|

|

市場調査レポート

商品コード

1443437

LIB向けSi負極技術の現状と見通し(~2035年)<2024> LIB Si-Anode Technology Status and Outlook (~2035) |

||||||

|

|||||||

| LIB向けSi負極技術の現状と見通し(~2035年) |

|

出版日: 2024年02月21日

発行: SNE Research

ページ情報: 英文 539 Pages

納期: お問合せ

|

全表示

- 概要

- 目次

リチウムイオンバッテリーの負極材料は、今日まで炭素系が主流です。初期は非晶質炭素材料が広く使われていましたが、現在は天然黒鉛と合成黒鉛が主な選択肢となっています。近年の動向では、黒鉛材料の理論的容量限界を克服し、優れた電気化学反応性と長寿命を有する材料を開発するため、特にシリコン(Si)を中心とした新しい負極材料の検討が活発に行われています。特に電気自動車やエネルギー貯蔵システムに使用される大型バッテリー市場では、高容量負極材料の需要が高まっています。従来は炭素系負極材料や黒鉛系負極材料が主流でしたが、特に業界内では金属複合材料であるシリコン系負極材料への注目が高まっています。高容量負極のニーズが高まるにつれ、これらの材料を確保するための競合は激化しています。このような状況の中、シリコン系負極材料を開発し製造する新規参入企業は増加の一途をたどっています。

2020年初頭の時点では、シリコン系高容量材料の開発は主に10~20社にとどまっていました。しかし現在の情勢を見ると、60社超がシリコン系材料の開発と量産準備に積極的に取り組んでいます。シリコン系材料は、電気自動車の航続距離の限界に対処し、急速充電機能の需要を満たす高容量バッテリーの開発に不可欠です。電気自動車OEMとバッテリー企業は、2035年までシリコン負極材料の年間成長率が30%になると予測しています。負極材料市場全体におけるシリコン負極材料の市場シェアは、2019年の1%から2030年までに7%、さらに2035年までに10%に拡大すると予測されます。

炭素系、黒鉛系に加え、Si-C複合材料、Si合金、SiOxがリチウムイオンバッテリーの代表的な高容量負極材料です。中でもSiOxとSi合金は実用化にもっとも近い材料であり、一部のバッテリーメーカーは積極的にSiOxとSi合金を組み込んだ高容量バッテリーを開発しています。しかし、寿命や体積膨張(スエリング)などの課題は依然として残っており、これらの課題に対処するための活動が続けられています。シリコン(Si)系負極の領域では、近年の関連技術の動向について産学双方から発表がありました。

当レポートでは、xEV(電気自動車)、ESS(エネルギー貯蔵システム)、IT用途に使用されるリチウムイオンバッテリー向け負極材料の市場について調査分析し、Si系負極開発の技術の進歩と性能の向上、Si系高容量負極材料(Si合金、SiOx、Si-C複合材料)の産学双方における最新の開発状況などの情報を提供しています。

