|

|

市場調査レポート

商品コード

1457876

Geelyの電化、接続性、インテリジェンス、シェアリングにおけるレイアウトの分析Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing |

||||||

|

|||||||

| Geelyの電化、接続性、インテリジェンス、シェアリングにおけるレイアウトの分析 |

|

出版日: 2024年03月10日

発行: ResearchInChina

ページ情報: 英文 125 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

中国有数の自動車グループであるGeelyは、電化、接続性、インテリジェンス、シェアリングにおいて包括的なレイアウトを行っています。

Geelyは10を超えるブランドを擁します。2023年に前年比20%増の約279万台を売り上げました。Geelyは明らかに、新エネルギー車時代の「Volkswagen Group」を目指しています。

Volkswagen Groupには10のブランドがあり、各ブランドは互いに密接な関係にはありませんが、内部技術の拡張と継承において高い関連性を持っています。Volkswagen傘下の各ブランドは、対外的・対内的な協力関係という点では非常に独立性が高く、それぞれ独自の経営・管理モデルを持っています。近年、GeelyはVolkswagenから学び、統一された内部基盤技術と独立したブランドの戦略的構築を追求しています。この過程で、Geelyはアーキテクチャを通じて自動車を製造し、統一された技術アーキテクチャを形成することを望んでいます。しかし、経営構造全体では、Geelyは各事業単位を徹底的に市場志向で管理しています。

Sustainable Experience Architecture(SEA)は、Geelyの複数のブランドが共有する技術基盤として、ホイールベース1,800mm~3,300mmの範囲でAクラスからEクラスまでのフルサイズの車両をカバーし、セダン、SUV、MPV、小型都市型車両、スポーツカー、ピックアップ、未来のモビリティのすべてのスタイリングニーズに対応します。

2023年、Volkswagen Groupの新車売上台数は924万台、Geelyは約279万台でした。両者の差は歴然としています。GeelyがVolkswagenに追いつく機会は新エネルギー車にあります。「新エネルギー車時代のVolkswagen Groupになる」という目標を達成するために、Geelyは以下の4つの局面で活動します。

まず、アーキテクチャーを利用した車作りです。2023年末までに、SEAは6つのブランドと11の生産モデルを強化します。

第二に、産業チェーンを垂直統合します。技術エコシステムのレイアウトから、「電気駆動、バッテリー、電気制御」のコア技術とインテリジェンス、そしてインテリジェント製造とエネルギー補給システムに至るまで、Geelyは新エネルギー車の中核分野におけるフルスタックの独立した研究開発と垂直統合に注力し、規模の経済を向上させます。

第三に、技術への取り組みです。Geelyが自主開発した高度インテリジェントドライビング向けSEAは、高速道路NZP、都市NZP、インテリジェントパーキングなどの一般的なインテリジェントドライビングシナリオをターゲットとしており、ますます多くのモデルに搭載されています。IVIに関しては、GeelyはQualcomm 8295コンピューティングプラットフォームをベースとする自社開発ソリューションを持っているだけでなく、Meizu IVIシステムを通じてFlyme Autoを立ち上げ、その他のIVIシステムとコア機能を共有しています。現在、Polestar、Lynk & Co、Galaxyの複数のモデルがFlyme Autoに接続されています。バージョン2.0は今年発売される予定です。

第四に、ブランドにシナジーを与えることです。Geelyブランドは、Geely China Star、Galaxy、GEOMEの3つの主要シリーズを含む、さまざまな動力形式を持つ高価値の人気ブランドとして位置づけられています。中高級ブランドであるLynk & Coは、スーパーハイブリッドを特徴としています。高級インテリジェントBEVブランドのZEEKRは、完全電化製品を提供しています。

