|

|

市場調査レポート

商品コード

1503399

ポリエチレンフラノエート(PEF)市場の2030年までの予測:用途別、エンドユーザー別、販売チャネル別、地域別の世界分析Polyethylene Furanoate Market Forecasts to 2030 - Global Analysis By Application, End User, Sales Channel and By Geography |

||||||

カスタマイズ可能

|

|||||||

| ポリエチレンフラノエート(PEF)市場の2030年までの予測:用途別、エンドユーザー別、販売チャネル別、地域別の世界分析 |

|

出版日: 2024年06月06日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

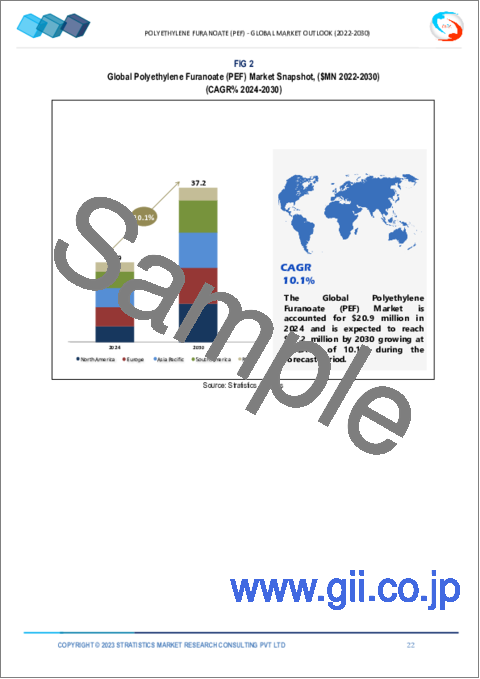

Stratistics MRCによると、ポリエチレンフラノエート(PEF)の世界市場は2024年に2,090万米ドルを占め、予測期間中にCAGR 10.1%で成長し、2030年には3,720万米ドルに達すると予想されています。

ポリエチレンフラノエート(PEF)は、植物糖などの再生可能資源から作られるバイオベースのポリエステルです。優れたバリア特性で知られています。PEFは炭酸飲料の保存と賞味期限の延長に優れています。PEFの成長の原動力は、持続可能なパッケージング・ソリューションに対する需要の増加、環境意識の高まり、カーボンフットプリントの削減に対する規制の圧力です。PEFは飲料業界や包装業界において牽引力を増しており、今後数年間で大幅な市場拡大が見込まれます。

欧州バイオプラスチック協会によると、バイオベースポリマーの世界生産能力は、2021年の約211万トンから2026年には約287万トンに増加すると予想されています。

持続可能な生分解性素材への需要の高まり

プラスチック汚染や環境悪化に対する世界の懸念の高まりは、ポリエチレンフラノエート(PEF)のような持続可能な生分解性材料の需要を促進しています。PEFは100%バイオベースでリサイクル可能なポリマーであるため、PETのような従来のプラスチックに比べてカーボンフットプリントが低いです。そのため、環境負荷の低減を目指す産業界にとって魅力的な選択肢となっています。消費者の意識の高まりと、環境に優しい材料を採用するよう求める規制の圧力が、PEF市場の成長をさらに後押ししています。

限られた生産能力

PEFの生産能力が限られていることが、市場の大きな抑制要因となっています。現在のPEFの製造インフラは従来のプラスチックほど発達しておらず、供給上の制約につながっています。この制限は、特に包装のような需要の高い分野でのPEFの拡張性と普及に影響を与えます。加えて、PEF生産設備の設置に必要な高額な初期投資が製造業者の足かせとなり、市場の成長をさらに制限しています。

研究開発への投資

研究開発(R&D)への投資はPEF市場にとって大きなチャンスです。生産プロセスを改善し、PEFの特性を向上させ、生産コストを削減するためには、継続的な研究開発努力が不可欠です。触媒開発、重合技術、再生可能原料の使用における革新は、PEF生産の効率と拡張性を大幅に高めることができます。研究開発投資の増加は、PEFの新しい用途の発見にもつながり、市場の可能性を拡大します。

