|

市場調査レポート

商品コード

1752105

コグニティブコンピューティングの世界市場(~2035年):コンポーネントタイプ別、技術タイプ別、展開タイプ別、企業タイプ別、エンドユーザータイプ別、地域別、産業動向、予測Cognitive Computing Market, Till 2035: Distribution by Type of Component, Type of Technology, Type of Deployment, Type of Enterprise, Type of End User, and Geographical Regions: Industry Trends and Global Forecasts |

||||||

カスタマイズ可能

|

|||||||

| コグニティブコンピューティングの世界市場(~2035年):コンポーネントタイプ別、技術タイプ別、展開タイプ別、企業タイプ別、エンドユーザータイプ別、地域別、産業動向、予測 |

|

出版日: 2025年06月12日

発行: Roots Analysis

ページ情報: 英文 179 Pages

納期: 7~10営業日

|

全表示

- 概要

- 目次

コグニティブコンピューティング市場の概要

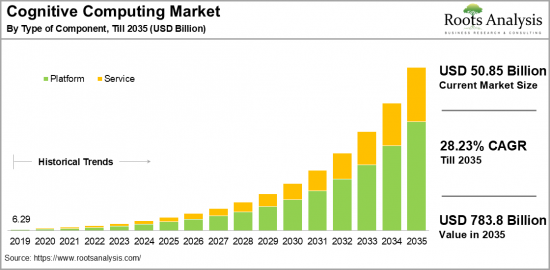

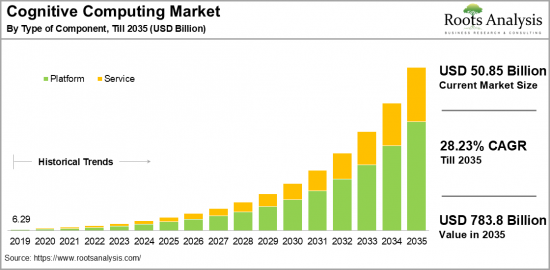

世界のコグニティブコンピューティングの市場規模は、現在の508億5,000万米ドルから2035年までに7,838億米ドルに達すると予測され、2035年までの予測期間にCAGRで28.23%の成長が見込まれます。

コグニティブコンピューティング市場:成長と動向

コグニティブコンピューティングは、コンピューターベースのフレームワークを通じて人間の認知プロセスを模倣するAIの部門です。このシステムは、機械学習、自然言語処理、深層学習、自己適応アルゴリズム、データマイニング、パターン認識などのさまざまな技術を採用して人間の脳の機能を再現し、より大規模で迅速な意思決定と問題解決能力を可能にします。

コグニティブコンピューティング開発の目的は、通常人間の思考を必要とする複雑な問題に対処する能力をコンピューターに持たせることです。従来のコンピューティングとは異なり、コグニティブシステムは、ユーザーのインタラクションに基づいて学習し調整したり、文脈や意味を把握しながら自然言語を処理し解釈したりすることができます。さらに、その推論と複雑な問題解決スキルは、膨大な量の構造化データと非構造化データを調べ、隠れた知見を明らかにし、可能性のあるソリューションや提言を示すことで、複雑な概念の解明を促進します。

時間の経過とともに、技術の継続的な進歩は、コンピューターインテリジェンスを強化する新たな機会を開いてきました。その結果、コグニティブコンピューティング市場は急速に進化し、大きな成長を示しています。AIや機械学習などのスマート技術の採用がさまざまな産業で増加していることが、コグニティブコンピューティングソリューションの需要をさらに促進しています。これは特に、データドリブンな意思決定や大規模なデータ処理に有益です。その未開発の可能性を認識し、ビジネスリーダーは技術開発に徐々に投資しています。

クラウドコンピューティングの統合の増加、医療におけるコグニティブソリューションの利用の増加、継続的な技術の進歩などのさまざまな要因に後押しされ、コグニティブコンピューティング市場は予測期間に大きく成長する見込みです。

当レポートでは、世界のコグニティブコンピューティング市場について調査分析し、市場規模の推計と機会の分析、競合情勢、企業プロファイル、近年の発展などの情報を提供しています。

