|

|

市場調査レポート

商品コード

1625292

シルク市場の2030年までの予測:製品別、生産工程別、用途別、地域別の世界分析Silk Market Forecasts to 2030 - Global Analysis By Product (Mulberry Silk, Tussar Silk, Eri Silk, Muga Silk, Spider Silk and Other Products), Production Process, Application and By Geography |

||||||

カスタマイズ可能

|

|||||||

| シルク市場の2030年までの予測:製品別、生産工程別、用途別、地域別の世界分析 |

|

出版日: 2025年01月01日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界のシルク市場は2024年に223億米ドルを占め、予測期間中にCAGR 9.8%で成長し、2030年には392億米ドルに達すると予想されています。

シルクは、主にカイコ(Bombyx mori moth)の幼虫から生産される天然繊維です。その柔らかさ、滑らかな肌触り、光沢のある外観で知られ、繊維製品として高く評価されています。絹繊維はフィブロインという、強靭でありながら軽量で柔軟なタンパク質で構成されています。4,000年以上前に中国で生まれた絹の生産は、養蚕として知られ、世界的に広まりました。この生地は、その高級感と耐久性からファッション界で高い人気を誇り、その多用途性は家庭用家具、医療用縫合糸、工業用にも及んでいます。

高級繊維製品への需要の高まり

エレガンスと贅沢の象徴であるシルクは、デザイナーズドレスやイブニングウェアを含む高級衣料品の素材として人気があります。特に新興市場におけるシルクベースの衣料品に対する需要の増加は、富裕層消費者の増加によるものであり、その贅沢な質感と外観からブライダルウェアや特別な日のための衣料品としても人気があります。ファッションハウスやデザイナーはシルクを使用したコレクションを拡大し、限定生産の高級衣料品への需要を後押ししており、ユニークで高品質、かつ審美的に魅力的な衣料品を求める消費者の嗜好に合致しています。

労働集約的な生産工程

伝統的な方法であるシルクの生産は時間がかかり、品質を保証するために多大な人手を必要とします。合成繊維とは異なり、シルクの生産には時間がかかり、熟練した労働力が必要です。養蚕地域は熟練労働者に大きく依存していますが、熟練労働者の数は限られていることが多く、新しい労働者の育成には時間がかかります。このため、シルク生産の拡張性や市場の需要に迅速に対応する能力が制限されています。

環境に優しい天然繊維の人気の高まり

天然タンパク質繊維であるシルクは、ポリエステルなどの合成繊維に代わる持続可能な繊維として人気を集めています。合成繊維の環境への影響に対する懸念が高まる中、シルクは環境に優しい高級品として注目されています。調達の透明性とシルク生産の環境上の利点を強調するブランドは、シルクを環境意識の高い消費者にとって贅沢でありながら責任ある選択肢として位置づけ、シルク市場に利益をもたらしています。

合成繊維との競合

合成繊維は、その汎用性、性能の利点、メンテナンスの容易さにより人気が高まっており、生地技術の進歩により、ファッショナブルで現代的と見られています。合成繊維は実用的で、手入れが簡単で、さまざまな色、質感、仕上げがあります。吸湿発散性、伸縮性、防シワ性などの革新的な機能により、アクティブウェア、スポーツウェア、カジュアルウェアに人気があります。このため、シルクのようなデリケートな素材の需要が減少し、市場の成長を妨げています。

COVID-19の影響

COVID-19の大流行はシルク市場に大きな影響を与え、操業停止や労働力不足により生産とサプライチェーンが混乱しました。消費者が必需品を優先したため、シルクを含む高級品の需要も減少しました。さらに、国際貿易規制がシルクの輸出を妨げ、市場の成長にさらに影響を与えました。しかし、世界経済が再開し、パンデミック後の高級織物に対する需要が回復し始めると、市場は回復の兆しを見せました。

予測期間中、タッサーシルク分野が最大になると予想される

タッサーシルクは桑絹に代わるユニークであまり商業的に生産されていないシルクを提供し、ユニークで環境に優しいテキスタイルを求める消費者に応えるため、予測期間中最大になると予想されます。その素朴で有機的な外観は、民族衣装や伝統的な衣服で評価され、ニッチな顧客層を引き付けています。タッサーシルクはファッションやインテリアデザインに使用されることで、特に大量生産よりも独自性を優先するバイヤーにとって魅力が高まっています。

