|

|

市場調査レポート

商品コード

1408946

アルミニウムの世界市場:供給源別、製品タイプ別、最終用途別、地域別:産業分析、規模、シェア、成長、動向、予測(2023年~2030年)Aluminum Market by Product Type, End-Users, and Geography (North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa): Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2023-2030 |

||||||

カスタマイズ可能

|

|||||||

| アルミニウムの世界市場:供給源別、製品タイプ別、最終用途別、地域別:産業分析、規模、シェア、成長、動向、予測(2023年~2030年) |

|

出版日: 2023年11月29日

発行: Persistence Market Research

ページ情報: 英文 221 Pages

納期: 2~5営業日

|

- 全表示

- 概要

- 目次

Persistence Market Research社は、世界のアルミニウム市場に関する詳細なレポートを発表し、重要な市場力学、動向、機会、課題を徹底的に調査しました。当レポートでは、市場構造に関する詳細な洞察を提供し、2023年から2030年にわたるアルミニウム市場の予測成長経路を明確にするデータと統計に裏打ちされた独占的な情報を提供するよう努めています。

世界のアルミニウム市場はCAGR 5.6%で拡大し、2023年の264億米ドルから2030年末には387億米ドルに増加すると予測されます。

主要インサイト

- アルミニウム市場規模(2023年):264億米ドル

- 予測市場価値(2030年):387億米ドル

- 世界の市場成長率(2023年~2030年のCAGR):5.6%

- 過去の市場成長率(2018年~2022年のCAGR):4.8%

アルミニウム市場 - 調査範囲

アルミニウム市場は、そのリサイクル性、軽さ、耐腐食性で不可欠です。航空宇宙、自動車、建設、包装などの主要分野がその需要を牽引し、経済にとって極めて重要です。原材料の入手可能性、技術の進歩、地政学、世界の需要動向などの要因が市場の健全性を形成しています。航空宇宙産業と自動車産業からの高い需要は、アルミニウムの軽量で耐久性のある特性によって後押しされ、極めて重要です。特に発展途上国では、都市化による建設業の貢献が大きいです。電気分解やリサイクルのような生産プロセスの進歩は、費用対効果と持続可能性を高める。環境に優しい材料やグリーン技術を支援する政府の取り組みは、市場をさらに活性化させる。貿易政策や制裁措置といった地政学的要因が大きな役割を果たしており、効果的なナビゲーションのためには市場力学を包括的に理解する必要性が強調されています。

アルミニウム市場の成長促進要因:

世界のアルミニウム市場は、産業界全体で持続可能性への注目が高まっていることから活況を呈しています。リサイクル可能で二酸化炭素排出量が少ないアルミニウムは、このシフトにおける主要企業です。自動車部門では、顕著な変革が進行中です。環境に優しい輸送手段へのニーズと世界の気候変動への意識に応えるため、自動車メーカーは軽量で燃費の良い自動車を製造するためにアルミニウムをますます使用するようになっています。アルミニウムのリサイクルは環境への影響を大幅に軽減し、最初の製造よりもはるかに少ないエネルギーで済みます。これは、二酸化炭素排出量を削減し、産業生態系への影響を軽減するための世界の取り組みと一致しています。さらに、アルミニウムの軽量性は、燃費を向上させ、厳しい排ガス規制を満たし、化石燃料使用に関する懸念に対処する上で極めて重要です。

市場の抑制要因:

世界のアルミニウム市場は大きく成長しているもの、ボーキサイトを中心とする必須原材料の確保が大きな課題となっています。ボーキサイトは世界的に偏在しており、一部の地域に集中しているため、サプライチェーンはその地域の地政学的、環境的、経済的要因による混乱の影響を受けやすいです。建設や自動車などの部門が牽引するアルミニウム需要の増大は、原料の安定供給の必要性を高めています。

地政学的な不確実性は、国際貿易や国際関係に依存するアルミニウム市場に影響を与え、もう一つのハードルとなります。主要なアルミニウム生産国間の貿易摩擦や関税紛争は、サプライチェーンの混乱につながり、価格設定や市場力学に影響を及ぼす可能性があります。例えば、アルミニウム輸入に対する関税は、価格構造を変化させ、不確実性を生み出す可能性があります。主要なアルミニウム生産地域での外交紛争や地政学的不安により、突然原材料の入手が困難になると、生産スケジュールや市場全体の安定が損なわれる可能性があります。

市場機会:

世界のアルミニウム市場は、業界全体の進歩を促進する急速な技術革新から大きな恩恵を受けています。電解や不活性陽極技術のようなアルミニウム製錬の革新は、アルミニウムの一次生産効率を高め、エネルギー消費量と業界の二酸化炭素排出量を削減します。こうした進歩は持続可能性の目標に沿うものであり、アルミニウムは従来の素材と比べてより環境に優しい選択肢と位置づけられています。

さらに、テクノロジーはアルミニウムのリサイクルに革命をもたらし、循環経済を促進しています。高度なふるい分けと分離技術により、消費者使用後を含むさまざまな供給源からアルミニウムを回収し、リサイクルすることが可能になりました。効率的で持続可能な手法へのシフトは、環境目標を支援するだけでなく、世界のアルミニウム市場に拡大と効率化の新たな道を開くものです。

本レポートで扱う主な質問

- アルミニウムの世界市場の現在の規模は、金額ベース、数量ベースでどの程度か?

- 最も急成長している市場セグメントは?

- アルミニウム市場の主要企業は?

- 原材料価格、環境規制、技術的混乱など、アルミニウム市場が直面する主な課題は何か?

- 成長の鍵となる機会は何か?

