|

市場調査レポート

商品コード

1762544

ヘルスケアデジタルマーケティング市場:業界動向と世界の予測 - 技術タイプ別、製品タイプ別、エンドユーザー別、主要地域別Healthcare Digital Marketing Market: Industry Trends and Global Forecasts - Distribution by Type of Technology, Type of Product, End User and Key Geographical Regions |

||||||

カスタマイズ可能

|

|||||||

| ヘルスケアデジタルマーケティング市場:業界動向と世界の予測 - 技術タイプ別、製品タイプ別、エンドユーザー別、主要地域別 |

|

出版日: 2025年07月04日

発行: Roots Analysis

ページ情報: 英文 177 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

ヘルスケアデジタルマーケティング市場:概要

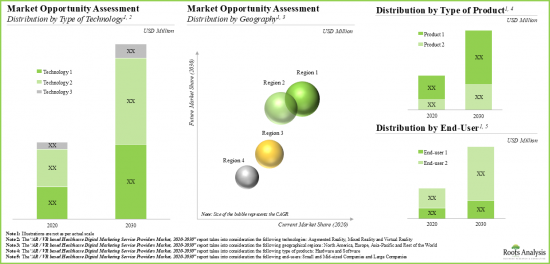

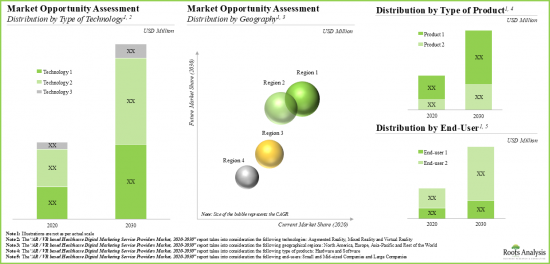

世界のヘルスケアデジタルマーケティングの市場規模は今年、3億500万米ドルとなりました。同市場は、予測期間中に26%のCAGRで拡大すると予測されています。

市場セグメンテーションと機会分析は、以下のパラメータでセグメント化されています:

技術タイプ

- AR

- VR

- MR

製品タイプ

- ハードウェア

- ソフトウェア

エンドユーザー

- 中小製薬会社

- 大手製薬会社

主要地域

- 北米

- 欧州

- アジア太平洋

- その他の地域

ヘルスケアデジタルマーケティング市場:成長と動向

ヘルスケア産業の進化は、テクノロジーの進歩と没入型・双方向型テクノロジーの採用増加によって推進されています。世界中でデジタル化が進む中、健康データのリアルタイム・データ・アクセス、管理、分析の必要性が著しく高まっています。その結果、多くの製薬会社は、教育・マーケティング・コンテンツに体験的でインタラクティブな次元を提供するため、拡張現実(AR)や仮想現実(VR)の機能を取り入れ始めています。さらに、従来の戦略とは異なり、デジタルマーケティングは費用対効果が高いだけでなく、ターゲットを絞ったアウトリーチやデータ主導の結果など、さらなるメリットも提供します。

ヘルスケア業界のデジタル広告への貢献は世界全体の2%に過ぎませんが、消費者側からもこの形態のマーケティングへの関心が高まっていることは注目に値します。現在、医薬品マーケティングにおけるAR/VRの用途は、トレーニング、教育、展示会でのデモンストレーションに限られているが、専門家は、その真の可能性はまだ開拓されていないと考えています。さらに、多くの利害関係者は、オンライン購入に関する顧客の視点が進化するにつれて、現在のシナリオに関して楽観的であり続けています。実際、これはデジタル広告の専門家だけでなく、オンライン小売業者にも有利な機会をもたらしています。

ヘルスケアデジタルマーケティング市場:主要インサイト

当レポートでは、世界のヘルスケアデジタルマーケティング市場の現状を掘り下げ、業界内の潜在的な成長機会を特定しています。主な調査結果は以下の通りです:

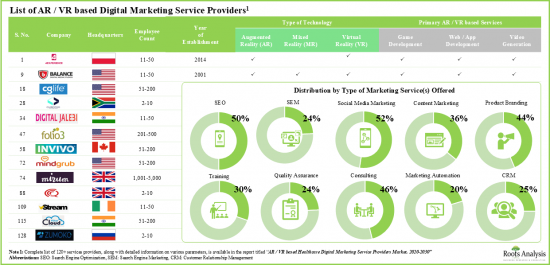

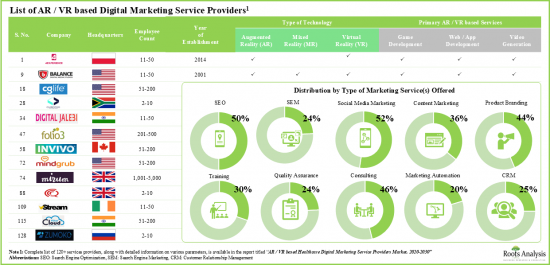

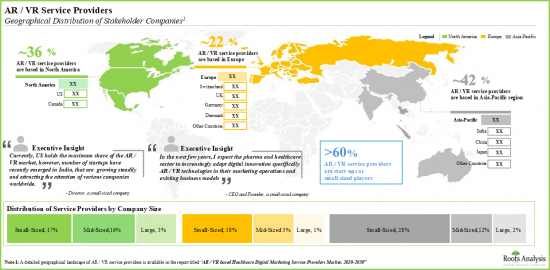

- 現在、120社以上の企業が世界のヘルスケア業界にAR/VRおよび関連デジタルマーケティングサービスを提供していると主張しています。

- 過去5年間で、数社がこの領域に参入し、ARとVRの両方の技術を利用したアプリ開発と動画/コンテンツ生成サービスを提供しています。

- サービス・プロバイダーの大半はARとVR技術に基づいたサービスを提供していますが、MRベースのソリューションがこの領域で徐々に人気を集めています。

- この分野の企業の70%以上がAR/VRベースのウェブサイト/アプリ開発、3600のビデオ/アニメーション・デザイン・サービスを提供していることは注目に値します。

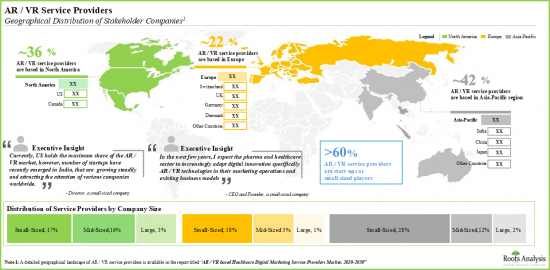

- 2010年以降に設立された企業の50%以上がアジア太平洋地域に本社を置いており、Acodez、Clevbrain、Fluper、Infinito VFXなどがその例です。

- この分野に従事する企業の大半は新興国地域に拠点を置いており、市場情勢は中小企業の存在によって特徴付けられています。

- 競争優位性を獲得するため、各社は能力を拡大し、それぞれのサービス・ポートフォリオを強化するために多大な努力を払っています。

- 大手製薬企業も、AR/VR技術を活用したさまざまなデジタル・マーケティングや患者・医師トレーニングに基づく取り組みに多額の投資を行っています。

- AR/VRベースのマーケティング・ツールの人気が高まっていることから、さまざまな治療法開発企業がAR/VRサービス・プロバイダーと提携する可能性が高いです。

- ヘルスケア業界におけるAR/VRベースの技術の採用率が予想されることから、デジタルマーケティングサービスプロバイダー市場は今後10年間、年率~26%の成長率で成長する可能性が高いです。

