|

|

市場調査レポート

商品コード

1491698

電気自動車テレマティクスの世界市場の評価:技術別、車両別、用途別、地域別、機会、予測(2017年~2031年)Electric Vehicle Telematics Market Assessment, By Technology, By Vehicle, By Application, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 電気自動車テレマティクスの世界市場の評価:技術別、車両別、用途別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年06月10日

発行: Markets & Data

ページ情報: 英文 223 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の電気自動車テレマティクスの市場規模は、2023年の100億4,000万米ドルから2031年に326億米ドルに達すると予測され、2024年~2031年の予測期間にCAGRで15.86%の成長が見込まれます。インフォテインメントシステム、大型多機能ディスプレイ、さまざまな技術の統合により、自動車機器メーカーは電気自動車向けの先進システムを構築できます。環境問題、政府支援、手頃な価格の機能性により、電気自動車の普及が進んでいるため、世界中で電気自動車のテレマティクスの売上が増加する見込みです。電気自動車には、電気トランスミッション、バッテリーシステム、そして完全デジタル化された車両テレマティクスが搭載されています。これは、コネクテッドカー技術、インターネット、Wi-Fi、スマートフォン接続、カメラやセンサーのモニタリングを利用したものです。さらに、EV充電インフラ、インセンティブ、補助金の充実が電気自動車普及の拡大に寄与しており、EVテレマティクスやインフォテインメントシステムを含むEVコンポーネントの需要が増加しています。

先進の自動車技術やオンボード診断システムのスペースも、将来に対応可能なEVテレマティクスの利用を可能にしています。これらには、より先進の接続ツール、インフォテインメントディスプレイ、モニタリングシステムなどが含まれます。自動車メーカーや機器メーカーは、提供するテレマティクスシステムにおいて、高性能で包括的なダイナミクスと高速処理を実現することに注力しています。

例えば、Tata Motorsは2024年1月、10.25インチのタッチスクリーンインフォテインメントシステムと2スポークのステアリングホイールを備えた新デザインのPunch EVを発売しました。その他のテレマティクス機能には、セミデジタル計器クラスタ、360度カメラ、自動空調、エレクトロニックスタビリティコントロール(ESC)、タイヤ空気圧モニタリングシステム(TPMS)などがあります。

高度なEVフリート管理とAI統合が市場拡大を後押し

電気自動車の売上が増加するにつれて、電気自動車専用に設計されたテレマティクスソリューションの需要も高まっており、予測期間の市場成長を促進する見込みです。AIや機械学習のような先進技術は、バッテリーの充電状態、推定航続距離、エネルギー消費など、電気自動車特有の要素に関する知見を提供することで、より効果的な車両の管理と運用を可能にすると考えられます。テレマティクスシステムは、車両の位置、状態、性能データをリアルタイムで提供し、車両運行の最適化に不可欠です。テレマティクスは、ルート計画、メンテナンスのスケジュール、充電時間などを支援することで、電気自動車フリートが生産性と効率を最大化できるよう支援することができます。二酸化炭素排出が環境に与える悪影響への意識が高まるにつれ、人々は二酸化炭素排出を減らす方法を模索しています。EVは従来のガソリン車よりも温室効果ガスの排出が少なく、環境にやさしいです。

例えば2023年4月、Continental AGとHere Technologies Pvt.Ltd.は、商用車の安全性と燃料節約機能を高めるためにIVECo SpAと提携しました。Continentalが車両測位と拡張可能な4G/5Gテレマティクスコントロールユニットを提供する一方、HEREは欧州連合内のあらゆる道路の有効な制限速度情報を提供します。

IoTの展開と技術の進歩が市場成長を促進

IoTの展開は、5Gネットワークと高速ネットワークの登場とともに、コネクテッドカー技術を次のレベルに引き上げます。車両の位置、ドライバーの行動、エンジン診断、その他の重要な指標はすべて、IoTベースのテレマティクスシステムによってリアルタイムで追跡できます。これにより、フリート管理者は、車両のルート変更やドライバーの安全性などについて、十分な情報に基づいた判断を迅速に下すことが可能になります。リアルタイムの車両データモニタリングにより、IoT統合テレマティクスはメンテナンスの必要性を予測することができ、事後的なメンテナンスではなく、予防的なメンテナンスを可能にします。これにより、メンテナンス費用と車両のダウンタイムが削減されます。