競合情報とビジネス戦略:

Alcoa Corporation、Rio Tinto Group、China Hongqiao Group Limitedなど、世界のアルミニウム業界の主要企業は、多様な戦略によって優位性を維持しています。中国虹橋集団は一貫した生産改善への投資により、世界最大の生産者となっています。企業がバリューチェーンの複数の段階をコントロールする垂直統合は、効率性と費用対効果を高める。リオ・ティントやアルコアに見られるように、世界なプレゼンスを持つことは、地域的なリスクを軽減し、経済変動に効果的に対応するのに役立ちます。

主要企業プロファイル

- Aluminum Corporation of China Limited (Chalco)

- China Hongqiao Group Co. Ltd.

- United Company Rusal IPJSC

- Shandong Xinfa Aluminium Group

- Rio Tinto Group

- Emirates Global Aluminium

- Alcoa Corporation

- State Power Investment Corporation Limited (SPIC)

- Norsk Hydro ASA

- Hindalco Industries Limited

- Vedanta Limited

- South32 Limited

アルミニウム市場セグメンテーション:

一次アルミニウムは建設と自動車需要に牽引され世界市場を独占しているが、二次アルミニウムはリサイクルに焦点を当て成長しています。押出アルミニウムが適応性でリードし、電線・ケーブル分野が急成長している。

自動車産業は、燃費効率を高めるために軽量材料を重視し、大きな市場シェアを占めています。包装はアルミニウムの特性により成長し、箔や容器での使用が増加しています。

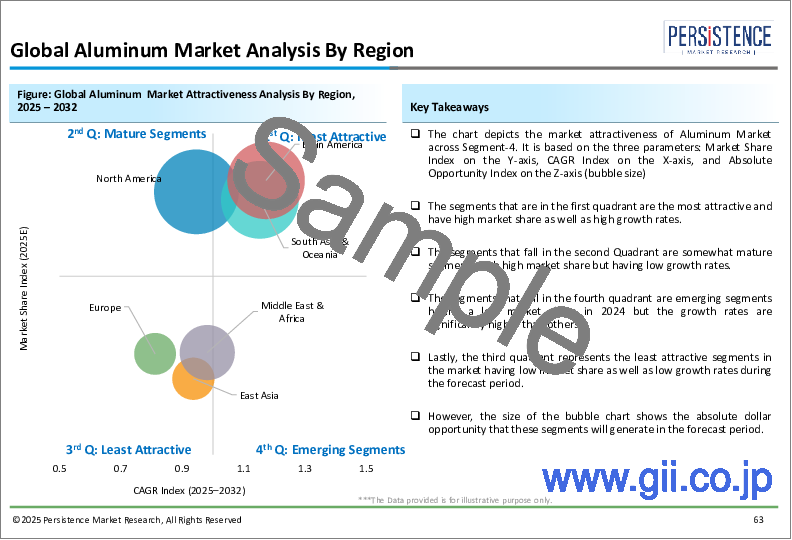

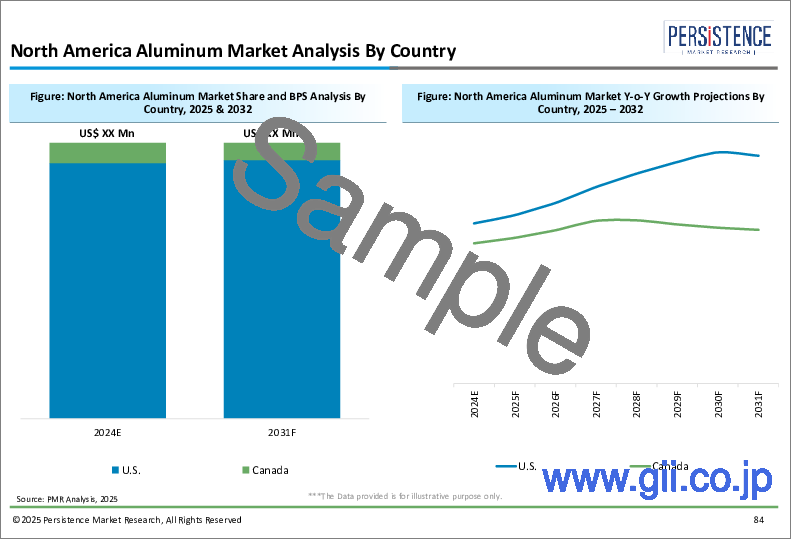

北米は自動車と建築の旺盛な需要に後押しされてリードしています。南アジアとオセアニアは、工業化とインフラ整備によって急速に拡大しており、業界関係者にチャンスを提供しています。

供給源別

- 一次アルミニウム

- 二次アルミニウム

製品タイプ別

- 平板

- 押出

- 鍛造

- 鋳造

- ワイヤー・ケーブル

- その他(パウダー、ペーストなど)

最終用途別

- 自動車

- 従来型

- 電気自動車

- 輸送

- 航空宇宙

- 船舶

- 鉄道

- 包装

- 建設

- 耐久消費財

- 機械・設備

- 電気機器

- その他(スポーツ用品など)

地域別

- 北米

- 欧州

- 東アジア

- 南アジア・オセアニア

- ラテンアメリカ

- 中東・アフリカ

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の範囲と定義

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 主要な動向

- 供給源のライフサイクル分析

- アルミニウム市場:バリューチェーン

- 製品タイプ別のサプライヤー一覧

- メーカー一覧

- 販売代理店一覧

- 最終用途一覧

- 収益性分析

- ポーターファイブフォースの分析

- 地政学的緊張:市場への影響

- マクロ経済的要因

- 世界の分野別の展望

- 世界のGDP成長率の見通し

- 世界の親市場概要

- 予測要因 - 関連性と影響

- 規制とテクノロジーの情勢

第3章 世界のアルミニウム市場の見通し:実績(2018年~2022年)と予測(2023年~2030年)