ヘルスケアデジタルマーケティング市場の参入企業例

- ARWorks

- CG Life

- CubeZoo

- Impact XM

- INVIVO Communications

- Mirum

- Pixacore

- Random42

- Quast Media

- Tipping Point Media

- vStream

目次

第1章 序文

第2章 エグゼクティブサマリー

第3章 イントロダクション

- 章の概要

- 医薬品マーケティングにおける主な課題

- デジタルマーケティングの重要性

- 人気のデジタルマーケティング戦略

- 医薬品デジタルマーケティングにおける拡張現実(AR)と仮想現実(VR)の活用

- AR/VR業界の成長制約

- 将来の展望

第4章 AR/VRベースのヘルスケアデジタルマーケティング企業:現在の市場情勢

- 章の概要

- 製薬業界におけるデジタルマーケティング:市場全体

第5章 企業競争力分析

- 章の概要

- 調査手法と主要なパラメータ

- 競争力分析:北米に拠点を置くAR/VRベースのデジタルマーケティングサービスプロバイダー

- 競争力分析:欧州に拠点を置くAR/VRベースのデジタルマーケティングサービスプロバイダー

- 競争力分析:アジア太平洋に拠点を置くAR/VRベースのデジタルマーケティングサービスプロバイダー

第6章 企業プロファイル

- 章の概要

- ARworks

- CG Life

- CubeZoo

- Impact XM

- INVIVO Communications

- Mindgrub

- Mirum

- PIXACORE

- Quast Media

- Random42

- Tipping Point Media

- vStream

第7章 潜在的な戦略的パートナー

- 章の概要

- 範囲と調査手法

- デジタルマーケティング企業にとっての潜在的な戦略的パートナー

第8章 大手製薬会社のデジタルマーケティング関連の取り組み

第9章 ケーススタディ

- 章の概要

- Zocular向けNarola Infotech

- Actelion向けViscira

- LifeLabs向けSoftCover VR

- MISA向けVirtual Reality Ireland

- vCura向けViitorCloud

- リラヴァティ病院向けKwebmaker

- My Health Meter向けIntermind

- Providence Healthcare向けVR Vision

- Zoetis向けCitrusBits

第10章 市場予測

- 章の概要

- 予測調査手法と主要な前提条件

- 2030年までのヘルスケア業界におけるAR/VRベースのデジタルマーケティング機会

- ヘルスケア業界におけるAR/VRベースのデジタルマーケティングの機会:技術タイプ別

- ヘルスケア業界におけるAR/VRベースのデジタルマーケティングの機会:製品タイプ別

- ヘルスケア業界におけるAR/VRベースのデジタルマーケティングの機会:エンドユーザー別

- ヘルスケア業界におけるAR/VRベースのデジタルマーケティングの機会:主要地域別

第11章 エグゼクティブ洞察

第12章 結論

第13章 付録1:表形式データ

第14章 付録2:企業・団体一覧

List of Tables

- Figure 3.1 Digital Advertising Spend: Distribution by Type of Industry

- Figure 3.2 Challenges in Pharmaceutical Marketing

- Figure 3.3 Popular Digital Marketing Strategies

- Figure 3.4 Social Media Marketing Channels

- Figure 3.5 Search Engine Ranking Factors

- Figure 3.6 Benefits of AI in Digital Marketing

- Figure 4.1 AR / VR based Digital Marketing Service Providers: Distribution by Type of Technology

- Figure 4.2 AR / VR based Digital Marketing Service Providers: Distribution by AR / VR based Services Offered

- Figure 4.3 AR / VR based Digital Marketing Service Providers: Distribution by Type of Digital Marketing Services Offered

- Figure 4.4 AR / VR based Digital Marketing Service Providers: Distribution by Secondary Marketing Services Offered

- Figure 4.5 AR / VR based Digital Marketing Service Providers: Distribution by Year of Establishment.

- Figure 4.6 AR / VR based Digital Marketing Service Providers: Distribution by Company Size

- Figure 4.7 AR / VR based Digital Marketing Service Providers: Distribution by Geographical Location

- Figure 5.1 Competitiveness Analysis: AR / VR based Digital Marketing Service Providers based in North America

- Figure 5.2 Competitiveness Analysis: AR / VR based Digital Marketing Service Providers based in Europe

- Figure 5.3 Competitiveness Analysis: AR / VR based Digital Marketing Service Providers based in Asia-Pacific

- Figure 8.1 Big Pharma Initiatives: Distribution by Year

- Figure 8.2 Big Pharma Initiatives: Distribution by Type of Initiative

- Figure 8.3 Big Pharma Initiatives: Distribution by Type of Application Area

- Figure 8.4 Big Pharma Initiatives: Heat Map Analysis by Type of Application Area

- Figure 8.5 Big Pharma Initiatives: Distribution by Type of Solution

- Figure 8.6 Big Pharma Initiatives: Heat Map Analysis by Type of Solution

- Figure 8.7 Leading Players: Distribution by Number of Initiatives

- Figure 8.8 Leading Partners: Distribution by Number of Initiatives

- Figure 10.1 Overall AR / VR based Digital Marketing Opportunity in Healthcare Industry, Till 2035 (USD Billion)

- Figure 10.2 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Type of Technology (USD Billion)

- Figure 10.3 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Product (USD Billion)

- Figure 10.4 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by End-User (USD Billion)

- Figure 10.5 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Key Geographical Region (USD Billion)

- Figure 10.6 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America, Till 2035 (USD Billion)

- Figure 10.7 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of AR based Services, Till 2035 (USD Billion)

- Figure 10.8 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of VR based Services, Till 2035 (USD Billion)

- Figure 10.9 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of MR based Services, Till 2035 (USD Billion)

- Figure 10.10 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of Hardware Products, Till 2035 (USD Billion)

- Figure 10.11 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of Software Products, Till 2035 (USD Billion)

- Figure 10.12 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe, Till 2035 (USD Billion)

- Figure 10.13 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of AR based Services, Till 2035 (USD Billion)

- Figure 10.14 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of VR based Services, Till 2035 (USD Billion)

- Figure 10.15 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of MR based Services, Till 2035 (USD Billion)

- Figure 10.16 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of Hardware Products, Till 2035 (USD Billion)

- Figure 10.17 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of Software Products, Till 2035 (USD Billion)

- Figure 10.18 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific, Till 2035 (USD Billion)

- Figure 10.19 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific: Share of AR based Services, Till 2035 (USD Billion)

- Figure 10.20 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific: Share of VR based Services, Till 2035 (USD Billion)

