|

|

市場調査レポート

商品コード

1475035

インドのP2P (ピアツーピア) レンディング市場の評価:貸付モデル・与信タイプ・与信期間・貸し手タイプ・返済・エンドユーザー/借り手タイプ・地域別の機会および予測 (2018-2032年)India Peer-to-Peer Lending Market Assessment, By Lending Model, By Credit Type, By Credit Tenure, By Lender Type, By Returns, By End-user/Borrower Type, By Region, Opportunities and Forecast, FY2018-FY2032F |

||||||

カスタマイズ可能

|

|||||||

| インドのP2P (ピアツーピア) レンディング市場の評価:貸付モデル・与信タイプ・与信期間・貸し手タイプ・返済・エンドユーザー/借り手タイプ・地域別の機会および予測 (2018-2032年) |

|

出版日: 2024年05月08日

発行: Markets & Data

ページ情報: 英文 137 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

インドのP2P (ピアツーピア) レンディングの市場規模は、2024年の27億8,000万米ドルから、予測期間中は15.01%のCAGRで推移し、2032年には85億1,000万米ドルの規模に成長すると予測されています。

P2Pレンディングはインドでは新しい概念ではありませんが、インターネットへの幅広いアクセスとデジタル化により、市場力学は変化し、過去10年間で、P2P融資は革新的で便利な資金調達手段に変わっています。インド市場において、P2Pレンディングは、アクセスのしやすさ、柔軟性、融資のコントロールのしやすさ、投資に対する一定のリターンなど様々な利点があるため、人気となっています。

インドのP2Pレンディング市場は、インド経済の成長、都市化、可処分所得の増加、個人消費の増加、デジタル化により、目覚ましい成長率で成長しています。インドの金融業界は年々劇的に変化しており、ローン申請書に記入し、ローンの承認を何日も待つ時代から、個人でもビジネスでも、消費者ローンを組むのに数回クリックするだけで、融資金が即座に入金される現在のシナリオまで、消費者金融は大きな変貌を遂げ、P2P融資市場はその最前線に立っています。また、政府による規制やコンプライアンス要件が、P2Pレンディング市場における消費者の信頼構築に役立っています。これらすべての要因がそろったことで市場は成長し、多くの既存企業の成長と、新規企業による参入の機会を創出しています。

技術の採用とデジタルトランスフォーメーション:

インドのP2Pレンディング市場は大きく成長し、金融業界に完全な変革をもたらしました。インドにおける金融サービスの急速なデジタル化は、P2Pレンディングの成長と進化を推進する極めて重要な原動力として際立っています。スマートフォンの普及と販売台数が増加し、国全体でインターネットが利用できるようになったことで、デジタル手段を通じたP2Pレンディングがより多くの人々に認知されるようになりました。借り手と貸し手は、オンラインプラットフォームを通じて便利に貸し借りを行うことができ、地理的な制約をなくすことができます。デジタルトランスフォーメーションはインドのP2Pレンディング市場に有利に働き、企業はウェブサイトやモバイルアプリを立ち上げ、ユーザーがスマートフォンから貸し借りサービスにアクセスできるようにしており、金融包摂や外出先での取引を促進しています。

当レポートでは、インドのP2P (ピアツーピア) レンディングの市場を調査し、市場の定義と概要、市場規模の推移・予測、各種区分・地域別の詳細分析、産業構造、市場成長への影響因子の分析、ケーススタディ、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 COVID-19がインドのP2P (ピアツーピア) レンディング市場に与える影響

第4章 エグゼクティブサマリー

第5章 顧客の声

- 人口統計

- 市場認知度と製品情報

- ブランド認知度とロイヤルティ

- 融資決定において考慮される要素

- 購入目的

- 購入頻度

- 購入媒体

- ブランドアンバサダーやインフルエンサーマーケティングが製品/ブランドの浸透に果たす役割

第6章 インドのP2P (ピアツーピア) レンディング市場の展望

- 市場規模・予測

- 貸付モデル別

- 直接

- マーケットプレース

- 与信タイプ別

- ビジネスローン

- 個人ローン

- その他

- 与信期間別

- 短期 (最長12か月)