- 主なハイライト

- 市場数量予測

- 市場規模と前年比成長率

- 絶対的利益の機会

- 市場規模分析と予測

- 過去の市場規模分析(2013年~2016年)

- 現在の市場規模予測(2018年~2026年)

- 世界のアルミニウム市場の見通し:供給源別

- イントロダクション/主な調査結果

- 過去の市場規模と数量分析:供給源別(2018年~2022年)

- 現在の市場規模と数量予測:供給源別(2023年~2030年)

- 市場の魅力度分析:供給源別

- 世界のアルミニウム市場の見通し:製品タイプ別

- イントロダクション/主な調査結果

- 過去の市場規模と数量分析:製品タイプ別(2018年~2022年)

- 現在の市場規模と数量予測:製品タイプ別(2023年~2030年)

- 市場の魅力度分析:製品タイプ別

- 世界のアルミニウム市場の見通し:最終用途別

- イントロダクション/主な調査結果

- 過去の市場規模と数量分析:最終用途別(2018年~2022年)

- 現在の市場規模と数量予測:最終用途別(2023年~2030年)

- 市場の魅力度分析:最終用途

第4章 世界のアルミニウム市場の見通し:地域別

- 主なハイライト

- 過去の市場規模と数量分析:地域別(2018年~2022年)

- 現在の市場規模と数量予測:地域別(2023年~2030年)

- 北米

- 欧州

- 東アジア

- 南アジア・オセアニア

- ラテンアメリカ

- 中東・アフリカ

- 市場の魅力度分析:地域別

第5章 北米のアルミニウム市場の見通し:実績(2018年~2022年)と予測(2023年~2030年)

- 主なハイライト

- 価格分析

- 過去の市場規模と数量分析:市場別(2018年~2022年)

- 国別

- 供給源別

- 製品タイプ別

- 最終用途別

- 現在の市場規模と数量予測:国別(2023年~2030年)

- 米国

- カナダ

- 現在の市場規模と数量予測:供給源別(2023年~2030年)

- 一次アルミニウム

- 二次アルミニウム

- 現在の市場規模と数量予測:製品タイプ別(2023年~2030年)

- 平板

- 押出

- 鍛造

- 鋳造

- ワイヤー・ケーブル

- その他(パウダー、ペーストなど)

- 現在の市場規模と数量予測:最終用途別(2023年~2030年)

- 自動車

- 輸送

- 建設

- 耐久消費財

- 機械・設備

- 電気

- その他(スポーツ用品等)

- 市場の魅力度分析

第6章 欧州のアルミニウム市場の見通し:実績(2018年~2022年)と予測(2023年~2030年)

- 主なハイライト

- 価格分析

- 過去の市場規模と数量分析:市場別(2018年~2022年)

- 国別

- 供給源別

- 製品タイプ別

- 最終用途別

- 現在の市場規模と数量予測:国別(2023年~2030年)

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- トルキエ

- その他欧州

- 現在の市場規模と数量予測:供給源別(2023年~2030年)

- 一次アルミニウム

- 二次アルミニウム

- 現在の市場規模と数量予測:製品タイプ別(2023年~2030年)

- 平板

- 押出

- 鍛造

- 鋳造

- ワイヤー・ケーブル

- その他(パウダー、ペーストなど)

- 現在の市場規模と数量予測:最終用途別(2023年~2030年)

- 自動車

- 輸送

- 包装

- 建設

- 耐久消費財

- 機械・設備

- 電気

- その他(スポーツ用品等)

- 市場の魅力度分析

第7章 東アジアのアルミニウム市場の見通し:実績(2018年~2022年)と予測(2023年~2030年)

- 主なハイライト

- 価格分析

- 過去の市場規模と数量分析:市場別(2018年~2022年)

- 国別

- 供給源別

- 製品タイプ別

- 最終用途別

- 現在の市場規模と数量予測:国別(2023年~2030年)

- 中国

- 日本

- 韓国

- 現在の市場規模と数量予測:供給源別(2023年~2030年)

- 一次アルミニウム

- 二次アルミニウム

- 現在の市場規模と数量予測:製品タイプ別(2023年~2030年)

- 平板

- 押出

- 鍛造

- 鋳造

- ワイヤー・ケーブル

- その他(パウダー、ペーストなど)

- 現在の市場規模と最終用途別の数量(単位)の予測、2023~2030年

- 自動車

- 輸送

- 包装

- 建設

- 耐久消費財

- 機械・設備

- 電気

- その他(スポーツ用品等)

- 市場の魅力度分析

第8章 南アジア・オセアニアのアルミニウム市場の見通し:実績(2018年~2022年)と予測(2023年~2030年)

- 主なハイライト

- 価格分析

- 過去の市場規模と数量分析:市場別(2018年~2022年)

- 国別

- 供給源別

- 製品タイプ別

- 最終用途別

- 現在の市場規模と数量予測:国別(2023年~2030年)

- インド

- 東南アジア

- ニュージーランド

- その他南アジア・オセアニア

- 現在の市場規模と数量予測:供給源別(2023年~2030年)

- 一次アルミニウム

- 二次アルミニウム

- 現在の市場規模と数量予測:製品タイプ別(2023年~2030年)

- 平板

- 押出

- 鍛造

- 鋳造

- ワイヤー・ケーブル

- その他(パウダー、ペーストなど)

- 現在の市場規模と数量予測:最終用途別(2023年~2030年)

- 自動車

- 輸送

- 包装

- 建設

- 耐久消費財

- 機械・設備

- 電気

- その他(スポーツ用品等)

- 市場の魅力度分析

第9章 ラテンアメリカのアルミニウム市場の見通し:過去(2018年~2022年)と予測(2023年~2030年)

- 主なハイライト

- 価格分析

- 過去の市場規模と数量分析:市場別(2018年~2022年)

- 国別

- 供給源別

- 製品タイプ別

- 最終用途別

- 現在の市場規模と数量予測:国別(2023年~2030年)

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 現在の市場規模と数量予測:供給源別(2023年~2030年)

- 一次アルミニウム

- 二次アルミニウム

- 現在の市場規模と数量予測:製品タイプ別(2023年~2030年)

- 平板

- 押出

- 鍛造

- 鋳造

- ワイヤー・ケーブル

- その他(パウダー、ペーストなど)

- 現在の市場規模と数量予測:最終用途別(2023年~2030年)

- 自動車

- 輸送

- 包装

- 建設

- 耐久消費財

- 機械・設備

- 電気

- その他(スポーツ用品等)

- 市場の魅力度分析

第10章 中東・アフリカのアルミニウム市場の見通し:実績(2018年~2022年)と予測(2023年~2030年)

- 主なハイライト

- 価格分析

- 過去の市場規模と数量分析:市場別(2018年~2022年)

- 国別

- 供給源別

- 製品タイプ別

- 最終用途別

- 現在の市場規模と数量予測:国別(2023年~2030年)

- GCC

- エジプト

- 南アフリカ

- 北アフリカ

- その他中東とアフリカ

- 現在の市場規模と数量予測:供給源別(2023年~2030年)

- 一次アルミニウム

- 二次アルミニウム

- 現在の市場規模と数量予測:製品タイプ別(2023年~2030年)

- 平板

- 押出

- 鍛造

- 鋳造

- ワイヤー・ケーブル

- その他(パウダー、ペーストなど)

- 現在の市場規模と数量予測:最終用途別(2023年~2030年)

- 自動車

- 輸送

- 包装

- 建設

- 耐久消費財

- 機械・設備

- 電気

- その他(スポーツ用品等)

- 市場の魅力度分析

第11章 競合情勢

- 市場シェア分析(2022年)

- 市場構造

- 企業プロファイル(詳細 - 概要、財務、戦略、最近の動向)

- Aluminum Corporation of China Limited (Chalco)

- China Hongqiao Group Co. Ltd.

- United Company Rusal IPJSC

- Shandong Xinfa Aluminium Group

- Rio Tinto Group

- Emirates Global Aluminium

- Alcoa Corporation

- State Power Investment Corporation Limited (SPIC)

- Norsk Hydro ASA

- Hindalco Industries Limited

- Vedanta Limited

- South32 Limited

第12章 付録

Persistence Market Research has released an in-depth report on the worldwide Aluminum market, delivering a thorough examination of crucial market dynamics, trends, opportunities, and challenges. The report furnishes detailed insights into the market structure, striving to provide exclusive information supported by data and statistics that delineate the anticipated growth path of the Aluminum market spanning from 2023 to 2030.

The global Aluminum market is forecast to expand at a CAGR of 5.6% and thereby increase from a value of US$ 26.4 Billion in 2023, to US$ 38.7 Billion by the end of 2030.

Key Insights

- Aluminum Market Size (2023E): US$ 26.4 Billion

- Projected Market Value (2030F): US$ 38.7 Billion

- Global Market Growth Rate (CAGR 2023 to 2030): 5.6%

- Historical Market Growth Rate (CAGR 2018 to 2022): 4.8%

Aluminum Market - Report Scope

The aluminum market is vital for its recyclability, lightness, and corrosion resistance. Key sectors like aerospace, automotive, construction, and packaging drive its demand, making it crucial for the economy. Factors like raw material availability, technological advancements, geopolitics, and global demand trends shape the market's health. High demand from aerospace and automotive industries, boosted by aluminum's lightweight and durable properties, is pivotal. Construction, especially in developing nations, contributes significantly due to urbanization. Advancements in production processes, like electrolysis and recycling, enhance cost-effectiveness and sustainability. Government initiatives supporting eco-friendly materials and green tech further fuel the market. Geopolitical factors, such as trade policies and sanctions, play a substantial role, emphasizing the need for a comprehensive understanding of market dynamics for effective navigation.

Market Growth Drivers for Aluminum:

The global aluminum market is booming due to a rising focus on sustainability across industries. Aluminum, with its recyclability and low carbon emissions, is a key player in this shift. In the automotive sector, a notable transformation is underway. Automakers, responding to the need for eco-friendly transportation and global climate awareness, are increasingly using aluminum to make lightweight, fuel-efficient vehicles. Recycling aluminum significantly reduces its environmental impact, requiring much less energy than initial manufacturing. This aligns with global efforts to cut carbon emissions and lessen industrial ecological effects. Additionally, aluminum's lightweight nature is crucial for improving fuel efficiency, helping meet strict emission regulations and addressing concerns about fossil fuel use.

Market Restraints:

Despite the global aluminum market's significant growth, a major challenge lies in securing essential raw materials, mainly bauxite. Bauxite is unevenly distributed globally, concentrated in a few regions, making the supply chain vulnerable to disruptions from geopolitical, environmental, or economic factors in those areas. The escalating demand for aluminum, driven by sectors like construction and automotive, intensifies the need for a steady supply of raw materials.

Geopolitical uncertainties pose another hurdle, impacting the aluminum market due to its dependence on international trade and relations. Trade tensions and tariff disputes among major aluminum-producing countries can lead to supply chain disruptions, affecting pricing and market dynamics. Tariffs on aluminum imports, for instance, can alter pricing structures and create uncertainty. Sudden raw material availability issues due to diplomatic disputes or geopolitical unrest in key aluminum-producing areas can disrupt production schedules and overall market stability.

Market Opportunities:

The global aluminum market benefits greatly from rapid technological innovations driving progress across the industry. Innovations in aluminum smelting, like electrolysis and inert anode technology, enhance primary aluminum production efficiency, reducing energy consumption and the industry's carbon footprint. These advancements align with sustainability goals, positioning aluminum as a more environmentally friendly option compared to traditional materials.

Moreover, technology is revolutionizing aluminum recycling, promoting a circular economy. Advanced sifting and separation technologies enable the recovery and recycling of aluminum from various sources, including post-consumer use. This shift toward efficient and sustainable practices not only supports environmental objectives but also opens new avenues for expansion and efficiency in the worldwide aluminum market.

Key Questions Answered in Report:

- What is the current size of the global Aluminum market in terms of value and volume?

- Which market segments are growing the fastest?

- Who are the key players in the Aluminum market?

- What are the major challenges facing the Aluminum market, such as raw material pricing, environmental regulations, or technological disruptions?

- What are the key opportunities for growth?

Competitive Intelligence and Business Strategy:

Key players in the global aluminum industry, like Alcoa Corporation, Rio Tinto Group, and China Hongqiao Group Limited, maintain dominance through diverse strategies. They often focus on expanding production capacity, with China Hongqiao Group being the world's largest producer due to consistent investment in production improvements. Vertical integration, where companies control multiple stages of the value chain, enhances efficiency and cost-effectiveness. Having a global presence, as seen with Rio Tinto and Alcoa, helps mitigate regional risks and respond effectively to economic changes.

Key Companies Profiled

- Aluminum Corporation of China Limited (Chalco)

- China Hongqiao Group Co. Ltd.

- United Company Rusal IPJSC

- Shandong Xinfa Aluminium Group

- Rio Tinto Group

- Emirates Global Aluminium

- Alcoa Corporation

- State Power Investment Corporation Limited (SPIC)

- Norsk Hydro ASA

- Hindalco Industries Limited

- Vedanta Limited

- South32 Limited

Aluminum Market Research Segmentation:

Primary aluminum dominates the global market, driven by construction and automotive demand, while secondary aluminum grows with a focus on recycling. Extruded aluminum leads in adaptability, and the wires and cables sector sees rapid growth.

The automotive industry holds a significant market share, emphasizing lightweight materials for fuel efficiency. Packaging grows due to aluminum's properties and increased use in foils and containers.

North America leads, fueled by strong demand in automotive and construction. South Asia and Oceania show rapid expansion, driven by industrialization and infrastructure development, offering opportunities for industry players.

By Source:

- Primary Alumiun

- Secondary Aluminum

By Product Type:

- Flat

- Extruded

- Forged

- Cast

- Wires & Cables

- Misc. (Powder, Pastes, etc.)

By End Use:

- Automotive

- Conventional

- Electric Vehicles

- Transportation

- Aerospace

- Marine

- Rail

- Packaging

- Construction

- Consumer Durables

- Machinery & Equipment

- Electrical

- Misc. (Sport Goods, etc.)

By Region:

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

Table of Contents

1. Executive Summary

- 1.1. Global Aluminum Market Snapshot, 2023 and 2030

- 1.2. Market Opportunity Assessment, 2023 - 2030, US$ Mn

- 1.3. Key Market Trends

- 1.4. Future Market Projections

- 1.5. Premium Market Insights

- 1.6. Industry Developments and Key Market Events

- 1.7. PMR Analysis and Recommendations

2. Market Overview

- 2.1. Market Scope and Definition

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.2. Restraints

- 2.2.3. Opportunity

- 2.2.4. Challenges

- 2.2.5. Key Trends

- 2.3. Source Lifecycle Analysis

- 2.4. Aluminum Market: Value Chain

- 2.4.1. List of Raw Product Type Supplier

- 2.4.2. List of Manufacturers

- 2.4.3. List of Distributors

- 2.4.4. List of End Uses

- 2.4.5. Profitability Analysis

- 2.5. Porter Five Force's Analysis

- 2.6. Geopolitical Tensions: Market Impact

- 2.7. Macro-Economic Factors

- 2.7.1. Global Sectorial Outlook

- 2.7.2. Global GDP Growth Outlook

- 2.7.3. Global Parent Market Overview

- 2.8. Forecast Factors - Relevance and Impact

- 2.9. Regulatory and Technology Landscape

3. Global Aluminum Market Outlook: Historical (2018 - 2022) and Forecast (2023 - 2030)

- 3.1. Key Highlights

- 3.1.1. Market Volume (Units) Projections

- 3.1.2. Market Size and Y-o-Y Growth

- 3.1.3. Absolute $ Opportunity

- 3.2. Market Size (US$ Mn) Analysis and Forecast

- 3.2.1. Historical Market Size Analysis, 2013-2016

- 3.2.2. Current Market Size Forecast, 2018-2026

- 3.3. Global Aluminum Market Outlook: Source

- 3.3.1. Introduction / Key Findings

- 3.3.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis By Source, 2018 - 2022

- 3.3.3. Current Market Size (US$ Mn) and Volume (Units) Forecast By Source, 2023 - 2030

- 3.3.3.1. Primary Alumiun

- 3.3.3.2. Secondary Aluminum

- 3.4. Market Attractiveness Analysis: Source

- 3.5. Global Aluminum Market Outlook: Product Type

- 3.5.1. Introduction / Key Findings

- 3.5.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis By Product Type, 2018 - 2022

- 3.5.3. Current Market Size (US$ Mn) and Volume (Units) Forecast By Product Type, 2023 - 2030

- 3.5.3.1. Flat

- 3.5.3.2. Extruded

- 3.5.3.3. Forged

- 3.5.3.4. Cast

- 3.5.3.5. Wires & Cables

- 3.5.3.6. Misc. (Powder, Pastes, etc.)

- 3.6. Market Attractiveness Analysis: Product Type

- 3.7. Global Aluminum Market Outlook: End Use

- 3.7.1. Introduction / Key Findings

- 3.7.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis By End Use, 2018 - 2022

- 3.7.3. Current Market Size (US$ Mn) and Volume (Units) Forecast By End Use, 2023 - 2030

- 3.7.3.1. Automotive

- 3.7.3.1.1. Conventional

- 3.7.3.1.2. Electric Vehicles

- 3.7.3.2. Transportation

- 3.7.3.2.1. Aerospace

- 3.7.3.2.2. Marine

- 3.7.3.2.3. Rail

- 3.7.3.3. Packaging

- 3.7.3.4. Construction

- 3.7.3.5. Consumer Durables

- 3.7.3.6. Machinery & Equipment

- 3.7.3.7. Electrical

- 3.7.3.8. Misc. (Sport Goods, etc.)

- 3.7.3.1. Automotive

- 3.8. Market Attractiveness Analysis: End Use

4. Global Aluminum Market Outlook: Region

- 4.1. Key Highlights

- 4.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis By Region, 2018 - 2022

- 4.3. Current Market Size (US$ Mn) and Volume (Units) Forecast By Region, 2023 - 2030

- 4.3.1. North America

- 4.3.2. Europe

- 4.3.3. East Asia

- 4.3.4. South Asia and Oceania

- 4.3.5. Latin America

- 4.3.6. Middle East & Africa (MEA)

- 4.4. Market Attractiveness Analysis: Region

5. North America Aluminum Market Outlook: Historical (2018 - 2022) and Forecast (2023 - 2030)

- 5.1. Key Highlights

- 5.2. Pricing Analysis

- 5.3. Historical Market Size (US$ Mn) and Volume (Units) Analysis By Market, 2018 - 2022

- 5.3.1. By Country

- 5.3.2. By Source

- 5.3.3. By Product Type

- 5.3.4. By End Use

- 5.4. Current Market Size (US$ Mn) and Volume (Units) Forecast By Country, 2023 - 2030

- 5.4.1. U.S.

- 5.4.2. Canada

- 5.5. Current Market Size (US$ Mn) and Volume (Units) Forecast By Source, 2023 - 2030

- 5.5.1. Primary Alumiun

- 5.5.2. Secondary Aluminum

- 5.6. Current Market Size (US$ Mn) and Volume (Units) Forecast By Product Type, 2023 - 2030

- 5.6.1. Flat

- 5.6.2. Extruded

- 5.6.3. Forged

- 5.6.4. Cast

- 5.6.5. Wires & Cables

- 5.6.6. Misc. (Powder, Pastes, etc.)

- 5.7. Current Market Size (US$ Mn) and Volume (Units) Forecast By End Use, 2023 - 2030

- 5.7.1. Automotive

- 5.7.1.1. Conventional

- 5.7.1.2. Electric Vehicles

- 5.7.2. Transportation

- 5.7.2.1. Aerospace

- 5.7.2.2. Marine

- 5.7.2.3. Rail

- 5.7.3. Packaging

- 5.7.4. Construction

- 5.7.5. Consumer Durables

- 5.7.6. Machinery & Equipment

- 5.7.7. Electrical

- 5.7.8. Misc. (Sport Goods, etc.)

- 5.7.1. Automotive

- 5.8. Market Attractiveness Analysis

6. Europe Aluminum Market Outlook: Historical (2018 - 2022) and Forecast (2023 - 2030)

- 6.1. Key Highlights

- 6.2. Pricing Analysis

- 6.3. Historical Market Size (US$ Mn) and Volume (Units) Analysis By Market, 2018 - 2022

- 6.3.1. By Country

- 6.3.2. By Source

- 6.3.3. By Product Type

- 6.3.4. By End Use

- 6.4. Current Market Size (US$ Mn) and Volume (Units) Forecast By Country, 2023 - 2030

- 6.4.1. Germany

- 6.4.2. France

- 6.4.3. U.K.

- 6.4.4. Italy

- 6.4.5. Spain

- 6.4.6. Russia

- 6.4.7. T rkiye

- 6.4.8. Rest of Europe

- 6.5. Current Market Size (US$ Mn) and Volume (Units) Forecast By Source, 2023 - 2030

- 6.5.1. Primary Alumiun

- 6.5.2. Secondary Aluminum

- 6.6. Current Market Size (US$ Mn) and Volume (Units) Forecast By Product Type, 2023 - 2030

- 6.6.1. Flat

- 6.6.2. Extruded

- 6.6.3. Forged

- 6.6.4. Cast

- 6.6.5. Wires & Cables

- 6.6.6. Misc. (Powder, Pastes, etc.)

- 6.7. Current Market Size (US$ Mn) and Volume (Units) Forecast By End Use, 2023 - 2030

- 6.7.1. Automotive

- 6.7.1.1. Conventional

- 6.7.1.2. Electric Vehicles

- 6.7.2. Transportation

- 6.7.2.1. Aerospace

- 6.7.2.2. Marine

- 6.7.2.3. Rail

- 6.7.3. Packaging

- 6.7.4. Construction

- 6.7.5. Consumer Durables

- 6.7.6. Machinery & Equipment

- 6.7.7. Electrical

- 6.7.8. Misc. (Sport Goods, etc.)