変動する原料

原料価格の変動は、ポリエチレンフラノエート(PEF)市場に大きな脅威をもたらします。PEFの生産はバイオベース原料に依存しており、これらの原料は農作物の収穫量の変動、サプライチェーンの混乱、市場の需要シフトによって価格が変動する可能性があります。この予測不可能性は生産コストに影響し、メーカーが安定した価格設定と収益性を維持することを困難にしています。このような変動は、PEF生産への投資を抑制し、市場の成長を妨げる可能性があります。

COVID-19の影響:

COVID-19の流行はPEF市場に様々な影響を与えました。環境意識の高まりから持続可能な包装材料への需要が高まった一方で、サプライチェーンの混乱や製造の遅れが生産の妨げとなった。パンデミックは、レジリエントで持続可能なサプライチェーンの重要性を浮き彫りにし、短期的な課題にもかかわらずPEFの長期的な成長見通しを後押ししました。

予測期間中、飲食品包装分野が最大となる見込み

予測期間中、飲食品包装分野が最大となる見込み。PEFの二酸化炭素や酸素のようなガスに対する優れたバリア特性は包装用途に理想的であり、より長い保存期間と製品品質の維持を保証します。持続可能なパッケージング・ソリューションに対する消費者の嗜好の高まりや、使い捨てプラスチックに対する厳しい規制が、飲食品業界におけるPEFの採用を促進しており、市場成長に大きく寄与しています。

eコマース・プラットフォーム分野は予測期間中最も高いCAGRが見込まれる

eコマース・プラットフォーム分野は、予測期間中に最も高いCAGRが見込まれます。eコマースの急成長により、効率的で持続可能なパッケージング・ソリューションへの需要が高まっています。高い引張強度や耐熱性といったPEFの優れた機械的特性は、eコマース分野における包装用途に適しています。オンラインショッピングへのシフトと、耐久性があり環境に優しい包装材料へのニーズが、このセグメントの高い成長率を牽引しています。

最大のシェアを持つ地域

北米地域がポリエチレンフラノエート(PEF)市場を独占しています。同地域の高度なインフラ、持続可能な技術への多額の投資、厳しい環境規制が市場シェアをリードしています。高い消費者意識と環境に優しいパッケージング・ソリューションへの需要が北米でのPEFの採用をさらに促進し、北米をPEFの最大市場にしています。

CAGRが最も高い地域:

アジア太平洋地域は、ポリエチレンフラノエート(PEF)市場の急速な成長を予測しています。特に中国やインドのような国々で、パッケージングや消費財産業への投資が増加していることが市場拡大の原動力となっています。持続可能性への注目の高まりは、有利な政府政策や消費者意識の高まりと相まって、同地域におけるPEFの採用を後押しし、予測期間中のCAGRを最高値に導くと予想されます。

無料カスタマイズサービス:

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレイヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査情報源

- 1次調査情報源

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 用途分析

- エンドユーザー分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界のポリエチレンフラノエート(PEF)市場:用途別

- ボトル

- 食品容器

- フィルム・シート

- 繊維・織物

- その他の用途

第6章 世界のポリエチレンフラノエート(PEF)市場:エンドユーザー別

- 飲食品パッケージ

- 自動車

- 電子機器・電気部品

- 医療・ヘルスケア

- テキスタイル

- 農業

- その他のエンドユーザー

第7章 世界のポリエチレンフラノエート(PEF)市場:販売チャネル別

- 直接販売

- 流通チャネル

- eコマースプラットフォーム

第8章 世界のポリエチレンフラノエート(PEF)市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第9章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第10章 企業プロファイリング

- Avantium

- Danone

- Toyobo Co., Ltd.

- Alpla

- The Coca-Cola Company

- BASF SE

- Corbion N.V.

- Synvina

- Wifag-Polytype Holding AG

- Tereos

- Mitsui & Co., Ltd.

