における乾式電極プロセスの応用例

第3章 各企業の開発動向

- 韓国と国際産業における乾式電極プロセス開発動向

- 韓国企業の開発動向

- LG Energy Solutions

- Samsung SDI

- SK On

- Cosmos Lab

- CNP Solutions

- 国外企業の開発動向

- TESLA

- Sakuu (US)

- Anaphite (UK)

- LiCap Technology (US)

- AM Batteries (US)

- PowerCo SE

- Dragonfly Energy (US)

- ZEON

- Daikin

- Chemours (US)

- Huacai Technology (China)

- Baosheng Energy Technology (China)

- Li Yuanheng (China)

- 機器メーカーの開発動向

- Hanwha Momentum

- CIS

- PNT

- Yunsung F&C

- NainTech

- GITech (Korea)

- KATOP (China)

- Shanghai Lianjing Automation Technology

- TOB New battery

- TMAX Battery Equipment

- Shenzhen Tsingyan Electronic Technology

- Huacai Technology

- ATEIOS System (US)

- EIRICH (Germany)

- Fraunhofer IWS

- 学術・研究機関の開発動向

- Korea Institute of Energy Technology

- Yonsei University

- Korea University

- Ulsan Institute of Science and Technology

- Sungkyunkwan University

- Gacheon University

- Fraunhofer ISIT

- Karlsruhe Institute of Technology (KIT)

- Dry Coating Forum

第4章 特許分析

- 国外の乾式プロセス開発特許

- 国外の乾式プロセス開発特許のリスト

- Maxwell Technologies

- Fraunhofer IWS

- TESLA

- Licap New Energy Technologies

- Dragonfly Energy

- Anaphite Ltd

- 韓国の乾式プロセス開発特許

- LG Chem, LG Energy Solution patents

- Samsung SDI

- SK On

- Hyundai Kia

- Yunsung F&C

- Cosmos Lab

- Korea Ceramic Technology Institute

第5章 各国の調査プロジェクト

- 米国エネルギー省のプロジェクト

- Oak Ridge National Lab

- NAVITAS Systems

- EUのプロジェクト

- ELIBAMA program

- HORIZON Europe : NOVOC project

- Horizon Europe : BatWoMan

- 韓国の国家プロジェクト

- Ministry of Trade and Industry

- Ministry of Education

- Ministry of Science and Technology

- Ministry of Economy and Finance

第6章 市場見通し(調査見通し)

- SNE Research

- EV Tank

- ESP Analysis

- Industry ARC

- QY Research

- Verified Market Reports

Electric vehicles themselves do not emit greenhouse gases, but the manufacturing process of electric vehicles has been criticized for emitting carbon and destroying the environment. A representative example is the battery, which accounts for about 40% of the manufacturing cost of electric vehicles.

During the battery manufacturing process, a considerable amount of electric energy is consumed, especially in drying and recovering NMP, which is a cause of greenhouse gas emissions. According to one research result, 42 kg of CO2 is generated per kWh due to solvent drying in the wet manufacturing process, and volatile organic compounds (VOCs), which are environmental pollutants, are also emitted into the atmosphere. In contrast, dry electrodes do not have a solvent drying and recovery process, so they consume less electric energy and do not emit VOCs, making them an environmentally friendly process.

In order to increase energy density, a thick film electrode of >100 micrometer or more is required. In the current wet process, it is difficult to make a thick film electrode due to the layer separation phenomenon between the solvent and the material. Since the specific gravity of each material such as the active material, conductive material, and binder is different, if the coating is thick, the binder and conductive material float to the electrode surface. In the wet process, it is difficult to coat the electrode with a thickness of about 100 micrometer or more.

By using a dry process, the active material-conductive material-binder can be evenly distributed without this layer separation phenomenon, so a thick-film electrode can be created, which can increase the capacity and energy density of the battery.

In 2019, Tesla acquired Maxwell Technologies, a supercapacitor company with dry electrode technology, and announced at Battery Day in September 2020 that it would introduce dry electrodes. Tesla sold Maxwell to UCAP in 2021, two years later, but was able to secure dry electrode technology. According to experts who directly obtained and analyzed the Tesla 4680 battery, the battery applied a dry electrode only to the anode, and the existing wet electrode was adopted for the cathode.

It is not known why Tesla has not yet applied the dry electrode process to the cathode, but there is analysis that the yield of the dry electrode process is low and cannot be mass-produced. There are also foreign media reports that the low yield of the 4680 battery is affecting the production of the Cybertruck.

The principle of the dry coating process is simple, but there are considerable challenges at each stage in implementing it in practice. It is not easy to evenly mix the active material, conductive material, and binder without using a solvent. It is even more difficult to evenly apply the non-viscous powder to the current collector. If the yield is low, the production cost increases. Dry electrodes were introduced to reduce costs, but they can actually act as a cost increase factor.

In addition to Tesla, domestic and foreign companies are currently announcing that they are developing a P/P scale dry process, but it is expected that all 46-phi cylindrical batteries to be initially produced will be produced using a wet process. The 4680 battery that LGES will produce in the fourth quarter of 2024 on a P/P scale will apply a wet process to both cathode and anode, and this battery will be supplied to Tesla. Recently, LGES announced that it will complete the construction of a dry electrode process P/P line in the Ochang Energy Plant in the fourth quarter of 2024 and will apply it starting in 2028. Samsung SDI, SK On, Panasonic, CATL, and Kumyang, which recently announced that they are also developing dry electrode technology.

In addition, Volkswagen of Germany announced in June 2023 that it was developing a dry electrode process with Koenig & Bauer, a German printing equipment specialist. Volkswagen plans to start industrial production by 2027. It is not known exactly how Volkswagen and Koenig & Bauer are developing the dry electrode.

The dry process can reduce energy costs by 30% because the drying process is unnecessary, and the area required for drying can be reduced by 50%. The 4680 battery using the dry process can theoretically be cheaper than the LFP battery, but the technology development has not been successful yet.

The introduction of the dry process has great potential as a carbon-neutral process for manufacturing lithium secondary batteries, and the commercialization of dry electrode technology is expected to greatly contribute to reducing battery manufacturing costs while improving performance. Although no company has succeeded in mass production so far, it is very likely that the dry electrode process will become a trend in the near future as major companies are spurring technology development. In addition, the development of the dry electrode process can be applied to the manufacturing process of all-solid-state batteries, which are next-generation batteries. In fact, interest in all-solid-state batteries is increasing both domestically and internationally, and plans for mass production are being established.

This report provides technical information such as the necessity of developing a carbon-neutral process in the secondary battery industry, issues with the existing wet process, and issues with the current dry process, as well as information on recent development trends in dry electrode processes and all-solid-state battery development by many companies, with the aim of forecasting the current and near-future status of the dry process.

Strong Points of This Report:

- 1. Includes rich technical content on the background and development of the dry electrode process

- 2. Includes detailed descriptions of the types of dry electrode processes and electrode process issues

- 3. Includes detailed comparisons of the pros and cons of dry and wet processes as well as battery applications

- 4. Includes detailed technical content on the application of the dry electrode process to the next-generation battery, the all-solid-state battery

- 5. Includes detailed information on the development trends of electrode processes, materials, and equipment companies in the domestic and international industries

- 6. Includes a list of patents related to the dry electrode process of domestic and foreign companies and an analysis of major patents

- 7. Includes research support projects and main contents by country related to dry electrodes

- 8. Includes market outlooks from major research companies on the dry electrode process

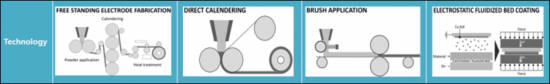

[Difference between dry and wet processes for electrode manufacturing]

| Advantages | Super caps | compact | ||

| Challenges | Risk of segregation | Risk of segregation | Risk of segregation | mixing |

| Key players | Tesla(Maxwell Technologies | Technical Univ. Dresden Fraunhofer IWS | Technical Univ. Dresden Fraunhofer ISIT | Technical Univ. Braunschweig Fraunhofer IPA |

| TRL | 6 | 5 | 4->6 | 4->6 |

| References | US Patent US2006/0133012A1 10/817 590. Apr. 1. 2008. | Germany Patent DE102017208220A1. Nov. 22. 2018. | Proc. Fraunhofer ISIT - Achievements Results Annu. Rep., 2017.pp.32-33 | Energy Technol., vol. 8, no. 2. 2020. Art. no. 1900309 |

Table of Contents

1. Dry Electrode Processes for Thick Film Electrodes in LIBs

- 1.1. The need for carbon-neutral processes in the LIB industry

- 1.1.1. Increased demand for EV due to carbon neutrality regulations

- 1.1.2. Plans to limit carbon emissions and ban sales of ICE vehicles

- 1.1.3. EV transition plans and verticalized secondary battery companies

- 1.1.4. Industry Issues related to carbon neutrality regulations

- 1.1.5. Secondary battery electrode process, costs and energy consumption

- 1.2. The need for thick film electrodes in Li-ion batteries

- 1.3. Wet-based electrode manufacturing process issues

- 1.4. Background on adopting dry processes

- 1.4.1. Historical and technological advances in dry electrode

- 1.4.2. History of key technology developments in dry film

- 1.4.3. Dry electrode technology: overcoming the limitations of wet coatings

- 1.4.4. Dry process and binder development: number of papers and patents

- 1.4.5. Dry process and binder development: patent analysis

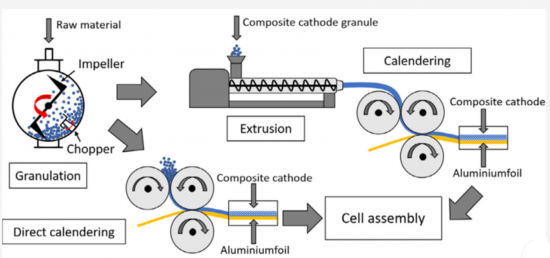

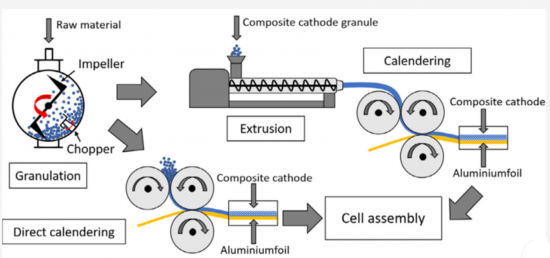

- 1.4.6. Electrode manufacturing with extrusion technology

- 1.4.7. Extrusion and melt processing

- 1.4.8. Melt extrusion: solvent vs. solvent-free application differences

- 1.4.9. Dry electrode application: Tesla anode

- 1.4.10. Dry electrode application: Tesla cathode

- 1.4.11. Dry electrode application: composite cathode

- 1.4.12. Dry electrode application: Pre-lithiation

- 1.4.13. Battery binder characteristics: 7 types compared

- 1.4.14. Types of binders used in dry processes

- 1.4.15. Binder properties used in dry processes

- 1.4.16. Water (PTFE, PAA) vs. oil (PVDF) binders: Performance & tradeoffs

- 1.4.17. Applying PTFE binders

- 1.5. Dry electrode process types

- 1.5.1. Selection of a dry coating process for dry electrodes

- 1.5.2. Comparison and selection of dry coating technologies

- 1.5.3. Dry mixing and coating

- 1.5.4. Comparison of electrochemical behavior of dry and wet electrodes

- 1.5.5. Features of Dry electrode process technologies in LIB application

- 1.5.6. Free standing electrode technology

- 1.5.7. Direct calendaring technology

- 1.5.8. Powder sheeting technology

- 1.5.9. Electrostatic spraying technology

- 1.5.10. Melt deposition technology

- 1.5.11. Powder compaction technology

- 1.5.12. Melt extrusion technology

- 1.6. Issues with dry electrode process

- 1.6.1. Technical hurdles in dry process technology

- 1.6.2. Challenges of dry process in LIB manufacturing

- 1.6.3. Electrical properties of PTFE

- 1.7. Comparison of dry vs. wet processes

- 1.7.1. Comparison of wet and dry process manufacturing technologies

- 1.7.2. Comparison of cell characteristics for dry vs. wet process technologies

- 1.7.3. Disadvantages of the wet process

- 1.7.4. Pros and cons of wet process alternative options

- 1.7.5. Benefits of adopting dry process technology

- 1.7.6. Benefits of adopting dry process technology (speed performance)

- 1.7.7. Benefits of adopting dry process technology (ion channels)

- 1.7.8. Benefits of adopting dry process technology (low cost)

- 1.7.9. Benefits of adopting dry process technology (Machine characteristics)

- 1.7.10. Dry vs. wet characteristics: Applies to cathode, anode

- 1.7.11. Cell performance of electrochemical electrodes

- 1.7.12. Fabrication and characterization of dry electrodes for LIBs

- 1.7.13. Applying dry electrodes : (LFP + CNT + PTFE) cathode

- 1.7.14. Applying dry electrodes : (NCM622 + PVDF) cathode

- 1.7.15. A comprehensive comparison of dry vs. wet process technologies

- 1.8. PTFE fiberization

- 1.8.1. PTFE fiberization reaction

- 1.8.2. PTFE fiberization process

- 1.8.3. PTFE fiberization application

- 1.8.4. Factors affecting PTFE fibrillation

- 1.8.5. Side effects of PTFE binders

- 1.8.6. Blocking the adverse effects of PTFE binders: Graphite surface coat

- 1.8.7. Preparation of graphite anodes by PTFE fiberization method

- 1.8.8. Developing PTFE modified materials

- 1.8.9. Innovative technologies and systems for PTFE-based cells

2. Next Secondary Battery (All-Solid-State Battery) Dry Electrode Processes

- 2.1. Global development trends of solid-state batteries

- 2.1.1. Types and the system configurations of solid-state batteries

- 2.1.2. Design and solutions for high energy density LIBs

- 2.1.3. Dry composite cathode manufacturing methods

- 2.1.4. Overseas all-solid-state battery development trends

- 2.1.5. Korean all-solid-state battery development trends

- 2.2. The need for adopting dry electrode process in solid-state batteries

- 2.3. Examples of dry electrode process applications in solid-state batteries

- 2.3.1. Korean and international companies

- 2.3.2. Korean and international papers

- 2.3.3. Li-S batteries with PTFE

- 2.3.4. Cobalt-free (LNMO) cells with PTFE

- 2.3.5. Solid-state batteries with PTFE (sulfide, oxide, halide)

