|

|

市場調査レポート

商品コード

1780263

オンデバイスAIの世界市場、コンポーネント別、展開別、テクノロジー別、地域別、機会、予測、2018年~2032年Global On-Device AI Market Assessment, By Component, By Deployment, By Technology, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| オンデバイスAIの世界市場、コンポーネント別、展開別、テクノロジー別、地域別、機会、予測、2018年~2032年 |

|

出版日: 2025年07月31日

発行: Markets & Data

ページ情報: 英文 237 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のオンデバイスAI市場は、予測期間2025-2032年のCAGRが15.67%に達し、2024年の54億米ドルから2032年には173億米ドルに成長すると予測されます。世界のオンデバイスAI市場は、リアルタイム処理、データプライバシーの強化、クラウドインフラへの依存度の低減に対する需要の高まりにより急速に拡大しています。AIチップセットとモデル最適化の進歩により、スマートフォン、ウェアラブル、エッジデバイスにインテリジェント機能をシームレスに統合できるようになっています。

スマートフォン、ウェアラブル、スマートホームシステム、産業用IoTデバイス、その他のテクノロジーが日常生活やビジネスにますます統合されるにつれ、クラウドインフラストラクチャに縛られるのではなく、ローカルのAI処理機能に対する需要が急増しています。このパラダイムシフトは、データの処理、共有、安全性の確保方法に顕著な変化をもたらし、インテリジェントなエッジコンピューティングの新時代を切り開いています。オンデバイスAIは、データプライバシーへの懸念が高まる中、また、低遅延、セキュリティ強化、オフライン機能が求められる遠隔地やリアルタイムの使用事例における接続制限の中で、魅力的な価値を提供します。AIモデル圧縮の急速な発展、ニューラル・プロセッシング・ユニット(NPU)などの革新的なチップ設計、軽量ニューラルアーキテクチャの大幅な進歩により、リソースに制約のあるデバイスでも、音声認識、コンピュータ・ビジョン、自然言語処理、高度な分析などの複雑なタスクをほぼリアルタイムで実行できるようになりました。自動車、ヘルスケア、家電など、インテリジェントで分散型のAIソリューションを採用する業界が増えるにつれ、世界のオンデバイスAI市場は上昇の一途をたどっており、革新的なテクノロジー体験の次の時代を支えることになると思われます。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 米国の関税の影響

第4章 エグゼクティブサマリー

第5章 お客様の声

- 回答者の人口統計

- ブランド認知度

- 購入決定時に考慮される要素

- 購入後に直面する課題

第6章 世界のオンデバイスAI市場の展望、2018年~2032年

- 市場規模分析と予測

- 金額別

- 市場シェア分析と予測

- コンポーネント別

- ハードウェア

- ソフトウェア

- 展開別

- クラウド

- オンプレミス

- テクノロジー別

- オンデバイスAI

- 自然言語処理

- コンピュータービジョン

- 音声認識

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 企業別市場シェア分析(上位5社およびその他- 金額別、2024年)

- コンポーネント別

- 2024年市場マップ分析

- コンポーネント別

- 展開別

- テクノロジー別

- 地域別

第7章 北米のオンデバイスAI市場の展望、2018年~2032年

- 市場規模分析と予測

- 金額別

- 市場シェア分析と予測

- コンポーネント別

- ハードウェア

- ソフトウェア

- 展開別

- クラウド

- オンプレミス

- テクノロジー別

- オンデバイスAI

- 自然言語処理

- コンピュータービジョン

- 音声認識

- 国別

- 米国

- カナダ

- メキシコ

- コンポーネント別

- 国別市場評価

- 米国のオンデバイスAI市場展望(2018年~2032年)

- 市場規模分析と予測

- 市場シェア分析と予測

- 米国のオンデバイスAI市場展望(2018年~2032年)

すべてのセグメントは、対象となるすべての地域と国に提供されます。

第8章 欧州のオンデバイスAI市場の展望、2018年~2032年

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第9章 アジア太平洋のオンデバイスAI市場の展望、2018年~2032年