- NatureWorks LLC

- Origin Materials

- PEFerence

- Futerro

- Sulzer Ltd

- VTT Technical Research Centre of Finland

- Anellotech

- Carbios

List of Tables

- Table 1 Global Polyethylene Furanoate (PEF) Market Outlook, By Region (2022-2030) ($MN)

- Table 2 Global Polyethylene Furanoate (PEF) Market Outlook, By Application (2022-2030) ($MN)

- Table 3 Global Polyethylene Furanoate (PEF) Market Outlook, By Bottles (2022-2030) ($MN)

- Table 4 Global Polyethylene Furanoate (PEF) Market Outlook, By Food Containers (2022-2030) ($MN)

- Table 5 Global Polyethylene Furanoate (PEF) Market Outlook, By Films & Sheets (2022-2030) ($MN)

- Table 6 Global Polyethylene Furanoate (PEF) Market Outlook, By Fibers & Textiles (2022-2030) ($MN)

- Table 7 Global Polyethylene Furanoate (PEF) Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 8 Global Polyethylene Furanoate (PEF) Market Outlook, By End User (2022-2030) ($MN)

- Table 9 Global Polyethylene Furanoate (PEF) Market Outlook, By Food & Beverage Packaging (2022-2030) ($MN)

- Table 10 Global Polyethylene Furanoate (PEF) Market Outlook, By Automotive (2022-2030) ($MN)

- Table 11 Global Polyethylene Furanoate (PEF) Market Outlook, By Electronics & Electrical Components (2022-2030) ($MN)

- Table 12 Global Polyethylene Furanoate (PEF) Market Outlook, By Medical & Healthcare (2022-2030) ($MN)

- Table 13 Global Polyethylene Furanoate (PEF) Market Outlook, By Textiles (2022-2030) ($MN)

- Table 14 Global Polyethylene Furanoate (PEF) Market Outlook, By Agriculture (2022-2030) ($MN)

- Table 15 Global Polyethylene Furanoate (PEF) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 16 Global Polyethylene Furanoate (PEF) Market Outlook, By Sales Channel (2022-2030) ($MN)

- Table 17 Global Polyethylene Furanoate (PEF) Market Outlook, By Direct Sales (2022-2030) ($MN)

- Table 18 Global Polyethylene Furanoate (PEF) Market Outlook, By Distribution Channels (2022-2030) ($MN)

- Table 19 Global Polyethylene Furanoate (PEF) Market Outlook, By E-commerce Platforms (2022-2030) ($MN)

- Table 20 North America Polyethylene Furanoate (PEF) Market Outlook, By Country (2022-2030) ($MN)

- Table 21 North America Polyethylene Furanoate (PEF) Market Outlook, By Application (2022-2030) ($MN)

- Table 22 North America Polyethylene Furanoate (PEF) Market Outlook, By Bottles (2022-2030) ($MN)

- Table 23 North America Polyethylene Furanoate (PEF) Market Outlook, By Food Containers (2022-2030) ($MN)

- Table 24 North America Polyethylene Furanoate (PEF) Market Outlook, By Films & Sheets (2022-2030) ($MN)

- Table 25 North America Polyethylene Furanoate (PEF) Market Outlook, By Fibers & Textiles (2022-2030) ($MN)

- Table 26 North America Polyethylene Furanoate (PEF) Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 27 North America Polyethylene Furanoate (PEF) Market Outlook, By End User (2022-2030) ($MN)

- Table 28 North America Polyethylene Furanoate (PEF) Market Outlook, By Food & Beverage Packaging (2022-2030) ($MN)

- Table 29 North America Polyethylene Furanoate (PEF) Market Outlook, By Automotive (2022-2030) ($MN)

- Table 30 North America Polyethylene Furanoate (PEF) Market Outlook, By Electronics & Electrical Components (2022-2030) ($MN)

- Table 31 North America Polyethylene Furanoate (PEF) Market Outlook, By Medical & Healthcare (2022-2030) ($MN)

- Table 32 North America Polyethylene Furanoate (PEF) Market Outlook, By Textiles (2022-2030) ($MN)

