|

|

市場調査レポート

商品コード

1619489

外壁システム市場:製品タイプ別、エンドユーザー別、地域別、機会、予測、2018年~2032年Exterior Wall System Market Assessment, By Product, By Type, By End-user, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 外壁システム市場:製品タイプ別、エンドユーザー別、地域別、機会、予測、2018年~2032年 |

|

出版日: 2024年12月23日

発行: Markets & Data

ページ情報: 英文 227 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の外壁システムの市場規模は、2025年~2032年の予測期間中に7.46%のCAGRで拡大し、2024年の1,717億6,000万米ドルから2032年には3,054億2,000万米ドルに成長すると予測されています。外壁システム市場は、世界の建設ブーム、持続可能性への要求の高まり、継続的な技術進歩に後押しされ、大幅な成長を遂げています。エネルギー効率を重視し、厳しい環境規制や建築基準法を遵守する傾向が強まっていることから、高性能でエネルギー効率の高い壁パネルへの需要が高まっています。外壁システムには、被覆材、断熱材、保護塗料など多様なソリューションが含まれ、これらはすべて、熱性能と美観を向上させながら商業ビルの耐久性を高めるように設計されています。

さらに同市場では、複合材料、高性能断熱材、耐候性コーティングなどの先端材料の台頭が見られます。スマート技術の統合は、住宅における革新的な壁パネルの需要を大幅に高め、エネルギー消費と気候制御を最適化します。さらに、環境にやさしく、耐火性があり、持続可能な製品の生産にますます注目が集まっていることも、規制による圧力やグリーン・ビルディング・ソリューションに対する消費者の嗜好に後押しされ、市場の成長を大きく後押ししています。このようなダイナミックな環境から、外壁システム市場はより広範な建設業界において重要な構成要素となっています。競合情勢は、Saint-Gobain、Kingspan、Rockwoolといった世界の大手企業が支配的であり、これらの企業は積極的に製品ポートフォリオを拡大し、市場の進化するニーズに対応するために広範な研究開発能力を活用しています。これらの企業は技術革新と持続可能性に取り組んでおり、業界の最先端を走り続けています。

当レポートでは、世界の外壁システム市場について調査し、市場の概要とともに、製品タイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の外壁システム市場の見通し、2018年~2032年

- 市場規模の分析と予測

- 市場シェア分析と予測

- 市場マップ分析、2024年

- 製品別

- タイプ別

- エンドユーザー別

- 地域別

第6章 北米の外壁システム市場の見通し、2018年~2032年

第7章 欧州の外壁システム市場の見通し、2018年~2032年

第8章 アジア太平洋の外壁システム市場の見通し、2018年~2032年

第9章 南米の外壁システム市場の見通し、2018年~2032年

第10章 中東・アフリカの外壁システム市場の見通し、2018年~2032年

第11章 需要供給分析

第12章 バリューチェーン分析

第13章 ポーターのファイブフォース分析

第14章 PESTLE分析

第15章 価格分析

第16章 市場力学

第17章 市場の動向と発展

第18章 ケーススタディ

第19章 競合情勢

- 市場リーダートップ5の競合マトリックス

- 参入企業トップ5のSWOT分析

- 市場の主要参入企業トップ10の情勢

- Magicrete Building Solutions Private Limited

- LEBEN INDIA PRIVATE LIMITED

- BAMCO Inc.

- DUROCK ALFACING INTERNATIONAL LIMITED

- Louisiana-Pacific Corporation

- Cornerstone Building Brands, Inc.

- Saint-Gobain Group

- Alcoa Corporation

- Evonik Industries AG

- DuPont de Nemours, Inc.

第20章 戦略的提言

第21章 お問い合わせと免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 2. Global Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 3. Global Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 4. Global Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 5. Global Exterior Wall System Market Share (%), By Region, 2018-2032F

- Figure 6. North America Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 7. North America Exterior Wall System Market Share (%), By Product, 2018-2032F

