|

市場調査レポート

商品コード

1737057

DNA合成技術およびサービス市場:DNA合成方法別、主要な応用分野別、企業規模別、主要地域別DNA Synthesis Technologies and Services Market Distribution by Method of DNA Synthesis, Key Applications Areas, Company Size, and Key Geographical Regions |

||||||

カスタマイズ可能

|

|||||||

| DNA合成技術およびサービス市場:DNA合成方法別、主要な応用分野別、企業規模別、主要地域別 |

|

出版日: 2025年05月26日

発行: Roots Analysis

ページ情報: 英文 199 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

世界のDNA合成技術およびサービスの市場規模は、2035年までの予測期間中に21.6%のCAGRで拡大し、現在の12億米ドルから2035年までに86億米ドルに成長すると推定・予測されています。

市場セグメンテーションと機会分析は、以下のパラメータで区分されていまする:

DNA合成方法別

- 化学的方法

- 酵素的方法

主要な応用分野別

- 調査・診断

- 治療薬

企業規模別

- 小規模

- 中規模

- 大企業

主要地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

DNA合成技術とサービス市場:成長と動向

人工DNA合成の概念は、遺伝子回路設計、遺伝子工学、ゲノム合成、遺伝性疾患の診断・治療など、さまざまな分野に広く影響を及ぼしています。合成生物学が、世界のヘルスケア、農業、製造業、環境問題に対する新たな解決策を提供できる破壊的技術として台頭してきたことは特筆に値します。さらに、最近の分子生物学分野の動向は、(DNAの化学合成に使用される)自動ロバスト化学物質の開発など、ゲノムのハイスループット研究を可能にする生物システムの工学化に貢献しています。合成生物学は、次世代シークエンシング(NGS)技術によって生成されたシークエンシングデータと組み合わせることで、RNAやDNAの定量的解析を可能にし、病気やその他の生物学的現象に関連する遺伝的変異を研究することができます。

特筆すべきは、ここ数年のCOVID-19の普及により、患者に強力な免疫反応を誘導するDNAおよびRNAベースのワクチン開発に大きな弾みがついたことです。さらに、カスタマイズされたDNAおよびRNA合成と、遺伝子編集のためのCRISPR技術やその他の合成生物学技術との組み合わせは、幅広い疾患適応症の標準治療を変える可能性を示しています。DNA合成技術は、DNAの並列合成を容易にするだけでなく、比類のない精度、拡張性、スピードを提供します。

複数の企業が独自の酵素的DNA合成プラットフォームを開発し、従来のDNA合成法に比べて明確な利点(DNA断片の長さを長くできる可能性、アクセスのしやすさ、利便性の向上など)を提供しています。さらに、医学研究者や医薬品開発者のかなりの割合が、DNA合成や製造の専門知識を提供すると主張する第三者のプラットフォームやサービス・プロバイダーにDNA合成や複製作業を委託することを好んでいます。幅広い用途でDNAに対するニーズが高まっていることから、DNA合成およびDNA複製プラットフォーム・サービス業界は、予測期間中に注目すべき市場成長を遂げる可能性が高いと考えられます。

DNA合成技術とサービス市場:主要インサイト

当レポートでは、DNA合成技術とサービス市場の現状を掘り下げ、業界内の潜在的な成長機会を特定しています。当レポートの主な調査結果は以下の通り:

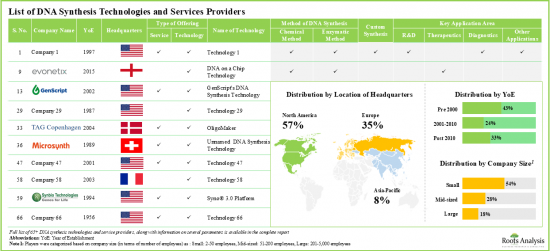

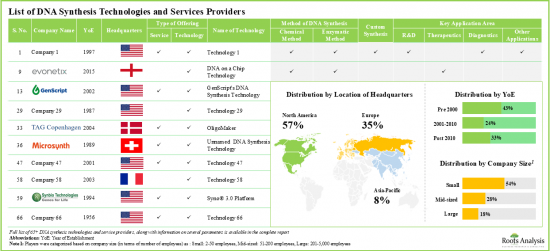

- 現在、約65社がDNA合成技術や関連サービスに必要な専門知識を有していると主張しています。そのうち、50%以上が小規模企業であり、最近設立されたばかりです。

- これらの技術・サービスプロバイダーは、DNAの合成に様々な生物医学分野での応用が可能な、費用対効果の高い方法を採用していると主張しています。

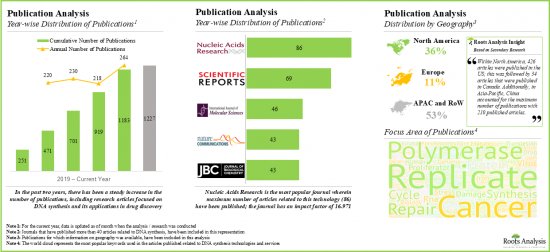

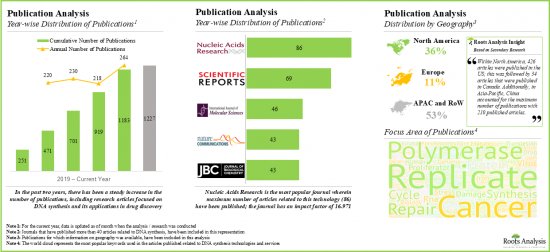

- ここ数年、DNA合成技術やサービスに関連する科学文献の出版が著しく増加しており、そのような論文は50カ国以上で出版されています。

- DNA合成技術とサービスに対する関心の高まりは、最近のパートナーシップ活動の増加にも反映されており、実際、2019年から2021年にかけて、パートナーシップ活動はCAGR18%で増加しました。

