|

|

市場調査レポート

商品コード

1576102

油圧ポンプの世界市場の評価:タイプ別、用途別、動力源別、地域別、機会、予測(2017年~2031年)Hydraulic Pump Market Assessment, By Type [Gear Pump, Piston Pump, Vane Pump, Water Pump, Others], By Application [Construction, Automotive, Agriculture, Others], By Power Source [Gas, Electric], By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 油圧ポンプの世界市場の評価:タイプ別、用途別、動力源別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年10月24日

発行: Markets & Data

ページ情報: 英文 220 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の油圧ポンプの市場規模は、2023年の106億4,000万米ドルから2031年に143億6,000万米ドルに達すると予測され、予測期間の2024年~2031年にCAGRで3.82%の成長が見込まれます。自動化とスマートテクノロジーは、油圧ポンプ市場の需要を一変させる可能性が高いです。先進の材料と製造技術に加え、ポンプ設計におけるナノテクノロジーが市場成長を促進しています。油圧ポンプの予知保全、設計、機能を伴う産業経営の自動化とデジタル化は、さまざまな部門における運転の性能、持続可能性、安全性を向上させると予測されます。

油圧システムが性能と信頼性の面で強化された大きな理由は、先進材料の利用、デジタルソリューション、工学的特注設計です。産業界がインダストリー4.0規格を遵守し、グリーン技術を採用する中、新しい油圧技術への要求は増大し、開発と工学活動の新しいパターンが強化されると予測されます。油圧工学におけるもっとも重要な発展の1つは、最新の設計の信頼性です。油圧システムの初期段階では、複雑な設計は製造と設置に多くの時間を要します。3Dモデリングの助けを借りた最新の油圧ポンプ設計は、性能と効率を向上させています。さらに、作動油に含まれる埃の減少や、油圧機械のコンポーネントから埃を確実に排除すること、診断方法の改良により、油圧システムの効率は大幅に向上しています。各社は、効率と性能に優れた油圧ポンプを幅広く提供しています。

例えば、Grundfos Holding A/Sは2024年1月、エネルギー効率を高めた新しいSP 6インチ油圧ポンプを発表しました。この新世代SPポンプは、最適化された信頼性の高い油圧、エネルギー効率の向上、製品寿命の延長を実現しています。このポンプは、永久磁石モーター、堅牢な設計、拡張された温度範囲により高い効率を実現しています。

当レポートでは、世界の油圧ポンプ市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢などを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

- 製品と市場情報

- ブランド認知の方式

- 購入決定において考慮される要素

- ポンプの種類

- 流量

- 圧力定格

- 効率

- 流体との適合性

- サイズと重量

- 取り付けオプション

- プライバシーと規制の考慮

第5章 世界の油圧ポンプ市場の見通し(2017年~2031年)

- 市場規模の分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- タイプ別

- 用途別

- 動力源別

- 地域別

- 市場シェア分析:企業別(金額)(上位5社とその他 - 2023年)

- 市場マップ分析(2023年)

- タイプ別

- 用途別

- 動力源別

- 地域別

第6章 北米の油圧ポンプ市場の見通し(2017年~2031年)

- 市場規模の分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- タイプ別

- 用途別

- 動力源別

- シェア:国別

- 各国の市場の評価

- 米国の油圧ポンプ市場の見通し(2017年~2031年)

- カナダ

- メキシコ

第7章 欧州の油圧ポンプ市場の見通し(2017年~2031年)

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第8章 アジア太平洋の油圧ポンプ市場の見通し(2017年~2031年)

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第9章 南米の油圧ポンプ市場の見通し(2017年~2031年)

- ブラジル

- アルゼンチン

第10章 中東・アフリカの油圧ポンプ市場の見通し(2017年~2031年)

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第11章 需給分析

第12章 輸入と輸出の分析

第13章 バリューチェーン分析

第14章 ポーターのファイブフォース分析

第15章 PESTLE分析

第16章 価格分析

第17章 市場力学

- 市場促進要因

- 市場の課題

第18章 市場の動向と発展

第19章 ケーススタディ

第20章 競合情勢

- マーケットリーダー上位5社の競合マトリクス

- 上位5社のSWOT分析

- 主要企業上位10社の情勢

- Bosch Rexroth AG

- Bucher Hydraulics GmbH

- Linde Hydraulics GmbH & Co. KG

- Eaton Corporation plc

- Parker-Hannifin Corporation

- Viking Pump Inc.