- Table 33 North America Polyethylene Furanoate (PEF) Market Outlook, By Agriculture (2022-2030) ($MN)

- Table 34 North America Polyethylene Furanoate (PEF) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 35 North America Polyethylene Furanoate (PEF) Market Outlook, By Sales Channel (2022-2030) ($MN)

- Table 36 North America Polyethylene Furanoate (PEF) Market Outlook, By Direct Sales (2022-2030) ($MN)

- Table 37 North America Polyethylene Furanoate (PEF) Market Outlook, By Distribution Channels (2022-2030) ($MN)

- Table 38 North America Polyethylene Furanoate (PEF) Market Outlook, By E-commerce Platforms (2022-2030) ($MN)

- Table 39 Europe Polyethylene Furanoate (PEF) Market Outlook, By Country (2022-2030) ($MN)

- Table 40 Europe Polyethylene Furanoate (PEF) Market Outlook, By Application (2022-2030) ($MN)

- Table 41 Europe Polyethylene Furanoate (PEF) Market Outlook, By Bottles (2022-2030) ($MN)

- Table 42 Europe Polyethylene Furanoate (PEF) Market Outlook, By Food Containers (2022-2030) ($MN)

- Table 43 Europe Polyethylene Furanoate (PEF) Market Outlook, By Films & Sheets (2022-2030) ($MN)

- Table 44 Europe Polyethylene Furanoate (PEF) Market Outlook, By Fibers & Textiles (2022-2030) ($MN)

- Table 45 Europe Polyethylene Furanoate (PEF) Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 46 Europe Polyethylene Furanoate (PEF) Market Outlook, By End User (2022-2030) ($MN)

- Table 47 Europe Polyethylene Furanoate (PEF) Market Outlook, By Food & Beverage Packaging (2022-2030) ($MN)

- Table 48 Europe Polyethylene Furanoate (PEF) Market Outlook, By Automotive (2022-2030) ($MN)

- Table 49 Europe Polyethylene Furanoate (PEF) Market Outlook, By Electronics & Electrical Components (2022-2030) ($MN)

- Table 50 Europe Polyethylene Furanoate (PEF) Market Outlook, By Medical & Healthcare (2022-2030) ($MN)

- Table 51 Europe Polyethylene Furanoate (PEF) Market Outlook, By Textiles (2022-2030) ($MN)

- Table 52 Europe Polyethylene Furanoate (PEF) Market Outlook, By Agriculture (2022-2030) ($MN)

- Table 53 Europe Polyethylene Furanoate (PEF) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 54 Europe Polyethylene Furanoate (PEF) Market Outlook, By Sales Channel (2022-2030) ($MN)

- Table 55 Europe Polyethylene Furanoate (PEF) Market Outlook, By Direct Sales (2022-2030) ($MN)

- Table 56 Europe Polyethylene Furanoate (PEF) Market Outlook, By Distribution Channels (2022-2030) ($MN)

- Table 57 Europe Polyethylene Furanoate (PEF) Market Outlook, By E-commerce Platforms (2022-2030) ($MN)

- Table 58 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Country (2022-2030) ($MN)

- Table 59 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Application (2022-2030) ($MN)

- Table 60 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Bottles (2022-2030) ($MN)

- Table 61 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Food Containers (2022-2030) ($MN)

- Table 62 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Films & Sheets (2022-2030) ($MN)

- Table 63 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Fibers & Textiles (2022-2030) ($MN)

- Table 64 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 65 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By End User (2022-2030) ($MN)

- Table 66 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Food & Beverage Packaging (2022-2030) ($MN)

- Table 67 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Automotive (2022-2030) ($MN)

- Table 68 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Electronics & Electrical Components (2022-2030) ($MN)

- Table 69 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Medical & Healthcare (2022-2030) ($MN)

- Table 70 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Textiles (2022-2030) ($MN)

- Table 71 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Agriculture (2022-2030) ($MN)

