|

|

市場調査レポート

商品コード

1296891

IPカメラの世界市場2023-2030Global IP Camera Market 2023-2030 |

||||||

カスタマイズ可能

|

|||||||

| IPカメラの世界市場2023-2030 |

|

出版日: 2023年05月26日

発行: Orion Market Research

ページ情報: 英文 145 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のIPカメラ市場は、予測期間中にCAGR 12.8%で大きく成長しています。サーマルカメラの出現とビデオ監視におけるIoTの浸透により、インターネットプロトコルベースのカメラシステムの需要が大幅に増加しています。これらのカメラの商業ビルや住宅への採用が増加していることが、市場の成長を後押ししています。スマートホームの動向の高まりに伴い、セキュリティに対するニーズが高まっており、これが予測期間中のIPカメラ市場を牽引すると予測されています。セキュリティへの関心の高まりから、ビデオ監視は重要です。

スマートフォンユーザーの増加や、セキュリティソリューションの分割払いの利用が可能であることが、近い将来市場を牽引すると予測されます。これらのカメラの利点は、侵入者アラーム、周辺監視、アクセス制御、遠隔ビデオ監視です。ネットワーク技術の継続的な研究開発とともに、革新的なIPベース製品の製品リリースや発売は、市場の主要プレーヤーが採用する戦略的イニシアティブです。産業施設において、作業員の安全と安心を確保するための最新のセキュリティ技術に対する需要が高まっていることなどが、予測期間中にIPカメラ市場の成長が期待される要因です。

簡単な設置、無制限のストレージ機能、費用対効果の高い遠隔監視が、さまざまな産業分野でのカメラの採用を後押ししています。分散型ストレージソリッドステートデバイスを含むストレージデバイス容量の強化、高度なコーディング標準の採用、サーバ仮想化が予測期間中の市場成長を後押ししています。ユーザーは、インターネットに接続されたコンピューターやローカルネットワーク内のコンピューターを使って、世界中のどこからでも画像や動画を見ることができます。これらのシステムは、アナログの閉回路CCTVカメラに比べ、大きな拡張性と柔軟性を提供します。

さらに、政府施設、BFSI、軍事、防衛を含む様々な産業分野での赤外線ソリューションに対する需要の増加が市場成長に寄与しています。赤外線カメラは、住宅、ビジネス、公共施設のセキュリティと安全性を向上させるために、視認性の低い条件下で主に使用されています。これにより、交通・監視部門を含む政府部門は、夜間の道路セキュリティを管理することができます。同市場では、さまざまな企業が交通監視用に設計された赤外線ソリューションの開拓に取り組んでいます。例えば、フリアーシステムズは、戦術・法執行システム、交通監視システム、交通検知システムなど幅広い赤外線カメラを提供しています。

セグメント別の展望

企業は、マルチサーバー環境で動作する柔軟性と信頼性の向上により、分散型ソリューションに依存しています。これらの企業は、コスト効率の高いセキュリティソリューションの導入に注力しており、分散型技術への移行を促進しています。アプリケーション別に見ると、住宅、商業、工業、交通、政府、公共施設、その他があります。政府部門は、高度なセキュリティ技術に対する需要の高まりにより著しく成長しています。業界のさまざまなメーカーが、政府施設向けに特別に設計されたセキュリティソリューションを開発しています。

地域別展望

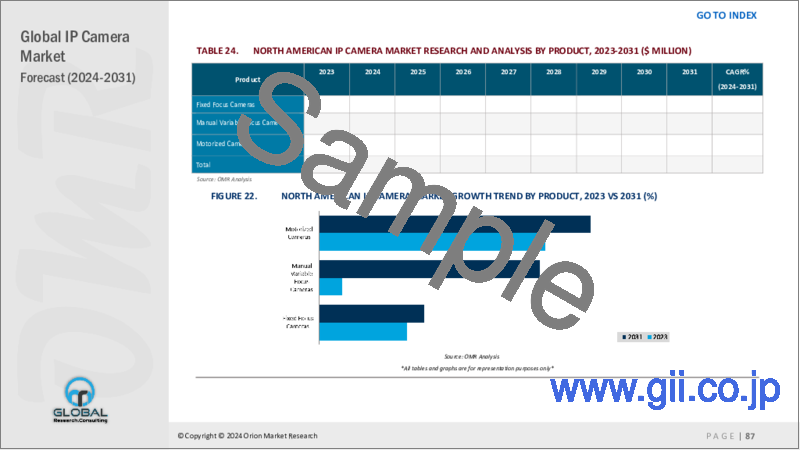

これらの地域の中で、北米地域は予測期間中にIPカメラ市場で大きなシェアを占めると予測されています。同地域におけるIPカメラ市場の成長は、主に大手企業の存在や同地域におけるセキュリティ懸念の高まりなどの要因によってもたらされます。例えば、2018年1月、アマゾンは米国で、買い物客が数百台のカメラを通して監視される自動化されたコンビニエンスストアの新規開店を紹介しました。したがって、このような要因が予測期間中のIPカメラ市場の成長に影響を与えると予想されます。