- Danfoss A/S

- Kawasaki Heavy Industries Ltd.

- Daikin Industries Ltd.

- Continental Hydraulics Inc.

第21章 戦略的推奨

第22章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 2. Global Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 3. Global Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 4. Global Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 5. Global Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 6. Global Hydraulic Pump Market Share (%), By Region, 2017-2031F

- Figure 7. North America Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 8. North America Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 9. North America Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 10. North America Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 11. North America Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 12. North America Hydraulic Pump Market Share (%), By Country, 2017-2031F

- Figure 13. United States Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

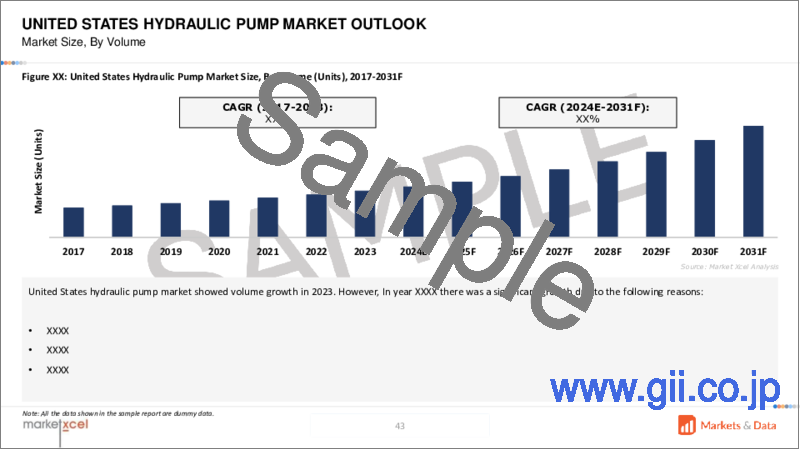

- Figure 14. United States Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 15. United States Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 16. United States Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 17. United States Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 18. Canada Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 19. Canada Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 20. Canada Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 21. Canada Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 22. Canada Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 23. Mexico Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 24. Mexico Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 25. Mexico Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 26. Mexico Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 27. Mexico Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 28. Europe Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 29. Europe Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 30. Europe Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 31. Europe Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 32. Europe Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 33. Europe Hydraulic Pump Market Share (%), By Country, 2017-2031F

- Figure 34. Germany Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 35. Germany Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 36. Germany Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 37. Germany Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 38. Germany Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 39. France Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 40. France Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 41. France Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 42. France Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 43. France Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 44. Italy Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 45. Italy Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 46. Italy Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 47. Italy Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 48. Italy Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 49. United Kingdom Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 50. United Kingdom Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 51. United Kingdom Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 52. United Kingdom Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 53. United Kingdom Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 54. Russia Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 55. Russia Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 56. Russia Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 57. Russia Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 58. Russia Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 59. Netherlands Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 60. Netherlands Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 61. Netherlands Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 62. Netherlands Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 63. Netherlands Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 64. Spain Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 65. Spain Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 66. Spain Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 67. Spain Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 68. Spain Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 69. Turkey Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 70. Turkey Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 71. Turkey Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 72. Turkey Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 73. Turkey Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 74. Poland Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 75. Poland Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 76. Poland Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 77. Poland Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 78. Poland Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 79. South America Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 80. South America Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 81. South America Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 82. South America Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 83. South America Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 84. South America Hydraulic Pump Market Share (%), By Country, 2017-2031F

