|

|

市場調査レポート

商品コード

1681638

産業用コーティングの市場規模、シェア、成長分析:技術別、樹脂タイプ別、最終用途産業別、地域別 - 産業予測 2025~2032年Industrial Coatings Market Size, Share, and Growth Analysis, By Technology (Waterborne Coatings, Solventborne Coatings), By Resin Type (Acrylic Resin, Alkyd Resin), By End-Use Industry, By Region - Industry Forecast 2025-2032 |

||||||

|

|||||||

| 産業用コーティングの市場規模、シェア、成長分析:技術別、樹脂タイプ別、最終用途産業別、地域別 - 産業予測 2025~2032年 |

|

出版日: 2025年03月08日

発行: SkyQuest

ページ情報: 英文 202 Pages

納期: 3~5営業日

|

全表示

- 概要

- 目次

産業用コーティング市場規模は2023年に1,052億米ドルとなり、2024年の1,093億米ドルから2032年には1,484億4,000万米ドルに成長し、予測期間(2025-2032年)のCAGRは3.9%で成長する見通しです。

世界の産業用コーティング市場は、自動車、航空宇宙、建設、海洋などの分野で採用が増加しており、力強い成長を遂げています。液体、粉体、前処理を含む様々なコーティング形態が、スプレー、浸漬、ロールコーティングなどの方法で適用されます。カスタマイズされた自動車用塗料に対する需要の高まりと、熟練労働者と大手メーカーに支えられた航空宇宙産業への投資の拡大は、特に米国における大きな成長促進要因です。さらに、アジア太平洋地域における可処分所得の上昇と相まって、自動車保護に対する意識の高まりが市場拡大をさらに後押ししています。耐久性のあるソリューションに対する包装業界の動向や、環境に優しい技術の進歩も大きく寄与しており、耐久性、耐紫外線性、耐候性を特徴とする高性能コーティングへの顕著な傾向が見られます。

目次

イントロダクション

- 調査の目的

- 調査範囲

- 定義

調査手法

- 情報調達

- 二次と一次データの方法

- 市場規模予測

- 市場の前提条件と制限

エグゼクティブサマリー

- 世界市場の見通し

- 供給と需要の動向分析

- セグメント別機会分析

市場力学と見通し

- 市場概要

- 市場規模

- 市場力学

- 促進要因と機会

- 抑制要因と課題

- ポーターの分析

主な市場の考察

- 重要成功要因

- 競合の程度

- 主な投資機会

- 市場エコシステム

- 市場の魅力指数(2024年)

- PESTEL分析

- マクロ経済指標

- バリューチェーン分析

- 価格分析

- サプライチェーン分析

- ケーススタディ分析

- 技術分析

- 顧客と購買基準の分析

- 貿易分析

- 特許分析

産業用コーティング市場規模:技術別& CAGR(2025-2032)

- 市場概要

- 水性コーティング

- 溶剤系コーティング

- 粉体コーティング

- その他の技術

産業用コーティング市場規模:樹脂タイプ別& CAGR(2025-2032)

- 市場概要

- アクリル樹脂

- アルキド樹脂

- エポキシ樹脂

- ポリエステル樹脂

- ポリウレタン樹脂

- フッ素樹脂

- その他の樹脂タイプ

産業用コーティング市場規模:最終用途産業別& CAGR(2025-2032)

- 市場概要

- 一般産業

- 保護

- 自動車OEM

- 産業用木材

- 自動車補修

- コイル

- 包装

- 海洋

- 航空宇宙

- 鉄道

産業用コーティング市場規模:地域別& CAGR(2025-2032)

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- スペイン

- フランス

- 英国

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ地域

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他中東・アフリカ

競合情報

- 上位5社の比較

- 主要企業の市場ポジショニング(2024年)

- 主な市場企業が採用した戦略

- 最近の市場動向

- 企業の市場シェア分析(2024年)

- 主要企業の企業プロファイル

- 企業の詳細

- 製品ポートフォリオ分析

- 企業のセグメント別シェア分析

- 収益の前年比比較(2022-2024)

主要企業プロファイル

- AkzoNobel N.V.(Netherlands)

- PPG Industries Inc.(United States)

- The Sherwin-Williams Company(United States)

- BASF SE(Germany)

- Jotun A/S(Norway)

- RPM International Inc.(United States)

- Hempel A/S(Denmark)