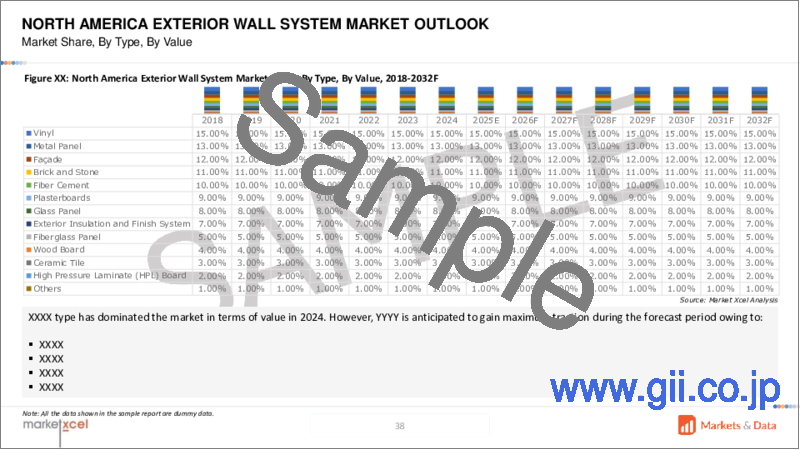

- Figure 8. North America Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 9. North America Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 10. North America Exterior Wall System Market Share (%), By Country, 2018-2032F

- Figure 11. United States Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 12. United States Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 13. United States Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 14. United States Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 15. Canada Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 16. Canada Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 17. Canada Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 18. Canada Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 19. Mexico Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 20. Mexico Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 21. Mexico Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 22. Mexico Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 23. Europe Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 24. Europe Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 25. Europe Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 26. Europe Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 27. Europe Exterior Wall System Market Share (%), By Country, 2018-2032F

- Figure 28. Germany Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 29. Germany Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 30. Germany Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 31. Germany Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 32. France Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 33. France Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 34. France Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 35. France Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 36. Italy Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 37. Italy Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 38. Italy Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 39. Italy Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 40. United Kingdom Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 41. United Kingdom Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 42. United Kingdom Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 43. United Kingdom Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 44. Russia Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 45. Russia Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 46. Russia Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 47. Russia Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 48. Netherlands Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 49. Netherlands Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 50. Netherlands Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 51. Netherlands Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 52. Spain Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 53. Spain Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 54. Spain Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 55. Spain Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 56. Turkey Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 57. Turkey Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 58. Turkey Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 59. Turkey Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 60. Poland Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 61. Poland Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 62. Poland Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 63. Poland Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 64. South America Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 65. South America Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 66. South America Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 67. South America Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 68. South America Exterior Wall System Market Share (%), By Country, 2018-2032F

- Figure 69. Brazil Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 70. Brazil Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 71. Brazil Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 72. Brazil Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 73. Argentina Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 74. Argentina Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 75. Argentina Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 76. Argentina Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 77. Asia-Pacific Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 78. Asia-Pacific Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 79. Asia-Pacific Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 80. Asia-Pacific Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 81. Asia-Pacific Exterior Wall System Market Share (%), By Country, 2018-2032F

- Figure 82. India Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 83. India Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 84. India Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 85. India Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 86. China Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 87. China Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 88. China Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 89. China Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 90. Japan Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 91. Japan Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 92. Japan Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 93. Japan Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 94. Australia Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 95. Australia Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 96. Australia Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 97. Australia Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 98. Vietnam Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 99. Vietnam Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 100. Vietnam Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 101. Vietnam Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 102. South Korea Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 103. South Korea Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 104. South Korea Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 105. South Korea Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 106. Indonesia Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 107. Indonesia Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 108. Indonesia Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 109. Indonesia Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 110. Philippines Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 111. Philippines Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 112. Philippines Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 113. Philippines Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 114. Middle East & Africa Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 115. Middle East & Africa Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 116. Middle East & Africa Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 117. Middle East & Africa Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 118. Middle East & Africa Exterior Wall System Market Share (%), By Country, 2018-2032F

- Figure 119. Saudi Arabia Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 120. Saudi Arabia Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 121. Saudi Arabia Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 122. Saudi Arabia Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 123. UAE Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 124. UAE Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 125. UAE Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 126. UAE Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 127. South Africa Exterior Wall System Market, By Value, In USD Billion, 2018-2032F

- Figure 128. South Africa Exterior Wall System Market Share (%), By Product, 2018-2032F

- Figure 129. South Africa Exterior Wall System Market Share (%), By Type, 2018-2032F

- Figure 130. South Africa Exterior Wall System Market Share (%), By End-user, 2018-2032F

- Figure 131. By Product Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 132. By Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 133. By End-user Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 134. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global exterior wall system market is projected to witness a CAGR of 7.46% during the forecast period 2025-2032, growing from USD 171.76 billion in 2024 to USD 305.42 billion in 2032. The exterior wall systems market is experiencing substantial growth, propelled by the global construction boom, heightened sustainability demands, and ongoing technological advancements. The increasing emphasis on energy efficiency and adherence to stringent environmental regulations and building codes has increased demand for high-performing, energy-efficient wall panels. Exterior wall systems encompass a diverse range of solutions, including cladding, insulation, and protective coatings, all designed to enhance the durability of commercial buildings while improving thermal performance and aesthetic appeal. Moreover, the market is witnessing the emergence of advanced materials such as composites, high-performance insulations, and weather-resistant coatings. Integrating smart technologies significantly enhances the demand for innovative wall panels in residential buildings, optimizing energy consumption and climate control. Additionally, the increasing focus on producing environmentally friendly, fire-resistant, and sustainable products-driven by regulatory pressures and consumer preferences for green building solutions-substantially propels market growth. This dynamic environment positions the exterior wall systems market as a critical component within the broader construction industry. The competitive landscape is dominated by global leaders such as Saint-Gobain, Kingspan, and Rockwool, who are actively expanding their product portfolios and leveraging extensive research and development capabilities to address the market's evolving needs. These companies are committed to innovation and sustainability, ensuring they remain at the forefront of industry advancements.

