|

|

市場調査レポート

商品コード

1520614

自動車用サイバーセキュリティの世界市場の評価:製品別、車両タイプ別、用途別、セキュリティタイプ別、地域別、機会、予測、2017年~2031年Automotive Cybersecurity Market Assessment, By Product, By Vehicle Type, By Application, By Security Type, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 自動車用サイバーセキュリティの世界市場の評価:製品別、車両タイプ別、用途別、セキュリティタイプ別、地域別、機会、予測、2017年~2031年 |

|

出版日: 2024年07月25日

発行: Markets & Data

ページ情報: 英文 225 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の自動車用サイバーセキュリティの市場規模は、2024年から2031年の予測期間中にCAGR 18.93%で拡大し、2023年の78億3,000万米ドルから2031年には313億4,000万米ドルに上昇すると予測されています。同市場は近年著しい成長を遂げています。コネクテッドカーや自動運転車の生産・販売の増加、ADAS(先進運転支援システム)技術の導入の増加、半自律走行車や自律走行車の需要の増加により、今後も力強い拡大ペースを維持すると予測されます。また、電気自動車需要の増加、急速なパーソナライゼーション傾向、1人当たり所得の増加も、世界の自動車用サイバーセキュリティ市場の成長を後押ししています。自動車業界の車両所有者は、サイバーセキュリティがシールドの役割を果たし、コンピュータベースの脅威から最新の自動車を保護するため、サイバーセキュリティを強く求めています。さらに現在、自動車メーカーは個人データや運転パターンを保存する先進的な自動車を導入しています。サイバーセキュリティは、このデータを防ぎ、セキュリティとプライバシーを危険にさらすことを回避するのに役立ち、世界の自動車用サイバーセキュリティ市場の需要を押し上げています。

コネクテッドカーの機能を向上させるためのさまざまな研究開発活動への投資の増加は、世界の自動車用サイバーセキュリティ市場の成長を促進すると予測されています。新興国の各国政府は、自動車の所有者情報を保護し、サイバーセキュリティに関する認識を広めるために、さまざまな規則や規制を実施しています。さらに、企業は需要の高まりに対応し、サイバーセキュリティの脅威を減らすために潜在的な問題を認識するために協力しています。

自動車業界では、人工知能、5G、モノのインターネットなどの高度な機能を搭載したコネクテッドカーへの需要が高まっており、自動車メーカーが世界の自動車用サイバーセキュリティ市場で最大のシェアを占める機会が生まれています。コネクテッドカーはドライバーの機動性と安全性を高め、最先端の接続性を備えているため、世界の自動車用サイバーセキュリティ市場の需要を促進しています。同市場の企業は、緊急サービス接続、Wi-Fiホットスポット、より良いナビゲーションとアラートのためのクラウドベースのテレマティクスを特徴とするコネクテッドカーを導入しており、予測期間中の市場成長を大きく促進すると予想されます。コネクテッドカーの急速な導入と生産は、ソフトウェア定義車両(SDV)の出現と相まって、世界の自動車用サイバーセキュリティ市場の成長を促進しています。また、コネクテッドカーにおけるサイバーセキュリティの需要の高まりに対応するため、各社がプラットフォームを立ち上げています。

当レポートでは、世界の自動車用サイバーセキュリティ市場について調査し、市場の概要とともに、製品別、車両タイプ別、用途別、セキュリティタイプ別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の自動車用サイバーセキュリティ市場の見通し、2017年~2031年

- 市場規模と予測

- 製品別

- 車両タイプ別

- 用途別

- セキュリティタイプ別

- 地域別

- 企業別市場シェア(%)、2023年

第6章 世界の自動車用サイバーセキュリティ市場の見通し、地域別、2017年~2031年

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第7章 市場マッピング、2023年

第8章 マクロ環境と産業構造

- 需要供給分析

- 輸出入分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第9章 市場力学

第10章 主要参入企業の情勢

第11章 価格分析

第12章 ケーススタディ

第13章 主要参入企業の見通し

- Infineon Technologies AG

- Continental AG (Argus Cyber Security Ltd.)