織物部門は予測期間中最も高いCAGRが見込まれます。

伝統的な手織機と近代的な機械化織機では生産規模が異なるため、予測期間中、織物分野のCAGRが最も高くなると予想されます。伝統的な手法では複雑なデザインが可能であるのに対し、機械化織機では低コストでの大量生産が可能です。しかし、一部のシルク市場セグメントでは機械化織物へのシフトが生地の真正性や独自性を低下させ、高級志向のバイヤーへのアピールに影響を与える可能性があります。

最大のシェアを持つ地域:

北米では持続可能で倫理的に生産された生地に対する動向が高まっているため、予測期間中、北米が最大の市場シェアを占めると予想されます。消費者は環境に優しい素材にシフトしており、シルクのような天然繊維の需要が増加しています。倫理的な生産慣行、公正な賃金、持続可能性は、環境意識の高いバイヤーと共鳴しています。北米の消費者は、持続可能性と倫理的な調達を優先するシルクブランドに目を向けており、環境に配慮したシルク製品市場に利益をもたらしています。

CAGRが最も高い地域:

アジア太平洋地域は、中国、インド、日本、韓国などの国々におけるシルク消費の増加により、予測期間中最も高いCAGRを維持すると予想されます。シルクは贅沢、伝統、文化遺産と関連しており、特にインドでは婚礼衣装や伝統的な服装に使用されています。これらの国々では中産階級が増加し、可処分所得が増加しているため、高級衣料品、寝具、アクセサリーなどの贅沢で高級なシルク製品に対する需要が急増しています。この動向は日本や韓国でも見られ、シルクは豪華さと品質の象徴であり続けています。

無料のカスタマイズサービス:

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご提供いたします:

- 企業プロファイル

- 追加市場企業の包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査情報源

- 1次調査情報源

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 製品分析

- 用途分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界のシルク市場:製品別

- マルベリーシルク

- タッサーシルク

- エリシルク

- ムガシルク

- クモの糸

- その他の製品

第6章 世界のシルク市場:生産工程別

- 養蚕

- 巻き上げ

- 製糸

- 織り

- その他の製造工程

第7章 世界のシルク市場:用途別

- 繊維・アパレル

- 家庭用家具

- 外科用縫合糸および創傷被覆材

- 化粧品・パーソナルケア

- 高級品・アクセサリー

- その他の用途

第8章 世界のシルク市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第9章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第10章 企業プロファイリング

- AM Silk GmbH

- Anhui Silk Co. Ltd.

- Bolt Threads

- China Silk Corporation

- Entogenetics Inc

- Jiangsu Sutong Cocoon And Silk Co.

- Jinchengjiang Xinxing Cocoon Silk Co., Ltd.

- Kraig Biocraft Laboratories, Inc.

- Libas Textiles Ltd.

- ShengKun Silk Manufacturing Co., Ltd.

- Sichuan Nanchong Liuhe(Group)Corp.

- Silk India international Ltd.

- Wensli Group Co. Ltd.

- Wujiang First Textile Co., Ltd.

- Zhejiang Jiaxin Silk Co., Ltd.

List of Tables

- Table 1 Global Silk Market Outlook, By Region (2022-2030) ($MN)

- Table 2 Global Silk Market Outlook, By Product (2022-2030) ($MN)

- Table 3 Global Silk Market Outlook, By Mulberry Silk (2022-2030) ($MN)

- Table 4 Global Silk Market Outlook, By Tussar Silk (2022-2030) ($MN)

- Table 5 Global Silk Market Outlook, By Eri Silk (2022-2030) ($MN)

- Table 6 Global Silk Market Outlook, By Muga Silk (2022-2030) ($MN)

- Table 7 Global Silk Market Outlook, By Spider Silk (2022-2030) ($MN)

- Table 8 Global Silk Market Outlook, By Other Products (2022-2030) ($MN)

- Table 9 Global Silk Market Outlook, By Production Process (2022-2030) ($MN)

- Table 10 Global Silk Market Outlook, By Sericulture (2022-2030) ($MN)

- Table 11 Global Silk Market Outlook, By Reeling (2022-2030) ($MN)

- Table 12 Global Silk Market Outlook, By Throwing (2022-2030) ($MN)