- 長期 (12か月以上)

- 貸し手タイプ別

- 個人

- 企業

- HUF

- 個人の団体

- 機関投資家

- その他

- 返済別

- 一括

- 月次返済

- エンドユーザー/借り手タイプ別

- 自然人

- 事業体

- その他

- 地域別

- 北部

- 南部

- 東部

- 西部・中央部

- 市場シェア:企業別、2024年

第7章 市場マッピング、2024年

- 貸付モデル別

- 与信タイプ別

- 与信期間別

- 貸し手タイプ別

- 返済別

- エンドユーザー/借り手別

- 地域別

第8章 マクロ環境と産業構造

- 需給分析

- 規制の枠組みとコンプライアンス

- PESTEL分析

- ポーターのファイブフォース分析

第9章 市場力学

- 成長促進因子

- 成長阻害因子 (課題・制約)

第10章 主要企業の情勢

- 市場リーダー上位5社の競合マトリックス

- 市場リーダー上位5社の市場収益分析

- M&A・ジョイントベンチャー (該当する場合)

- SWOT分析 (参入5社)

- 特許分析 (該当する場合)

第11章 価格分析

- 個人の貸し手による価格設定

- 金利分析 (借り手・貸し手別)

第12章 ケーススタディ

第13章 主要企業の展望

- Fairassets Technologies Private Limited ('Faircent')

- Trickle Flood Technologies Private Limited

- Bridge Fintech Solutions Private Limited ("finzy")

- Transactree Technologies Private Limited (Lendbox)

- NDX P2P PRIVATE LIMITED ("LiquiLoans")

- FINTELLIGENCE DATA SCIENCE PRIVATE LIMITED ("RupeeCircle")

- M/s Dipamkara Web Ventures Private Limited (i-lend)

- Monexo Fintech Private Limited

- RNVP Technology Private Limited (i2i)

- Resilient Innovations Private Limited (12% Club)

第14章 戦略的提言

第15章 当社について・免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. India Peer-to-Peer Lending Market, By Value, In USD Billion, FY2018-FY2032F

- Figure 2. India Peer-to-Peer Lending Market Share (%), By Lending Model, FY2018-FY2032F

- Figure 3. India Peer-to-Peer Lending Market Share (%), By Credit Type, FY2018-FY2032F

- Figure 4. India Peer-to-Peer Lending Market Share (%), By Credit Tenure, FY2018-FY2032F

- Figure 5. India Peer-to-Peer Lending Market Share (%), By Lender Type, FY2018-FY2032F

- Figure 6. India Peer-to-Peer Lending Market Share (%), By Returns, FY2018-FY2032F

- Figure 7. India Peer-to-Peer Lending Market Share (%), By End-user/Borrower Type, FY2018-FY2032F

- Figure 8. India Peer-to-Peer Lending Market Share (%), By Region, FY2018-FY2032F

- Figure 9. By Lending Model Map-Market Size (USD Billion) & Growth Rate (%), FY2024

- Figure 10. By Credit Type Map-Market Size (USD Billion) & Growth Rate (%), FY2024

- Figure 11. By Credit Tenure Map-Market Size (USD Billion) & Growth Rate (%), FY2024

- Figure 12. By Lender Type Map-Market Size (USD Billion) & Growth Rate (%), FY2024