- Robert Bosch GmbH (ETAS GmbH)

- Garrett Motion Inc.

- Intel Corporation

- Aptiv PLC

- Dellfer, Inc.

- NVIDIA Corp

- NXM Labs Inc.

- Karamba Security Ltd.

- Upstream Security Ltd.

第14章 戦略的提言

第15章 お問い合わせと免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 2. Global Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 3. Global Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 4. Global Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 5. Global Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 6. Global Automotive Cybersecurity Market Share (%), By Region, 2017-2031F

- Figure 7. North America Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 8. North America Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 9. North America Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 10. North America Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

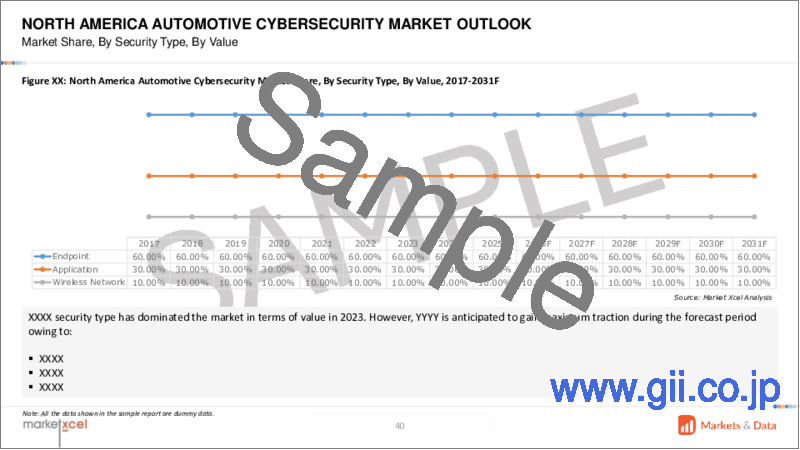

- Figure 11. North America Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 12. North America Automotive Cybersecurity Market Share (%), By Country, 2017-2031F

- Figure 13. United States Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 14. United States Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 15. United States Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 16. United States Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 17. United States Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 18. Canada Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 19. Canada Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 20. Canada Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 21. Canada Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 22. Canada Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 23. Mexico Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 24. Mexico Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 25. Mexico Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 26. Mexico Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 27. Mexico Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 28. Europe Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 29. Europe Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 30. Europe Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 31. Europe Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 32. Europe Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 33. Europe Automotive Cybersecurity Market Share (%), By Country, 2017-2031F

- Figure 34. Germany Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 35. Germany Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 36. Germany Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 37. Germany Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 38. Germany Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 39. France Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 40. France Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 41. France Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 42. France Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 43. France Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 44. Italy Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 45. Italy Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 46. Italy Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 47. Italy Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 48. Italy Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 49. United Kingdom Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 50. United Kingdom Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 51. United Kingdom Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 52. United Kingdom Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 53. United Kingdom Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 54. Russia Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 55. Russia Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 56. Russia Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 57. Russia Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 58. Russia Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 59. Netherlands Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 60. Netherlands Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 61. Netherlands Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 62. Netherlands Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 63. Netherlands Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 64. Spain Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 65. Spain Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 66. Spain Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 67. Spain Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 68. Spain Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 69. Turkey Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 70. Turkey Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 71. Turkey Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 72. Turkey Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 73. Turkey Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 74. Poland Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 75. Poland Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 76. Poland Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 77. Poland Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 78. Poland Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 79. South America Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 80. South America Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 81. South America Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 82. South America Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 83. South America Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 84. South America Automotive Cybersecurity Market Share (%), By Country, 2017-2031F

- Figure 85. Brazil Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 86. Brazil Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 87. Brazil Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 88. Brazil Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 89. Brazil Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 90. Argentina Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 91. Argentina Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 92. Argentina Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 93. Argentina Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 94. Argentina Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 95. Asia-Pacific Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 96. Asia-Pacific Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 97. Asia-Pacific Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 98. Asia-Pacific Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 99. Asia-Pacific Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 100. Asia-Pacific Automotive Cybersecurity Market Share (%), By Country, 2017-2031F