当レポートでは、Geelyについて調査し、電化、接続性、インテリジェンス、シェアリングにおける同社の戦略や開発動向などを分析しています。

目次

第1章 電化、接続性、インテリジェンス、シェアリングにおけるGeelyの戦略の分析

- 概要

- プロファイル

- Geelyのブランドレイアウト

- Geelyのブランド発展の歴史

- Geelyの売上台数

- GeelyのR&Dセンター

- Geelyの開発計画

- 「Smart Geely 2025」戦略

- Geelyのチップ計画

- Geelyの開発戦略(2024年)

- Polestarの開発ジレンマ

- スマートの現状

- 自動車プラットフォーム

- EEA

- 電化、インテリジェントシャーシレイアウト

- インテリジェントドライビングシステム

- インテリジェントコックピット

- ソフトウェア、AI

- IoV(Internet of Vehicles)と情報サービス

- 主要モデルとサプライヤー

- その他の事業と国外事業のレイアウト

第2章 電化、接続性、インテリジェンス、シェアリングの開発動向

第3章 OEMと新モデルの力学

第4章 自動車インテリジェンスと接続性の開発力学

第5章 自動車の電化とインテリジェントシャーシの動向

第6章 政策、規制、規格、市場データ

Geely, one of the leading automotive groups in China, makes comprehensive layout in electrification, connectivity, intelligence and sharing.

Geely boasts more than ten brands. In 2023, it sold a total of about 2.79 million vehicles, a year-on-year increase of 20%. Geely clearly aims to become "Volkswagen Group" in the era of new energy vehicles.

Volkswagen Group has 10 brands, each of which is not closely related to one another but highly related in the extension and inheritance of internal technologies. In terms of external and internal cooperation, the brands under Volkswagen are very independent and have their own operation and management models. In recent years, Geely has been learning from Volkswagen and pursuing the strategic construction of unified internal underlying technology and independent brands. In this process, Geely builds cars through architectures, hoping to form unified technology architecture. But in the whole management structure, Geely thoroughly manages each business unit in a market-oriented manner.

As a technical base shared by multiple brands of Geely, the Sustainable Experience Architecture (SEA) covers full size of vehicles from A-class cars to E-class in the wheelbase range of 1,800mm-3,300mm, and meets all styling needs of sedans, SUVs, MPVs, small urban vehicles, sports cars, pickups and future vehicles for mobility.

In 2023, Volkswagen Group sold 9.24 million new vehicles, while Geely sold about 2.79 million units. The gap between them is obvious. Geely's opportunity to catch up with Volkswagen lies in new energy vehicles. To achieve the goal of "becoming Volkswagen Group in the era of new energy vehicles", Geely will take efforts in the following four aspects:

First of all, it uses architectures to build cars. By the end of 2023, SEA had empowered 6 brands and 11 production models.

Second, it vertically integrates the industry chain. From technological ecosystem layout, to core technologies of "electric drive, batteries and electric control" and intelligence, and then to intelligent manufacturing and energy replenishment systems, Geely focuses on full-stack independent R&D and vertical integration in the core fields of new energy vehicles to improve economies of scale.

Third, it works on technologies. Geely's self-developed SEA for high-level intelligent driving targets common intelligent driving scenarios such as highway NZP, urban NZP and intelligent parking, and is mounted on ever more models. In terms of IVI, Geely not only has a self-developed solution based on Qualcomm 8295 computing platform, but also launched Flyme Auto through Meizu IVI system to share its core capabilities with other IVI systems. At present multiple models of Polestar, Lynk & Co and Galaxy have been connected to it. The version 2.0 will be launched this year.

Fourth, it synergizes brands. The Geely brand is positioned as a high-value popular brand with various power forms, including three main series: Geely China Star, Galaxy, and GEOME. Lynk & Co, a mid-to-high-end brand, features super hybrids. The luxury intelligent BEV brand ZEEKR offers all-electric products.

Geely sets ambitious goals, but it faces pros and cons, as follows.

Pros 1: Geely independently develops high-compute chips and gets ahead of other major automakers in satellite technology.