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第10章 南米のオンデバイスAI市場の展望、2018年~2032年

- ブラジル

- アルゼンチン

第11章 中東・アフリカのオンデバイスAI市場の展望、2018年~2032年

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第12章 ポーターのファイブフォース分析

第13章 PESTLE分析

第14章 市場力学

- 市場促進要因

- 市場の課題

第15章 市場動向と発展

第16章 ケーススタディ

第17章 競合情勢

- 市場リーダー上位5社の競合マトリックス

- トップ5企業のSWOT分析

- 市場トップ10の主要企業の情勢

- Advanced Micro Devices, Inc.

- 会社概要

- 主要経営陣

- 提供される主な製品/サービス

- 主要財務状況(報告時点)

- 主要市場への注力と地理的プレゼンス

- 最近の動向/コラボレーション/ パートナーシップ/ 合併と買収

- Amazon.com, Inc.

- Apple Inc.

- Google LLC

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Untether AI

- Meta Platforms, Inc.

上記の企業は市場シェアに応じて注文を保留するものではなく、調査作業中に入手可能な情報に応じて変更される可能性があります。

第18章 戦略的提言

第19章 調査会社について・免責事項

List of Tables

- Table 1. Competition Matrix of Top 5 Market Leaders

- Table 2. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 3. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 2. Global On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 3. Global On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 4. Global On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 5. Global On-Device AI Market Share (%), By Region, 2018-2032F

- Figure 6. North America On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 7. North America On-Device AI Market Share (%), By Component, 2018-2032F

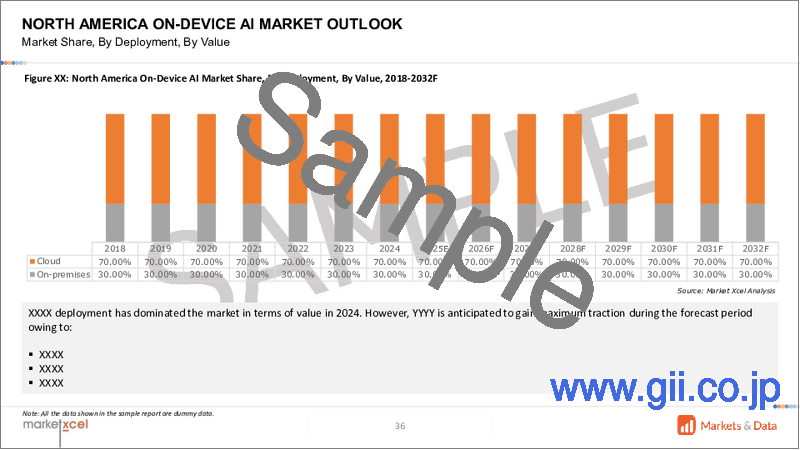

- Figure 8. North America On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 9. North America On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 10. North America On-Device AI Market Share (%), By Country, 2018-2032F

- Figure 11. United States On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 12. United States On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 13. United States On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 14. United States On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 15. Canada On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 16. Canada On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 17. Canada On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 18. Canada On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 19. Mexico On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 20. Mexico On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 21. Mexico On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 22. Mexico On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 23. Europe On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 24. Europe On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 25. Europe On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 26. Europe On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 27. Europe On-Device AI Market Share (%), By Country, 2018-2032F

- Figure 28. Germany On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 29. Germany On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 30. Germany On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 31. Germany On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 32. France On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 33. France On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 34. France On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 35. France On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 36. Italy On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 37. Italy On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 38. Italy On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 39. Italy On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 40. United Kingdom On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 41. United Kingdom On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 42. United Kingdom On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 43. United Kingdom On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 44. Russia On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 45. Russia On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 46. Russia On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 47. Russia On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 48. Netherlands On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 49. Netherlands On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 50. Netherlands On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 51. Netherlands On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 52. Spain On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 53. Spain On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 54. Spain On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 55. Spain On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 56. Turkey On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 57. Turkey On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 58. Turkey On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 59. Turkey On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 60. Poland On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 61. Poland On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 62. Poland On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 63. Poland On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 64. South America On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 65. South America On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 66. South America On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 67. South America On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 68. South America On-Device AI Market Share (%), By Country, 2018-2032F