- Figure 101. India Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 102. India Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 103. India Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 104. India Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 105. India Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 106. China Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 107. China Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 108. China Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 109. China Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 110. China Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 111. Japan Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 112. Japan Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 113. Japan Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 114. Japan Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 115. Japan Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 116. Australia Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 117. Australia Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 118. Australia Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 119. Australia Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 120. Australia Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 121. Vietnam Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 122. Vietnam Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 123. Vietnam Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 124. Vietnam Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 125. Vietnam Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 126. South Korea Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 127. South Korea Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 128. South Korea Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 129. South Korea Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 130. South Korea Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 131. Indonesia Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 132. Indonesia Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 133. Indonesia Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 134. Indonesia Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 135. Indonesia Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 136. Philippines Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 137. Philippines Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 138. Philippines Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 139. Philippines Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 140. Philippines Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 141. Middle East & Africa Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 142. Middle East & Africa Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 143. Middle East & Africa Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 144. Middle East & Africa Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 145. Middle East & Africa Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 146. Middle East & Africa Automotive Cybersecurity Market Share (%), By Country, 2017-2031F

- Figure 147. Saudi Arabia Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 148. Saudi Arabia Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 149. Saudi Arabia Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 150. Saudi Arabia Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 151. Saudi Arabia Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 152. UAE Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 153. UAE Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 154. UAE Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 155. UAE Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 156. UAE Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 157. South Africa Automotive Cybersecurity Market, By Value, In USD Billion, 2017-2031F

- Figure 158. South Africa Automotive Cybersecurity Market Share (%), By Product, 2017-2031F

- Figure 159. South Africa Automotive Cybersecurity Market Share (%), By Vehicle Type, 2017-2031F

- Figure 160. South Africa Automotive Cybersecurity Market Share (%), By Application, 2017-2031F

- Figure 161. South Africa Automotive Cybersecurity Market Share (%), By Security Type, 2017-2031F

- Figure 162. By Product Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 163. By Vehicle Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 164. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 165. By Security Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 166. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global automotive cybersecurity market is anticipated to observe a CAGR of 18.93% during the forecast period 2024-2031, rising from USD 7.83 billion in 2023 to USD 31.34 billion in 2031. The market has experienced significant growth in recent years. It is projected to maintain a strong pace of expansion in the coming years due to growing production and sales of connected and automated vehicles, rising implementation of advanced driver-assistance system (ADAS) technology, and growing demand for semi-autonomous and autonomous vehicles. Also, an increase in demand for electric vehicles, a rapid personalization trend, and a rise in per capita income propels the global automotive cybersecurity market growth. Vehicle owners in the automotive industry demand cybersecurity significantly as it acts as a shield, safeguarding their modern automobiles from computer-based threats. In addition, during the present times, automakers are introducing advanced vehicles that store personal data and driving patterns. Cybersecurity helps prevent this data and avoids endangering security and privacy, boosting the global automotive cybersecurity market demand.

Increasing investment in different research and development activities to advance the functioning of connected cars is projected to propel the global automotive cybersecurity market growth. Governments across emerging countries are implementing different rules and regulations to protect vehicle owner information and spread awareness concerning cybersecurity. Moreover, companies are collaborating to address the rising demand and recognize potential issues to reduce cybersecurity threats.

For instance, in May 2024, Keysight Technologies, Inc. announced a partnership with ETAS GmbH to provide automakers and automotive suppliers with an all-inclusive automotive cybersecurity solution to ensure the protection of vehicles.

Rising Adoption and Launch of Connected Cars Drive Market Growth

In the automotive industry, the demand for connected cars is rising as they are equipped with advanced features, including artificial intelligence, 5G, and the Internet of Things, creating opportunities for automakers to dominate the largest global automotive cybersecurity market share. Connected cars enhance mobility and safety for drivers, and they are equipped with cutting-edge connectivity, propelling the global automotive cybersecurity market demand. Companies in the market are introducing connected cars featuring emergency service connectivity, Wi-Fi hotspots, and cloud-based telematics for better navigation and alerts, which is anticipated to foster market growth significantly in the forecast period. The rapid adoption and production of connected cars, coupled with the emergence of software-defined vehicles (SDV), are driving the global automotive cybersecurity market growth. In addition, companies are launching a platform to address the rising demand for cybersecurity in connected cars.

For instance, in May 2022, Trend Micro Inc. launched VicOne, a vehicle cybersecurity solution venture, to address the issue faced by connected car makers in conforming with new international standards and regulations. This also aims to reinforce the global competitiveness of Taiwan's automotive supply chain and aid in attaining a foothold in the coming connected car market by addressing the vehicle cybersecurity specifications demanded of global automakers.

Rising Investment by Companies in Automotive Cybersecurity Drives Market Growth

The demand for electric and hybrid vehicles is rising across developed as well as developing countries, propelling the global automotive cybersecurity market growth. Manufacturers of electric vehicles are investing heavily in advancing the features of EVs to offer a seamless driving experience. The investment by companies also amplifies the requirement for purpose-built IoT cybersecurity solutions that efficiently safeguard mobility. In addition, investment offers opportunities to enhance the application and features of automobiles and accelerate the company's development of automotive security products along with expansion plans.

For instance, in April 2024, Upstream Security Ltd. received an investment from Cisco Systems, Inc. to protect mobility-connected vehicles and IoT devices across the globe. This investment offers opportunities to deepen the impact on the IoT sector along with automotive and transportation.

Government Favorable Rules and Regulations Push the Market Demand

Governments across the globe are introducing emission standards, laws, and rules due to rising environmental concerns, which resulted in the rise in the cost of offering electrical drivetrain components in the forecast period. In addition, across some specific countries, the integration of safety features, including rear-view mirror, emergency braking, lane departure warning system, stability control, and rear-view mirror has been made compulsory. Also, governments of different countries are implementing regulations focused on developing cybersecurity standards and the best methods to guide producers and other stakeholders. Additionally, the increasing investment in research and development activities by legal authorities focused on improving cybersecurity standards is driving the growth of the global automotive cybersecurity market.

For instance, in January 2024, the United Nations announced an expansion of its cybersecurity management regulation to motorcycles and scooters. This move is particularly significant given the development of features like adaptative cruise control and advanced connectivity in the motorcycle industry, which are raising concerns about potential cyber risks.

Passenger Cars Dominate with the Largest Share in the Global Automotive Cybersecurity Market

Passenger cars register the largest market share in the global market due to an increase in per capita of individuals, rising investments towards autonomous mobility, and growing sales of luxury-class vehicles in emerging countries. Manufacturers of passenger cars are introducing passenger cars equipped with connected features, including passenger vehicle telematics, infotainment systems, and autonomous capabilities. Also, they are investing in advancing features of connected passenger cars to protect sensitive data and confirming the safety of passenger cars coupled with passengers driving the demand for passenger cars. Governments in emerging countries are implementing different systems to protect the function of four-wheelers from cyber threats.

For instance, in November 2023, the Indian Ministry of Road Transport and Highways proposed uniform Cyber Security and Management Systems requirements for certain categories of four-wheelers, including commercial and passenger vehicles to prevent their functions from cyber threats.

North America Registers the Largest Automotive Cybersecurity Market Size

North America dominates the largest market size in the global market due to its large production of passenger vehicles, rising penetration of connected cars, and growing purchasing power of the middle-class income population. Also, the demand for automotive cybersecurity is rising due to increasing demand from consumers for comfortable driving and the safety of drivers and passengers. Manufacturers in the North America automotive cybersecurity market is spreading awareness concerning cyber-attacks on vehicles that encourage the adoption of electric functions in connected vehicles as well as hybrid vehicles which further drives the market growth. Also, companies in North America are planning to set up an automotive penetration testing lab to address the growing demand.

For instance, in April 2024, Argus Cyber Security Ltd., one of the leading companies in automotive cyber security, announced the establishment of a new penetration testing lab in Detroit, Michigan, to address the rising requirement from North American original equipment manufacturers (OEMs) and Tier 1 suppliers for domestic cyber security penetration testing services.

Future Market Scenario (2024-2031F)

Advanced innovation in the technology of vehicles and favorable government policies drive the demand for automotive cybersecurity market growth.

Incorporating formal methods and validation approaches has become essential in confirming the security of automotive systems, fostering the global automotive cybersecurity market growth.

Vehicle-to-everything communication technology allows vehicles to communicate with other vehicles and integrates lane departure warning systems, fostering global market growth.

The forward collision warning system is another groundbreaking technology in the global market that boasts revenue.

Key Players Landscape and Outlook

Companies in the global market are significantly investing in different research and development activities to expand their footprint and secure distribution networks at an international level. Key companies in the market are efficiently making innovations to access a fleet of vehicles remotely. They integrate vehicle control functions and turn on advanced safety features to mitigate cyber threats. In addition, companies are adopting different growth strategies, including joint ventures, new product launches, partnerships, amalgamation, and others, to expand their product portfolios and footprints. In March 2024, Upstream Security Ltd. announced the launch of the GenAI tool to tackle rising vehicle cyber-attacks.

In February 2024, Autocrypt Co., Ltd. announced a strategic partnership with MicroNova AG to advance automotive cybersecurity and to focus on the development of innovative test solutions in the field of automotive cybersecurity.

Table of Contents

1. Research Methodology

2. Project Scope and Definitions

3. Executive Summary

4. Voice of Customer

- 4.1. Product and Market Intelligence

- 4.2. Mode of Brand Awareness

- 4.3. Factors Considered in Purchase Decisions

- 4.3.1. Features and Other Value-Added Service

- 4.3.2. Compatibility

- 4.3.3. Efficiency of Solutions

- 4.3.4. After-Sales Support

- 4.4. Consideration of Privacy and Safety Regulations

5. Global Automotive Cybersecurity Market Outlook, 2017-2031F

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. By Product

- 5.2.1. Software

- 5.2.2. Hardware

- 5.3. By Vehicle Type

- 5.3.1. Passenger Vehicle

- 5.3.2. Commercial Vehicle

- 5.4. By Application

- 5.4.1. Body Control and Comfort

- 5.4.2. Telematics

- 5.4.3. ADAS and Safety

- 5.4.4. Powertrain Systems

- 5.4.5. Infotainment

- 5.4.6. Others

- 5.5. By Security Type

- 5.5.1. Endpoint

- 5.5.2. Application

- 5.5.3. Wireless Network

- 5.6. By Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia-Pacific

- 5.6.4. South America

- 5.6.5. Middle East and Africa

- 5.7. By Company Market Share (%), 2023

6. Global Automotive Cybersecurity Market Outlook, By Region, 2017-2031F

- 6.1. North America*

- 6.1.1. Market Size & Forecast

- 6.1.1.1. By Value

- 6.1.2. By Product

- 6.1.2.1. Software

- 6.1.2.2. Hardware

- 6.1.3. By Vehicle Type

- 6.1.3.1. Passenger Vehicle

- 6.1.3.2. Commercial Vehicle

- 6.1.4. By Application

- 6.1.4.1. Body Control and Comfort

- 6.1.4.2. Telematics

- 6.1.4.3. ADAS and Safety

- 6.1.4.4. Powertrain Systems

- 6.1.4.5. Infotainment

- 6.1.4.6. Others

- 6.1.5. By Security Type

- 6.1.5.1. Endpoint

- 6.1.5.2. Application

- 6.1.5.3. Wireless Network

- 6.1.6. United States*

- 6.1.6.1. Market Size & Forecast

- 6.1.6.1.1. By Value

- 6.1.6.2. By Product

- 6.1.6.2.1. Software

- 6.1.6.2.2. Hardware

- 6.1.6.3. By Vehicle Type

- 6.1.6.3.1. Passenger Vehicle

- 6.1.6.3.2. Commercial Vehicle

- 6.1.6.4. By Application

- 6.1.6.4.1. Body Control and Comfort

- 6.1.6.4.2. Telematics

- 6.1.6.4.3. ADAS and Safety

- 6.1.6.4.4. Powertrain Systems

- 6.1.6.4.5. Infotainment

- 6.1.6.4.6. Others

- 6.1.6.5. By Security Type

- 6.1.6.5.1. Endpoint

- 6.1.6.5.2. Application

- 6.1.6.5.3. Wireless Network

- 6.1.6.1. Market Size & Forecast

- 6.1.7. Canada

- 6.1.8. Mexico

- 6.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered

- 6.2. Europe

- 6.2.1. Germany

- 6.2.2. France

- 6.2.3. Italy

- 6.2.4. United Kingdom

- 6.2.5. Russia

- 6.2.6. Netherlands

- 6.2.7. Spain

- 6.2.8. Turkey

- 6.2.9. Poland

- 6.3. Asia-Pacific

- 6.3.1. India

- 6.3.2. China

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Vietnam

- 6.3.6. South Korea

- 6.3.7. Indonesia

- 6.3.8. Philippines

- 6.4. South America

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.5. Middle East and Africa

- 6.5.1. Saudi Arabia

- 6.5.2. UAE

- 6.5.3. South Africa

7. Market Mapping, 2023

- 7.1. By Product

- 7.2. By Vehicle Type

- 7.3. By Application

- 7.4. By Security Type

- 7.5. By Region

8. Macro Environment and Industry Structure

- 8.1. Demand Supply Analysis

- 8.2. Import Export Analysis

- 8.3. Value Chain Analysis

- 8.4. PESTEL Analysis

- 8.4.1. Political Factors

- 8.4.2. Economic System

- 8.4.3. Social Implications

- 8.4.4. Technological Advancements

- 8.4.5. Environmental Impacts

- 8.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 8.5. Porter's Five Forces Analysis

- 8.5.1. Supplier Power

- 8.5.2. Buyer Power

- 8.5.3. Substitution Threat

- 8.5.4. Threat From New Entrant

- 8.5.5. Competitive Rivalry

9. Market Dynamics

- 9.1. Growth Drivers

- 9.2. Growth Inhibitors (Challenges and Restraints)

10. Key Players Landscape

- 10.1. Competition Matrix of Top Five Market Leaders

- 10.2. Market Revenue Analysis of Top Five Market Leaders (By Value, 2023)

- 10.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4. SWOT Analysis (For Five Market Players)

- 10.5. Patent Analysis (If Applicable)

11. Pricing Analysis

12. Case Studies

13. Key Players Outlook

- 13.1. Infineon Technologies AG

- 13.1.1. Company Details

- 13.1.2. Key Management Personnel

- 13.1.3. Products and Services

- 13.1.4. Financials (As Reported)

- 13.1.5. Key Market Focus and Geographical Presence

- 13.1.6. Recent Developments

- 13.2. Continental AG (Argus Cyber Security Ltd.)

- 13.3. Robert Bosch GmbH (ETAS GmbH)

- 13.4. Garrett Motion Inc.

- 13.5. Intel Corporation

- 13.6. Aptiv PLC

- 13.7. Dellfer, Inc.

- 13.8. NVIDIA Corp

- 13.9. NXM Labs Inc.

- 13.10. Karamba Security Ltd.

- 13.11. Upstream Security Ltd.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.