|

|

市場調査レポート

商品コード

1499969

オリゴヌクレオチド合成の世界市場の評価:製品別、タイプ別、用途別、エンドユーザー別、地域別、機会、予測(2017年~2031年)Oligonucleotide Synthesis Market Assessment, By Product, By Type, By Application, By End-user, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| オリゴヌクレオチド合成の世界市場の評価:製品別、タイプ別、用途別、エンドユーザー別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年06月25日

発行: Markets & Data

ページ情報: 英文 233 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のオリゴヌクレオチド合成の市場規模は、2023年の60億6,000万米ドルから2031年に187億6,000万米ドルに達すると予測され、2024年~2031年の予測期間にCAGRで15.17%の成長が見込まれます。市場の成長は、製薬・バイオテクノロジー部門における研究開発投資の増加、さまざまな企業間の共同研究やパートナーシップの増加、慢性疾患の流行、法医学や遺伝子検査、研究活動で使用されるカスタムオリゴヌクレオチドに対する需要の高まりによって支えられています。

研究開発投資の増加は、オリゴヌクレオチド合成市場における世界の大きな動向です。2023年9月、スペインの主要製薬企業の1つであるInsud Pharma Groupは、Chemo India Formulation Private Limitedにオリゴヌクレオチドセンターを開設しました。この研究・生産センターは、オリゴヌクレオチドの商業生産と研究に注力します。この施設は、Drug Control Center of India、Spanish Health Agency、米国FDA(米国食品医薬品協会)の検査と承認を受けました。

新しい製品や技術の導入は、市場に有利な成長機会を提供します。2024年4月、Asahi Kasei Bioprocess Inc.は、最新のオリオ製造イノベーションであるTHESYS ACS ERGO合成カラムを発表しました。このカラムは、製品の品質を維持し、ユーザーの安全性を維持しながら、切り替え時間の短縮を実現します。THESYS ACS ERGOは、作業者にやさしい設計により、安全でスムーズな切り替えを可能にし、バッチ間の非効率性を低減するように設計されています。THESYS ACS ERGOの時間短縮機能は、メンテナンスと交換プロセスでネジボルトを使用しないことによって達成されます。

M&Aが市場拡大を支える

市場の成長を支えているのは、世界中のさまざまな地域におけるM&Aや提携の増加です。こうした活動により、企業は共同研究を成功させ、先進技術の発見、提供、開発を確実に進めることができます。M&Aは企業の有機的拡大を助け、研究開発活動や新しい治療法や技術の開発の推進に必要な資金を提供し、オリゴヌクレオチド合成の世界市場の成長を後押しします。

2024年6月、GSK plcはオリゴヌクレオチド治療薬の可能性を活用するため、Elsie Biotechnologies, LLCを5,000万米ドルで買収すると発表しました。オリゴヌクレオチドは遺伝子発現を調節するユニークな能力を持っており、低分子生物製剤や分子では対応できないような幅広い治療ターゲットに対応できる可能性があります。Elsieは、オリゴヌクレオチド治療薬の送達の最適化、毒性の低減、効力の増強に注力しています。Elsieの買収により、GSKは遺伝子調節における研究開発の強化が見込まれます。さらに、GSKによる機器学習とAIの活用は、Elsieのプラットフォームからのデータと組み合わせることで、将来のオリゴヌクレオチド設計の合理化に向けた予測モデルの開発を支援すると予測されています。

診断における用途の増加が市場の成長を後押し

さまざまな疾患や障害の流行によるオリゴヌクレオチド需要の増加は、オリゴヌクレオチド合成の世界的な需要を強化しています。研究や診断の用途では、オリゴヌクレオチドは多孔質ガラス(CPG)を用いて合成されます。分子生物学では、オリゴヌクレオチドはハイブリダイゼーションアッセイやポリメラーゼ連鎖反応を用いて目的のRNAやDNA配列を検出するのに役立ちます。オリゴヌクレオチドベースのマイクロアレイは、さまざまな細胞タイプや組織における遺伝子発現レベルを分析するために開発され、オリゴヌクレオチドプローブは、遺伝子疾患に関連する多型や特定の変異を同定するために使用することができます。遺伝性疾患の患者数の増加が、診断介入向けオリゴヌクレオチドの需要を高めています。Epilepsy Foundationの推計によると、2万人~4万人に1人がドラベ症候群です。