In November 2024, VOX India, a leading interior and exterior building material company, expanded its product line by launching three versatile wall panels: the Infratop Four Lamella SV26, Fronto SV24, and Welo SV22. These panels cater to the growing demand for visually stunning, durable, and multi-functional materials that elevate spaces across residential and commercial settings.

Growing Construction Activities in the Real Estate Sector Propels the Demand for Wall Systems

The growing construction activities in the real estate markets across the globe are a primary driver for the demand for wall systems; owing to the increasing urbanization in the world, there is a greater requirement for efficient and aesthetically pleasing building solutions to accommodate expanding populations. Therefore, home development interest in exterior wall systems with superior insulation, energy efficiency, and weather protection has risen. Increasingly, homebuyers are seeking more eco-friendly alternatives, leading builders to include newer materials such as insulated panels, fiberglass, and plaster boards in their plans. As a result, the construction of homes in the countryside is expected to drive the future of the wall systems market, with companies Tata Steel, and Saint-Gobain at the forefront, providing innovative solutions.

For instance, in November 2024, Innovators Facade Systems Limited received USD 12.98 million worth of work orders from Prestige Mulund Realty. The work orders involve designing, developing, supplying, fabricating, and installing facade work, including stone cladding, for residential housing. Facade work involves the design, construction, and installation of the exterior part of a building, which is often the most visually prominent aspect.

New Product Launches Propel Wall System Market Growth

New product launches with innovative features and upgrades have been significant growth drivers in the wall system market, fueled by a growing demand for green buildings and sustainable construction. Innovative solutions such as sandwich panels, which offer exceptional insulation properties and energy efficiency, are in huge demand for diverse European applications. Furthermore, the facade systems, metal and aluminum panels, fiberglass, and plaster boards offer lightweight durability with aesthetic versatility. In contrast, fiberglass panels provide excellent insulation and moisture resistance, hence improving the overall performance of buildings and boosting the overall market. As the market evolves, companies like Kingspan Group, Tata Steel, Saint-Gobain, and ArcelorMittal are leading the way by continuously innovating their product offerings to meet the growing demands for energy-efficient and environmentally friendly building solutions like sandwich panels.

For instance, in June 2022, Mekpan Panel increased its production capacity to 8.5 million m2 of panels per year. Its range of wall panels and insulation includes polyurethane rigid foam- and polyisocyanurate polyiso foam-based products. This expansion aligns with the growing demand for high-quality wall sandwich panels, driven by their effectiveness in enhancing building durability and energy efficiency. This will create a lucrative growth outlook for market growth in the long run.

Non-residential Dominates the Market Growth

Due to the growing demand from commercial, industrial, and institutional buildings for exterior wall systems, non-residential construction dominates the market growth for exterior wall systems. These vary from office complexes to other healthcare facilities, educational setups, and even retail floors. Rapid urbanization, increasing population densities, and robust economic expansion significantly influence the growth trajectory, necessitating enhanced infrastructure to support burgeoning commercial activities. In addition, government plans to enhance public infrastructure will further drive investments in non-residential construction projects around the world, propelling the demand for exterior wall systems. Companies strive to optimize efficiency and adjust to changing market conditions by delivering and fabricating products with different features to install them at renowned buildings.

For instance, in March 2023, Bamco Inc. announced to be a part of the renovation of the iconic One Times Square building, a 26-story tower at 1475 Broadway in Times Square incorporating an all-new BAMCO solid aluminum plate facade. The project will bring a USD 500 million 21st-century facelift to the 395-foot-tall trapezoidal-shaped structure, BAMCO will be fabricating approximately 60,000 square feet of our D-500 Rainscreen system utilizing Alfrex solid aluminum plate sheets and custom "fin" extrusions.