At present, only Tesla and Geely have achieved independent R&D and mass production of high-compute chips. ECARX, a subsidiary of Geely, has developed E01 and E02 cockpit chips independently, and Longying No.1 together with SiEngine Technology. These chips have been mass-produced and mounted on vehicles.

On February 3, Geely conducted its second successful satellite launch in Xichang Satellite Launch Center, and sent eleven satellites into low Earth orbit, finishing the deployment of the second orbital plane of the Geely Future Mobility Constellation. Geely is currently the only Chinese independent automaker that launches satellites.

The Geely Future Mobility Constellation technology allows vehicles to achieve instantaneous "centimeter-level" high-precision positioning and accurate route planning, and then enable applications such as vehicle cloud management, V2X-based intelligent driving and automated parking.

Pros 2: Geely's sales in January soared by 110% on a like-on-like basis, surpassing BYD.

Geely sold 213,487 vehicles in January 2024, a year-on-year spurt of 110% and a month-on-month jump of approximately 46%, of which 65,826 units were new energy vehicles, rocketing by 591% from the prior-year period. BYD sold a total of 201,493 vehicles in January, up 33.9% from the same period last year.

The surging sales of Geely's brands in January 2024 lay the foundation for Geely to achieve its long-term strategic goals.

Pros 3: Geely has strong capital operation capabilities and its brands have been listed one after another.

Geely has 7 listed companies: Geely Automobile Holdings Limited (0175.HK), Zhejiang Qianjiang Motorcycle Co., Ltd. (000913.SZ), Hanma Technology Group Co., Ltd. (600375.SS), Lifan Technology (Group) Co., Ltd. (601777.SS), ECARX (NASDAQ: ECX), Polestar (NASDAQ: PSNYW), and Volvo (STO: VOLV-B).

Other brands under Geely are also gearing up for listing. Lotus will go public the US stock market through backdoor listing; ZEEKR has also submitted a prospectus for listing in the US stock market.

Other brands, including RADAR and Farizon Auto, are also seeking to be listed.

Cons 1: Geely faces difficulties in realizing its 2025 Strategy.

In 2021, Geely set its 2025 strategic goals: to invest RMB150 billion in R&D over five years, build an international R&D system based on the global "5 major R&D centers + 5 major styling centers", and head toward the intelligent era.

The investment in R&D in five years is RMB150 billion, namely, RMB30 billion per year. In fact, Geely's R&D investment was RMB6.7 billion in 2022, and is estimated to be RMB12 billion in 2023. Geely's R&D investment is the same with that of NIO and Li Auto both with a single brand, but much lower than first-tier brands like BYD, Toyota and Volkswagen.

Geely still needs to do a lot of work to unify the technical base and achieve economies of scale. Geely performs best in electrification technology. The advanced SEA allows Geely to launch new cars and popular models faster than its counterparts. Geely's models such as ZEEKR and Galaxy are well accepted by the market, with surging sales volume.

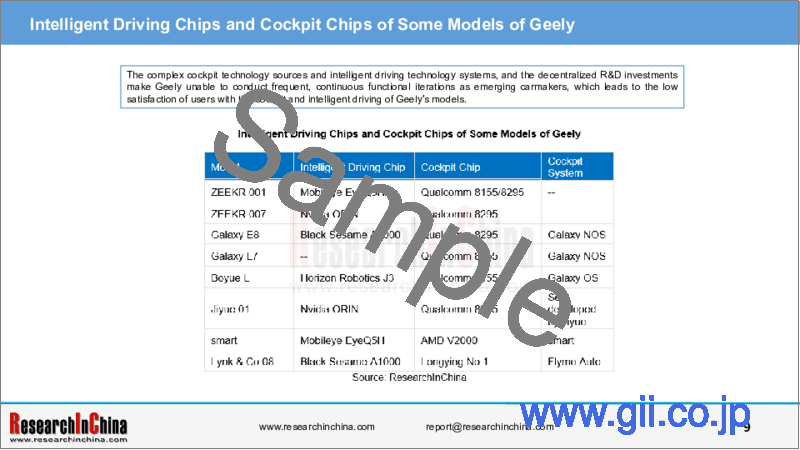

However, Geely has not unified its technical bases of cockpit and intelligent driving. Different models are often supported by different suppliers of intelligent driving chips and systems, and cockpit chips and systems.