- 過去数年間、DNA合成技術分野の研究と革新に関連する継続的な取り組みを支援するため、150の学術助成金が様々な組織に授与されています。

- DNA合成技術とサービス市場の将来性に気づいた複数の投資家が、過去5年間に7億5,000万米ドル以上を投資しています。

- 2016年以降、DNA合成技術に関連する特許が11,000件以上出願/付与されており、この業界における知的財産の強力なポートフォリオを確立しています。

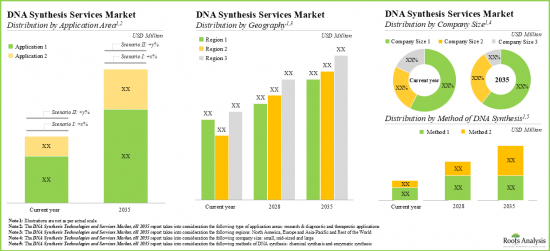

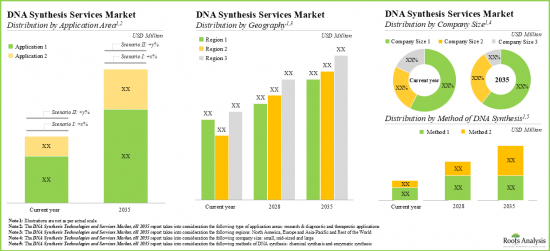

- DNA合成サービス市場は、2035年まで年率21.5%以上の成長率が見込まれ、合成方法、応用分野、企業規模、地域別成長機会が分散される可能性が高いです。

DNA合成技術とサービス市場:主要セグメント

DNA合成方法別では、市場は化学的方法と酵素的方法に区分されます。現在、DNA合成の化学的方法が世界のDNA合成技術およびサービス市場で最大のシェアを占めています。また、酵素法はDNAの分離・合成に酵素の利用が増加していることから、成長ペースが速まる可能性が高いです。

主要な応用分野別では、市場は研究・診断と治療に区分されます。現在、研究・診断分野が世界のDNA合成技術およびサービス市場で最も高い割合を占めています。治療分野のDNA合成技術およびサービス市場は、比較的高いCAGRで成長する可能性が高いことは注目に値します。

企業規模別では、市場は中小企業、中堅企業、大企業に区分されます。現在、DNA合成技術およびサービス市場では大企業セグメントが最大シェアを占めています。さらに、小規模企業セグメントのDNA合成技術およびサービス市場は、比較的高いCAGRで成長する可能性が高いことは注目に値します。

主要地域別に見ると、市場は北米、欧州、アジア太平洋地域、その他の地域に区分されます。現在、北米が世界のDNA合成技術およびサービス市場を独占し、最大の収益シェアを占めています。

当レポートでは、世界のDNA合成技術およびサービス市場について調査し、市場の概要とともに、DNA合成方法別、主要な応用分野別、企業規模別、主要地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 序文

第2章 エグゼクティブサマリー

第3章 イントロダクション

- 章の概要

- DNA合成イントロダクション

- DNA合成の構成要素

- DNA合成技術

- DNA合成の応用

- 将来の展望

第4章 市場概要:DNA合成技術とサービス

- 章の概要

- DNA合成技術とサービス:市場情勢

- DNA合成技術とサービス:主要業界参入企業

第5章 企業プロファイル

- 章の概要

- Ajinomoto Bio-Pharma Services

- ATUM

- DNA Script

- Eurofins Genomics

- Gene Universal

- GenScript

- Synbio Technologies

第6章 ケーススタディ:オリゴヌクレオチド製造(調査および診断への応用)

- 章の概要

- 研究よび診断用途に重点を置くオリゴヌクレオチド製造業者:市場情勢

第7章 ケーススタディ:オリゴヌクレオチド製造業者(治療用途)

- 章の概要

- 治療用途に重点を置くオリゴヌクレオチド製造業者:市場情勢

第8章 パートナーシップとコラボレーション

第9章 資金調達と投資分析

第10章 助成金分析

第11章 出版物の分析

第12章 特許分析

第13章 DNA合成サービス:市場予測と機会分析

- 章の概要

- 主要な前提と予測調査手法

- 世界のDNA合成サービス市場(2035年まで)

- 北米におけるDNA合成サービス市場(2035年まで)

- 欧州におけるDNA合成サービス市場(2035年まで)

- アジア太平洋およびその他の地域におけるDNA合成サービス市場(2035年まで)

第14章 結論

第15章 付録1:表形式データ

第16章 付録II:企業および組織の一覧

List of Tables

- Table 4.1 DNA Synthesis Technologies and Services: Information on Developers, Type of Offering, Method of DNA Synthesis, Type of DNA Molecule, Custom Offerings and Type of Application Area

- Table 4.2 DNA Synthesis Technologies and Services Providers: Information on Year of Establishment, Company Size and Geography

- Table 5.1 DNA Synthesis Technology and Service Providers: List of Companies Profiled

- Table 5.2 Ajinomoto Bio-Pharma Services: Company Snapshot

- Table 5.3 Ajinomoto Bio-Pharma Services: Technology / Service Portfolio

- Table 5.4 Ajinomoto Bio-Pharma Services: Recent Developments and Future Outlook

- Table 5.5 ATUM: Company Snapshot

- Table 5.6 ATUM: Technology / Service Portfolio

- Table 5.7 DNA Script: Company Snapshot

- Table 5.8 DNA Script: Technology / Service Portfolio

- Table 5.9 DNA Script: Recent Developments and Future Outlook

- Table 5.10 Eurofins Genomics: Company Snapshot

- Table 5.11 Eurofins Genomics: Technology / Service Portfolio

- Table 5.12 Gene Universal: Company Snapshot

- Table 5.13 Gene Universal: Technology / Service Portfolio

- Table 5.14 GenScript: Company Snapshot

- Table 5.15 GenScript Technology / Service Portfolio

- Table 5.16 GenScript: Recent Developments and Future Outlook

- Table 5.17 Synbio Technologies: Company Snapshot

- Table 5.18 Synbio Technologies: Technology / Service Portfolio

- Table 6.1 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: List of Industry Players

- Table 6.2 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Information on Location of Manufacturing Facilities and Regulatory Accreditations / Certifications

- Table 6.3 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Information on Type of Oligonucleotide Manufactured and Type of Service(s) Offered

- Table 6.4 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Information on Type of Manufacturing Service(s) Offered

- Table 6.5 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Information on Type of Modification(s) and Type of Purification Method(s) Used