- Figure 69. Brazil On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 70. Brazil On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 71. Brazil On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 72. Brazil On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 73. Argentina On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 74. Argentina On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 75. Argentina On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 76. Argentina On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 77. Asia-Pacific On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 78. Asia-Pacific On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 79. Asia-Pacific On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 80. Asia-Pacific On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 81. Asia-Pacific On-Device AI Market Share (%), By Country, 2018-2032F

- Figure 82. India On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 83. India On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 84. India On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 85. India On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 86. China On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 87. China On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 88. China On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 89. China On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 90. Japan On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 91. Japan On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 92. Japan On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 93. Japan On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 94. Australia On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 95. Australia On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 96. Australia On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 97. Australia On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 98. Vietnam On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 99. Vietnam On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 100. Vietnam On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 101. Vietnam On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 102. South Korea On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 103. South Korea On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 104. South Korea On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 105. South Korea On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 106. Indonesia On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 107. Indonesia On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 108. Indonesia On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 109. Indonesia On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 110. Philippines On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 111. Philippines On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 112. Philippines On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 113. Philippines On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 114. Middle East & Africa On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 115. Middle East & Africa On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 116. Middle East & Africa On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 117. Middle East & Africa On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 118. Middle East & Africa On-Device AI Market Share (%), By Country, 2018-2032F

- Figure 119. Saudi Arabia On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 120. Saudi Arabia On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 121. Saudi Arabia On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 122. Saudi Arabia On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 123. UAE On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 124. UAE On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 125. UAE On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 126. UAE On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 127. South Africa On-Device AI Market, By Value, In USD Billion, 2018-2032F

- Figure 128. South Africa On-Device AI Market Share (%), By Component, 2018-2032F

- Figure 129. South Africa On-Device AI Market Share (%), By Deployment, 2018-2032F

- Figure 130. South Africa On-Device AI Market Share (%), By Technology, 2018-2032F

- Figure 131. By Component Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 132. By Deployment Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 133. By Technology Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 134. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global on-device AI market is projected to witness a CAGR of 15.67% during the forecast period 2025-2032, growing from USD 5.40 billion in 2024 to USD 17.30 billion in 2032. The global on-device AI market is rapidly expanding due to the growing demand for real-time processing, enhanced data privacy, and reduced dependency on cloud infrastructure. Advancements in AI chipsets and model optimization are enabling seamless integration of intelligent features across smartphones, wearables, and edge devices.

With the increasing integration of smartphones, wearables, smart home systems, industrial IoT devices, and other technologies into daily life and business, the demand for local AI processing capabilities, rather than being tied to cloud infrastructure, has skyrocketed. This paradigm shift is creating a notable change in how we process, share, and secure data, ushering in a new era of intelligent edge computing. On-device AI offers compelling value in an era of growing data privacy concerns, as well as connectivity limitations in remote or real-time use cases, where lower latency, enhanced security, and offline capabilities are required. Rapid developments in AI model compression, innovative chip designs, such as Neural Processing Units (NPUs), and significant advancements in lightweight neural architectures have enabled resource-constrained devices to perform complex tasks, including speech recognition, computer vision, natural language processing, and advanced analytics, in near real-time. As more industries adopt intelligent, decentralized AI solutions, including automotive, healthcare, and consumer electronics, the global on-device AI market has nowhere to go but up, and will support the next era of innovative technology experiences.