The complex cockpit technology sources and intelligent driving technology systems, and the decentralized R&D investments make Geely unable to conduct frequent, continuous functional iterations as emerging carmakers, which leads to the low satisfaction of users with the cockpit and intelligent driving of Geely's models.

The Flyme Auto solution adopted by Lynk & Co 08 EM-P is praised by users in terms of touch experience, UI aesthetics, interaction details and car-phone interconnect. According to Geely's latest "technology focus" strategy, the intelligent driving system and cockpit system accepted by consumers will be seen in more models of Geely brands.

Cons 2: Declining profits and fewer profitable brands

Since its establishment, Geely has figured out three multi-brand strategies: First, Geely launched three brands: Free Cruiser, KingKong and Vision from 2004 to 2007. Second, it unveiled Emgrand, GLEAGLE and Englon in 2008. In 2014, Geely returned to the "One Geely" strategy in time.

Third, Geely launched brands such as Emgrand L, Emgrand GS, and Boyue, and gradually formed more than a dozen passenger car brands by way of acquisitions from 2015 to 2017. But the brands that can make profits independently are only Geely and Volvo, and others need more financial support.

The investment in too many brands consumes the funds of Geely and lowers its profitability. From 2018 to 2021, the net income of Geely plunged from RMB12.55 billion to RMB4.847 billion. In the first half of 2023, Geely recorded only RMB1.57 billion in net come.

By the end of the third quarter of 2023, Geely has had the total assets of RMB640.399 billion, and the total liabilities of RMB441.599 billion increasing RMB61 billion over the end of the previous year, with the debt ratio up to 68.96%, a warning figure for the company. In contrast, Geely's debt ratio was higher than that of Changan Automobile (60.4%), SAIC (63.95%), Great Wall Motor (65.64%) and GAC (40.8%) but lower than BYD's (77.37%). Therefore, in January 2024, Geely reduced its shares worth nearly USD680 million in Volvo to gain more financial support for the electrified and intelligent transformation.

In short, Geely has great product R&D and capital operation capabilities. In January 2024, it gained momentum and had the potential to become a global first-tier manufacturer of new energy vehicles. Amid the sluggish economic environment in 2024, only by implementing the strategy of "architecture-based car making, vertical integration, technology focus, and brand synergy" can Geely hope to become the "Volkswagen Group in the era of new energy vehicles."

Table of Contents

1 Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

- 1.1.1 Overview

- 1.1.1 Profile

- 1.1.2 Brand Layout of Geely

- 1.1.3 Brand Development History of Geely

- 1.1.4 Sales Volume of Geely

- 1.1.5 R&D Centers of Geely

- 1.1.6 Development Planning of Geely

- 1.1.7 "Smart Geely 2025" Strategy

- 1.1.8 Chip Planning of Geely

- 1.1.9 Development Strategy of Geely in 2024

- 1.1.10 Development Dilemma of Polestar

- 1.1.11 Status Quo of smart

- 1.2 Automotive Platform

- 1.2.1 New Energy Modular Platform Planning

- 1.2.2 Introduction to Sustainable Experience Architecture (SEA)