- Figure 10.21 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific: Share of MR based Services, Till 2035 (USD Billion)

- Figure 10.22 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific: Share of Hardware Products, Till 2035 (USD Billion)

- Figure 10.23 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific: Share of Software Products, Till 2035 (USD Billion)

LIST OF TABLES

- Table 4.1 AR / VR based Digital Marketing Service Providers: Information on Type of Technology and Affiliated Services Offered

- Table 4.2 AR / VR based Digital Marketing Service Providers: Information on Type of Digital Marketing Services Offered

- Table 4.3 AR / VR based Digital Marketing Service Providers: Information on Secondary Marketing Services Offered

- Table 4.4 AR / VR based Digital Marketing Service Providers: List of Companies

- Table 6.1 ARworks: Company Snapshot

- Table 6.2 CG Life: Company Snapshot

- Table 6.3 CG Life: Recent Developments and Future Outlook

- Table 6.4 CubeZoo: Company Snapshot

- Table 6.5 Impact XM: Company Snapshot

- Table 6.6 Impact XM: Recent Developments and Future Outlook

- Table 6.7 INVIVO Communications: Company Snapshot

- Table 6.8 INVIVO Communications: Recent Developments and Future Outlook

- Table 6.9 Mindgrub: Company Snapshot

- Table 6.10 Mindgrub: Recent Developments and Future Outlook

- Table 6.11 Mirum: Company Snapshot

- Table 6.12 Mirum: Recent Developments and Future Outlook

- Table 6.13 PIXACORE: Company Snapshot

- Table 6.14 PIXACORE: Recent Developments and Future Outlook

- Table 6.15 Quast Media: Company Snapshot

- Table 6.16 Random42: Company Snapshot

- Table 6.17 Rando m42: Recent Developments and Future Outlook

- Table 6.18 Tipping Point Media: Company Snapshot

- Table 6.19 vStream: Company Snapshot

- Table 6.20 vStream: Recent Developments and Future Outlook

- Table 7.1 Most Likely Partners

- Table 7.2 Likely Partners

- Table 7.3 Less Likely Partners

- Table 7.4 Least Likely Partners

- Table 13.1 AR / VR based Digital Marketing Service Providers: Distribution by Type of Technology

- Table 13.2 AR / VR based Digital Marketing Service Providers: Distribution by AR / VR based Services Offered

- Table 13.3 AR / VR based Digital Marketing Service Providers: Distribution by Digital Marketing Servises Offered

- Table 13.4 AR / VR based Digital Marketing Service Providers: Distribution by Secondary Marketing Services Offered

- Table 13.5 AR / VR based Digital Marketing Service Providers: Distribution by Year of Establishment

- Table 13.6 AR / VR based Digital Marketing Service Providers: Distribution by Company Size

- Table 13.7 AR / VR based Digital Marketing Service Providers: Distribution by Geographical Location

- Table 13.8 Big Pharma Initiatives: Distribution by Year

- Table 13.9 Big Pharma Initiatives: Distribution by Type of Initiative

- Table 13.10 Big Pharma Initiatives: Distribution by Type of Application Area

- Table 13.11 Big Pharma Initiatives: Distribution by Type of Solution

- Table 13.12 Leading Players: Analysis by Number of Initiatives

- Table 13.13 Leading Partners: Analysis by Number of Initiatives

- Table 13.14 Overall AR / VR based Digital Marketing Opportunity in Healthcare Industry, Till 2035 (USD Billion)

- Table 13.15 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Type of Technology (USD Billion)

- Table 13.16 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Product (USD Billion)

- Table 13.17 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by End-User (USD Billion)

- Table 13.18 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Key Geographical Region (USD Billion)

- Table 13.19 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America, Till 2035 (USD Billion)

- Table 13.20 AR / VR based Digital Marketing Opportunity in Healthcare Industry: in North America: Share of AR based Services, Till 2035 (USD Billion)

- Table 13.21 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of VR based Services, Till 2035 (USD Billion)

- Table 13.22 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of MR based Services, Till 2035 (USD Billion)

- Table 13.23 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of Hardware Products, Till 2035 (USD Billion)

- Table 13.24 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of Software Products, Till 2035 (USD Billion)

- Table 13.25 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe, Till 2035 (USD Billion)

- Table 13.26 AR / VR based Digital Marketing Opportunity in Healthcare Industry: in Europe: Share of AR based Services, Till 2035 (USD Billion)

- Table 13.27 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of VR based Services, Till 2035 (USD Billion)

- Table 13.28 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of MR based Services, Till 2035 (USD Billion)

- Table 13.29 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of Hardware Products, Till 2035 (USD Billion)

- Table 13.30 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of Software Products, Till 2035 (USD Billion)

- Table 13.31 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific, Till 2035 (USD Billion)

- Table 13.32 AR / VR based Digital Marketing Opportunity in Healthcare Industry: in Asia-Pacific: Share of AR based Services, Till 2035 (USD Billion)

- Table 13.33 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Share of VR based Services, Till 2035 (USD Billion)

- Table 13.34 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Share of MR based Services, Till 2035 (USD Billion)

- Table 13.35 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Share of Hardware Products, Till 2035 (USD Billion)

- Table 13.36 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Share of Software Products, Till 2035 (USD Billion)

- Table 13.37 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World, Till 2035 (USD Billion)

- Table 13.38 AR / VR based Digital Marketing Opportunity in Healthcare Industry: in Rest of the World: Share of AR based Services, Till 2035 (USD Billion)

- Table 13.39 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Share of VR based Services, Till 2035 (USD Billion)

- Table 13.40 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Share of MR based Services, Till 2035 (USD Billion)

- Table 13.41 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Share of Hardware Products, Till 2035 (USD Billion)

- Table 13.42 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Share of Software Products, Till 2035 (USD Billion)

List of Figures

- Figure 3.1 Digital Advertising Spend: Distribution by Type of Industry

- Figure 3.2 Challenges in Pharmaceutical Marketing

- Figure 3.3 Popular Digital Marketing Strategies

- Figure 3.4 Social Media Marketing Channels

- Figure 3.5 Search Engine Ranking Factors

- Figure 3.6 Benefits of AI in Digital Marketing

- Figure 4.1 AR / VR based Digital Marketing Service Providers: Distribution by Type of Technology

- Figure 4.2 AR / VR based Digital Marketing Service Providers: Distribution by AR / VR based Services Offered

- Figure 4.3 AR / VR based Digital Marketing Service Providers: Distribution by Type of Digital Marketing Services Offered

- Figure 4.4 AR / VR based Digital Marketing Service Providers: Distribution by Secondary Marketing Services Offered

- Figure 4.5 AR / VR based Digital Marketing Service Providers: Distribution by Year of Establishment.

- Figure 4.6 AR / VR based Digital Marketing Service Providers: Distribution by Company Size

- Figure 4.7 AR / VR based Digital Marketing Service Providers: Distribution by Geographical Location

- Figure 5.1 Competitiveness Analysis: AR / VR based Digital Marketing Service Providers based in North America

- Figure 5.2 Competitiveness Analysis: AR / VR based Digital Marketing Service Providers based in Europe

- Figure 5.3 Competitiveness Analysis: AR / VR based Digital Marketing Service Providers based in Asia-Pacific

- Figure 8.1 Big Pharma Initiatives: Distribution by Year

- Figure 8.2 Big Pharma Initiatives: Distribution by Type of Initiative

- Figure 8.3 Big Pharma Initiatives: Distribution by Type of Application Area

- Figure 8.4 Big Pharma Initiatives: Heat Map Analysis by Type of Application Area

- Figure 8.5 Big Pharma Initiatives: Distribution by Type of Solution

- Figure 8.6 Big Pharma Initiatives: Heat Map Analysis by Type of Solution

- Figure 8.7 Leading Players: Distribution by Number of Initiatives

- Figure 8.8 Leading Partners: Distribution by Number of Initiatives

- Figure 10.1 Overall AR / VR based Digital Marketing Opportunity in Healthcare Industry, Till 2035 (USD Billion)

- Figure 10.2 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Type of Technology (USD Billion)

- Figure 10.3 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Product (USD Billion)

- Figure 10.4 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by End-User (USD Billion)

- Figure 10.5 AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Key Geographical Region (USD Billion)

- Figure 10.6 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America, Till 2035 (USD Billion)

- Figure 10.7 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of AR based Services, Till 2035 (USD Billion)

- Figure 10.8 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of VR based Services, Till 2035 (USD Billion)

- Figure 10.9 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of MR based Services, Till 2035 (USD Billion)

- Figure 10.10 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of Hardware Products, Till 2035 (USD Billion)

- Figure 10.11 AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of Software Products, Till 2035 (USD Billion)

- Figure 10.12 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe, Till 2035 (USD Billion)

- Figure 10.13 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of AR based Services, Till 2035 (USD Billion)

- Figure 10.14 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of VR based Services, Till 2035 (USD Billion)

- Figure 10.15 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of MR based Services, Till 2035 (USD Billion)

- Figure 10.16 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of Hardware Products, Till 2035 (USD Billion)

- Figure 10.17 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of Software Products, Till 2035 (USD Billion)

- Figure 10.18 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific, Till 2035 (USD Billion)

- Figure 10.19 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific: Share of AR based Services, Till 2035 (USD Billion)

- Figure 10.20 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific: Share of VR based Services, Till 2035 (USD Billion)

- Figure 10.21 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific: Share of MR based Services, Till 2035 (USD Billion)

- Figure 10.22 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific: Share of Hardware Products, Till 2035 (USD Billion)

- Figure 10.23 AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia Pacific: Share of Software Products, Till 2035 (USD Billion)

HEALTHCARE DIGITAL MARKETING MARKET: OVERVIEW

As per Roots Analysis, the global healthcare digital marketing market valued at USD 305 million in the current year is anticipated to grow at a CAGR of 26% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Technology

- AR

- VR

- MR

Type of Product

- Hardware

- Software

End User

- Small and Mid-sized Pharma Companies

- Large Pharma Companies

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

HEALTHCARE DIGITAL MARKETING MARKET: GROWTH AND TRENDS

The evolution of the healthcare industry is being driven by advancements in technology and the rising adoption of immersive and interactive technologies. With increasing digitization across the globe, the need for real-time data access, management and analysis of health data has gained remarkable importance. Consequently, many pharma companies have begun incorporating augmented reality (AR) and virtual reality (VR) features, in order to offer an experiential and interactive dimension to their educational / marketing content. Further, unlike traditional strategies, digital marketing is not only more cost-effective but also provides additional advantages, including targeted outreach and data-driven results.

It is worth highlighting that although the contribution of the healthcare industry is merely 2% of the global spending on digital advertising, there is a growing interest in this form of marketing from the consumer side as well. Currently, the applications of AR / VR in pharma marketing are limited to training, education and demonstrations in tradeshows; however, experts believe that its true potential is yet to be tapped. Further, many stakeholders remain optimistic regarding the current scenario, as the customer perspective regarding online purchases evolves. In fact, this presents lucrative opportunities for online retailers, as well as digital advertising specialists.

HEALTHCARE DIGITAL MARKETING MARKET: KEY INSIGHTS

The report delves into the current state of the global healthcare digital marketing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, more than 120 companies claim to offer AR / VR and affiliated digital marketing services to the global healthcare industry.

- In the last five years, several companies have entered this domain, offering app development and video / content generation services, through the use of both AR and VR technologies.

- Although, majority of the service providers offer services based on AR and VR technologies, MR based solutions are gradually gaining traction in this domain.

- It is worth highlighting that more than 70% of companies in this domain offer AR / VR based website / app development and 3600 video / animation design services.

- More than 50% of the companies established post 2010 are headquartered in Asia-Pacific region; examples include Acodez, Clevbrain, Fluperand Infinito VFX.

- Majority of the companies engaged in this field are based in developing regions; the market landscape is characterized by the presence of both small and mid-sized firms.

- In order to achieve a competitive edge, companies are putting in significant efforts to expand their capabilities and enhance their respective service portfolios.

- Big pharma players have also invested significantly in various digital marketing and patient / physician training-based initiatives through the use of AR / VR technologies.

- Given the growing popularity of AR / VR based marketing tools, various therapy developers are likely to forge alliances with AR / VR service providers in the foreseen future.

- Owing to the anticipated rate of adoption of AR / VR based technologies in the healthcare industry, the digital marketing service providers market is likely to grow at an annualized growth rate of ~26%, over the next decade.

Example Players in the Healthcare Digital Marketing Market

- ARWorks

- CG Life

- CubeZoo

- Impact XM

- INVIVO Communications

- Mirum

- Pixacore

- Random42

- Quast Media

- Tipping Point Media

- vStream

HEALTHCARE DIGITAL MARKETING MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the healthcare digital marketing market, focusing on key market segments, including [A] type of technology, [B] type of product, [C] end user and [D] key geographical regions.

- Market Landscape: A comprehensive evaluation of the companies offering AR / VR based digital marketing services, based on several relevant parameters, such as [A] type of technology, [B] AR / VR specific services, [C] additional digital marketing services, [D] year of establishment, [E] company size and [F] location of headquarters.

- Company Competitiveness Analysis: A comprehensive competitive analysis of digital marketing companies, examining factors, such as [A] supplier power and [B] service strength.

- Company Profiles: In-depth profiles of the companies offering services related to digital marketing, focusing on [A] overview of the company, [B] financial information (if available) and [C] recent developments and an informed future outlook.

- Potential Strategic Partners: An insightful analysis of the potential strategic partners in healthcare digital marketing market, based on several parameters, such as [A] number of trials, [B] therapeutic area, [C] geographical footprint and [D] company size.