- Figure 85. Brazil Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 86. Brazil Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 87. Brazil Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 88. Brazil Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 89. Brazil Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 90. Argentina Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 91. Argentina Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 92. Argentina Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 93. Argentina Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 94. Argentina Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 95. Asia-Pacific Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 96. Asia-Pacific Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 97. Asia-Pacific Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 98. Asia-Pacific Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 99. Asia-Pacific Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 100. Asia-Pacific Hydraulic Pump Market Share (%), By Country, 2017-2031F

- Figure 101. India Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 102. India Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 103. India Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 104. India Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 105. India Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 106. China Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 107. China Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 108. China Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 109. China Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 110. China Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 111. Japan Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 112. Japan Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 113. Japan Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 114. Japan Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 115. Japan Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 116. Australia Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 117. Australia Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 118. Australia Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 119. Australia Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 120. Australia Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 121. Vietnam Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 122. Vietnam Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 123. Vietnam Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 124. Vietnam Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 125. Vietnam Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 126. South Korea Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 127. South Korea Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 128. South Korea Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 129. South Korea Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 130. South Korea Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 131. Indonesia Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 132. Indonesia Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 133. Indonesia Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 134. Indonesia Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 135. Indonesia Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 136. Philippines Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 137. Philippines Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 138. Philippines Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 139. Philippines Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 140. Philippines Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 141. Middle East & Africa Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 142. Middle East & Africa Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 143. Middle East & Africa Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 144. Middle East & Africa Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 145. Middle East & Africa Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 146. Middle East & Africa Hydraulic Pump Market Share (%), By Country, 2017-2031F

- Figure 147. Saudi Arabia Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 148. Saudi Arabia Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 149. Saudi Arabia Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 150. Saudi Arabia Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 151. Saudi Arabia Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 152. UAE Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 153. UAE Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 154. UAE Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 155. UAE Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 156. UAE Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 157. South Africa Hydraulic Pump Market, By Value, in USD Billion, 2017-2031F

- Figure 158. South Africa Hydraulic Pump Market, By Volume, in Units, 2017-2031F

- Figure 159. South Africa Hydraulic Pump Market Share (%), By Type, 2017-2031F

- Figure 160. South Africa Hydraulic Pump Market Share (%), By Application, 2017-2031F

- Figure 161. South Africa Hydraulic Pump Market Share (%), By Power Source, 2017-2031F

- Figure 162. By Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 163. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 164. By Power Source Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 165. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global hydraulic pump market is projected to witness a CAGR of 3.82% during the forecast period 2024-2031, growing from USD 10.64 billion in 2023 to USD 14.36 billion in 2031. Automation and smart technologies are likely to transform the demand of the hydraulic pump market. Advanced materials and manufacturing techniques, along with nanotechnology in pump designing, fuel the market growth. The automation and digitization of industrial operations, accompanied by predictive maintenance and design and functions of hydraulic pumps, are expected to improve the performance, sustainability, and safety of operations in different sectors.

Major ways that hydraulic systems have enhanced in terms of performance and reliability are through the utilization of advanced materials, digital solutions, and engineered bespoke designs. With industries adhering to Industry 4.0 standards and adopting green technologies, the call for new hydraulic technologies is projected to increase, enhancing developments and new patterns of engineering activities. One of the most crucial developments in hydraulic engineering has been made on the reliability of modern designs. In the initial phase of hydraulic systems, complex designs take more time to manufacture and install. Newer hydraulic pump designs, with the help of 3D modeling, have enhanced performance and efficiency. Furthermore, less dust in hydraulic oil, dust that is reliably kept out of the hydraulic machinery's components, and better diagnostic methods have enabled hydraulic systems to be much more efficient. Companies offer an extended range of hydraulic pumps that excel in efficiency and performance.

For instance, in January 2024, Grundfos Holding A/S launched a new SP 6-inch hydraulic pump for increased energy efficiency. This new generation SP pump has optimized and reliable hydraulics, improved energy efficiency, and a longer product lifetime. The pump is highly efficient due to the permanent magnet motor, robust design, and extended temperature range.