- Table 13 Global Silk Market Outlook, By Weaving (2022-2030) ($MN)

- Table 14 Global Silk Market Outlook, By Other Production Processes (2022-2030) ($MN)

- Table 15 Global Silk Market Outlook, By Application (2022-2030) ($MN)

- Table 16 Global Silk Market Outlook, By Textiles & Apparel (2022-2030) ($MN)

- Table 17 Global Silk Market Outlook, By Home Furnishings (2022-2030) ($MN)

- Table 18 Global Silk Market Outlook, By Surgical Sutures & Wound Dressings (2022-2030) ($MN)

- Table 19 Global Silk Market Outlook, By Cosmetics & Personal Care (2022-2030) ($MN)

- Table 20 Global Silk Market Outlook, By Luxury Goods & Accessories (2022-2030) ($MN)

- Table 21 Global Silk Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 22 North America Silk Market Outlook, By Country (2022-2030) ($MN)

- Table 23 North America Silk Market Outlook, By Product (2022-2030) ($MN)

- Table 24 North America Silk Market Outlook, By Mulberry Silk (2022-2030) ($MN)

- Table 25 North America Silk Market Outlook, By Tussar Silk (2022-2030) ($MN)

- Table 26 North America Silk Market Outlook, By Eri Silk (2022-2030) ($MN)

- Table 27 North America Silk Market Outlook, By Muga Silk (2022-2030) ($MN)

- Table 28 North America Silk Market Outlook, By Spider Silk (2022-2030) ($MN)

- Table 29 North America Silk Market Outlook, By Other Products (2022-2030) ($MN)

- Table 30 North America Silk Market Outlook, By Production Process (2022-2030) ($MN)

- Table 31 North America Silk Market Outlook, By Sericulture (2022-2030) ($MN)

- Table 32 North America Silk Market Outlook, By Reeling (2022-2030) ($MN)

- Table 33 North America Silk Market Outlook, By Throwing (2022-2030) ($MN)

- Table 34 North America Silk Market Outlook, By Weaving (2022-2030) ($MN)

- Table 35 North America Silk Market Outlook, By Other Production Processes (2022-2030) ($MN)

- Table 36 North America Silk Market Outlook, By Application (2022-2030) ($MN)

- Table 37 North America Silk Market Outlook, By Textiles & Apparel (2022-2030) ($MN)

- Table 38 North America Silk Market Outlook, By Home Furnishings (2022-2030) ($MN)

- Table 39 North America Silk Market Outlook, By Surgical Sutures & Wound Dressings (2022-2030) ($MN)

- Table 40 North America Silk Market Outlook, By Cosmetics & Personal Care (2022-2030) ($MN)

- Table 41 North America Silk Market Outlook, By Luxury Goods & Accessories (2022-2030) ($MN)

- Table 42 North America Silk Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 43 Europe Silk Market Outlook, By Country (2022-2030) ($MN)

- Table 44 Europe Silk Market Outlook, By Product (2022-2030) ($MN)

- Table 45 Europe Silk Market Outlook, By Mulberry Silk (2022-2030) ($MN)

- Table 46 Europe Silk Market Outlook, By Tussar Silk (2022-2030) ($MN)

- Table 47 Europe Silk Market Outlook, By Eri Silk (2022-2030) ($MN)

- Table 48 Europe Silk Market Outlook, By Muga Silk (2022-2030) ($MN)

- Table 49 Europe Silk Market Outlook, By Spider Silk (2022-2030) ($MN)

- Table 50 Europe Silk Market Outlook, By Other Products (2022-2030) ($MN)

- Table 51 Europe Silk Market Outlook, By Production Process (2022-2030) ($MN)

- Table 52 Europe Silk Market Outlook, By Sericulture (2022-2030) ($MN)

- Table 53 Europe Silk Market Outlook, By Reeling (2022-2030) ($MN)

- Table 54 Europe Silk Market Outlook, By Throwing (2022-2030) ($MN)

- Table 55 Europe Silk Market Outlook, By Weaving (2022-2030) ($MN)

- Table 56 Europe Silk Market Outlook, By Other Production Processes (2022-2030) ($MN)

- Table 57 Europe Silk Market Outlook, By Application (2022-2030) ($MN)

- Table 58 Europe Silk Market Outlook, By Textiles & Apparel (2022-2030) ($MN)

- Table 59 Europe Silk Market Outlook, By Home Furnishings (2022-2030) ($MN)

- Table 60 Europe Silk Market Outlook, By Surgical Sutures & Wound Dressings (2022-2030) ($MN)

- Table 61 Europe Silk Market Outlook, By Cosmetics & Personal Care (2022-2030) ($MN)

- Table 62 Europe Silk Market Outlook, By Luxury Goods & Accessories (2022-2030) ($MN)

- Table 63 Europe Silk Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 64 Asia Pacific Silk Market Outlook, By Country (2022-2030) ($MN)

- Table 65 Asia Pacific Silk Market Outlook, By Product (2022-2030) ($MN)

- Table 66 Asia Pacific Silk Market Outlook, By Mulberry Silk (2022-2030) ($MN)

- Table 67 Asia Pacific Silk Market Outlook, By Tussar Silk (2022-2030) ($MN)

- Table 68 Asia Pacific Silk Market Outlook, By Eri Silk (2022-2030) ($MN)

- Table 69 Asia Pacific Silk Market Outlook, By Muga Silk (2022-2030) ($MN)

- Table 70 Asia Pacific Silk Market Outlook, By Spider Silk (2022-2030) ($MN)

- Table 71 Asia Pacific Silk Market Outlook, By Other Products (2022-2030) ($MN)

- Table 72 Asia Pacific Silk Market Outlook, By Production Process (2022-2030) ($MN)

- Table 73 Asia Pacific Silk Market Outlook, By Sericulture (2022-2030) ($MN)

- Table 74 Asia Pacific Silk Market Outlook, By Reeling (2022-2030) ($MN)

- Table 75 Asia Pacific Silk Market Outlook, By Throwing (2022-2030) ($MN)

- Table 76 Asia Pacific Silk Market Outlook, By Weaving (2022-2030) ($MN)

- Table 77 Asia Pacific Silk Market Outlook, By Other Production Processes (2022-2030) ($MN)

- Table 78 Asia Pacific Silk Market Outlook, By Application (2022-2030) ($MN)

- Table 79 Asia Pacific Silk Market Outlook, By Textiles & Apparel (2022-2030) ($MN)

- Table 80 Asia Pacific Silk Market Outlook, By Home Furnishings (2022-2030) ($MN)

- Table 81 Asia Pacific Silk Market Outlook, By Surgical Sutures & Wound Dressings (2022-2030) ($MN)

- Table 82 Asia Pacific Silk Market Outlook, By Cosmetics & Personal Care (2022-2030) ($MN)

- Table 83 Asia Pacific Silk Market Outlook, By Luxury Goods & Accessories (2022-2030) ($MN)

- Table 84 Asia Pacific Silk Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 85 South America Silk Market Outlook, By Country (2022-2030) ($MN)

- Table 86 South America Silk Market Outlook, By Product (2022-2030) ($MN)

- Table 87 South America Silk Market Outlook, By Mulberry Silk (2022-2030) ($MN)

- Table 88 South America Silk Market Outlook, By Tussar Silk (2022-2030) ($MN)

- Table 89 South America Silk Market Outlook, By Eri Silk (2022-2030) ($MN)

- Table 90 South America Silk Market Outlook, By Muga Silk (2022-2030) ($MN)

- Table 91 South America Silk Market Outlook, By Spider Silk (2022-2030) ($MN)

- Table 92 South America Silk Market Outlook, By Other Products (2022-2030) ($MN)

- Table 93 South America Silk Market Outlook, By Production Process (2022-2030) ($MN)

- Table 94 South America Silk Market Outlook, By Sericulture (2022-2030) ($MN)

- Table 95 South America Silk Market Outlook, By Reeling (2022-2030) ($MN)

- Table 96 South America Silk Market Outlook, By Throwing (2022-2030) ($MN)

- Table 97 South America Silk Market Outlook, By Weaving (2022-2030) ($MN)

- Table 98 South America Silk Market Outlook, By Other Production Processes (2022-2030) ($MN)

- Table 99 South America Silk Market Outlook, By Application (2022-2030) ($MN)

- Table 100 South America Silk Market Outlook, By Textiles & Apparel (2022-2030) ($MN)

- Table 101 South America Silk Market Outlook, By Home Furnishings (2022-2030) ($MN)

- Table 102 South America Silk Market Outlook, By Surgical Sutures & Wound Dressings (2022-2030) ($MN)

- Table 103 South America Silk Market Outlook, By Cosmetics & Personal Care (2022-2030) ($MN)

- Table 104 South America Silk Market Outlook, By Luxury Goods & Accessories (2022-2030) ($MN)

- Table 105 South America Silk Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 106 Middle East & Africa Silk Market Outlook, By Country (2022-2030) ($MN)

- Table 107 Middle East & Africa Silk Market Outlook, By Product (2022-2030) ($MN)

- Table 108 Middle East & Africa Silk Market Outlook, By Mulberry Silk (2022-2030) ($MN)

- Table 109 Middle East & Africa Silk Market Outlook, By Tussar Silk (2022-2030) ($MN)

- Table 110 Middle East & Africa Silk Market Outlook, By Eri Silk (2022-2030) ($MN)

- Table 111 Middle East & Africa Silk Market Outlook, By Muga Silk (2022-2030) ($MN)

- Table 112 Middle East & Africa Silk Market Outlook, By Spider Silk (2022-2030) ($MN)

- Table 113 Middle East & Africa Silk Market Outlook, By Other Products (2022-2030) ($MN)

- Table 114 Middle East & Africa Silk Market Outlook, By Production Process (2022-2030) ($MN)

- Table 115 Middle East & Africa Silk Market Outlook, By Sericulture (2022-2030) ($MN)

- Table 116 Middle East & Africa Silk Market Outlook, By Reeling (2022-2030) ($MN)

- Table 117 Middle East & Africa Silk Market Outlook, By Throwing (2022-2030) ($MN)

- Table 118 Middle East & Africa Silk Market Outlook, By Weaving (2022-2030) ($MN)

- Table 119 Middle East & Africa Silk Market Outlook, By Other Production Processes (2022-2030) ($MN)

- Table 120 Middle East & Africa Silk Market Outlook, By Application (2022-2030) ($MN)

- Table 121 Middle East & Africa Silk Market Outlook, By Textiles & Apparel (2022-2030) ($MN)

- Table 122 Middle East & Africa Silk Market Outlook, By Home Furnishings (2022-2030) ($MN)

- Table 123 Middle East & Africa Silk Market Outlook, By Surgical Sutures & Wound Dressings (2022-2030) ($MN)

- Table 124 Middle East & Africa Silk Market Outlook, By Cosmetics & Personal Care (2022-2030) ($MN)

- Table 125 Middle East & Africa Silk Market Outlook, By Luxury Goods & Accessories (2022-2030) ($MN)

- Table 126 Middle East & Africa Silk Market Outlook, By Other Applications (2022-2030) ($MN)

According to Stratistics MRC, the Global Silk Market is accounted for $22.3 billion in 2024 and is expected to reach $39.2 billion by 2030 growing at a CAGR of 9.8% during the forecast period. Silk is a natural fiber produced by silkworms, primarily from the Bombyx mori moth larvae. It is known for its softness, smooth texture, and shiny appearance, making it highly valued in textiles. Silk fibers are composed of fibroin, a strong yet lightweight and flexible protein. Originating in China over 4,000 years ago, silk production, known as sericulture, has spread globally. The fabric is highly sought after in fashion for its luxurious feel and durability, and its versatility extends to home furnishings, medical sutures, and industrial uses.

Market Dynamics:

Driver:

Increasing demand for luxury and premium textile products

Silk, a symbol of elegance and luxury, is a popular material for high-end apparel, including designer dresses and evening wear. The increasing demand for silk-based garments, particularly in emerging markets, is driven by the increasing number of affluent consumers and is also popular for bridal wear and special occasions due to its luxurious texture and appearance. Fashion houses and designers are expanding their collections with silk, boosting demand for exclusive, limited-edition garments, aligning with consumer preferences for unique, high-quality, and aesthetically appealing clothing.

Restraint:

Labor-intensive production process

Silk production, a traditional method, is slow and requires significant human labor to ensure quality. Unlike synthetic fibers, silk production is slower and requires skilled labor. Sericulture regions heavily rely on skilled labor, but the number of skilled workers is often limited, and training new workers can be time-consuming. This restricts the scalability of silk production and its ability to quickly respond to market demand.