- 6.7.1. Automotive

- 6.8. Market Attractiveness Analysis

7. East Asia Aluminum Market Outlook: Historical (2018 - 2022) and Forecast (2023 - 2030)

- 7.1. Key Highlights

- 7.2. Pricing Analysis

- 7.3. Historical Market Size (US$ Mn) and Volume (Units) Analysis By Market, 2018 - 2022

- 7.3.1. By Country

- 7.3.2. By Source

- 7.3.3. By Product Type

- 7.3.4. By End Use

- 7.4. Current Market Size (US$ Mn) and Volume (Units) Forecast By Country, 2023 - 2030

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. South Korea

- 7.5. Current Market Size (US$ Mn) and Volume (Units) Forecast By Source, 2023 - 2030

- 7.5.1. Primary Alumiun

- 7.5.2. Secondary Aluminum

- 7.6. Current Market Size (US$ Mn) and Volume (Units) Forecast By Product Type, 2023 - 2030

- 7.6.1. Flat

- 7.6.2. Extruded

- 7.6.3. Forged

- 7.6.4. Cast

- 7.6.5. Wires & Cables

- 7.6.6. Misc. (Powder, Pastes, etc.)

- 7.7. Current Market Size (US$ Mn) and Volume (Units) Forecast By End Use, 2023 - 2030

- 7.7.1. Automotive

- 7.7.1.1. Conventional

- 7.7.1.2. Electric Vehicles

- 7.7.2. Transportation

- 7.7.2.1. Aerospace

- 7.7.2.2. Marine

- 7.7.2.3. Rail

- 7.7.3. Packaging

- 7.7.4. Construction

- 7.7.5. Consumer Durables

- 7.7.6. Machinery & Equipment

- 7.7.7. Electrical

- 7.7.8. Misc. (Sport Goods, etc.)

- 7.7.1. Automotive

- 7.8. Market Attractiveness Analysis

8. South Asia & Oceania Aluminum Market Outlook: Historical (2018 - 2022) and Forecast (2023 - 2030)

- 8.1. Key Highlights

- 8.2. Pricing Analysis

- 8.3. Historical Market Size (US$ Mn) and Volume (Units) Analysis By Market, 2018 - 2022

- 8.3.1. By Country

- 8.3.2. By Source

- 8.3.3. By Product Type

- 8.3.4. By End Use

- 8.4. Current Market Size (US$ Mn) and Volume (Units) Forecast By Country, 2023 - 2030

- 8.4.1. India

- 8.4.2. Southeast Asia

- 8.4.3. ANZ

- 8.4.4. Rest of South Asia & Oceania

- 8.5. Current Market Size (US$ Mn) and Volume (Units) Forecast By Source, 2023 - 2030

- 8.5.1. Primary Alumiun

- 8.5.2. Secondary Aluminum

- 8.6. Current Market Size (US$ Mn) and Volume (Units) Forecast By Product Type, 2023 - 2030

- 8.6.1. Flat

- 8.6.2. Extruded

- 8.6.3. Forged

- 8.6.4. Cast

- 8.6.5. Wires & Cables

- 8.6.6. Misc. (Powder, Pastes, etc.)

- 8.7. Current Market Size (US$ Mn) and Volume (Units) Forecast By End Use, 2023 - 2030

- 8.7.1. Automotive

- 8.7.1.1. Conventional

- 8.7.1.2. Electric Vehicles

- 8.7.2. Transportation

- 8.7.2.1. Aerospace

- 8.7.2.2. Marine

- 8.7.2.3. Rail

- 8.7.3. Packaging

- 8.7.4. Construction

- 8.7.5. Consumer Durables

- 8.7.6. Machinery & Equipment

- 8.7.7. Electrical

- 8.7.8. Misc. (Sport Goods, etc.)

- 8.7.1. Automotive

- 8.8. Market Attractiveness Analysis

9. Latin America Aluminum Market Outlook: Historical (2018 - 2022) and Forecast (2023 - 2030)

- 9.1. Key Highlights

- 9.2. Pricing Analysis

- 9.3. Historical Market Size (US$ Mn) and Volume (Units) Analysis By Market, 2018 - 2022

- 9.3.1. By Country

- 9.3.2. By Source

- 9.3.3. By Product Type

- 9.3.4. By End Use

- 9.4. Current Market Size (US$ Mn) and Volume (Units) Forecast By Country, 2023 - 2030

- 9.4.1. Brazil

- 9.4.2. Mexico

- 9.4.3. Rest of Latin America

- 9.5. Current Market Size (US$ Mn) and Volume (Units) Forecast By Source, 2023 - 2030

- 9.5.1. Primary Alumiun

- 9.5.2. Secondary Aluminum

- 9.6. Current Market Size (US$ Mn) and Volume (Units) Forecast By Product Type, 2023 - 2030

- 9.6.1. Flat

- 9.6.2. Extruded

- 9.6.3. Forged

- 9.6.4. Cast

- 9.6.5. Wires & Cables

- 9.6.6. Misc. (Powder, Pastes, etc.)

- 9.7. Current Market Size (US$ Mn) and Volume (Units) Forecast By End Use, 2023 - 2030

- 9.7.1. Automotive

- 9.7.1.1. Conventional

- 9.7.1.2. Electric Vehicles

- 9.7.2. Transportation

- 9.7.2.1. Aerospace

- 9.7.2.2. Marine

- 9.7.2.3. Rail

- 9.7.3. Packaging

- 9.7.4. Construction

- 9.7.5. Consumer Durables

- 9.7.6. Machinery & Equipment

- 9.7.7. Electrical

- 9.7.8. Misc. (Sport Goods, etc.)

- 9.7.1. Automotive

- 9.8. Market Attractiveness Analysis

10. Middle East & Africa Aluminum Market Outlook: Historical (2018 - 2022) and Forecast (2023 - 2030)

- 10.1. Key Highlights

- 10.2. Pricing Analysis

- 10.3. Historical Market Size (US$ Mn) and Volume (Units) Analysis By Market, 2018 - 2022

- 10.3.1. By Country

- 10.3.2. By Source

- 10.3.3. By Product Type

- 10.3.4. By End Use

- 10.4. Current Market Size (US$ Mn) and Volume (Units) Forecast By Country, 2023 - 2030

- 10.4.1. GCC

- 10.4.2. Egypt

- 10.4.3. South Africa

- 10.4.4. Northern Africa

- 10.4.5. Rest of Middle East & Africa

- 10.5. Current Market Size (US$ Mn) and Volume (Units) Forecast By Source, 2023 - 2030

- 10.5.1. Primary Alumiun

- 10.5.2. Secondary Aluminum

- 10.6. Current Market Size (US$ Mn) and Volume (Units) Forecast By Product Type, 2023 - 2030

- 10.6.1. Flat

- 10.6.2. Extruded

- 10.6.3. Forged

- 10.6.4. Cast

- 10.6.5. Wires & Cables

- 10.6.6. Misc. (Powder, Pastes, etc.)

- 10.7. Current Market Size (US$ Mn) and Volume (Units) Forecast By End Use, 2023 - 2030

- 10.7.1. Automotive

- 10.7.1.1. Conventional

- 10.7.1.2. Electric Vehicles

- 10.7.2. Transportation

- 10.7.2.1. Aerospace

- 10.7.2.2. Marine

- 10.7.2.3. Rail

- 10.7.3. Packaging

- 10.7.4. Construction

- 10.7.5. Consumer Durables

- 10.7.6. Machinery & Equipment

- 10.7.7. Electrical

- 10.7.8. Misc. (Sport Goods, etc.)

- 10.7.1. Automotive

- 10.8. Market Attractiveness Analysis

11. Competition Landscape

- 11.1. Market Share Analysis, 2022

- 11.2. Market Structure

- 11.2.1. Competition Intensity Mapping By Market

- 11.2.2. Competition Analog IC

- 11.2.3. Apparent Product Capacity

- 11.3. Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- 11.3.1. Aluminum Corporation of China Limited (Chalco)

- 11.3.1.1. Overview

- 11.3.1.2. Segments and Product

- 11.3.1.3. Key Financials

- 11.3.1.4. Market Developments

- 11.3.1.5. Market Strategy

- 11.3.2. China Hongqiao Group Co. Ltd.

- 11.3.2.1. Overview

- 11.3.2.2. Segments and Product

- 11.3.2.3. Key Financials

- 11.3.2.4. Market Developments

- 11.3.2.5. Market Strategy

- 11.3.3. United Company Rusal IPJSC

- 11.3.3.1. Overview

- 11.3.3.2. Segments and Product

- 11.3.3.3. Key Financials

- 11.3.3.4. Market Developments

- 11.3.3.5. Market Strategy

- 11.3.4. Shandong Xinfa Aluminium Group

- 11.3.4.1. Overview

- 11.3.4.2. Segments and Product

- 11.3.4.3. Key Financials

- 11.3.4.4. Market Developments

- 11.3.4.5. Market Strategy

- 11.3.5. Rio Tinto Group

- 11.3.5.1. Overview

- 11.3.5.2. Segments and Product

- 11.3.5.3. Key Financials

- 11.3.5.4. Market Developments

- 11.3.5.5. Market Strategy

- 11.3.6. Emirates Global Aluminium

- 11.3.6.1. Overview

- 11.3.6.2. Segments and Product

- 11.3.6.3. Key Financials

- 11.3.6.4. Market Developments

- 11.3.6.5. Market Strategy

- 11.3.7. Alcoa Corporation

- 11.3.7.1. Overview

- 11.3.7.2. Segments and Product

- 11.3.7.3. Key Financials

- 11.3.7.4. Market Developments

- 11.3.7.5. Market Strategy

- 11.3.8. State Power Investment Corporation Limited (SPIC)

- 11.3.8.1. Overview

- 11.3.8.2. Segments and Product

- 11.3.8.3. Key Financials

- 11.3.8.4. Market Developments

- 11.3.8.5. Market Strategy

- 11.3.9. Norsk Hydro ASA

- 11.3.9.1. Overview

- 11.3.9.2. Segments and Product

- 11.3.9.3. Key Financials

- 11.3.9.4. Market Developments

- 11.3.9.5. Market Strategy

- 11.3.10. Hindalco Industries Limited

- 11.3.10.1. Overview

- 11.3.10.2. Segments and Product

- 11.3.10.3. Key Financials

- 11.3.10.4. Market Developments

- 11.3.10.5. Market Strategy

- 11.3.11. Vedanta Limited

- 11.3.11.1. Overview

- 11.3.11.2. Segments and Product

- 11.3.11.3. Key Financials

- 11.3.11.4. Market Developments

- 11.3.11.5. Market Strategy

- 11.3.12. South32 Limited

- 11.3.12.1. Overview

- 11.3.12.2. Segments and Product

- 11.3.12.3. Key Financials

- 11.3.12.4. Market Developments

- 11.3.12.5. Market Strategy

- 11.3.1. Aluminum Corporation of China Limited (Chalco)

12. Appendix

- 12.1. Research Methodology

- 12.2. Research Assumptions

- 12.3. Acronyms and Abbreviations