Integration of Smart Technology, Digital Twin Technology, and VSDs to Propel Market Growth

The growing trend of incorporating IoT and smart sensors in hydraulic pumps is limiting human interventions, allowing users to monitor the pump efficiently without any movement. Users can perform predictive maintenance and operate pumps more efficiently and with less downtime. The future trends of the hydraulic pump market will likely focus more on automation due to the demand for precision and efficiency in pumping activities across industries. Automating hydraulic systems is likely to improve productivity and limit manual work.

Design and operational advantages of hydraulic pumps with the digital twin concept allows creating performance prediction, failure forecasting, and maintenance. Variable speed drive (VSD) technology is becoming more widely applied in hydraulic systems, enabling pump rotational speed adjustment. This contributes to better efficiency and effectiveness, especially when there are variable requirements in the process. Companies focus on delivering hydraulic pumps with efficient control and higher performance.

For instance, in June 2023, SPX Flow Inc.'s Bolting Systems launched a new hydraulic pump, PE60. The pump offers increased control technology, autocycle functionality, longer runtime, and plug-and-play accessories. The new hydraulic pump is intended for torquing applications that need continuous autocycle operation or manual driving of hydraulic wrenches.

Wide Range Applications and Rising Automation to Shape the Global Market Demand

Hydraulic pumps are in demand from sectors such as construction, agriculture, automotive, and manufacturing due to the accompanying growth in infrastructure development and machinery automation. The hydraulic pump market will focus on developing more automation features in the future owing to the rising applications of hydraulic systems in industrial machines for precise and efficient needs. There will be continuous integration of hydraulic power with IoT technologies in factories due to rapidly expanding automation.

As the world grapples with the challenges of climate change, technological advancements will allow for the invention of environmentally friendly hydraulic pumps that cater to green industries, such as wind and solar energy systems. The emergence of electric and hybrid hydraulic technologies allows more efficiency and sustainability than traditional hydraulic pumps. Hence, companies tend to deliver pumps with better designs, allowing them to function efficiently.

For instance, in March 2023, Bosch Rexroth Inc. presented a highly efficient A3V pump platform, A3V2Q045, for medium-pressure industrial hydraulics applications. The high-efficiency pump comes with speed-controlled, cyclic applications that sustainably save energy through the speed control of a variable pump. The company is further advancing industrial hydraulics' sustainability with its high-speed variable displacement pumps for medium-pressure applications.

Gear Pump Segment Leads the Market Share with Wide Applications and Design Efficiency

The gear pump segment leads the share of the global hydraulic pump market. Gear pumps are characterized by their straightforward designs, including two or more gears that mesh together to create a continuous flow of fluid. Gear pumps are known for their high volumetric efficiency, enabling them to transfer fluids with minimal leakage and energy loss. The design allows compact construction, making them suitable for applications where space is limited. This delivers versatility in applications, including automotive, construction, oil and gas, and food and beverages. This strong foundation, combined with continuous innovations in gear pumps, leads the segment to hold the highest market share. Companies focus on developing environment-friendly high-pressure gear pumps. For instance, in January 2024, Shimadzu Corporation introduced the MLP2 Series, an environmentally friendly next-generation SGP2 Series high-pressure gear pump. In addition to improving durability by removing the plating process of the cast iron body used in the SGP2 series, this new pump provides maximum surge pressure from 29.4 MPa to 30 MPa and the rated pressure from 24.5 MPa to 25 MPa.

Asia-Pacific to Hold the Dominating Hydraulic Pump Market Share

Asia-Pacific leads the share of the global hydraulic market owing to the use of hydraulic systems in production lines and the growth of manufacturing industries, especially in China and India. Hydraulic pumps are essential for industrial operations in automotive and machinery manufacturing. The boom in construction due to rapid urbanization has made Asia-Pacific a highly potential market for construction equipment. Hydraulic pumps are essential in building highways, bridges, and high-rise buildings in construction projects.