Asia-Pacific Leads the Market Growth

Asia-Pacific leads the exterior wall system market because of rapid urbanization and significant real estate development across the region. Governments of countries, including China, Indonesia, and India, are funding extensively and drafting policies to propel their construction sector and enhance the number of homes and commercial space. The growing focus on energy-efficient products for buildings creates a strong demand for more advanced wall panel systems with better insulation and higher durability. Furthermore, the increasing disposable incomes and initiatives taken by the government, coupled with growing investments from companies in the region, are further propelling the demand for wall panels.

For instance, in November 2023, Ciputra Group successfully launched its newest project, namely CitraLand City Sampali Kota Deli Megapolitan in Medan. CitraLand City Sampali City Deli Megapolitan was developed by Ciputra Group with KPN Group and in collaboration with PT Perkebunan Nusantara 2. Asia-Pacific is well-positioned to continue dominating the wall panels system market in the coming years, given the growing emphasis on sustainable practices and regulatory support for green building initiatives.

Future Market Scenario (2025 - 2032F)

The exterior wall systems market is expected to experience robust growth driven by increasing construction activities and the rising demand for energy-efficient and sustainable building solutions, particularly in emerging economies.

Stringent government regulations aimed at enhancing energy efficiency and reducing carbon emissions are likely to propel the adoption of innovative exterior wall systems, which offer superior insulation and environmental performance.

The integration of advanced materials and technologies, such as lightweight composites and smart building solutions, will further enhance the functionality and appeal of exterior wall systems, catering to evolving consumer preferences.

As urbanization continues to accelerate globally, the market will benefit from heightened investments in infrastructure development, positioning exterior wall systems as a critical component in modern construction practices.

Key Players Landscape and Outlook

The competitive landscape of the exterior wall systems market is characterized by a diverse array of established companies and emerging players striving for market share. Major players are focusing on innovation, product development, and strategic partnerships to enhance their offerings. These companies are investing heavily in research and development to introduce advanced materials such as insulated panels, lightweight cladding systems, and sustainable facade solutions that meet the increasing demand for energy-efficient buildings. Companies are adopting various strategies, including mergers and acquisitions, to expand their geographical presence and tap into new markets. This dynamic environment fosters competition and encourages continuous improvement in product quality and launching new products in the market.

For instance, in March 2023, DUROCK ALFACING INTERNATIONAL LIMITED introduced PUCCS NC. This system features the GDDC circular grooved PUCC-ROCK virgin wool insulation board, which includes a 10mm deep air space that complies with building codes and professional insurance requirements. This innovative approach enhances safety and performance in insulation systems.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Executive Summary