当レポートでは、世界の電気自動車テレマティクス市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢と見通しなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 顧客の声

- フリートの互換性

- リアルタイム追跡

- スケーラビリティ

- 費用対効果

- 先進機能

- ユーザーフレンドリーなインターフェース

- 統合

第5章 世界の電気自動車テレマティクス市場の見通し(2017年~2031年)

- 市場規模と予測

- 金額

- 数量

- 技術別

- 組み込み

- 改造

- 車両別

- 乗用車

- 商用車

- 用途別

- エンターテインメント

- 情報

- ナビゲーション

- 安全性・セキュリティ

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 市場シェア:企業別(2023年)

第6章 世界の電気自動車テレマティクス市場の見通し:地域別(2017年~2031年)

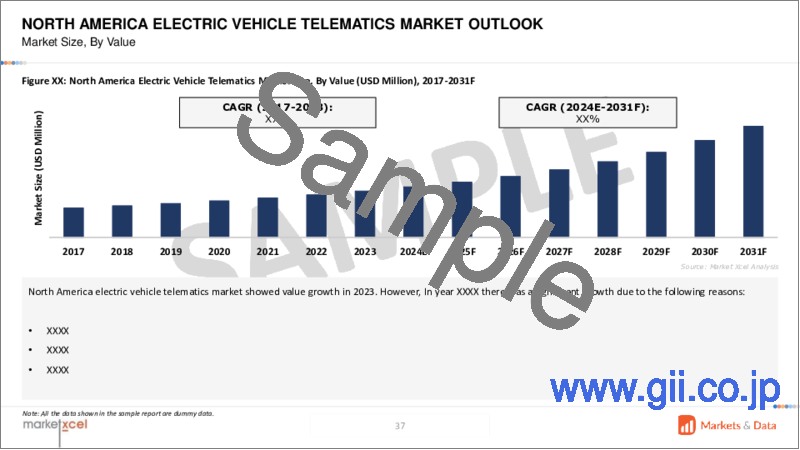

- 北米

- 市場規模と予測

- 技術別

- 車両別

- 用途別

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

- アジア太平洋

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

- 南米

- ブラジル

- アルゼンチン

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第7章 市場マッピング(2023年)

- 技術別

- 車両別

- 用途別

- 地域別

第8章 マクロ環境と産業構造

- 需給分析

- 輸入輸出分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第9章 市場力学

- 成長促進要因

- 成長抑制要因(課題、抑制要因)

第10章 主要企業の情勢

- マーケットリーダー上位5社の競合マトリクス

- マーケットリーダー上位5社の市場収益分析(金額)(2023年)

- 合併と買収/合弁事業(該当する場合)

- SWOT分析(市場企業5社)

- 特許分析(該当する場合)

第11章 価格分析

第12章 ケーススタディ

第13章 主要企業の見通し

- Continental AG

- Trimble Inc.

- Geotab Inc.

- Agero Inc.

- Airbiquity Inc.

- Robert Bosch GmbH

- CSS Electronics

- Intellicar Telematics Pvt. Ltd.

- Inventure Ltd.

- TomTom International

第14章 戦略的推奨

第15章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 2. Global Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 3. Global Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 4. Global Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 5. Global Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 6. Global Electric Vehicle Telematics Market Share (%), By Region, 2017-2031F

- Figure 7. North America Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 8. North America Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 9. North America Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 10. North America Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 11. North America Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 12. North America Electric Vehicle Telematics Market Share (%), By Country, 2017-2031F

- Figure 13. United States Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 14. United States Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 15. United States Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 16. United States Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 17. United States Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 18. Canada Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 19. Canada Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 20. Canada Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 21. Canada Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 22. Canada Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 23. Mexico Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 24. Mexico Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 25. Mexico Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 26. Mexico Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 27. Mexico Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 28. Europe Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 29. Europe Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 30. Europe Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 31. Europe Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 32. Europe Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 33. Europe Electric Vehicle Telematics Market Share (%), By Country, 2017-2031F

- Figure 34. Germany Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 35. Germany Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 36. Germany Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 37. Germany Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 38. Germany Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 39. France Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 40. France Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 41. France Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 42. France Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 43. France Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 44. Italy Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 45. Italy Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 46. Italy Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 47. Italy Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 48. Italy Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 49. United Kingdom Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 50. United Kingdom Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 51. United Kingdom Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 52. United Kingdom Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 53. United Kingdom Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 54. Russia Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 55. Russia Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 56. Russia Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 57. Russia Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 58. Russia Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 59. Netherlands Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 60. Netherlands Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 61. Netherlands Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 62. Netherlands Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 63. Netherlands Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 64. Spain Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 65. Spain Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 66. Spain Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 67. Spain Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 68. Spain Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 69. Turkey Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 70. Turkey Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 71. Turkey Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 72. Turkey Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 73. Turkey Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 74. Poland Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 75. Poland Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 76. Poland Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 77. Poland Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 78. Poland Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 79. South America Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 80. South America Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 81. South America Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 82. South America Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 83. South America Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 84. South America Electric Vehicle Telematics Market Share (%), By Country, 2017-2031F

- Figure 85. Brazil Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 86. Brazil Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 87. Brazil Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 88. Brazil Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 89. Brazil Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 90. Argentina Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 91. Argentina Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 92. Argentina Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 93. Argentina Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 94. Argentina Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 95. Asia-Pacific Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 96. Asia-Pacific Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 97. Asia-Pacific Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 98. Asia-Pacific Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 99. Asia-Pacific Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 100. Asia-Pacific Electric Vehicle Telematics Market Share (%), By Country, 2017-2031F

- Figure 101. India Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 102. India Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 103. India Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 104. India Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 105. India Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 106. China Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 107. China Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 108. China Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 109. China Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 110. China Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 111. Japan Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 112. Japan Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 113. Japan Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 114. Japan Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 115. Japan Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 116. Australia Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 117. Australia Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 118. Australia Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 119. Australia Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 120. Australia Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 121. Vietnam Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 122. Vietnam Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 123. Vietnam Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 124. Vietnam Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 125. Vietnam Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 126. South Korea Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 127. South Korea Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 128. South Korea Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 129. South Korea Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 130. South Korea Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 131. Indonesia Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 132. Indonesia Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 133. Indonesia Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 134. Indonesia Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 135. Indonesia Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 136. Philippines Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 137. Philippines Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 138. Philippines Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 139. Philippines Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 140. Philippines Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 141. Middle East & Africa Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 142. Middle East & Africa Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 143. Middle East & Africa Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 144. Middle East & Africa Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 145. Middle East & Africa Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 146. Middle East & Africa Electric Vehicle Telematics Market Share (%), By Country, 2017-2031F

- Figure 147. Saudi Arabia Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 148. Saudi Arabia Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 149. Saudi Arabia Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 150. Saudi Arabia Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 151. Saudi Arabia Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 152. UAE Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 153. UAE Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 154. UAE Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 155. UAE Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 156. UAE Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 157. South Africa Electric Vehicle Telematics Market, By Value, in USD Billion, 2017-2031F

- Figure 158. South Africa Electric Vehicle Telematics Market, By Volume, in Units, 2017-2031F

- Figure 159. South Africa Electric Vehicle Telematics Market Share (%), By Technology, 2017-2031F

- Figure 160. South Africa Electric Vehicle Telematics Market Share (%), By Vehicle, 2017-2031F

- Figure 161. South Africa Electric Vehicle Telematics Market Share (%), By Application, 2017-2031F

- Figure 162. By Technology Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 163. By Vehicle Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 164. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 165. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global electric vehicle telematics market is projected to witness a CAGR of 15.86% during the forecast period 2024-2031, growing from USD 10.04 billion in 2023 to USD 32.6 billion in 2031. The infotainment systems, big multi-functional displays, and integration of different technologies enable auto equipment leaders to build advanced systems for electric vehicles. The higher adoption of EVs due to environmental concerns, government support, and affordable functionality is likely to increase the sales of EV telematics across the globe. Electric vehicles hold electric transmission, battery systems, and a full digitized version of vehicle telematics. This utilizes connected car technology, internet, Wi-Fi, smartphone connectivity, and camera and sensor monitoring. Furthermore, the enhanced EV charging infrastructure, incentives, and subsidies are helping scale up electric vehicle adoption, increasing the demand for EV components, including EV telematics and infotainment systems.

The space for advanced autotech and on-board diagnostic systems also enables the usage of future-ready EV telematics. These include higher connectivity tools, infotainment displays, and monitoring systems. The vehicle manufacturers and equipment producers focus on delivering high-performance, inclusive dynamics and faster processing in the telematics systems they provide.

For instance, in January 2024, Tata Motors launched its newly designed Punch EV with a 10.25-inch touchscreen infotainment system and a two-spoke steering wheel. Other telematics features include a semi-digital instrument cluster, a 360-degree camera, automatic climate control, electronic stability control (ESC), and a tire pressure monitoring system (TPMS).

Higher EV Fleet Management Along with AI Integration to Fuel Market Expansion

As the sales of electric vehicles rise, the demand for telematics solutions designed especially for electric vehicles has also risen and it is expected to fuel market growth during the forecast period. Advanced technologies like artificial intelligence and machine learning will likely enable more effective fleet management and operation by offering insights into EV-specific factors, including battery state of charge, range estimate, and energy consumption. Telematics systems provide real-time vehicle location, status, and performance data, essential for optimizing fleet operations. Telematics can assist electric vehicle fleets maximize productivity and efficiency by helping to plan routes, schedule maintenance, and charge times. People are searching for methods to lessen their carbon footprint as they become more conscious of the damaging effects of carbon emissions on the environment. EVs are more environmentally friendly than conventional gasoline-powered cars since they produce less greenhouse emissions and pollution.

For instance, in April 2023, Continental AG and Here Technologies Pvt. Ltd. partnered with IVECo SpA to increase safety and fuel-saving functions in commercial vehicles. While Continental delivers vehicle positioning and a scalable 4G/5G telematics control unit, HERE provides validated speed limit information for any road in the European Union.

IoT Deployment and Technological Advancements to Thrive Market Growth

Internet of Things (IoT) deployment, along with the advent of 5G networks and faster networks, delivers connected car technology to the next level. The location of vehicles, driver behavior, engine diagnostics, and other vital metrics can all be tracked in real time by IoT-based telematics systems. This makes it possible for fleet managers to swiftly make well-informed judgments about things like vehicle rerouting and driver safety. Real-time vehicle data monitoring enables IoT-integrated telematics to anticipate maintenance needs, enabling proactive and preventative maintenance as opposed to reactive. This lowers maintenance expenses and vehicle downtime. These telematic solutions can enhance overall vehicle and driver safety with features like remote vehicle speed limit limits, collision alerts for emergency personnel, and vehicle authentication. The companies also launch diagnostic telematics that help vehicle owners to monitor their vehicle's overall condition.

For instance, in November 2023, Reliance Jio Infocomm Ltd. introduced JioMotive, an onboard diagnostics (OBD) plug-and-play system aimed at enhancing vehicle security and in-car connectivity. By plugging the device into their car's OBD port, customers can access in-car WiFi services, vehicle tracking and monitoring functions, and more.

Government's Support to Telematics Infrastructure to Fuel Market Growth

Implementation and commercialization of telematics technology for electric vehicles could not have been implemented without the crucial role of government authorities. From permits to safety regulations, governments across the globe focus on promoting EV technology that restricts fossil fuel consumption and increases sustainability. Governments across the globe support and fund infrastructure for telematics. The ability of telematics technology to lower carbon emissions and enhance air quality has been acknowledged by governments worldwide. Governments and private companies are now working together to develop infrastructure for battery charging and standardize telematics procedures. These regulations encourage and recognize new ventures and creative ideas while guaranteeing the proper application of telematics technology.

For instance, in April 2022, the Government of India announced plans to create interoperability standards and a telematics policy during Budget 2022-2023 to improve the efficiency of the telematics ecosystem and accelerate the adoption of electric vehicles.

The Advent of Smart Transportation and Commercial EV Adoption to Fuel Segmental Growth

The market is divided into segments according to application, including entertainment, safety and security, information and navigation, diagnostics, and others. The information and navigation category will lead the market throughout the forecast period. To help drivers navigate their routes more effectively, information and navigation telematics systems can offer real-time traffic updates, weather reports, and other helpful data. As a result, time can be saved, and driving can become more convenient and less stressful. By giving real-time information on road conditions, traffic congestion, and other possible risks, navigation telematics systems can assist drivers in staying on track and preventing accidents. This can help drivers avoid risky circumstances and make well-informed judgments. Telematics systems for information and navigation can also be tailored to drivers' requirements and tastes, making driving a more individualized experience. Innovative and practical features are anticipated to be introduced to these systems as technology advances, enhancing consumer appeal.

For instance, in September 2022, Colorado-based powertrain manufacturer Lightning eMotors launched a new EV telematics and charger management software product designed for fleets. For both new and old lightning EVs, there is a software suite called Lightning Insights, which is offered on a subscription basis. An API for integrating third-party software is also included.

Asia-Pacific Dominates the Global Electric Vehicle Telematics Market

Throughout the forecast period, Asia-Pacific is anticipated to hold a dominant market share in the global electric vehicle telematics market. The usage of connected cars, outfitted with sensors and communication technologies to offer real-time data and insights, is significantly rising throughout the region. The need for vehicle telematics, which may assist drivers and fleet managers in managing their vehicles more skillfully, has increased. Governments in Asia-Pacific are taking steps to encourage vehicle telematics, such as enacting laws requiring the installation of telematics systems in commercial vehicles. This has contributed to the local demand for car telematics. Hence, the local manufacturers are also building new telematics systems to advance the local automotive manufacturers. Local manufacturers are strengthening their supply chain in the Asia-Pacific region.

For instance, in January 2024, China's BYD Company Ltd. debuted three battery-electric models in Indonesia to take the lead in the market in the largest economy in Southeast Asia. In the fourth quarter, BYD surpassed Tesla to become the leading electric vehicle manufacturer in the world, with the majority of its 526,000 sales vehicles heading to China.

Future Market Scenario (2024-2031F)

Increased EV adoption, advanced infotainment systems, and advanced integrated technology are flourishing the market growth.

Rising penetration of Internet and IoT deployment to increase the demand for advanced vehicles with higher connectivity.

The dominance of battery electric vehicles, technological advancements, and increased R&D are projected to garner market expansion.

The adoption of EVs in emerging economies like China and India is expected to add value to the global market.

Key Players Landscape and Outlook

The electric vehicle telematics market players experiment with advanced technology like artificial intelligence, the Internet of Things (IoT), and advanced sensory technology. Competitors also strategize with partnerships, acquisitions, and mergers to expand their supply chain and distribution channels. These collaborations usually utilize the advanced technology of technological giants, majoring in telematics.

In May 2022, TVS Motor sold Intellicar Telematics Pvt. Ltd. to Fabric IoT Pvt. Ltd. for USD 5.39 million. The disposal is a component of the company's digital portfolio's value generation strategies.

In December 2023, Geotab Inc., a global leader in connected transportation solutions, was honored at the What Van? Awards. For the second year in a row, its potent fleet telematics solutions, particularly for vans and light commercial vehicles (LCVs), won the telematics category.

Table of Contents

1. Research Methodology

2. Project Scope and Definitions

3. Executive Summary

4. Voice of Customer

- 4.1. Fleet Compatibility

- 4.2. Real-Time Tracking

- 4.3. Scalability

- 4.4. Cost-Effectiveness

- 4.5. Advanced Features

- 4.6. User-Friendly Interface

- 4.7. Integration

5. Global Electric Vehicle Telematics Market Outlook, 2017-2031F

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. By Technology

- 5.2.1. Embedded

- 5.2.2. Retrofitted

- 5.3. By Vehicle

- 5.3.1. Passenger Vehicles

- 5.3.2. Commercial Vehicles

- 5.4. By Application

- 5.4.1. Entertainment

- 5.4.2. Information

- 5.4.3. Navigation

- 5.4.4. Safety & Security

- 5.5. By Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia-Pacific

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.6. By Company Market Share (%), 2023

6. Global Electric Vehicle Telematics Market Outlook, By Region, 2017-2031F

- 6.1. North America*

- 6.1.1. Market Size & Forecast

- 6.1.1.1. By Value

- 6.1.1.2. By Volume

- 6.1.2. By Technology

- 6.1.2.1. Embedded

- 6.1.2.2. Retrofitted

- 6.1.3. By Vehicle

- 6.1.3.1. Passenger Vehicles

- 6.1.3.2. Commercial Vehicles

- 6.1.4. By Application

- 6.1.4.1. Entertainment

- 6.1.4.2. Information

- 6.1.4.3. Navigation

- 6.1.4.4. Safety and Security

- 6.1.5. United States*

- 6.1.5.1. Market Size & Forecast

- 6.1.5.1.1. By Value

- 6.1.5.1.2. By Volume

- 6.1.5.2. By Technology

- 6.1.5.2.1. Embedded

- 6.1.5.2.2. Retrofitted

- 6.1.5.3. By Vehicle

- 6.1.5.3.1. Passenger Vehicles

- 6.1.5.3.2. Commercial Vehicles

- 6.1.5.4. By Application

- 6.1.5.4.1. Entertainment

- 6.1.5.4.2. Information

- 6.1.5.4.3. Navigation

- 6.1.5.4.4. Safety and Security

- 6.1.5.1. Market Size & Forecast

- 6.1.6. Canada

- 6.1.7. Mexico

- 6.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered

- 6.2. Europe

- 6.2.1. Germany

- 6.2.2. France

- 6.2.3. Italy

- 6.2.4. United Kingdom

- 6.2.5. Russia

- 6.2.6. Netherlands

- 6.2.7. Spain

- 6.2.8. Turkey

- 6.2.9. Poland

- 6.3. Asia-Pacific

- 6.3.1. India

- 6.3.2. China

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Vietnam

- 6.3.6. South Korea

- 6.3.7. Indonesia

- 6.3.8. Philippines

- 6.4. South America

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.5. Middle East and Africa

- 6.5.1. Saudi Arabia

- 6.5.2. UAE

- 6.5.3. South Africa

7. Market Mapping, 2023

- 7.1. By Technology

- 7.2. By Vehicle

- 7.3. By Application

- 7.4. By Region

8. Macro Environment and Industry Structure

- 8.1. Demand Supply Analysis

- 8.2. Import Export Analysis

- 8.3. Value Chain Analysis

- 8.4. PESTEL Analysis

- 8.4.1. Political Factors

- 8.4.2. Economic System

- 8.4.3. Social Implications

- 8.4.4. Technological Advancements

- 8.4.5. Environmental Impacts

- 8.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 8.5. Porter's Five Forces Analysis

- 8.5.1. Supplier Power

- 8.5.2. Buyer Power

- 8.5.3. Substitution Threat

- 8.5.4. Threat From New Entrants

- 8.5.5. Competitive Rivalry

9. Market Dynamics

- 9.1. Growth Drivers

- 9.2. Growth Inhibitors (Challenges and Restraints)

10. Key Players Landscape

- 10.1. Competition Matrix of Top Five Market Leaders

- 10.2. Market Revenue Analysis of Top Five Market Leaders (By Value, 2023)

- 10.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4. SWOT Analysis (For Five Market Players)

- 10.5. Patent Analysis (If Applicable)

11. Pricing Analysis

12. Case Studies

13. Key Players Outlook

- 13.1. Continental AG

- 13.1.1. Company Details

- 13.1.2. Key Management Personnel

- 13.1.3. Products and Services

- 13.1.4. Financials (As Reported)

- 13.1.5. Key Market Focus and Geographical Presence

- 13.1.6. Recent Developments

- 13.2. Trimble Inc.

- 13.3. Geotab Inc.

- 13.4. Agero Inc.

- 13.5. Airbiquity Inc.

- 13.6. Robert Bosch GmbH

- 13.7. CSS Electronics

- 13.8. Intellicar Telematics Pvt. Ltd.

- 13.9. Inventure Ltd.

- 13.10. TomTom International

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.