|

|

市場調査レポート

商品コード

1586356

プロセス分光法市場、規模、シェア、動向、産業分析レポート:コンポーネント別、技術別、用途別、地域別 - 市場予測、2024年~2032年Process Spectroscopy Market Size, Share, Trends, Industry Analysis Report: By Component, Technology, Application, and Region - Market Forecast, 2024-2032 |

||||||

カスタマイズ可能

|

|||||||

| プロセス分光法市場、規模、シェア、動向、産業分析レポート:コンポーネント別、技術別、用途別、地域別 - 市場予測、2024年~2032年 |

|

出版日: 2024年10月01日

発行: Polaris Market Research

ページ情報: 英文 119 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

Polaris Market Researchの最新調査によると、プロセス分光法の世界市場規模は2032年までに522億5,000万米ドルに達する見込みです。この調査レポートは、現在の市場力学を詳細に洞察し、将来の市場成長に関する分析を提供しています。

プロセス分光法市場は、石油・ガス、製薬、食品・農業、化学産業など複数の産業で採用が増加しており、力強い成長を遂げています。プロセス分光法には、近赤外(NIR)、フーリエ変換赤外(FTIR)、ラマン、紫外可視(UV-Vis)分光法などの技術が含まれます。これらの技術は、工業プロセスのリアルタイムモニタリングや制御に採用されています。これらの技術は、非破壊分析、迅速なデータ取得、複雑な混合物の分析など数多くの利点を提供し、製薬、飲食品、化学、石油・ガス、バイオテクノロジーなどの産業で重宝されています。

プロセス分光法市場の主な成長促進要因は、品質管理と規制遵守に対する需要の高まりです。厳しい規制、特に医薬品や飲食品業界では、製品の安全性と品質を確保するために、生産プロセスの正確で継続的なモニタリングが必要です。プロセス分光法は、リアルタイムの分析と即時の是正措置を可能にすることで、これらの基準を達成するために必要なツールを提供し、コンプライアンス違反や製品リコールのリスクを最小限に抑えます。

技術的進歩は市場成長において重要な役割を果たしています。分光技術の革新と、コンパクトで持ち運び可能な使いやすい機器の開発により、その用途と利用可能性が拡大しました。さらに、自動化およびデータ分析プラットフォームと分光法の統合は、プロセスの効率と意思決定を強化し、さまざまな分野での採用をさらに促進しています。

プロセス分光法市場レポートハイライト

技術別に見ると、分子分光法セグメントは、様々な産業における品質管理とコンプライアンスへの広範な応用により、2023年のプロセス分光法市場で最大の収益シェアを占めました。

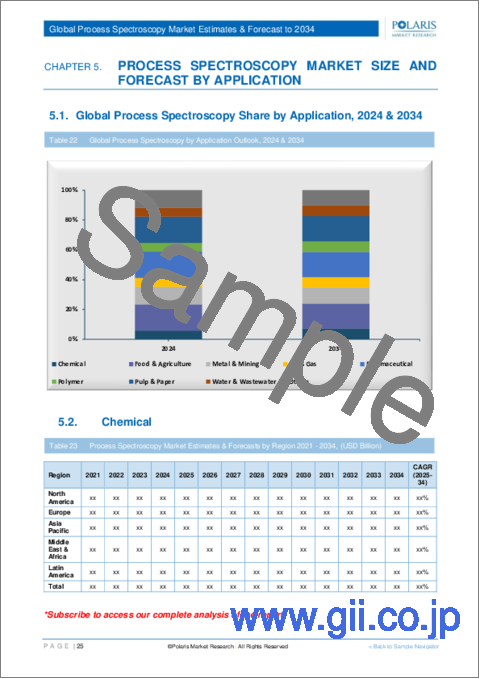

食品&農業セグメントは、用途別では、品質保証、規制遵守、連続リアルタイムモニタリングとプロセス最適化のための先端技術採用の需要増により、最高のCAGRを記録すると予測されています。