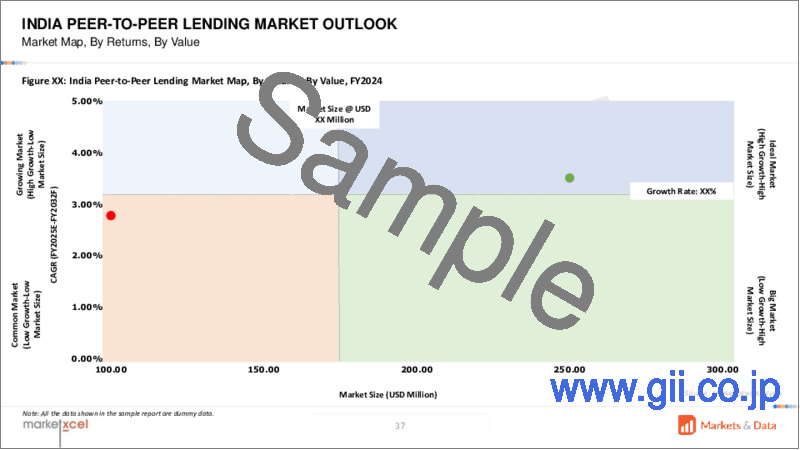

- Figure 13. By Returns Map-Market Size (USD Billion) & Growth Rate (%), FY2024

- Figure 14. By End-user/Borrower Type Map-Market Size (USD Billion) & Growth Rate (%), FY2024

- Figure 15. By Region Map-Market Size (USD Billion) & Growth Rate (%), FY2024

India peer-to-peer lending market is projected to witness a CAGR of 15.01% during the forecast period FY2025-FY2032, growing from USD 2.78 billion in FY2024 to USD 8.51 billion in FY2032. Peer-to-peer lending is not a novel concept in India. However, with wide access to the internet and digitalization, market dynamics have changed, and over the past decade, peer-to-peer lending has turned into an innovative and convenient means of financing. One of the key features and concept of peer-to-peer lending is elimination of a financial institution as an intermediary in the deal between a lender and a borrower. In the Indian market, peer-to-peer lending is becoming popular among Indian demographics due to the various benefits such as ease of access, flexibility, more control over lending, and constant returns on investment.

India peer-to-peer lending market is growing at an impressive growth rate owing to the growing Indian economy, urbanization, rising disposable income, rise in consumer spending, and digitalization. Indian financing industry is drastically changing over the years, from filling out loan applications and waiting for loan approval for days to current scenarios when obtaining a consumer loan, be it personal or business, takes a few clicks and the loan money is immediately or at most deposited into the borrower's account within a day, consumer financing has experienced a tremendous transformation and peer-to-peer lending market stands at the forefront of the transition. The adoption of technology by consumers has helped the market to expand consistently by allowing the market players to reach out to their key stakeholders without making any physical presence. Regulatory and compliance requirements by the government have aided in building consumer trust in the P2P lending market. With all the factors coming together, the market is poised to grow and create opportunities for many existing players to grow and new ones to enter the market.

Adoption of Technology and Digital Transformation

India peer-to-peer lending market has grown significantly and seen a complete transformation in finance industry. The rapid digitalization of financial services in India stands out as a pivotal driver propelling the growth and evolution of P2P lending. Higher usage and sales of smartphones and internet availability across the country have helped create awareness of P2P lending through digital means to a wider audience. Borrowers and lenders can engage in lending and borrowing activities conveniently through online platforms, eliminating geographical constraints. Digital transformation is a boon for India peer-to-peer lending market as players have launched their websites and mobiles applications to enable users to access lending and borrowing services from their smartphones, promoting financial inclusion and on-the-go transactions.

For instance, e-KYC is a major benefit to the market players because of the adoption of technology and digitalization. Through a computer or a mobile device, getting a KYC (know your customer) has never been easier and simpler for businesses and companies by saving time, money, and resources.

Lendbox, India's top peer-to-peer lending platform has disrupted the traditional lending market. Lendbox has made significant investments in developing a more personalized customer experience. Their emphasis on sales and technology has benefited the company's growth, as Lendbox has Assets Under Management (AUM) of over 2,600 crores as of January 2024.

Young Demographics and Rapid Urbanization

Indian economy is witnessing rapid urbanization with more villages turning into towns or cities, people are moving towards urban areas in search of better living conditions and work opportunities. Indian population consists largely of young individuals, with a median age below 30 years, who are tech-savvy and more inclined toward digital financial solutions. Moreover, the financial literacy rate is higher in urban areas due to which urban people have the knowledge to avail and utilize the peer-to-peer finance platforms in a better way. These P2P lending platforms leverage demographic trends, offering user-friendly interfaces, and mobile accessibility to cater to the preferences of younger generation.

