|

|

市場調査レポート

商品コード

1622386

産業用コンピュータ断層撮影の市場規模、シェア、成長分析、提供別、タイプ別、スキャン技術別、用途別、最終用途別、地域別 - 産業予測、2025~2032年Industrial Computed Tomography Market Size, Share, Growth Analysis, By Offering (Equipment, Services), By Type (High-Voltage CT, Micro CT), By Scanning Technique, By Application, By End Use, By Region - Industry Forecast 2025-2032 |

||||||

|

|||||||

| 産業用コンピュータ断層撮影の市場規模、シェア、成長分析、提供別、タイプ別、スキャン技術別、用途別、最終用途別、地域別 - 産業予測、2025~2032年 |

|

出版日: 2024年12月22日

発行: SkyQuest

ページ情報: 英文 157 Pages

納期: 3~5営業日

|

全表示

- 概要

- 目次

産業用コンピュータ断層撮影市場規模は、2023年に3億8,184万米ドルと評価され、2024年の4億475万米ドルから2032年には6億4,512万米ドルに成長し、予測期間(2025-2032年)のCAGRは6%で成長する見通しです。

産業用コンピュータ断層撮影(CT)市場は、主に自動車、航空宇宙、防衛、エレクトロニクスなどの産業で積層造形の採用が増加していることを背景に、大きな成長が見込まれています。3Dプリンティングは、従来の製造ではコストがかかり、課題も多い複雑な構造の作成を可能にします。産業用CTスキャナーは、このような複雑な設計の非破壊検査に不可欠であり、メーカーはその強度と能力を効果的に評価することができます。この技術は、微細部品から大型部品まで正確にスキャンできるため、製品開発コストを大幅に削減できます。さらに、欠陥検出や故障解析などの機能により、工業用CTは製品の品質を高め、リコールリスクを最小限に抑えます。このような利点の組み合わせにより、コンピュータ断層検査は産業分野における技術革新の重要な担い手として位置付けられ、将来の市場拡大を牽引します。

目次

イントロダクション

- 調査の目的

- 調査範囲

- 定義

調査手法

- 情報調達

- 二次データと一次データの方法

- 市場規模予測

- 市場の前提条件と制限

エグゼクティブサマリー

- 世界市場の見通し

- 供給と需要の動向分析

- セグメント別機会分析

市場力学と見通し

- 市場概要

- 市場規模

- 市場力学

- 促進要因と機会

- 抑制要因と課題

- ポーターの分析

主な市場の考察

- 重要成功要因

- 競合の程度

- 主な投資機会

- 市場エコシステム

- 市場の魅力指数(2024年)

- PESTEL分析

- マクロ経済指標

- バリューチェーン分析

- 価格分析

- 規制情勢

- ケーススタディ

- 技術の進歩

産業用コンピュータ断層撮影市場規模:提供別

- 市場概要

- 装置

- サービス

産業用コンピュータ断層撮影市場規模:タイプ別

- 市場概要

- 高電圧CT

- マイクロCT

- その他

産業用コンピュータ断層撮影市場規模:スキャン技術別

- 市場概要

- ファンビームCT

- コーンビームCT

- その他

産業用コンピュータ断層撮影市場規模:用途別

- 市場概要

- 欠陥検出と検査

- 故障解析

- アセンブリ分析

- 寸法と公差の解析

- その他

産業用コンピュータ断層撮影市場規模:最終用途別

- 市場概要

- 石油・ガス

- 航空宇宙および防衛

- 自動車

- エレクトロニクス

- その他

産業用コンピュータ断層撮影市場規模

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- スペイン

- フランス

- 英国

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ地域

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他中東・アフリカ

競合情報

- 上位5社の比較

- 主要企業の市場ポジショニング(2024年)

- 主な市場企業が採用した戦略

- 市場の最近の動向

- 企業の市場シェア分析(2024年)

- 主要企業の企業プロファイル

- 会社概要

- 製品ポートフォリオ分析

- セグメント別シェア分析

- 収益の前年比比較(2022-2024)

主要企業プロファイル

- Waygate Technologies(USA)

- Carl Zeiss AG(Germany)

- Yxlon International GmbH(Comet Group)(Germany)

- Wenzel Group(Germany)

- Nikon Metrology NV(Nikon Corporation)(Belgium)

- Diondo GmbH(Germany)

- Werth Messtechnik GmbH(Germany)

