|

|

市場調査レポート

商品コード

1254638

インシュアテック(InsurTech)の世界市場:考察と予測 (2029年まで)Global InsurTech (Insurance Technology) Market Insights Forecast to 2029 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| インシュアテック(InsurTech)の世界市場:考察と予測 (2029年まで) |

|

出版日: 2023年04月10日

発行: QYResearch

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のインシュアテック(InsurTech)の市場規模は、COVID-19パンデミックとロシア・ウクライナ戦争の影響により、2022年の122億米ドルから、2029年には412億9,000万米ドルに達すると予測されており、2023年から2029年の間に18.80%のCAGRで成長する見通しです。

目次

第1章 分析概要

- 分析範囲

- 種類別の市場分析

- 市場規模の成長率:種類別 (2018年・2022年・2029年)

- クラウドコンピューティング

- IoT

- AI

- その他

- 用途別の市場

- 市場シェア:用途別 (2018年・2022年・2029年)

- 損害保険

- 医療保険

- 生命保険

- 前提・制約条件

- 分析対象

- 分析期間

第2章 世界の成長動向

- 世界のインシュアテック市場の展望 (2018年~2029年)

- インシュアテックの成長動向:地域別

- インシュアテックの市場力学

第3章 主要企業別の競合情勢

- 世界のインシュアテックの収益:企業別

- 市場シェア:企業の種類別 (ティア1、ティア2、ティア3)

- 分析対象企業:インシュアテックの収益別のランキング (2021年・2022年・2023年)

- 世界のインシュアテック市場の集中度

- インシュアテックの主要企業:本社

- スタートアップ企業一覧

- Clearcover

- Lemonade

- Oscar Health, Inc.

- Inaza

- Companjon

- Instanda

- IptiQ

- Cytora

第4章 インシュアテック:種類別の内訳データ

- 過去の市場規模:種類別 (2018年~2023年)

- 市場規模の予測:種類別 (2024年~2029年)

第5章 インシュアテック:用途別の内訳データ

- 過去の市場規模:用途別 (2018年~2023年)

- 市場規模の予測:用途別 (2024年~2029年)

第6章 北米

- 北米のインシュアテックの市場規模 (2018年~2029年)

- 北米のインシュアテックの市場規模:種類別

- 北米のインシュアテックの市場規模:用途別

- 北米のインシュアテックの市場規模:国別

- 米国

- カナダ

第7章 欧州

- 欧州のインシュアテックの市場規模 (2018年~2029年)

- 欧州のインシュアテックの市場規模:種類別

- 欧州のインシュアテックの市場規模:用途別

- 欧州のインシュアテックの市場規模:国別

- ドイツ

- フランス

- 英国

- イタリア

- ロシア

第8章 中国

- 中国のインシュアテックの市場規模 (2018年~2029年)

- 中国のインシュアテックの市場規模:種類別

- 中国のインシュアテックの市場規模:用途別

第9章 アジア (中国以外)

- アジアのインシュアテックの市場規模 (2018年~2029年)

- アジアのインシュアテックの市場規模:種類別

- アジアのインシュアテックの市場規模:用途別

- アジアのインシュアテックの市場規模:地域別

- 日本

- 韓国

- 東南アジア

- インド

第10章 中東・アフリカ・ラテンアメリカ

- 中東・アフリカ・ラテンアメリカのインシュアテックの市場規模 (2018年~2029年)

- 中東・アフリカ・ラテンアメリカのインシュアテックの市場規模:種類別

- 中東・アフリカ・ラテンアメリカのインシュアテックの市場規模:用途別

- 中東・アフリカ・ラテンアメリカのインシュアテックの市場規模:国別

- メキシコ

- ブラジル

- アルゼンチン

- 中東

- アフリカ

第11章 主要企業のプロファイル

- Zipari

- Corvus Insurance

- Wipro Limited

- DXC Technology Company

- Majesco

- OutSystems

- Damco Group

- Octo

- ControlExpert

- Sureify

- iSoftStone

- eBaoTech

第12章 アナリストの見解/結論

第13章 付録

List of Tables

- Table 1. Global InsurTech (Insurance Technology) Market Size Growth Rate by Type (US$ Million): 2018 VS 2022 VS 2029

- Table 2. Global InsurTech (Insurance Technology) Market Size Growth by Application (US$ Million): 2018 VS 2022 VS 2029

- Table 3. Global InsurTech (Insurance Technology) Market Size Growth Rate (CAGR) by Region (US$ Million): 2018 VS 2022 VS 2029

- Table 4. Global InsurTech (Insurance Technology) Market Size by Region (2018-2023) & (US$ Million)

- Table 5. Global InsurTech (Insurance Technology) Market Share by Region (2018-2023)

- Table 6. Global InsurTech (Insurance Technology) Forecasted Market Size by Region (2024-2029) & (US$ Million)

- Table 7. Global InsurTech (Insurance Technology) Market Share by Region (2024-2029)

- Table 8. InsurTech (Insurance Technology) Market Trends

- Table 9. InsurTech (Insurance Technology) Market Drivers

- Table 10. InsurTech (Insurance Technology) Market Challenges

- Table 11. InsurTech (Insurance Technology) Market Restraints

- Table 12. Global InsurTech (Insurance Technology) Revenue by Players (2018-2023) & (US$ Million)

- Table 13. Global InsurTech (Insurance Technology) Market Share by Players (2018-2023)

- Table 14. Global Top InsurTech (Insurance Technology) Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in InsurTech (Insurance Technology) as of 2021)

- Table 15. Global InsurTech (Insurance Technology) Industry Ranking 2021 VS 2022 VS 2023

- Table 16. Global 5 Largest Players Market Share by InsurTech (Insurance Technology) Revenue (CR5 and HHI) & (2018-2023)

- Table 17. Global Key Players of InsurTech (Insurance Technology), Headquarters

- Table 18. Global InsurTech (Insurance Technology) Market Size by Type (2018-2023) & (US$ Million)

- Table 19. Global InsurTech (Insurance Technology) Revenue Market Share by Type (2018-2023)

- Table 20. Global InsurTech (Insurance Technology) Forecasted Market Size by Type (2024-2029) & (US$ Million)

- Table 21. Global InsurTech (Insurance Technology) Revenue Market Share by Type (2024-2029)

- Table 22. Global InsurTech (Insurance Technology) Market Size by Application (2018-2023) & (US$ Million)

- Table 23. Global InsurTech (Insurance Technology) Revenue Market Share by Application (2018-2023)

- Table 24. Global InsurTech (Insurance Technology) Forecasted Market Size by Application (2024-2029) & (US$ Million)

- Table 25. Global InsurTech (Insurance Technology) Revenue Market Share by Application (2024-2029)

- Table 26. North America InsurTech (Insurance Technology) Market Size by Type (2018-2023) & (US$ Million)

- Table 27. North America InsurTech (Insurance Technology) Market Size by Type (2024-2029) & (US$ Million)

- Table 28. North America InsurTech (Insurance Technology) Market Size by Application (2018-2023) & (US$ Million)

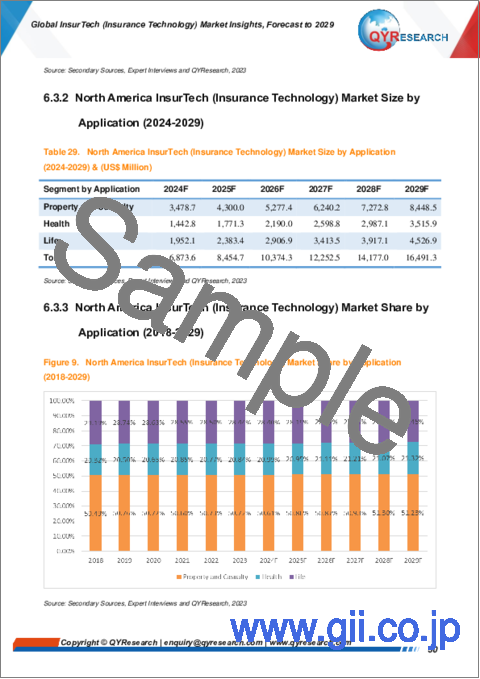

- Table 29. North America InsurTech (Insurance Technology) Market Size by Application (2024-2029) & (US$ Million)

- Table 30. North America InsurTech (Insurance Technology) Growth Rate (CAGR) by Country (US$ Million): 2018 VS 2022 VS 2029

- Table 31. North America InsurTech (Insurance Technology) Market Size by Country (2018-2023) & (US$ Million)

- Table 32. North America InsurTech (Insurance Technology) Market Size by Country (2024-2029) & (US$ Million)

- Table 33. Europe InsurTech (Insurance Technology) Market Size by Type (2018-2023) & (US$ Million)

- Table 34. Europe InsurTech (Insurance Technology) Market Size by Type (2024-2029) & (US$ Million)

- Table 35. Europe InsurTech (Insurance Technology) Market Size by Application (2018-2023) & (US$ Million)

- Table 36. Europe InsurTech (Insurance Technology) Market Size by Application (2024-2029) & (US$ Million)

- Table 37. Europe InsurTech (Insurance Technology) Growth Rate (CAGR) by Country (US$ Million): 2018 VS 2022 VS 2029

- Table 38. Europe InsurTech (Insurance Technology) Market Size by Country (2018-2023) & (US$ Million)

- Table 39. Europe InsurTech (Insurance Technology) Market Size by Country (2024-2029) & (US$ Million)

- Table 40. China InsurTech (Insurance Technology) Market Size by Type (2018-2023) & (US$ Million)

- Table 41. China InsurTech (Insurance Technology) Market Size by Type (2024-2029) & (US$ Million)

- Table 42. China InsurTech (Insurance Technology) Market Size by Application (2018-2023) & (US$ Million)

- Table 43. China InsurTech (Insurance Technology) Market Size by Application (2024-2029) & (US$ Million)

- Table 44. Asia InsurTech (Insurance Technology) Market Size by Type (2018-2023) & (US$ Million)

- Table 45. Asia InsurTech (Insurance Technology) Market Size by Type (2024-2029) & (US$ Million)

- Table 46. Asia InsurTech (Insurance Technology) Market Size by Application (2018-2023) & (US$ Million)

- Table 47. Asia InsurTech (Insurance Technology) Market Size by Application (2024-2029) & (US$ Million)

- Table 48. Asia InsurTech (Insurance Technology) Growth Rate (CAGR) by Region (US$ Million): 2018 VS 2022 VS 2029

- Table 49. Asia InsurTech (Insurance Technology) Market Size by Region (2018-2023) & (US$ Million)

- Table 50. Asia InsurTech (Insurance Technology) Market Size by Region (2024-2029) & (US$ Million)

- Table 51. Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Type (2018-2023) & (US$ Million)

- Table 52. Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Type (2024-2029) & (US$ Million)

- Table 53. Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Application (2018-2023) & (US$ Million)

- Table 54. Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Application (2024-2029) & (US$ Million)

- Table 55. Middle East, Africa, and Latin America InsurTech (Insurance Technology) Growth Rate (CAGR) by Country (US$ Million): 2018 VS 2022 VS 2029

- Table 56. Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Country (2018-2023) & (US$ Million)

- Table 57. Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Country (2024-2029) & (US$ Million)

- Table 58. Zipari Company Details

- Table 59. Zipari Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 60. Corvus Insurance Company Details

- Table 61. Corvus Insurance InsurTech (Insurance Technology) Product

- Table 62. Corvus Insurance Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 63. Wipro Limited Company Details

- Table 64. Wipro Limited InsurTech (Insurance Technology) Product

- Table 65. Wipro Limited Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 66. DXC Technology Company Company Details

- Table 67. DXC Technology Company InsurTech (Insurance Technology) Product

- Table 68. DXC Technology Company Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 69. Majesco Company Details

- Table 70. Majesco InsurTech (Insurance Technology) Product

- Table 71. Majesco Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 72. OutSystems Company Details

- Table 73. OutSystems Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 74. Damco Group Company Details

- Table 75. Damco Group InsurTech (Insurance Technology) Product

- Table 76. Damco Group Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 77. Octo Company Details

- Table 78. Octo Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 79. ControlExpert Company Details

- Table 80. ControlExpert Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 81. Sureify Company Details

- Table 82. Sureify InsurTech (Insurance Technology) Product

- Table 83. Sureify Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 84. iSoftStone Company Details

- Table 85. iSoftStone InsurTech (Insurance Technology) Product

- Table 86. iSoftStone Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 87. eBaoTech Company Details

- Table 88. eBaoTech InsurTech (Insurance Technology) Product

- Table 89. eBaoTech Revenue in InsurTech (Insurance Technology) Business (2018-2023) & (US$ Million)

- Table 90. Research Programs/Design for This Report

- Table 91. Key Data Information from Secondary Sources

- Table 92. Key Data Information from Primary Sources

- Table 93. QYR Business Unit and Senior & Team Lead Analysts

List of Figures

- Figure 1. Global InsurTech (Insurance Technology) Market Share by Type: 2022 VS 2029

- Figure 2. Global InsurTech (Insurance Technology) Market Share by Application: 2022 VS 2029

- Figure 3. InsurTech (Insurance Technology) Report Years Considered

- Figure 4. Global InsurTech (Insurance Technology) Market Size (US$ Million), Year-over-Year: 2018-2029

- Figure 5. Global InsurTech (Insurance Technology) Market Size, (US$ Million), 2018 VS 2022 VS 2029

- Figure 6. Global InsurTech (Insurance Technology) Market Share by Region: 2022 VS 2029

- Figure 7. North America InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 8. North America InsurTech (Insurance Technology) Market Share by Type (2018-2029)

- Figure 9. North America InsurTech (Insurance Technology) Market Share by Application (2018-2029)

- Figure 10. United States InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 11. Canada InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 12. Europe InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 13. Europe InsurTech (Insurance Technology) Market Share by Type (2018-2029)

- Figure 14. Europe InsurTech (Insurance Technology) Market Share by Application (2018-2029)

- Figure 15. Germany InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 16. France InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 17. U.K. InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 18. Italy InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 19. Russia InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 20. China InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 21. China InsurTech (Insurance Technology) Market Share by Type (2018-2029)

- Figure 22. China InsurTech (Insurance Technology) Market Share by Application (2018-2029)

- Figure 23. Asia InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 24. Asia InsurTech (Insurance Technology) Market Share by Type (2018-2029)

- Figure 25. Asia InsurTech (Insurance Technology) Market Share by Application (2018-2029)

- Figure 26. Japan InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 27. South Korea InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 28. Southeast Asia InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 29. India InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 30. Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 31. Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Share by Type (2018-2029)

- Figure 32. Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Share by Application (2018-2029)

- Figure 33. Mexico InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 34. Brazil InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 35. Argentina InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 36. Middle East InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 37. Africa InsurTech (Insurance Technology) Market Size YoY Growth (2018-2029) & (US$ Million)

- Figure 38. Bottom-up and Top-down Approaches for This Report

- Figure 39. Data Triangulation

- Figure 40. Key Executives Interviewed

Market Analysis and Insights:

Due to the COVID-19 pandemic and Russia-Ukraine War Influence, the global InsurTech (Insurance Technology) market size is projected to reach US$ 41.29 billion by 2029, from US$ 12.20 billion in 2022, at a CAGR of 18.80% during 2023-2029.

The global key companies of InsurTech (Insurance Technology) include: DXC Technology, Damco Solutions, Wipro Limited, Majesco, Octo, etc. In 2022, the global top five players had a share approximately 11.54% in terms of revenue.

Report Includes

This report presents an overview of global market for InsurTech (Insurance Technology) market size. Analyses of the global market trends, with historic market revenue data for 2018 - 2022, estimates for 2023, and projections of CAGR through 2029.

This report researches the key producers of InsurTech (Insurance Technology), also provides the revenue of main regions and countries. Highlights of the upcoming market potential for InsurTech (Insurance Technology), and key regions/countries of focus to forecast this market into various segments and sub-segments. Country specific data and market value analysis for the U.S., Canada, China, Japan, South Korea, Southeast Asia, India, Germany, the U.K., Italy, Middle East, Africa, and Other Countries.

This report focuses on the InsurTech (Insurance Technology) revenue, market share and industry ranking of main companies, data from 2018 to 2023. Identification of the major stakeholders in the global InsurTech (Insurance Technology) market, and analysis of their competitive landscape and market positioning based on recent developments and segmental revenues. This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way.

This report analyzes the segments data by Type and by Application, revenue, and growth rate, from 2018 to 2029. Evaluation and forecast the market size for InsurTech (Insurance Technology) revenue, projected growth trends, production technology, application and end-user industry.

Descriptive company profiles of the major global players, including Zipari, Corvus Insurance, Wipro Limited, DXC Technology Company, Majesco, and OutSystems, etc.

By Company

- Zipari

- Corvus Insurance

- Wipro Limited

- DXC Technology Company

- Majesco

- OutSystems

- Damco Solutions

- Octo

- ControlExpert

- Sureify

- iSoftStone

- eBaoTech

Segment by Type

- Cloud Computing

- IoT

- AI

- Others

Segment by Application

- Property and Casualty

- Health

- Life

By Region

- North America

- United States

- Canada

- China

- Asia

- Japan

- South Korea

- Southeast Asia

- India

- Rest of Asia

- Europe

- Germany

- France

- U.K.

- Italy

- Russia

- Rest of Europe

- Middle East, Africa, and Latin America

- Mexico

- Brazil

- Argentina

- Middle East

- Africa

- Others

Chapter Outline

- Chapter 1: Introduces the report scope of the report, executive summary of different market segments (product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

- Chapter 2: Revenue of InsurTech (Insurance Technology) in global and regional level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world. This section also introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by companies in the industry, and the analysis of relevant policies in the industry.

- Chapter 3: Detailed analysis of InsurTech (Insurance Technology) companies competitive landscape, revenue, market share and industry ranking, latest development plan, merger, and acquisition information, etc.

- Chapter 4: Provides the analysis of various market segments by Type, covering the revenue, and development potential of each market segment, to help readers find the blue ocean market in different market segments.

- Chapter 5: Provides the analysis of various market segments by Application, covering the revenue, and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

- Chapter 6: North America (US & Canada) by Type, by Application and by country, revenue for each segment.

- Chapter 7: Europe by Type, by Application and by country, revenue for each segment.

- Chapter 8: China by Type, and by Application, revenue for each segment.

- Chapter 9: Asia (excluding China) by Type, by Application and by region, revenue for each segment.

- Chapter 10: Middle East, Africa, and Latin America by Type, by Application and by country, revenue for each segment.

- Chapter 11: Provides profiles of key companies, introducing the basic situation of the main companies in the market in detail, including product descriptions and specifications, InsurTech (Insurance Technology) revenue, gross margin, etc.

- Chapter 12: Analyst's Viewpoints/Conclusions

Table of Contents

1 Report Overview

- 1.1 Study Scope

- 1.2 Market Analysis by Type

- 1.2.1 Global InsurTech (Insurance Technology) Market Size Growth Rate by Type: 2018 VS 2022 VS 2029

- 1.2.2 Cloud Computing

- 1.2.3 IoT

- 1.2.4 AI

- 1.2.5 Others

- 1.3 Market by Application

- 1.3.1 Global InsurTech (Insurance Technology) Market Share by Application: 2018 VS 2022 VS 2029

- 1.3.2 Property and Casualty

- 1.3.3 Health

- 1.3.4 Life

- 1.4 Assumptions and Limitations

- 1.5 Study Objectives

- 1.6 Years Considered

2 Global Growth Trends

- 2.1 Global InsurTech (Insurance Technology) Market Perspective (2018-2029)

- 2.2 Global InsurTech (Insurance Technology) Growth Trends by Region

- 2.2.1 Global InsurTech (Insurance Technology) Market Size by Region: 2018 VS 2022 VS 2029

- 2.2.2 InsurTech (Insurance Technology) Historic Market Size by Region (2018-2023)

- 2.2.3 InsurTech (Insurance Technology) Forecasted Market Size by Region (2024-2029)

- 2.3 InsurTech (Insurance Technology) Market Dynamics

- 2.3.1 InsurTech (Insurance Technology) Industry Trends

- 2.3.2 InsurTech (Insurance Technology) Market Drivers

- 2.3.3 InsurTech (Insurance Technology) Market Challenges

- 2.3.4 InsurTech (Insurance Technology) Market Restraints

3 Competition Landscape by Key Players

- 3.1 Global Revenue InsurTech (Insurance Technology) by Players

- 3.1.1 Global InsurTech (Insurance Technology) Revenue by Players (2018-2023)

- 3.1.2 Global InsurTech (Insurance Technology) Revenue Market Share by Players (2018-2023)

- 3.2 Global InsurTech (Insurance Technology) Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

- 3.3 Global Key Players of InsurTech (Insurance Technology), Ranking by Revenue, 2021 VS 2022 VS 2023

- 3.4 Global InsurTech (Insurance Technology) Market Concentration Ratio

- 3.5 Global Key Players of InsurTech (Insurance Technology) Head office

- 3.6 Start-up Company List

- 3.6.1 Clearcover

- 3.6.2 Lemonade

- 3.6.3 Oscar Health, Inc.

- 3.6.4 Inaza

- 3.6.5 Companjon

- 3.6.6 Instanda

- 3.6.7 IptiQ

- 3.6.8 Cytora

4 InsurTech (Insurance Technology) Breakdown Data by Type

- 4.1 Global InsurTech (Insurance Technology) Historic Market Size by Type (2018-2023)

- 4.2 Global InsurTech (Insurance Technology) Forecasted Market Size by Type (2024-2029)

5 InsurTech (Insurance Technology) Breakdown Data by Application

- 5.1 Global InsurTech (Insurance Technology) Historic Market Size by Application (2018-2023)

- 5.2 Global InsurTech (Insurance Technology) Forecasted Market Size by Application (2024-2029)

6 North America

- 6.1 North America InsurTech (Insurance Technology) Market Size (2018-2029)

- 6.2 North America InsurTech (Insurance Technology) Market Size by Type

- 6.2.1 North America InsurTech (Insurance Technology) Market Size by Type (2018-2023)

- 6.2.2 North America InsurTech (Insurance Technology) Market Size by Type (2024-2029)

- 6.2.3 North America InsurTech (Insurance Technology) Market Share by Type (2018-2029)

- 6.3 North America InsurTech (Insurance Technology) Market Size by Application

- 6.3.1 North America InsurTech (Insurance Technology) Market Size by Application (2018-2023)

- 6.3.2 North America InsurTech (Insurance Technology) Market Size by Application (2024-2029)

- 6.3.3 North America InsurTech (Insurance Technology) Market Share by Application (2018-2029)

- 6.4 North America InsurTech (Insurance Technology) Market Size by Country

- 6.4.1 North America InsurTech (Insurance Technology) Market Size by Country: 2018 VS 2022 VS 2029

- 6.4.2 North America InsurTech (Insurance Technology) Market Size by Country (2018-2023)

- 6.4.3 North America InsurTech (Insurance Technology) Market Share by Country (2024-2029)

- 6.4.4 United States

- 6.4.5 Canada

7 Europe

- 7.1 Europe InsurTech (Insurance Technology) Market Size (2018-2029)

- 7.2 Europe InsurTech (Insurance Technology) Market Size by Type

- 7.2.1 Europe InsurTech (Insurance Technology) Market Size by Type (2018-2023)

- 7.2.2 Europe InsurTech (Insurance Technology) Market Size by Type (2024-2029)

- 7.2.3 Europe InsurTech (Insurance Technology) Market Share by Type (2018-2029)

- 7.3 Europe InsurTech (Insurance Technology) Market Size by Application

- 7.3.1 Europe InsurTech (Insurance Technology) Market Size by Application (2018-2023)

- 7.3.2 Europe InsurTech (Insurance Technology) Market Size by Application (2024-2029)

- 7.3.3 Europe InsurTech (Insurance Technology) Market Share by Application (2018-2029)

- 7.4 Europe InsurTech (Insurance Technology) Market Size by Country

- 7.4.1 Europe InsurTech (Insurance Technology) Market Size by Country: 2018 VS 2022 VS 2029

- 7.4.2 Europe InsurTech (Insurance Technology) Market Size by Country (2018-2023)

- 7.4.3 Europe InsurTech (Insurance Technology) Market Size by Country (2024-2029)

- 7.4.4 Germany

- 7.4.5 France

- 7.4.6 U.K.

- 7.4.7 Italy

- 7.4.8 Russia

8 China

- 8.1 China InsurTech (Insurance Technology) Market Size (2018-2029)

- 8.2 China InsurTech (Insurance Technology) Market Size by Type

- 8.2.1 China InsurTech (Insurance Technology) Market Size by Type (2018-2023)

- 8.2.2 China InsurTech (Insurance Technology) Market Size by Type (2024-2029)

- 8.2.3 China InsurTech (Insurance Technology) Market Share by Type (2018-2029)

- 8.3 China InsurTech (Insurance Technology) Market Size by Application

- 8.3.1 China InsurTech (Insurance Technology) Market Size by Application (2018-2023)

- 8.3.2 China InsurTech (Insurance Technology) Market Size by Application (2024-2029)

- 8.3.3 China InsurTech (Insurance Technology) Market Share by Application (2018-2029)

9 Asia (excluding China)

- 9.1 Asia InsurTech (Insurance Technology) Market Size (2018-2029)

- 9.2 Asia InsurTech (Insurance Technology) Market Size by Type

- 9.2.1 Asia InsurTech (Insurance Technology) Market Size by Type (2018-2023)

- 9.2.2 Asia InsurTech (Insurance Technology) Market Size by Type (2024-2029)

- 9.2.3 Asia InsurTech (Insurance Technology) Market Share by Type (2018-2029)

- 9.3 Asia InsurTech (Insurance Technology) Market Size by Application

- 9.3.1 Asia InsurTech (Insurance Technology) Market Size by Application (2018-2023)

- 9.3.2 Asia InsurTech (Insurance Technology) Market Size by Application (2024-2029)

- 9.3.3 Asia InsurTech (Insurance Technology) Market Share by Application (2018-2029)

- 9.4 Asia InsurTech (Insurance Technology) Market Size by Region

- 9.4.1 Asia InsurTech (Insurance Technology) Market Size by Region: 2018 VS 2022 VS 2029

- 9.4.2 Asia InsurTech (Insurance Technology) Market Size by Region (2018-2023)

- 9.4.3 Asia InsurTech (Insurance Technology) Market Size by Region (2024-2029)

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.4.7 India

10 Middle East, Africa, and Latin America

- 10.1 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size (2018-2029)

- 10.2 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Type

- 10.2.1 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Type (2018-2023)

- 10.2.2 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Type (2024-2029)

- 10.2.3 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Share by Type (2018-2029)

- 10.3 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Application

- 10.3.1 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Application (2018-2023)

- 10.3.2 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Application (2024-2029)

- 10.3.3 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Share by Application (2018-2029)

- 10.4 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Country

- 10.4.1 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Country: 2018 VS 2022 VS 2029

- 10.4.2 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Country (2018-2023)

- 10.4.3 Middle East, Africa, and Latin America InsurTech (Insurance Technology) Market Size by Country (2024-2029)

- 10.4.4 Mexico

- 10.4.5 Brazil

- 10.4.6 Argentina

- 10.4.7 Middle East

- 10.4.8 Africa

11 Key Players Profiles

- 11.1 Zipari

- 11.1.1 Zipari Company Details

- 11.1.2 Zipari Business Overview

- 11.1.3 Zipari InsurTech (Insurance Technology) Introduction

- 11.1.4 Zipari Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.2 Corvus Insurance

- 11.2.1 Corvus Insurance Company Details

- 11.2.2 Corvus Insurance Business Overview

- 11.2.3 Corvus Insurance InsurTech (Insurance Technology) Introduction

- 11.2.4 Corvus Insurance Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.3 Wipro Limited

- 11.3.1 Wipro Limited Company Details

- 11.3.2 Wipro Limited Business Overview

- 11.3.3 Wipro Limited InsurTech (Insurance Technology) Introduction

- 11.3.4 Wipro Limited Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.4 DXC Technology Company

- 11.4.1 DXC Technology Company Company Details

- 11.4.2 DXC Technology Company Business Overview

- 11.4.3 DXC Technology Company InsurTech (Insurance Technology) Introduction

- 11.4.4 DXC Technology Company Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.5 Majesco

- 11.5.1 Majesco Company Details

- 11.5.2 Majesco Business Overview

- 11.5.3 Majesco InsurTech (Insurance Technology) Introduction

- 11.5.4 Majesco Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.6 OutSystems

- 11.6.1 OutSystems Company Details

- 11.6.2 OutSystems Business Overview

- 11.6.3 OutSystems InsurTech (Insurance Technology) Introduction

- 11.6.4 OutSystems Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.7 Damco Group

- 11.7.1 Damco Group Company Details

- 11.7.2 Damco Group Business Overview

- 11.7.3 Damco Group InsurTech (Insurance Technology) Introduction

- 11.7.4 Damco Group Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.8 Octo

- 11.8.1 Octo Company Details

- 11.8.2 Octo Business Overview

- 11.8.3 Octo InsurTech (Insurance Technology) Introduction

- 11.8.4 Octo Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.9 ControlExpert

- 11.9.1 ControlExpert Company Details

- 11.9.2 ControlExpert Business Overview

- 11.9.3 ControlExpert InsurTech (Insurance Technology) Introduction

- 11.9.4 ControlExpert Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.10 Sureify

- 11.10.1 Sureify Company Details

- 11.10.2 Sureify Business Overview

- 11.10.3 Sureify InsurTech (Insurance Technology) Introduction

- 11.10.4 Sureify Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.11 iSoftStone

- 11.11.1 iSoftStone Company Details

- 11.11.2 iSoftStone Business Overview

- 11.11.3 iSoftStone InsurTech (Insurance Technology) Introduction

- 11.11.4 iSoftStone Revenue in InsurTech (Insurance Technology) Business (2018-2023)

- 11.12 eBaoTech

- 11.12.1 eBaoTech Company Details

- 11.12.2 eBaoTech Business Overview

- 11.12.3 eBaoTech InsurTech (Insurance Technology) Introduction

- 11.12.4 eBaoTech Revenue in InsurTech (Insurance Technology) Business (2018-2023)

12 Analyst's Viewpoints/Conclusions

13 Appendix

- 13.1 Research Methodology

- 13.1.1 Methodology/Research Approach

- 13.1.2 Data Source

- 13.2 Author Details

- 13.3 Disclaimer