Rising Demand for Privacy-Centric AI Solutions Drives Global On-Device AI Market Growth

As data privacy continues to be a significant issue, the demand for AI models that run directly on users' devices (without a cloud connection) is skyrocketing. On-device AI visits less data to third-party cloud services, creating less risk of data breaches and risk of sensitive data (personal messages, biological identifiers, locations) being left out in the world, while also being compliant with various global data protection regulations (GDPR, CCPA), for example. When consumers become more privacy-conscious, providing data-free AI will be viewed as a more strategic approach.

This recent emerging demand was demonstrated in March of 2025 when Qualcomm Technologies, Inc. released its latest on-device AI development at MWC 2025. Qualcomm detailed its new Snapdragon platforms, which were developed to deliver higher, faster, and more efficient AI across mobile phones, IoT devices, and vehicles. These new chipsets enable the ability to run complex tasks locally, such as voice recognition, computer vision, or contextual AI, with no reliance on the internet or external connections. Thus, it improves user privacy and latency. This new perspective, which prioritizes privacy and leans towards device-based processing, is influencing the mapping of AI development strategies.

Growing Need for Low-Latency AI Across Edge Devices Accelerates the Market Growth

Low latency is a key feature for applications running on smartphones, wearables, autonomous vehicles, and industrial IoT devices. While cloud AI is powerful, it suffers from the latency of internet connectivity and server load times. On-device AI enables users to perform final inference locally on devices, allowing for real-time decision-making in often time-sensitive applications, such as navigation, augmented reality, voice assistance, and security monitoring.

An excellent demonstration of this trend is Google LLC's launch of Gemma 3n in June 2025. Gemma 3n is a lightweight multimodal AI model that only needs 2 GB of RAM to operate. This model can accept audio, image, video, and text as inputs, all while operating directly on edge devices such as smartphones. Using the Gemma 3n model allows for quick responsiveness in offline applications. The underlying architecture of Gemma 3n ensures that edge-AI features, such as speech recognition or photo enhancement, do not lag (or appear to lag) regardless of whether the device is connected to the network. This transition from cloud AI to low-latency, high-performance AI is crucial to unlocking the next generation of intelligent edge applications. As businesses and governments explore ways to reduce reliance on cloud infrastructure while capturing speed and features, investment in on-device models and specialized chipsets is accelerating market development.

Natural Language Processing Segment Holds a Significant Share in Global On-Device AI Market

Natural Language Processing (NLP) is a crucial component of the global on-device AI ecosystem, as these applications are embedded in personal devices, enterprise tools, and embedded devices. In other words, NLP enables machines to comprehend, interpret, and generate human language. Applications such as real-time transcription services like Otter, intelligent voice assistant services like Siri, predictive text features like the "suggested text" function on smartphones, as well as AI-prompted summarization tools such as ChatGPT, are heavily reliant on NLP capabilities to operate. As demand from users for accelerated, context-based interaction escalates and the pressure regarding data privacy increases, NLP models that run directly have become a vital differentiator in an evolving AI ecosystem.

One of the most prominent examples of this transition in the market occurred in March 2025. It was at this time that Arm Limited developed on-device processing optimization of the "Stable Audio Open" model with Stability AI, utilizing Arm's KleidiAI technology. This technology enables Arm CPUs to process data 30 times faster, ultimately allowing mobile devices to create high-quality custom audio clips from natural language prompts, all without requiring an internet connection. This advancement illustrates how, when combined with modern hardware, on-device natural language processing has the potential to transform how audio is created and interacted with by users, offering reduced latency and improved privacy. As NLP advances towards transformer models and multimodal learning, it will gain influence in adding intelligence and interactions to devices at the edge. It is already the leading segment in the on-device AI ecosystem and the practical applications will continue to increase.

North America Dominates the Global On-Device AI Market

North America is currently the dominant region in the global on-device AI market, driven by its advanced technological infrastructure, concentration of AI and semiconductor companies, and increasing ownership of smart devices. This area is home to key players in this space who are investing heavily in on-device AI and driving innovation. These companies are embedding more sophisticated AI features into more user devices (smartphones, wearables, personal computing devices, and automobiles) in ways that improve the user experience while retaining users' data privacy. Regional dominance is reinforced by favorable government initiatives, a digitally literate user base, and a culture of research and development (R&D) conducive to on-device AI advancements. North America also has a highly thriving startup ecosystem that is rapidly exploring the applications of edge AI, particularly in the domains of health technologies, automotive, and industrial automation.