- Table 72 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 73 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Sales Channel (2022-2030) ($MN)

- Table 74 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Direct Sales (2022-2030) ($MN)

- Table 75 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By Distribution Channels (2022-2030) ($MN)

- Table 76 Asia Pacific Polyethylene Furanoate (PEF) Market Outlook, By E-commerce Platforms (2022-2030) ($MN)

- Table 77 South America Polyethylene Furanoate (PEF) Market Outlook, By Country (2022-2030) ($MN)

- Table 78 South America Polyethylene Furanoate (PEF) Market Outlook, By Application (2022-2030) ($MN)

- Table 79 South America Polyethylene Furanoate (PEF) Market Outlook, By Bottles (2022-2030) ($MN)

- Table 80 South America Polyethylene Furanoate (PEF) Market Outlook, By Food Containers (2022-2030) ($MN)

- Table 81 South America Polyethylene Furanoate (PEF) Market Outlook, By Films & Sheets (2022-2030) ($MN)

- Table 82 South America Polyethylene Furanoate (PEF) Market Outlook, By Fibers & Textiles (2022-2030) ($MN)

- Table 83 South America Polyethylene Furanoate (PEF) Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 84 South America Polyethylene Furanoate (PEF) Market Outlook, By End User (2022-2030) ($MN)

- Table 85 South America Polyethylene Furanoate (PEF) Market Outlook, By Food & Beverage Packaging (2022-2030) ($MN)

- Table 86 South America Polyethylene Furanoate (PEF) Market Outlook, By Automotive (2022-2030) ($MN)

- Table 87 South America Polyethylene Furanoate (PEF) Market Outlook, By Electronics & Electrical Components (2022-2030) ($MN)

- Table 88 South America Polyethylene Furanoate (PEF) Market Outlook, By Medical & Healthcare (2022-2030) ($MN)

- Table 89 South America Polyethylene Furanoate (PEF) Market Outlook, By Textiles (2022-2030) ($MN)

- Table 90 South America Polyethylene Furanoate (PEF) Market Outlook, By Agriculture (2022-2030) ($MN)

- Table 91 South America Polyethylene Furanoate (PEF) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 92 South America Polyethylene Furanoate (PEF) Market Outlook, By Sales Channel (2022-2030) ($MN)

- Table 93 South America Polyethylene Furanoate (PEF) Market Outlook, By Direct Sales (2022-2030) ($MN)

- Table 94 South America Polyethylene Furanoate (PEF) Market Outlook, By Distribution Channels (2022-2030) ($MN)

- Table 95 South America Polyethylene Furanoate (PEF) Market Outlook, By E-commerce Platforms (2022-2030) ($MN)

- Table 96 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Country (2022-2030) ($MN)

- Table 97 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Application (2022-2030) ($MN)

- Table 98 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Bottles (2022-2030) ($MN)

- Table 99 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Food Containers (2022-2030) ($MN)

- Table 100 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Films & Sheets (2022-2030) ($MN)

- Table 101 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Fibers & Textiles (2022-2030) ($MN)

- Table 102 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 103 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By End User (2022-2030) ($MN)

- Table 104 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Food & Beverage Packaging (2022-2030) ($MN)

- Table 105 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Automotive (2022-2030) ($MN)

- Table 106 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Electronics & Electrical Components (2022-2030) ($MN)

- Table 107 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Medical & Healthcare (2022-2030) ($MN)

- Table 108 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Textiles (2022-2030) ($MN)

- Table 109 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Agriculture (2022-2030) ($MN)

- Table 110 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 111 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Sales Channel (2022-2030) ($MN)

- Table 112 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Direct Sales (2022-2030) ($MN)

- Table 113 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By Distribution Channels (2022-2030) ($MN)

- Table 114 Middle East & Africa Polyethylene Furanoate (PEF) Market Outlook, By E-commerce Platforms (2022-2030) ($MN)

According to Stratistics MRC, the Global Polyethylene Furanoate (PEF) Market is accounted for $20.9 million in 2024 and is expected to reach $37.2 million by 2030 growing at a CAGR of 10.1% during the forecast period. Polyethylene Furanoate (PEF) is bio-based polyester made from renewable resources like plant sugars. It is known for its superior barrier properties. PEF excels at preserving carbonated beverages and extending shelf life. The growth of PEF is driven by the increasing demand for sustainable packaging solutions, rising environmental awareness, and regulatory pressures to reduce carbon footprints. It is gaining traction in the beverage and packaging industries, promising significant market expansion in the years ahead.