目次

レポートの概要

第1章 LIBの概要

- LIBの実績

- LIBの種類と特徴

- LIBの原理

- LIBのコンポーネント

- LIBの応用分野

- 負極材料の技術の現状と開発動向

第2章 LIB負極材料の種類と特徴

- 求められる特性とLIB負極材料の種類

- 炭素系負極材料の特性

- 金属系負極材料の特性

- 化合物系負極材料の特性

第3章 リチウムイオンバッテリー向け高容量Si系負極材料の技術開発の現状

- 高容量リチウムイオンバッテリーの開発経緯と方向性

- 高容量Si系負極材料の基本特性

- 合金系負極材料の問題点と解決策

- 高容量Si負極材料の技術開発の動向

第4章 高出力Si系負極材料の技術開発の現状

- 高出力負極材料の概要

- 高出力急速充電向け負極材料

- 負極の観点から見た急速充電

第5章 LIB負極材料市場の動向と見通し

- LIB負極材料市場の現状

- 負極材料の需要:国別

- 負極材料の需要:材料別

- 市場情勢:サプライヤー別

- 負極材料の需要:LIB企業別

- LIB負極材料の供給の見通し

- 負極材料の生産能力の見通し

- 負極材料の出荷数の現状と見通し

- 負極材料の供給の見通し

- LIB負極材料の価格の見通し

- 負極材料の価格構造

- NG/AG/Si系

- 負極材料の価格動向

- NG/AG/Si系

- 各種黒鉛の価格状況

- ニードルコークスとピッチの価格状況

- 価格の見通し:負極材料サプライヤー別

- 負極材料の価格構造

第6章 LIB負極材料メーカーの現状

- LIB負極材料企業の概要

- LIB負極材料メーカーの現状

黒鉛/カーボン系負極材料メーカー

- 1. BTR

- 2. Shanshan

- 3. Zichen

- 4. Shinzoom (Changsha Xingcheng)

- 5. Kaijin

- 6. XFH (XiangFengHua)

- 7. Hitachi Chemical (Resonac)

- 8. Mitsubishi Chemical

- 9. JFE Chemical

- 10. POSCO FutureM

- 11. Aekyung Chemical

Si系負極材料メーカー(韓国/アジア)

- 12. Daejoo Electronic Materials

- 13. Shin-Etsu

- 14. MK Electronics

- 15. Il-jin Electric

- 16. EG

- 17. Hansol Chemical

- 18. Innox Eco Chemical

- 19. FIC Advanced Materials

- 20. LPN

- 21. Osaka Titan

- 22. POSCO Silicon Solution

- 23. TCK ((TOKAI CARBON KOREA)

- 24. NM Tech (Acquired by Truewin)

- 25. KBG

- 26. Neo Battery Materials

- 27. Korea Metal Silicon

- 28. EN PLUS

- 29. Lotte Energy Materials

- 30. Dong-jin Semichem

- 31. SJ Advanced Materials

- 32. IEL Science

- 33. S Materials

- 34. HNS

- 35. Y-Fine Tech

- 36. Hana Materials

Si系負極材料メーカー(中国)

- 37. Haoxin Tech

- 38. Longtime Tech

- 39. Gotion

- 40. Shinghwa

- 41. Tianmulake

- 42. Chengdu Guibao

- 43. Jereh

- 44. Huawei

- 45. Xinan

- 46. Kingi

Si系負極材料メーカー(北米、欧州)

- 47. Group14 (With SK Materials)

- 48. NEXEON (With SKC)

- 49. Sila Nano Technologies

- 50. Enovix

- 51. Enervate

- 52. EO Cell

- 53. Amprius Technologies

- 54. Nanotek' Instrument

- 55. One D

- 56. Nanograf

- 57. LeydenJar

- 58. ADVANO

- 59. Targray

- 60. StoreDot

- 61. Trion Battery

- 62. Black Diamond Structures

- 63. Nanospan

第7章 参考文献

The anode material for lithium-ion batteries has predominantly been carbon-based to date. In the early stages, amorphous carbon materials were widely used, but presently, natural and synthetic graphite are the primary choices. Recently, there has been active consideration of new anode materials, particularly those centered around silicon (Si), to overcome the theoretical capacity limits of graphite materials and develop materials with excellent electrochemical reaction potential and extended lifespan. The demand for high-capacity anode materials has been increasing, particularly in the market for large-scale batteries used in electric vehicles and energy storage systems. While carbon and graphite-based anode materials were traditionally prevalent, there is a growing focus, especially within the industry, on silicon-based anode materials, which are metal composites. The competition to secure these materials has intensified as the need for high-capacity anode rises. In this context, there is a continual increase in new entrants developing and manufacturing silicon-based anode materials.

As of early 2020, silicon-based high-capacity materials were primarily developed by only 10-20 companies. However, the current landscape shows that over 60 companies are actively engaged in the development and preparation for mass production of silicon-based materials. Silicon-based materials are essential for the development of high-capacity batteries to address the range limitations of electric vehicles and meet the demand for fast-charging capabilities. Electric vehicle OEMs and battery companies anticipate a projected annual growth rate of 30% for silicon anode materials until 2035. The market share of silicon anode materials in the overall anode material market is expected to expand from 1% in 2019 to 7% in 2030 and further to 10% by 2035.