- 1.2.3 Main Features of SEA

- 1.2.4 GEEA 3.0 and ZEEKR's Next-generation EEA

- 1.2.5 Geely Galaxy NOS

- 1.2.6 Hardware Evolution of G-Pilot Intelligent Driving System

- 1.2.7 Geely Cloud Platform

- 1.2.8 Geely Xingrui Intelligent Computing Center

- 1.3 EEA

- 1.3.1 Geely's EEA Development Route

- 1.3.2 GEEA 3.0

- 1.3.3 SOA-based Operating System

- 1.3.4 GEEA3.0: Architecture Features and Developer Platform

- 1.3.5 Key Technology: SOA

- 1.3.6 Key Technology: SiEngine Cockpit and Autonomous Driving SoC

- 1.3.7 Key Technology: Super Brain

- 1.3.8 ZEEKR: Evolution of EEA

- 1.3.9 ZEEKR: Fusion Path of Driving Zone Controllers

- 1.3.10 ZEEKR: Fusion Strategy of Driving Zone Controllers

- 1.3.11 ZEEKR: Development Challenges for Driving Zone Controllers and Solutions

- 1.3.12 ZEEKR: Functions and Features of PCMU Driving Zone Controllers

- 1.4 Electrification and Intelligent Chassis Layout

- 1.4.1 Geely's Hybrid Development Route

- 1.4.2 Thor Hybrid

- 1.4.3 Thor Smart Engine Hi*X

- 1.4.4 Intelligent Electric Hybrid LynkE-Motive Technology

- 1.4.5 Geely Leishen Electric Hybrid 8848 Platform

- 1.4.6 Development Stages of Geely's Automotive Thermal Management System

- 1.4.7 Direct Heat Pump System of Lynk & Co ZERO

- 1.4.8 Development of Geely's Charging and Swapping Facilities

- 1.4.9 Geely Integrates EDUs and Power Domain Controllers

- 1.4.10 Chassis Layout (1)

- 1.4.11 Chassis Layout (2)

- 1.4.12 ZEEKR's Power Chassis Domain Integration Solution (1)

- 1.4.13 ZEEKR's Power Chassis Domain Integration Solution (2)

- 1.5 Intelligent Driving System

- 1.5.1 Geely's ADAS Strategic Planning

- 1.5.2 "Smart Geely 2025" Strategy: Intelligent Cockpit

- 1.5.3 Geely's Self-developed ADAS Path

- 1.5.4 Geely's ADAS Technology Layout: Intelligent Driving Domain Controllers

- 1.5.5 Geely's ADAS Technology Layout: Chips

- 1.5.6 Geely's ADAS Technology Layout: High-precision Positioning/HD Maps

- 1.5.7 Geely's ADAS Technology Layout: Tianqiong Pro Computing Platform

- 1.5.8 Geely's ADAS Technology Layout: Geely Xingrui Intelligent Computing Center

- 1.5.9 Geely's ADAS Technology Layout: Foundation Model

- 1.5.10 Geely's ADAS Development Roadmap: Autonomous Driving & Automated Parking

- 1.5.11 Geely's ADAS Application Solutions (1)

- 1.5.12 Geely's ADAS Application Solutions (2)

- 1.5.13 Geely's Parking Solutions

- 1.5.14 Typical Models Equipped with Geely's ADAS: L2.5

- 1.5.15 Typical Models Equipped with Geely's ADAS: L2.9

- 1.5.16 Geely's Autonomous Driving Tests: Simulation Tests

- 1.5.17 Geely's Autonomous Driving Tests: Closed Road Tests

- 1.5.18 Geely's Autonomous Driving Tests: Open Road Tests

- 1.5.19 Geely's ADAS Partners

- 1.5.20 Geely's Investment and Cooperation in ADAS

- 1.6 Intelligent Cockpit

- 1.6.1 Geely's Intelligent Cockpit

- 1.6.2 Geely's Cockpit Chip Layout

- 1.6.3 ECARX's Intelligent Cockpit Computing Platform: Antora

- 1.6.4 ECARX's Intelligent Cockpit Computing Platform: Makalu

- 1.6.5 Geely AR-HUD

- 1.6.6 Typical Model: ZEEKR X

- 1.6.7 Typical Model: Galaxy L7

- 1.6.8 Smart Surface Application of Geely Borui/ZEEKR X

- 1.7 Software and AI

- 1.7.1 Geely's Software Business Strategy

- 1.7.2 Geely's Software Business: More Than 1,000 APIs

- 1.7.3 Xingrui Intelligent Computing Center

- 1.7.4 ROBO Galaxy Intelligent Driving Cloud Data Factory

- 1.7.5 Geely's Data Closed Loop System

- 1.7.6 ROBO Galaxy Toolchain Solution

- 1.7.7 Geely's Data Production Method

- 1.7.8 Underlying Software Abstraction of Geely's Self-developed Algorithm

- 1.7.9 Geely's SOA-based Design for Self-developed Intelligent Driving

- 1.7.10 Geely's Global Platform Operation System

- 1.7.11 Geely's Foundation Model

- 1.8 Internet of Vehicles and Information Services

- 1.8.1 Geely's Automotive Information Service System Layout

- 1.8.2 Development History of Geely's Automotive Information Service System

- 1.8.3 Introduction to GKUI System

- 1.8.4 Updates to Galaxy OS 1.2

- 1.8.5 Highlights of Galaxy OS Air (1)

- 1.8.5 Highlights of Galaxy OS Air (2)

- 1.8.5 Highlights of Galaxy OS Air (3)

- 1.8.6 Models Equipped with Galaxy OS Air

- 1.8.7 Lynk & Co's Automotive Information Service System Iteration

- 1.8.8 Models Equipped with LYNK OS N

- 1.8.9 Partner of Lynk & Co's Automotive Information Service System: Meizu

- 1.8.10 Geometry Cooperates with Huawei

- 1.8.11 Cockpit Entertainment Ecology of the Geely Brand

- 1.8.12 Partners of Geely's Automotive Information Service System

- 1.8.13 Dynamics of Geely's Automotive Information Service System

- 1.9 Key Models and Suppliers

- 1.9.1 Model Planning of Geely

- 1.9.2 Model Planning of the Geely Brand

- 1.9.3 Typical Models of the Geely Brand

- 1.9.4 Model Planning of Lynk & Co

- 1.9.5 Typical Models of Lynk & Co

- 1.9.6 Lynk & Co & Meizu

- 1.9.7 Model Planning of Geometry

- 1.9.8 Typical Models of Geometry

- 1.9.9 Model Planning of ZEEKR

- 1.9.10 Typical Models of ZEEKR

- 1.9.11 Typical Models of ZEEKR: Feedback of ZEEKR 001 Users

- 1.9.12 ZEEKR X

- 1.9.13 Model Planning of Livan

- 1.9.14 Model Planning of Galaxy

- 1.9.15 Typical Models of Galaxy

- 1.9.16 Major Suppliers of Geely Galaxy

- 1.9.17 Main Suppliers of Jiyue

- 1.9.18 Main Suppliers of ZEEKR

- 1.10 Other Business and Overseas Business Layout

- 1.10.1 Geely's Overseas Development History

- 1.10.2 Geely's Overseas Factory Layout

- 1.10.3 Geely's Overseas Sales Volume

- 1.10.4 Geely's Main Overseas Models

- 1.10.5 Geely's Overseas Layout

2 Development Trends of Electrification, Connectivity, Intelligence and Sharing

- 2.1 Trend 1

- 2.1.1 Performance Comparison

- 2.1.2 Case 1

- 2.2 Trend 2

- 2.2.1 Case Comparison

- 2.3 Trend 3

- 2.3.1 Functional Comparison

- 2.4 Trend 4

3 Dynamics of OEMs and New Models

- 3.1 Dynamics of Domestic Traditional Automakers and New Models

- 3.2 Dynamics of Domestic Emerging Automakers and New Models

- 3.3 Dynamics of Foreign Automakers and New Models

4 Development Dynamics of Automotive Intelligence and Connectivity

- 4.1 ADAS and Autonomous Driving

- 4.2 Intelligent Cockpit

- 4.3 Sensors

- 4.4 Dynamics of Automotive Chips and Software