According to the European Bioplastics association, the global production capacity of bio-based polymers is expected to increase from around 2.11 million tonnes in 2021 to approximately 2.87 million tonnes in 2026.

Market Dynamics:

Driver:

Growing demand for sustainable and biodegradable materials

The increasing global concern over plastic pollution and environmental degradation is driving the demand for sustainable and biodegradable materials like Polyethylene Furanoate (PEF). PEF, being a 100% bio-based and recyclable polymer, offers a lower carbon footprint compared to traditional plastics such as PET. This makes it an attractive alternative for industries aiming to reduce their environmental impact. The rising consumer awareness and regulatory pressures to adopt eco-friendly materials are further propelling the growth of the PEF market.

Restraint:

Limited production capacity

The limited production capacity of PEF is a significant restraint in the market. The current manufacturing infrastructure for PEF is not as developed as that for conventional plastics, leading to supply constraints. This limitation affects the scalability and widespread adoption of PEF, particularly in high-demand sectors like packaging. Additionally, the high initial investment required for setting up PEF production facilities can deter manufacturers, further restricting market growth.

Opportunity:

Investment in R&D

Investment in research and development (R&D) presents a substantial opportunity for the PEF market. Continuous R&D efforts are essential to improve the production processes, enhance the properties of PEF, and reduce production costs. Innovations in catalyst development, polymerization techniques, and the use of renewable feedstocks can significantly boost the efficiency and scalability of PEF production. Increased R&D investments can also lead to the discovery of new applications for PEF, expanding its market potential.

Threat:

Fluctuating raw material

Fluctuating raw material prices pose a significant threat to the polyethylene furanoate (PEF) market. PEF production relies on biobased raw materials, which can experience price volatility due to agricultural yield variations, supply chain disruptions, and market demand shifts. This unpredictability affects production costs, making it challenging for manufacturers to maintain stable pricing and profitability. Such fluctuations can deter investment in PEF production and hinder market growth.

Covid-19 Impact:

The COVID-19 pandemic had a mixed impact on the PEF market. While the demand for sustainable packaging materials increased due to heightened environmental awareness, supply chain disruptions and manufacturing delays hindered production. The pandemic underscored the importance of resilient and sustainable supply chains, driving long-term growth prospects for PEF despite short-term challenges.

The food & beverage packaging segment is expected to be the largest during the forecast period

The food & beverage packaging segment is expected to be the largest during the forecast period. PEF's superior barrier properties against gases like carbon dioxide and oxygen make it ideal for packaging applications, ensuring longer shelf life and maintaining product quality. The growing consumer preference for sustainable packaging solutions and stringent regulations on single-use plastics are driving the adoption of PEF in the food and beverage industry, contributing significantly to market growth.

The e-commerce platforms segment is expected to have the highest CAGR during the forecast period

The e-commerce platforms segment is expected to have the highest CAGR during the forecast period. The rapid growth of e-commerce has increased the demand for efficient and sustainable packaging solutions. PEF's excellent mechanical properties, such as high tensile strength and heat resistance, make it suitable for packaging applications in the e-commerce sector. The shift towards online shopping and the need for durable, eco-friendly packaging materials are driving the high growth rate of this segment.

Region with largest share:

The North America region is positioned to dominate the Polyethylene Furanoate (PEF) Market. The region's advanced infrastructure, significant investments in sustainable technologies, and stringent environmental regulations contribute to its leading market share. The high consumer awareness and demand for eco-friendly packaging solutions further drive the adoption of PEF in North America, making it the largest market for PEF.