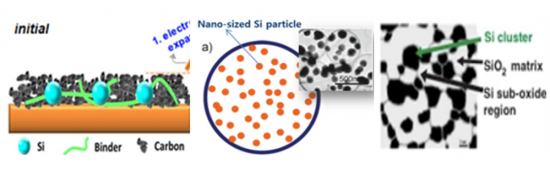

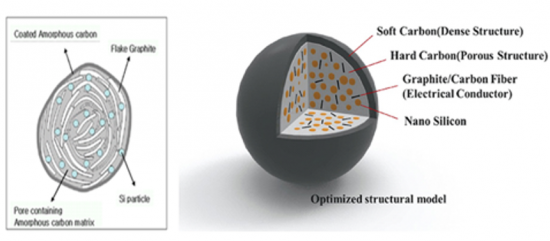

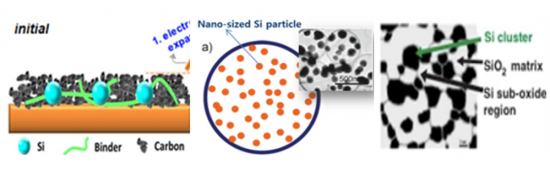

In addition to carbon-based and graphite-based materials, Si-C composite, Si-alloy, and SiOx are representative high-capacity anode materials for lithium-ion batteries. Among these, SiOx and Si-alloy are the closest to commercialization, with some battery manufacturers actively developing high-capacity batteries by incorporating them. However, challenges such as lifespan and volume expansion (swelling) persist, prompting ongoing efforts to address these issues. In the realm of silicon (Si)-based anodes, recent announcements of related technological developments have been made by both industry and academia. Anode material companies are also concentrating on new technology development, fostering expectations for imminent commercialization.

This report serves as a technical document focusing on recent developments in the anode material market for lithium-ion batteries used in xEV (electric vehicles), ESS (energy storage systems), and IT applications. Specifically, it delves into the technological advancements and performance enhancements in Si-based anode development for high-capacity batteries. The report provides an overview of the latest developments in Si-based high-capacity anode materials (Si-alloy, SiOx, Si-C composite) by both industry and academia. It also examines the current status and challenges associated with batteries incorporating these materials, aiming to offer insights and potential solutions for future developments in high-capacity/high-output battery technologies.

Strong Point of this report:

- 1. Overall market share and technological status of anode materials for lithium-ion batteries. (including graphite-based and silicon-based materials.)

- 2. Technical issues and key technological factors related to high-capacity silicon-based anode materials.

- 3. Recent technological developments in silicon-based anode materials by battery manufacturers.

- 4. Applications and commercialization prospects for future silicon-based anode materials.

- 5. Technological trends and product introductions from over 70 global silicon-based anode material companies.

Table of Contents

Report Overview

Chapter I. Overview of LIBs

- 1.1. History of LIBs

- 1.2. Types and Characteristics of LIBs

- 1.3. Principle of LIBs

- 1.3.1. Charging / Discharging Reactions

- 1.3.2. Voltage

- 1.3.3. Movement of Charge and Ions

- 1.3.4. Theoretical Capacity

- 1.4. Components of LIBs

- 1.4.1. Cathode active materials

- 1.4.2. Anode active materials

- 1.4.3. Seperator

- 1.4.4. Electrolyte

- 1.5. Application areas of LIBs

- 1.6. Technology Status and Development Trend of Anode Materials

Chapter II. Types and Characteristics of LIB Anode Materials

- 2.1. Required Characteristics and Types of LIB Anode Materials

- 2.2. Characteristics of Carbon-based Anode Materials

- 2.2.1. Graphite-based Anode Materials

- 2.2.2. Amorphous Carbon-based Anode Materials

- 2.2.3. Carbon-based Anode Materials / Electrolyte Interfacial Reaction

- 2.3. Characteristics of Metal-based Anode Materials

- 2.3.1. Lithium Metal Anode Materials

- 2.3.2. Alloy-based Anode Materials

- 2.4. Characteristics of Compound-Based Anode Materials

- 2.4.1. Oxide-Based Anode Materials

- 2.4.2. Nitride-Based Anode Materials

Chapter III. Current Status of Technological Development for High-Capacity Si-Based Anode Materials for Lithium-ion Batteries