- Nippon Paint Holdings Co. Ltd.(Japan)

- Kansai Paint Co. Ltd.(Japan)

- Asian Paints Ltd.(India)

- Beckers Group(Germany)

- KCC Corporation(South Korea)

- Berger Paints India Ltd.(India)

- Teknos Group Oy(Finland)

- Noroo Paint & Coatings Co. Ltd.(South Korea)

- Diamond Vogel Paints(United States)

- The Magni Group, Inc.(United States)

- BARPIMO S.A.(Spain)

- DAW SE(Germany)

結論と提言

Industrial Coatings Market size was valued at USD 105.2 billion in 2023 and is poised to grow from USD 109.3 billion in 2024 to USD 148.44 billion by 2032, growing at a CAGR of 3.9% during the forecast period (2025-2032).

The global industrial coatings market is experiencing robust growth, fueled by increasing adoption across sectors such as automotive, aerospace, construction, and marine. Various coating forms, including liquid, powder, and pretreatment, are applied through methods like spray, dip, and roll coating. The rising demand for customized automotive paints and growing investments in the aerospace industry-supported by skilled labor and major manufacturers-are significant growth drivers, especially in the US. Additionally, heightened awareness of vehicle protection, coupled with rising disposable incomes in the Asia-Pacific region, is further boosting market expansion. The packaging industry's demands for durable solutions and advancements in eco-friendly technologies also contribute significantly, marking a notable trend towards high-performance coatings characterized by durability, UV resistance, and weather protection.

Top-down and bottom-up approaches were used to estimate and validate the size of the Industrial Coatings market and to estimate the size of various other dependent submarkets. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares split, and breakdowns were determined using secondary sources and verified through Primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

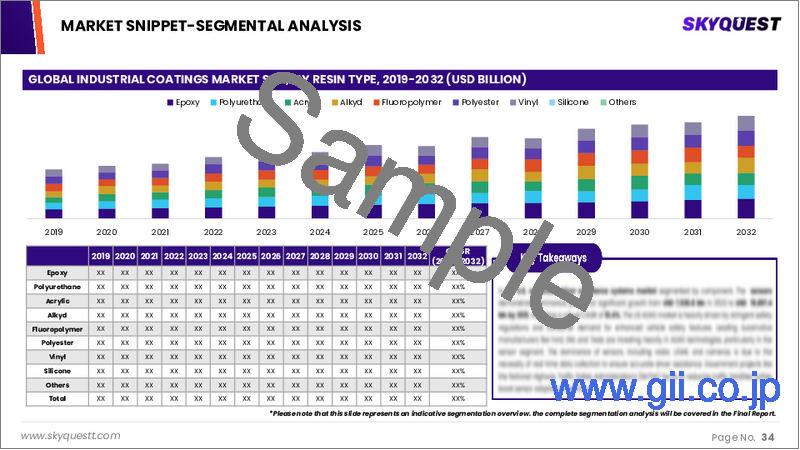

Industrial Coatings Market Segments Analysis

Global Industrial Coatings Market is segmented by Technology, Resin Type, End-Use Industry and region. Based on Technology, the market is segmented into Waterborne Coatings, Solventborne Coatings, Powder Coatings and Other Technologies. Based on Resin Type, the market is segmented into Acrylic Resin, Alkyd Resin, Epoxy Resin, Polyester Resin,PolyurethaneResin, Fluoropolymer Resin and Other Resin Types. Based on End-Use Industry, the market is segmented into General Industrial, Protective, Automotive OEM, Industrial Wood, Automotive Refinish, Coil, Packaging, Marine, Aerospace and Rail. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Driver of the Industrial Coatings Market

The Industrial Coatings market is driven by the growing demand across various sectors, including automotive and construction, where the need for protection against severe environmental conditions is paramount. These coatings offer essential resistance to corrosion, abrasion, and chemicals, significantly enhancing the durability and longevity of products. By extending the lifespan of materials, industrial coatings also contribute to reduced maintenance expenses, making them an attractive investment for businesses seeking to optimize performance and lower operational costs. As industries continue to prioritize quality and longevity, the adoption of industrial coatings is expected to rise, further propelling market growth.