- North Star Imaging(USA)

- RX Solutions(France)

- VJ Technologies Inc.(USA)

- VisiConsult GmbH(Germany)

- Rayscan Technologies GmbH(Germany)

- Rigaku Corporation(Japan)

- Omron Corporation(Japan)

- Shimadzu Corporation(Japan)

- Lumafield(USA)

- Analogic Corporation(USA)

- GE HealthCare(USA)

- Siemens Healthineers(Germany)

- Canon Medical Systems Corporation(Japan)

結論と推奨事項

Industrial Computed Tomography Market size was valued at USD 381.84 Million in 2023 and is poised to grow from USD 404.75 Million in 2024 to USD 645.12 Million by 2032, growing at a CAGR of 6% during the forecast period (2025-2032).

The industrial computed tomography (CT) market is poised for significant growth, primarily fueled by the rising adoption of additive manufacturing across industries such as automotive, aerospace, defense, and electronics. 3D printing enables the creation of complex structures that are costly and challenging to manufacture traditionally. Industrial CT scanners are vital for non-destructive testing of these intricate designs, allowing manufacturers to assess their strength and capabilities effectively. The technology offers precise scanning of both micro and large components, significantly reducing product development costs. Moreover, with capabilities including flaw detection and failure analysis, industrial CT enhances product quality and minimizes recall risks. This combination of benefits positions computed tomography as a crucial enabler of innovation in the industrial sector, driving future market expansion.

Top-down and bottom-up approaches were used to estimate and validate the size of the Industrial Computed Tomography market and to estimate the size of various other dependent submarkets. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares split, and breakdowns were determined using secondary sources and verified through Primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Industrial Computed Tomography Market Segmental Analysis

Global Industrial Computed Tomography Market is segmented by offering, type, scanning technique, application, end use and region. Based on offering, the market is segmented into equipment and services. Based on type, the market is segmented into high-voltage CT, micro CT and others. Based on scanning technique, the market is segmented into fan-beam CT, cone-beam CT and others. Based on application, the market is segmented into flaw detection and inspection, failure analysis, assembly analysis, dimensioning and tolerancing analysis and others. Based on end use, the market is segmented into oil & gas, aerospace and defense, automotive, electronics and others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Driver of the Industrial Computed Tomography Market

The surge in additive manufacturing across diverse sectors is significantly propelling the growth of the industrial computed tomography market. As industries increasingly adopt 3D printing technologies, the need for effective quality assurance mechanisms becomes crucial. Industrial computed tomography offers a non-destructive testing solution that allows for thorough inspection and validation of intricately designed 3D printed components. This capability not only enhances product reliability and performance but also fosters innovation in design and production processes, further augmenting the demand for CT scanning technologies. Consequently, the integration of advanced CT solutions is becoming vital for maintaining high standards in the evolving landscape of manufacturing.

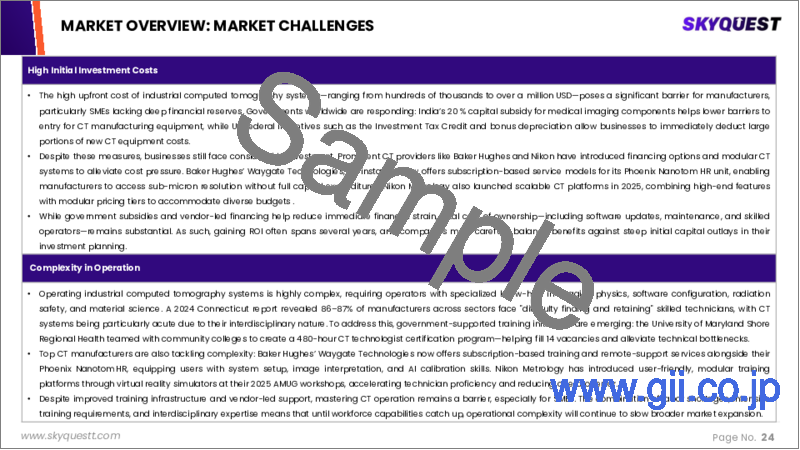

Restraints in the Industrial Computed Tomography Market

Restraints in the Industrial Computed Tomography market include the significant initial investment required for the acquisition of equipment, software, and specialized personnel. This upfront financial burden poses a challenge, particularly for small and medium-sized enterprises (SMEs) that may have constrained budgets. The high costs associated with adopting advanced computed tomography systems can deter these companies from integrating this technology into their operations, as they may struggle to justify the expense in relation to their limited financial capabilities. Consequently, this financial barrier can hinder market growth and limit accessibility for a vital segment of the industry.