目次

セクション1 レポートの概要

第1章 序文

第2章 調査手法

第3章 市場力学

第4章 マクロ経済指標

セクション2 定性的な知見

第5章 エグゼクティブサマリー

第6章 イントロダクション

第7章 規制シナリオ

セクション3 市場の概要

第8章 主要企業の包括的なデータベース

第9章 競合情勢

第10章 ホワイトスペース分析

第11章 企業の競争力の分析

第12章 コグニティブコンピューティング市場におけるスタートアップエコシステム

セクション4 企業プロファイル

第13章 企業プロファイル

- 章の概要

- Acuiti

- Alphabet

- AWS

- BurstIQ

- Cisco

- CognitiveScale

- ColdLight Solutions

- Expert System

- E-Zest

- IBM

- Microsoft

- Numenta

- Palantir Technologies

- Red Skios

- Saffron Technology

- SAS

- SparkCognition

- TCS

- Teradata

- Vantage Labs

- Vicarious

- Virtusa

セクション5 市場動向

第14章 メガトレンドの分析

第15章 アンメットニーズの分析

第16章 特許分析

第17章 近年の発展

セクション6 市場機会の分析

第18章 世界のコグニティブコンピューティング市場

第19章 市場機会:コンポーネントタイプ別

第20章 市場機会:技術タイプ別

第21章 市場機会:展開タイプ別

第22章 市場機会:企業タイプ別

第23章 市場機会:エンドユーザータイプ別

第24章 北米のコグニティブコンピューティング市場の機会

第25章 欧州のコグニティブコンピューティング市場の機会

第26章 アジアのコグニティブコンピューティング市場の機会

第27章 中東・北アフリカ(MENA)のコグニティブコンピューティング市場の機会

第28章 ラテンアメリカのコグニティブコンピューティング市場の機会

第29章 その他の地域のコグニティブコンピューティング市場の機会

第30章 市場集中分析:主要企業別

第31章 隣接市場の分析

セクション7 戦略ツール

第32章 勝利の鍵となる戦略

第33章 ポーターのファイブフォース分析

第34章 SWOT分析

第35章 バリューチェーン分析

第36章 Rootsの戦略的提言

セクション8 その他の独占的知見

第37章 1次調査からの知見

第38章 レポートの結論

セクション9 付録

Cognitive Computing Market Overview

As per Roots Analysis, the global cognitive computing market size is estimated to grow from USD 50.85 billion in the current year to USD 783.8 billion by 2035, at a CAGR of 28.23% during the forecast period, till 2035.

The opportunity for cognitive computing market has been distributed across the following segments:

Type of Component

- Platform

- Services

Type of Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Others

Type of Deployment

- Cloud-based

- On-premises

Type of Enterprise

- Large Enterprises

- Small & Medium Enterprises

Type of End User

- BFSI

- Government and Defense

- Healthcare

- IT & Telecommunication

- Media & Entertainment

- Retail & E-commerce

- Others

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

COGNITIVE COMPUTING MARKET: GROWTH AND TRENDS

Cognitive computing is a sector of artificial intelligence that mimics human cognitive processes through a computer-based framework. This system employs a variety of technologies, including machine learning, natural language processing, deep learning, self-adaptive algorithms, data mining, and pattern recognition to replicate the functioning of the human brain, enabling quicker decision-making and problem-solving abilities on a larger scale.

The aim of cognitive computing development is to equip computers with the ability to deal with intricate issues that typically require human thinking. Unlike conventional computing, cognitive systems can learn and adjust based on user interactions, as well as process and interpret natural language while grasping context and meaning. Additionally, their reasoning and intricate problem-solving skills facilitate the resolution of complex concepts by examining vast amounts of structured and unstructured data, revealing hidden insights, and presenting possible solutions or recommendations.

With time, ongoing advancements in technology have opened up new opportunities for enhancing computer intelligence. As a result, the cognitive computing market is rapidly evolving and experiencing significant growth. The increasing adoption of smart technologies such as artificial intelligence and machine learning across various industries is further driving the demand for cognitive computing solutions. This is particularly beneficial for data-driven decision-making and large-scale data processing. Acknowledging its unexploited potential, business leaders are progressively investing in technological development.

Driven by various factors such as an increase in cloud computing integration, rise in the application of cognitive solutions in healthcare, and continuous technological progress, the cognitive computing market is expected to witness significant growth during the forecast period.

COGNITIVE COMPUTING MARKET: KEY SEGMENTS

Market Share by Type of Component

Based on type of component, the global cognitive computing market is segmented into platform and service. According to our estimates, currently, platform segment captures the majority share of the market. This can be attributed to the growing adoption of advanced analytics platforms in various industries, allowing organizations to scale their cognitive computing solutions according to their needs. The key features driving demand for this component include its scalability, flexibility, and integration capabilities, which enable businesses to begin and expand their cognitive solutions without significant investments in on-premises infrastructure.

However, the service component is anticipated to grow at a relatively higher CAGR during the forecast period. This growth can be linked to the rising demand and initiatives taken by companies to reduce cognitive analytics timelines by utilizing sophisticated cognitive services.

Market Share by Type of Technology

Based on type of technology, the cognitive computing market is segmented into deep learning, machine learning, natural language processing, and others. According to our estimates, currently, natural language processing segment captures the majority of the market. This can be attributed to its fundamental capability to facilitate a more intuitive and meaningful interaction between humans and computers by interpreting and comprehending human language. Additionally, the rise of conversational AI, text analytics, sentiment analysis, and document automation is driving the demand for natural language processing.

However, the machine learning segment is anticipated to grow at a relatively higher CAGR during the forecast period.

Market Share by Type of Deployment

Based on type of deployment, the cognitive computing market is segmented into cloud-based and on-premises. According to our estimates, currently, cloud based segment captures the majority share of the market. This can be attributed to its ability to adjust cognitive computing capabilities in response to demand while maintaining reasonable costs. Moreover, its availability enables organizations to implement cognitive computing applications among distributed teams and in remote settings.

However, the on-premises deployment segment is anticipated to grow at a relatively higher CAGR during the forecast period. This is due to the rising need from large enterprises to enhance the management of their extensive data with improved security.

Market Share by Type of Enterprise

Based on type of enterprise, the cognitive computing market is segmented into large enterprises and small and medium enterprises. According to our estimates, currently, large enterprise segment captures the majority share of the market. This can be attributed to the rise in adoption of advanced cognitive computing technologies and the integration of machine learning applications and IoT.

However, the small and medium enterprises segment is anticipated to grow at a relatively higher CAGR during the forecast period. This surge can be linked to the increased use of cloud computing, owing to its cost-effectiveness, which reduces the reliance on costly on-premises hardware and lowers operational expenses, along with facilitating smaller-scale implementations.

Market Share by Type of End User

Based on type of end user, the cognitive computing market is segmented into BFSI, government and defense, healthcare, it & telecommunication, media & entertainment, retail & e-commerce, and others. According to our estimates, currently, BFSI segment captures the majority share of the market. This can be attributed to the increasing demand for fraud detection and risk management, driven by the substantial amount of transactional and behavioral data. To meet this need, the industry requires cognitive computing systems that facilitate real-time data processing for identifying fraudulent activities and potential security threats.

In addition, the healthcare industry is widely embracing cognitive computing for purposes such as disease diagnosis and treatment, personalized medicine, medical research, and drug discovery. Further, its automated reasoning capabilities are beneficial for predictive analytics, which can anticipate public health trends and identify at-risk populations, making it extensively utilized in the field. Consequently, this segment is projected to experience a relatively higher CAGR during the forecast period.

Market Share by Geographical Regions

Based on geographical regions, the cognitive computing market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. However, Asia is anticipated to experience a higher compound annual growth rate (CAGR) during the forecast period, driven by increasing industrialization, the rise of startup companies, and a significant adoption of enterprise cognitive systems in the area.

Example Players in Cognitive Computing Market

- Acuiti

- Alphabet

- AWS

- BurstlQ

- Cisco

- CognitiveScale

- ColdLight Solutions

- Expert System

- E-Zest

- IBM

- Microsoft

- Numenta

- Palantir Technologies

- Red Skios

- Saffron

- SAS

- SparkCognition

- TCS

- Teradata

- Vantage Labs

- Vicarious

- Virtusa

COGNITIVE COMPUTING MARKET: RESEARCH COVERAGE

The report on the cognitive computing market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the cognitive computing market, focusing on key market segments, including [A] type of component, [B] type of technology, [C] type of deployment, [D] type of enterprise, [E] type of end user, and [F] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the cognitive computing market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the cognitive computing market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] cognitive computing portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in cognitive computing industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the cognitive computing domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the cognitive computing market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the cognitive computing market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in cognitive computing market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Cognitive Computing Market

- 6.2.1. Type of Component

- 6.2.2. Type of Technology

- 6.2.3. Type of Deployment

- 6.2.4. Type of Enterprise

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Cognitive Computing: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Ownership Structure

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE COGNITIVE COMPUTING MARKET

- 12.1. Cognitive Computing: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. Acuiti*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Alphabet

- 13.4. AWS

- 13.5. BurstIQ

- 13.6. Cisco

- 13.7. CognitiveScale

- 13.8. ColdLight Solutions

- 13.9. Expert System

- 13.10. E-Zest

- 13.11. Google

- 13.12. IBM

- 13.13. Microsoft

- 13.14. Numenta

- 13.15. Palantir Technologies

- 13.16. Red Skios

- 13.17. Saffron Technology

- 13.18. SAS

- 13.19. SparkCognition

- 13.20. TCS

- 13.21. Teradata

- 13.22. Vantage Labs

- 13.23. Vicarious

- 13.24. Virtusa

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMEET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL COGNITIVE COMPUTING MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global Cognitive Computing, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Cognitive Computing Market for Platform: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Cognitive Computing Market for Service: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

- 19.8.1. Secondary Sources

- 19.8.2. Primary Sources

- 19.8.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF TECHNOLOGY

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Cognitive Computing Market for Deep Learning: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Cognitive Computing Market for Machine Learning: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Cognitive Computing Market for Natural Language Processing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.9. Cognitive Computing Market for Other: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.10. Data Triangulation and Validation

- 20.10.1. Secondary Sources

- 20.10.2. Primary Sources

- 20.10.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON TYPE OF DEPLOYMENT

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Cognitive Computing Market for Cloud-Based: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Cognitive Computing Market for On-Premises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Data Triangulation and Validation

- 21.8.1. Secondary Sources

- 21.8.2. Primary Sources

- 21.8.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON TYPE OF ENTERPRISE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Cognitive Computing Market for Large Enterprise: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Cognitive Computing Market for Small and Medium Enterprise: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.8. Data Triangulation and Validation

- 22.8.1. Secondary Sources

- 22.8.2. Primary Sources

- 22.8.3. Statistical Modeling

23. MARKET OPPORTUNITIES BASED ON TYPE OF END USER

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Cognitive Computing Market for BFSI: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Cognitive Computing Market for Government and Defense: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.8. Cognitive Computing Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.9. Cognitive Computing Market for IT & Telecommunication: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.10. Cognitive Computing Market for Media & Entertainment: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.11. Cognitive Computing Market for Retail & E-commerce: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.12. Cognitive Computing Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.13. Data Triangulation and Validation

- 23.13.1. Secondary Sources

- 23.13.2. Primary Sources

- 23.13.3. Statistical Modeling

24. MARKET OPPORTUNITIES FOR COGNITIVE COMPUTING IN NORTH AMERICA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Cognitive Computing Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Cognitive Computing Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Cognitive Computing Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Cognitive Computing Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Cognitive Computing Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR COGNITIVE COMPUTING IN EUROPE

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Cognitive Computing Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Cognitive Computing Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Cognitive Computing Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Cognitive Computing Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Cognitive Computing Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Cognitive Computing Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Cognitive Computing Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.7. Cognitive Computing Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.8. Cognitive Computing Market in the Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.9. Cognitive Computing Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.10. Cognitive Computing Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.11. Cognitive Computing Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.12. Cognitive Computing Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.13. Cognitive Computing Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.14. Cognitive Computing Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.15. Cognitive Computing Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.16. Cognitive Computing Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR COGNITIVE COMPUTING IN ASIA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Cognitive Computing Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Cognitive Computing Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Cognitive Computing Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Cognitive Computing Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Cognitive Computing Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Cognitive Computing Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Cognitive Computing Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR COGNITIVE COMPUTING IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Cognitive Computing Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Cognitive Computing Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 27.6.2. Cognitive Computing Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Cognitive Computing Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.4. Cognitive Computing Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.5. Cognitive Computing Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.6. Cognitive Computing Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.7. Neuromorphic Computing Marke in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.8. Cognitive Computing Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR COGNITIVE COMPUTING IN LATIN AMERICA

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Cognitive Computing Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.1. Cognitive Computing Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.2. Cognitive Computing Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.3. Cognitive Computing Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.4. Cognitive Computing Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.5. Cognitive Computing Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.6. Cognitive Computing Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.7. Data Triangulation and Validation

29. MARKET OPPORTUNITIES FOR COGNITIVE COMPUTING IN REST OF THE WORLD

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Revenue Shift Analysis

- 29.4. Market Movement Analysis

- 29.5. Penetration-Growth (P-G) Matrix

- 29.6. Cognitive Computing Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.1. Cognitive Computing Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.2. Cognitive Computing Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.3. Cognitive Computing Market in Other Countries

- 29.7. Data Triangulation and Validation

30. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 30.1. Leading Player 1

- 30.2. Leading Player 2

- 30.3. Leading Player 3

- 30.4. Leading Player 4

- 30.5. Leading Player 5

- 30.6. Leading Player 6

- 30.7. Leading Player 7

- 30.8. Leading Player 8

31. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

32. KEY WINNING STRATEGIES

33. PORTER'S FIVE FORCES ANALYSIS

34. SWOT ANALYSIS

35. VALUE CHAIN ANALYSIS

36. ROOTS STRATEGIC RECOMMENDATIONS

- 36.1. Chapter Overview

- 36.2. Key Business-related Strategies

- 36.2.1. Research & Development

- 36.2.2. Product Manufacturing

- 36.2.3. Commercialization / Go-to-Market

- 36.2.4. Sales and Marketing

- 36.3. Key Operations-related Strategies

- 36.3.1. Risk Management

- 36.3.2. Workforce

- 36.3.3. Finance

- 36.3.4. Others