当レポートでは、世界のオリゴヌクレオチド合成市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢と見通しなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 世界のオリゴヌクレオチド合成市場の見通し(2017年~2031年)

- 市場規模と予測

- 金額

- 製品別

- オリゴヌクレオチド

- 機器

- 試薬

- タイプ別

- カスタマイズされたオリゴ

- あらかじめ設計されたオリゴ

- 用途別

- 治療

- 診断

- 研究

- エンドユーザー別

- 製薬企業、バイオテクノロジー企業

- 診断検査室

- 学術研究機関

- 病院

- 地域別

- 北米

- 南米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 市場シェア:企業別(2023年)

第5章 世界のオリゴヌクレオチド合成市場の見通し:地域別(2017年~2031年)

- 北米

- 市場規模と予測

- 製品別

- タイプ別

- 用途別

- エンドユーザー別

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

- アジア太平洋

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

- 南米

- ブラジル

- アルゼンチン

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第6章 市場マッピング(2023年)

- 製品別

- タイプ別

- 用途別

- エンドユーザー別

- 地域別

第7章 マクロ環境と産業構造

- 需給分析

- 輸入輸出分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第8章 市場力学

- 成長促進要因

- 成長抑制要因(課題、抑制要因)

第9章 規制枠組みとイノベーション

- 臨床試験

- 特許情勢

- 規制当局の承認

- イノベーション/新技術

第10章 主要企業の情勢

- マーケットリーダー上位5社の競合マトリクス

- マーケットリーダー上位5社の市場収益の分析(2023年)

- 合併と買収/合弁事業(該当する場合)

- SWOT分析(市場企業5社)

- 特許分析(該当する場合)

第11章 ケーススタディ

第12章 主要企業の見通し

- Thermo Fisher Scientific Inc.

- Merck & Co., Inc.

- Agilent Technologies, Inc.

- Eurofins Scientific SE

- Bio-Synthesis, Inc.

- Danaher Corporation

- KANEKA CORPORATION

- Sarepta Therapeutics, Inc.

- Biogen Inc.

- GenScript Biotech Corporation

第13章 戦略的推奨

第14章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 2. Global Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 3. Global Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 4. Global Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 5. Global Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 6. Global Oligonucleotide Market Share (%), By Region, 2017-2031F

- Figure 7. North America Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 8. North America Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 9. North America Oligonucleotide Market Share (%), By Type, 2017-2031F

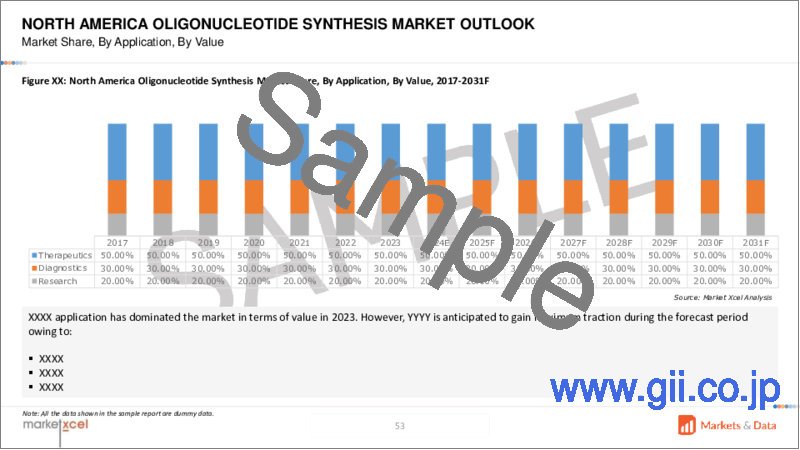

- Figure 10. North America Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 11. North America Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 12. North America Oligonucleotide Market Share (%), By Country, 2017-2031F

- Figure 13. United States Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 14. United States Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 15. United States Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 16. United States Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 17. United States Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 18. Canada Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 19. Canada Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 20. Canada Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 21. Canada Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 22. Canada Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 23. Mexico Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 24. Mexico Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 25. Mexico Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 26. Mexico Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 27. Mexico Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 28. Europe Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 29. Europe Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 30. Europe Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 31. Europe Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 32. Europe Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 33. Europe Oligonucleotide Market Share (%), By Country, 2017-2031F

- Figure 34. Germany Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 35. Germany Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 36. Germany Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 37. Germany Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 38. Germany Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 39. France Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 40. France Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 41. France Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 42. France Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 43. France Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 44. Italy Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 45. Italy Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 46. Italy Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 47. Italy Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 48. Italy Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 49. United Kingdom Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 50. United Kingdom Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 51. United Kingdom Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 52. United Kingdom Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 53. United Kingdom Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 54. Russia Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 55. Russia Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 56. Russia Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 57. Russia Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 58. Russia Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 59. Netherlands Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 60. Netherlands Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 61. Netherlands Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 62. Netherlands Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 63. Netherlands Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 64. Spain Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 65. Spain Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 66. Spain Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 67. Spain Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 68. Spain Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 69. Turkey Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 70. Turkey Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 71. Turkey Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 72. Turkey Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 73. Turkey Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 74. Poland Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 75. Poland Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 76. Poland Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 77. Poland Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 78. Poland Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 79. South America Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 80. South America Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 81. South America Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 82. South America Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 83. South America Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 84. South America Oligonucleotide Market Share (%), By Country, 2017-2031F

- Figure 85. Brazil Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 86. Brazil Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 87. Brazil Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 88. Brazil Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 89. Brazil Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 90. Argentina Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 91. Argentina Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 92. Argentina Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 93. Argentina Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 94. Argentina Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 95. Asia-Pacific Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 96. Asia-Pacific Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 97. Asia-Pacific Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 98. Asia-Pacific Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 99. Asia-Pacific Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 100. Asia-Pacific Oligonucleotide Market Share (%), By Country, 2017-2031F

- Figure 101. India Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 102. India Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 103. India Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 104. India Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 105. India Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 106. China Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 107. China Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 108. China Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 109. China Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 110. China Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 111. Japan Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 112. Japan Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 113. Japan Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 114. Japan Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 115. Japan Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 116. Australia Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 117. Australia Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 118. Australia Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 119. Australia Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 120. Australia Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 121. Vietnam Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 122. Vietnam Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 123. Vietnam Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 124. Vietnam Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 125. Vietnam Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 126. South Korea Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 127. South Korea Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 128. South Korea Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 129. South Korea Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 130. South Korea Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 131. Indonesia Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 132. Indonesia Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 133. Indonesia Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 134. Indonesia Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 135. Indonesia Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 136. Philippines Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 137. Philippines Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 138. Philippines Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 139. Philippines Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 140. Philippines Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 141. Middle East & Africa Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 142. Middle East & Africa Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 143. Middle East & Africa Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 144. Middle East & Africa Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 145. Middle East & Africa Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 146. Middle East & Africa Oligonucleotide Market Share (%), By Country, 2017-2031F

- Figure 147. Saudi Arabia Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 148. Saudi Arabia Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 149. Saudi Arabia Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 150. Saudi Arabia Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 151. Saudi Arabia Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 152. UAE Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 153. UAE Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 154. UAE Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 155. UAE Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 156. UAE Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 157. South Africa Oligonucleotide Market, By Value, In USD Billion, 2017-2031F

- Figure 158. South Africa Oligonucleotide Market Share (%), By Product, 2017-2031F

- Figure 159. South Africa Oligonucleotide Market Share (%), By Type, 2017-2031F

- Figure 160. South Africa Oligonucleotide Market Share (%), By Application, 2017-2031F

- Figure 161. South Africa Oligonucleotide Market Share (%), By End-user, 2017-2031F

- Figure 162. By Product Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 163. By Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 164. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 165. By End-user Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 166. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global oligonucleotide synthesis market is projected to witness a CAGR of 15.17% during the forecast period 2024-2031F, growing from USD 6.06 billion in 2023 to USD 18.76 billion in 2031F. The market's growth is supported by the increasing investments towards research and development activities in the pharmaceutical and biotechnology sectors, rising collaborations and partnerships among various companies, growing prevalence of chronic diseases, and rising demand for custom oligonucleotides for use in forensics, genetic testing, and research activities.

Rising research and development investments are a major global trend in the oligonucleotide synthesis market. In September 2023, Insud Pharma Group, one of the leading Spanish pharmaceutical companies, inaugurated its oligonucleotide center at Chemo India Formulation Private Limited. The research and production center will focus on commercial production and research on oligonucleotides. The facility was inspected and approved by the Drug Control Center of India, Spanish Health Agency, and the US FDA (United States Food and Drug Association).

Introducing novel products and technologies provides lucrative growth opportunities to the market. In April 2024, Asahi Kasei Bioprocess Inc. unveiled their latest olio manufacturing innovation, the THESYS ACS ERGO synthesis column, which offers reduced changeover time while maintaining the quality of the product and maintaining user safety. The THESYS ACS ERGO facilitates a safe and smooth changeover between runs with the help of its operator-friendly design and is engineered to reduce inefficiencies between batches. The time-saving feature of the THESYS ACS ERGO is achieved by eliminating the utilization of threaded bolts in the maintenance and changeover process.

Mergers and Acquisitions are Supporting Market Expansion

The growth of the market is supported by the rising mergers and acquisitions and successful collaborations in various regions across the globe. These activities allow companies to follow through with successful research collaborations and ensure the discovery, delivery, and development of advanced technologies. Mergers and acquisitions aid in the company's organic expansion and provide necessary funds for driving research and development activities and development of novel therapies and technologies, thus bolstering the global oligonucleotide synthesis market growth.

In June 2024, GSK plc announced the acquisition of Elsie Biotechnologies, LLC for USD 50 million to capitalize on the potential of oligonucleotide therapeutics. The unique ability of the oligonucleotides to modulate gene expressions makes them a potential modality for addressing a wide range of therapeutic targets that might not be amenable to small biologics and molecules. Elsie is focused on optimizing delivery, reducing toxicity, and enhancing the potency of oligonucleotide therapeutics. With the acquisition of Elsie, GSK is expected to enhance its research and development efforts in gene modulation. Furthermore, the utilization of machine learning and artificial intelligence by GSK, in combination with the data from Elsie's platform, is expected to support the development of predictive models for streamlining future oligonucleotide designs.

Rising Applications in Diagnostics Bolsters the Market Growth

The rising demand for oligonucleotides due to the growing prevalence of various diseases and disorders is bolstering the global demand for oligonucleotide synthesis. For research and diagnostic applications, oligonucleotides are synthesized using controlled pore glass (CPG). In molecular biology, oligonucleotides aid in detecting the desired RNA and DNA sequences using hybridization assays and polymerase chain reactions. The oligonucleotide-based microarrays have been developed to analyze the gene expression levels in various cell types and tissues, and oligonucleotide probes can be used to identify polymorphisms and specific mutations associated with genetic disorders. The rise in the number of cases of genetic disorders is thus bolstering the demand for oligonucleotides for diagnostic interventions. According to the estimates of the epilepsy foundation, 1 in 20,000 to 1 in 40,000 individuals have Dravet Syndrome.

Therapeutics Segment to Account for Significant Global Oligonucleotide Synthesis Market Share

The growth of the segment is aided by the rising prevalence of chronic diseases and increasing utilization of oligonucleotides in drug development processes. Over the past few years' oligonucleotides have demonstrated the ability to provide patients with major therapeutic benefits, future developments are expected to boost the expansion of the segment. The segment's growth is supported by the rise in the number of collaborations to support the discovery and development of oligonucleotide therapeutics. In May 2024, Orbit Discovery Ltd. and Secarna Pharmaceuticals GmbH & Co. entered in a collaboration for developing peptide-conjugated targeted antisense oligonucleotide (ASO) therapeutics. The collaboration aims to expand Secarna's reach of antisense approaches and strengthen their ability of creating targeted antisense therapeutics, allowing them to offer novel treatment solutions for a wide range of diseases.

Additionally, the growth of the market is supported by the rising investments in companies that are focused on the development of targeted oligonucleotide therapeutics. In January 2022, Ceptur Therapeutics, Inc. announced the completion of a USD 75 million Series A financing. The biotechnology company focuses on the development of targeted oligonucleotide therapeutics that are based on U1 Adaptor Technology. Such investments are expected to support the development of novel products, propelling the expansion of the segment.

North America Accounts for Significant Market Share

The factors supporting the market's growth in North America include rising investments towards the development of advanced therapeutic solutions, rapid expansion of the healthcare and pharmaceutical sectors, and increasing prevalence of various chronic diseases. According to the estimates of the National Cancer Institute, approximately 2,001,140 cases of cancer and 611,720 deaths from the disease are expected to occur in the United States in 2024.

The growing emphasis on novel product development coupled with rising approvals from the US FDA further supports the market expansion. In June 2024, the FDA approved Geron Corporation's RYTELO (imetelstat), an oligonucleotide telomerase inhibitor for treating adults with low-to-intermediate-1 risk myelodysplastic syndromes (LR-MDS) that have transfusion-dependent anemia and require four or more units of red blood cells over eight weeks. Approval was given based on the safety and efficacy findings from the placebo-controlled, randomized, phase 3 IMerge trial.

Furthermore, rising investments in the development of oligonucleotide manufacturing facilities are supporting the expansion of the market in North America. In November 2023, Integrated DNA Technologies, Inc. opened its new therapeutic oligonucleotide manufacturing facility in Iowa, the United States. The site manufactures gene therapy reagents and cGMP cells, including donor oligos for homology-directed repair and sgRNAs (single guide RNAs).

Future Market Scenario (2024 - 2031F)

The potential applications for oligonucleotide synthesis are expected to expand over the forecast period, from gene regulation to gene editing and personalized medicine, novel applications of oligonucleotide synthesis are anticipated to emerge. Future applications and innovations are expected to increasingly focus on personalized medicines and the designing of oligonucleotides that are capable of targeting specific genomic regions or mutations, strengthening the possibility of developing therapies tailored to specific patient requirements, thus facilitating the growth of the market in the forecast period.

Furthermore, the rise in the number of research activities that use oligonucleotides as interventions or treatments is expected to support the expansion of the market in the coming years. The University College London (UCL) is conducting an interventional study, which is expected to conclude in August 2025, to assess if the drug NIO752 reduces the production of tau protein by the brain. In normal conditions tau is responsible for stabilizing neuronal microtubules, however in Alzheimer's the protein builds up in the brain and causes damage.

Key Players Landscape and Outlook

The rising investments by companies across the globe towards developing oligonucleotide manufacturing facilities is expected to boost the global oligonucleotide synthesis market size. Companies are increasingly focusing on forming strategic partnerships and alliances to support such development activities. In April 2024, Axolabs Gmbh and Asahi Kasei Bioprocess Inc. (AKB), part of the Asahi Kasei Group, announced a partnership to build a cGMP manufacturing facility in Berlin to accelerate the commercialization and development of oligonucleotide-based therapies.

Such investments are increasing as oligonucleotide therapies offer targeted approaches for protein production and gene expression modulation and can potentially treat a broad range of diseases. At present, the FDA has approved eighteen oligonucleotide drugs.

Additionally, the market's growth is supported by the rising investments by the key market players in oligonucleotide manufacturing suites. In March 2024, Merck announced the opening of its first cGMP Oligonucleotide Manufacturing suite in Missouri, the United States. The development is expected to enhance the company's oligo offerings to include cGMP quality oligos tailored for clinical and diagnostic markets.

Table of Contents

1. Research Methodology

2. Project Scope and Definitions

3. Executive Summary

4. Global Oligonucleotide Synthesis Market Outlook, 2017-2031F

- 4.1. Market Size & Forecast

- 4.1.1. By Value

- 4.2. By Product

- 4.2.1. Oligonucleotides

- 4.2.1.1. DNA

- 4.2.1.1.1. Array-based

- 4.2.1.1.2. Column-based

- 4.2.1.2. RNA

- 4.2.1.2.1. Technology

- 4.2.1.2.1.1. Array-based

- 4.2.1.2.1.2. Column-based

- 4.2.1.2.2. Type

- 4.2.1.2.2.1. CRISPR (sgRNA)

- 4.2.1.2.2.2. Short RNA Oligos

- 4.2.1.2.2.3. Long RNA Oligos

- 4.2.1.2.1. Technology

- 4.2.1.1. DNA

- 4.2.2. Equipment

- 4.2.3. Reagents

- 4.2.1. Oligonucleotides

- 4.3. By Type

- 4.3.1. Customized Oligos

- 4.3.2. Predesigned Oligos

- 4.4. By Application

- 4.4.1. Therapeutics

- 4.4.2. Diagnostics

- 4.4.3. Research

- 4.5. By End-user

- 4.5.1. Pharmaceutical and Biotechnology Company

- 4.5.2. Diagnostic Laboratories

- 4.5.3. Academic Research Institutes

- 4.5.4. Hospitals

- 4.6. By Region

- 4.6.1. North America

- 4.6.2. South America

- 4.6.3. Europe

- 4.6.4. Asia-Pacific

- 4.6.5. Middle East and Africa

- 4.7. By Company Market Share (%), 2023

5. Global Oligonucleotide Synthesis Market Outlook, By Region, 2017-2031F

- 5.1. North America*

- 5.1.1. Market Size & Forecast

- 5.1.1.1. By Value

- 5.1.2. By Product

- 5.1.2.1. Oligonucleotides

- 5.1.2.1.1. DNA

- 5.1.2.1.1.1. Array-based

- 5.1.2.1.1.2. Column-based

- 5.1.2.1.2. RNA

- 5.1.2.1.2.1. Technology

- 5.1.2.1.2.1.1. Array-based

- 5.1.2.1.2.1.2. Column-based

- 5.1.2.1.2.2. Type

- 5.1.2.1.2.2.1. CRISPR (sgRNA)

- 5.1.2.1.2.2.2. Short RNA Oligos

- 5.1.2.1.2.2.3. Long RNA Oligos

- 5.1.2.1.1. DNA

- 5.1.2.2. Equipment

- 5.1.2.3. Reagents

- 5.1.2.1. Oligonucleotides

- 5.1.3. By Type

- 5.1.3.1. Customized Oligos

- 5.1.3.2. Predesigned Oligos

- 5.1.4. By Application

- 5.1.4.1. Therapeutics

- 5.1.4.2. Diagnostics

- 5.1.4.3. Research

- 5.1.5. By End-user

- 5.1.5.1. Pharmaceutical and Biotechnology Company

- 5.1.5.2. Diagnostic Laboratories

- 5.1.5.3. Academic Research Institutes

- 5.1.5.4. Hospitals

- 5.1.6. United States*

- 5.1.6.1. Market Size & Forecast

- 5.1.6.1.1. By Value

- 5.1.6.2. By Product

- 5.1.6.2.1. Oligonucleotides

- 5.1.6.2.1.1. DNA

- 5.1.6.2.1.1.1. Array-based

- 5.1.6.2.1.1.2. Column-based

- 5.1.6.2.1.2. RNA

- 5.1.6.2.1.2.1. Technology

- 5.1.6.2.1.2.1.1. Array-based

- 5.1.6.2.1.2.1.2. Column-based

- 5.1.6.2.1.2.2. Type

- 5.1.6.2.1.2.2.1. CRISPR (sgRNA)

- 5.1.6.2.1.2.2.2. Short RNA Oligos

- 5.1.6.2.1.2.2.3. Long RNA Oligos

- 5.1.6.2.2. Equipment

- 5.1.6.2.3. Reagents

- 5.1.6.2.1. Oligonucleotides

- 5.1.6.3. By Type

- 5.1.6.3.1. Customized Oligos

- 5.1.6.3.2. Predesigned Oligos

- 5.1.6.4. By Application

- 5.1.6.4.1. Therapeutics

- 5.1.6.4.2. Diagnostics

- 5.1.6.4.3. Research

- 5.1.6.5. By End-user

- 5.1.6.5.1. Pharmaceutical and Biotechnology Company

- 5.1.6.5.2. Diagnostic Laboratories

- 5.1.6.5.3. Academic Research Institutes

- 5.1.6.5.4. Hospitals

- 5.1.6.1. Market Size & Forecast

- 5.1.7. Canada

- 5.1.8. Mexico

- 5.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered

- 5.2. Europe

- 5.2.1. Germany

- 5.2.2. France

- 5.2.3. Italy

- 5.2.4. United Kingdom

- 5.2.5. Russia

- 5.2.6. Netherlands

- 5.2.7. Spain

- 5.2.8. Turkey

- 5.2.9. Poland

- 5.3. Asia-Pacific

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Vietnam

- 5.3.6. South Korea

- 5.3.7. Indonesia

- 5.3.8. Philippines

- 5.4. South America

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.5. Middle East and Africa

- 5.5.1. Saudi Arabia

- 5.5.2. UAE

- 5.5.3. South Africa

6. Market Mapping, 2023

- 6.1. By Product

- 6.2. By Type

- 6.3. By Application

- 6.4. By End-user

- 6.5. By Region

7. Macro Environment and Industry Structure

- 7.1. Supply Demand Analysis

- 7.2. Import Export Analysis

- 7.3. Value Chain Analysis

- 7.4. PESTEL Analysis

- 7.4.1. Political Factors

- 7.4.2. Economic System

- 7.4.3. Social Implications

- 7.4.4. Technological Advancements

- 7.4.5. Environmental Impacts

- 7.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 7.5. Porter's Five Forces Analysis

- 7.5.1. Supplier Power

- 7.5.2. Buyer Power

- 7.5.3. Substitution Threat

- 7.5.4. Threat from New Entrant

- 7.5.5. Competitive Rivalry

8. Market Dynamics

- 8.1. Growth Drivers

- 8.2. Growth Inhibitors (Challenges and Restraints)

9. Regulatory Framework and Innovation

- 9.1. Clinical Trials

- 9.2. Patent Landscape

- 9.3. Regulatory Approvals

- 9.4. Innovations/Emerging Technologies

10. Key Players Landscape

- 10.1. Competition Matrix of Top Five Market Leaders

- 10.2. Market Revenue Analysis of Top Five Market Leaders (By Value, 2023)

- 10.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4. SWOT Analysis (For Five Market Players)

- 10.5. Patent Analysis (If Applicable)

11. Case Studies

12. Key Players Outlook

- 12.1. Thermo Fisher Scientific Inc.

- 12.1.1. Company Details

- 12.1.2. Key Management Personnel

- 12.1.3. Products and Services

- 12.1.4. Financials (As reported)

- 12.1.5. Key Market Focus and Geographical Presence

- 12.1.6. Recent Developments

- 12.2. Merck & Co., Inc.

- 12.3. Agilent Technologies, Inc.

- 12.4. Eurofins Scientific SE

- 12.5. Bio-Synthesis, Inc.

- 12.6. Danaher Corporation

- 12.7. KANEKA CORPORATION

- 12.8. Sarepta Therapeutics, Inc.

- 12.9. Biogen Inc.

- 12.10. GenScript Biotech Corporation

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work