- 3.1. Development History and Direction of High-Capacity Lithium-ion Batteries

- 3.2. Basic Characteristics of High-Capacity Si-based Anode Materials

- 3.2.1. Lithium Insertion/Extraction Reactions of Si-based Anode Materials

- 3.2.2. Issues of Si-based Anode Materials and Degradation Mechanisms

- 3.2.3. Volume Expansion Control of Si-based Anode Materials

- 3.3. Problems and Solutions for Alloy-based Anode Materials

- 3.3.1. Representative Problems

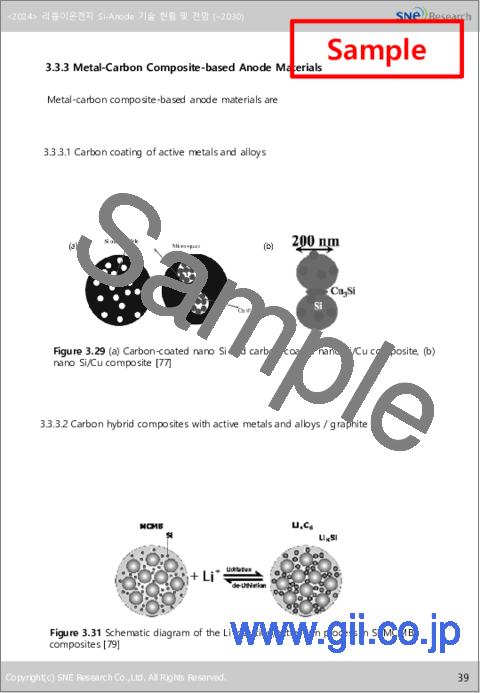

- 3.3.2. Metal Composite-based Anode Materials

- 3.3.3. Metal-Carbon Composite-based Anode Materials

- 3.3. Trends in the Technological Development of High-Capacity Si Anode Materials

- 3.3.1. SiOx Anode Materials

- Structural Characteristics

- Electrochemical Properties

- Manufacturing Methods

- Application of Prelithiation Process

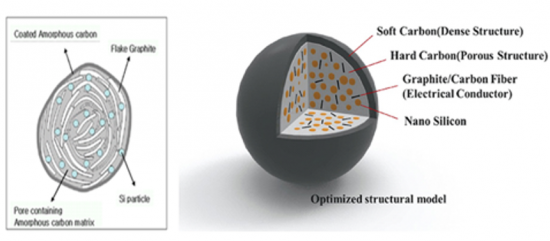

- 3.3.2. Si-C Composite Anode Materials

- 3.3.3. Si-M Alloy Anode Materials

- 3.3.4. Practical Application Research of Si Anode Materials

- Differences of Electrochemical Behavior

- Si Single Electrode and Si/Graphite Hybrid Electrode

- 3.3.5. Various Nanostructures of Si-based Anode Materials

- Si nanostructure

- Porous Si structure

- Nano-Si/C structure

- Nano-Si/metal or polymer structure

- 3.3.6. Binders for Si-based Anode Materials

- 3.3.7. Current Collectors for Si-based Anode Materials

- 3.3.8. Comprehensive Review of Research Trends in Si-based Anodes and Future Research Directions

- 3.3.9. Examples of Si-based Anode Material Developments in Academic/Industries

- 3.3.10. Key Technology Roadmap for Si-Based Anode Materials

- 3.3.1. SiOx Anode Materials

Chapter IV. Current Status of High-Output Si-Based Anode Material Technology Development

- 4.1. Overview of High-Output Anode Materials

- 4.2. Anode Materials for High-Output Fast Charging

- 4.2.1. Intercalation Materials

- 4.2.2. Alloy-based Materials / Transition Materials

- 4.2.3. Nano-Structured Micro-Sized Particles (Nano-structured micro-sized particles)

