|

|

市場調査レポート

商品コード

1348749

インテリジェントコックピットドメインコントローラー・SoC市場(2023年第2四半期)Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2 |

||||||

|

|||||||

| インテリジェントコックピットドメインコントローラー・SoC市場(2023年第2四半期) |

|

出版日: 2023年09月04日

発行: ResearchInChina

ページ情報: 英文 110 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

2021年第1四半期~2023年第2四半期、中国の乗用車におけるインテリジェントコックピットドメインコントローラーの搭載数は全体的に増加傾向を示しました。2023年第1四半期に年率で96.7%増の96万4,800台、搭載率は23.7%、2023年第2四半期には119.7%増の132万5,700台、搭載率は25.6%に達しました。

当レポートでは、インテリジェントコックピットドメインコントローラー・SoC市場について調査し、搭載数と普及率のデータや企業のデータ、産業の発展動向などの情報を提供しています。

目次

第1章 全体のデータの動向

- コックピットドメインコントローラーの全体の搭載

- コックピットドメインコントローラーの搭載数(2021年第1四半期~2023年第2四半期)

- コックピットドメインコントローラーの搭載数:価格帯別(2021年第1四半期~2023年第2四半期)

- コックピットドメインコントローラーの普及率:価格帯別(2021年第1四半期~2023年第2四半期)

- コックピットドメインコントローラーの搭載数と普及率:OEMタイプ別(2021年第1四半期~2023年第2四半期)

- コックピットドメインコントローラーの搭載数と普及率:エネルギータイプ別(2021年第1四半期~2023年第2四半期)

- 中国の乗用車ブランドのコックピットドメインコントローラー搭載数と普及率上位15(2023年第2四半期)

- 中国の乗用車モデルのコックピットドメインコントローラー搭載数上位15(2023年第2四半期)

- 搭載数:コックピットレベル別

- コックピットドメインコントローラーベンダーの市場シェア

- コックピットドメインコントローラーベンダー上位10社(2023年第2四半期)

- 中国の独立系OEMのコックピットドメインコントローラーベンダー上位10社(2023年第2四半期)

- ジョイントベンチャーOEMのコックピットドメインコントローラーベンダー上位10社(2023年第2四半期)

- コックピットドメインコントローラーSoCベンダーの市場シェア

- コックピットドメインコントローラーSoCベンダーの市場シェア(2023年第2四半期)

- コックピットドメインコントローラーSoCの市場シェア:タイプ別(2023年第2四半期)

- Qualcomm 8155 SoCの市場シェア(2023年第2四半期)

- 中国の独立系OEMのコックピットドメインコントローラーSoCの市場シェア(2023年第2四半期)

- ジョイントベンチャーOEMのコックピットドメインコントローラーSoCの市場シェア(2023年第2四半期)

- 10万~20万人民元の車両モデル向けインテリジェントコックピットの市場データ

- 20万~30万人民元の車両モデル向けインテリジェントコックピットの市場データ

- 30万~50万人民元の車両モデル向けインテリジェントコックピットの市場データ

第2章 コックピットドメインコントローラー企業のデータと力学

- FindDreams Technology

- Megatronix

- Continental

- Desay SV

- Yanfeng Visteon

- Harman

- Bosch

- Panasonic

第3章 コックピットドメインコントローラーSoCベンダーのデータと力学

- Qualcomm

- AMD

- Intel

- Renesas

- Samsung

- NVIDIA

- MediaTek

- Huawei

- TI

- その他のコックピットSoC企業の力学

- UNISOC

- SiEngine

第4章 予測データと動向

- 予測データ

- コックピットドメインコントローラーの搭載数と普及率(2021年第1四半期~2024年第4四半期)

- コックピットドメインコントローラーの搭載数と普及率:ベンダータイプ別(2021年第1四半期~2024年第4四半期)

- コックピットドメインコントローラーの搭載数と普及率:コックピットレベル別(2021年第1四半期~2024年第4四半期)

- コックピットドメインコントローラーの搭載数:価格別(2021年第1四半期~2024年第4四半期)

- コックピットドメインコントローラー・SoCの市場規模(2021年第1四半期~2024年第4四半期)

- 動向

- 現在主流のコックピットSoCとSoCベースのドメインコントローラーの購入価格

- 現在主流のコックピットSoCの長所と短所

- MCUの購入価格、中国の代替ソリューションと統合

- コックピットドメインコントローラーとSoCの開発動向

- セントラルコンピューティングプラットフォームのコックピット・ドライビング統合動向に関する見解

- Qualcomm SA8255Pが再びインテリジェントコックピット市場を席巻する可能性

- Qualcomm SA8255P、8155、8295の比較

- SA8255Pの機能安全設計

- SA8255Pと8295Pのさらなる比較

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.

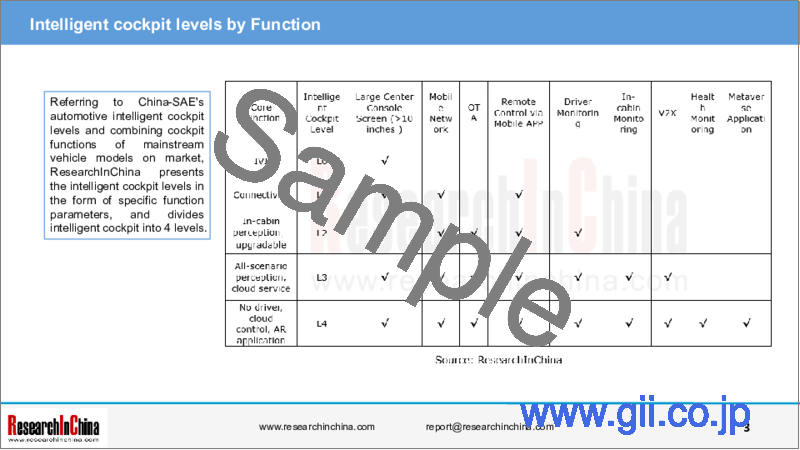

On May 17, 2023, the "White Paper on Automotive Intelligent Cockpit Levels and Comprehensive Evaluation" prepared by China-SAE together with industry professionals was officially released. It defines five levels of intelligent cockpits from L0 to L4.

Referring to China-SAE's automotive intelligent cockpit levels and combining cockpit functions of mainstream vehicle models on market, ResearchInChina presents the intelligent cockpit levels in the form of specific function parameters, and divides intelligent cockpit into 4 levels.

This Report only studies vehicle models with both L1+ intelligent cockpit functions (including L1, L2, L3 and L4) and cockpit domain controllers.

According to ResearchInChina, from 2021Q1 to 2023Q2, the installations of intelligent cockpit domain controllers in passenger cars in China showed an overall upward trend. In 2023Q1, the installations surged by 96.7% on an annualized basis to 964,800 units, and the installation rate was 23.7%; in 2023Q2, the installations reached 1,325,700 units, soaring by 119.7%, and the installation rate was 25.6%.

Currently, cockpit domain controller and intelligent driving domain controller are very similar in hardware architecture, both being the SoC+MCU solution. The core of cockpit domain controller is cockpit SoC, and single-chip multi-system solutions prevail at present. In 2023Q2, single-SoC solutions swept 92.6%, largely from Qualcomm and AMD; dual-SoC solutions made up 7.4%, mainly Qualcomm 8155.

From the sales of models of differing intelligent cockpit levels, it can be seen that in 2023Q2, the sales of models equipped with L1 intelligent cockpit with cockpit domain controller reached 950,000 units, jumping by 104.7% from the prior-year period, of which joint venture and Chinese independent automakers each occupied more than 40%; the sales of models with equipped with L2 intelligent cockpit with cockpit domain controller were 357,000 units, a like-on-like spurt of 170.5%, of which Chinese independent automakers accounted for 61%, and emerging car brands shared 32.4%; the sales of models equipped with L3 intelligent cockpit with cockpit domain controller were 1,8000 units, of which emerging car brands swept 98.8%.

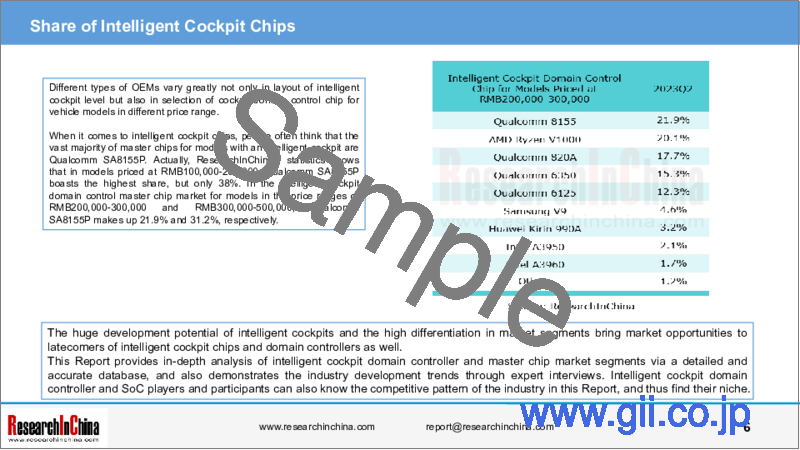

Different types of OEMs vary greatly not only in layout of intelligent cockpit level but also in selection of cockpit domain control chip for vehicle models in different price range.

When it comes to intelligent cockpit chips, people often think that the vast majority of master chips for models with an intelligent cockpit are Qualcomm SA8155P. Actually, ResearchInChina's statistics shows that in models priced at RMB100,000-200,000, Qualcomm SA8155P boasts the highest share, but only 38%. In the intelligent cockpit domain control master chip market for models in the price ranges of RMB200,000-300,000 and RMB300,000-500,000, Qualcomm SA8155P makes up 21.9% and 31.2%, respectively.

The huge development potential of intelligent cockpits and the high differentiation in market segments bring market opportunities to latecomers of intelligent cockpit chips and domain controllers as well.

This Report provides in-depth analysis of intelligent cockpit domain controller and master chip market segments via a detailed and accurate database, and also demonstrates the industry development trends through expert interviews. Intelligent cockpit domain controller and SoC players and participants can also know the competitive pattern of the industry in this Report, and thus find their niche.

Table of Contents

Intelligent Cockpit Levels Defined in the "White Paper on Automotive Intelligent Cockpit Levels and Comprehensive Evaluation"

Intelligent Cockpit Levels Defined by ResearchInChina: Referring to the "White Paper on Automotive Intelligent Cockpit Levels and Comprehensive Evaluation" and Presenting in the Form of Specific Parameters.

1 Overall Data Trends

- 1.1 Overall Installation of Cockpit Domain Controller

- 1.1.1 Installations of Cockpit Domain Controller, 2021Q1-2023Q2

- 1.1.2 Installations of Cockpit Domain Controller (by Price Range), 2021Q1-2023Q2

- 1.1.3 Penetration Rate of Cockpit Domain Controller (by Price Range), 2021Q1-2023Q2

- 1.1.4 Installations and Penetration Rate of Cockpit Domain Controller (by OEM Type), 2021Q1-2023Q2

- 1.1.5 Installations and Penetration Rate of Cockpit Domain Controller (by Energy Type), 2021Q1-2023Q2

- 1.1.6 TOP 15 Passenger Car Brands in China by Installations of Cockpit Domain Controller, and Their Penetration Rate, 2023Q2

- 1.1.7 TOP 15 Passenger Car Models in China by Installations of Cockpit Domain Controller, 2023Q2

- 1.2 Installation by Cockpit Level

- 1.2.1 Structure of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller

- 1.2.2 Sales of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller (by OEM Type)

- 1.2.3 Sales Structure of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller (by OEM Type), 2023Q2

- 1.2.4 Sales Structure of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller (by Energy Type), 2021Q1-2023Q2

- 1.2.5 Sales Structure of Vehicle Models of Differing Cockpit Levels (by Energy Type), 2023Q2

- 1.3 Market Share of Cockpit Domain Controller Vendors

- 1.3.1 TOP 10 Cockpit Domain Controller Vendors, 2023Q2

- 1.3.2 TOP 10 Cockpit Domain Controller Vendors for Chinese Independent OEMs, 2023Q2

- 1.3.3 TOP 10 Cockpit Domain Controller Vendors for Joint Venture OEMs, 2023Q2

- 1.4 Market Share of Cockpit Domain Controller SoC Vendors

- 1.4.1 Market Share of Cockpit Domain Controller SoC Vendors, 2023Q2

- 1.4.2 Market Share of Cockpit Domain Controller SoCs by Type, 2023Q2

- 1.4.3 Market Share of Qualcomm 8155 SoC, 2023Q2

- 1.4.4 Cockpit Domain Controller SoC Market Share of Chinese Independent OEMs, 2023Q2

- 1.4.5 Cockpit Domain Controller SoC Market Share of Joint Venture OEMs, 2023Q2

- 1.5 Market Data of Intelligent Cockpits for Vehicle Models Priced at RMB100,000-200,000

- 1.5.1 Sales and Penetration of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB100,000-200,000

- 1.5.2 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB100,000-200,000 (by OEM Type)

- 1.5.3 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB100,000-200,000 (by Energy Type)

- 1.5.4 Share of Cockpit Domain Controllers Vendors for Vehicle Models Priced at RMB100,000-200,00

- 1.5.5 Share of Cockpit Domain Controller Master Chip Vendors for Vehicle Models Priced at RMB100,000-200,000

- 1.5.6 Market Share of Cockpit Domain Controller Master Chips (by Type) for Vehicle Models Priced at RMB100,000-200,000

- 1.6 Market Data of Intelligent Cockpits for Vehicle Models Priced at RMB200,000-300,000

- 1.6.1 Sales and Penetration of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB200,000-300,000

- 1.6.2 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB200,000-300,000 (by OEM Type)

- 1.6.3 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB200,000-300,000 (by Energy Type)

- 1.6.4 Share of Cockpit Domain Controllers Vendors for Vehicle Models Priced at RMB200,000-300,000

- 1.6.5 Share of Cockpit Domain Controller Master Chip Vendors for Vehicle Models Priced at RMB200,000-300,000

- 1.6.6 Market Share of Cockpit Domain Controller Master Chips (by Type) for Vehicle Models Priced at RMB200,000-300,000

- 1.7 Market Data of Intelligent Cockpits for Vehicle Models Priced at RMB300,000-500,000

- 1.7.1 Sales and Penetration of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB300,000-500,000

- 1.7.2 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB300,000-500,000 (by OEM Type)

- 1.7.3 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB300,000-500,000 (by Energy Type)

- 1.7.4 Share of Cockpit Domain Controllers Vendors for Vehicle Models Priced at RMB300,000-500,000

- 1.7.5 Share of Cockpit Domain Controller Master Chip Vendors for Vehicle Models Priced at RMB300,000-500,000

- 1.7.6 Market Share of Cockpit Domain Controller Master Chips (by Type) for Vehicle Models Priced at RMB300,000-500,000

2 Data and Dynamics of Cockpit Domain Controller Companies

- 2.1 FindDreams Technology

- 2.1.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 2.2 Megatronix

- 2.2.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 2.3 Continental

- 2.3.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 2.3.2 Latest Dynamics

- 2.4 Desay SV

- 2.4.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 2.4.2 Latest Dynamics

- 2.5 Yanfeng Visteon

- 2.5.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 2.5.2 Latest Dynamics

- 2.6 Harman

- 2.6.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 2.7 Bosch

- 2.7.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 2.8 Panasonic

- 2.8.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3 Data and Dynamics of Cockpit Domain Controller SoC Vendors

- 3.1 Qualcomm

- 3.1.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 3.1.2 Qualcomm SA8155P to Be Installed in BMW Models

- 3.1.3 Cooperation between Qualcomm and Leapmotor

- 3.1.4 Leapmotor's Qualcomm-based Cockpit-driving Integrated Solution

- 3.2 AMD

- 3.2.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 3.3 Intel

- 3.3.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 3.4 Renesas

- 3.4.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 3.5 Samsung

- 3.5.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 3.5.2 Latest Dynamics

- 3.6 NVIDIA

- 3.6.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 3.6.2 Latest Dynamics

- 3.7 MediaTek

- 3.7.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 3.8 Huawei

- 3.8.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 3.9 TI

- 3.9.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

- 3.10 Dynamics of Other Cockpit SoC Players

- 3.10.1 UNISOC

- 3.10.2 SiEngine

4 Forecast Data and Trends

- 4.1 Forecast Data

- 4.1.1 Cockpit Domain Controller Installations and Penetration Rate, 2021Q1-2024Q4E

- 4.1.2 Cockpit Domain Controller Installations and Penetration Rate by Vendor Type, 2021Q1-2024Q4E

- 4.1.3 Cockpit Domain Controller Installations and Penetration Rate by Cockpit Level, 2021Q1-2024Q4E

- 4.1.4 Cockpit Domain Controller Installations by Price, 2021Q1-2024Q4E

- 4.1.5 Cockpit Domain Controller and SoC Market Size, 2021Q1-2024Q4E

- 4.2 Trends

- 4.2.1 Purchase Prices of Current Mainstream Cockpit SoCs and Domain Controllers Based on the SoCs

- 4.2.2 Advantages and Shortcomings of Current Mainstream Cockpit SoCs

- 4.2.3 MCU Purchase Price, Chinese Alternative Solutions and Integration

- 4.2.4 Development Trends of Cockpit Domain Controller and SoC

- 4.2.5 Views on Cockpit-driving Integration Trend of Central Computing Platforms

- 4.3 Qualcomm SA8255P May Once Again Sweep up the Intelligent Cockpit Market

- 4.3.1 Comparison between Qualcomm SA8255P, 8155 and 8295

- 4.3.2 Functional Safety Design of SA8255P

- 4.3.3 Further Comparison between SA8255P and 8295P