- Table 7.1 Oligonucleotide Manufacturers Focused on Therapeutic Applications: List of Industry Players

- Table 7.2 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Information on Location of Manufacturing Facilities and Regulatory Accreditations / Certifications

- Table 7.3 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Information on Type of Oligonucleotide Manufactured and Type of Offering

- Table 7.4 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Information on Type of Manufacturing Service(s) Offered

- Table 7.5 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Information on Type of Modification(s) and Type of Purification Method(s) Used

- Table 8.1 DNA Synthesis Technologies and Services Providers: List of Partnerships and Collaborations, Since 2017 (till March)

- Table 9.1 DNA Synthesis Technologies: List of Funding Instances, Since 2017 (till March)

- Table 9.2 Funding and Investment Analysis: Summary of Investments

- Table 10.1 DNA Synthesis Technologies and Services: List of Academic Grants

- Table 12.1 Patent Analysis: CPC Symbols

- Table 12.2 Patent Analysis: Most Popular CPC Symbols

- Table 12.3 Patent Analysis: List of Top 10 CPC Symbols

- Table 12.4 Patent Analysis: List of Relatively High Value Patents

- Table 16.1 DNA Synthesis Technologies and Services: Distribution by Type of Offering

- Table 16.2 DNA Synthesis Technologies and Services: Distribution by Method of DNA Synthesis

- Table 16.3 DNA Synthesis Technologies and Services: Distribution by Type of DNA Molecule

- Table 16.4 DNA Synthesis Technologies and Services: Distribution by Custom Synthesis

- Table 16.5 DNA Synthesis Technologies and Services: Distribution by Application Area

- Table 16.6 DNA Synthesis Technologies and Service Providers: Distribution by Year of Establishment

- Table 16.7 DNA Synthesis Technologies and Service Providers: Distribution by Company Size

- Table 16.8 DNA Synthesis Technologies and Service Providers Distribution by Location of Headquarters

- Table 16.9 DNA Synthesis Technologies and Service Providers Distribution by Application and Region

- Table 16.10 Ajinomoto Bio-Pharma Services: Annual Revenues Since FY 2018 (JPY Billion)

- Table 16.11 Eurofins Genomics: Annual Revenues Since FY 2018 (JPY Billion)

- Table 16.12 GenScript: Annual Revenues, Since FY 2018 (USD Billion)

- Table 16.13 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Year of Establishment

- Table 16.14 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Company Size

- Table 16.15 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Scale of Operation

- Table 16.16 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Location of Headquarters

- Table 16.17 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Location of Manufacturing Facilities (Country-wise)

- Table 16.18 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Regulatory Accreditations / Certifications

- Table 16.19 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Type of Oligonucleotide Manufactured

- Table 16.20 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Type of Offering

- Table 16.21 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Company Size and Type of Offering

- Table 16.22 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Type of Oligonucleotide Manufactured and Type of Offering (Custom Synthesis)

- Table 16.23 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Type of Manufacturing Service(s) Offered

- Table 16.24 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Year of Establishment

- Table 16.25 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Company Size

- Table 16.26 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Scale of Operation

- Table 16.27 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Location of Headquarters6

- Table 16.28 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Location of Manufacturing Facilities (Country-wise)

- Table 16.29 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Regulatory Accreditations / Certifications

- Table 16.30 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Type of Oligonucleotide Manufactured

- Table 16.31 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Type of Offering

- Table 16.32 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Company Size and Type of Offering16

- Table 16.33 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Type of Oligonucleotide Manufactured and Type of Offering (Modification)

- Table 16.34 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Type of Manufacturing Service (s) Offered

- Table 16.35 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2017

- Table 16.36 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 16.37 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2017

- Table 16.38 Most Active Players: Distribution by Number of Partnerships

- Table 16.39 Partnerships and Collaborations: Distribution by Type of Partner

- Table 16.40 Partnerships and Collaborations: Distribution by Year and Type of Partner

- Table 16.41 Partnerships and Collaborations: Regional Distribution

- Table 16.42 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 16.43 DNA Synthesis Technologies: Distribution by Year of Investment, Since 2017

- Table 16.44 DNA Synthesis Technologies: Cumulative Amount Invested by Year, Since 2017 (USD Million)

- Table 16.45 Funding and Investments: Distribution by Type of Funding

- Table 16.46 Funding and Investments: Distribution of Amount Invested by Type of Funding (USD Million)

- Table 16.47 Distribution by Type of Venture Capital Funding

- Table 16.48 Most Active Players: Distribution by Number of Funding Rounds

- Table 16.49 Most Active Players: Distribution by Amount Raised Since 2017 (USD Million)

- Table 16.50 Funding and Investment: Distribution of investors by number of instances

- Table 16.51 Funding and Investment Analysis: Regional Distribution of Total Amount Invested, Since 2017

- Table 16.52 Grant Analysis: Distribution by Year of Grant Award

- Table 16.53 Grant Analysis: Distribution by Grant Amount Awarded

- Table 16.54 Grant Analysis: Distribution by Administering Institute Center

- Table 16.55 Grant Analysis: Distribution by Support Period

- Table 16.56 Grant Analysis: Distribution by Administering Institute Center and Support Year

- Table 16.57 Grant Analysis: Distribution by Type of Grant Application

- Table 16.58 Grant Analysis: Distribution by Grant Activity Code

- Table 16.59 Grant Analysis: Word Cloud of Study Titles

- Table 16.60 Grant Analysis: Distribution by Purpose of Grant Award

- Table 16.61 Grant Analysis: Distribution by Type of Recipient Organization

- Table 16.62 Popular NIH Departments: Distribution by Number of Grants

- Table 16.63 Prominent Program Officers: Distribution by Number of Grants

- Table 16.64 Publication Analysis: Cumulative Year-wise Trend, Since 2017

- Table 16.65 Publication Analysis: Quarterly Distribution of Publications

- Table 16.66 Publication Analysis: Distribution by Type of Article

- Table 16.67 Publication Analysis: Word Cloud of Study Titles

- Table 16.68 Analysis by Popular Keywords

- Table 16.69 Most Popular Authors: Distribution by Number of Publications

- Table 16.70 Popular Publishers: Distribution by Number of Publications

- Table 16.71 Popular Journals: Distribution by Number of Publications

- Table 16.72 Popular Journals: Distribution by Number of Publications

- Table 16.73 Publication Analysis: Distribution by Geography

- Table 16.74 Patent Analysis: Distribution by Type of Patent

- Table 16.75 Patent Analysis: Cumulative Distribution by Publication Year

- Table 16.76 Patent Analysis: Distribution of Granted Patents by Publication Year