4. Voice of Customer

- 4.1. Product and Market Intelligence

- 4.2. Brand Awareness

- 4.3. Factors Considered in Purchase Decisions

- 4.3.1. Features and Other Value-Added Service

- 4.3.2. Strength and Longer Lifespan

- 4.3.3. Efficiency of Solutions

- 4.3.4. After-Sales Support

- 4.4. Consideration of Privacy and Regulations

5. Global Exterior Wall System Market Outlook, 2018-2032F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Product

- 5.2.1.1. Ventilated

- 5.2.1.2. Curtain Wall Systems

- 5.2.1.3. Non-Ventilated

- 5.2.2. By Type

- 5.2.2.1. Vinyl

- 5.2.2.2. Metal Panel

- 5.2.2.3. Facade

- 5.2.2.4. Brick and Stone

- 5.2.2.5. Fiber Cement

- 5.2.2.6. Plasterboards

- 5.2.2.7. Glass Panel

- 5.2.2.8. Exterior Insulation and Finish System

- 5.2.2.9. Fiberglass Panel

- 5.2.2.10. Wood Board

- 5.2.2.11. Ceramic Tile

- 5.2.2.12. High Pressure Laminate (HPL) Board

- 5.2.2.13. Others

- 5.2.3. By End-user

- 5.2.3.1. Residential

- 5.2.3.2. Non-Residential

- 5.2.4. By Region

- 5.2.4.1. North America

- 5.2.4.2. Europe

- 5.2.4.3. Asia-Pacific

- 5.2.4.4. South America

- 5.2.4.5. Middle East and Africa

- 5.2.5. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 5.2.1. By Product

- 5.3. Market Map Analysis, 2024

- 5.3.1. By Product

- 5.3.2. By Type

- 5.3.3. By End-user

- 5.3.4. By Region

6. North America Exterior Wall System Market Outlook, 2018-2032F*

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Product

- 6.2.1.1. Ventilated

- 6.2.1.2. Curtain Wall Systems

- 6.2.1.3. Non-Ventilated

- 6.2.2. By Type

- 6.2.2.1. Vinyl

- 6.2.2.2. Metal Panel

- 6.2.2.3. Facade

- 6.2.2.4. Brick and Stone

- 6.2.2.5. Fiber Cement

- 6.2.2.6. Plasterboards

- 6.2.2.7. Glass Panel

- 6.2.2.8. Exterior Insulation and Finish System

- 6.2.2.9. Fiberglass Panel

- 6.2.2.10. Wood Board

- 6.2.2.11. Ceramic Tile

- 6.2.2.12. High Pressure Laminate (HPL) Board

- 6.2.2.13. Others

- 6.2.3. By End-user

- 6.2.3.1. Residential

- 6.2.3.2. Non-Residential

- 6.2.4. By Country Share

- 6.2.4.1. United States

- 6.2.4.2. Canada

- 6.2.4.3. Mexico

- 6.2.1. By Product

- 6.3. Country Market Assessment

- 6.3.1. United States Exterior Wall System Market Outlook, 2018-2032F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Product

- 6.3.1.2.1.1. Ventilated

- 6.3.1.2.1.2. Curtain Wall Systems

- 6.3.1.2.1.3. Non-Ventilated

- 6.3.1.2.2. By Type

- 6.3.1.2.2.1. Vinyl

- 6.3.1.2.2.2. Metal Panel

- 6.3.1.2.2.3. Facade

- 6.3.1.2.2.4. Brick and Stone

- 6.3.1.2.2.5. Fiber Cement

- 6.3.1.2.2.6. Plasterboards

- 6.3.1.2.2.7. Glass Panel

- 6.3.1.2.2.8. Exterior Insulation and Finish System

- 6.3.1.2.2.9. Fiberglass Panel

- 6.3.1.2.2.10. Wood Board

- 6.3.1.2.2.11. Ceramic Tile

- 6.3.1.2.2.12. High Pressure Laminate (HPL) Board

- 6.3.1.2.2.13. Others

- 6.3.1.2.3. By End-user

- 6.3.1.2.3.1. Residential

- 6.3.1.2.3.2. Non-Residential

- 6.3.1.2.1. By Product

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Exterior Wall System Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

7. Europe Exterior Wall System Market Outlook, 2018-2032F

- 7.1. Germany

- 7.2. France

- 7.3. Italy

- 7.4. United Kingdom

- 7.5. Russia

- 7.6. Netherlands

- 7.7. Spain

- 7.8. Turkey

- 7.9. Poland

8. Asia-Pacific Exterior Wall System Market Outlook, 2018-2032F

- 8.1. India

- 8.2. China

- 8.3. Japan

- 8.4. Australia

- 8.5. Vietnam

- 8.6. South Korea

- 8.7. Indonesia

- 8.8. Philippines

9. South America Exterior Wall System Market Outlook, 2018-2032F

- 9.1. Brazil

- 9.2. Argentina

10. Middle East and Africa Exterior Wall System Market Outlook, 2018-2032F

- 10.1. Saudi Arabia

- 10.2. UAE

- 10.3. South Africa

11. Demand Supply Analysis

12. Value Chain Analysis

13. Porter's Five Forces Analysis

14. PESTLE Analysis

15. Pricing Analysis

16. Market Dynamics

- 16.1. Market Drivers

- 16.2. Market Challenges

17. Market Trends and Developments

18. Case Studies

19. Competitive Landscape

- 19.1. Competition Matrix of Top 5 Market Leaders

- 19.2. SWOT Analysis for Top 5 Players

- 19.3. Key Players Landscape for Top 10 Market Players

- 19.3.1. Magicrete Building Solutions Private Limited

- 19.3.1.1. Company Details

- 19.3.1.2. Key Management Personnel

- 19.3.1.3. Products and Services

- 19.3.1.4. Financials (As Reported)

- 19.3.1.5. Key Market Focus and Geographical Presence

- 19.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 19.3.2. LEBEN INDIA PRIVATE LIMITED

- 19.3.3. BAMCO Inc.

- 19.3.4. DUROCK ALFACING INTERNATIONAL LIMITED

- 19.3.5. Louisiana-Pacific Corporation

- 19.3.6. Cornerstone Building Brands, Inc.

- 19.3.7. Saint-Gobain Group

- 19.3.8. Alcoa Corporation

- 19.3.9. Evonik Industries AG

- 19.3.10. DuPont de Nemours, Inc.

- 19.3.1. Magicrete Building Solutions Private Limited

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.