2023年、北米は、高度な産業インフラ、技術と研究への多額の投資、厳格な規制基準、大手分光器メーカーの強力なプレゼンスにより、プロセス分光法器市場で最大のシェアを占めました。

アジア太平洋は、予測期間中に最も高いCAGRを記録すると予測されています。急速な工業化、製薬・食品産業の拡大、技術導入を促進する政府の支援策が、この地域の市場成長に寄与する主な要因です。

ABB;Agilent Technologies, Inc.;Bruker;BUCHI;Danaher;FOSS;HORIBA;Endress+Hauser Group Services AG;Sartorius AG;Shimadzu Corporation;Thermo Fisher Scientific Inc.

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 世界プロセス分光法市場の洞察

- 市場スナップショット

- プロセス分光法市場力学

- 促進要因と機会

- 医薬品の発見と開発における質量分析の利用の増加

- さまざまな分野でラマン分光法の採用が増加

- 抑制要因と課題

- 分光機器は、精度と信頼性を確保するために定期的なメンテナンスと校正が必要です。

- 促進要因と機会

- PESTEL分析

- プロセス分光法市場の用途動向

- バリューチェーン分析

- COVID-19の影響分析

第5章 世界のプロセス分光法市場:コンポーネント別

- 主な調査結果

- イントロダクション

- ハードウェア

- ソフトウェア

第6章 世界のプロセス分光法市場:技術別

- 主な調査結果

- イントロダクション

- 原子分光法

- 質量分析法

- 分子分光法

第7章 世界のプロセス分光法市場:用途別

- 主な調査結果

- イントロダクション

- 化学薬品

- 食品と農業

- 金属・鉱業

- 石油・ガス

- 製薬

- ポリマー

- パルプ・紙

- 水と廃水

- その他

第8章 世界のプロセス分光法市場:地域別

- 主な調査結果

- イントロダクション

- プロセス分光法市場評価:地域別、2019年~2032年

- 北米

- 北米:コンポーネント別、2019年~2032年

- 北米:技術別、2019年~2032年

- 北米:用途別、2019年~2032年

- 米国

- カナダ

- 欧州

- 欧州:コンポーネント別、2019年~2032年

- 欧州:技術別、2019年~2032年

- 欧州:用途別、2019年~2032年

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- オランダ

- ロシア

- その他欧州

- アジア太平洋

- アジア太平洋地域:コンポーネント別、2019年~2032年

- アジア太平洋地域:技術別、2019年~2032年

- アジア太平洋地域:用途別、2019年~2032年

- 中国

- インド

- マレーシア

- 日本

- インドネシア

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東・アフリカ:コンポーネント別、2019年~2032年

- 中東・アフリカ:技術別、2019年~2032年

- 中東・アフリカ:用途別、2019年~2032年

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- 南アフリカ

- その他中東とアフリカ

- ラテンアメリカ

- ラテンアメリカ:コンポーネント別、2019年~2032年

- ラテンアメリカ:技術別、2019年~2032年

- ラテンアメリカ:用途別、2019年~2032年

- メキシコ

- ブラジル

- アルゼンチン

- その他ラテンアメリカ

第9章 競合情勢

- 拡大と買収の分析

- 拡大

- 買収

- 提携/協業/合意/公開

第10章 企業プロファイル

- ABB

- Agilent Technologies, Inc.

- Bruker

- BUCHI

- Danaher

- FOSS

- HORIBA

- Endress+Hauser Group Services AG

- Sartorius AG

- Shimadzu Corporation

List of Tables:

- Table 1 Global Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 2 Global Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 3 Global Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 4 North America: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 5 North America: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 6 North America: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 7 US: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 8 US: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 9 US: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 10 Canada: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 11 Canada: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 12 Canada: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 13 Europe: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 14 Europe: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 15 Europe: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 16 UK: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 17 UK: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 18 UK: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 19 France: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 20 France: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 21 France: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 22 Germany: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 23 Germany: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 24 Germany: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 25 Italy: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 26 Italy: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 27 Italy: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 28 Spain: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 29 Spain: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 30 Spain: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 31 Netherlands: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 32 Netherlands: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 33 Netherlands: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 34 Russia: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 35 Russia: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 36 Russia: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 37 Rest of Europe: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 38 Rest of Europe: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 39 Rest of Europe: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 40 Asia Pacific: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 41 Asia Pacific: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 42 Asia Pacific: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 43 China: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 44 China: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 45 China: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 46 India: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 47 India: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 48 India: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 49 Malaysia: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 50 Malaysia: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 51 Malaysia: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 52 Japan: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 53 Japan: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 54 Japan: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 55 Indonesia: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 56 Indonesia: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 57 Indonesia: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 58 South Korea: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 59 South Korea: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 60 South Korea: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 61 Australia: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 62 Australia: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 63 Australia: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 64 Rest of Asia Pacific: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 65 Rest of Asia Pacific: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 66 Rest of Asia Pacific: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 67 Middle East & Africa: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 68 Middle East & Africa: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 69 Middle East & Africa: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 70 Saudi Arabia: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 71 Saudi Arabia: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 72 Saudi Arabia: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 73 UAE: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 74 UAE: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 75 UAE: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 76 Israel: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 77 Israel: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 78 Israel: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 79 South Africa: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 80 South Africa: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 81 South Africa: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 82 Rest of Middle East & Africa: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 83 Rest of Middle East & Africa: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 84 Rest of Middle East & Africa: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 85 Latin America: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 86 Latin America: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 87 Latin America: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 88 Mexico: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 89 Mexico: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 90 Mexico: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 91 Brazil: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 92 Brazil: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 93 Brazil: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 94 Argentina: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 95 Argentina: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 96 Argentina: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- Table 97 Rest of Latin America: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- Table 98 Rest of Latin America: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- Table 99 Rest of Latin America: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

List of Figures:

- Figure 1. Global Process Spectroscopy Market, 2019-2032 (USD Billion)

- Figure 2. Integrated Ecosystem

- Figure 3. Research Methodology: Top-Down & Bottom-Up Price

- Figure 4. Market by Geography

- Figure 5. Porter's Five Forces

- Figure 6. Market by Component

- Figure 7. Global Process Spectroscopy Market, by Component, 2023 & 2032 (USD Billion)

- Figure 8. Market by Technology

- Figure 9. Global Process Spectroscopy Market, by Technology, 2023 & 2032 (USD Billion)

- Figure 10. Market by Application

- Figure 11. Global Process Spectroscopy Market, by Application, 2023 & 2032 (USD Billion)

The global process spectroscopy market size is expected to reach USD 52.25 billion by 2032, according to a new study by Polaris Market Research. The report "Process Spectroscopy Market Size, Share, Trends, Industry Analysis Report - By Component, Technology (Atomic Spectroscopy, Mass Spectroscopy, and Molecular Spectroscopy), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa); Segment Forecast, 2024 - 2032" gives a detailed insight into current market dynamics and provides analysis on future market growth.

The process spectroscopy market is experiencing robust growth due to its rising adoption across multiple industries such as oil & gas, pharmaceuticals, food & agriculture, and chemical industries. Process spectroscopy encompasses a range of techniques such as Near-Infrared (NIR), Fourier Transform Infrared (FTIR), Raman, and Ultraviolet-Visible (UV-Vis) spectroscopy. The techniques are employed for real-time monitoring and control of industrial processes. These techniques offer numerous advantages, including nondestructive analysis, rapid data acquisition, and complex mixture analyze, making them invaluable in industries such as pharmaceuticals, food & beverages, chemicals, oil & gas, and biotechnology.

The primary growth drivers for the process spectroscopy market are the increasing demand for quality control and regulatory compliance. Stringent regulations, especially in the pharmaceuticals and food & beverages industries, necessitate precise and continuous monitoring of production processes to ensure product safety and quality. Process spectroscopy delivers the necessary tools for achieving these standards by enabling real-time analysis and immediate corrective actions, thereby minimizing the risk of noncompliance and product recalls.

Technological advancements play a crucial role in market growth. Innovations in spectroscopic techniques and the development of compact, portable, and user-friendly instruments have expanded their applications and accessibility. Additionally, the integration of spectroscopy with automation and data analytics platforms enhances process efficiency and decision-making, further driving its adoption across various sectors.

Process Spectroscopy Market Report Highlights

Based on technology, the molecular spectroscopy segment accounted for the largest revenue share in the process spectroscopy market in 2023 due to its extensive application in quality control and compliance across various industries.

The food & agriculture segment, by application, is expected to register the highest CAGR due to increasing demand for quality assurance, regulatory compliance, and the adoption of advanced technologies for continuous real-time monitoring and process optimization.

In 2023, North America accounted for the largest share in the process spectroscopy market due to its advanced industrial infrastructure, significant investments in technology and research, stringent regulatory standards, and a strong presence of leading spectroscopy manufacturers.

Asia Pacific is expected to record the highest CAGR during the forecast period. Rapid industrialization, expanding pharmaceutical and food industries, and supportive government initiatives promoting technological adoption are key factors contributing to the regional market growth.

ABB; Agilent Technologies, Inc.; Bruker; BUCHI; Danaher; FOSS; HORIBA; Endress+Hauser Group Services AG; Sartorius AG; Shimadzu Corporation; Thermo Fisher Scientific Inc.; and Yokogawa Electric Corporation are among the global key market players.

Polaris Market Research has segmented the process spectroscopy market report on the basis of component, technology, application, and region:

By Component Outlook (Revenue - USD billion, 2019-2032)

- Hardware

- Software

By Technology Outlook (Revenue - USD billion, 2019-2032)

- Atomic Spectroscopy

- Mass Spectroscopy

- Molecular Spectroscopy

- NIR

- FT-IR

- Raman

- NMR

- Others

By Application Outlook (Revenue - USD billion, 2019-2032)

- Chemical

- Food & Agriculture

- Metal & Mining

- Oil & Gas

- Pharmaceutical

- Polymer

- Pulp & Paper

- Water & Wastewater

- Others

By Regional Outlook (Revenue - USD billion, 2019-2032)

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Australia

- Rest of Asia Pacific

- Latin America

- Argentina

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

- Rest of Middle East & Africa

Table of Contents

1. Introduction

- 1.1. Report Description

- 1.1.1. Objectives of the Study

- 1.1.2. Market Scope

- 1.1.3. Assumptions

- 1.2. Stakeholders

2. Executive Summary

- 2.1. Market Highlights

3. Research Methodology

- 3.1. Overview

- 3.1.1. Data Mining

- 3.2. Data Sources

- 3.2.1. Primary Sources

- 3.2.2. Secondary Sources

4. Global Process Spectroscopy Market Insights

- 4.1. Process Spectroscopy Market - Market Snapshot

- 4.2. Process Spectroscopy Market Dynamics

- 4.2.1. Drivers and Opportunities

- 4.2.1.1. Increasing Utilization of Mass Spectrometry in Drug Discovery and Development

- 4.2.1.2. Rising Adoption of Raman Spectroscopy Across Various Sectors

- 4.2.2. Restraints and Challenges

- 4.2.2.1. Spectroscopy Equipment Requires Regular Maintenance and Calibration to Ensure Accuracy and Reliability

- 4.2.1. Drivers and Opportunities

- 4.3. Porter's Five Forces Analysis

- 4.3.1. Bargaining Power of Suppliers (Moderate)

- 4.3.2. Threats of New Entrants: (Low)

- 4.3.3. Bargaining Power of Buyers (Moderate)

- 4.3.4. Threat of Substitute (Moderate)

- 4.3.5. Rivalry among existing firms (High)

- 4.4. PESTEL Analysis

- 4.5. Process Spectroscopy Market Application Trends

- 4.6. Value Chain Analysis

- 4.7. COVID-19 Impact Analysis

5. Global Process Spectroscopy Market, by Component

- 5.1. Key Findings

- 5.2. Introduction

- 5.2.1. Global Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 5.3. Hardware

- 5.3.1. Global Process Spectroscopy Market, by Hardware, by Region, 2019-2032 (USD Billion)

- 5.4. Software

- 5.4.1. Global Process Spectroscopy Market, by Software, by Region, 2019-2032 (USD Billion)

6. Global Process Spectroscopy Market, by Technology

- 6.1. Key Findings

- 6.2. Introduction

- 6.2.1. Global Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 6.3. Atomic Spectroscopy

- 6.3.1. Global Process Spectroscopy Market, by Atomic Spectroscopy, by Region, 2019-2032 (USD Billion)

- 6.4. Mass Spectroscopy

- 6.4.1. Global Process Spectroscopy Market, by Mass Spectroscopy, by Region, 2019-2032 (USD Billion)

- 6.5. Molecular Spectroscopy

- 6.5.1. Global Process Spectroscopy Market, by Molecular Spectroscopy, by Region, 2019-2032 (USD Billion)

- 6.5.2. NIR

- 6.5.2.1. Global Process Spectroscopy Market, by NIR, by Region, 2019-2032 (USD Billion)

- 6.5.3. FT-IR

- 6.5.3.1. Global Process Spectroscopy Market, by FT-IR, by Region, 2019-2032 (USD Billion)

- 6.5.4. Raman

- 6.5.4.1. Global Process Spectroscopy Market, by Raman, by Region, 2019-2032 (USD Billion)

- 6.5.5. NMR

- 6.5.5.1. Global Process Spectroscopy Market, by NMR, by Region, 2019-2032 (USD Billion)

- 6.5.6. Others

- 6.5.6.1. Global Process Spectroscopy Market, by Others, by Region, 2019-2032 (USD Billion)

7. Global Process Spectroscopy Market, by Application

- 7.1. Key Findings

- 7.2. Introduction

- 7.2.1. Global Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 7.3. Chemical

- 7.3.1. Global Process Spectroscopy Market, by Chemical, by Region, 2019-2032 (USD Billion)

- 7.4. Food & Agriculture

- 7.4.1. Global Process Spectroscopy Market, by Food & Agriculture, by Region, 2019-2032 (USD Billion)

- 7.5. Metal & Mining

- 7.5.1. Global Process Spectroscopy Market, by Metal & Mining, by Region, 2019-2032 (USD Billion)

- 7.6. Oil & Gas

- 7.6.1. Global Process Spectroscopy Market, by Oil & Gas, by Region, 2019-2032 (USD Billion)

- 7.7. Pharmaceutical

- 7.7.1. Global Process Spectroscopy Market, by Pharmaceutical, by Region, 2019-2032 (USD Billion)

- 7.8. Polymer

- 7.8.1. Global Process Spectroscopy Market, by Polymer, by Region, 2019-2032 (USD Billion)

- 7.9. Pulp & Paper

- 7.9.1. Global Process Spectroscopy Market, by Pulp & Paper, by Region, 2019-2032 (USD Billion)

- 7.10. Water & Wastewater

- 7.10.1. Global Process Spectroscopy Market, by Water & Wastewater, by Region, 2019-2032 (USD Billion)

- 7.11. Others

- 7.11.1. Global Process Spectroscopy Market, by Others, by Region, 2019-2032 (USD Billion)

8. Global Process Spectroscopy Market, by Geography

- 8.1. Key Findings

- 8.2. Introduction

- 8.2.1. Process Spectroscopy Market Assessment, By Geography, 2019-2032 (USD Billion)

- 8.3. Process Spectroscopy Market - North America

- 8.3.1. North America: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.3.2. North America: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.3.3. North America: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.3.4. Process Spectroscopy Market - US

- 8.3.4.1. US: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.3.4.2. US: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.3.4.3. US: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.3.5. Process Spectroscopy Market - Canada

- 8.3.5.1. Canada: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.3.5.2. Canada: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.3.5.3. Canada: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.4. Process Spectroscopy Market - Europe

- 8.4.1. Europe: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.4.2. Europe: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.4.3. Europe: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.4.4. Process Spectroscopy Market - UK

- 8.4.4.1. UK: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.4.4.2. UK: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.4.4.3. UK: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.4.5. Process Spectroscopy Market - France

- 8.4.5.1. France: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.4.5.2. France: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.4.5.3. France: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.4.6. Process Spectroscopy Market - Germany

- 8.4.6.1. Germany: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.4.6.2. Germany: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.4.6.3. Germany: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.4.7. Process Spectroscopy Market - Italy

- 8.4.7.1. Italy: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.4.7.2. Italy: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.4.7.3. Italy: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.4.8. Process Spectroscopy Market - Spain

- 8.4.8.1. Spain: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.4.8.2. Spain: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.4.8.3. Spain: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.4.9. Process Spectroscopy Market - Netherlands

- 8.4.9.1. Netherlands: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.4.9.2. Netherlands: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.4.9.3. Netherlands: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.4.10. Process Spectroscopy Market - Russia

- 8.4.10.1. Russia: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.4.10.2. Russia: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.4.10.3. Russia: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.4.11. Process Spectroscopy Market - Rest of Europe

- 8.4.11.1. Rest of Europe: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.4.11.2. Rest of Europe: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.4.11.3. Rest of Europe: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.5. Process Spectroscopy Market - Asia Pacific

- 8.5.1. Asia Pacific: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.5.2. Asia Pacific: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.5.3. Asia Pacific: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.5.4. Process Spectroscopy Market - China

- 8.5.4.1. China: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.5.4.2. China: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.5.4.3. China: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.5.5. Process Spectroscopy Market - India

- 8.5.5.1. India: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.5.5.2. India: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.5.5.3. India: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.5.6. Process Spectroscopy Market - Malaysia

- 8.5.6.1. Malaysia: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.5.6.2. Malaysia: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.5.6.3. Malaysia: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.5.7. Process Spectroscopy Market - Japan

- 8.5.7.1. Japan: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.5.7.2. Japan: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.5.7.3. Japan: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.5.8. Process Spectroscopy Market - Indonesia

- 8.5.8.1. Indonesia: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.5.8.2. Indonesia: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.5.8.3. Indonesia: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.5.9. Process Spectroscopy Market - South Korea

- 8.5.9.1. South Korea: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.5.9.2. South Korea: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.5.9.3. South Korea: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.5.10. Process Spectroscopy Market - Australia

- 8.5.10.1. Australia: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.5.10.2. Australia: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.5.10.3. Australia: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.5.11. Process Spectroscopy Market - Rest of Asia Pacific

- 8.5.11.1. Rest of Asia Pacific: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.5.11.2. Rest of Asia Pacific: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.5.11.3. Rest of Asia Pacific: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.6. Process Spectroscopy Market - Middle East & Africa

- 8.6.1. Middle East & Africa: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.6.2. Middle East & Africa: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.6.3. Middle East & Africa: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.6.4. Process Spectroscopy Market - Saudi Arabia

- 8.6.4.1. Saudi Arabia: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.6.4.2. Saudi Arabia: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.6.4.3. Saudi Arabia: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.6.5. Process Spectroscopy Market - UAE

- 8.6.5.1. UAE: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.6.5.2. UAE: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.6.5.3. UAE: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.6.6. Process Spectroscopy Market - Israel

- 8.6.6.1. Israel: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.6.6.2. Israel: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.6.6.3. Israel: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.6.7. Process Spectroscopy Market - South Africa

- 8.6.7.1. South Africa: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.6.7.2. South Africa: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.6.7.3. South Africa: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.6.8. Process Spectroscopy Market - Rest of Middle East & Africa

- 8.6.8.1. Rest of Middle East & Africa: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.6.8.2. Rest of Middle East & Africa: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.6.8.3. Rest of Middle East & Africa: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.7. Process Spectroscopy Market - Latin America

- 8.7.1. Latin America: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.7.2. Latin America: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.7.3. Latin America: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.7.4. Process Spectroscopy Market - Mexico

- 8.7.4.1. Mexico: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.7.4.2. Mexico: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.7.4.3. Mexico: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.7.5. Process Spectroscopy Market - Brazil

- 8.7.5.1. Brazil: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.7.5.2. Brazil: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.7.5.3. Brazil: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.7.6. Process Spectroscopy Market - Argentina

- 8.7.6.1. Argentina: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.7.6.2. Argentina: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.7.6.3. Argentina: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

- 8.7.7. Process Spectroscopy Market - Rest of Latin America

- 8.7.7.1. Rest of Latin America: Process Spectroscopy Market, by Component, 2019-2032 (USD Billion)

- 8.7.7.2. Rest of Latin America: Process Spectroscopy Market, by Technology, 2019-2032 (USD Billion)

- 8.7.7.3. Rest of Latin America: Process Spectroscopy Market, by Application, 2019-2032 (USD Billion)

9. Competitive Landscape

- 9.1. Expansion and Acquisition Analysis

- 9.1.1. Expansion

- 9.1.2. Acquisitions

- 9.2. Partnerships/Collaborations/Agreements/Exhibitions

10. Company Profiles

- 10.1. ABB

- 10.1.1. Company Overview

- 10.1.2. Financial Performance

- 10.1.3. Product Benchmarking

- 10.1.4. Recent Development

- 10.2. Agilent Technologies, Inc.

- 10.2.1. Company Overview

- 10.2.2. Financial Performance

- 10.2.3. Product Benchmarking

- 10.2.4. Recent Development

- 10.3. Bruker

- 10.3.1. Company Overview

- 10.3.2. Financial Performance

- 10.3.3. Product Benchmarking

- 10.3.4. Recent Development

- 10.4. BUCHI

- 10.4.1. Company Overview

- 10.4.2. Financial Performance

- 10.4.3. Product Benchmarking

- 10.4.4. Recent Development

- 10.5. Danaher

- 10.5.1. Company Overview

- 10.5.2. Financial Performance

- 10.5.3. Product Benchmarking

- 10.5.4. Recent Development

- 10.6. FOSS

- 10.6.1. Company Overview

- 10.6.2. Financial Performance

- 10.6.3. Product Benchmarking

- 10.6.4. Recent Development

- 10.7. HORIBA

- 10.7.1. Company Overview

- 10.7.2. Financial Performance

- 10.7.3. Product Benchmarking

- 10.7.4. Recent Development

- 10.8. Endress+Hauser Group Services AG

- 10.8.1. Company Overview

- 10.8.2. Financial Performance

- 10.8.3. Product Benchmarking

- 10.8.4. Recent Development

- 10.9. Sartorius AG

- 10.9.1. Company Overview

- 10.9.2. Financial Performance

- 10.9.3. Product Benchmarking

- 10.9.4. Recent Development

- 10.10. Shimadzu Corporation

- 10.10.1. Company Overview

- 10.10.2. Financial Performance

- 10.10.3. Product Benchmarking

- 10.10.4. Recent Development