Major Asia-Pacific countries are investing heavily in infrastructure to support economic growth. Projects related to highways, railways, and airports rely on hydraulic equipment for construction and maintenance, driving the demand for hydraulic pumps. As agricultural practices evolve, the need for efficient irrigation systems powered by hydraulic pumps grows. It is especially crucial in countries with large agricultural sectors like India that urge Indian companies to launch new hydraulic pump systems suitable for different industrial scales.

For instance, in September 2024, Precision Hydraulics Engineers launched premier recon pumps, revolutionizing efficiency and reliability in hydraulic systems. By making this calculated decision, the company intends to help SMEs and other small-scale industrial participants who struggle to afford expensive new pumps while delivering environmentally friendly and sustainable practices.

Future Market Scenario (2024 - 2031F)

Hydraulic pumps are expected to integrate with Internet of Things (IoT) technology, allowing real-time monitoring and data collection. It is likely to enable predictive maintenance, reducing downtime and improving operational efficiency.

The adoption of variable speed drives (VSDs) allows hydraulic pumps to adjust their output based on demand, leading to significant energy savings and reduced wear.

Innovations in pump design, such as improved fluid dynamics and materials, are anticipated to contribute to higher efficiency levels and reduced energy consumption.

Key Players Landscape and Outlook

Key players in the hydraulic pump market are adopting multifaceted strategies to maintain competitive advantage and drive growth. Many are investing heavily in research and development to innovate and enhance product performance, focusing on energy efficiency and advanced materials. Strategic partnerships and collaborations with technology firms are increasingly common, enabling access to IoT and automation technologies that improve system integration. Additionally, companies are expanding their global footprint through mergers and acquisitions, enhancing their supply chain capabilities and market presence in emerging economies. Emphasizing customer-centric solutions, also offer tailored products and services to meet specific industry needs, strengthening customer loyalty and capturing new market segments.

For instance, in August 2024, Parker-Hannifin Corporation's Pump & Motor Division Europe announced the launch of its new T7G Series of hydraulic pumps for trucks. This range of single and double hydraulic vane pumps is ideal for installation in any kind of truck using the ISO 7653 mounting standard as it features new, stronger housings along with Parker's most recent pump variable speed drive technology.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Executive Summary

4. Voice of Customer

- 4.1. Product and Market Intelligence

- 4.2. Mode of Brand Awareness

- 4.3. Factors Considered in Purchase Decisions

- 4.3.1. Type of Pumps

- 4.3.2. Flow Rate

- 4.3.3. Pressure Rating

- 4.3.4. Efficiency

- 4.3.5. Compatibility with Fluids

- 4.3.6. Size and Weight

- 4.3.7. Mounting Options

- 4.4. Consideration of Privacy and Regulations

5. Global Hydraulic Pump Market Outlook, 2017-2031F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Type

- 5.2.1.1. Gear Pump

- 5.2.1.2. Piston Pump

- 5.2.1.3. Vane Pump

- 5.2.1.4. Water Pump

- 5.2.1.5. Others

- 5.2.2. By Application

- 5.2.2.1. Construction

- 5.2.2.2. Automotive

- 5.2.2.3. Agriculture

- 5.2.2.4. Others

- 5.2.3. By Power Source

- 5.2.3.1. Gas

- 5.2.3.2. Electric

- 5.2.4. By Region

- 5.2.4.1. North America

- 5.2.4.2. Europe

- 5.2.4.3. Asia-Pacific

- 5.2.4.4. South America

- 5.2.4.5. Middle East and Africa

- 5.2.5. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2023)