目次

第1章 レポート概要

- 業界の現状分析と成長ポテンシャルの展望

- 調査方法とツール

- 市場内訳

- セグメント別

- 地域別

第2章 市場概要と洞察

- 調査範囲

- アナリストの洞察と現在の市場動向

- 主な調査結果

- 推奨事項

- 結論

第3章 競合情勢

- 主要企業分析

- Axis Communications AB

- 概要

- 財務分析

- SWOT分析

- 最近の動向

- Robert Bosch GmbH

- 会社概要

- 財務分析

- SWOT分析

- 最近の動向

- Hangzhou Hikvision Digital Technology Co., Ltd.

- 概要

- 財務分析

- SWOT分析

- 最近の動向

- Hanwha Techwin Co., Ltd.

- 概要

- 財務分析

- SWOT分析

- 最近の動向

- Panasonic Corp.

- 概要

- 財務分析

- SWOT分析

- 最近の動向

- 主要戦略分析

第4章 市場セグメンテーション

- IPカメラの世界市場:製品別

- 固定焦点カメラ

- 手動可変焦点カメラ

- 電動カメラ

- IPカメラの世界市場:接続別

- 集中型

- 分散型

- IPカメラの世界市場:用途別

- 住宅用

- 商業用

- 産業用

- 運輸

- 政府機関

- 公共施設

- その他

- 重要インフラ

第5章 地域分析

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- イタリア

- スペイン

- フランス

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 世界のその他の地域

第6章 企業プロファイル

- Alarm.com

- Axis Communications AB

- Cisco System, Inc.

- Costar Video Systems

- Genetec Inc.

- GeoVision Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hanwha Techwin Co., Ltd.

- Honeywell International, Inc.

- Infinova Canada, Ltd.

- Johnson Control, Inc.

- Kintronics, Inc.

- Konica Minolta Business Solutions U.S.A., Inc.

- NETGEAR Inc.

- Panasonic Corp.

- Robert Bosch GmbH

- Schneider Electric SE

- Shenzhen Apexis Electronic Co., Ltd.

- Sony Corp.

- VIVOTEK, Inc.

- Zhejiang Dahua Technology Co., Ltd.

LIST OF TABLES

- 1. GLOBAL IP CAMERA MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

- 2. GLOBAL FIXED FOCUS CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 3. GLOBAL MANUAL VARIABLE FOCUS CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 4. GLOBAL MOTORIZED CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 5. GLOBAL IP CAMERA MARKET RESEARCH AND ANALYSIS BY CONNECTION, 2022-2030 ($ MILLION)

- 6. GLOBAL CENTRALIZED IP CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 7. GLOBAL DECENTRALIZED IP CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 8. GLOBAL IP CAMERA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

- 9. GLOBAL RESIDENTIAL IP CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 10. GLOBAL INDUSTRIAL IP CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 11. GLOBAL PUBLIC PLACES IP CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 12. GLOBAL TRANSPORTATION IP CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 13. GLOBAL IP CAMERA GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 14. GLOBAL COMMERCIAL IP CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 15. GLOBAL OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

- 16. NORTH AMERICA IP CAMERA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

- 17. NORTH AMERICAN IP CAMERA MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

- 18. NORTH AMERICAN IP CAMERA MARKET RESEARCH AND ANALYSIS BY CONNECTION, 2022-2030 ($ MILLION)

- 19. NORTH AMERICAN IP CAMERA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

- 20. EUROPE IP CAMERA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

- 21. EUROPE IP CAMERA MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

- 22. EUROPE IP CAMERA MARKET RESEARCH AND ANALYSIS BY CONNECTION, 2022-2030 ($ MILLION)

- 23. EUROPE IP CAMERA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

- 24. ASIA-PACIFIC IP CAMERA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

- 25. ASIA-PACIFIC IP CAMERA MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

- 26. ASIA-PACIFIC IP CAMERA MARKET RESEARCH AND ANALYSIS BY CONNECTION, 2022-2030 ($ MILLION)

- 27. ASIA-PACIFIC IP CAMERA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

- 28. REST OF THE WORLD IP CAMERA MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