- Table 16.77 Patent Analysis: Distribution of Filed Patents Publication Year

- Table 16.78 Patent Analysis: Distribution by Type of Patent and Publication Year

- Table 16.79 Patent Analysis: Distribution by Issuing Authority

- Table 16.80 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant

- Table 16.81 Leading Industry Players: Distribution by Number of Patents

- Table 16.82 Leading Non-Industry Players: Distribution by Number of Patents

- Table 16.83 Patent Analysis: Distribution by Patent Age

- Table 16.84 Patent Analysis: Distribution by Relative Valuation

- Table 16.85 Global DNA Synthesis Services Market: Distribution by Method of DNA Synthesis, Till 2035 (USD Million)

- Table 16.86 Global DNA Synthesis Services Market: Distribution by Company Size, Till 2035 (USD Million)

- Table 16.87 Global DNA Synthesis Services Market: Distribution by Company Size, Till 2035 (USD Million)

- Table 16.88 Global DNA Synthesis Services Market: Distribution by Type of Application Area, Till 2035 (USD Million)

- Table 16.89 Global DNA Synthesis Services Market: Distribution by Geography, Till 2035 (USD Million)

- Table 16.90 DNA Synthesis Services Market in North America, Till 2035 (USD Million)

- Table 16.91 DNA Synthesis Services Market in North America: Distribution by Method of DNA Synthesis, Till 2035 (USD Million)

- Table 16.92 DNA Synthesis Services Market in North America: Distribution by Type of Application Area, Till 2035 (USD Million)

- Table 16.93 DNA Synthesis Services Market in North America: Distribution by Company Size, Till 2035 (USD Million)

- Table 16.94 DNA Synthesis Services Market in Europe, Till 2035 (USD Million)

- Table 16.95 DNA Synthesis Services Market in Europe: Distribution by Method of DNA Synthesis, Till 2035 (USD Million)

- Table 16.96 DNA Synthesis Services Market in Europe: Distribution by Type of Application Area, Till 2035 (USD Million)

- Table 16.97 DNA Synthesis Services Market in Europe: Distribution by Company Size, Till 2035 (USD Million)

- Table 16.98 DNA Synthesis Services Market in Asia-Pacific and Rest of the World, Till 2035 (USD Million)

- Table 16.99 DNA Synthesis Services Market in Asia-Pacific and Rest of the World: Distribution by Method of DNA Synthesis, Till 2035 (USD Million)

- Table 16.100 DNA Synthesis Services Market in Asia-Pacific and Rest of the World: Distribution by Type of Application Area, Till 2035 (USD Million)

- Table 16.101 DNA Synthesis Services Market in Asia-Pacific and Rest of the World: Distribution by Company Size, Till 2035 (USD Million)

List of Figures

- Figure 3.1 DNA Synthesis 5' to 3'

- Figure 3.2 DNA Synthesis: Direction of Fork Movement

- Figure 3.3 Leading Strand Synthesis

- Figure 3.4 Lagging Strand Synthesis

- Figure 3.5 Applications of DNA Synthesis

- Figure 4.1 DNA Synthesis Technologies and Services: Distribution by Type of Offering

- Figure 4.2 DNA Synthesis Technologies and Services: Distribution by Method of DNA Synthesis

- Figure 4.3 DNA Synthesis Technologies and Services: Distribution by Type of DNA Molecule

- Figure 4.4 DNA Synthesis Technologies and Services: Distribution by Custom Offerings

- Figure 4.5 DNA Synthesis Technologies and Services: Distribution by Application Area

- Figure 4.6 DNA Synthesis Technologies and Service Providers: Distribution by Year of Establishment

- Figure 4.7 DNA Synthesis Technologies and Service Providers: Distribution by Company Size

- Figure 4.8 DNA Synthesis Technologies and Service Providers: Distribution by Location of Headquarters

- Figure 4.9 DNA Synthesis Technologies and Service Providers: Distribution by Application Area and Region

- Figure 5.1 Ajinomoto Bio-Pharma Services: Annual Revenues Since FY 2018 (JPY Billion)

- Figure 5.2 Eurofins Genomics: Annual Revenues Since FY 2018 (JPY Billion)

- Figure 5.3 GenScript: Annual Revenues, Since FY 2018 (USD Billion)

- Figure 6.1 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Year of Establishment

- Figure 6.2 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Company Size

- Figure 6.3 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Scale of Operation

- Figure 6.4 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Geographical Location

- Figure 6.5 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Location of Manufacturing Facilities (Country-wise)

- Figure 6.6 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Regulatory Accreditations / Certifications

- Figure 6.7 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Type of Oligonucleotide Manufactured

- Figure 6.8 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Type of Offering

- Figure 6.9 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Company Size and Type of Offering

- Figure 6.10 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Type of Oligonucleotide Manufactured and Type of Offering (Custom Synthesis)

- Figure 6.11 Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Distribution by Type of Manufacturing Service(s) Offered

- Figure 7.1 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Year of Establishment

- Figure 7.2 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Company Size

- Figure 7.3 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Scale of Operation

- Figure 7.5 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Geographical Location

- Figure 7.6 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Location of Manufacturing Facilities (Country-wise)

- Figure 7.7 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Regulatory Accreditations / Certifications

- Figure 7.8 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Type of Oligonucleotide Manufactured

- Figure 7.9 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Type of Offering

- Figure 7.10 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Company Size and Type of Offering

- Figure 7.11 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Type of Oligonucleotide Manufactured and Type of Offering (Modification)

- Figure 7.13 Oligonucleotide Manufacturers Focused on Therapeutic Applications: Distribution by Type of Manufacturing Service (s) Offered