- 5.2.1. By Type

- 5.3. Market Map Analysis, 2023

- 5.3.1. By Type

- 5.3.2. By Application

- 5.3.3. By Power Sources

- 5.3.4. By Region

6. North America Hydraulic Pump Market Outlook, 2017-2031F*

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Type

- 6.2.1.1. Gear Pump

- 6.2.1.2. Piston Pump

- 6.2.1.3. Vane Pump

- 6.2.1.4. Water Pump

- 6.2.1.5. Others

- 6.2.2. By Application

- 6.2.2.1. Construction

- 6.2.2.2. Automotive

- 6.2.2.3. Agriculture

- 6.2.2.4. Others

- 6.2.3. By Power Source

- 6.2.3.1. Gas

- 6.2.3.2. Electric

- 6.2.4. By Country Share

- 6.2.4.1. United States

- 6.2.4.2. Canada

- 6.2.4.3. Mexico

- 6.2.1. By Type

- 6.3. Country Market Assessment

- 6.3.1. United States Hydraulic Pump Market Outlook, 2017-2031F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.1.2. By Volume

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Type

- 6.3.1.2.1.1. Gear Pump

- 6.3.1.2.1.2. Piston Pump

- 6.3.1.2.1.3. Vane Pump

- 6.3.1.2.1.4. Water Pump

- 6.3.1.2.1.5. Others

- 6.3.1.2.2. By Application

- 6.3.1.2.2.1. Construction

- 6.3.1.2.2.2. Automotive

- 6.3.1.2.2.3. Agriculture

- 6.3.1.2.2.4. Others

- 6.3.1.2.3. By Power Source

- 6.3.1.2.3.1. Gas

- 6.3.1.2.3.2. Electric

- 6.3.1.2.1. By Type

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Hydraulic Pump Market Outlook, 2017-2031F*

All segments will be provided for all regions and countries covered

7. Europe Hydraulic Pump Market Outlook, 2017-2031F

- 7.1. Germany

- 7.2. France

- 7.3. Italy

- 7.4. United Kingdom

- 7.5. Russia

- 7.6. Netherlands

- 7.7. Spain

- 7.8. Turkey

- 7.9. Poland

8. Asia-Pacific Hydraulic Pump Market Outlook, 2017-2031F

- 8.1. India

- 8.2. China

- 8.3. Japan

- 8.4. Australia

- 8.5. Vietnam

- 8.6. South Korea

- 8.7. Indonesia

- 8.8. Philippines

9. South America Hydraulic Pump Market Outlook, 2017-2031F

- 9.1. Brazil

- 9.2. Argentina

10. Middle East and Africa Hydraulic Pump Market Outlook, 2017-2031F

- 10.1. Saudi Arabia

- 10.2. UAE

- 10.3. South Africa

11. Demand Supply Analysis

12. Import and Export Analysis

13. Value Chain Analysis

14. Porter's Five Forces Analysis

15. PESTLE Analysis

16. Pricing Analysis

17. Market Dynamics

- 17.1. Market Drivers

- 17.2. Market Challenges

18. Market Trends and Developments

19. Case Studies

20. Competitive Landscape

- 20.1. Competition Matrix of Top 5 Market Leaders

- 20.2. SWOT Analysis for Top 5 Players

- 20.3. Key Players Landscape for Top 10 Market Players

- 20.3.1. Bosch Rexroth AG

- 20.3.1.1. Company Details

- 20.3.1.2. Key Management Personnel

- 20.3.1.3. Products and Services

- 20.3.1.4. Financials (As Reported)

- 20.3.1.5. Key Market Focus and Geographical Presence

- 20.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 20.3.2. Bucher Hydraulics GmbH,

- 20.3.3. Linde Hydraulics GmbH & Co. KG

- 20.3.4. Eaton Corporation plc

- 20.3.5. Parker-Hannifin Corporation

- 20.3.6. Viking Pump Inc.

- 20.3.7. Danfoss A/S

- 20.3.8. Kawasaki Heavy Industries Ltd.

- 20.3.9. Daikin Industries Ltd.

- 20.3.10. Continental Hydraulics Inc.

- 20.3.1. Bosch Rexroth AG

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.