- 29. REST OF THE WORLD IP CAMERA MARKET RESEARCH AND ANALYSIS BY CONNECTION, 2022-2030 ($ MILLION)

- 30. REST OF THE WORLD IP CAMERA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

LIST OF FIGURES

- 1. GLOBAL IP CAMERA MARKET SHARE BY PRODUCT, 2022 VS 2030 (%)

- 2. GLOBAL IP CAMERA MARKET SHARE BY CONNECTION, 2022 VS 2030 (%)

- 3. GLOBAL IP CAMERA MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

- 4. GLOBAL IP CAMERA MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 5. GLOBAL FIXED FOCUS CAMERAS MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 6. GLOBAL MANUAL VARIABLE FOCUS CAMERAS MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 7. GLOBAL MOTORIZED CAMERAS MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 8. GLOBAL CENTRALIZED IP CAMERA MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 9. GLOBAL DECENTRALIZED IP CAMERA MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 10. GLOBAL RESIDENTIAL IP CAMERA MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 11. GLOBAL INDUSTRIAL IP CAMERA MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 12. GLOBAL PUBLIC PLACES IP CAMERA MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 13. GLOBAL TRANSPORTATION IP CAMERA MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 14. GLOBAL IP CAMERA GOVERNMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 15. GLOBAL COMMERCIAL IP CAMERA MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 16. GLOBAL OTHER APPLICATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

- 17. THE US IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 18. CANADA IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 19. UK IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 20. FRANCE IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 21. GERMANY IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 22. ITALY IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 23. SPAIN IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 24. ROE IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 25. INDIA IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 26. CHINA IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 27. JAPAN IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 28. REST OF ASIA-PACIFIC IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

- 29. REST OF THE WORLD IP CAMERA MARKET SIZE, 2022-2030 ($ MILLION)

Global IP camera market is significantly growing at a CAGR of 12.8% during the forecast period. The emergence of thermal cameras and the penetration of IoT in video surveillance have resulted in a significant increase in the demand for Internet protocol-based camera systems. The growing adoption of these cameras in commercial and residential buildings has propelled the market growth. There is a need for security with the growing trend of smart homes that is anticipated to drive the IP camera market during the forecast period. Video surveillance is important due to the increasing security concern.

The increasing number of smartphone users and the availability of installment policies for security solutions are projected to drive the market in the near future. The benefits of these cameras are intruder alarms, perimeter surveillance, access control, and remote video surveillance. The product releases and launches of innovative IP-based products along with ongoing research and development in networking technology are the strategic initiatives adopted by key market players in the market. Factors such as the growing demand for modern security technologies in industrial facilities to ensure the safety and security of workers are expected to grow in the IP camera market during the forecast period.

Easy installation, limitless storage capabilities, and cost-effective and remote monitoring have propelled the adoption of cameras across different industry verticals. Enhancements in storage device capacities that include decentralized storage solid-state devices, adoption of advanced coding standards, and server virtualization are boosting the growth of the market during the forecast period. The users can view images and videos by a computer connected to the internet and within a local network from anywhere across the globe. These systems offer a large degree of scalability and flexibility as compared to analog closed-circuit CCTV cameras.

Additionally, an increase in demand for infrared solutions in the various industrial sectors that include government facilities, BFSI, military, and defense is contributing to market growth. Infrared cameras are largely used for improving the security and safety of residential, business, and public facilities in low visibility conditions. It allows governmental departments that include traffic & surveillance units to manage road security at nighttime. Various market players in the market are engaged in developing an infrared solution that is designed for the application of traffic monitoring and surveillance. For instance, the FLIR system provides a large range of thermal cameras with tactical & law enforcement systems, traffic monitoring systems, and traffic detection systems.

Segmental Outlook

The global IP camera market is segmented based on product, connection, and application. Based on the product, the market is segmented into fixed-focus cameras, manual variable-focus cameras, and motorized cameras. Based on the connection, the market is segmented into centralized and decentralized. Decentralized systems have witnessed large adoption in the market due to the rising number of video surveillance solutions that are being installed in facilities. It comprises the feature of built-in storage that allows the data to be stored in a digital media storage device that includes a flash drive, hard disk drive, SD card, and network-attached storage that decreases the cost of buying video recorder solutions.

Enterprises are dependent on decentralized solutions owing to growing flexibility and reliability to operate in a multi-server environment. These organizations are focusing on implementing cost-effective security solutions which are enhancing them to shift to decentralized technologies that propel the growth of the IP camera market during the forecast period. Based on the application, residential, commercial, industrial, transportation, government, public places, and others. The government sector is significantly growing owing to the rising demand for advanced security technologies. Different manufacturers in the industry are developing security solutions specifically designed for government facilities.