- Figure 8.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2017

- Figure 8.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 8.3 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 8.4 Partnerships and Collaborations: Distribution by Year and Type of Partner

- Figure 8.5 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2017

- Figure 8.6 Most Active Players: Distribution by Number of Partnerships

- Figure 8.7 Partnerships and Collaborations: Regional Distribution

- Figure 8.8 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 9.1 DNA Synthesis Technologies: Cumulative Distribution by Year of Investment, Since 2017

- Figure 9.2 DNA Synthesis Technologies: Cumulative Amount Invested by Year, Since 2017 (USD Million)

- Figure 9.3 Funding and Investments: Distribution by Type of Funding

- Figure 9.4 Funding and Investments: Distribution of Amount Invested by Type of Funding (USD Million)

- Figure 9.5 Funding and Investments: Distribution by Type of Venture Capital Funding

- Figure 9.6 Most Active Players: Distribution by Number of Funding Instances

- Figure 9.7 Most Active Players: Distribution by Amount Raised, Since 2017 (USD Million)

- Figure 9.8 Funding and Investments: Distribution of Investors by Number of Instances

- Figure 9.9 Funding and Investments: Regional Distribution by Amount Invested, Since 2017

- Figure 9.10 Summary of Funding and Investments

- Figure 10.1. Grant Analysis: Distribution by Year of Grant Award (Since 2017)

- Figure 10.2. Grant Analysis: Distribution by Grant Amount Awarded (USD Million)

- Figure 10.3. Grant Analysis: Distribution by Administering Institute Center

- Figure 10.4. Grant Analysis: Distribution by Support Period

- Figure 10.5. Grant Analysis: Distribution by Administering Institute Center and Support Period

- Figure 10.6. Grant Analysis: Distribution by Type of Grant Application

- Figure 10.7. Grant Analysis: Distribution by Grant Activity Code

- Figure 10.8. Word Cloud Analysis: Emerging Focus Areas

- Figure 10.9. Grant Analysis: Distribution by Purpose of Grant Award

- Figure 10.10. Popular NIH Departments: Distribution by Number of Grants

- Figure 10.11. Grant Analysis: Distribution by Type of Recipient Organization

- Figure 10.12. Prominent Program Officers: Distribution by Number of Grants

- Figure 11.1. Publication Analysis: Cumulative Year-wise Trend, Since 2017

- Figure 11.2. Publication Analysis: Quarterly Distribution of Publications, Since 2017

- Figure 11.3. Publication Analysis: Distribution by Type of Article

- Figure 11.4. Word Cloud Analysis: Emerging Focus Areas

- Figure 11.5. Analysis by Popular Keywords

- Figure 11.6. Most Popular Authors: Distribution by Number of Publications

- Figure 11.7. Popular Publishers: Distribution by Number of Publications

- Figure 11.8. Popular Journals: Distribution by Number of Publications

- Figure 11.9. Publication Analysis: Distribution by Therapeutic Area

- Figure 11.10. Publication Analysis: Distribution by Geography

- Figure 12.1. Patent Analysis: Distribution by Type of Patent

- Figure 12.2. Patent Analysis: Cumulative Distribution by Publication Year (Since 2017)

- Figure 12.3. Patent Analysis: Year-wise Distribution of Granted Patents, Since 2017

- Figure 12.4. Patent Analysis: Year-wise Distribution of Filed Patents, Since 2017

- Figure 12.5. Patent Analysis: Distribution by Type of Patent and Publication Year

- Figure 12.6. Patent Analysis: Distribution by Issuing Authority

- Figure 12.7. Patent Analysis: Distribution by CPC Symbols

- Figure 12.8. Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant

- Figure 12.9. Word Cloud Analysis: Emerging Focus Areas

- Figure 12.10. Leading Industry Players: Distribution by Number of Patents

- Figure 12.11. Leading Non-Industry Players: Distribution by Number of Patents

- Figure 12.12. Patent Analysis: Distribution by Patent Age

- Figure 12.13. Patent Analysis: Distribution by Relative Valuation

- Figure 13.1. Global DNA Synthesis Services Market: Distribution by Method of DNA Synthesis, Till 2035 (USD Million)

- Figure 13.2. Global DNA Synthesis Services Market: Distribution by Company Size, Till 2035 (USD Million)

- Figure 13.3. Global DNA Synthesis Services Market: Distribution by Application Area, Till 2035 (USD Million)

- Figure 13.4. Global DNA Synthesis Services Market: Distribution by Geography, Till 2035 (USD Million)

- Figure 13.5. DNA Synthesis Services Market in North America, Till 2035 (USD Million)

- Figure 13.6. DNA Synthesis Services Market in North America: Distribution by Method of DNA Synthesis, Till 2035 (USD Million)

- Figure 13.7. DNA Synthesis Services Market in North America: Distribution by Application Area, Till 2035 (USD Million)

- Figure 13.8. DNA Synthesis Services Market in North America: Distribution by Company Size, Till 2035 (USD Million)

- Figure 13.9. DNA Synthesis Services Market in Europe, Till 2035 (USD Million)

- Figure 13.10. DNA Synthesis Services Market in Europe: Distribution by Method of DNA Synthesis, Till 2035 (USD Million)

- Figure 13.11. DNA Synthesis Services Market in Europe: Distribution by Application Area, Till 2035 (USD Million)

- Figure 13.12. DNA Synthesis Services Market in Europe: Distribution by Company Size, Till 2035 (USD Million)

- Figure 13.13. DNA Synthesis Services Market in Asia-Pacific and Rest of the World, Till 2035 (USD Million)

- Figure 13.14. DNA Synthesis Services Market in Asia-Pacific and Rest of the World: Distribution by Method of DNA Synthesis, Till 2035 (USD Million)

- Figure 13.15. DNA Synthesis Services Market in Asia-Pacific and Rest of the World: Distribution by Application Area, Till 2035 (USD Million)

- Figure 13.16. DNA Synthesis Services Market in Asia-Pacific and Rest of the World: Distribution by Company Size, Till 2035 (USD Million)

- Figure 14.1. Concluding Remarks: Overall Market Landscape of DNA Synthesis Technologies and Services