Market Trends of the Industrial Computed Tomography Market

The Industrial Computed Tomography (CT) market is witnessing a notable trend of increased applications in research and development across various sectors. With the growing demand for precision and efficiency in product design, industrial CT is increasingly utilized to examine materials, components, and prototypes during the development phase. This shift allows manufacturers to detect imperfections, streamline design processes, and enhance product performance, leading to significant reductions in time-to-market and overall development costs. As industries prioritize innovation and quality, the integration of advanced CT scanning technologies in R&D initiatives is poised to drive market growth and profitability in the coming years.

Table of Contents

Introduction

- Objectives of the Study

- Scope of the Report

- Definitions

Research Methodology

- Information Procurement

- Secondary & Primary Data Methods

- Market Size Estimation

- Market Assumptions & Limitations

Executive Summary

- Global Market Outlook

- Supply & Demand Trend Analysis

- Segmental Opportunity Analysis

Market Dynamics & Outlook

- Market Overview

- Market Size

- Market Dynamics

- Drivers & Opportunities

- Restraints & Challenges

- Porters Analysis

- Competitive rivalry

- Threat of substitute

- Bargaining power of buyers

- Threat of new entrants

- Bargaining power of suppliers

Key Market Insights

- Key Success Factors

- Degree of Competition

- Top Investment Pockets

- Market Ecosystem

- Market Attractiveness Index, 2024

- PESTEL Analysis

- Macro-Economic Indicators

- Value Chain Analysis

- Pricing Analysis

- Regulatory Landscape

- Case Studies

- Technological Advancement

Global Industrial Computed Tomography Market Size by Offering & CAGR (2025-2032)

- Market Overview

- Equipment

- Services

Global Industrial Computed Tomography Market Size by Type & CAGR (2025-2032)

- Market Overview

- High-Voltage CT

- Micro CT

- Others

Global Industrial Computed Tomography Market Size by Scanning Technique & CAGR (2025-2032)

- Market Overview

- Fan-Beam CT

- Cone-Beam CT

- Others

Global Industrial Computed Tomography Market Size by Application & CAGR (2025-2032)

- Market Overview

- Flaw Detection and Inspection

- Failure Analysis

- Assembly Analysis

- Dimensioning and Tolerancing Analysis

- Others

Global Industrial Computed Tomography Market Size by End Use & CAGR (2025-2032)

- Market Overview

- Oil & Gas

- Aerospace and Defense

- Automotive

- Electronics

- Others

Global Industrial Computed Tomography Market Size & CAGR (2025-2032)

- North America (Offering, Type, Scanning Technique, Application, End Use)

- US

- Canada

- Europe (Offering, Type, Scanning Technique, Application, End Use)

- Germany

- Spain

- France

- UK

- Italy

- Rest of Europe

- Asia Pacific (Offering, Type, Scanning Technique, Application, End Use)

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America (Offering, Type, Scanning Technique, Application, End Use)

- Brazil

- Rest of Latin America

- Middle East & Africa (Offering, Type, Scanning Technique, Application, End Use)

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Competitive Intelligence

- Top 5 Player Comparison

- Market Positioning of Key Players, 2024

- Strategies Adopted by Key Market Players

- Recent Developments in the Market

- Company Market Share Analysis, 2024

- Company Profiles of All Key Players

- Company Details

- Product Portfolio Analysis

- Company's Segmental Share Analysis

- Revenue Y-O-Y Comparison (2022-2024)

Key Company Profiles

- Waygate Technologies (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Carl Zeiss AG (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Yxlon International GmbH (Comet Group) (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Wenzel Group (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Nikon Metrology NV (Nikon Corporation) (Belgium)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Diondo GmbH (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Werth Messtechnik GmbH (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- North Star Imaging (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- RX Solutions (France)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- VJ Technologies Inc. (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- VisiConsult GmbH (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Rayscan Technologies GmbH (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Rigaku Corporation (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Omron Corporation (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Shimadzu Corporation (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Lumafield (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Analogic Corporation (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- GE HealthCare (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Siemens Healthineers (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Canon Medical Systems Corporation (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments