|

|

市場調査レポート

商品コード

1504256

有効性試験の世界市場:評価 - サービスタイプ別、用途別、エンドユーザー別、地域別、機会、予測、2017~2031年Efficacy Testing Market Assessment, By Service Type, By Application, By End-user, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 有効性試験の世界市場:評価 - サービスタイプ別、用途別、エンドユーザー別、地域別、機会、予測、2017~2031年 |

|

出版日: 2024年07月01日

発行: Markets & Data

ページ情報: 英文 221 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の有効性試験の市場規模は、2024~2031年の予測期間中にCAGR 7.34%で成長し、2023年の3億6,663万米ドルから2031年には6億4,629万米ドルに達すると予測されます。有効性試験市場の拡大は、画期的な新薬や治療法の出現によって推進されています。医薬品や化粧品を管理する規制は、製品の安全性を重視し、医薬品有効成分(API)の有効性を確保することに重点を置いています。市場は、医薬品の規制遵守とバリデーションに重点を置き、防腐剤有効性試験(PET)などの多様なアプローチを取り入れています。これらの方法は、規制当局、標準化団体、産業団体、個々の企業間の協力を通じて長年にわたって発展してきました。これらの規制機関の主な目的は、高い文書化基準と科学的規制を遵守することです。新興国では、まだ十分に開拓されていない市場の潜在的可能性と大幅な成長見込みを背景に、多額の投資が行われています。

さまざまな製薬企業、研究機関、政府支援の間で、提携、共同研究、契約、M&Aなどの戦略が行われています。2022年3月、PFNonwovensとSmart Plastic Technologiesは、Smart Plasticの特許出願中のSPTek ECLIPSE技術をPFNonwovensの衛生・医療用不織布製品に組み込む独占共同開発契約を締結しました。この契約は、製品の徹底的な調査と有効性試験を経て、医療・衛生用途の不織布に生物同化素材を利用するための一歩を踏み出しました。

世界の有効性試験市場は、革新的な医薬品や治療法に対する世界の需要の高まりに牽引され、成長を遂げようとしています。このような需要は、がん、糖尿病、結核、心臓病などの慢性疾患や感染症の有病率の増加から生じています。慢性疾患に罹患することの多い老年人口の拡大も、新薬や治療薬に対する需要の増加に寄与しています。政府のイニシアチブはヘルスケアインフラを改善し、製薬産業と有効性試験市場の成長を促進します。さらに、遺伝性疾患やがんの罹患率の上昇が、個別化薬剤の需要をも押し上げています。さらに、感染症に対する感受性の個人差や、予後や治療法の設計における個人間の予測不可能性が、個別化医薬品のニーズの高まりに寄与しています。多くの患者が存在するため、個人の行動や身体反応には大きなばらつきがあり、有効性を高めるために個別化された医薬品への需要が強調され、その結果、医薬品の有効性試験の需要を牽引しています。

当レポートでは、世界の有効性試験市場について調査し、市場の概要とともに、サービスタイプ別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業プロファイルなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 世界の有効性試験市場の展望、2017~2031年

- 市場規模・予測

- サービスタイプ別

- 用途別

- エンドユーザー別

- 地域別

- 企業別市場シェア(%)、2023年

第5章 世界の有効性試験市場の展望、地域別、2017~2031年

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第6章 市場マッピング、2023年

第7章 マクロ環境・産業構造

- 需要供給分析

- 輸出入分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第8章 市場力学

第9章 規制枠組みとイノベーション

第10章 主要参入企業の情勢

第11章 価格分析

第12章 ケーススタディ

第13章 主要参入企業の展望

- Eurofins Viracor

- River Laboratories International, Inc.

- Becton, Dickinson and Company

- Societe Generale de Surveillance

- Merck KGaA

- bioMerieux SA

- Pacific Biolabs Inc

- WuXi AppTec

- North American Science Associates LLC

- Accugen Laboratories, Inc.

第14章 戦略的提言

第15章 会社概要・免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 2. Global Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 3. Global Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 4. Global Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 5. Global Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 6. Global Efficacy Testing Market Share (%), By Region, 2017-2031F

- Figure 7. North America Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 8. North America Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

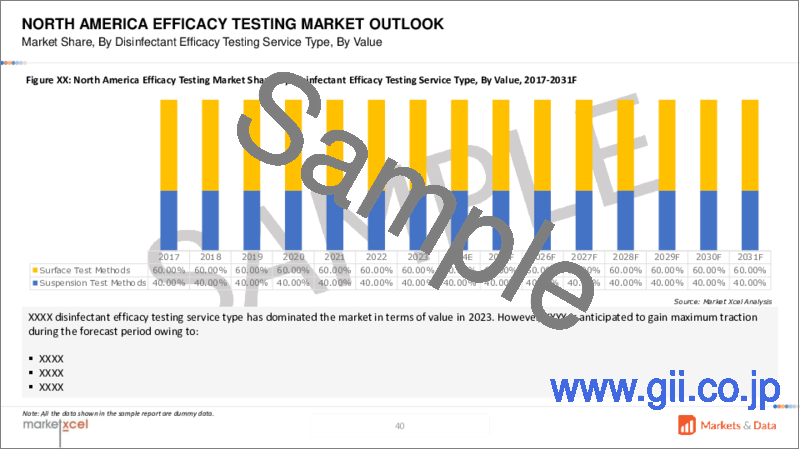

- Figure 9. North America Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 10. North America Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 11. North America Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 12. North America Efficacy Testing Market Share (%), By Country, 2017-2031F

- Figure 13. United States Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 14. United States Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 15. United States Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 16. United States Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 17. United States Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 18. Canada Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 19. Canada Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 20. Canada Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 21. Canada Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 22. Canada Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 23. Mexico Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 24. Mexico Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 25. Mexico Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 26. Mexico Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 27. Mexico Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 28. Europe Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 29. Europe Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 30. Europe Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 31. Europe Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 32. Europe Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 33. Europe Efficacy Testing Market Share (%), By Country, 2017-2031F

- Figure 34. Germany Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 35. Germany Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 36. Germany Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 37. Germany Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 38. Germany Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 39. France Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 40. France Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 41. France Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 42. France Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 43. France Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 44. Italy Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 45. Italy Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 46. Italy Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 47. Italy Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 48. Italy Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 49. United Kingdom Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 50. United Kingdom Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 51. United Kingdom Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 52. United Kingdom Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 53. United Kingdom Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 54. Russia Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 55. Russia Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 56. Russia Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 57. Russia Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 58. Russia Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 59. Netherlands Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 60. Netherlands Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 61. Netherlands Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 62. Netherlands Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 63. Netherlands Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 64. Spain Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 65. Spain Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 66. Spain Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 67. Spain Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 68. Spain Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 69. Turkey Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 70. Turkey Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 71. Turkey Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 72. Turkey Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 73. Turkey Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 74. Poland Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 75. Poland Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 76. Poland Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 77. Poland Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 78. Poland Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 79. South America Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 80. South America Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 81. South America Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 82. South America Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 83. South America Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 84. South America Efficacy Testing Market Share (%), By Country, 2017-2031F

- Figure 85. Brazil Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 86. Brazil Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 87. Brazil Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 88. Brazil Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 89. Brazil Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 90. Argentina Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 91. Argentina Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 92. Argentina Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 93. Argentina Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 94. Argentina Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 95. Asia-Pacific Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 96. Asia-Pacific Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 97. Asia-Pacific Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 98. Asia-Pacific Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 99. Asia-Pacific Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 100. Asia-Pacific Efficacy Testing Market Share (%), By Country, 2017-2031F

- Figure 101. India Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 102. India Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 103. India Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 104. India Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 105. India Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 106. China Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 107. China Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 108. China Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 109. China Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 110. China Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 111. Japan Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 112. Japan Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 113. Japan Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 114. Japan Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 115. Japan Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 116. Australia Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 117. Australia Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 118. Australia Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 119. Australia Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 120. Australia Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 121. Vietnam Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 122. Vietnam Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 123. Vietnam Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 124. Vietnam Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 125. Vietnam Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 126. South Korea Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 127. South Korea Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 128. South Korea Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 129. South Korea Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 130. South Korea Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 131. Indonesia Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 132. Indonesia Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 133. Indonesia Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 134. Indonesia Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 135. Indonesia Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 136. Philippines Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 137. Philippines Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 138. Philippines Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 139. Philippines Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 140. Philippines Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 141. Middle East & Africa Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 142. Middle East & Africa Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 143. Middle East & Africa Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 144. Middle East & Africa Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 145. Middle East & Africa Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 146. Middle East & Africa Efficacy Testing Market Share (%), By Country, 2017-2031F

- Figure 147. Saudi Arabia Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 148. Saudi Arabia Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 149. Saudi Arabia Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 150. Saudi Arabia Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 151. Saudi Arabia Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 152. UAE Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 153. UAE Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 154. UAE Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 155. UAE Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 156. UAE Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 157. South Africa Efficacy Testing Market, By Value, in USD Million, 2017-2031F

- Figure 158. South Africa Efficacy Testing Market, By Volume, in Million Units, 2017-2031F

- Figure 159. South Africa Efficacy Testing Market Share (%), By Service Type, 2017-2031F

- Figure 160. South Africa Efficacy Testing Market Share (%), By Application, 2017-2031F

- Figure 161. South Africa Efficacy Testing Market Share (%), By End-user, 2017-2031F

- Figure 162. By Service Type Map-Market Size (USD Million) & Growth Rate (%), 2023

- Figure 163. By Application Map-Market Size (USD Million) & Growth Rate (%), 2023

- Figure 164. By End-user Map-Market Size (USD Million) & Growth Rate (%), 2023

- Figure 165. By Region Map-Market Size (USD Million) & Growth Rate (%), 2023

Global efficacy testing market is projected to witness a CAGR of 7.34% during the forecast period 2024-2031, growing from USD 366.63 million in 2023 to USD 646.29 million in 2031. The expansion of the efficacy testing market is propelled by the advent of revolutionary, novel drugs and therapies. Regulations governing pharmaceutical and cosmetic products emphasize product safety, with a central focus on ensuring the efficacy of the active pharmaceutical ingredient (API). The marketplaces significance on regulatory compliance and validation of pharmaceutical products, incorporating diverse approaches such as preservative efficacy testing (PET). These methods have evolved over the years through collaboration among regulatory agencies, standards organizations, industry groups, and individual companies. The primary objective of these regulatory entities is to adhere to high documentation standards and scientific regulations. Significant investments are being made in emerging economies, driven by the untapped potential and substantial growth prospects in markets that are yet to be fully explored.

Strategies, such as partnerships, collaborations, agreements, and mergers and acquisitions, are taking place between different pharmaceutical companies, research institutes, and government support. In March 2022, PFNonwovens and Smart Plastic Technologies entered an exclusive joint development agreement to incorporate Smart Plastic's patent pending SPTek ECLIPSE technology into PFNonwovens' hygiene and medical nonwoven products. This agreement marked a step toward utilizing bio-assimilated materials in nonwovens for medical and hygiene applications, following thorough research and efficacy testing of the products.

In August 2022, Biocytogen Pharmaceuticals (Beijing) Co., Ltd. engaged in a global licensing arrangement with Merck to utilize Biocytogen's RenMice(TM) platform. As per the agreement, Merck gained complete access to Biocytogen's RenMice(TM) platform for the exploration and advancement of fully human antibody therapeutics across an extensive array of drug targets.

Rising Demand for Novel Drugs and Therapies

The global efficacy testing market is poised for growth, driven by the increasing demand for innovative drugs and therapies worldwide. This demand emerges from the increasing prevalence of chronic and infectious diseases like cancer, diabetes, tuberculosis, and heart diseases. The expanding geriatric population, often afflicted with chronic conditions, contributes to the increased demand for novel drugs and therapies. Government initiatives will improve healthcare infrastructure and fuel the growth of the pharmaceutical industry and efficacy testing market. Moreover, the rising incidence of genetic disorders and cancer is driving the demand for personalized drugs as well. Additionally, the varying susceptibility of individuals to infections and the inter-individual unpredictability in designing prognosis and treatments contribute to the growing need for personalized medicines. The substantial patient pool results in significant variations in individual behavior and bodily response, highlighting the demand for personalized medicines to enhance efficacy and, consequently, driving the demand for drug efficacy testing.

For instance, on July 26, 2023, the EU Commission published Regulation (EU) 2023/1545 amending Cosmetic Regulation (EC) 1223/2009 concerning allergens. This update includes new substances and revised restrictions on Cosmetic Product Labelling, expanding the number of allergens to be indicated in the INCI list of a finished cosmetic product if present at levels greater than 0.001% for leave-on products or 0.01% for rinse-off products.

Growing Adoption of Quality by Design (QbD) Approach

The healthcare sector is currently witnessing a notable trend as pharmaceutical and biotechnological companies increasingly embrace the quality by design (QbD) approach. This adoption stems from the critical emphasis on ensuring the stability and efficacy of drugs, both for patients and the companies. Many organizations are integrating the QbD approach to systematically identify, explain, and manage all sources of variability affecting a process, thereby safeguarding the quality of drugs. This ensures that the finished medicine consistently adheres to predefined performance characteristics right from the outset. Since the inception of QbD concepts, the industry has promptly embraced them to guarantee the quality of pharmaceutical and biotechnological products in compliance with regulatory requirements, employing approved research and development (R&D) and manufacturing procedures. Numerous quality requirements have been made mandatory for pharmaceutical or biotechnological products. The QbD approach has proven to be advantageous for pharmaceutical and biopharmaceutical companies, emphasizing that enhancing drug quality requires more than just increasing tests, thereby a proper R&D approach is indispensable.

A study in July 2023 highlighted that incorporating the Quality by Design (QbD) principle in the development of bilayer tablets will enhance product design and improve the quality, safety, and efficacy of drug products. According to the study, bilayer tablets have shown promising results for the development of fixed-dose combination (FDC) formulations.

Dominance of Pharmaceutical Manufacturing Applicants

The segment focusing on pharmaceutical manufacturing by application is poised for substantial growth in the forecast period. Clinical testing of drugs not only validates their performance and safety, but also enhances the credibility and authority of their packaging and marketing. The rising usage of drugs and vaccines contributes to an increased demand for efficacy testing, consequently propelling the growth of this segment. A considerable amount of testing and trials is required to give support to a newly developed drug throughout its manufacturing process. From discovery to development, and till the launch of a drug, a manufacturing company makes sure to pass its drug through many different phases and trials. Consequently, numerous companies are placing emphasis on efficacy testing for drugs in every phase. Efficacy testing, integral to drug research and development, verifies claims made on packaging or in marketing and ensures the intended use of the product. Preservative efficacy tests, crucial for confirming the safety of topical drugs for direct skin application, are also conducted. The mandatory regulation of these tests creates numerous opportunities for drug related efficacy testing.

Various countries are implementing rules and regulations to ensure compliance with claims made about drugs and vaccines. For example, Pfizer-BioNTech COVID-19 vaccine in May 2022, exhibited robust immune response, notable efficacy, and favorable safety in children aged 6 months to under 5 years after the administration of the third dose. The descriptive analysis revealed a vaccine efficacy of 80.3% during the period when the Omicron variant was predominant.

North America is Dominating the Global Efficacy Testing Market

Throughout the forecast period, North America is expected to lead the efficacy testing market, driven by factors such as increased research and development (R&D) activities and the widespread adoption of the quality by design (QbD) approach among regional market players. The pharmaceutical sector in North America is increasingly emphasizing outsourcing to contract research organizations (CROs) for drug development. Additionally, investments by government in contract development and manufacturing organizations (CDMO), drug substance, and drug product manufacturing capacities contribute to this dominance. The region boasts a well-established pharmaceutical industry, substantial R&D spending, a strong presence of major service providers, and a growing inclination among pharmaceutical and cosmetic companies to outsource analytical testing. According to OECD, in October 2022, pharmaceutical spending as a percentage of gross domestic product (GDP) was 2.08%, 1.72%, and 1.34% in the United States, Canada, and Mexico, respectively. This highlights the significant involvement of major players, manufacturers, and government organizations in product development, fostering demand for efficacy testing services and contributing to the overall growth of the examined market.

Future Market Scenario (2024 - 2031F)

Growth in demand of novel drugs and therapies to tackle numerous diseases presents the biggest opportunity for the efficacy testing market. Adoption of advanced and effective approaches have been devised to ensure the efficacy of APIs, which presents yet another opportunity in the market. R&D and heavy investments made by governments and healthcare companies is promoting developments in the efficacy testing market, and new labs and brands in this area of development are introducing advanced technologies, which, in turn, is propelling the market. For instance, SkinScience Analytics aims to transform the testing domain through its dedication to stringent scientific methodologies and commitment towards consumer welfare. Launched in August 2023 and based in Tucson, AZ, the lab specializes in various essential tests for product safety, encompassing the human repeat insult patch test (HRIPT), cumulative irritation testing, and safety-in-use evaluations.

Key Players Landscape and Outlook

Numerous companies, such as Eurofins Viracor, River Laboratories International, Inc., Becton, Dickinson and Company, Societe Generale de Surveillance, Merck KGaA, bioMerieux SA, Pacific Biolabs Inc, WuXi AppTec, North American Science Associates LLC, Accugen Laboratories, Inc., etc., are directing their attention towards organic growth initiatives, including product launches, approvals, and endeavors like patents and events. Organic growth strategies observed in the market include acquisitions, partnerships, and collaborations. These initiatives have facilitated the expansion of business operations and the customer base for efficacy testing market players. Market players in the efficacy testing market are poised to encounter promising growth prospects in the global market. The primary focus of these leading players is directed towards the rapidly expanding market segment, aiming to thrive and excel in a competitive market environment. Additionally, these market players emphasize collaboration and license agreements as strategic initiatives that are anticipated to propel market growth.

In June 2022, SGS inaugurated a dedicated biosafety level-2 microbiological laboratory within its testing facility in Phoenix, Arizona. Occupying approximately 4,000 square feet within the 12,000-square-foot building, this new laboratory will specialize in conducting efficacy testing for hand sanitizer and antibacterial hand soap.

In June 2022, Eurofins Cosmetics & Personal Care acquired CRA Korea Inc., a clinical testing laboratory situated in South Korea. This laboratory predominantly specializes in delivering safety and efficacy studies, consumer tests and personal care industry.

Table of Contents

1. Research Methodology

2. Project Scope & Definitions

3. Executive Summary

4. Global Efficacy Testing Market Outlook, 2017-2031F

- 4.1. Market Size & Forecast

- 4.1.1. By Value

- 4.1.2. By Volume

- 4.2. By Service Type

- 4.2.1. Antimicrobial/ Preservative Efficacy Testing

- 4.2.1.1. Traditional Test Methods

- 4.2.1.2. Rapid Test Methods

- 4.2.2. Disinfectant Efficacy Testing

- 4.2.2.1. Surface Test Methods

- 4.2.2.2. Suspension Test Methods

- 4.2.1. Antimicrobial/ Preservative Efficacy Testing

- 4.3. By Application

- 4.3.1. Pharmaceutical Manufacturing

- 4.3.2. Cosmetics and Personal Care Products

- 4.3.3. Consumer Products

- 4.3.4. Medical Devices

- 4.4. By End-user

- 4.4.1. Pharmaceutical Companies

- 4.4.2. Laboratories

- 4.4.3. Research Institutes

- 4.4.4. Others

- 4.5. By Region

- 4.5.1. North America

- 4.5.2. Europe

- 4.5.3. Asia-Pacific

- 4.5.4. South End-user America

- 4.5.5. Middle East and Africa

- 4.6. By Company Market Share (%), 2023

5. Global Efficacy Testing Market Outlook, By Region, 2017-2031F

- 5.1. North America*

- 5.1.1. Market Size & Forecast

- 5.1.1.1. By Value

- 5.1.1.2. By Volume

- 5.1.2. By Service Type

- 5.1.2.1. Antimicrobial/ Preservative Efficacy Testing

- 5.1.2.1.1. Traditional Test Methods

- 5.1.2.1.2. Rapid Test Methods

- 5.1.2.2. Disinfectant Efficacy Testing

- 5.1.2.2.1. Surface Test Methods

- 5.1.2.2.2. Suspension Test Methods

- 5.1.2.1. Antimicrobial/ Preservative Efficacy Testing

- 5.1.3. By Application

- 5.1.3.1. Pharmaceutical Manufacturing

- 5.1.3.2. Cosmetics and Personal Care Products

- 5.1.3.3. Consumer Products

- 5.1.3.4. Medical Devices

- 5.1.4. By End-user

- 5.1.4.1. Pharmaceutical Companies

- 5.1.4.2. Laboratories

- 5.1.4.3. Research Institutes

- 5.1.4.4. Others

- 5.1.5. United States*

- 5.1.5.1. Market Size & Forecast

- 5.1.5.1.1. By Value

- 5.1.5.1.2. By Volume

- 5.1.5.2. By Service Type

- 5.1.5.2.1. Antimicrobial/ Preservative Efficacy Testing

- 5.1.5.2.1.1. Traditional Test Methods

- 5.1.5.2.1.2. Rapid Test Methods

- 5.1.5.2.2. Disinfectant Efficacy Testing

- 5.1.5.2.2.1. Surface Test Methods

- 5.1.5.2.2.2. Suspension Test Methods

- 5.1.5.2.1. Antimicrobial/ Preservative Efficacy Testing

- 5.1.5.3. By Application

- 5.1.5.3.1. Pharmaceutical Manufacturing

- 5.1.5.3.2. Cosmetics and Personal Care Products

- 5.1.5.3.3. Consumer Products

- 5.1.5.3.4. Medical Devices

- 5.1.5.4. By End-user

- 5.1.5.4.1. Pharmaceutical Companies

- 5.1.5.4.2. Laboratories

- 5.1.5.4.3. Research Institutes

- 5.1.5.4.4. Others

- 5.1.5.1. Market Size & Forecast

- 5.1.6. Canada

- 5.1.7. Mexico

- 5.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered

- 5.2. Europe

- 5.2.1. Germany

- 5.2.2. France

- 5.2.3. Italy

- 5.2.4. United Kingdom

- 5.2.5. Russia

- 5.2.6. Netherlands

- 5.2.7. Spain

- 5.2.8. Turkey

- 5.2.9. Poland

- 5.3. Asia-Pacific

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Vietnam

- 5.3.6. South Korea

- 5.3.7. Indonesia

- 5.3.8. Philippines

- 5.4. South America

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.5. Middle East & Africa

- 5.5.1. Saudi Arabia

- 5.5.2. UAE

- 5.5.3. South Africa

6. Market Mapping, 2023

- 6.1. By Service Type

- 6.2. By Application

- 6.3. By End-user

- 6.4. By Region

7. Macro Environment and Industry Structure

- 7.1. Demand Supply Analysis

- 7.2. Import Export Analysis

- 7.3. Value Chain Analysis

- 7.4. PESTEL Analysis

- 7.4.1. Political Factors

- 7.4.2. Economic System

- 7.4.3. Social Implications

- 7.4.4. Technological Advancements

- 7.4.5. Environmental Impacts

- 7.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 7.5. Porter's Five Forces Analysis

- 7.5.1. Supplier Power

- 7.5.2. Buyer Power

- 7.5.3. Substitution Threat

- 7.5.4. Threat from New Entrant

- 7.5.5. Competitive Rivalry

8. Market Dynamics

- 8.1. Growth Drivers

- 8.2. Growth Inhibitors (Challenges and Restraints)

9. Regulatory Framework and Innovation

- 9.1. Patent Landscape

- 9.2. Innovations/Emerging Technologies

10. Key Players Landscape

- 10.1. Competition Matrix of Top Five Market Leaders

- 10.2. Market Revenue Analysis of Top Five Market Leaders (in %, 2023)

- 10.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4. SWOT Analysis (For Five Market Players)

- 10.5. Patent Analysis (If Applicable)

11. Pricing Analysis

12. Case Studies

13. Key Players Outlook

- 13.1. Eurofins Viracor

- 13.1.1. Company Details

- 13.1.2. Key Management Personnel

- 13.1.3. Products & Services

- 13.1.4. Financials (As reported)

- 13.1.5. Key Market Focus & Geographical Presence

- 13.1.6. Recent Developments

- 13.2. River Laboratories International, Inc.

- 13.3. Becton, Dickinson and Company

- 13.4. Societe Generale de Surveillance

- 13.5. Merck KGaA

- 13.6. bioMerieux SA

- 13.7. Pacific Biolabs Inc

- 13.8. WuXi AppTec

- 13.9. North American Science Associates LLC

- 13.10. Accugen Laboratories, Inc.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.