Regional Outlooks

Global IP camera market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific holds the largest market share in the IP camera market during the forecast period due to the high demand in industrial, critical infrastructure, transportation, and military & defense sectors. Additionally, the ongoing enhancement of various SMEs and large enterprises in emerging economies along with the Smart City project is expected to create a demand for security solutions.

Among these regions, the North American region is anticipated to account for a significant share of the IP camera market during the forecast period. The growth of the IP camera market in the region is primarily driven by factors such as the presence of major companies and growing security concerns in the region. For instance, in January 2018, Amazon introduced the opening of a new automated convenience store in the US where shoppers are monitored through hundreds of cameras. Thus, such factors are expected to impact the growth of the IP camera market during the forecast period.

Market Players Outlook

The key players in the IP camera market include Panasonic Corp., Sony Corp., Axis Communications AB, Honeywell International, Inc. Robert Bosch GmbH, Hangzhou Hikvision Digital Technology Co., Ltd., Hanwha Techwin Co., Ltd., and Schneider Electric SE.

Table of Contents

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- 1.1. Research Methods and Tools

- 1.2. Market Breakdown

- 1.2.1. By Segments

- 1.2.2. By Region

2. Market Overview and Insights

- 2.1. Scope of the Report

- 2.2. Analyst Insight & Current Market Trends

- 2.2.1. Key Findings

- 2.2.2. Recommendations

- 2.2.3. Conclusion

3. Competitive Landscape

- 3.1. Key Company Analysis

- 3.2. Axis Communications AB

- 3.2.1. Overview

- 3.2.2. Financial Analysis

- 3.2.3. SWOT Analysis

- 3.2.4. Recent Developments

- 3.3. Robert Bosch GmbH

- 3.3.1. Overview

- 3.3.2. Financial Analysis

- 3.3.3. SWOT Analysis

- 3.3.4. Recent Developments

- 3.4. Hangzhou Hikvision Digital Technology Co., Ltd.

- 3.4.1. Overview

- 3.4.2. Financial Analysis

- 3.4.3. SWOT Analysis

- 3.4.4. Recent Developments

- 3.5. Hanwha Techwin Co., Ltd.

- 3.5.1. Overview

- 3.5.2. Financial Analysis

- 3.5.3. SWOT Analysis

- 3.5.4. Recent Developments

- 3.6. Panasonic Corp.

- 3.6.1. Overview

- 3.6.2. Financial Analysis

- 3.6.3. SWOT Analysis

- 3.6.4. Recent Developments

- 3.7. Key Strategy Analysis

4. Market Segmentation

- 4.1. Global IP Camera Market by Product

- 4.1.1. Fixed Focus Cameras

- 4.1.2. Manual Variable Focus Cameras

- 4.1.3. Motorized Cameras

- 4.2. Global IP Camera Market by Connection

- 4.2.1. Centralized

- 4.2.2. Decentralized

- 4.3. Global IP Camera Market by Application

- 4.3.1. Residential

- 4.3.2. Commercial

- 4.3.3. Industrial

- 4.3.4. Transportation

- 4.3.5. Government

- 4.3.6. Public Places

- 4.3.7. Other

- 4.3.7.1. Critical Infrastructure

5. Regional Analysis

- 5.1. North America

- 5.1.1. United States

- 5.1.2. Canada

- 5.2. Europe

- 5.2.1. UK

- 5.2.2. Germany

- 5.2.3. Italy

- 5.2.4. Spain

- 5.2.5. France

- 5.2.6. Rest of Europe

- 5.3. Asia-Pacific

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Rest of the World

6. Company Profiles

- 6.1. Alarm.com

- 6.2. Axis Communications AB

- 6.3. Cisco System, Inc.

- 6.4. Costar Video Systems

- 6.5. Genetec Inc.

- 6.6. GeoVision Inc.

- 6.7. Hangzhou Hikvision Digital Technology Co., Ltd.

- 6.8. Hanwha Techwin Co., Ltd.

- 6.9. Honeywell International, Inc.

- 6.10. Infinova Canada, Ltd.

- 6.11. Johnson Control, Inc.

- 6.12. Kintronics, Inc.

- 6.13. Konica Minolta Business Solutions U.S.A., Inc.

- 6.14. NETGEAR Inc.

- 6.15. Panasonic Corp.

- 6.16. Robert Bosch GmbH

- 6.17. Schneider Electric SE

- 6.18. Shenzhen Apexis Electronic Co., Ltd.

- 6.19. Sony Corp.

- 6.20. VIVOTEK, Inc.

- 6.21. Zhejiang Dahua Technology Co., Ltd.