In younger demographic, peer-to-peer lending is considered an investment option to gain a regular income through higher interest rates on their saving. The large and youthful population of India is more inclined to borrow money for various needs, such as education, housing and personal expenses, and people leveraging P2P lending platforms to the fullest as they are quick and convenient. However, millennials are the largest stakeholders in India peer-to-peer lending market as borrowers.

In collaboration with Lend Box, an RBI-registered P2P licensed NBFC in India, in December 2022, EaseMyDeal introduced Profit++, a peer-to-peer lending product that promises to yield returns of flat 10% annually. By launching Proft++ as a New Online Product on their App, EaseMyDeal has made the investing process incredibly simple, transparent, and quick. Proft++ offers lenders with choice, flexibility, and convenience while investing.

Technological Advancements in India Peer-to-Peer Lending Market

Like other markets and industries, where technology plays an important role in its operations and growth, India peer-to-peer lending market is not so far to adopt various technologies that aid in the market growth. Digitalization is one of the components that is continuously helping the market with adoption of advanced technologies such as artificial intelligence (AI), machine learning, and blockchain. These technologies give an added advantage to P2P platforms over the other financial markets.

Blockchain, the underlying technology that powers cryptocurrencies such as Bitcoin, provides a decentralized and secure platform for conducting and documenting financial transactions. P2P lending services can use blockchain to increase transparency, decrease fraud, and improve the lending process.

AI-powered algorithms can analyze massive volumes of financial and non-financial data to evaluate a customer's creditworthiness properly and objectively. AI algorithms can evaluate an applicant's creditworthiness by analyzing their financial history, credit scores, income statements, and social media activity. These algorithms use machine learning approaches to continuously learn and enhance their credit evaluation models based on data trends and past performance.

By adopting these technologies, P2P lending platforms can make a more automated process where a lender can find the right match with a borrower and the borrower can find the best lender as per their requirement.

Future Market Scenario (2025-2032F)

India peer-to-peer lending market is poised to grow at an impressive growth rate in the forecast period owing to growing market awareness and convenience provided by the market players.

The market is regulated by the Indian government due to consumer interest and it is expected that the Indian government and the Central Bank (RBI) will bring more rules and guidelines in the future for the market.

In coming years, Generation Z will become an important customer for the market as an expansion to the consumer base of Millennials who currently make the largest customer segment of India P2P lending market.

Key Players Landscape and Outlook

India peer-to-peer lending market is an evolving and dynamic market comprising diverse players including non-banking financial companies (NBFCs) and fintech startups offering consumer finance services in the realm of peer-to-peer lending. The outlook is positive as the market is untapped with limited market players creating new opportunities in the market and innovations on their platforms and strategies. India peer-to-peer lending market is positive for years to come, owing to the growing urban population, increasing financial education, digitalization, young population, changing behavior towards borrowing and lastly economic growth. Technology will play an important role for the market players to gain a competitive edge and create a USP.

In May 2022, Fi Money, a neobank, expanded its offering by launching an investing platform to attract regular investors. For it, the firm's savings arm shortly launched a peer-to-peer lending platform.

Table of Contents

1.Research Methodology

2.Project Scope & Definitions

3.Impact of COVID-19 on India Peer-to-Peer Lending Market

4.Executive Summary

5.Voice of Customer

- 5.1.Demographics (Gender; Income - Low, Mid and High; Geography; Nationality; etc.)

- 5.2.Market Awareness and Product Information

- 5.3.Brand Awareness and Loyalty

- 5.4.Factors Considered in Lending Decision

- 5.4.1.Institution Name

- 5.4.2.Interest Rate

- 5.4.3.Returns

- 5.4.4.Loan Period

- 5.4.5.Collateral

- 5.4.6.Charges

- 5.4.7.Investment Options

- 5.4.8.Credit Worthiness

- 5.5.Purpose of Purchase

- 5.6.Frequency of Purchase

- 5.7.Medium of Purchase

- 5.8.Role of Brand Ambassador or Influencer Marketing on Product/Brand Absorption

6.India Peer-to-Peer Lending Market Outlook, FY2018-FY2032

- 6.1.Market Size & Forecast

- 6.1.1.By Value

- 6.2.By Lending Model

- 6.2.1.Direct

- 6.2.2.Marketplace

- 6.3.By Credit Type

- 6.3.1.Business Loan

- 6.3.2.Personal Loan

- 6.3.2.1.Marriage Loan

- 6.3.2.2.Education Loan

- 6.3.2.3.Medical Loan

- 6.3.2.4.Home Renovation Loan

- 6.3.2.5.Others

- 6.3.3.Others

- 6.4.By Credit Tenure

- 6.4.1.Short-term (Up to 12 months)

- 6.4.2.Long-term (More than 12 months)

- 6.5.By Lender Type

- 6.5.1.Individual

- 6.5.2.Firm

- 6.5.3.HUF

- 6.5.4.Body of Individuals

- 6.5.5.Institutional Investors

- 6.5.6.Others

- 6.6.By Returns

- 6.6.1.Lumpsum

- 6.6.2.Monthly Returns

- 6.7.By End-user / Borrower Type

- 6.7.1.Natural Person

- 6.7.2.Business Entity

- 6.7.3.Others

- 6.8.By Region

- 6.8.1.North

- 6.8.2.South

- 6.8.3.East

- 6.8.4.West and Central

- 6.9.By Company Market Share (%), FY2024

7.Market Mapping, FY2024

- 7.1.By Lending Model

- 7.2.By Credit Type

- 7.3.By Credit Tenure

- 7.4.By Lender Type

- 7.5.By Returns

- 7.6.By End-user / borrower

- 7.7.By Region

8.Macro Environment and Industry Structure

- 8.1.Supply Demand Analysis

- 8.2.Regulatory Framework and Compliance

- 8.2.1.RBI Guidelines and Policies

- 8.2.2.Monetary & Fiscal Policies

- 8.2.3.Taxation Policies

- 8.3.PESTEL Analysis

- 8.3.1.Political Factors

- 8.3.2.Economic System

- 8.3.3.Social Implications

- 8.3.4.Technological Advancements

- 8.3.5.Environmental Impacts

- 8.3.6.Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 8.4.Porter's Five Forces Analysis

- 8.4.1.Supplier Power

- 8.4.2.Buyer Power

- 8.4.3.Substitution Threat

- 8.4.4.Threat from New Entrant

- 8.4.5.Competitive Rivalry

9.Market Dynamics

- 9.1.Growth Drivers

- 9.2.Growth Inhibitors (Challenges and Restraints)

10.Key Players Landscape

- 10.1.Competition Matrix of Top Five Market Leaders

- 10.2.Market Revenue Analysis of Top Five Market Leaders (in %, FY2024)

- 10.3.Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4.SWOT Analysis (For Five Market Players)

- 10.5.Patent Analysis (If Applicable)

11.Pricing Analysis

- 11.1.Pricing by Individual Lenders

- 11.2.Interest Rate Analysis (by Borrower and Lender)

12.Case Studies

13.Key Players Outlook

- 13.1.Fairassets Technologies Private Limited ('Faircent')

- 13.1.1.Company Details

- 13.1.2.Key Management Personnel

- 13.1.3.Products & Services

- 13.1.4.Financials (As reported)

- 13.1.5.Key Market Focus & Geographical Presence

- 13.1.6.Recent Developments

- 13.2.Trickle Flood Technologies Private Limited

- 13.3.Bridge Fintech Solutions Private Limited ("finzy")

- 13.4.Transactree Technologies Private Limited (Lendbox)

- 13.5.NDX P2P PRIVATE LIMITED ("LiquiLoans")

- 13.6.FINTELLIGENCE DATA SCIENCE PRIVATE LIMITED ("RupeeCircle")

- 13.7.M/s Dipamkara Web Ventures Private Limited (i-lend)

- 13.8.Monexo Fintech Private Limited

- 13.9.RNVP Technology Private Limited (i2i)

- 13.10.Resilient Innovations Private Limited (12% Club)

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work