|

|

市場調査レポート

商品コード

1491696

携帯式通信システムの世界市場の評価:タイプ別、用途別、最終用途産業別、地域別、機会、予測(2017年~2031年)Man-Portable Communication Systems Market Assessment, By Type, By Application, By End-use Industry, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| 携帯式通信システムの世界市場の評価:タイプ別、用途別、最終用途産業別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年06月10日

発行: Markets & Data

ページ情報: 英文 221 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の携帯式通信システムの市場規模は、2023年の451億米ドルから2031年に729億7,000万米ドルに達すると予測され、予測期間の2024年~2031年にCAGRで6.2%の成長が見込まれます。市場は、軍事要員、法執行機関、緊急対応要員がさまざまな作戦環境で使用するために設計された多様な通信機器を意味します。これらのシステムは、その部門に展開された部隊に不可欠な通話機能を提供し、部隊の接続性を維持し、任務を調整し、重要な事実をリアルタイムで交換することを可能にします。携帯式通信システムの主なコンポーネントは、ハンドヘルド無線機、戦術ヘッドセット、非公開ポジション無線機、兵士着用システム、マンパック無線機で構成されています。これらの機器は、頑丈で軽量、問題なく持ち運びが可能で、歩行中や車両内で同時に携帯電話を閉じることができ、動的な状況において機敏に動作します。

携帯式通信システムの市場規模は、多くの要因によって成長しています。状況認識と作戦の有効性を高めるため、軍事や安全ビジネスで先進の通信技術への需要が高まっていることが、市場の活況を後押ししています。さらに、部隊に超近代的な通話システムを装備することを目的とした兵士の近代化プログラムへの注目の高まりが、マーケットプレイスの成長に拍車をかけています。さらに、技術の進歩は、マーケットプレイスのパノラマを形成する上で重要な役割を果たしており、ソフトウェア無線(SDR)、安定した音声統計暗号化、組み込まれたコミュニティ中心の才能に沿った技術革新は、製品の改善と差別化を推進しています。さらに、地政学的緊張、対テロ作戦、平和維持活動は、信頼性が高く相互運用可能な通信回答を求めることに寄与し、世界市場の活性化を促進しています。

携帯式通信システム市場の主要企業には、セットアップ保護請負業者、電子機器メーカー、特殊通信技術プロバイダーなどが含まれます。これらの企業は、製品の性能、信頼性、耐久性、相互運用性、カスタマーサービスなどの要素で競合し、マーケットプレイス機能を維持し、競合優位性を獲得しています。海軍の近代化活動と安全保障上の厳しい状況が、地域内で先進の通信能力を必要とする圧力をかけているため、全体として、市場は今後も発展し続けると予測されます。

衛星通信需要の高まりが市場拡大に影響

衛星ベースの通信に対する需要の高まりは、携帯式通信システム市場の成長に影響を与えます。衛星ベースの通信は主に、軍事や防衛作戦に関連する数多くの利点を提供し、PCベース向けの衛星テレビの採用を促進し、携帯式通信システムを容易にします。衛星通信は、従来の地上波ネットワークが利用できなかったり信頼できなかったりする遠隔地や過酷な環境での接続性を提供します。この機能は、砂漠、山岳地帯、森林、海洋環境など、多くの地形で活動する軍事にとって特に重要であり、通信ハイパーリンクを維持することは、プロジェクトの遂行と人員の安全にとって極めて重要です。さらに、衛星ベースの通信は世界中をカバーし、軍事の従業員が巨大な距離を通してシームレスに話すことを可能にし、フロアベースの全くネットワークが届かない地域でも。この機能により、部隊は作戦を調整し、情報を共有し、場所に関係なくリアルタイムの最新情報を入手することができ、状況認識と作戦の有効性を高めることができます。

さらに、PC向け衛星テレビは、地上波ネットワークが途絶えたり妨害されたりした場合に、通信経路の機会を提供することで、弾力性と冗長性を提供します。冗長性は、敵対勢力が通信チャネルを混乱させようとするかもしれない敵対的な、あるいは争いの絶えない環境において、通信の継続性を確保するために極めて重要です。さらに、衛星ベースの通話システムは、高帯域幅の記録伝送を支援し、分散した部隊や司令部間で、ビデオフィード、画像、センサー記録とともに、大量のマルチメディア情報の交換を可能にします。この機能は、複雑な作戦に従事する海軍の従業員の選択能力を高め、コラボレーションを促進します。

当レポートでは、世界の携帯式通信システム市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢と見通しなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 エグゼクティブサマリー

第4章 世界の携帯式通信システム市場の見通し(2017年~2031年)

- 市場規模と予測

- 金額

- タイプ別

- 無線

- 衛星

- その他

- 用途別

- 陸上

- 航空

- 海上

- 最終用途産業別

- 軍事・防衛

- 鉱業

- 通信

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 市場シェア:企業別(2023年)

第5章 世界の携帯式通信システム市場の見通し:地域別(2017年~2031年)

- 北米

- 市場規模と予測

- タイプ別

- 用途別

- 最終用途産業別

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

- アジア太平洋

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

- 南米

- ブラジル

- アルゼンチン

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第6章 市場マッピング(2023年)

- タイプ別

- 用途別

- 最終用途産業別

- 地域別

第7章 マクロ環境と産業構造

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第8章 市場力学

- 成長促進要因

- 成長抑制要因(課題、抑制要因)

第9章 主要企業の情勢

- マーケットリーダー上位5社の競合マトリクス

- マーケットリーダー上位5社の市場収益分析(金額)(2023年)

- 合併と買収/合弁事業(該当する場合)

- SWOT分析(市場企業5社)

- 特許分析(該当する場合)

第10章 ケーススタディ

第11章 主要企業の見通し

- L3Harris Technologies (formerly Harris Corporation)

- Thales Group

- BAE Systems plc

- General Dynamics Corporation

- Collins Aerospace (formerly Rockwell Collins)

- Raytheon Technologies Corporation

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Safran S.A.

- Northrop Grumman Corporation

第12章 戦略的推奨

第13章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 2. Global Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 3. Global Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 4. Global Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 5. Global Man-Portable Communication Systems Market Share (%), By Region, 2017-2031F

- Figure 6. North America Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 7. North America Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 8. North America Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 9. North America Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

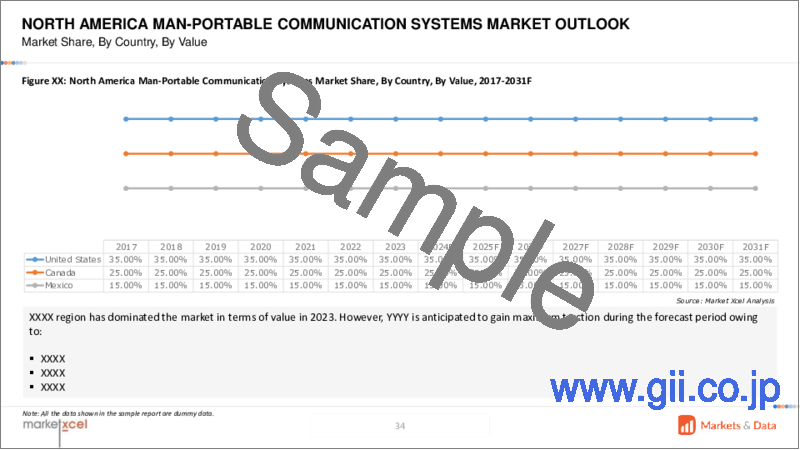

- Figure 10. North America Man-Portable Communication Systems Market Share (%), By Country, 2017-2031F

- Figure 11. United States Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 12. United States Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 13. United States Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 14. United States Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 15. Canada Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 16. Canada Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 17. Canada Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 18. Canada Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 19. Mexico Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 20. Mexico Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 21. Mexico Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 22. Mexico Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 23. Europe Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 24. Europe Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 25. Europe Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 26. Europe Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 27. Europe Man-Portable Communication Systems Market Share (%), By Country, 2017-2031F

- Figure 28. Germany Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 29. Germany Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 30. Germany Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 31. Germany Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 32. France Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 33. France Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 34. France Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 35. France Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 36. Italy Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 37. Italy Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 38. Italy Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 39. Italy Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 40. United Kingdom Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 41. United Kingdom Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 42. United Kingdom Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 43. United Kingdom Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 44. Russia Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 45. Russia Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 46. Russia Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 47. Russia Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 48. Netherlands Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 49. Netherlands Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 50. Netherlands Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 51. Netherlands Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 52. Spain Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 53. Spain Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 54. Spain Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 55. Spain Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 56. Turkey Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 57. Turkey Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 58. Turkey Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 59. Turkey Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 60. Poland Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 61. Poland Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 62. Poland Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 63. Poland Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 64. South America Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 65. South America Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 66. South America Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 67. South America Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 68. South America Man-Portable Communication Systems Market Share (%), By Country, 2017-2031F

- Figure 69. Brazil Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 70. Brazil Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 71. Brazil Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 72. Brazil Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 73. Argentina Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 74. Argentina Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 75. Argentina Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 76. Argentina Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 77. Asia-Pacific Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 78. Asia-Pacific Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 79. Asia-Pacific Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 80. Asia-Pacific Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 81. Asia-Pacific Man-Portable Communication Systems Market Share (%), By Country, 2017-2031F

- Figure 82. India Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 83. India Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 84. India Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 85. India Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 86. China Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 87. China Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 88. China Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 89. China Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 90. Japan Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 91. Japan Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 92. Japan Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 93. Japan Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 94. Australia Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 95. Australia Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 96. Australia Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 97. Australia Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 98. Vietnam Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 99. Vietnam Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 100. Vietnam Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 101. Vietnam Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 102. South Korea Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 103. South Korea Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 104. South Korea Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 105. South Korea Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 106. Indonesia Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 107. Indonesia Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 108. Indonesia Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 109. Indonesia Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 110. Philippines Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 111. Philippines Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 112. Philippines Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 113. Philippines Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 114. Middle East & Africa Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 115. Middle East & Africa Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 116. Middle East & Africa Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 117. Middle East & Africa Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 118. Middle East & Africa Man-Portable Communication Systems Market Share (%), By Country, 2017-2031F

- Figure 119. Saudi Arabia Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 120. Saudi Arabia Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 121. Saudi Arabia Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 122. Saudi Arabia Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 123. UAE Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 124. UAE Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 125. UAE Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 126. UAE Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 127. South Africa Man-Portable Communication Systems Market, By Value, in USD Billion, 2017-2031F

- Figure 128. South Africa Man-Portable Communication Systems Market Share (%), By Type, 2017-2031F

- Figure 129. South Africa Man-Portable Communication Systems Market Share (%), By Application, 2017-2031F

- Figure 130. South Africa Man-Portable Communication Systems Market Share (%), By End-use Industry, 2017-2031F

- Figure 131. By Type Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 132. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 133. By End-use Industry Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 134. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global man-portable communication systems market is projected to witness a CAGR of 6.2% during the forecast period 2024-2031, growing from USD 45.1 billion in 2023 to USD 72.97 billion in 2031. The man-portable communication systems market signifies a diverse range of communication devices designed for use by military personnel, law enforcement agencies, and emergency responders in various operational environments. These systems offer vital verbal exchange capabilities for troops deployed within the discipline, permitting them to keep connectivity, coordinate missions, and exchange important facts in real time. Key components of man-portable communication structures consist of handheld radios, tactical headsets, non-public position radios, soldier-worn systems, and manpack radios. These devices are rugged, lightweight, without problems, portable, permitting customers to hold them while walking or in vehicles simultaneously as closing cellular and agile in dynamic situations.

The man-portable communication systems market size is growing due to numerous factors. The increasing demand for advanced communique technologies by using military and safety businesses to beautify situational attention and operational effectiveness drives the market boom. Additionally, the rising focus on soldier modernization programs aimed at equipping troops with ultra-modern verbal exchange systems, fueling the marketplace growth. Moreover, technological advancements play a crucial role in shaping the marketplace panorama, with innovations along with software-described radios (SDRs), steady voice statistics encryption, and incorporated community-centric talents driving product improvement and differentiation. Furthermore, geopolitical tensions, counterterrorism operations, and peacekeeping missions contribute to the call for reliable and interoperable communication answers, fostering market boom globally.

The leading players in man-portable communication systems market include set up protection contractors, electronics producers, and specialized communication technology providers. These businesses compete on factors such as product performance, reliability, durability, interoperability, and customer service to preserve their marketplace function and gain competitive advantages. Overall, the market for man-transportable communication systems is anticipated to maintain developing as navy modernization efforts and security demanding situations pressure needed for advanced communication talents inside the area.

Rising Demand for Satellite Based Communication Influence the Market Expansion

The rising demand for satellite-based communication impacts the man-portable communication systems market growth. Satellite-based communication offers numerous benefits that are mainly relevant to army and defense operations, driving the adoption of satellite TV for pc-based facilitates man-portable communication systems. Satellite communication presents connectivity in remote or austere environments in which conventional terrestrial networks may be unavailable or unreliable. The functionality is specifically vital for army forces operating in numerous terrains, including deserts, mountains, forests, and maritime environments, where maintaining communication hyperlinks is crucial for project fulfillment and personnel safety. Additionally, satellite-based communication offers global coverage, permitting army employees to talk seamlessly throughout giant distances, along with in areas past the reach of floor-based totally networks. The capability allows troops to coordinate operations, share intelligence, and get hold of real-time updates irrespective of their place, enhancing situational cognizance and operational effectiveness.

Moreover, satellite TV for PC verbal exchange provides resilience and redundancy through imparting opportunity communique paths in case of disruptions or jamming of terrestrial networks. Redundancy is critical for making sure the continuity of communication in antagonistic or contested environments where adversaries might try to disrupt communication channels. Furthermore, satellite-based totally verbal exchange systems aid high-bandwidth records transmission, allowing the change of big volumes of multimedia information, along with video feeds, imagery, and sensor records, among dispersed units and command centers. The functionality enhances selection-making abilities and facilitates collaboration amongst navy employees engaged in complex operations.

In September 2023, OneWeb, a main global Low Earth Orbit (LEO) satellite TV for PC communications provider, brought a brand-new soldier-portable, light-weight user terminal (UT) designed for deployment near the tactical aspect. Named as FoldSat LEo Ku OW Mil terminal, it represents OneWeb's inaugural completely ruggedized consumer terminal, mainly engineered to be self-aligning, easy to set up, and optimized for operation across the OneWeb Ku-Band LEO satellite TV for PC constellation. Capable of attaining download speeds of as much as 195Mbps and upload speeds of 32Mbps, the terminal features outside GNSS input to help operation in GPS-denied environments. The FoldSat LEO terminal is meticulously designed to match compactly into a backpack whilst folded, improving its portability for discipline operations.

Deployment of Advanced Communication Technologies by Military and Defense Forces Worldwide

The deployment of advanced communication through military and defense forces is driven by operational abilities, keeping strategic gain, and adapting to evolving threats in modern-day war. One key area of cognizance is adopting software-defined radio (SDRs), which offer flexibility, interoperability, and adaptability to changing project requirements. SDRs allow military employees to seamlessly switch between one-of-a-type waveforms and frequencies, allowing communique across several systems and networks. Versatility complements situational recognition and operational effectiveness at the battlefield. The integration of consistent voice and records encryption technologies guarantees the confidentiality and integrity of conversation transmissions, safeguarding touchy statistics from interception or tampering through adversaries. Advanced encryption techniques defend military communications from unauthorized access and cyber threats, retaining operational protection and challenge achievement.

Additionally, the deployment of a protected community-centric communication system allows real-time collaboration, records sharing, and decision-making among dispersed units and command centers. These systems leverage interconnected networks to provide commanders with a complete view of the battlefield, deliberating coordinated and synchronized operations across one-of-a-kind theaters of operation. Overall, the deployment of advanced communique technology with the resource of army and protection forces international is driven via the want for stronger interoperability, safety, and efficiency in communication systems.

In September 2023, the Indian Army procured superior hand-held and light-weight suitcase-based satellite communication (Satcom) gadgets to supply steady satellite TV for PC television for pc-based communications to troops deployed in far off and rugged terrains alongside the Line of Actual Control (LAC) with China, in addition to Special Forces involved in precision operations. The Army concluded a settlement with the Protection Public Sector Undertaking (PSU), Bharat Electronics (BEL), for over a hundred and sixty mobile strong satellite terminals (MSSTs). According to a Defence Ministry of India report, the settlement is the most current in a chain of similar contracts signed in brand-new months.

North America Dominating Man-Portable Communication Systems Market Share

North America, especially the United States, boasts the sector's biggest military finances, constantly outspending different areas on navy fees. According to SIPRI (Stockholm International Peace Research Institute), the United States accounted for about forty percent of worldwide army spending in 2020, indicating a huge funding in protection talents, such as communication structures. The region is home to main protection contractors and producers focusing on communique systems. Companies such as L3Harris Technologies, General Dynamics Corporation, and Raytheon Technologies Corporation are distinguished game enthusiasts inside the worldwide protection industry, with a sturdy consciousness on developing and presenting superior man-portable communique systems.

The United States, as a primary global navy electricity, continues its presence in numerous international areas, regularly carrying out military operations and peacekeeping missions. The operational requirements of deployed forces necessitate dependable and effective communique structures and the usage of call for man-transportable solutions.

North America benefits from a strong environment of studies and improvement establishments, academic facilities, and technology hubs that strain innovation in communique technology. The surroundings foster the improvement of cutting-edge-day guy-portable verbal exchange structures tailor-made to the evolving wishes of army and defense forces. The location's regulatory framework and protection regulations prioritize technological advancement, innovation, and protection, providing a conducive environment for improving and deploying advanced communication systems.

In June 2021, L3Harris Technologies secured USD 42 million in combined orders, with USD 10 million of total furnished beneath the Naval Information Warfare System Command's Portable Radio Program IDIQ agreement N00039-18-D-0070, to useful aid the United States Air Force. The company will offer Falcon IV hand-held and guy-transportable tactical radio machine, ensuring Special Warfare airmen have resilient communications talents and facilitating a complex conflict manage gadget. These orders are part of an ongoing initiative in the Air Force to enhance the era, assisting the Advanced Battle Management System and CJADC2 projects. The Air Force Special Warfare utility workplace uses the Falcon IV(R) radio family and C4I-intercom system to deliver constant communications in key mission regions, consisting of Global Access, Precision Strike, and Personnel Recovery.

Future Market Scenario (2024 - 2031F)

According to man-portable communication systems market analysis, the Defense industry technology advancement will majorly fuel the growth of the market.

The integration of SATCOM will influence the man-portable communication systems market demand growth.

Remote sensing technology will further be being utilized to scatter the demand of the market.

Robotics and machine learning algorithm adoption will be a key man-portable communication systems market trend in the upcoming years.

Key Players Landscape and Outlook

The man-portable communication systems market showcases a dynamic landscape with prominent players. In January 2024, Orbit Communication Systems has recently secured USD 36.7 million in orders for its satellite communique technology for protection programs. The Israel-based organization has finalized a settlement with the Israeli Ministry of Defense to deliver advanced conversation systems worth approximately USD 16.6 million. Furthermore, Orbit has been presented with a USD 16.5 million contract via the United States Air Force to improve, carrier, and upkeep its Airborne Digital Audio System (ADAS) communications control structures installed in the KC-135 plane. The contract extends for an extra 60 months.

Moreover, Orbit has received a USD 3.6 million order from a European integrator for satellite communication systems intended for naval military platforms.

Table of Contents

1. Research Methodology

2. Project Scope and Definitions

3. Executive Summary

4. Global Man-Portable Communication Systems Market Outlook, 2017-2031F

- 4.1. Market Size & Forecast

- 4.1.1. By Value

- 4.2. By Type

- 4.2.1. Radio

- 4.2.2. Satellite

- 4.2.3. Others

- 4.3. By Application

- 4.3.1. Land

- 4.3.2. Air

- 4.3.3. Marine

- 4.4. By End-use Industry

- 4.4.1. Military and Defense

- 4.4.2. Mining

- 4.4.3. Telecommunication

- 4.4.4. Others

- 4.5. By Region

- 4.5.1. North America

- 4.5.2. Europe

- 4.5.3. Asia-Pacific

- 4.5.4. South America

- 4.5.5. Middle East and Africa

- 4.6. By Company Market Share (%), 2023

5. Global Man-Portable Communication Systems Market Outlook, By Region, 2017-2031F

- 5.1. North America*

- 5.1.1. Market Size & Forecast

- 5.1.1.1. By Value

- 5.1.2. By Type

- 5.1.2.1. Radio

- 5.1.2.2. Satellite

- 5.1.2.3. Others

- 5.1.3. By Application

- 5.1.3.1. Land

- 5.1.3.2. Air

- 5.1.3.3. Marine

- 5.1.4. By End-use Industry

- 5.1.4.1. Military and Defense

- 5.1.4.2. Mining

- 5.1.4.3. Telecommunication

- 5.1.4.4. Others

- 5.1.5. United States*

- 5.1.5.1. Market Size & Forecast

- 5.1.5.1.1. By Value

- 5.1.5.2. By Type

- 5.1.5.2.1. Radio

- 5.1.5.2.2. Satellite

- 5.1.5.2.3. Others

- 5.1.5.3. By Application

- 5.1.5.3.1. Land

- 5.1.5.3.2. Air

- 5.1.5.3.3. Marine

- 5.1.5.4. By End-use Industry

- 5.1.5.4.1. Military and Defense

- 5.1.5.4.2. Mining

- 5.1.5.4.3. Telecommunication

- 5.1.5.4.4. Others

- 5.1.5.1. Market Size & Forecast

- 5.1.6. Canada

- 5.1.7. Mexico

- 5.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered

- 5.2. Europe

- 5.2.1. Germany

- 5.2.2. France

- 5.2.3. Italy

- 5.2.4. United Kingdom

- 5.2.5. Russia

- 5.2.6. Netherlands

- 5.2.7. Spain

- 5.2.8. Turkey

- 5.2.9. Poland

- 5.3. Asia-Pacific

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Vietnam

- 5.3.6. South Korea

- 5.3.7. Indonesia

- 5.3.8. Philippines

- 5.4. South America

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.5. Middle East and Africa

- 5.5.1. Saudi Arabia

- 5.5.2. UAE

- 5.5.3. South Africa

6. Market Mapping, 2023

- 6.1. By Type

- 6.2. By Application

- 6.3. By End-use Industry

- 6.4. By Region

7. Macro Environment and Industry Structure

- 7.1. Value Chain Analysis

- 7.2. PESTEL Analysis

- 7.2.1. Political Factors

- 7.2.2. Economic System

- 7.2.3. Social Implications

- 7.2.4. Technological Advancements

- 7.2.5. Environmental Impacts

- 7.2.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 7.3. Porter's Five Forces Analysis

- 7.3.1. Supplier Power

- 7.3.2. Buyer Power

- 7.3.3. Substitution Threat

- 7.3.4. Threat from New Entrant

- 7.3.5. Competitive Rivalry

8. Market Dynamics

- 8.1. Growth Drivers

- 8.2. Growth Inhibitors (Challenges and Restraints)

9. Key Players Landscape

- 9.1. Competition Matrix of Top Five Market Leaders

- 9.2. Market Revenue Analysis of Top Five Market Leaders (By Value, 2023)

- 9.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 9.4. SWOT Analysis (For Five Market Players)

- 9.5. Patent Analysis (If Applicable)

10. Case Studies

11. Key Players Outlook

- 11.1. L3Harris Technologies (formerly Harris Corporation)

- 11.1.1. Company Details

- 11.1.2. Key Management Personnel

- 11.1.3. Products and Services

- 11.1.4. Financials (As reported)

- 11.1.5. Key Market Focus and Geographical Presence

- 11.1.6. Recent Developments

- 11.2. Thales Group

- 11.3. BAE Systems plc

- 11.4. General Dynamics Corporation

- 11.5. Collins Aerospace (formerly Rockwell Collins)

- 11.6. Raytheon Technologies Corporation

- 11.7. Leonardo S.p.A.

- 11.8. Elbit Systems Ltd.

- 11.9. Safran S.A.

- 11.10. Northrop Grumman Corporation

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.