Restraints in the Industrial Coatings Market

The Industrial Coatings market is facing significant challenges due to stringent government regulations concerning the utilization of hazardous chemicals within various industries. These regulations are put in place to protect the health of workers who may be exposed to these harmful substances, as they can result in serious health complications. Additionally, there is a growing shift towards environmentally friendly alternatives, which further constrains the market's expansion. As companies strive to comply with regulatory requirements while adapting to consumer preferences for sustainable options, the market dynamics are inevitably being affected, placing additional pressure on traditional industrial coating practices.

Market Trends of the Industrial Coatings Market

The industrial coatings market is witnessing a significant trend towards the adoption of eco-friendly coatings, driven by heightened environmental awareness and stringent governmental regulations. The demand for low volatile organic compounds (VOCs) and reduced hazardous air pollutants has surged, favoring waterborne, powder, and high-solid coatings. Innovations within this sector are enhancing product formulations, providing superior protection against corrosion, abrasion, and other harsh environmental challenges. This shift not only addresses environmental concerns but also meets industry requirements for durability and performance, thereby propelling market growth. As companies increasingly prioritize sustainability, the industrial coatings market is set to expand robustly in the coming years.

Table of Contents

Introduction

- Objectives of the Study

- Scope of the Report

- Definitions

Research Methodology

- Information Procurement

- Secondary & Primary Data Methods

- Market Size Estimation

- Market Assumptions & Limitations

Executive Summary

- Global Market Outlook

- Supply & Demand Trend Analysis

- Segmental Opportunity Analysis

Market Dynamics & Outlook

- Market Overview

- Market Size

- Market Dynamics

- Drivers & Opportunities

- Restraints & Challenges

- Porters Analysis

- Competitive rivalry

- Threat of substitute

- Bargaining power of buyers

- Threat of new entrants

- Bargaining power of suppliers

Key Market Insights

- Key Success Factors

- Degree of Competition

- Top Investment Pockets

- Market Ecosystem

- Market Attractiveness Index, 2024

- PESTEL Analysis

- Macro-Economic Indicators

- Value Chain Analysis

- Pricing Analysis

- Supply Chain Analysis

- Case Study Analysis

- Technology Analysis

- Customer And Buying Criteria Analysis

- Trade Analysis

- Patent Analysis

Global Industrial Coatings Market Size by Technology & CAGR (2025-2032)

- Market Overview

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- Other Technologies

Global Industrial Coatings Market Size by Resin Type & CAGR (2025-2032)

- Market Overview

- Acrylic Resin

- Alkyd Resin

- Epoxy Resin

- Polyester Resin

- Polyurethane Resin

- Fluoropolymer Resin

- Other Resin Types

Global Industrial Coatings Market Size by End-Use Industry & CAGR (2025-2032)

- Market Overview

- General Industrial

- Protective

- Automotive OEM

- Industrial Wood

- Automotive Refinish

- Coil

- Packaging

- Marine

- Aerospace

- Rail

Global Industrial Coatings Market Size & CAGR (2025-2032)

- North America (Technology, Resin Type, End-Use Industry)

- US

- Canada

- Europe (Technology, Resin Type, End-Use Industry)

- Germany

- Spain

- France

- UK

- Italy

- Rest of Europe

- Asia Pacific (Technology, Resin Type, End-Use Industry)

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America (Technology, Resin Type, End-Use Industry)

- Brazil

- Rest of Latin America

- Middle East & Africa (Technology, Resin Type, End-Use Industry)

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Competitive Intelligence

- Top 5 Player Comparison

- Market Positioning of Key Players, 2024

- Strategies Adopted by Key Market Players

- Recent Developments in the Market

- Company Market Share Analysis, 2024

- Company Profiles of All Key Players

- Company Details

- Product Portfolio Analysis

- Company's Segmental Share Analysis

- Revenue Y-O-Y Comparison (2022-2024)

Key Company Profiles

- AkzoNobel N.V. (Netherlands)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- PPG Industries Inc. (United States)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- The Sherwin-Williams Company (United States)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- BASF SE (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Jotun A/S (Norway)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- RPM International Inc. (United States)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Hempel A/S (Denmark)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Nippon Paint Holdings Co. Ltd. (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Kansai Paint Co. Ltd. (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Asian Paints Ltd. (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Beckers Group (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- KCC Corporation (South Korea)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Berger Paints India Ltd. (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Teknos Group Oy (Finland)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Noroo Paint & Coatings Co. Ltd. (South Korea)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Diamond Vogel Paints (United States)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- The Magni Group, Inc. (United States)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- BARPIMO S.A. (Spain)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- DAW SE (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments