|

|

市場調査レポート

商品コード

1421768

鉄道シミュレーション市場、シェア、規模、動向、産業分析レポート:コンポーネント別、シミュレータタイプ別、地域別、セグメント別予測、2023年~2032年Simulated Train Market Share, Size, Trends, Industry Analysis Report, By Component ; By Simulator Type ; By Region; Segment Forecast, 2023 - 2032 |

||||||

カスタマイズ可能

|

|||||||

| 鉄道シミュレーション市場、シェア、規模、動向、産業分析レポート:コンポーネント別、シミュレータタイプ別、地域別、セグメント別予測、2023年~2032年 |

|

出版日: 2023年12月23日

発行: Polaris Market Research

ページ情報: 英文 117 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

Polaris Market Research社の最新調査によると、世界の鉄道シミュレーション市場規模は2032年までに204億5,000万米ドルに達する見込みです。このレポートは、現在の市場力学を詳細に洞察し、将来の市場成長に関する分析を提供しています。

鉄道シミュレーション技術は、実際の列車の操作や感覚を再現するもので、物理的な線路を必要とせず、訓練や娯楽に役立ちます。この技術は、実際の列車システムと比較した費用対効果、ニーズに合わせた制御された体験、安全対策の強化など、大きなメリットを提供します。この市場を後押ししているのは、鉄道訓練におけるシミュレーション技術の採用の拡大、洗練された列車運転シミュレーターに対する需要の急増、訓練費用の効率化の必要性です。

鉄道分野では安全性が最も重要であり、運転士訓練にシミュレーション環境を採用することで、リスクを大幅に軽減し、緊急事態への備えを強化することができます。世界中の規制当局は、より厳格な安全対策とトレーニングの前提条件を強化しています。シミュレーションに基づく訓練は、実際の危険を伴わないさまざまなシナリオを乗務員に体験させます。鉄道の安全運行が急務であることは、先進的な鉄道シミュレーション技術の導入を後押しする重要な原動力となっています。

さらに、著名なテクノロジー企業や鉄道業界団体は、鉄道シミュレーションシステムの高度化、適応性、リアリズムの向上を目指して研究開発を強化しています。学術機関や研究拠点との連携は、コンピューティングの進歩を活用した革新的シミュレーションの推進に役立っています。人工知能、クラウドコンピューティング、予測分析などの最先端ソリューションの統合は、鉄道シミュレーション技術の習熟度と影響力を高めています。

ビッグデータ解析と人工知能アルゴリズムを組み込むことで、シミュレーション訓練で生成される膨大なデータから貴重な洞察を引き出すことができます。AIには、個々のオペレーターのニーズに合わせてカスタマイズされた適応学習体験を作り上げる可能性があります。予測分析により、潜在的な課題を事前に特定し、スキルを向上させることができます。AIとビッグデータを活用したデータ主導型のシミュレーショントレーニングは、エビデンスに基づいた指導を可能にし、優れた成果をもたらします。

しかし、開発・配備費用の高さは、鉄道シミュレーション市場の成長を阻害する要因の1つである:先進的な鉄道シミュレーション・システムの導入には、ハードウェアとソフトウェア技術の両方に多額の初期投資が必要となります。さらに、これらのシミュレーターを既存のインフラに統合するには、相応のコストがかかります。このような財政的負担は、小規模な地下鉄鉄道事業者や訓練センターにとって特に困難なものとなる可能性があります。プロバイダーがより低予算のソリューションを導入しない限り、限られた予算が普及の妨げになる可能性があります。

鉄道シミュレーション市場レポートハイライト

ソフトウェア分野は、技術の進歩により予測期間中に最も高いCAGRで成長すると予想されます。

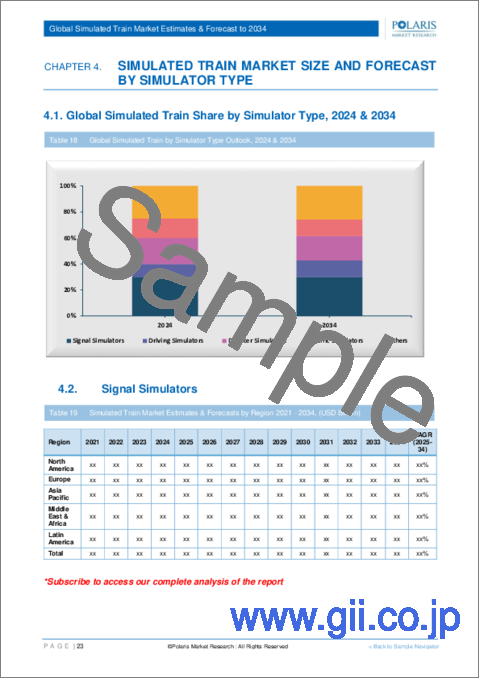

運転シミュレータ分野は2022年に最大の市場シェアを占めたが、これは主に適応性と拡張性の容易さによる。

技術の飛躍的な成長と新興国での研究開発投資の増加により、北米地域が2022年の市場シェアの大半を占める

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 世界の鉄道シミュレーション市場に関する洞察

- 鉄道シミュレーション市場- 業界スナップショット

- 鉄道市場力学のシミュレーション

- 促進要因と機会

- 技術の進歩に対するさらなる注目

- トレーニングと教育の需要の増加

- 抑制要因と課題

- 初期投資コストが高い

- 促進要因と機会

- PESTLE分析

- 鉄道シミュレーション業界の動向

- バリューチェーン分析

- COVID-19感染症の影響分析

第5章 世界の鉄道シミュレーション市場、コンポーネント別

- 主な調査結果

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第6章 世界の鉄道シミュレーション市場、シミュレータタイプ別

- 主な調査結果

- イントロダクション

- 信号シミュレータ

- ドライビングシミュレータ

- 災害シミュレーター

- 交通シミュレーター

- その他

第7章 世界の鉄道シミュレーション市場、地域別

- 主な調査結果

- イントロダクション

- 鉄道シミュレーション市場評価、地域別、2019-2032

- 鉄道シミュレーション市場-北米

- 北米:鉄道シミュレーション市場、シミュレータタイプ別、2019~2032年

- 北米:鉄道シミュレーション市場、コンポーネント別、2019~2032年

- 鉄道シミュレーション市場-米国

- 鉄道シミュレーション市場- カナダ

- 鉄道シミュレーション市場- 欧州

- 欧州:鉄道シミュレーション市場、シミュレータタイプ別、2019~2032年

- 欧州:鉄道シミュレーション市場、コンポーネント別、2019~2032年

- 鉄道シミュレーション市場- 英国

- 鉄道シミュレーション市場- フランス

- 鉄道シミュレーション市場- ドイツ

- 鉄道シミュレーション市場- イタリア

- 鉄道シミュレーション市場- スペイン

- 鉄道シミュレーション市場- オランダ

- 鉄道シミュレーション市場- ロシア

- 鉄道シミュレーション市場- アジア太平洋

- アジア太平洋:鉄道シミュレーション市場、シミュレータタイプ別、2019~2032年

- アジア太平洋:鉄道シミュレーション市場、コンポーネント別、2019~2032年

- 鉄道シミュレーション市場- 中国

- 鉄道シミュレーション市場- インド

- 鉄道シミュレーション市場- マレーシア

- 鉄道シミュレーション市場- 日本

- 鉄道シミュレーション市場- インドネシア

- 鉄道シミュレーション市場- 韓国

- 鉄道シミュレーション市場-中東およびアフリカ

- 中東およびアフリカ:鉄道シミュレーション市場、シミュレータタイプ別、2019~2032年

- 中東およびアフリカ:鉄道シミュレーション市場、コンポーネント別、2019~2032年

- 鉄道シミュレーション市場- サウジアラビア

- 鉄道シミュレーション市場- アラブ首長国連邦

- 鉄道シミュレーション市場- イスラエル

- 鉄道シミュレーション市場- 南アフリカ

- 鉄道シミュレーション市場-ラテンアメリカ

- ラテンアメリカ:鉄道シミュレーション市場、シミュレータタイプ別、2019~2032年

- ラテンアメリカ:鉄道シミュレーション市場、コンポーネント別、2019~2032年

- 鉄道シミュレーション市場- メキシコ

- 鉄道シミュレーション市場- ブラジル

- 鉄道シミュレーション市場- アルゼンチン

第8章 競合情勢

- 拡張と買収の分析

- 拡大

- 買収

- 提携/協業/合意/公開

第9章 企業プロファイル

- Ansaldo STS S.p.A.

- CORYS

- Cybernetica

- Foerst GmbH

- Interfleet Technology

- Krauss-Maffei Wegmann GmbH & Co. KG

- Lander Simulation & Training Solutions, S.A.

- Mechatronics

- Moog Inc.

- Oktal Sydac

- Opal-RT

- Osimco

- Systra Group

- Thales Group

- Transurb Simulation

List of Tables

- Table 1 Global Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 2 Global Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 3 Simulated Train Market Assessment, By Geography, 2019-2032 (USD Billion)

- Table 4 North America: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 5 North America: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 6 U.S.: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 7 U.S.: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 8 Canada: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 9 Canada: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 10 Europe: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 11 Europe: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 12 UK: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 13 UK: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 14 France: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 15 France: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 16 Germany: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 17 Germany: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 18 Italy: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 19 Italy: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 20 Spain: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 21 Spain: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 22 Netherlands: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 23 Netherlands: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 24 Russia: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 25 Russia: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 26 Asia Pacific: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 27 Asia Pacific: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 28 China: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 29 China: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 30 India: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 31 India: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 32 Malaysia: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 33 Malaysia: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 34 Japan: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 35 Japan: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 36 Indonesia: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 37 Indonesia: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 38 South Korea: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 39 South Korea: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 40 Middle East & Africa: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 41 Middle East & Africa: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 42 Saudi Arabia: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 43 Saudi Arabia: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 44 UAE: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 45 UAE: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 46 Israel: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 47 Israel: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 48 South Africa: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 49 South Africa: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 50 Latin America: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 51 Latin America: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 52 Mexico: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 53 Mexico: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 54 Brazil: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 55 Brazil: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- Table 56 Argentina: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- Table 57 Argentina: Simulated Train Market, by Component, 2019-2032 (USD Billion)

List of Figures

- Figure 1 Global Simulated Train Market, 2019-2032 (USD Billion)

- Figure 2 Integrated Ecosystem

- Figure 3 Research Methodology: Top-Down & Bottom-Up Approach

- Figure 4 Market by Geography

- Figure 5 Porter's Five Forces

- Figure 6 Market by Simulator Type

- Figure 7 Global Simulated Train Market, by Simulator Type, 2022 & 2032 (USD Billion)

- Figure 8 Market by Component

- Figure 9 Global Simulated Train Market, by Component, 2022 & 2032 (USD Billion)

- Figure 10 Simulated Train Market Assessment, By Geography, 2019-2032 (USD Billion)

- Figure 11 Strategic Analysis - Simulated Train Market

The global simulated train market size is expected to reach USD 20.45 billion by 2032, according to a new study by Polaris Market Research. The report "Simulated Train Market Share, Size, Trends, Industry Analysis Report, By Component (Hardware, Software, Services); By Simulator Type (Signal Simulators, Driving Simulators, Disaster Simulators, Traffic Simulators, Others); By Region; Segment Forecast, 2023 - 2032" gives a detailed insight into current market dynamics and provides analysis on future market growth.

Simulated train technology replicates the operations and sensations of actual trains, serving training and entertainment purposes without the necessity of physical tracks. This technology offers significant benefits, including cost-effectiveness compared to real train systems, tailored and controlled experiences, and enhanced safety measures. The market is propelled by the growing embrace of simulation tech in railway training, a surge in demand for sophisticated train driving simulators, and the imperative to streamline training expenses.

Safety holds utmost importance in the rail sector, and employing simulated environments for operator training markedly diminishes risks and enhances readiness for emergencies. Regulatory authorities worldwide are enforcing more stringent safety measures and training prerequisites. Simulation-based training grants crews exposure to various scenarios without actual hazards. The imperative for secure railway operations stands as a prominent driver propelling the uptake of advanced simulated train technologies.

Moreover, prominent technology companies and railway industry associations are intensifying research and development endeavors to elevate the sophistication, adaptability, and realism of train simulation systems. Collaborations with academic institutions and research hubs are instrumental in driving innovative simulations capitalizing on advancements in computing. The integration of cutting-edge solutions such as artificial intelligence, cloud computing, and predictive analytics is amplifying the proficiency and impact of train simulation technologies.

Incorporating big data analytics and artificial intelligence algorithms can extract invaluable insights from the extensive data generated in simulated training. AI has the potential to craft adaptive learning experiences customized to individual operator needs. Predictive analytics can proactively pinpoint potential challenges and elevate skills. Utilizing data-driven simulation training with AI and big data empowers evidence-based instruction, resulting in superior outcomes.

However, higher development and deployment expenses are one of the restraining factors hampering the simulated train market growth: The implementation of advanced train simulation systems entails substantial initial investments in both hardware and software technologies. Moreover, there are notable costs associated with integrating these simulators into existing infrastructure. This financial commitment can be particularly challenging for smaller metro rail operators and training centers. Unless providers introduce more budget-friendly solutions, limited budgets may impede widespread adoption.

Simulated Train Market Report Highlights

The software segment is expected to grow at the highest CAGR during the projected period due to technological advancements

The driving simulators segment accounted for the largest market share in 2022, which is mainly driven by ease in adaptability and scalability

North American region dominated the market with a majority share in 2022, owing to exponential growth in technology and rising R&D investments across emerging economies

The global key market players include: Krauss-Maffei Wegmann GmbH & Co. KG, Lander Simulation & Training Solutions, S.A., Mechatronics, Moog Inc., Oktal Sydac, Opal-RT

Polaris Market Research has segmented the simulated train market report based on component, simulator type, and region:

Simulated Train, Component Outlook (Revenue - USD Billion, 2019 - 2032)

- Hardware

- Software

- Services

Simulated Train, Simulator Type Outlook (Revenue - USD Billion, 2019 - 2032)

- Signal Simulators

- Driving Simulators

- Disaster Simulators

- Traffic Simulators

- Others

Simulated Train, Regional Outlook (Revenue - USD Billion, 2019 - 2032)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Latin America

- Argentina

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

Table of Contents

1. Introduction

- 1.1. Report Description

- 1.1.1. Objectives of the Study

- 1.1.2. Market Scope

- 1.1.3. Assumptions

- 1.2. Stakeholders

2. Executive Summary

- 2.1. Market Highlights

3. Research Methodology

- 3.1. Overview

- 3.1.1. Data Mining

- 3.2. Data Sources

- 3.2.1. Primary Sources

- 3.2.2. Secondary Sources

4. Global Simulated Train Market Insights

- 4.1. Simulated Train Market - Industry Snapshot

- 4.2. Simulated Train Market Dynamics

- 4.2.1. Drivers and Opportunities

- 4.2.1.1. Increased focus on technical advancements

- 4.2.1.2. Increased Demand for Training and Education

- 4.2.2. Restraints and Challenges

- 4.2.2.1. High Initial Investment Costs

- 4.2.1. Drivers and Opportunities

- 4.3. Porter's Five Forces Analysis

- 4.3.1. Bargaining Power of Suppliers (Moderate)

- 4.3.2. Threats of New Entrants: (Low)

- 4.3.3. Bargaining Power of Buyers (Moderate)

- 4.3.4. Threat of Substitute (Moderate)

- 4.3.5. Rivalry among existing firms (High)

- 4.4. PESTLE Analysis

- 4.5. Simulated Train Industry trends

- 4.6. Value Chain Analysis

- 4.7. COVID-19 Impact Analysis

5. Global Simulated Train Market, by Component

- 5.1. Key Findings

- 5.2. Introduction

- 5.2.1. Global Simulated Train, by Component, 2019-2032 (USD Billion)

- 5.3. Hardware

- 5.3.1. Global Simulated Train Market, by Hardware, by Region, 2019-2032 (USD Billion)

- 5.4. Software

- 5.4.1. Global Simulated Train Market, by Software, by Region, 2019-2032 (USD Billion)

- 5.5. Services

- 5.5.1. Global Simulated Train Market, by Services, by Region, 2019-2032 (USD Billion)

6. Global Simulated Train Market, by Simulator Type

- 6.1. Key Findings

- 6.2. Introduction

- 6.2.1. Global Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 6.3. Signal Simulators

- 6.3.1. Global Simulated Train Market, by Signal Simulators, by Region, 2019-2032 (USD Billion)

- 6.4. Driving Simulators

- 6.4.1. Global Simulated Train Market, by Driving Simulators, by Region, 2019-2032 (USD Billion)

- 6.3. Disaster Simulators

- 6.3.1. Global Simulated Train Market, by Disaster Simulators, by Region, 2019-2032 (USD Billion)

- 6.4. Traffic Simulators

- 6.4.1. Global Simulated Train Market, by Traffic Simulators, by Region, 2019-2032 (USD Billion)

- 6.3. Others

- 6.3.1. Global Simulated Train Market, by Others, by Region, 2019-2032 (USD Billion)

7. Global Simulated Train Market, by Geography

- 7.1. Key findings

- 7.2. Introduction

- 7.2.1. Simulated Train Market Assessment, By Geography, 2019-2032 (USD Billion)

- 7.3. Simulated Train Market - North America

- 7.3.1. North America: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.3.2. North America: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.3.3. Simulated Train Market - U.S.

- 7.3.3.1. U.S.: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.3.3.2. U.S.: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.3.4. Simulated Train Market - Canada

- 7.3.4.1. Canada: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.3.4.2. Canada: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.4. Simulated Train Market - Europe

- 7.4.1. Europe: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.4.2. Europe: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.4.3. Simulated Train Market - UK

- 7.4.3.1. UK: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.4.3.2. UK: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.4.4. Simulated Train Market - France

- 7.4.4.1. France: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.4.4.2. France: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.4.5. Simulated Train Market - Germany

- 7.4.5.1. Germany: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.4.5.2. Germany: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.4.6. Simulated Train Market - Italy

- 7.4.6.1. Italy: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.4.6.2. Italy: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.4.7. Simulated Train Market - Spain

- 7.4.7.1. Spain: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.4.7.2. Spain: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.4.8. Simulated Train Market - Netherlands

- 7.4.8.1. Netherlands: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.4.8.2. Netherlands: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.4.9. Simulated Train Market - Russia

- 7.4.9.1. Russia: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.4.9.2. Russia: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.5. Simulated Train Market - Asia Pacific

- 7.5.1. Asia Pacific: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.5.2. Asia Pacific: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.5.3. Simulated Train Market - China

- 7.5.3.1. China: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.5.3.2. China: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.5.4. Simulated Train Market - India

- 7.5.4.1. India: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.5.4.2. India: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.5.5. Simulated Train Market - Malaysia

- 7.5.5.1. Malaysia: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.5.5.2. Malaysia: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.5.6. Simulated Train Market - Japan

- 7.5.6.1. Japan: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.5.6.2. Japan: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.5.7. Simulated Train Market - Indonesia

- 7.5.7.1. Indonesia: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.5.7.2. Indonesia: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.5.8. Simulated Train Market - South Korea

- 7.5.8.1. South Korea: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.5.8.2. South Korea: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.6. Simulated Train Market - Middle East & Africa

- 7.6.1. Middle East & Africa: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.6.2. Middle East & Africa: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.6.3. Simulated Train Market - Saudi Arabia

- 7.6.3.1. Saudi Arabia: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.6.3.2. Saudi Arabia: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.6.4. Simulated Train Market - UAE

- 7.6.4.1. UAE: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.6.4.2. UAE: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.6.5. Simulated Train Market - Israel

- 7.6.5.1. Israel: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.6.5.2. Israel: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.6.6. Simulated Train Market - South Africa

- 7.6.6.1. South Africa: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.6.6.2. South Africa: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.7. Simulated Train Market - Latin America

- 7.7.1. Latin America: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.7.2. Latin America: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.7.3. Simulated Train Market - Mexico

- 7.7.3.1. Mexico: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.7.3.2. Mexico: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.7.4. Simulated Train Market - Brazil

- 7.7.4.1. Brazil: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.7.4.2. Brazil: Simulated Train Market, by Component, 2019-2032 (USD Billion)

- 7.7.5. Simulated Train Market - Argentina

- 7.7.5.1. Argentina: Simulated Train Market, by Simulator Type, 2019-2032 (USD Billion)

- 7.7.5.2. Argentina: Simulated Train Market, by Component, 2019-2032 (USD Billion)

8. Competitive Landscape

- 8.1. Expansion and Acquisition Analysis

- 8.1.1. Expansion

- 8.1.2. Acquisitions

- 8.2. Partnerships/Collaborations/Agreements/Exhibitions

9. Company Profiles

- 9.1. Ansaldo STS S.p.A.

- 9.1.1. Company Overview

- 9.1.2. Financial Performance

- 9.1.3. Product Benchmarking

- 9.1.4. Recent Development

- 9.2. CORYS

- 9.2.1. Company Overview

- 9.2.2. Financial Performance

- 9.2.3. Product Benchmarking

- 9.2.4. Recent Development

- 9.3. Cybernetica

- 9.3.1. Company Overview

- 9.3.2. Financial Performance

- 9.3.3. Product Benchmarking

- 9.3.4. Recent Development

- 9.4. Foerst GmbH

- 9.4.1. Company Overview

- 9.4.2. Financial Performance

- 9.4.3. Product Benchmarking

- 9.4.4. Recent Development

- 9.5. Interfleet Technology

- 9.5.1. Company Overview

- 9.5.2. Financial Performance

- 9.5.3. Product Benchmarking

- 9.5.4. Recent Development

- 9.6. Krauss-Maffei Wegmann GmbH & Co. KG

- 9.6.1. Company Overview

- 9.6.2. Financial Performance

- 9.6.3. Product Benchmarking

- 9.6.4. Recent Development

- 9.7. Lander Simulation & Training Solutions, S.A.

- 9.7.1. Company Overview

- 9.7.2. Financial Performance

- 9.7.3. Product Benchmarking

- 9.7.4. Recent Development

- 9.8. Mechatronics

- 9.8.1. Company Overview

- 9.8.2. Financial Performance

- 9.8.3. Product Benchmarking

- 9.8.4. Recent Development

- 9.9. Moog Inc.

- 9.9.1. Company Overview

- 9.9.2. Financial Performance

- 9.9.3. Product Benchmarking

- 9.9.4. Recent Development

- 9.10. Oktal Sydac

- 9.10.1. Company Overview

- 9.10.2. Financial Performance

- 9.10.3. Product Benchmarking

- 9.10.4. Recent Development

- 9.11. Opal-RT

- 9.11.1. Company Overview

- 9.11.2. Financial Performance

- 9.11.3. Product Benchmarking

- 9.11.4. Recent Development

- 9.12. Osimco

- 9.12.1. Company Overview

- 9.12.2. Financial Performance

- 9.12.3. Product Benchmarking

- 9.12.4. Recent Development

- 9.13. Systra Group

- 9.13.1. Company Overview

- 9.13.2. Financial Performance

- 9.13.3. Product Benchmarking

- 9.13.4. Recent Development

- 9.14. Thales Group

- 9.14.1. Company Overview

- 9.14.2. Financial Performance

- 9.14.3. Product Benchmarking

- 9.14.4. Recent Development

- 9.15. Transurb Simulation

- 9.15.1. Company Overview

- 9.15.2. Financial Performance

- 9.15.3. Product Benchmarking

- 9.15.4. Recent Development