- 2.3.6. Solid-state electrolyte membranes for solid-state batteries with PTFE

- 2.3.7. Application of inorganic solid electrolytes

- 2.3.8. Application of polymeric solid-state electrolytes

- 2.3.9. Solid-state batteries with dry process (400 Wh/kg)

- 2.3.10. Solid-state batteries with dry process (energy density comparison)

3. Development Trends by Company

- 3.1. Dry electrode process development trends in Korean and international industry

- 3.1.1. International dry process development trends

- 3.1.2. Korean dry process development trends

- 3.1.3. Challenges to dry electrode processes

- 3.1.4. Pros and cons of the dry electrode process

- 3.2. Korean company development trends

- 3.2.1. LG Energy Solutions

- 3.2.2. Samsung SDI

- 3.2.3. SK On

- 3.2.4. Cosmos Lab

- 3.2.5. CNP Solutions

- 3.3. Overseas company development trends

- 3.3.1. TESLA

- 3.3.2. Sakuu (USA)

- 3.3.3. Anaphite (UK)

- 3.3.4. LiCap Technology (USA)

- 3.3.5. AM Batteries (USA)

- 3.3.6. PowerCo SE

- 3.3.7. Dragonfly Energy (USA)

- 3.3.8. ZEON

- 3.3.9. Daikin

- 3.3.10. Chemours (USA)

- 3.3.11. Huacai Technology (China)

- 3.3.12. Baosheng Energy Technology (China)

- 3.3.13. Li Yuanheng (China)

- 3.4. Equipment manufacturer development trends

- 3.4.1. Hanwha Momentum

- 3.4.2. CIS

- 3.4.3. PNT

- 3.4.4. Yunsung F&C

- 3.4.5. NainTech

- 3.4.6. GITech (Korea)

- 3.4.7. KATOP (China)

- 3.4.8. Shanghai Lianjing Automation Technology

- 3.4.9. TOB New battery

- 3.4.10. TMAX Battery Equipment

- 3.4.11. Shenzhen Tsingyan Electronic Technology

- 3.4.12. Huacai Technology

- 3.4.13. ATEIOS System (USA)

- 3.4.14. EIRICH (Germany)

- 3.4.15. Fraunhofer IWS

- 3.5. Development trends in academic and research institutions

- 3.5.1. Korea Institute of Energy Technology

- 3.5.2. Yonsei University

- 3.5.3. Korea University

- 3.5.4. Ulsan Institute of Science and Technology

- 3.5.5. Sungkyunkwan University

- 3.5.6. Gacheon University

- 3.5.7. Fraunhofer ISIT

- 3.5.8. Karlsruhe Institute of Technology (KIT)

- 3.5.9. Dry Coating Forum

4. Patent Analysis

- 4.1. Overseas dry process development patents

- 4.1.1. Overseas dry process development patent list

- 4.1.2. Maxwell Technologies

- 4.1.3. Fraunhofer IWS

- 4.1.4. TESLA

- 4.1.5. Licap New Energy Technologies

- 4.1.6. Dragonfly Energy

- 4.1.7. Anaphite Ltd

- 4.2. Korean dry process development patents

- 4.2.1. LG Chem, LG Energy Solution patents

- 4.2.2. Samsung SDI

- 4.2.3. SK On

- 4.2.4. Hyundai Kia

- 4.2.5. Yunsung F&C

- 4.2.6. Cosmos Lab

- 4.2.7. Korea Ceramic Technology Institute

5. Research Projects by Country

- 5.1. US DOE projects

- 5.1.1. Oak Ridge National Lab

- 5.1.2. NAVITAS Systems

- 5.2. EU projects

- 5.2.1. ELIBAMA program

- 5.2.2. HORIZON Europe : NOVOC project

- 5.2.3. Horizon Europe : BatWoMan

- 5.3. Korean national projects

- 5.3.1. Ministry of Trade and Industry

- 5.3.2. Ministry of Education

- 5.3.3. Ministry of Science and Technology

- 5.3.4. Ministry of Economy and Finance

6. Market outlook (research outlook)

- 6.1. SNE Research

- 6.2. EV Tank

- 6.3. ESP Analysis

- 6.4. Industry ARC

- 6.5. QY Research

- 6.6. Verified Market Reports