- Big Pharma Initiatives: A comprehensive analysis of the recent AR / VR based initiatives undertaken by big pharma players in healthcare digital marketing market, based on various relevant parameters, such as [A] year of initiative, [B] type of initiative, [C] type of application area, [D] type of solution and [E] number of initiatives.

- Case Study: A detailed discussion on the recent use cases, wherein various digital marketing strategies have been adopted by healthcare companies, highlighting various business needs of such players and key takeaways of the solutions provided by the digital marketing companies.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Key Challenges in Pharmaceutical Marketing

- 3.2.1. Need for Product Differentiation

- 3.2.2. Growing Demand for Patient Centric Healthcare

- 3.2.3. Lack of Standard Performance Metrics

- 3.2.4. Need for Scientific Communication

- 3.3. Importance of Digital Marketing

- 3.4. Popular Digital Marketing Strategies

- 3.4.1. Social Media Marketing

- 3.4.2. Content Marketing Strategy

- 3.4.3. Marketing Automation

- 3.4.4. Search Engine Optimization and Marketing

- 3.4.5. Artificial Intelligence based Marketing

- 3.5. Use of Augmented Reality and Virtual Reality (AR / VR) in Pharmaceutical Digital Marketing

- 3.6. Growth Constraints in AR / VR Industry

- 3.7. Future Perspectives

4. AR / VR BASED HEALTHCARE DIGITAL MARKETING COMPANIES: CURRENT MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Digital Marketing in Pharmaceutical Industry: Overall Market

- 4.2.1. Analysis by Type of Technology

- 4.2.2. Analysis by AR / VR based Services Offered

- 4.2.3. Analysis by Type of Digital Marketing Services Offered

- 4.2.4. Analysis by Secondary Marketing Services Offered

- 4.2.5. Analysis by Year of Establishment

- 4.2.6. Analysis by Company Size

- 4.2.7. Analysis by Geographical Location

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Methodology and Key Parameters

- 5.2.1. Competitiveness Analysis: AR / VR based Digital Marketing Service Providers based in North America

- 5.2.2. Competitiveness Analysis: AR / VR based Digital Marketing Service Providers based in Europe

- 5.2.3. Competitiveness Analysis: AR / VR based Digital Marketing Service Providers based in Asia-Pacific

6. COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. ARworks

- 6.2.1. Company Overview

- 6.2.2. Recent Developments and Future Outlook

- 6.3. CG Life

- 6.3.1. Company Overview

- 6.3.2. Recent Developments and Future Outlook

- 6.4. CubeZoo

- 6.4.1. Company Overview

- 6.4.2. Recent Developments and Future Outlook

6. 5. Impact XM

6. 5.1. Company Overview

6. 5.2. Recent Developments and Future Outlook

- 6.6. INVIVO Communications

- 6.6.1. Company overview

- 6.6.2. Recent Developments and Future Outlook

- 6.7. Mindgrub

- 6.7.1. Company Overview

- 6.7.2. Recent Developments and Future Outlook

- 6.8. Mirum

- 6.8.1. Company Overview

- 6.8.2. Recent Developments and Future Outlook

- 6.9. PIXACORE

- 6.9.1. Company Overview

- 6.9.2. Recent Developments and Future Outlook

- 6.10. Quast Media

- 6.10.1. Company Overview

- 6.10.2. Recent Developments and Future Outlook

- 6.11. Random42

- 6.11.1. Company Overview

- 6.11.2. Recent Developments and Future Outlook

- 6.12. Tipping Point Media

- 6.12.1. Company Overview

- 6.12.2. Recent Developments and Future Outlook

- 6.13. vStream

- 6.13.1. Company Overview

- 6.13.2. Recent Developments and Future Outlook

7. POTENTIAL STRATEGIC PARTNERS

- 7.1. Chapter Overview

- 7.2. Scope and Methodology

- 7.3. Potential Strategic Partners for Digital Marketing Companies

- 7.3.1. Most Likely Partners

- 7.3.2. Likely Partners

- 7.3.3. Less Likely Partners

- 7.3.4. Least Likely Partners

8. DIGITAL MARKETING RELATED INITIATIVES OF BIG PHARMA PLAYERS

- 8.1. Chapter Overview

- 8.1.1. Analysis by Year

- 8.1.2. Analysis by Type of Initiative

- 8.1.3. Analysis by Type of Application Area

- 8.1.4. Analysis by Type of Solution

- 8.1.5. Leading Players: Analysis by Number of Initiatives

- 8.1.6. Leading Partners: Analysis by Number of Initiatives

9. CASE STUDY

- 9.1. Chapter Overview

- 9.2. Narola Infotech for Zocular

- 9.2.1. Narola Infotech

- 9.2.2. Zocular

- 9.2.3. Business Needs

- 9.2.4. Objectives Achieved and Solutions Provided

- 9.3. Viscira for Actelion

- 9.3.1. Viscira

- 9.3.2. Actelion

- 9.3.3. Business Needs

- 9.3.4. Objectives Achieved and Solutions Provided

- 9.4. SoftCover VR for LifeLabs

- 9.4.1. SoftCover VR

- 9.4.2. LifeLabs

- 9.4.3. Business Needs

- 9.4.4. Objectives Achieved and Solutions Provided

- 9.5. Virtual Reality Ireland for MISA

- 9.5.1. Virtual Reality Ireland

- 9.5.2. MISA

- 9.5.3. Business Needs

- 9.5.4. Objectives Achieved and Solutions Provided

- 9.6. ViitorCloud for vCura

- 9.6.1. ViitorCloud

- 9.6.2. vCura

- 9.6.3. Business Needs

- 9.6.4. Objectives Achieved and Solutions Provided

- 9.7. Kwebmaker for Lilavati Hospital

- 9.7.1. Kwebmaker

- 9.7.2. Lilavati Hospital

- 9.7.3. Business Needs

- 9.7.4. Objectives Achieved and Solutions Provided

- 9.8. Intermind for My Health Meter

- 9.8.1. Intermind

- 9.8.2. My Health Meter

- 9.8.3. Business Needs

- 9.8.4. Objectives Achieved and Solutions Provided

- 9.9. VR Vision for Providence Healthcare

- 9.9.1. VR Vision

- 9.9.2. Providence Healthcare

- 9.9.3. Business Needs

- 9.9.4. Objectives Achieved and Solutions Provided

- 9.10. CitrusBits for Zoetis

- 9.10.1. CitrusBits

- 9.10.2. Zoetis

- 9.10.3. Business Needs

- 9.10.4. Objectives Achieved and Solutions Provided

10. MARKET FORECAST

- 10.1. Chapter Overview

- 10.2. Forecast Methodology and Key Assumptions

- 10.3. Overall AR / VR based Digital Marketing Opportunity in Healthcare Industry, Till 2030

- 10.4. AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Type of Technology

- 10.5. AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Product

- 10.6. AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by End-User

- 10.7. AR / VR based Digital Marketing Opportunity in Healthcare Industry: Distribution by Key Geographical Regions

- 10.7.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America, Till 2035

- 10.7.1.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Distribution by Type of Technology

- 10.7.1.1.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of AR based Services

- 10.7.1.1.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America:Share of VR based Services, Till 2035

- 10.7.1.1.3. AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of Mixed Reality (MR) based Services

- 10.7.1.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Distribution by Type of Product

- 10.7.1.2.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of Hardware Products, Till 2035

- 10.7.1.2.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Share of Software Products, Till 2035

- 10.7.1.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America: Distribution by Type of Technology

- 10.7.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe, Till 2035

- 10.7.2.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Distribution by Type of Technology, Till 2035

- 10.7.2.1.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of AR based Services, Till 2035

- 10.7.2.1.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of VR based Services, Till 2035

- 10.7.2.1.3. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of AR based Services, Till 2035

- 10.7.2.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Distribution by Type of Product

- 10.7.2.2.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: share of Hardware Products, Till 2035

- 10.7.2.2.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Share of Software Products, Till 2035

- 10.7.2.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Europe: Distribution by Type of Technology, Till 2035

- 10.7.3. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific, Till 2035

- 10.7.3.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Distribution by Type of Technology

- 10.7.3.1.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Share of AR based Services

- 10.7.3.1.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Share of VR based Services, Till 2035

- 10.7.3.1.3. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Share of MR based Services

- 10.7.3.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Distribution by Type of Product

- 10.7.3.2.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Share of Hardware Products, Till 2035

- 10.7.3.2.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Share of Software Products, Till 2035

- 10.7.3.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Asia-Pacific: Distribution by Type of Technology

- 10.7.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World, Till 2035

- 10.7.1.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Distribution by Type of Technology

- 10.7.1.1.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Share of AR based Services

- 10.7.1.1.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Share of VR based Services. Till 2035

- 10.7.1.1.3. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Share of MR based Services

- 10.7.1.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Distribution by Type of Product

- 10.7.1.2.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Share of Hardware Products, Till 2035

- 10.7.1.2.2. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Share of Software Products, Till 2035

- 10.7.1.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in Rest of the World: Distribution by Type of Technology

- 10.7.1. AR / VR based Digital Marketing Opportunity in Healthcare Industry in North America, Till 2035

11. EXECUTIVE INSIGHTS

- 11.1. Chapter Overview

- 11.2. Company A

- 11.2.1. Interview Transcript: Director

- 11.3. Company B

- 11.3.1. Interview Transcript: Founder and CEO