Opportunity:

Growing popularity of eco-friendly and natural fibers

Silk, a natural protein fiber, is gaining popularity as a sustainable alternative to synthetic fibers like polyester. As concerns about the environmental impact of synthetic fibers rise, silk is seen as a premium eco-friendly product. Brands emphasizing transparency in sourcing and the environmental benefits of silk production are positioning silk as a luxurious yet responsible option for eco-conscious consumers, benefiting the silk market.

Threat:

Competition from synthetic fibers

Synthetic fibers are increasingly popular due to their versatility, performance benefits, and ease of maintenance and are seen as fashionable and contemporary, due to advancements in fabric technology. They are practical, easy to care for, and come in various colors, textures, and finishes. Innovations like moisture-wicking, stretchability, and wrinkle resistance have made them popular in activewear, sportswear, and casual clothing. This reduces demand for delicate materials like silk hampering the market growth.

Covid-19 Impact

The COVID-19 pandemic significantly impacted the silk market, disrupting production and supply chains due to lockdowns and labor shortages. The demand for luxury goods, including silk, also declined as consumers prioritized essential items. Additionally, international trade restrictions hampered silk exports, further affecting market growth. However, the market showed signs of recovery as global economies reopened, and the demand for premium textiles in the post-pandemic era began to rebound.

The tussar silk segment is expected to be the largest during the forecast period

The tussar silk is expected to be the largest during the forecast period as it offers a unique and less commercially produced alternative to mulberry silk, catering to consumers seeking unique and eco-friendly textiles. Its rustic, organic appearance is valued in ethnic and traditional garments, attracting a niche customer base. Tussar silk's use in fashion and interior design has enhanced its appeal, particularly for buyers prioritizing uniqueness over mass production.

The weaving segment is expected to have the highest CAGR during the forecast period

The weaving segment is expected to have the highest CAGR during the forecast period because traditional handloom weaving and modern mechanized looms differ in production scale. Traditional methods allow intricate designs, while mechanized weaving enables mass production at lower costs. However, the shift towards mechanized weaving in certain silk market segments may diminish the fabric's authenticity and uniqueness, potentially affecting its appeal to luxury buyers.

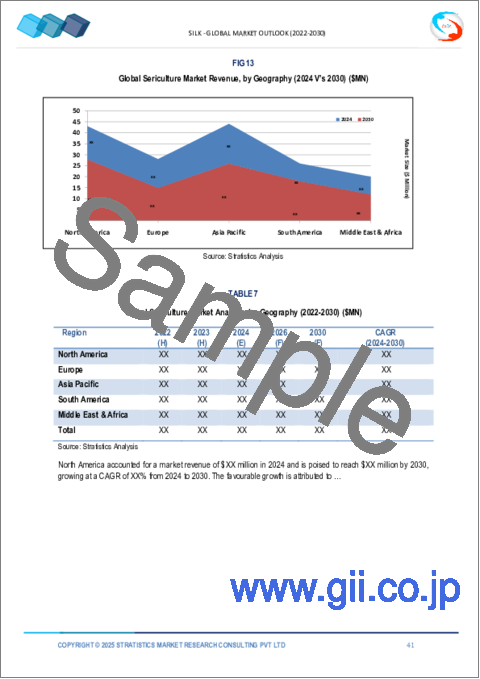

Region with largest share:

North America is anticipated to hold the largest market share during the forecast period owing to growing trend in North America toward sustainable and ethically produced fabrics. Consumers are shifting towards eco-friendly materials, increasing demand for natural fibers like silk. Ethical production practices, fair wages, and sustainability resonate with environmentally conscious buyers. North American consumers are turning to silk brands prioritizing sustainability and ethical sourcing, benefiting the market for eco-conscious silk products.

Region with highest CAGR:

Asia Pacific is expected to hold the highest CAGR over the forecast period due to growing silk consumption in countries like China, India, Japan, and South Korea. Silk is associated with luxury, tradition, and cultural heritage, particularly in India, where it is used for wedding garments and traditional attire. The growing middle class and disposable income in these countries have led to a surge in demand for luxury and premium silk products, such as high-end clothing, bedding, and accessories. This trend is also observed in Japan and South Korea, where silk remains a symbol of opulence and quality.

Key players in the market

Some of the key players in Silk market include AM Silk GmbH, Anhui Silk Co. Ltd., Bolt Threads, China Silk Corporation, Entogenetics Inc, Jiangsu Sutong Cocoon And Silk Co., Jinchengjiang Xinxing Cocoon Silk Co., Ltd., Kraig Biocraft Laboratories, Inc., Libas Textiles Ltd., ShengKun Silk Manufacturing Co., Ltd., Sichuan Nanchong Liuhe (Group) Corp., Silk India international Ltd., Wensli Group Co. Ltd., Wujiang First Textile Co., Ltd. and Zhejiang Jiaxin Silk Co Ltd.

Key Developments:

In November 2023, Bolt Threads secured significant partnerships for the commercial production of their bioengineered silk and "Mylo" leather, which is produced from mycelium. This collaboration is set to expand their sustainable product line further into fashion and textiles. The company continues to push its mission of replacing animal-derived materials with innovative biofabricated alternatives.

In October 2023, Wujiang First Textile Co. continued to lead the Chinese silk fabric market with its high-quality raw silk and fabric production. The company has committed to improving its environmental sustainability practices as part of its broader market strategy

In September 2023, Entogenetics has been progressing with its biotechnology platform for producing silk proteins, with applications in medical devices and textiles. The company has been ramping up efforts to commercialize its spider silk production, targeting sustainable and high-performance material markets.

Products Covered:

- Mulberry Silk

- Tussar Silk

- Eri Silk

- Muga Silk

- Spider Silk

- Other Products

Production Processes Covered:

- Sericulture

- Reeling

- Throwing

- Weaving

- Other Production Processes

Applications Covered:

- Textiles & Apparel

- Home Furnishings

- Surgical Sutures & Wound Dressings

- Cosmetics & Personal Care

- Luxury Goods & Accessories

- Other Applications

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2022, 2023, 2024, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Product Analysis

- 3.7 Application Analysis

- 3.8 Emerging Markets

- 3.9 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Silk Market, By Product

- 5.1 Introduction

- 5.2 Mulberry Silk

- 5.3 Tussar Silk

- 5.4 Eri Silk

- 5.5 Muga Silk

- 5.6 Spider Silk

- 5.7 Other Products

6 Global Silk Market, By Production Process

- 6.1 Introduction

- 6.2 Sericulture

- 6.3 Reeling

- 6.4 Throwing

- 6.5 Weaving

- 6.6 Other Production Processes

7 Global Silk Market, By Application

- 7.1 Introduction

- 7.2 Textiles & Apparel

- 7.3 Home Furnishings

- 7.4 Surgical Sutures & Wound Dressings

- 7.5 Cosmetics & Personal Care

- 7.6 Luxury Goods & Accessories

- 7.7 Other Applications

8 Global Silk Market, By Geography

- 8.1 Introduction

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 New Zealand

- 8.4.6 South Korea

- 8.4.7 Rest of Asia Pacific

- 8.5 South America

- 8.5.1 Argentina

- 8.5.2 Brazil

- 8.5.3 Chile

- 8.5.4 Rest of South America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 Qatar

- 8.6.4 South Africa

- 8.6.5 Rest of Middle East & Africa

9 Key Developments

- 9.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 9.2 Acquisitions & Mergers

- 9.3 New Product Launch

- 9.4 Expansions

- 9.5 Other Key Strategies

10 Company Profiling

- 10.1 AM Silk GmbH

- 10.2 Anhui Silk Co. Ltd.

- 10.3 Bolt Threads

- 10.4 China Silk Corporation

- 10.5 Entogenetics Inc

- 10.6 Jiangsu Sutong Cocoon And Silk Co.

- 10.7 Jinchengjiang Xinxing Cocoon Silk Co., Ltd.

- 10.8 Kraig Biocraft Laboratories, Inc.

- 10.9 Libas Textiles Ltd.

- 10.10 ShengKun Silk Manufacturing Co., Ltd.

- 10.11 Sichuan Nanchong Liuhe (Group) Corp.

- 10.12 Silk India international Ltd.

- 10.13 Wensli Group Co. Ltd.

- 10.14 Wujiang First Textile Co., Ltd.

- 10.15 Zhejiang Jiaxin Silk Co., Ltd.