A notable example of this trend was demonstrated in June 2025 when Apple Inc. (California, US) announced new Apple Intelligence features at WWDC 2025, which allowed data models to run completely on-device. Meaning that these AI models run on iPhones, iPads and Macs entirely on-device, improving performance while also meeting privacy concerns, which are a prevalent consumer concern in North America. With continuous investment in this technology, North America is likely to maintain its leadership in on-device AI, as it is technologically ahead in terms of experience, has a high level of ownership penetration, and is experiencing emerging technological advancements.

Impact of U.S. Tariffs on Global On-Device AI Market

The ramifications of U.S. tariffs on on-device AI are modest but still significant. Tariff restrictions on semiconductors and other electronic components from China are a known source of cost increase for U.S.-based firms. Still, many companies have attempted to offset these impacts by diversifying their global supply chains and/or relocating production to other non-tariff countries. These costs represent additional expenses for consumers that may indirectly impact on the pricing and availability of AI-enabled consumer devices. However, the predominant domestic tech giants associated with on-device AI are Apple, Qualcomm, and Google, so the U.S. is likely to continue leading the field. In the long term, if tariffs persist, there may be increased regional production of chips to strengthen vertical integration and resilience; however, this could lead to less global collaboration and sharing of technology.

Key Players Landscape and Outlook

The global on-device AI market is fragmented, with a handful of technology companies vying to provide the public with faster, more private, and efficient AI capabilities on-device. A combination of well-established semiconductor manufacturers, cloud companies, consumer electronics companies, and AI-based companies frames the market. Notable players in the on-device AI market include Apple Inc., Google LLC, Microsoft Corporation, and others who have been working on integrating generative AI capabilities into mobile phones, laptops, smartwatches, autonomous vehicles, and IoT devices by effectively optimizing the hardware and software of on-device AI for low-power, high-performance processing.

One notable event was in May 2025, when NVIDIA Corporation launched its AI-First DGX personal computing solutions in collaboration with leading hardware manufacturers. These solutions aim to deliver data center-class AI performance on local devices, enabling enterprises and developers to build and run their advanced on-device AI workloads without relying on the cloud. Additionally, they launched NV Link Fusion, a new silicon-based architecture that enables semi-custom AI infrastructures on silicon, completing NVIDIA's strategy for decentralizing AI computation and providing scalability for edge AI across various industries.

The future for the on-device AI space looks promising. With the increasing demand for real-time AI, user privacy, and enhanced efficiency of edge computing, companies will move towards greater innovation. For customers and stakeholders, it will be essential to partner with vendors that offer scalable, secure and power-efficient on-device AI solutions. On-device AI adoption will continue to advance with improvements in AI chips, model compression, and integration at the operating system level, benefiting both developed and developing markets.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Impact of U.S. Tariffs

4. Executive Summary

5. Voice of Customers

- 5.1. Respondent Demographics

- 5.2. Brand Awareness

- 5.3. Factors Considered in Purchase Decisions

- 5.4. Challenges Faced Post Purchase

6. Global On-Device AI Market Outlook, 2018-2032F

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Component

- 6.2.1.1. Hardware

- 6.2.1.2. Software

- 6.2.2. By Deployment

- 6.2.2.1. Cloud

- 6.2.2.2. On-premises

- 6.2.3. By Technology

- 6.2.3.1. On-Device AI

- 6.2.3.2. Natural Language Processing

- 6.2.3.3. Computer Vision

- 6.2.3.4. Speech Recognition

- 6.2.4. By Region

- 6.2.4.1. North America

- 6.2.4.2. Europe

- 6.2.4.3. Asia-Pacific

- 6.2.4.4. South America

- 6.2.4.5. Middle East and Africa

- 6.2.5. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 6.2.1. By Component