- 4.2.4. Si-Graphite Hybrid Materials (SEAG)

- 4.2.5. Graphene-SiO2 Materials (Graphene Ball)

- 4.3. Fast Charging from Anode Perspective

- 4.3.1. Factors Influencing Anode Materials (Active Materials)

- 4.3.2. Factors Influencing Electrodes

- 4.3.3. Design of Fast Charging Technology by Major Battery Companies

- 4.4.4. Summary and Future Outlook

Chapter V. Trends and Outlook in the LIB Anode Material Market

- 5.1. Current Status of LIB Anode Material Market

- 5.1.1. Demand for Anode Materials by Country

- 5.1.2. Demand for Anode Materials by Material Type

- 5.1.3. Market Status by Supplier

- 5.1.4. Demand for Anode Materials by LIB Companies

- SDI/LGES/SKon/Panasonic/CATL/ATL/BYD/Lishen/Guoxuan/AESC/CALB

- 5.2. Supply Outlook for LIB Anode Materials

- 5.2.1. Outlook of Anode Material Production Capacity

- 5.2.2. Status and Outlook of Anode Material Shipments

- 5.2.3. Supply Outlook for Anode Materials

- 5.3. Price Outlook for LIB Anode Materials

- 5.3.1. Anode Material Price Structure

- NG/AG/Si-based

- 5.3.2. Anode Material Price Trends

- NG/AG/Si-based

- 5.3.3. Price Status of Different Types of Graphite

- 5.3.4. Price Status of Needle Coke and Pitch

- 5.3.5. Price Outlook by Anode Material Suppliers

- 5.3.1. Anode Material Price Structure

Chapter VI. Current Status of LIB Anode Material Manufacturers

- 6.1. Summary of LIB Anode Material Companies

- 6.2. Current Status of LIB Anode Material Manufacturers

Graphite/Carbon-Based Anode Material Manufacturers

- 1. BTR

- 2. Shanshan

- 3. Zichen

- 4. Shinzoom(Changsha Xingcheng)

- 5. Kaijin

- 6. XFH(XiangFengHua)

- 7. Hitachi Chemical(Resonac)

- 8. Mitsubishi Chemical

- 9. JFE Chemical

- 10. POSCO FutureM

- 11. Aekyung Chemical

Si-based Anode Material Manufacturers (Korean/Asian)

- 12. Daejoo Electronic Materials

- 13. Shin-Etsu

- 14. MK Electronics

- 15. Il-jin Electric

- 16. EG

- 17. Hansol Chemical

- 18. Innox Eco Chemical

- 19. FIC Advanced Materials

- 20. LPN

- 21. Osaka Titan

- 22. POSCO Silicon Solution

- 23. TCK((TOKAI CARBON KOREA)

- 24. NM Tech(Acquired by Truewin)

- 25. KBG

- 26. Neo Battery Materials

- 27. Korea Metal Silicon

- 28. EN PLUS

- 29. Lotte Energy Materials

- 30. Dong-jin Semichem

- 31. SJ Advanced Materials

- 32. IEL Science

- 33. S Materials

- 34. HNS

- 35. Y-Fine Tech

- 36. Hana Materials

Si-Based Anode Material Manufacturers (Chinese)

- 37. Haoxin Tech

- 38. Longtime Tech

- 39. Gotion

- 40. Shinghwa

- 41. Tianmulake

- 42. Chengdu Guibao

- 43. Jereh

- 44. Huawei

- 45. Xinan

- 46. Kingi

Si-based Anode Material Manufacturers (North America, Europe)

- 47. Group14 (With SK Materials)

- 48. NEXEON (With SKC)

- 49. Sila Nano Technologies

- 50. Enovix

- 51. Enervate

- 52. EO Cell

- 53. Amprius Technologies

- 54. Nanotek' Instrument

- 55. One D

- 56. Nanograf

- 57. LeydenJar

- 58. ADVANO

- 59. Targray

- 60. StoreDot

- 61. Trion Battery

- 62. Black Diamond Structures

- 63. Nanospan