Region with highest CAGR:

The Asia Pacific region anticipates rapid growth in the Polyethylene Furanoate (PEF) Market. Increasing investments in packaging and consumer goods industries, particularly in countries like China and India, are driving market expansion. The growing focus on sustainability, coupled with favorable government policies and rising consumer awareness, is expected to boost the adoption of PEF in the region, leading to the highest CAGR during the forecast period.

Key players in the market

Some of the key players in Polyethylene Furanoate (PEF) Market include Avantium, Danone, Toyobo Co., Ltd., Alpla, The Coca-Cola Company, BASF SE, Corbion N.V., Synvina, Wifag-Polytype Holding AG, Tereos, Mitsui & Co., Ltd., NatureWorks LLC, Origin Materials, PEFerence, Futerro, Sulzer Ltd, VTT Technical Research Centre of Finland, Anellotech and Carbios.

Key Developments:

In November 2023, Avantium has partnered with Dutch supermarket chain Albert Heijn to introduce PEF packaging for its own-brand products. This collaboration aims to transition to more sustainable packaging alternatives using Avantium's 100% plant-based and recyclable PEF material.

In November 2023, Avantium has also partnered with Pangaia to use its PEF material in a new sustainable apparel collection, targeting the fashion industry with PEF-based fibers and yarns.

Applications Covered:

- Bottles

- Food Containers

- Films & Sheets

- Fibers & Textiles

- Other Applications

End Users Covered:

- Food & Beverage Packaging

- Automotive

- Electronics & Electrical Components

- Medical & Healthcare

- Textiles

- Agriculture

- Other End Users

Sales Channels Covered:

- Direct Sales

- Distribution Channels

- E-commerce Platforms

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2022, 2023, 2024, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Application Analysis

- 3.7 End User Analysis

- 3.8 Emerging Markets

- 3.9 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Polyethylene Furanoate (PEF) Market, By Application

- 5.1 Introduction

- 5.2 Bottles

- 5.3 Food Containers

- 5.4 Films & Sheets

- 5.5 Fibers & Textiles

- 5.6 Other Applications

6 Global Polyethylene Furanoate (PEF) Market, By End User

- 6.1 Introduction

- 6.2 Food & Beverage Packaging

- 6.3 Automotive

- 6.4 Electronics & Electrical Components

- 6.5 Medical & Healthcare

- 6.6 Textiles

- 6.7 Agriculture

- 6.8 Other End Users

7 Global Polyethylene Furanoate (PEF) Market, By Sales Channel

- 7.1 Introduction

- 7.2 Direct Sales

- 7.3 Distribution Channels

- 7.4 E-commerce Platforms

8 Global Polyethylene Furanoate (PEF) Market, By Geography

- 8.1 Introduction

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 New Zealand

- 8.4.6 South Korea

- 8.4.7 Rest of Asia Pacific

- 8.5 South America

- 8.5.1 Argentina

- 8.5.2 Brazil

- 8.5.3 Chile

- 8.5.4 Rest of South America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 Qatar

- 8.6.4 South Africa

- 8.6.5 Rest of Middle East & Africa

9 Key Developments

- 9.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 9.2 Acquisitions & Mergers

- 9.3 New Product Launch

- 9.4 Expansions

- 9.5 Other Key Strategies

10 Company Profiling

- 10.1 Avantium

- 10.2 Danone

- 10.3 Toyobo Co., Ltd.

- 10.4 Alpla

- 10.5 The Coca-Cola Company

- 10.6 BASF SE

- 10.7 Corbion N.V.

- 10.8 Synvina

- 10.9 Wifag-Polytype Holding AG

- 10.10 Tereos

- 10.11 Mitsui & Co., Ltd.

- 10.12 NatureWorks LLC

- 10.13 Origin Materials

- 10.14 PEFerence

- 10.15 Futerro

- 10.16 Sulzer Ltd

- 10.17 VTT Technical Research Centre of Finland

- 10.18 Anellotech

- 10.19 Carbios