- 6.3. Market Map Analysis, 2024

- 6.3.1. By Component

- 6.3.2. By Deployment

- 6.3.3. By Technology

- 6.3.4. By Region

7. North America On-Device AI Market Outlook, 2018-2032F

- 7.1. Market Size Analysis & Forecast

- 7.1.1. By Value

- 7.2. Market Share Analysis & Forecast

- 7.2.1. By Component

- 7.2.1.1. Hardware

- 7.2.1.2. Software

- 7.2.2. By Deployment

- 7.2.2.1. Cloud

- 7.2.2.2. On-premises

- 7.2.3. By Technology

- 7.2.3.1. On-Device AI

- 7.2.3.2. Natural Language Processing

- 7.2.3.3. Computer Vision

- 7.2.3.4. Speech Recognition

- 7.2.4. By Country

- 7.2.4.1. United States

- 7.2.4.2. Canada

- 7.2.4.3. Mexico

- 7.2.1. By Component

- 7.3. Country Market Assessment

- 7.3.1. United States On-Device AI Market Outlook, 2018-2032F

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share Analysis & Forecast

- 7.3.1.2.1. By Component

- 7.3.1.2.1.1. Hardware

- 7.3.1.2.1.2. Software

- 7.3.1.2.2. By Deployment

- 7.3.1.2.2.1. Cloud

- 7.3.1.2.2.2. On-premises

- 7.3.1.2.3. By Technology

- 7.3.1.2.3.1. On-Device AI

- 7.3.1.2.3.2. Natural Language Processing

- 7.3.1.2.3.3. Computer Vision

- 7.3.1.2.3.4. Speech Recognition

- 7.3.1.2.1. By Component

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.1. United States On-Device AI Market Outlook, 2018-2032F

All segments will be provided for all regions and countries covered

8. Europe On-Device AI Market Outlook, 2018-2032F

- 8.1. Germany

- 8.2. France

- 8.3. Italy

- 8.4. United Kingdom

- 8.5. Russia

- 8.6. Netherlands

- 8.7. Spain

- 8.8. Turkey

- 8.9. Poland

9. Asia-Pacific On-Device AI Market Outlook, 2018-2032F

- 9.1. India

- 9.2. China

- 9.3. Japan

- 9.4. Australia

- 9.5. Vietnam

- 9.6. South Korea

- 9.7. Indonesia

- 9.8. Philippines

10. South America On-Device AI Market Outlook, 2018-2032F

- 10.1. Brazil

- 10.2. Argentina

11. Middle East and Africa On-Device AI Market Outlook, 2018-2032F

- 11.1. Saudi Arabia

- 11.2. UAE

- 11.3. South Africa

12. Porter's Five Forces Analysis

13. PESTLE Analysis

14. Market Dynamics

- 14.1. Market Drivers

- 14.2. Market Challenges

15. Market Trends and Developments

16. Case Studies

17. Competitive Landscape

- 17.1. Competition Matrix of Top 5 Market Leaders

- 17.2. SWOT Analysis for Top 5 Players

- 17.3. Key Players Landscape for Top 10 Market Players

- 17.3.1. Advanced Micro Devices, Inc.

- 17.3.1.1. Company Details

- 17.3.1.2. Key Management Personnel

- 17.3.1.3. Key Products/Services Offered

- 17.3.1.4. Key Financials (As Reported)

- 17.3.1.5. Key Market Focus and Geographical Presence

- 17.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 17.3.2. Amazon.com, Inc.

- 17.3.3. Apple Inc.

- 17.3.4. Google LLC

- 17.3.5. Intel Corporation

- 17.3.6. Microsoft Corporation

- 17.3.7. NVIDIA Corporation

- 17.3.8. Qualcomm Technologies, Inc.

- 17.3.9. Untether AI

- 17.3.10. Meta Platforms, Inc.

- 17.3.1. Advanced Micro Devices, Inc.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.