|

|

市場調査レポート

商品コード

1605308

フェロアロイの市場規模、シェア、成長分析、タイプ別、用途別、最終用途産業別、地域別 - 産業予測、2024年~2031年Ferroalloys Market Size, Share, Growth Analysis, By Type (Bulk Alloys, Nobel Alloys), By Application (Stainless Steel, Cast Iron), By End Use Industry (Construction, Automotive), By Region - Industry Forecast 2024-2031 |

||||||

|

|||||||

| フェロアロイの市場規模、シェア、成長分析、タイプ別、用途別、最終用途産業別、地域別 - 産業予測、2024年~2031年 |

|

出版日: 2024年12月03日

発行: SkyQuest

ページ情報: 英文 157 Pages

納期: 3~5営業日

|

全表示

- 概要

- 目次

フェロアロイの世界市場規模は、2022年に503億5,000万米ドルと評価され、2023年の539億2,000万米ドルから2031年には933億5,000万米ドルに成長し、予測期間(2024-2031年)のCAGRは7.1%で成長する見通しです。

フェロアロイは、溶融金属に特定の合金元素を実用的かつ経済的に添加することで、鋼や合金の特性を高めるという重要な役割を担っています。鉄鋼生産に不可欠なフェロアロイは、鉄鋼用途を精製・強化する能力として、産業界でますます認知されるようになっています。政府や国際機関は、特に発展途上国におけるフェロアロイの使用を促進することにより、環境問題の高まりに対応しています。注目すべき例としては、Elkem Metal Canada Inc.が挙げられます。同社は、冶金用石炭に代わる環境に優しいバイオカーボンブリケットを開発するために、連邦政府から500万カナダドルを、ケベック州政府から1,195万カナダドルを追加で獲得しました。このイニシアチブは、鋳造と製鉄所の環境フットプリントを大幅に削減することを目的としており、冶金石炭を持続可能なバイオブリケットに置き換えることで、年間10万トンのCO2換算量を削減する計画です。フェロアロイの需要は、優れた引張強度と耐久性を提供する能力によっても牽引されており、自動車および輸送分野の利害関係者にとって魅力的なものとなっています。COVID-19後の情勢では、業界関係者は市場成長を促すためにサプライヤーやエコシステム・パートナーとバランスの取れた関係を築こうと努力しており、様々な産業におけるフェロアロイの用途や投資の堅調な将来を示しています。

目次

イントロダクション

- 調査の目的

- 調査範囲

- 定義

調査手法

- 情報調達

- 二次データと一次データの方法

- 市場規模予測

- 市場の前提条件と制限

エグゼクティブサマリー

- 世界市場の見通し

- 供給と需要の動向分析

- セグメント別機会分析

市場力学と見通し

- 市場概要

- 市場規模

- 市場力学

- 促進要因と機会

- 抑制要因と課題

- ポーター分析と影響

- 競争企業間の敵対関係

- 代替品の脅威

- 買い手の交渉力

- 新規参入業者の脅威

- 供給企業の交渉力

主な市場の考察

- 重要成功要因

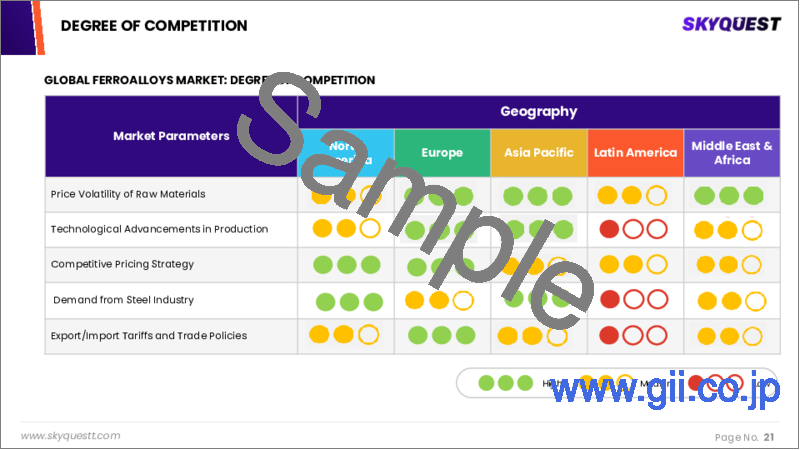

- 競合の程度

- 主な投資機会

- 市場エコシステム

- 市場の魅力指数(2023年)

- PESTEL分析

- マクロ経済指標

- バリューチェーン分析

- 価格分析

- 規制情勢

- ケーススタディ

フェロアロイの市場規模:タイプ別& CAGR(2024-2031)

- 市場概要

- バルク合金

- フェロシリコン

- フェロマンガン

- フェロクロム

- ノーブルアロイ

- フェロモリブデン

- フェロニッケル

- フェロバナジウム

フェロアロイの市場規模:用途別& CAGR(2024-2031)

- 市場概要

- 炭素鋼および低合金鋼

- ステンレス鋼

- 合金鋼

- 鋳鉄

- その他

- 超合金

- 溶接電極

フェロアロイの市場規模:最終用途産業別& CAGR(2024-2031)

- 市場概要

- 建築

- インフラストラクチャー

- 住宅

- 商業

- 自動車

- 乗用車

- 商用車

- 航空宇宙

- 航空機製造

- 宇宙船製造

- 石油・ガス

- 探検

- 生産

- その他

- エレクトロニクス

- 造船

フェロアロイの市場規模:地域別& CAGR(2024-2031)

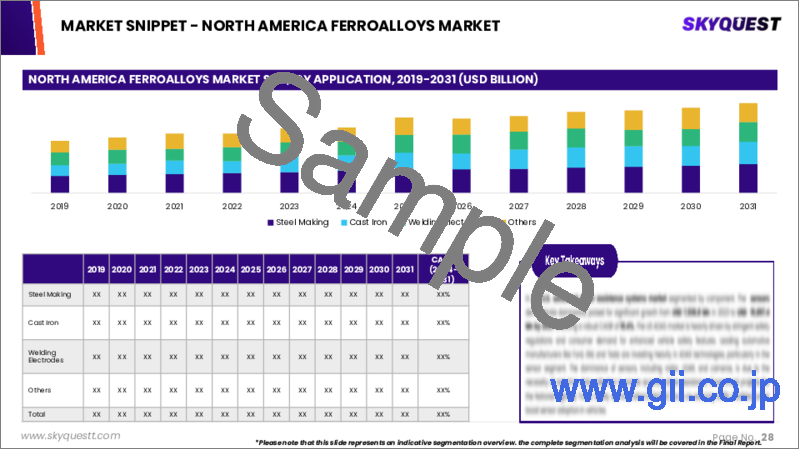

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- スペイン

- フランス

- イタリア

- その他欧州地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ地域

- 中東およびアフリカ

- GCC諸国

- 南アフリカ

- その他中東・アフリカ

競合情報

- 上位5社の比較

- 主要企業の市場ポジショニング(2023年)

- 主な市場企業が採用した戦略

- 市場の最近の動向

- 企業の市場シェア分析(2023年)

- 主要企業の企業プロファイル

- 会社概要

- 製品ポートフォリオ分析

- セグメント別シェア分析

- 収益の前年比比較(2021-2023)

主要企業プロファイル

- Glencore(Switzerland)

- Eurasian Resources Group(ERG)(Luxembourg)

- ArcelorMittal(Luxembourg)

- Tata Steel(India)

- China Minmetals Corporation(China)

- Jindal Steel & Power Ltd.(India)

- OM Holdings Ltd.(Singapore)

- SAIL(Steel Authority of India Limited)(India)

- Ferroglobe PLC(UK)

- Samancor Chrome(South Africa)

- Assmang Proprietary Limited(South Africa)

- Erdos Group(China)

- Henan Xibao Metallurgy Materials Group Co., Ltd.(China)

- Sheng Yan Group(China)

- Nikopol Ferroalloy Plant(Ukraine)

- Ferro Alloys Corporation Limited(India)

- Shanghai Shenjia Ferroalloys Co., Ltd.(China)

- Sinosteel Jilin Ferroalloy Corporation(China)

- Mitsubishi Corporation RtM Japan Ltd.(Japan)

- Vale S.A.(Brazil)

結論と推奨事項

Global Ferroalloys Market size was valued at USD 50.35 billion in 2022 and is poised to grow from USD 53.92 billion in 2023 to USD 93.35 billion by 2031, growing at a CAGR of 7.1% during the forecast period (2024-2031).

Ferroalloys play a critical role in enhancing the properties of steels and alloys through the practical and economical addition of specific alloying elements to molten metal. Essential for steel production, ferroalloys are increasingly recognized by the industrial sector for their capability to refine and strengthen steel applications. Governments and international organizations are responding to rising environmental concerns by promoting the usage of ferroalloys, particularly in developing nations; this support includes funding initiatives to facilitate their adoption. A noteworthy example is Elkem Metal Canada Inc., which secured CAD 5 million from the federal government and an additional CAD 11.95 million from the Quebec government to develop biocarbon briquettes-an eco-friendly alternative to metallurgical coal. This initiative aims to significantly reduce the environmental footprint of foundries and steelworks, with plans to cut 100,000 tonnes of CO2 equivalent annually by replacing metallurgical coal with sustainable bio-briquettes. The demand for ferroalloys is also being driven by their ability to deliver superior tensile strength and durability, making them attractive to stakeholders in the automotive and transportation sectors. In the post-COVID-19 landscape, industry players are striving to establish balanced relationships with suppliers and ecosystem partners to stimulate market growth, indicating a robust future for ferroalloy applications and investments across various industries.

Top-down and bottom-up approaches were used to estimate and validate the size of the Global Ferroalloys market and to estimate the size of various other dependent submarkets. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares split, and breakdowns were determined using secondary sources and verified through Primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Global Ferroalloys Market Segmental Analysis

Global Ferroalloys Market is segmented by type, application, end use industry and region. Based on type, the market is segmented into bulk alloys (ferrosilicon, ferromanganese, ferrochromium) and noble alloys (ferromolybdenum, ferronickel, ferrovanadium). Based on application, the market is segmented into carbon & low alloy steel, stainless steel, alloy steel, cast iron and others (superalloys, welding electrodes). Based on end use industry, the market is segmented into construction (infrastructure, residential, commercial), automotive (passenger vehicles, commercial vehicles), aerospace (aircraft manufacturing, spacecraft manufacturing), oil & gas (exploration, production) and others (electronics, shipbuilding). Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & and Africa.

Driver of the Global Ferroalloys Market

The global ferroalloys market is expected to see significant growth driven by the increasing demand for steel production worldwide. Various types of ferroalloys, including ferrochrome, ferrosilicon, ferromanganese, and ferromolybdenum, play crucial roles in different steel-making processes. For example, ferrovanadium enhances steel's resistance to aggressive chemicals such as alkalis and acids, while also improving the strength of casting and welding electrodes. The need for high-performance materials capable of withstanding extreme operational conditions in industries like aerospace and energy is propelling the demand for superalloys, which utilize ferroalloys. As the aerospace sector pushes for advanced aircraft manufacturing, the prospects for ferroalloys continue to brighten, presenting ample opportunities for stakeholders in this market.

Restraints in the Global Ferroalloys Market

The global ferroalloys market may face significant constraints due to the increasing substitution of stainless steel with carbon fibers. Known for their lightweight, high strength, and excellent load-bearing properties, carbon fibers are increasingly favored in the automotive industry, leading to an approximate 30% reduction in vehicle weight when utilized. The rising emphasis on fuel efficiency and the demand for lightweight vehicles further elevate the popularity of carbon fibers as a preferred material. Additionally, advancements in automated production processes make carbon fibers a more appealing option compared to stainless steel, ultimately posing challenges to the growth of the ferroalloys market in the future.

Market Trends of the Global Ferroalloys Market

The global ferroalloys market is poised for significant growth, driven primarily by the booming construction industry, which remains the largest end-use market for steel products such as rebars, sections, channels, and angles. Projections indicate robust expansion of the construction sector from 2022 to 2030, fueled by increasing infrastructure investments and urbanization trends. This surge in construction activities is expected to elevate the demand for ferroalloys, essential feedstocks in steel production, thereby bolstering the overall market. As the need for high-performance steel rises, the ferroalloys market is set to benefit from favorable market dynamics and increased consumption across various applications.

Table of Contents

Introduction

- Objectives of the Study

- Scope of the Report

- Definitions

Research Methodology

- Information Procurement

- Secondary & Primary Data Methods

- Market Size Estimation

- Market Assumptions & Limitations

Executive Summary

- Global Market Outlook

- Supply & Demand Trend Analysis

- Segmental Opportunity Analysis

Market Dynamics & Outlook

- Market Overview

- Market Size

- Market Dynamics

- Driver & Opportunities

- Restraints & Challenges

- Porters Analysis & Impact

- Competitive rivalry

- Threat of substitute

- Bargaining power of buyers

- Threat of new entrants

- Bargaining power of suppliers

Key Market Insights

- Key Success Factors

- Degree of Competition

- Top Investment Pockets

- Market Ecosystem

- Market Attractiveness Index, 2023

- PESTEL Analysis

- Macro-Economic Indicators

- Value Chain Analysis

- Pricing Analysis

- Regulatory Landscape

- Case Studies

Global Ferroalloys Market Size by Type & CAGR (2024-2031)

- Market Overview

- Bulk Alloys

- Ferrosilicon

- Ferromanganese

- Ferrochromium

- Noble Alloys

- Ferromolybdenum

- Ferronickel

- Ferrovanadium

Global Ferroalloys Market Size by Application & CAGR (2024-2031)

- Market Overview

- Carbon & Low Alloy Steel

- Stainless Steel

- Alloy Steel

- Cast Iron

- Others

- Superalloys

- Welding Electrodes

Global Ferroalloys Market Size by End Use Industry & CAGR (2024-2031)

- Market Overview

- Construction

- Infrastructure

- Residential

- Commercial

- Automotive

- Passenger Vehicles

- Commercial Vehicles

- Aerospace

- Aircraft Manufacturing

- Spacecraft Manufacturing

- Oil & Gas

- Exploration

- Production

- Others

- Electronics

- Shipbuilding

Global Ferroalloys Market Size & CAGR (2024-2031)

- North America, (Type, Application, End Use Industry)

- US

- Canada

- Europe, (Type, Application, End Use Industry)

- UK

- Germany

- Spain

- France

- Italy

- Rest of Europe

- Asia-Pacific, (Type, Application, End Use Industry)

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Latin America, (Type, Application, End Use Industry)

- Brazil

- Rest of Latin America

- Middle East & Africa, (Type, Application, End Use Industry)

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Competitive Intelligence

- Top 5 Player Comparison

- Market Positioning of Key Players, 2023

- Strategies Adopted by Key Market Players

- Recent Developments in the Market

- Company Market Share Analysis, 2023

- Company Profiles of All Key Players

- Company Details

- Product Portfolio Analysis

- Company's Segmental Share Analysis

- Revenue Y-O-Y Comparison (2021-2023)

Key Company Profiles

- Glencore (Switzerland)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Eurasian Resources Group (ERG) (Luxembourg)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- ArcelorMittal (Luxembourg)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Tata Steel (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- China Minmetals Corporation (China)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Jindal Steel & Power Ltd. (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- OM Holdings Ltd. (Singapore)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- SAIL (Steel Authority of India Limited) (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Ferroglobe PLC (UK)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Samancor Chrome (South Africa)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Assmang Proprietary Limited (South Africa)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Erdos Group (China)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Henan Xibao Metallurgy Materials Group Co., Ltd. (China)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Sheng Yan Group (China)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Nikopol Ferroalloy Plant (Ukraine)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Ferro Alloys Corporation Limited (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Shanghai Shenjia Ferroalloys Co., Ltd. (China)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Sinosteel Jilin Ferroalloy Corporation (China)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Mitsubishi Corporation RtM Japan Ltd. (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Vale S.A. (Brazil)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments