|

|

市場調査レポート

商品コード

1297867

主要Tier1サプライヤーのインテリジェントコックピット事業(2023年)(外国企業)Leading Tier1 Suppliers' Intelligent Cockpit Business Research Report, 2023 (Foreign Players) |

||||||

|

|||||||

| 主要Tier1サプライヤーのインテリジェントコックピット事業(2023年)(外国企業) |

|

出版日: 2023年06月16日

発行: ResearchInChina

ページ情報: 英文 420 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

Tier1 サプライヤーのコックピット ビジネスに関する調査: 新しい革新的なインテリジェント コックピット製品は、マルチドメイン統合、マルチモーダル インタラクション、およびこれまで以上に高度な機能統合を強調しています。

市場動向に従って、新世代のコックピット コンピューティング プラットフォームの開発に取り組み、コックピットを駆動する統合製品や中央コンピューティング プラットフォームなどの製品を展開します。

過去 2 年間、インテリジェント車両市場の発展傾向を厳密に追跡し、Neusoft Group、Yuanfeng Technology、Desay SV、ThunderSoft、Joynext、PATEO CONNECT+、ECARX、Bosch、Aptiv、Visteon を含む多数の Tier 1 サプライヤーが取り組んできました。新世代のコックピット製品を展開します。 Qualcomm 8155などの量産型インテリジェントコックピットコンピューティングプラットフォームをベースに、Qualcomm 8295やAMD Ryzenなどのより高性能なコックピットチップをベースにした新世代インテリジェントコックピットコンピューティングプラットフォーム製品のレイアウトも精力的に行っており、量産が開始される予定です。これらの製品の生産は 2023 年に予定されています。

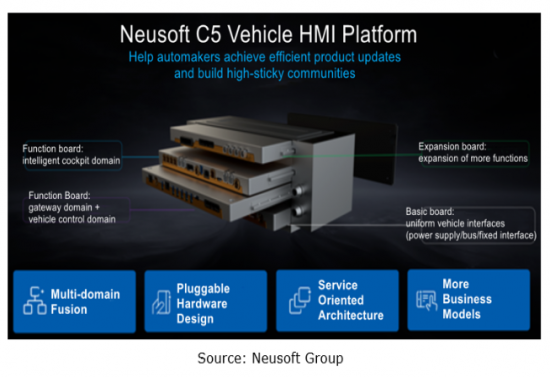

Neusoft グループは、2022 年に未来志向の車両 HMI プラットフォーム Neusoft C5 を開発および導入し、2023 年にはアップグレード バージョンもリリースしました。新しい車両 HMI プラットフォームは、基本ボード 1 枚、機能ボード 2 枚、および 1 枚のプラグ可能で拡張可能なハードウェアアーキテクチャ設計を引き続き使用しています。拡張ボードは統一されたインターフェースを介して結合されます。 Neusoft C5 はコンピューティング能力を向上させながら、基本的な車両機能、ゲートウェイ、車体制御、インテリジェント コックピット、その他の拡張機能の効率的な統合を可能にします。ソフトウェアの用語では、サービス指向アーキテクチャ(SOA) を通じてシーン エンジンを実装し、車両エンターテインメント システムに没入型でパーソナライズされたシーン エクスペリエンスを提供します。

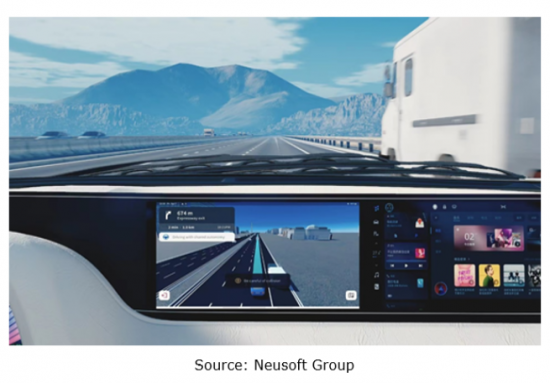

それだけでなく、Neusoft は、第 4 世代 Qualcomm Snapdragon Automotive Cockpit Platform に基づいて、高度なソフトウェアおよびハードアーキテクチャの設計能力をさらに活用し、マルチ ECU およびマルチドメインの統合を実現し、次世代の開発に取り組んでいます。インテリジェントなコックピットプラットフォーム。たった 1 つのチップを使用して、16 チャンネルのカメラ、 12チャンネルの超音波レーダー、その他のスクリーンの展開とアプリケーションをサポートし、コンピューティング能力、最先端の構成、エンターテイメント、セキュリティ、機能、そしてハードウェア。このプラットフォームは、ユーザーの室内インタラクション、快適性、安全性を向上させると同時に、自動車メーカーのコスト削減と効率の向上に役立ちます。この製品を搭載した新車は2023年9月に発売される予定です。

さらに、ここ 2 年でコックピット・パーキング統合製品やコックピット・ドライビング統合製品などのマルチドメイン統合製品も登場し、その一部は量産され車両に搭載されています。 2022 年、Yuanfeng Technology のチームは、Qualcomm 8155 SoC を使用して 4 台のカメラ、複数のスクリーン、12 個のレーダーの導入と使用をサポートするインテリジェント コックピット プラットフォームであるコックピット パーキング統合ソリューション 1.0 を開発し、インテリジェント コックピット 1.0 の機能ベースラインを統合しました。スーパーパーク 1.0 (AVM+APA)。スーパーパーク 1.0 は、97% の駐車スペース認識精度と 95% の駐車成功率を実現し、180 種類以上の主流の駐車スポットをカバーし、対面駐車をサポートします。型破りな駐車スペースの場合、カスタム AR パーキングを使用すると、ユーザーはスムーズに対処できます。

Yuanfeng Technology のコックピット・パーキング統合ソリューション 1.0 は、2022 年末に初めて Hycan A06 に搭載されました。2024 年までに、このソリューションを搭載した 6 つのモデルが販売される予定です。

Yuanfeng Technology のコックピット・パーキング統合ソリューション 2.0 の機能も開発され、OTA アップデートを通じて提供されます。コックピット・パーキング統合ソリューション 2.0 は、車両音声 GPT モデルを展開し、よりリアルで使いやすい 3D UI を組み込み、車線レベルの高解像度ナビゲーションにアップグレードします。スーパーパーク 2.0 は AVM/APA のパフォーマンスをさらに最適化し、平均駐車時間を 35 秒未満に短縮し、駐車成功率を 97% に高め、AVP 機能をアップグレードします。

一方、Yuanfeng Technologyは、2024年にコックピット・運転・駐車統合ソリューションを発表する予定です。このソリューションは、Intelligent Cockpit 2.0およびSuper Park 2.0の機能ベースラインに加えて、ACC、LCC、AEBなどの厳格な需要に応じた複数のADAS機能を追加します。 、BSD。

光学表示、非表示表示、認識可能表示などの新しい車両表示技術が車両に適用されています。

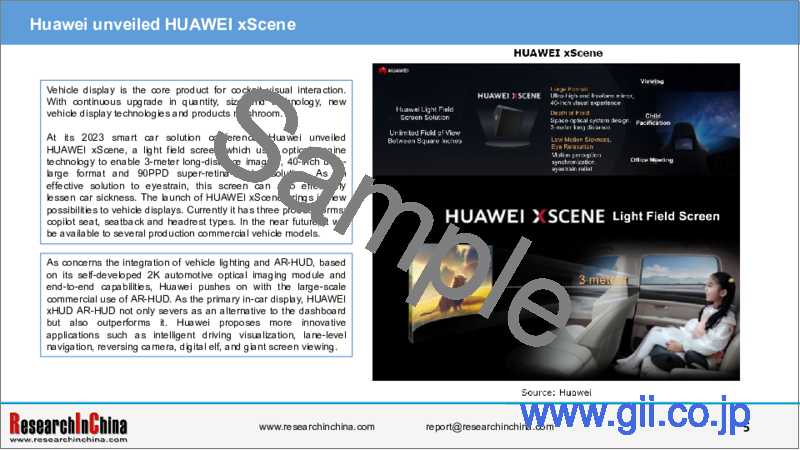

車両ディスプレイは、コックピットの視覚的インタラクションの中核となる製品です。量、サイズ、技術の継続的なアップグレードにより、新しい車両ディスプレイ技術と製品が急増します。

ファーウェイは2023年のスマートカーソリューションカンファレンスで、光学エンジン技術を使用して3メートルの長距離イメージング、40インチの超大型フォーマット、90PPDの超網膜レベルの解像度を可能にするライトフィールドスクリーンであるHUAWEI xSceneを発表しました。このスクリーンは目の疲れに対する効果的な解決策として、車酔いも効果的に軽減します。 HUAWEI xScene の発売は、車両ディスプレイに新たな可能性をもたらします。現在、副操縦士シートタイプ、シートバックタイプ、ヘッドレストタイプの3つの製品形態を展開しています。近い将来、いくつかの量産商用車モデルで利用可能になる予定です。

車両照明とAR-HUDの統合に関しては、自社開発の2K車載光学イメージングモジュールとエンドツーエンド機能に基づいて、ファーウェイはAR-HUDの大規模商用利用を推進しています。 HUAWEI xHUD AR-HUD は主要な車載ディスプレイとして、ダッシュボードの代替として機能するだけでなく、それよりも優れたパフォーマンスを発揮します。ファーウェイは、インテリジェントな運転視覚化、車線レベルのナビゲーション、リバースカメラ、デジタルエルフ、巨大スクリーン表示など、より革新的なアプリケーションを提案しています。

上海モーターショー2023で、コンチネンタルとそのパートナーであるtrinamiXは、共同開発した 促進要因識別ディスプレイを発表しました。これは、 促進要因の生体認証用のカメラソリューションを統合し、タッチレスで安全な 促進要因認証と詐欺や盗難からの保護を可能にする製品です。

さらに、コンチネンタルは、必要に応じてコンテンツを表示できる表示技術 In2visible も開発しました。不要時は人の目にはほとんど見えず、より高い安全性と快適性を提供します。

AI 基盤モデルなどの新しいテクノロジー別サポートされているマルチモーダル インタラクションにより、より詳細な情報と革新的な拡張が可能になります。

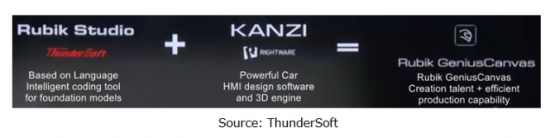

2023年5月、ThunderSoftはKanziモデルと基礎モデルを融合した製品「Rubik GeniusCanvas」をリリースしました。この製品は、ThunderSoft のインテリジェント コーディング基盤モデル Rubik Studio、車載 HMI 設計ソフトウェア、および 3D エンジン Kanzi で構築されており、コンセプト作成、3D 要素設計、特殊効果コード生成、およびシーン構築に関してデザイナーに超インテリジェントな支援を提供します。デザイナーは簡単な口頭対話を行うだけで、Rubik GeniusCanvas で必要に応じて画像をデザインし、モデルを構築できるため、車両コックピット HMI の設計効率と品質が大幅に向上します。

Rubik GeniusCanvas を使用すると、コンセプト作成サイクルが当初の 3 ~ 4 週間から約 1 週間に 70% 短縮され、3D 要素のデザイン サイクルが当初の 4 ~ 6 週間から約 3 日に 85% 短縮されます。

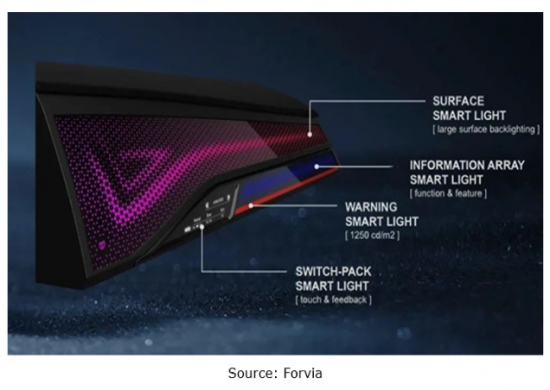

2023 年 4 月、Forvia の子会社である HELLA は、HELLA の最新のスリム ライト テクノロジーと高出力 RGB LED モジュールを使用し、HELLA の自社開発シミュレーション ソフトウェアと連携して、さまざまなダイナミックな照明シーンを可能にする新しいスマート サーフェス テクノロジーである Apollon を導入しました。 。この技術は、従来の静的照明に加え、複数の光源の点滅、流動、色の混合により、車間距離警告、方向指示器、新しい色が変化するアレイ光源などの多機能も可能にします。

2023 年 4 月、マレリは、カメラまたは LiDAR とヘッドライトを統合システムに組み合わせ、センサーを介して歩行者を認識する新しいインテリジェント車両照明製品 SmartCorner を発表しました。 Hon Jing Drive は、歩行者の知覚や目標方向の決定などのアルゴリズムを提供します。

マルチドメインおよびセントラルドメインコントローラーのトレンドの中で、Tier 1 サプライヤーは機能統合製品の導入に懸命に取り組んでいます。

マルチドメインおよびセントラルドメインコントローラーのトレンドの中で、かなりの数のTier 1サプライヤーが、車両ナビゲーション統合製品、ボディドメイン制御製品、エアバッグ統合製品などの機能統合製品のレイアウトに積極的に取り組んでいます。

2023年1月、Desay SVは、キーレスエントリーとスタート、スマートエアコン、電動テールゲート、インテリジェントタイヤ空気圧モニタリング、スマートシート、ワイパーコントロール、スマートライト、ウィンドウを含むほとんどのボディコントロール機能を統合したボディドメインコントローラー製品の量産化に成功しました。挟み込み防止および駐車レーダー。

フォービアは上海モーターショー2023で、ドアパネルとドアパネル上のCMSディスプレイを統合した量産カメラモニターシステム(CMS)統合ソリューションをデモンストレーションしました。

車両通信に関しては、T-BOX はスマート アンテナや V-Box などの製品と統合される傾向があります。たとえば、コンチネンタルはシャークフィン アンテナを統合した新世代の T-Box を開発しました。成熟したスマートアンテナ製品を提供するNeusoftは、「オールインワン」設計コンセプトと技術力により、車両のインテリジェント接続を効果的に実現し、配線コストを節約します。さらに、5G の特性に基づいて、自社開発の V2X プロトコル スタック (VeTalk) を統合することで、Neusoft は V2X DAY1 および DAY2 シーンのカスタマイズされた開発と新しい 5G アプリケーション シナリオの開発も提供します。 Neusoft はまた、4G/5G+V2X BOX を初めて発売し、量産を達成し、市場をリードしています。

現地化の中で、「海外+現地」の連携別市場拡大のメリットが際立っています。

近年、中国のインテリジェント自動車市場は急成長しています。中国市場は技術革新と消費の両面で世界の「風見鶏」となっています。地元の Tier 1 サプライヤーと外国企業の両方が、ローカライズされたレイアウトの作成に取り組んでいます。

外国のTier1 大手企業にとって、ローカライズされたソリューションとサービスのレイアウトは最優先事項となっています。自社の中国チームに加えて、中国の現地企業と協力して展開することは、彼らにとって市場を拡大するための新しい方法です。代表的なコラボレーションには、Bosch + Autolink、Bosch + WeRide、Continental + Motovis、ZF + Neusoft Reach などがあります。ハードウェアと機能のアップデートがますます迅速化する中、海外のTier1 サプライヤーと中国の現地テクノロジー企業との協力により、中国市場の変化への迅速な対応が可能になり、革新的な製品を求める OEM のニーズを満たすために、よりローカライズされたサービスが提供されます。そして多様化した製品。

たとえば、ボッシュはオートリンクと提携して中国のインテリジェント コックピット市場を展開しました。 2023 年 4 月、両社は、車内インテリジェンス、車両サービス、関連エコシステムを 1 つのミドルウェア、つまり破壊的なコックピット開発モードに創造的に統合する新世代のインテリジェント コックピット 4.0 を共同発表しました。このソリューションにより、さまざまな自動車メーカーによる効率的なカスタマイズが可能になり、パーソナライズされたブランドを構築できます。

「世界および中国の Tier 1 サプライヤーのインテリジェント コックピット ビジネス調査レポート 2023 年」は、次の2 巻で構成されています。

- 514 ページの「中国企業」では、中国の Tier 1 サプライヤー 9 社 (Neusoft Group、Yuanfeng Technology、Desay SV、ThunderSoft、Joyson Electronic、Foryou Group、PATEO CONNECT+、Huawei、ECARX) をカバーしています。

- 「海外企業」は 420 ページで、海外 Tier 1 サプライヤー 6 社 (コンチネンタル、ボッシュ、デンソー、フォービア、ヴァレオ、パナソニック) をカバーしています。

当レポートでは、中国の国外のインテリジェントコックピット市場について調査分析し、主要サプライヤー6社の情報を提供しています。

目次

第1章 Continentalのコックピット事業

- Continentalの経営

- Continentalのコックピットハイパフォーマンスコンピューター(HPC)事業

- ContinentalのIVI事業

- Continentalの車両ディスプレイ事業

- Continentalの車両通信事業

- Continentalの自動駐車事業

- Continentalの機内DMS/OMS事業

- Continentalのコックピット安全ソリューション事業

- Continentalのコックピットスマート表面材事業

- Continentalのコックピット事業の概要

第2章 Boschのコックピット事業

- Boschの経営

- Boschのコックピットハイパフォーマンスコンピューティングプラットフォーム事業

- Boschの車両ディスプレイ事業

- BoschのIVI事業

- Boschの車両通信事業

- Boschの自動駐車事業

- Boschの車室内DMS/OMS事業

- Boschのコックピットセーフティソリューション事業

- Boschのコックピット事業の概要

第3章 Densoのコックピット事業

- Densoの経営

- Densoのコックピットハイパフォーマンスコンピューティングプラットフォーム事業

- Densoの車両ディスプレイ事業

- DensoのIVI事業

- Densoの車室内温度管理システム事業

- Densoの車両DMS/OMS事業

- Densoの車両通信事業

- Densoの自動駐車事業

- Densoのコックピットセーフティソリューション事業

- Densoのコックピット事業の概要

第4章 Forvia(Faurecia and Hella)のコックピット事業

- Forviaの経営

- Forviaのコックピットコンピューティングプラットフォーム事業

- ForviaのECU・BCM事業

- ForviaのIVI事業

- Forviaの車両ディスプレイ事業

- Forviaのコックピット照明システム事業

- Forviaの未来のコックピット事業:未来のコックピット製品の開発動向

- Forviaの自動駐車事業

- Forviaの機内DMS/OMS事業

- Forviaのコックピットセーフティソリューション事業

- Forviaのコックピットスマート表面材事業

- Faureciaのシーティング事業

- Forviaのコックピット事業の概要

第5章 Panasonicのコックピット事業

- Panasonicの経営

- Panasonicのコックピットドメインコントローラーとチップ事業

- PanasonicのインテリジェントIVI事業(IVI/インフォテインメント/ディスプレイ)

- Panasonicの車両ディスプレイシステム事業

- PanasonicのT-BOX/C-V2X事業

- PanasonicのAVPシステム事業

- PanasonicのDMS事業

- Panasonicのコックピットセーフティモジュール事業

- Panasonicのコックピット事業の概要

第6章 Valeoのコックピット事業

- Valeoの経営

- Valeoの車両ディスプレイ事業

- Valeoのコックピット空調と熱管理システム事業

- Valeoの車両通信事業

- Valeoの自動駐車事業

- Valeoの機内DMS/OMS事業

- Valeoのコックピット事業の概要

Research on tier 1 suppliers' cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Following the market trend, work to develop new-generation cockpit computing platforms, and lay out products such as cockpit-driving integrated products and even central computing platforms.

In the past two years, closely following the development trend of the intelligent vehicle market, quite a few Tier 1 suppliers including Neusoft Group, Yuanfeng Technology, Desay SV, ThunderSoft, Joynext, PATEO CONNECT+, ECARX, Bosch, Aptiv, and Visteon have worked to deploy new-generation cockpit products. Based on the mass-produced intelligent cockpit computing platforms like Qualcomm 8155, they have also vigorously made layout of new-generation intelligent cockpit computing platform products based on higher-performance cockpit chips such as Qualcomm 8295 and AMD Ryzen, and are expected to start volume production of these products in 2023.

Neusoft Group developed and introduced the future-oriented vehicle HMI platform Neusoft C5 in 2022, and also released an upgraded version in 2023. The new vehicle HMI platform still uses the pluggable, expandable hardware architecture design where one basic board, two function boards and one expansion board are combined via uniform interfaces. While improving the computing power, Neusoft C5 enables efficient integration of basic vehicle functions, gateways, body control, intelligent cockpit, and other extended functions. In software's term, it implements the scene engine through service-oriented architecture (SOA), providing immersive and personalized scene experiences for the vehicle entertainment system.

Not only that, based on the 4th-generation Qualcomm Snapdragon Automotive Cockpit Platforms as well, Neusoft makes more use of its advanced software and hardware architecture design capabilities and achieves multi-ECU and multi-domain integration, so as to develop its next-generation intelligent cockpit platform. Only one chip is used to support the deployment and application of 16-channel cameras, 12-channel ultrasonic radars, and more screens, and achieve upgrade of intelligent cockpits in all aspects such as computing power, leading configuration, entertainment, security, function, and hardware. While improving the interior interaction, comfort and safety for users, the platform helps automakers cut costs and improve efficiency. New cars equipped with this product are expected to be available on market in September 2023.

Moreover, multi-domain integrated products such as cockpit-parking integrated and cockpit-driving integrated products have also been introduced in recent two years, and some of them have been mass-produced and installed in vehicles. In 2022, Yuanfeng Technology's team developed the Cockpit-Parking Integrated Solution 1.0, an intelligent cockpit platform that uses a Qualcomm 8155 SoC to support the deployment and use of 4 cameras, multiple screens and 12 radars, and integrates the capability baseline of Intelligent Cockpit 1.0 and Super Park 1.0 (AVM+APA). Wherein, the Super Park 1.0 delivers a parking space recognition accuracy of 97% and a parking success rate of 95%, covers more than 180 types of mainstream parking spots, and supports head-in parking; for unconventional parking spaces, the custom AR parking allows users to deal with in stride.

Yuanfeng Technology's Cockpit-Parking Integrated Solution 1.0 was first mounted on Hycan A06 in late 2022. By 2024, there will be 6 models packing the solution to be marketed.

The capabilities of Yuanfeng Technology's Cockpit-Parking Integrated Solution 2.0 will also be developed, and delivered via OTA updates. The Cockpit-Parking Integrated Solution 2.0 will deploy a vehicle voice GPT model, build in a more realistic and easy-to-use 3D UI, and upgrade to lane-level high-definition navigation; the Super Park 2.0 will further optimize AVM/APA performance, reducing the average parking time to less than 35s, increasing the parking success rate to 97%, and upgrading the AVP function.

Meanwhile, Yuanfeng Technology will announce its cockpit-driving-parking integrated solution in 2024. In addition to the capability baseline of Intelligent Cockpit 2.0 and Super Park 2.0, this solution will add multiple ADAS functions in rigid demand, such as ACC, LCC, AEB, and BSD.

New vehicle display technologies such as optical display, hidden display and recognizable display are applied to vehicles.

Vehicle display is the core product for cockpit visual interaction. With continuous upgrade in quantity, size and technology, new vehicle display technologies and products mushroom.

At its 2023 smart car solution conference, Huawei unveiled HUAWEI xScene, a light field screen which uses optical engine technology to enable 3-meter long-distance imaging, 40-inch ultra-large format and 90PPD super-retina-level resolution. As an effective solution to eyestrain, this screen can also effectively lessen car sickness. The launch of HUAWEI xScene brings in new possibilities to vehicle displays. Currently it has three product forms: copilot seat, seatback and headrest types. In the near future, it will be available to several production commercial vehicle models.

As concerns the integration of vehicle lighting and AR-HUD, based on its self-developed 2K automotive optical imaging module and end-to-end capabilities, Huawei pushes on with the large-scale commercial use of AR-HUD. As the primary in-car display, HUAWEI xHUD AR-HUD not only severs as an alternative to the dashboard but also outperforms it. Huawei proposes more innovative applications such as intelligent driving visualization, lane-level navigation, reversing camera, digital elf, and giant screen viewing.

At the Auto Shanghai 2023, Continental and its partner trinamiX introduced their co-developed Driver Identification Display, a product which integrates a camera solution for driver biometrics, allowing for touchless and secure driver authentication and protection against fraud and theft.

In addition, Continental has also developed In2visible, a display technology which enables display of content as needed. It is almost invisible to human eyes when not needed, thereby offering higher safety and comfort.

Supported by new technologies such as AI foundation models, multimodal interaction enables more details and innovative expansions.

In May 2023, ThunderSoft released "Rubik GeniusCanvas", a product that fuses Kanzi and foundation models. This product is built with ThunderSoft's intelligent coding foundation model Rubik Studio, automotive HMI design software, and 3D engine Kanzi, providing super intelligent assistance for designers in terms of concept creation, 3D element design, special effect code generation, and scene construction. Designers only need to provide some simple verbal dialogues, and Rubik GeniusCanvas can design images and build models as required, which greatly improves the design efficiency and quality of vehicle cockpit HMI.

Rubik GeniusCanvas helps to shorten the concept creation cycle by 70% from the original 3 or 4 weeks to about 1 week, and the 3D element design cycle by 85% from the original 4 or 6 weeks to about 3 days.

In April 2023, HELLA, a subsidiary of Forvia, introduced Apollon, a new smart surface technology which uses HELLA's latest Slim Light technology and high-power RGB LED modules and cooperates with HELLA's self-developed simulation software to enable a variety of dynamic lighting scenes. As well as conventional static lighting, this technology also enables multiple functions such as vehicle distance warning, turning indicator and new color-changing array light source by way of flashing, flowing, and color mixing of multiple light sources.

In April 2023, Marelli introduced SmartCorner™, a new intelligent vehicle lighting product which combines a camera or LiDAR and headlights into an integrated system and perceives pedestrians via sensors. Hong Jing Drive provides algorithms such as pedestrian perception and target orientation determination.

In the trend for multi-domain and central domain controllers, Tier 1 suppliers are trying hard to deploy function integrated products.

In the trend for multi-domain and central domain controllers, quite a few Tier 1 suppliers are aggressive in laying out function integrated products like vehicle navigation integrated, body domain control, and airbag integrated products.

In January 2023, Desay SV successfully incubated a mass-produced body domain controller product that integrates most body control functions including keyless entry and start, smart air conditioner, electric tailgate, intelligent tire pressure monitoring, smart seats, wiper control, smart lights, window anti-pinch and parking radar.

At the Auto Shanghai 2023, Forvia demonstrated its door panel and mass-produced camera monitor system (CMS) integrated solution that integrates the CMS displays on the door panels.

As for vehicle communication, T-BOX tends to integrate with products like smart antenna and V-Box. For example, Continental developed a new-generation T-Box that integrates a shark fin antenna; by virtue of the "all-in-one" design concept and technical strength, Neusoft that offers mature smart antenna products effectively realizes vehicle intelligent connection and saves wiring costs. More than that, based on the characteristics of 5G and integrating its self-developed V2X protocol stack (VeTalk), Neusoft also provides customized development of V2X DAY1 and DAY2 scenes and development of new 5G application scenarios. Neusoft is also the first one to launch 4G/5G+V2X BOX and achieve mass production, leading the market.

Amid localization, the advantage of "foreign + local" cooperative market expansion stands out.

In recent years, China's intelligent vehicle market has boomed. The Chinese market has become a global "wind vane" in both technological innovation and consumption. Both local Tier 1 suppliers and foreign companies are working to making localized layout.

Layout of localized solutions and services has become the top priority for foreign Tier 1 giants. In addition to their own Chinese teams, deploying together with China's local companies is a new way for them to make a market expansion. Typical collaborations include Bosch + Autolink, Bosch + WeRide, Continental + Motovis, and ZF + Neusoft Reach. In the context of ever faster update on hardware and functions, the cooperation between foreign Tier 1 suppliers and China's local technology companies enables a quick response to the changes in the Chinese market, and more localized services are provided to meet the needs of OEMs for innovative and diversified products.

For example, Bosch joined hands with Autolink to deploy China's intelligent cockpit market. In April 2023, they jointly announced the new-generation intelligent cockpit 4.0 which creatively integrates in-cabin intelligence, vehicle services and related ecosystems into one middleware, a disruptive cockpit development mode. The solution allows for efficient customization by different automakers to build personalized brands.

The “ Global and China Tier 1 Suppliers' Intelligent Cockpit Business Research Report, 2023” consists of two volumes:

- "Chinese Companies" in 514 pages, covering 9 Chinese Tier 1 suppliers, i.e., Neusoft Group, Yuanfeng Technology, Desay SV, ThunderSoft, Joyson Electronic, Foryou Group, PATEO CONNECT+, Huawei and ECARX;

- "Overseas Companies" in 420 pages, covering 6 foreign Tier 1 suppliers, i.e., Continental, Bosch, Denso, Forvia, Valeo, and Panasonic.

Table of Contents

1 Cockpit Business of Continental

- 1.1 Operation of Continental

- Business Status and R&D, 2022

- Operation of Intelligent Connectivity Business, 2022

- Planning for New Sources of Business Growth

- Development Plan for Vehicle Computing Business Unit (HPC) (1)

- Development Plan for Vehicle Computing Business Unit (HPC) (2)

- Development Plan for Vehicle Computing Business Unit (HPC) (3)

- Intelligent Cockpit HMI Products

- Key Autonomous Driving Products

- Products of Each Business Division

- Main Automotive Electronics R&D Centers in China

- Cockpit Electronics Production Bases (Body Electronics Division) in China

- Global Core Members

- Core Team in China

- Cockpit Electronics Product Line

- 1.2 Cockpit High Performance Computer (HPC) Business of Continental

- Cockpit HPC: Development Trends of Cockpit Domain Products

- Cockpit HPC: Integrated Interior Platform (IIP)

- Cockpit HPC: Architecture with Hardware and Software Separation

- HPC: System Software and Hardware Architecture

- HPC: SOA-oriented Domain Controller Development Concept (1)

- HPC: SOA-oriented Domain Controller Development Concept (2)

- Cockpit High Performance Computing Unit

- 1.3 IVI Business of Continental

- Multimedia System

- Multimedia System: Connected Infotainment

- Multimedia System: Speaker-less Sound System (Ac2ated Sound)

- 1.4 Vehicle Display Business of Continental

- Center Console Display Business: Product Development Trends

- Driver Identification Display

- Pillar-to-pillar Through-type Center Console Display Solution

- Pillar-to-pillar Through-type Center Console Display: Introduce "Privacy Function" in the Copilot Seat Screen

- Center Console Display Business: Shy Tech Display

- Center Console Display Business: Changan V-shaped Dashboard-Center Console Dual Display

- Center Console Display Business: Customer Base

- Cluster Business: Product Development Trends

- Cluster Business: Product Line

- HUD Business: Product Development Trends

- HUD Business: Product Line

- HUD Business: Panoramic Head-up Display (HUD) to Be Produced in 2026

- HUD Business: Product Line

- HUD Business: Product Strategy

- HUD Business: Integrate AR-HUD with ADAS and V2X Communication Technologies

- HUD Business: Promote TFT-based AR HUD in China

- HUD Business: Work with DigiLens

- HUD Business: Windshield Type Head-up Display System (W-HUD)

- HUD Business: Combiner Type Head-up Display System (C-HUD)

- HUD Business: Augmented Reality Head-Up Display (AR-HUD)

- 1.6 Vehicle Communication Business of Continental

- TBOX/C-V2X: Product Development Trends

- TBOX/C-V2X: 5G Hybrid V2X Platform Received Mass Production Orders

- TBOX/C-V2X: Smart Antenna

- TBOX/C-V2X: China TransInfo Technology Bought in UCIT and Became the Largest Shareholder

- TBOX/C-V2X: Advanced Intelligent Communication TBOX Products (1)

- TBOX/C-V2X: Advanced Intelligent Communication TBOX Products (2)

- Ultra-wideband (UWB) Communication Technology Layout

- UWB-based CoSmA System

- Application of CoSmA System (1)

- Application of CoSmA System (2)

- 1.7 Automated Parking Business of Continental

- Automated Parking Business: Product Development Trends

- 1.8 In-cabin DMS/OMS Business of Continental

- DMS/OMS: Integrating the Child-Presence Detection Function into CoSmA UWB Digital Key

- DMS/OMS: Interior Camera with Recognition Algorithm

- DMS/OMS: Introduced DMS and OMS Integrated Solutions

- DMS/OMS: Cooperation with CU-BX in Automotive Non-contact Occupant Health and Safety Detection System

- 1.9 Cockpit Safety Solution Business of Continental

- Cockpit Safety Business: Product Development Trends

- Cockpit Safety Module: OTA

- Cockpit Safety Module: Automotive Cybersecurity Solution

- Cockpit Safety Module: Provide Automotive Safety Solutions Integrating with Argus' Products (2)

- Cockpit Safety Module: OTA and EB Corbos Integration

- Cockpit Safety Module: Provide OTA Update Service for Volkswagen ID Electric Vehicles

- Cockpit Safety Module: Provide OTA Update Service for Weltmeister EX5

- Cockpit Safety Module: Vehicle Smart Gateway

- Cockpit Safety Module: Intelligent Central Gateway Server ICAS1 (Body HPC)

- 1.10 Cockpit Smart Surface Materials Business of Continental

- Smart Surface Materials: Benova Eco Protect

- Smart Surface Materials: Acella® Hylite Concept

- Smart Surface Materials: R&D Directions

- 1.11 Summary on Cockpit Business of Continental

- Summary on Cockpit Products, Suppliers and Customers (1)

- Summary on Cockpit Products, Suppliers and Customers (2)

- Summary on Cockpit Products, Suppliers and Customers (3)

2 Cockpit Business of Bosch

- 2.1 Operation of Bosch

- Operation in 2022 (1)

- Operation in 2022 (2)

- Employees and R&D Personnel, 2022

- Business Structure: Restructuring the Mobility Solutions Division

- Business Structure: "Bosch Mobility" Business under the Cross-Domain Computing Solutions Division (XC Division)

- Business Structure: Structure and Distribution of XC Division in China

- Distribution of R&D Centers of Bosch Car Multimedia and Software Business in China

- Distribution of Production Bases of Bosch Car Multimedia Division in China

- Core Team of Bosch China

- Cockpit Electronics Product Line

- 2.2 Cockpit High Performance Computing Platform Business of Bosch

- Development Trends of Cockpit Domain Products

- Cockpit Domain Control Platform Products: 2nd Generation 8295 Platform

- Cockpit Domain Control Platform Products: 1st Generation 81555 Platform (1)

- Cockpit Domain Control Platform Products: 1st Generation 81555 Platform (2)

- Cockpit Domain Control Platform Products: 1st Generation 81555 Platform (3)

- Cockpit Domain Control Platform Products: 1st Generation 81555 Platform (4)

- Cockpit Domain Control Platform Products: 1st Generation 81555 Platform (5)

- Cockpit Domain Control Platform: Intelligent Cockpit 4.0 Co-developed with Autolink

- Cockpit-driving Integrated Solution: Route Evolution

- Cockpit-driving Integrated Solution: Hardware Architecture

- Cockpit-driving Integrated Solution Design: Software Architecture

- 2.3 Vehicle Display Business of Bosch

- Development Trends of Vehicle Display Products

- Cockpit Display: Intelligent Cockpit Multi-screen Interaction Products

- Cockpit Display: Full LCD Cluster Products and Core Customers

- Cockpit Display: Mirror Cam System Business

- Cockpit Display: Human Machine Interface (HMI) Business Planning

- 2.4 IVI Business of Bosch

- IVI Business (1)

- IVI Business (2)

- 2.5 Vehicle Communication Business of Bosch

- Development Trends of Vehicle Communication Products

- Evolution Direction of T-BOX Architecture: Integrated Central Gateway and Communication Computing Platform

- Technical Features of Communication Domain Computing Platform

- V2X Products: Hybrid Connectivity Control Unit (CCU)

- V2X Products: Cooperation with Escrypt on Information Security

- UWB-based Digital Key Solution

- 2.6 Automated Parking Business of Bosch

- Development Trends of Automated Parking Products

- Promote Parking Lot AVP Solution

- Commercial Use of Parking Lot L4 AVP Technology Has Started

- Cooperated with Hycan to Create China's First Automated Valet Parking Ecosystem

- Automated Parking Technology Roadmap

- L2 Automated Parking Solution

- L3/L4 Automated Parking Solution

- 2.7 In-cabin DMS/OMS Business of Bosch

- DMS Business

- DMS Product System Architecture

- 2.8 Cockpit Safety Solutions Business of Bosch

- OTA Business Layout

- FOTA Technology Development Strategy

- FOTA Solution (1): Bosch FOTA

- FOTA Solution (2): Bosch FOTA

- FOTA Security Solution (1): Security Guarantee at Four Levels

- FOTA Security Solution (2): Escrypt Integrated Security Solution

- FOTA Application Scenario (1): Remote Flashing

- FOTA Application Scenario (2): Remote Diagnosis and Predictive Diagnosis

- FOTA Application Scenario (3): Bluetooth Digital Key

- FOTA Application Scenario (4): RCS Empowers Autonomous Driving Technology

- Partners and OTA Business Trend

- 2.9 Summary on Cockpit Business of Bosch

- Summary on Cockpit Products, Suppliers and Customers (1)

- Summary on Cockpit Products, Suppliers and Customers (2)

3 Cockpit Business of Denso

- 3.1 Operation of Denso

- Operation and Organizational Structure Adjustment, 2022

- Status Quo of Intelligent Connectivity Business

- Global R&D System

- R&D Centers in China

- CASE Strategic Layout and Core Technologies

- CASE Industrial Alliance Layout

- Core Team of Denso China

- Production Layout in China

- Automotive Electronics System

- Cockpit Electronics Product Line

- 3.2 Cockpit High Performance Computing Platform Business of Denso

- Cockpit Control Unit (CCU): Product Development Trends

- Intelligent Cockpit Design: Technology Roadmap

- Cockpit Control Unit (CCU): Application Case (Subaru)

- Intelligent Cockpit Design: Integrated Control of Cockpit System

- Intelligent Cockpit Design: Cockpit Integrated Control System Based on Virtualization Technology

- Intelligent Cockpit Design: Development of Service-Oriented Architecture (SOA)

- Cross Domain Layout

- Under the 2035 "Anxin" Strategy, the Cockpit of Future and Intelligent Driving Will Be Deeply Integrated

- Anxin Intelligent Cockpit System (1)

- Anxin Intelligent Cockpit System (2)

- Development Blueprint of Anxin Intelligent Cockpit System

- 3.3 Vehicle Display Business of Denso

- HUD Business: Product Development Trends

- HUD Business: Core Customer Base

- HUD Business: Adopt Kyocera TFT-LCD PGU

- HUD Business: Features of Contactless Control Technology

- HUD Business: Next-Generation HUD R&D Idea

- Center Console Display Business: Product Development Trends

- Center Console Display Business: Vehicle OLED Display Layout

- Center Console Display Business: Center Console Screen

- Center Console Display Business: Production Bases

- 3.4 IVI Business of Denso

- IVI Business: G-BOOK IVI System

- IVI Business: Car Navigation (Aftermarket)

- 3.5 In-cabin Thermal Management System Business of Denso

- Air Conditioner Controller Business: Cooperation with Human Machine Interface (HMI)

- Air Conditioner Controller Business: Air Conditioner Control Panel and HVAC (Thermostat)

- In-cabin Thermal Management Solution Jointly Launched by Neusoft Reach and Denso (1)

- In-cabin Thermal Management Solution Jointly Launched by Neusoft Reach and Denso (2)

- Automotive Thermal Management System Product Line (1)

- Automotive Thermal Management System Product Line (2)

- Automotive Thermal Management System Product Line (3)

- Automotive Thermal Management System Product Line (4)

- Heat Pump Air Conditioning System

- Application Case of Heat Pump Air Conditioning System

- Heat Pump Air Conditioning System Development Template

- Launched the Comfortable and Healthy Car Cockpit AiO BOX

- Introduced Thermal Management Flow Control Valve (MCV-e)

- 3.6 In-cabin DMS/OMS Business of Denso

- DMS Business: Product Development Trends

- DMS Business: Driver Status Monitor

- DMS Business: Technical Parameters

- DMS Business: Technical Features

- DMS Business: Commercial Vehicle DMS Jointly Developed with FotoNation

- 3.7 Vehicle Communication Business of Denso

- TBOX/V2X Business: Data Communication Module (DCM)

- TBOX/V2X Business: DSRC V2X Business Layout

- TBOX/V2X Business: V2X Vehicle Platooning Solution

- 3.8 Automated Parking Business of Denso

- AVP Business: AVP Implementation Timetable

- AVP Business: Invested in Zongmu Technology to Deploy AVP

- 3.9 Cockpit Safety Solution Business of Denso

- Neusoft Reach and Denso Cooperated to Develop EV Power Domain Controller xCU (1)

- Neusoft Reach and Denso Cooperated to Develop EV Power Domain Controller xCU (2)

- OTA Solutions and Partners

- Telematics Security Solution

- Cockpit Safety Module

- Denso Cooperated with Toyota to Invest in OTA Software System Developer Airbiquity

- Denso Cooperated with Launch Tech and China Unicom to Launch "Vehicle Fault Diagnosis Service" for the Aftermarket

- 3.10 Summary on Cockpit Business of Denso

- Summary on Cockpit Products, Suppliers and Customers (1)

- Summary on Cockpit Products, Suppliers and Customers (2)

- Summary on Cockpit Products, Suppliers and Customers (3)

4 Cockpit Business of Forvia (Faurecia and Hella)

- 4.1 Operation of Forvia

- Operation of Forvia, 2022 (1)

- Operation of Forvia, 2022 (2)

- Operation of Forvia, 2022 (3)

- Forvia's R&D Expenditure

- Faurecia's Technical Centers and Organizational Structure

- Distribution of Hella's R&D Centers and Production Bases Worldwide

- Distribution of Faurecia's R&D Centers in China

- Layout of Hella's R&D Centers in China

- Layout of Faurecia Clarion Electronics' Production Bases in China

- Layout of Hella's Automotive Electronics Production Bases in China

- Faurecia's Global Core Team

- Faurecia China's Core Team

- Core Team of Hella Electronics Asia Pacific

- Faurecia's Four Businesses Focus on the Two Technological Strategies: "Cockpit of Future" and "Sustainable Mobility"

- Development of Forvia's Automotive Electronics Business

- Software Capabilities of Forvia's Automotive Electronics Division

- Forvia's Automotive Electronics Division Focuses on Innovation of Three Product Lines: Cockpit Electronics, Display Technology, and ADAS

- Development of Forvia's Cockpit Electronics Business

- Forvia's Automotive Electronics Development Plan 2025

- Forvia's Automotive Electronics Development Plan 2025: Cabin Entertainment Controller

- Forvia's Automotive Electronics Development Plan 2025: Display Technology

- Forvia's Automotive Electronics Development Plan 2025: Haptic and Sensory Experience Solutions

- Forvia's Cockpit Electronics Product Line

- 4.2 Cockpit Computing Platform Business of Forvia

- Forvia's Cockpit Computing Platform: Development Trends of Cockpit Domain Products

- Faurecia's Cockpit Intelligence Platform (CIP): Single-processor Multi-screen Fusion System

- Faurecia's Cockpit Domain Controller Business: Evolving and Integrating More Functions

- Faurecia's Cockpit Domain Controller Business: Create A Multi-screen Integrated Cockpit System

- Faurecia's Cockpit Domain Controller Planning Goals

- 4.3 ECU and BCM Business of Forvia

- Development Trends of Forvia's Cockpit and Body ECU Products

- Development Trends of Forvia's Body Domain Controllers (PEPS+BCM+Gateway)

- Hella's Body Control Module (BCM)

- Hella Will Mass-produce the Smart Car Access with UWB

- Hella's Next-generation Vehicle Entry System: HELLA Smart Access

- Hella's Conventional Vehicle Entry Systems: Remote Key and ID Transmitter

- 4.4 IVI Business of Forvia

- Forvia's IVI System: Product Development Trends

- Faurecia's Smart Remote Tuner and User APP Store: Product Development Trends

- Faureci's IVI System

- Faurecia's Seamless Connection and IVI Solutions

- Faurecia's Vehicle Navigation System

- Faurecia and Phoenix Auto Intelligence Co-created An IVI System for Changan C75 plus

- 4.5 Vehicle Display Business of Forvia

- Forvia's Center Console Display Business: Product Development Trends

- Development of Faurecia's Display Business (1)

- Development of Faurecia's Display Business (2)

- Faurecia Offers Custom Vehicle Display Business Planning

- Faurecia and CANATU Cooperated to Develop 3D Touch Surface Display & 3D Touch Knob

- Faurecia's Mass-produced Dashboard and Center Console Display Products (Part)

- Faurecia IRYStec® Perceived Quality Display Solution

- Faurecia Helps Voyah Dreamer with Three-screen Integration

- Faurecia's Electronic Rearview Mirror (1)

- Faurecia's Electronic Rearview Mirror (2)

- Forvia's Integrated Control Panel Business: Product Development Trends

- Forvia's HMI Solutions

- Forvia's HMI Business: Seamless Connection and IVI Solutions

- Forvia's HMI Business: FIRST INCH Intelligent Control Unit

- Forvia Uses Haptic Technology to Develop High-end Automotive HMI

- 4.6 Cockpit Lighting System Business of Forvia

- Development Trends of Forvia's Intelligent Lighting System Products

- Hella Launched An Interior Lighting System Integrated with Intelligent Driving

- Hella's Exterior Intelligent Lighting System Integrated with Autonomous Driving

- Hella's High-resolution Lighting System - Digital Light SSL | HD

- Hella's Cockpit Lighting Control Unit

- Hella's Cockpit Lighting Control System - TRAILER TOW MODULES

- Hella and Faurecia Co-built A Demonstration Vehicle to Present Future Interior Lighting Design

- Hella's PM2.5 Sensor

- Hella Released Its Latest Smart Surface Technology "Apollon" (1)

- Hella Released Its Latest Smart Surface Technology "Apollon" (2)

- 4.7 Cockpit of the Future Business of Forvia

- Forvia's Cockpit of the Future Business: Development Trends of Cockpit of the Future Products

- Forvia's Cockpit of the Future Product Line

- Forvia's Cockpit of the Future

- Faurecia Launched the Intelligent and Immersive Cockpit of the Future

- Faurecia's Cockpit Cooperation Ecosystem

- Forvia Showcased the "Intelligent Cool Cockpit"

- Forvia's Intelligent Cockpit "Lumieres"

- 4.8 Automated Parking Business of Forvia

- Faurecia's Automated Parking Business: Product Development Trends

- Faurecia's Automated Parking Solutions

- Faurecia's Autonomous Pick-up Solution

- Faurecia's Surround View System Solution

- Development Trends of Hella's Automated Parking Products

- Hella Provides Fusion Perception Modules for Automated Parking

- Hella's 77GHz Radar Sensor

- 4.9 In-cabin DMS/OMS Business of Forvia

- Forvia's DMS Business: Product Development Trends

- Forvia's Smart Presence Detection Function

- Faurecia's Driver Monitoring System with Haptic Feedback (Interior Monitoring Systems)

- Faurecia's Camera Products

- 4.10 Cockpit Safety Solution Business of Forvia

- Forvia's Cockpit Safety Business: Product Development Trends

- Faurecia's Cockpit Safety: Cloud Connected Technical Solution

- Faurecia's Cockpit Safety: OTA

- Faurecia's Cockpit Safety: Automotive Cyber Security Solution

- 4.11 Cockpit Smart Surface Materials Business of Forvia

- Faurecia's Smart Surface Business

- Faurecia's Smart Surface Business: Investment

- Faurecia's Smart Surface Business: Applied to Intelligent Cockpit Interiors of ARCFOX αT

- 4.12 Seating Business of Forvia in the Trend for Intelligent Cockpits

- Faurecia's Seating Business

- Faurecia's Modular Design

- Faurecia's Active Wellness2.0 Seat

- Faurecia's New Control and Adjustment Methods of Smart Seats

- Faurecia's Natural Motion™ Seat Adjustment Technology

- Faurecia's "Cockpit Sterilization Guard"

- 4.13 Summary on Cockpit Business of Forvia

- Summary on Cockpit Products, Suppliers and Partners

- Summary on Cockpit Products, Suppliers and Customers

5 Cockpit Business of Panasonic

- 5.1 Operation of Panasonic

- Main Automotive Electronics Companies in China

- Automotive Electronics Business Structure and Product Lines

- Operating Business of Panasonic Automotive Systems Development Tianjin Co., Ltd.

- Distribution of R&D Bases of Automotive Electronics Business Worldwide

- Distribution of Main Production Bases of Automotive Electronics Business

- Core Team

- Cockpit Electronics Product Line

- 5.2 Cockpit Domain Controller and Chip Business of Panasonic

- Cockpit SPYDR: Cockpit Controller Development Trends

- New Generation Cockpit

- Cockpit Domain Controller Solution: SPYDR 2.0 & SPYDR 3.0

- Cockpit Domain Controller Solution: Key Features of SPYDR 2.0 & SPYDR 3.0

- Cockpit Electronics Layout

- Cockpit Electronics Computing Architecture

- Cockpit System Software Architecture

- Cockpit System Software Architecture: COQOS Software Operating System

- Domain Controller Chip: Sociconext Plans to Launch 5nm Automotive SOC

- Domain Controller Chip: Qualcomm SA6155P/SA8155P Processor

- 5.3 Intelligent IVI Business (IVI/Infotainment/Display) of Panasonic

- Skip Gen IVI Operating System: Development Trends of IVI

- Connected Car Electronic Cabin: SkipGen 3.0+SPYDR 3.0+Android 10

- Supply PIVI Pro IVI System to Land Rover Defender

- Summary of Intelligent Cockpit Technology Route

- 5.4 Vehicle Display System Business of Panasonic

- Vehicle Display System: Development Trends

- Conventional IVI + Display System Business: Japanese IVI System Products

- HUD: Supplying HUD to Nissan Skyline

- AR-HUD: Hardware Structure and Technical Features

- AR-HUD: New Augmented Reality Head-up display (AR-HUD)

- AR-HUD 2.0

- AR-HUD Applied to Toyota Concept Car

- 5.5 T-BOX/C-V2X Business of Panasonic

- Introduction to FICOSA TBOX Business

- Key Features of FICOSA TBOX

- FICOSA V2X Technology Roadmap Planning

- Technical Features (DSRC V2V/V2I) of FICOSA V2X

- Technical Features (DSRC V2P) of FICOSA V2X

- Technical Features (Radar and DSRC Integration) of FICOSA V2X

- FICOSA C-V2X Products: Technical Parameters

- FICOSA C-V2X Products: CarCom Platform

- FICOSA C-V2X: Technical Application

- 5.6 AVP System Business of Panasonic

- Automated Valet Parking (AVP) Business

- Technical Features of Automated Valet Parking (AVP) Products

- 5.7 DMS Business of Panasonic

- DMS Business: Product Development Trends

- 3D ToF Image Sensor

- DMS: Integration with Head-Up Display (HUD)

- DMS: Panasonic's Proprietary DMS Algorithm

- 5.8 Cockpit Safety Module Business of Panasonic

- SOC: Cooperated with McAfee to Establish A Security Operations Center (SOC)

- Introduced A Virtualization Security Innovation

- 5.9 Summary on Cockpit Business of Panasonic

- Summary on Cockpit Products, Suppliers and Customers (1)

- Summary on Cockpit Products, Suppliers and Customers (2)

6 Cockpit Business of Valeo

- 6.1 Operation of Valeo

- Operation in 2022

- R&D Personnel and Expenditure

- Production and R&D Layout (China)

- Organizational Structure and Product Solutions

- Product Line Development Planning

- Business Developments of Core Product Lines (1): Electrified Products

- Business Developments of Core Product Lines (2): Safe Solution Products

- Business Developments of Core Product Lines (3): Mobility Products

- Business Developments of Core Product Lines (4): Vehicle Controller Products

- Development of Intelligent Cockpit Business

- Development of Autonomous Driving Business (1)

- Development of Autonomous Driving Business (2)

- Development of Autonomous Driving Business (3)

- Future Development Plan for CDA Division

- China R&D Centers of CDA Division: Developments during 2020-2021

- Production Bases of CDA Division in China

- Global Management Team

- Core Team of Valeo China

- Cockpit Electronics Product Line

- 6.2 Vehicle Display Business of Valeo

- Integrated Center Console

- Dashboard and Multi-Display Integration

- L1-L4 HMI Systems

- HUD Products

- Cockpit Virtual Perception Technology: VoyageXR & CallXR

- Cockpit virtual perception Technology: VoyageXR

- eXtended Reality Experience

- Gesture Controlled HMI

- 6.3 Cockpit Air Conditioning and Thermal Management Systems Business of Valeo

- Integrated Control and Air Conditioner Controller Panel Products

- Air Conditioning System Assembly

- Vehicle Thermal Management System

- R-744 (CO2) Air Conditioning Assembly System

- FlexHeaters Smart Heating System

- Cockpit Environment Management System Smart Cocoon (1)

- Cockpit Environment Management System Smart Cocoon (2)

- In-cabin Air Solutions

- Battery Thermal Management System Products

- Major Customers of Vehicle Thermal Management System (1)

- Major Customers of Vehicle Thermal Management System (2)

- 6.4 Vehicle Communication Business of Valeo

- TCU (TBOX)/C-V2X Business

- 6.5 Automated Parking Business of Valeo

- Development History of Automated Parking Business

- Valeo and BMW Collaborated to Develop Next-generation L4 Automated Parking Technology

- Park4U® Sensor Upgrade Route

- Upgrade from Park4U® Automated Parking to Cruise4U and Drive4U

- Automated Parking Business in China

- Park4U and Cruise4U Require Very High Software Algorithm Development Capabilities

- 6.6 In-cabin DMS/OMS Business of Valeo

- DMS/OMS Products

- DMS Driving Warning System (1)

- DMS Driving Warning System (2)

- DMS Driving Warning System (3)

- DMS Driving Warning System (4)

- Launched the Occupant Monitoring System (OMS) Business

- In-cabin Monitoring System (IMS) Products (1): Requirement Definition

- In-cabin Monitoring System (IMS) Products (2): Function Definition

- In-cabin Monitoring System (IMS) Products (3): Integration with Temperature Management System

- In-cabin Monitoring System (IMS) Business (4): Gesture Recognition

- In-cabin Monitoring System (IMS) Business (5): Technical Architecture

- In-cabin Monitoring System (IMS) Business (6): Technical Architecture

- In-cabin Monitoring System (IMS) Business (7): Technical Architecture

- Driver Monitoring

- 6.7 Summary on Cockpit Business of Valeo

- Summary on Cockpit Products, Suppliers and Customers (1)

- Summary on Cockpit Products, Suppliers and Customers (2)