|

|

市場調査レポート

商品コード

1509677

自動運転車の世界市場の評価:車両タイプ別、レベル別、推進タイプ別、コンポーネント別、地域別、機会、予測(2017年~2031年)Autonomous Vehicles Market Assessment, By Vehicle Type, By Levels, By Propulsion Type, By Component, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 自動運転車の世界市場の評価:車両タイプ別、レベル別、推進タイプ別、コンポーネント別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年07月09日

発行: Markets & Data

ページ情報: 英文 232 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の自動運転車の市場規模は、2023年の382億6,000万米ドルから2031年に2,066億5,000万米ドルに達すると予測され、予測期間の2024年~2031年にCAGRで23.47%の成長が見込まれます。交通安全に対する意識の高まり、厳格な政府規制の増加、自動車技術の急速な技術の進歩、デジタルインフラの革新が、世界の自動運転車市場の成長を促進しています。自動運転車は、さまざまなアクチュエーター、センサー、機械学習システム、複合アルゴリズム、強力なプロセッサーを使用してソフトウェアを実装します。これらの車両は人間の制御を必要とせず、従来の自動車のようにどこへでも行くことができます。さらに、これらの車両は人間の同乗者を必要とせず、経験豊富な人間のドライバーが行うようなあらゆることができます。AI、機械学習、センサー技術の絶え間ない革新が、この種の自動車のデジタル機能の進歩を後押ししています。これらの技術は自動運転車の全体的な安全性を高め、統合システムの知覚と意思決定を強化する重要なコンポーネントとして機能します。

意思決定、知覚、システム全体の一貫性の向上が、世界の自動運転車の市場シェアの成長を助けます。

加えて、自動運転車は、障害者と非ドライバーに独立したモビリティを提供します。移動中、自動運転車は高いレベルの快適性と柔軟性を提供し、自動運転車の需要を促進しています。自動運転車の利点に加え、ハイブリッド車や電気自動車の販売を奨励する政府の取り組みも世界の自動運転車市場の成長を後押ししています。自動運転車のメーカーは、自動運転車の機能と信頼性を向上させるため、さまざまな研究開発活動に資金を提供しています。自動車メーカーはまた、世界的にフットプリントを拡大し、最大の市場シェアを記録するために、パートナーとの協力や提携を進めています。

例えば、Volkswagenwerk G.m.b.H.は2024年3月、レベル4自動運転車についてMobileye Global Inc.とのパートナーシップを発表し、Mobileyeの自動運転システムをVolkswagenの将来の自動車に組み込むことに注力しています。また、このパートナーシップにより、最先端の技術、利便性、安全性を備えた自動運転車を顧客に提供します。

世界市場を牽引するシェアードモビリティとAIベースのカメラシステムに対する需要の高まり

自動運転車は、人間なし、あるいはほとんど干渉されることなく機能することができます。自動運転車は、便利な輸送に加え、交通渋滞の緩和や人為的ミスに起因する事故を最小限に抑えるよう設計されています。これらの開発は、ライドシェアサービスの拡大を加速させます。自動運転車はシェアードモビリティで急速に普及しつつあります。さらに、AIカメラシステムの利点には、コスト削減、確実な安全性に向けた補完技術の導入、非常にコンパクトなフォームファクターなどがあります。さまざまな企業が、完全自動運転体験を顧客に提供するために、必須のセンサーやAIベースのカメラシステムに投資しています。

例えば2023年6月、ベンガルールを拠点とするAIスタートアップのMinus Zero Robotics Private Limitedは、高解像度のカメラセンサー群を搭載したインド初の完全自動運転車を発表しました。この車両は、あらゆる走行条件や環境下で人間の介入なしに走行でき、周囲のリアルタイム画像を撮影できます。

エネルギー効率の高い自動運転車へのニーズの高まりが市場成長を促進

市場の急速な動向の1つに、低燃費、排ガスフリー、またはエネルギー効率の高い自動車の採用の増加があります。厳しい排ガス規制により、自動車メーカーはバッテリー電気自動車や燃料電池電気自動車など、新世代のクリーンエネルギー自動車の開発を余儀なくされています。さらに、利用可能な化石燃料が制限されていることによる化石燃料の価格の上昇が、従来の化石燃料自動車の代替として、電気自動車を含むエネルギー効率の高い自動車への需要を後押ししています。これらの自動車は、エネルギー消費を最適化し、効率的な運転によって効果を向上させるために、先進の自律性と革新的な技術を備えています。したがって、世界中での高効率なクリーンエネルギー自動運転車に対する需要の高まりが、自動運転車市場の成長を後押ししています。さらに、メーカーは自動運転車の機能を進化させ、世界市場での競争力を高めるために協力や投資を行っています。

当レポートでは、世界の自動運転車市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢と見通しなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 顧客の声

- 製品と市場情報

- ブランド認知の方式

- 購入決定において考慮される要素

- プライバシーと安全規制の考慮

第5章 世界の自動運転車市場の見通し(2017年~2031年)

- 市場規模と予測

- 金額

- 数量

- 車両タイプ別

- 乗用車

- 商用車

- レベル別

- レベル0

- レベル1

- レベル2

- レベル3

- レベル4

- レベル5

- 推進タイプ別

- 半自律

- 完全自律

- コンポーネント別

- カメラユニット

- LiDAR

- レーダーセンサー

- 超音波センサー

- 赤外線センサー

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 市場シェア:企業別(2023年)

第6章 世界の自動運転車市場の見通し:地域別(2017年~2031年)

- 北米

- 市場規模と予測

- 車両タイプ別

- レベル別

- 推進タイプ別

- コンポーネント別

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

- アジア太平洋

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

- 南米

- ブラジル

- アルゼンチン

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第7章 市場マッピング(2023年)

- 車両タイプ別

- レベル別

- 推進タイプ別

- コンポーネント別

- 地域別

第8章 マクロ環境と産業構造

- 需給分析

- 輸入輸出分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第9章 市場力学

- 成長促進要因

- 成長抑制要因(課題、抑制要因)

第10章 主要企業の情勢

- マーケットリーダー上位5社の競合マトリクス

- マーケットリーダー上位5社の市場収益の分析(2023年)

- 合併と買収/合弁事業(該当する場合)

- SWOT分析(市場企業5社)

- 特許分析(該当する場合)

第11章 価格分析

第12章 ケーススタディ

第13章 主要企業の見通し

- Tesla Inc.

- Waymo LLC

- Cruise LLC

- Zoox, Inc.

- Baidu, Inc.

- Ford Motor Company

- Argo AI LLC

- Aurora Innovation, Inc.

- General Motors Company

- Nvidia Corporation

- Pony.ai, Inc.

- Bayerische Motoren Werke AG

- Toyota Motor Corporation

- Volkswagenwerk G.m.b.H.

第14章 戦略的推奨

第15章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 2. Global Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 3. Global Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 4. Global Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 5. Global Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 6. Global Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 7. Global Autonomous Vehicles Market Share (%), By Region, 2017-2031F

- Figure 8. North America Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 9. North America Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 10. North America Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 11. North America Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 12. North America Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 13. North America Autonomous Vehicles Market Share (%), By Component, 2017-2031F

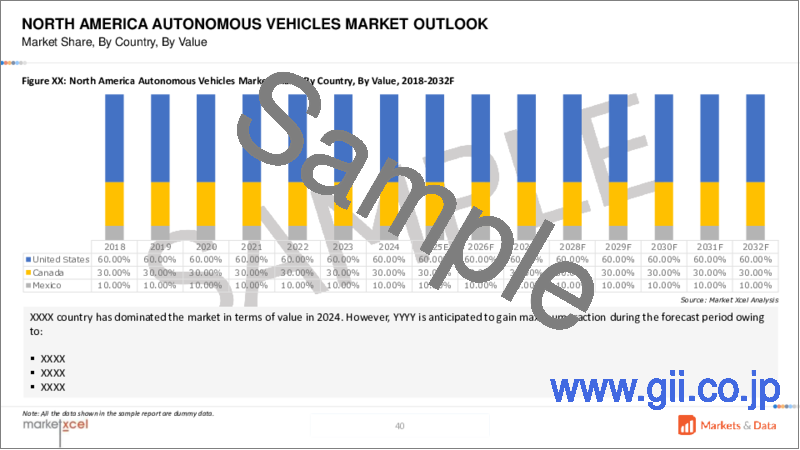

- Figure 14. North America Autonomous Vehicles Market Share (%), By Country, 2017-2031F

- Figure 15. United States Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 16. United States Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 17. United States Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 18. United States Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 19. United States Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 20. United States Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 21. Canada Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 22. Canada Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 23. Canada Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 24. Canada Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 25. Canada Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 26. Canada Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 27. Mexico Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 28. Mexico Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 29. Mexico Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 30. Mexico Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 31. Mexico Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 32. Mexico Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 33. Europe Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 34. Europe Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 35. Europe Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 36. Europe Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 37. Europe Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 38. Europe Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 39. Europe Autonomous Vehicles Market Share (%), By Country, 2017-2031F

- Figure 40. Germany Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 41. Germany Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 42. Germany Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 43. Germany Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 44. Germany Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 45. Germany Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 46. France Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 47. France Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 48. France Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 49. France Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 50. France Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 51. France Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 52. Italy Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 53. Italy Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 54. Italy Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 55. Italy Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 56. Italy Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 57. Italy Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 58. United Kingdom Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 59. United Kingdom Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 60. United Kingdom Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 61. United Kingdom Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 62. United Kingdom Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 63. United Kingdom Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 64. Russia Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 65. Russia Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 66. Russia Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 67. Russia Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 68. Russia Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 69. Russia Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 70. Netherlands Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 71. Netherlands Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 72. Netherlands Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 73. Netherlands Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 74. Netherlands Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 75. Netherlands Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 76. Spain Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 77. Spain Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 78. Spain Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 79. Spain Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 80. Spain Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 81. Spain Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 82. Turkey Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 83. Turkey Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 84. Turkey Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 85. Turkey Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 86. Turkey Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 87. Turkey Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 88. Poland Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 89. Poland Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 90. Poland Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 91. Poland Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 92. Poland Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 93. Poland Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 94. South America Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 95. South America Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 96. South America Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 97. South America Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 98. South America Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 99. South America Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 100. South America Autonomous Vehicles Market Share (%), By Country, 2017-2031F

- Figure 101. Brazil Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 102. Brazil Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 103. Brazil Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 104. Brazil Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 105. Brazil Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 106. Brazil Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 107. Argentina Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 108. Argentina Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 109. Argentina Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 110. Argentina Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 111. Argentina Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 112. Argentina Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 113. Asia-Pacific Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 114. Asia-Pacific Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 115. Asia-Pacific Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 116. Asia-Pacific Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 117. Asia-Pacific Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 118. Asia-Pacific Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 119. Asia-Pacific Autonomous Vehicles Market Share (%), By Country, 2017-2031F

- Figure 120. India Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 121. India Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 122. India Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 123. India Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 124. India Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 125. India Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 126. China Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 127. China Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 128. China Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 129. China Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 130. China Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 131. China Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 132. Japan Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 133. Japan Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 134. Japan Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 135. Japan Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 136. Japan Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 137. Japan Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 138. Australia Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 139. Australia Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 140. Australia Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 141. Australia Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 142. Australia Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 143. Australia Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 144. Vietnam Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 145. Vietnam Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 146. Vietnam Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 147. Vietnam Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 148. Vietnam Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 149. Vietnam Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 150. South Korea Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 151. South Korea Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 152. South Korea Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 153. South Korea Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 154. South Korea Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 155. South Korea Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 156. Indonesia Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 157. Indonesia Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 158. Indonesia Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 159. Indonesia Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 160. Indonesia Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 161. Indonesia Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 162. Philippines Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 163. Philippines Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 164. Philippines Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 165. Philippines Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 166. Philippines Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 167. Philippines Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 168. Middle East & Africa Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 169. Middle East & Africa Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 170. Middle East & Africa Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 171. Middle East & Africa Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 172. Middle East & Africa Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 173. Middle East & Africa Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 174. Middle East & Africa Autonomous Vehicles Market Share (%), By Country, 2017-2031F

- Figure 175. Saudi Arabia Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 176. Saudi Arabia Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 177. Saudi Arabia Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 178. Saudi Arabia Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 179. Saudi Arabia Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 180. Saudi Arabia Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 181. UAE Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 182. UAE Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 183. UAE Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 184. UAE Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 185. UAE Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 186. UAE Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 187. South Africa Autonomous Vehicles Market, By Value, In USD Billion, 2017-2031F

- Figure 188. South Africa Autonomous Vehicles Market, By Volume, In Units, 2017-2031F

- Figure 189. South Africa Autonomous Vehicles Market Share (%), By Vehicle Type, 2017-2031F

- Figure 190. South Africa Autonomous Vehicles Market Share (%), By Levels, 2017-2031F

- Figure 191. South Africa Autonomous Vehicles Market Share (%), By Propulsion Type, 2017-2031F

- Figure 192. South Africa Autonomous Vehicles Market Share (%), By Component, 2017-2031F

- Figure 193. By Vehicle Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 194. By Levels Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 195. By Propulsion Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 196. By Component Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 197. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global autonomous vehicles market is projected to observe a CAGR of 23.47% during the forecast period 2024-2031, growing from USD 38.26 billion in 2023 to USD 206.65 billion in 2031. Growing awareness about road safety, increasing strict government regulations, rapid technological advancements in automotive technologies, and innovations in digital infrastructure are driving the growth of the global autonomous vehicles market. An autonomous vehicle uses different actuators, sensors, machine learning systems, compound algorithms, and powerful processors to implement software. These vehicles do not require human control and can go anywhere like traditional cars. In addition, these do not require a human passenger and can do everything that an experienced human driver does. Constant innovations in artificial intelligence, machine learning, and sensor technologies are propelling advancements in the digital features of these types of cars. These technologies enhance the overall safety of autonomous vehicles and function as an important component in enhancing the perception and decision-making of integrated systems.

Advancement in decision-making, perception, and overall system consistency aids in the growth of global autonomous vehicles market share.

In addition, autonomous vehicles offer independent mobility to the disabled person coupled with non-drivers. While traveling, they provide a high level of comfort and flexibility, propelling a demand for autonomous vehicles. Besides the advantages of autonomous vehicles, government initiatives to encourage hybrid and electric vehicle sales are also driving the growth of the global market for autonomous vehicles. Producers of autonomous vehicles are funding different research and development activities to advance the functioning and reliability of autonomous vehicles. Automakers are also collaborating and partnering with partners to expand their footprint globally and register the largest market share.

For instance, in March 2024, Volkswagenwerk G.m.b.H. announced its partnership with Mobileye Global Inc. for level 4 autonomous vehicles to focus on incorporating Mobileye's self-driving system into Volkswagen's future cars. This partnership also offers customers autonomous vehicles with cutting-edge technology, convenience, and safety.

Growing Demand for Shared Mobility and AI-Based Camera Systems Driving the Global Market

Self-driving cars and autonomous vehicles can function without humans or with little interference. Autonomous vehicles are designed to minimize accidents resulting from eased traffic congestion and human error, coupled with convenient transportation. Their development will speed up the expansion of ridesharing services. Autonomous vehicles are rapidly attaining traction in shared mobility. In addition, the benefits of AI camera systems include cost savings, the implementation of complementary technologies for reliable safety, and a highly compact form factor. Different companies are investing in compulsory sensors and AI-based camera systems to offer fully autonomous driving experiences to their customers.

For instance, in June 2023, Minus Zero Robotics Private Limited a Bengaluru-based AI start-up, revealed India's first fully autonomous vehicle featuring a high-resolution camera-sensor suite. This vehicle can be run without human intervention in all driving conditions and environments and can capture real-time images of its surroundings.

Growing Requirement for Automated Energy-Efficient Vehicles to Promote Market Growth

One rapid trend in the market is the increasing adoption of fuel-efficient, emission-free, or energy-efficient automobiles. The strict emission regulations have compelled automakers to develop new-generation clean energy vehicles, comprising battery electric vehicles, fuel cell electric vehicles, and many more. Moreover, increasing fossil fuel prices owing to restricted availability propels demand for energy-efficient vehicles, including electric cars, as substitutes to traditional fossil fuel-powered vehicles. These vehicles are equipped with a high level of autonomy and innovative technologies to optimize energy consumption and deliver improved effectiveness through efficient driving. Hence, the rising demand for highly efficient clean energy autonomous vehicles globally propels the autonomous vehicle market growth. In addition, manufacturers are collaborating and investing to advance the features of autonomous vehicles and be competitive in the global market.

For instance, in October 2023, NEOM Company and Pony.ai, Inc. announced a joint venture to manufacture, develop, and deliver an autonomous driving service, energy-efficient autonomous vehicles, and smart vehicle infrastructure. This agreement contributes to building the world's first truly sustainable, autonomous, shared, and integrated mobility system across the globe.

Government Regulations Support the Market Growth

Regulatory bodies in different countries are increasingly favoring autonomous vehicles owing to their potential to lower the increasing number of road accidents. Many state governments have invested in the development of autonomous car infrastructure. For instance, in May 2023, the U.S. Department of Transportation Federal Highway Administration awarded the University of Michigan a USD 9.8 million federal grant to encourage connected vehicle research. This project is seen as part of the federal government's infrastructure initiative. In addition, automotive manufacturers comply with specifications and address safety standards set by different organizations, including the Insurance Institute for Highway Safety, the New Car Assessment Program, and the International Centre for Automotive Technology, to obtain vehicle authorization.

For instance, in 2024, the United States Department of Transportation initiated a USD 500 million grant program named Strengthening Mobility and Revolutionizing Transportation (SMART) to fund transportation technology projects. SMART will support initiatives comprising roadside sensors, autonomous vehicles, and aerial drones, aiming to invest in projects that bring transformative shifts in transportation.

Passenger Cars Segment Registers the Largest Market Share by Vehicle Type

The passenger car segment dominates the market growth due to the growing interest of consumers, increased disposable income, and the superior transportation mode. Autonomous vehicles are hands-free and stress-free transport, appealing to consumers looking for a relaxed and better driving experience. Steady advancements in technology, including AI algorithms, improved sensors, and connectivity, have made significant advancements in making passenger vehicles more handy and reliable. The passenger cars segment dominates the market as individuals choose private transport to avoid overcrowded public transport. There is an increase in demand for automated SUVs, and after the pandemic, the need to maintain social distancing has further increased the adoption rate of passenger cars. Moreover, the automakers are making significant innovations in autonomous driving to address the rising demand for autonomous passenger cars.

For instance, in October 2023, Tech Auto Private Limited announced a collaboration with Mobileye Global Inc. to achieve the objective of offering the pursuit of safe and reliable advanced driver-assistance systems (ADAS) and autonomous vehicle (AV) technology. This collaboration is also an important step towards offering safe software solutions in autonomous driving.

North America Registers the Largest Market Share

North America registers the highest market revenue share in the global autonomous vehicle market due to the region prioritizing the regulation of autonomous vehicle usage with precise demands. Governments are launching programs and delivering funding to confirm the safe deployment of autonomous vehicles. Different government initiatives, comprising funding and research and development programs for testing autonomous vehicles, are projected to propel market growth in North America. Increasing traffic congestion and fatalities, coupled with a public requirement for suitability, are fostering the requirement for safer and more efficient transportation choices in North America. Governments are enthusiastically developing guidelines to facilitate the testing and deployment of autonomous vehicles due to these challenges.

For instance, in March 2022, U.S. Transportation Secretary, Pete Buttigieg, announced that federal policy on autonomous vehicles would see 'meaningful' developments in the coming years.

Future Market Scenario (2024-2031F)

A significant amount of artificial intelligence programming in vehicle automation is driving the growth of the global autonomous vehicle market in the forecast period.

Innovations in advanced assistive driving systems are increasing demand for autonomous vehicles across the globe.

Increased technological innovations by OEMs for the advancement of autonomous vehicles is another key driving factor for market growth.

Increased energy savings and less environmental impact propelling the demand for autonomous vehicles.

Key Players Landscape and Outlook

Key players in the market provide a wide range of autonomous vehicles and services, aiming for consistent research and development to improve the technology. Their vehicles are equipped with proprietary autopilot systems, offering advanced driver assistance features and focusing on full self-driving capabilities. Furthermore, industry participants invest significantly in product development as autonomous vehicles require high-end electronic devices for advanced automotive features. Rapidly changing consumer preferences and rising awareness for environmentally friendly vehicles encourage market players to incorporate such features in their vehicles. These players often collaborate with electronic hardware manufacturing companies and other automakers to address rising consumer demand.

In June 2023, Tesla Inc. announced that this year Tesla self-driving cars will arrive. In this step, China is a major player in AI, and projected that China will become a leader in the field.

In April 2024, Waymo LLC announced that their self-driving cars are delivering Uber Eats (Uber Technologies, Inc.) orders for the very first time in the Phoenix metropolitan area.

Table of Contents

1. Research Methodology

2. Project Scope and Definitions

3. Executive Summary

4. Voice of Customer

- 4.1. Product and Market Intelligence

- 4.2. Mode of Brand Awareness

- 4.3. Factors Considered in Purchase Decisions

- 4.3.1. Features and Other Value-Added Service

- 4.3.2. Connected Infrastructure Compatibility

- 4.3.3. Efficiency of Solutions

- 4.3.4. After-Sales Support

- 4.4. Consideration of Privacy and Safety Regulations

5. Global Autonomous Vehicles Market Outlook, 2017-2031F

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. By Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. By Levels

- 5.3.1. Level 0

- 5.3.2. Level 1

- 5.3.3. Level 2

- 5.3.4. Level 3

- 5.3.5. Level 4

- 5.3.6. Level 5

- 5.4. By Propulsion Type

- 5.4.1. Semi-Autonomous

- 5.4.2. Fully Autonomous

- 5.5. By Components

- 5.5.1. Camera Unit

- 5.5.2. LiDAR

- 5.5.3. Radar Sensor

- 5.5.4. Ultrasonic Sensor

- 5.5.5. Infrared Sensor

- 5.6. By Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia-Pacific

- 5.6.4. South America

- 5.6.5. Middle East and Africa

- 5.7. By Company Market Share (%), 2023

6. Global Autonomous Vehicles Market Outlook, By Region, 2017-2031F

- 6.1. North America*

- 6.1.1. Market Size & Forecast

- 6.1.1.1. By Value

- 6.1.2. By Vehicle Type

- 6.1.2.1. Passenger Cars

- 6.1.2.2. Commercial Vehicles

- 6.1.3. By Levels

- 6.1.3.1. Level 0

- 6.1.3.2. Level 1

- 6.1.3.3. Level 2

- 6.1.3.4. Level 3

- 6.1.3.5. Level 4

- 6.1.3.6. Level 5

- 6.1.4. By Propulsion Type

- 6.1.4.1. Semi-Autonomous

- 6.1.4.2. Fully Autonomous

- 6.1.5. By Component

- 6.1.5.1. Camera Unit

- 6.1.5.2. LiDAR

- 6.1.5.3. Radar Sensor

- 6.1.5.4. Ultrasonic Sensor

- 6.1.5.5. Infrared Sensor

- 6.1.6. United States*

- 6.1.6.1. Market Size & Forecast

- 6.1.6.1.1. By Value

- 6.1.6.2. By Vehicle Type

- 6.1.6.2.1. Passenger Cars

- 6.1.6.2.2. Commercial Vehicles

- 6.1.6.3. By Levels

- 6.1.6.3.1. Level 0

- 6.1.6.3.2. Level 1

- 6.1.6.3.3. Level 2

- 6.1.6.3.4. Level 3

- 6.1.6.3.5. Level 4

- 6.1.6.3.6. Level 5

- 6.1.6.4. By Propulsion Type

- 6.1.6.4.1. Semi-Autonomous

- 6.1.6.4.2. Fully Autonomous

- 6.1.6.5. By Component

- 6.1.6.5.1. Camera Unit

- 6.1.6.5.2. LiDAR

- 6.1.6.5.3. Radar Sensor

- 6.1.6.5.4. Ultrasonic Sensor

- 6.1.6.5.5. Infrared Sensor

- 6.1.6.1. Market Size & Forecast

- 6.1.7. Canada

- 6.1.8. Mexico

- 6.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered

- 6.2. Europe

- 6.2.1. Germany

- 6.2.2. France

- 6.2.3. Italy

- 6.2.4. United Kingdom

- 6.2.5. Russia

- 6.2.6. Netherlands

- 6.2.7. Spain

- 6.2.8. Turkey

- 6.2.9. Poland

- 6.3. Asia-Pacific

- 6.3.1. India

- 6.3.2. China

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Vietnam

- 6.3.6. South Korea

- 6.3.7. Indonesia

- 6.3.8. Philippines

- 6.4. South America

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.5. Middle East and Africa

- 6.5.1. Saudi Arabia

- 6.5.2. UAE

- 6.5.3. South Africa

7. Market Mapping, 2023

- 7.1. By Vehicle Type

- 7.2. By Levels

- 7.3. By Propulsion Type

- 7.4. By Component

- 7.5. By Region

8. Macro Environment and Industry Structure

- 8.1. Demand Supply Analysis

- 8.2. Import Export Analysis

- 8.3. Value Chain Analysis

- 8.4. PESTEL Analysis

- 8.4.1. Political Factors

- 8.4.2. Economic System

- 8.4.3. Social Implications

- 8.4.4. Technological Advancements

- 8.4.5. Environmental Impacts

- 8.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 8.5. Porter's Five Forces Analysis

- 8.5.1. Supplier Power

- 8.5.2. Buyer Power

- 8.5.3. Substitution Threat

- 8.5.4. Threat From New Entrant

- 8.5.5. Competitive Rivalry

9. Market Dynamics

- 9.1. Growth Drivers

- 9.2. Growth Inhibitors (Challenges and Restraints)

10. Key Players Landscape

- 10.1. Competition Matrix of Top Five Market Leaders

- 10.2. Market Revenue Analysis of Top Five Market Leaders (By Value 2023)

- 10.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4. SWOT Analysis (For Five Market Players)

- 10.5. Patent Analysis (If Applicable)

11. Pricing Analysis

12. Case Studies

13. Key Players Outlook

- 13.1. Tesla Inc.

- 13.1.1. Company Details

- 13.1.2. Key Management Personnel

- 13.1.3. Products and Services

- 13.1.4. Financials (As Reported)

- 13.1.5. Key Market Focus and Geographical Presence

- 13.1.6. Recent Developments

- 13.2. Waymo LLC

- 13.3. Cruise LLC

- 13.4. Zoox, Inc.

- 13.5. Baidu, Inc.

- 13.6. Ford Motor Company

- 13.7. Argo AI LLC

- 13.8. Aurora Innovation, Inc.

- 13.9. General Motors Company

- 13.10. Nvidia Corporation

- 13.11. Pony.ai, Inc.

- 13.12. Bayerische Motoren Werke AG

- 13.13. Toyota Motor Corporation

- 13.14. Volkswagenwerk G.m.b.H.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.