- Figure 14.2. Concluding Remarks: Partnerships and Collaborations

- Figure 14.3. Concluding Remarks: Funding and Investments

- Figure 14.4. Concluding Remarks: Grant Analysis

- Figure 14.5. Concluding Remarks: Publication Analysis

- Figure 14.6. Concluding Remarks: Patent Analysis

DNA SYNTHESIS TECHNOLOGIES AND SERVICES MARKET: OVERVIEW

As per Roots Analysis, the global DNA synthesis technologies and services market is estimated to grow from USD 1.20 billion in the current year to USD 8.6 billion by 2035, at a CAGR of 21.6% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Method of DNA Synthesis

- Chemical Method

- Enzymatic Method

Key Applications Areas

- Research & Diagnostics

- Therapeutics

Company Size

- Small

- Mid-Sized

- Large

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

DNA SYNTHESIS TECHNOLOGIES AND SERVICES MARKET: GROWTH AND TRENDS

The concept of artificial DNA synthesis has a far-reaching impact across multiple areas, including genetic circuit design, genetic engineering, genome synthesis, diagnosis and treatment of genetic diseases. It is worth mentioning that synthetic biology has emerged as a disruptive technology, capable of delivering new solutions to global healthcare, agriculture, manufacturing and environmental challenges. Moreover, the recent advancements in the field of molecular biology, such as the development of automatic robust chemistries (used for chemical synthesis of DNA) have contributed towards the engineering of biological systems by enabling high-throughput study genomes. Synthetic biology, when combined with sequenced data generated by next generation sequencing (NGS) technology, allows quantitative analysis of RNA and DNA to study the genetic variations associated with the disease or other biological phenomena.

Notably, the spread of the COVID-19 in the past few years has given a significant boost to the development of DNA and RNA-based vaccines to induce potent immune responses in patients. Moreover, customized DNA and RNA synthesis coupled with CRISPR technologies for gene editing and other synthetic biology technologies have demonstrated the potential to change the standard of care for a wide range of disease indications. DNA synthesis technologies not only facilitate parallelized synthesis of DNA but also provide unmatched precision, scalability and speed.

Several companies have developed proprietary enzymatic DNA synthesis platforms offering distinct advantages (such as the potential to increase the length of DNA fragments, greater accessibility and convenience) over conventional DNA synthesis methods. Furthermore, a significant proportion of medical researchers and drug developers prefer to outsource DNA synthesis and replication operations to third-party platforms / service providers who claim to provide expertise in DNA synthesis and production. Given the rising need for DNA across a wide range of applications, we are led to believe that the DNA synthesis and DNA replication platforms and services industry is likely to witness noteworthy market growth during the forecast period.

DNA SYNTHESIS TECHNOLOGIES AND SERVICES MARKET: KEY INSIGHTS

The report delves into the current state of the DNA synthesis technologies and services market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Around 65 companies presently claim to have the required expertise for DNA synthesis technologies and affiliated services; of these, more than 50% of players are small companies and have recently been established.

- These technology and service providers claim to employ different cost-effective methods for the synthesis of DNA, having applications in various biomedical fields.

- There has been a notable increase in the published scientific literature related to DNA synthesis technologies and services in the last few years; such articles have been published in over 50 countries.

- The growing interest in DNA synthesis technologies and services is reflected by the increase in partnership activity in the recent past; in fact, between 2019 and 2021, the partnership activity increased at a CAGR of 18%.

- Over the past few years, 150 academic grants have been awarded to various organizations in order to support the ongoing efforts related to research and innovation in the field of DNA synthesis technologies.

- Several investors, having realized the future opportunity associated with the DNA synthesis technologies and services market, have invested more than USD 750 million in the past five years.

- More than 11,000 patents have been filed / granted related to DNA synthesis technologies since 2016, establishing a strong portfolio of intellectual property within this industry.

- The DNA synthesis services market is expected to witness an annualized growth rate of more than 21.5% till 2035; the opportunity is likely to be distributed across method of synthesis, application area, company size and geography.

DNA SYNTHESIS TECHNOLOGIES AND SERVICES MARKET: KEY SEGMENTS

Chemical Method Segment Occupies the Largest Share of the DNA Synthesis Technologies and Services Market

Based on the method of DNA synthesis, the market is segmented into chemical method and enzymatic method. At present, the chemical method of DNA synthesis holds the maximum share of the global DNA synthesis technologies and services market. Additionally, the enzymatic method segment is likely to grow at a faster pace owing to the increasing use of enzymes for DNA isolation and synthesis.

By Key Application Area, Therapeutics is the Fastest Growing Segment of the Global DNA Synthesis Technologies and Services Market

Based on the key application area, the market is segmented into research and diagnostics, and therapeutics. Currently, the research and diagnostics segment captures the highest proportion of the global DNA synthesis technologies and services market. It is worth highlighting that the DNA synthesis technologies and services market for therapeutics segment is likely to grow at a relatively higher CAGR.

Large Company Size Segment Occupy the Largest Share of the DNA Synthesis Technologies and Services Market by Company Size

Based on the company size, the market is segmented into small, mid-sized and large companies. At present, the large companies segment holds the maximum share of the DNA synthesis technologies and services market. Further, it is worth highlighting that the DNA synthesis technologies and services market for small companies' segment is likely to grow at a relatively higher CAGR.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. Currently, North America dominates the global DNA synthesis technologies and services market and accounts for the largest revenue share.

Example Players in the DNA Synthesis Technologies and Services Market

- Ajinomoto Bio-Pharma Services

- ATUM

- DNA Script

- Eurofins Genomics

- Gene Universal

- GenScript

- Synbio Technologies

DNA SYNTHESIS TECHNOLOGIES AND SERVICES MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global DNA synthesis technologies and services market, focusing on key market segments, including [A] method of DNA synthesis, [B] key application area, [C] company size and [D] key geographical regions.

- Market Landscape: A comprehensive evaluation of DNA synthesis technologies and services, based on several relevant parameters, such as [A] type of offering, [B] method of DNA synthesis, [C] type of DNA molecule, [D] custom offerings and [E] application area. Additionally, the report provides information on drug developers, focusing on [F] year of establishment, [G] company size and [H] location of headquarters.

- Company Profiles: In-depth profiles of key players engaged in providing technologies and services for DNA synthesis, focusing on [A] overview of the company, [B] financial information (if available), [C] technology / service portfolio, and [D] recent developments and [E] an informed future outlook.

- Case Study 1: A detailed discussion on the current market landscape of oligonucleotide manufacturers focused on research and diagnostic applications, based on [A] year of establishment, [B] company size, [C] scale of operation, [D] location of headquarters, [E] number of manufacturing facilities, [F] location of facility, [G] regulatory accreditations and certifications received, [H] type of oligonucleotide manufactured, [I] type of offering, [J] type of manufacturing service(s) offered and [K] type of modification(s) offered.

- Case Study 2: A detailed discussion on the current market landscape of oligonucleotide manufacturers focused on research and therapeutic applications, based on [A] year of establishment, [B] company size, [C] scale of operation, [D] location of headquarters, [E] number of manufacturing facilities, [F] location of facility, [G] regulatory accreditations and certifications received, [H] type of oligonucleotide manufactured, [I] type of offering, [J] type of manufacturing service(s) offered and [K] type of modification(s) offered.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the DNA synthesis technologies and services market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] most active players (in terms of the number of partnerships signed) and [E] geographical distribution of partnership activity.

- Funding and Investment Analysis: An in-depth analysis of the fundings raised by DNA synthesis technologies and services companies, based on relevant parameters, such as [A] year of funding, [B] amount invested, [C] type of funding, [D] leading players, [E] leading investors and [F] geography.

- Grants Analysis: An in-depth analysis of academic grants that have been awarded to various research institutes for projects related to DNA synthesis technologies and services, based on relevant parameters, such as [A] year of grant award, [B] amount awarded, [C] type of funding institute, [D] popular NIH departments, [E] support period, [F] emerging focus area, [G] purpose of grants, [H] grant activity code, [I] local recipients, [J] type of recipient organization, [K] study section and [L] type of grant application. The chapter also highlights the popular recipient organizations and prominent program officers.

- Publication Analysis: An insightful analysis of more than 12,000 peer-reviewed scientific articles related to research on DNA synthesis technologies, based on various relevant parameters, such as [A] year of publication, [B] key focus area, [C] type of article, [D] popular keywords, [E] popular authors, [F] therapeutic area, [G] geography and [H] key journals.

- Patent Analysis: An in-depth analysis of patents filed / granted till date in the autoinjectors domain, based on various relevant parameters, such as [A] publication year, [B] geography, [C] CPC symbols, [D] emerging focus areas, [E] type of applicant, [F] leading industry players and [G] patent valuation.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.3. Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Introduction to DNA Synthesis

- 3.3. Components of DNA Synthesis

- 3.3.1. Substrates

- 3.3.2. Template

- 3.3.3. Primer

- 3.3.4. Enzymes

- 3.3.5. Leading Strand Synthesis

- 3.3.6. Lagging Strand Synthesis

- 3.4. DNA Synthesis Technologies

- 3.4.1. Chemical Method of DNA Synthesis

- 3.4.2. Enzymatic Method of DNA Synthesis

- 3.5. Applications of DNA Synthesis

- 3.6. Future Perspectives

4. MARKET OVERVIEW: DNA SYNTHESIS TECHNOLOGIES AND SERVICES

- 4.1. Chapter Overview

- 4.2. DNA Synthesis Technologies and Services: Overall Market Landscape

- 4.2.1. Analysis by Type of Offering

- 4.2.2. Analysis by Method of DNA Synthesis

- 4.2.3. Analysis by Type of DNA Molecule

- 4.2.4. Analysis by Custom Offerings

- 4.2.5. Analysis by Application Area

- 4.3. DNA Synthesis Technologies and Services: Key Industry Players

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

- 4.3.3. Analysis by Location of Headquarters

- 4.3.4. Analysis by Application Area and Region

5. COMPANY PROFILES

- 5.1. Chapter Overview

- 5.2. Ajinomoto Bio-Pharma Services

- 5.2.1. Company Overview

- 5.2.2. Financial Information

- 5.2.3. Technology / Service Portfolio

- 5.2.4. Recent Developments and Future Outlook

- 5.3. ATUM

- 5.3.1. Company overview

- 5.3.2. Technology / Service Portfolio

- 5.3.3. Recent Developments and Future Outlook

- 5.4. DNA Script

- 5.4.1. Company Overview

- 5.4.2. Technology / Service Portfolio

- 5.4.3. Recent Developments and Future Outlook

- 5.5. Eurofins Genomics

- 5.5.1. Company Overview

- 5.5.2. Financial Information

- 5.5.3. Technology / Service Portfolio

- 5.5.4. Recent Developments and Future Outlook

- 5.6. Gene Universal

- 5.6.1. Company Overview

- 5.6.2. Technology / Service Portfolio

- 5.6.3. Recent Developments and Future Outlook

- 5.7. GenScript

- 5.7.1. Company Overview

- 5.7.2. Financial Information

- 5.7.3. Technology / Service Portfolio

- 5.7.4. Recent Developments and Future Outlook

- 5.8. Synbio Technologies

- 5.8.1. Company overview

- 5.8.2. Technology / Service Portfolio

- 5.8.3. Recent Developments and Future Outlook

6. CASE STUDY: OLIGONUCLEOTIDE MANUFACTURERES (RESEARCH AND DIAGNOSTIC APPLICATIONS)

- 6.1. Chapter Overview

- 6.2. Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Overall Market Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Scale of Operation

- 6.2.4. Analysis by Geographical Location

- 6.2.5. Analysis by Location of Manufacturing Facilities

- 6.2.6. Analysis by Regulatory Accreditations / Certifications Received

- 6.2.7. Analysis by Type of Oligonucleotide Manufactured

- 6.2.8. Analysis by Type of Offering

- 6.2.9. Analysis by Type of Manufacturing Service Offered

- 6.2.10. Analysis by Type of Modification

7. CASE STUDY: OLIGONUCLEOTIDE MANUFACTURERES (THERAPEUTIC APPLICATIONS)

- 7.1. Chapter Overview

- 7.2. Oligonucleotide Manufacturers Focused on Therapeutic Applications: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Scale of Operation

- 7.2.4. Analysis by Geographical Location

- 7.2.5. Analysis by Location of Manufacturing Facilities

- 7.2.6. Analysis by Regulatory Accreditations / Certifications

- 7.2.7. Analysis by Type of Oligonucleotide Manufactured

- 7.2.8. Analysis by Type of Offering

- 7.2.9. Analysis by Type of Manufacturing Service Offered

- 7.2.10. Analysis by Type of Modification

8. PARTNERSHIPS AND COLLABORATIONS

- 8.1. Chapter Overview

- 8.2. Partnership Models

- 8.3. DNA Synthesis Technologies and Services: List of Partnerships and Collaborations

- 8.3.1. Analysis by Year of Partnership

- 8.3.2. Analysis by Type of Partnership

- 8.3.3. Analysis by Type of Partner

- 8.3.4. Analysis by Year and Type of Partner

- 8.3.5. Most Active Players: Analysis by Number of Partnerships

- 8.3.6. Regional Analysis

- 8.3.6.1. Intercontinental and Intracontinental Agreements

9. FUNDING AND INVESTMENT ANALYSIS

- 9.1. Chapter Overview

- 9.2. Types of Funding

- 9.3. DNA Synthesis Technologies: Recent Funding Instances

- 9.4. Analysis by Year of Investment

- 9.5. Analysis by Amount Invested

- 9.6. Analysis by Amount Invested

- 9.7. Analysis by Type of Funding and Amount Invested

- 9.8. Analysis by Venture Capital Funding

- 9.9. Most Active Players: Analysis by Number of Funding Instances

- 9.10. Key Investors: Analysis by Number of Funding Instances

- 9.11. Regional Analysis by Amount Invested

- 9.12. Funding and Investment Summary

10. GRANT ANALYSIS

- 10.1. Chapter Overview

- 10.2. Analysis Methodology and Key Parameters

- 10.3. DNA Synthesis Technologies and Services: List of Academic Grants

- 10.3.1. Analysis by Year of Grant Award

- 10.3.2. Analysis by Grant Amount Awarded

- 10.3.3. Analysis by Administering Institute Center

- 10.3.4. Analysis by Support Period

- 10.3.5. Analysis by Administering Institute Center and Support Period

- 10.3.6. Analysis by Type of Grant Application

- 10.3.7. Analysis by Grant Activity Code

- 10.3.8. Word Cloud of Study Titles

- 10.3.9. Analysis by Purpose of Grant Award

- 10.3.10. Popular NIH Departments: Analysis by Number of Grants

- 10.3.11. Analysis by Type of Recipient Organization

10..12. Prominent Program Officers: Analysis by Number of Grants

11. PUBLICATION ANALYSIS

- 11.1. Chapter Overview

- 11.2. Analysis Methodology and Key Parameters

- 11.3. Analysis by Year of Publication

- 11.4. Analysis by Quarterly Distribution of Publication

- 11.5. Analysis by Type of Article

- 11.6. Analysis by Popular Keywords

- 11.7. Most Popular Authors: Analysis by Number of Publications

- 11.8. Popular Publishers: Analysis by Number of Publications

- 11.9. Popular Journals: Analysis by Number of Publications

- 11.10. Analysis by Therapeutic Area

- 11.11. Geographical Analysis

12. PATENT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Analysis Methodology and Key Parameters

- 12.3. DNA Synthesis Technologies and Services: Patent Analysis

- 12.3.1. Analysis by Type of Patent

- 12.3.2. Analysis by Publication Year

- 12.3.3. Analysis by Type of Patent and Publication Year

- 12.3.4. Analysis by Issuing Authority

- 12.3.5. Analysis by CPC Symbols

- 12.3.6. Analysis by Type of Applicant

- 12.3.7. Word Cloud Analysis: Emerging Focus Areas

- 12.3.8. Leading Industry Players: Analysis by Number of Patents

- 12.3.9. Leading Non-Industry Players: Analysis by Number of Patents

- 12.3.10. Leading Players: Analysis by Number of Patents

- 12.3.11. Leading Patents: International Patents

- 12.3.12. Analysis by Patent Characteristics

- 12.3.13. Patent Valuation Analysis

13. DNA SYNTHESIS SERVICES: MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Forecast Methodology

- 13.3. Global DNA Synthesis Services Market, Till 2035

- 13.3.1. Global DNA Synthesis Services Market: Distribution by Method of DNA Synthesis, Till 2035

- 13.3.2. Global DNA Synthesis Services Market: Distribution by Application Area, Till 2035

- 13.3.3. Global DNA Synthesis Services Market: Distribution by Company Size, Till 2035

- 13.3.4. Global DNA Synthesis Services Market: Distribution by Geography, Till 2035

- 13.4. DNA Synthesis Services Market in North America, Till 2035

- 13.4.1. DNA Synthesis Services Market in North America: Distribution by Method of DNA Synthesis, Till 2035

- 13.4.2. DNA Synthesis Services Market in North America: Distribution by Application Area, Till 2035

- 13.4.3. DNA Synthesis Services Market in North America: Distribution by Company Size, Till 2035

- 13.5. DNA Synthesis Services Market in Europe, Till 2035

- 13.5.1. DNA Synthesis Services Market in Europe: Distribution by Method of DNA Synthesis, Till 2035

- 13.5.2. DNA Synthesis Services Market in Europe: Distribution by Application Area, Till 2035

- 13.5.3. DNA Synthesis Services Market in Europe: Distribution by Company Size, Till 2035

- 13.6. DNA Synthesis Services Market in Asia-Pacific and Rest of the World, Till 2035

- 13.6.1. DNA Synthesis Services Market in Asia-Pacific and Rest of the World: Distribution by Method of DNA Synthesis, Till 2035

- 13.6.2. DNA Synthesis Services Market in Asia-Pacific and Rest of the World: Distribution by Application Area, Till 2035

- 13.6.3. DNA Synthesis Services Market in Asia-Pacific and Rest of the World: Distribution by Company Size, Till 2035