|

|

市場調査レポート

商品コード

1402446

無人航空機(UAV)の世界市場の評価:翼タイプ別、クラス別、用途別、動作方式別、最大離陸重量別、地域別、機会、予測(2018年~2030年)Global Unmanned Aerial Vehicle Market Assessment, By Wing Type, By Class, By Application, By Mode of Operation, By Maximum Take Off Weight, By Region, Opportunities and Forecast, 2018-2030F |

||||||

カスタマイズ可能

|

|||||||

| 無人航空機(UAV)の世界市場の評価:翼タイプ別、クラス別、用途別、動作方式別、最大離陸重量別、地域別、機会、予測(2018年~2030年) |

|

出版日: 2024年01月08日

発行: Markets & Data

ページ情報: 英文 354 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の無人航空機(UAV)の市場規模は、2022年に245億米ドル、2030年に626億4,000万米ドルに達し、2023年~2030年の予測期間にCAGRで12.45%の成長が見込まれています。

軍の要件が戦闘用UAV市場を促進

戦闘用UAVは、諜報、監視、偵察、ミサイルや爆弾を使用した精密攻撃への適応性から人気があります。100ヶ国以上がこの遠隔操作機を展開し、人命へのリスクを排除する任務を遂行しています。その迅速な展開は、センサーやミサイルなどのさまざまなペイロードを搭載し、新たな脅威に対応しています。これらのUAVは先進の監視能力を誇り、軍事情報活動にとって重要な高解像度のデータをリアルタイムで取得します。正確な攻撃を保証することで、有人航空機と比較して巻き添え被害を大幅に削減し、費用対効果の高い動作と維持を実現します。長時間の偵察任務を可能にする耐久性の高いモデルも知られています。広く採用されることで、現代戦におけるその計り知れない可能性が強調され、戦場における極めて重要な役割が誇示されます。

増加する商業用途

商業部門では、小型、超小型、ミニドローンの多様なフリートが広く展開されており、さまざまなセンサー、電子機器、ソフトウェアシステムを搭載することで、多くの目的に対応しています。例えば、商業用ドローンは写真撮影やビデオ撮影に優れており、バッテリー寿命が延長されたDJI Mavic 2 Proや最新のO3+伝送システムを搭載したDJI Mavic 3などの最先端のカメラを搭載し、15km先までの飛行を可能にしています。企業はUAVをマッピングや監視などの特殊な作業に活用し、LiDARセンサーのような技術でそれを強化しています。これらのセンサーは、森林の調査から交通事故の評価、浸食された海岸線のマッピングまで、さまざまな業界で応用可能な非常に詳細な3Dモデルの作成に不可欠なツールです。マッピングドローンは、大規模なプロジェクトで航空調査を行う地理空間の専門家にとって不可欠なものです。商業用途の幅が広がるにつれて、UAV市場は繁栄を続けています。

政府規制

政府は、特に急速に発展する無人航空機(UAV)の分野において、市民の安全を確保し、民間企業の成長を支援する責任があります。規制は、ドローンの安全な運用を保証し、事故や衝突を最小限に抑え、安全保障上の脅威を軽減する上で極めて重要です。規制は共有空域を管理し、民間航空とレクリエーションドローン操縦者の安全な共存を可能にします。規制はプライバシーとデータ保護の懸念に対処し、監視とデータ収集の実施に制限を課します。明確に定義された規制は、企業や投資家に明確な枠組みを提供し、UAV業界の成長とイノベーションを促進します。

AIと機械学習の強化がUAVの自律性とインテリジェンスに革命をもたらす

AIと機械学習の進歩により、無人航空機(UAV)の自律性とインテリジェンスが大幅に向上し、リアルタイムの意思決定、優れた障害物検知、天候への適応が可能になっています。これらの技術は、監視、偵察、災害管理にとって極めて重要であり、物体の同時識別、選択、追跡を可能にします。AIを活用したUAVの集団は、息の合った任務の遂行を保証し、その用途は農業、環境モニタリング、セキュリティなどの部門にまたがり、UAV業界の成長と革新を促進します。

COVID-19の影響

COVID-19パンデミックは、2020年と2021年の世界の無人航空機(UAV)市場に大きな影響を与え、生産と需給の力学を再構築しました。パンデミックは世界中の製造とサプライチェーンに混乱をもたらし、UAVの生産に影響を与えました。重要な課題の1つは半導体チップの不足で、UAVに不可欠な各種電子部品の生産に支障をきたしました。この不足は連鎖的に影響を及ぼし、UAVメーカーに遅延とコスト増をもたらしました。この影響は全世界に及び、特定のサプライヤーや製造拠点に依存しているためにより深刻な混乱に直面した地域もありました。こうした課題にもかかわらず、パンデミック中はUAVの需要が急増しました。政府、産業、組織は、監視、モニタリング、配送サービスなどのさまざまな用途にUAVを利用しました。非接触かつ遠隔のソリューションの必要性から、特に医療、農業、ロジスティクスなどの部門でUAVの採用が増加しました。配達用ドローンや監視用ドローンなど、特定のタイプのUAVの需要がこの期間に大幅に増加しました。医療のような業界は、医療品の配送や安全プロトコルの遵守の監視にUAVを活用しました。

当レポートでは、世界の無人航空機(UAV)市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢と見通しなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 世界の無人航空機(UAV)市場に対するCOVID-19の影響

第4章 ロシア・ウクライナ戦争の影響

第5章 エグゼクティブサマリー

第6章 顧客の声

- 経営幹部と上級管理職の回答者の人口統計

- UAVの主な用途

- 組織統合型UAV技術

- 組織にとっての主な機会

- 購入決定において一般的に考慮される要素

- 採用中に組織が直面した障壁

- UAV市場を形成する主な動向

- UAV産業への組織の関与の主な焦点

- 組織が専門とするプラットフォーム

- 現在その組織が注力している技術分野

- 研究開発への現在の投資

第7章 世界の無人航空機(UAV)市場の見通し、2018年~2030年に

- 市場規模と予測

- 金額

- 数量

- 翼タイプ別

- 固定翼

- 回転翼

- その他

- クラス別

- マイクロ/ミニUAV

- 戦術UAV

- 戦略的UAV

- その他

- 用途別

- 商業

- 防衛

- 民生

- その他

- 動作方式別

- 遠隔操作

- 半自律

- 完全自律

- 最大離陸重量別

- 15kg未満

- 15~50kg

- 50kg超

- 地域別

- アジア太平洋

- 欧州

- 北米

- 南米

- 中東・アフリカ

- 市場シェア:企業別(2022年)

第8章 世界の無人航空機(UAV)市場の見通し:地域別(2018年~2030年)

- 北米

- 市場規模と予測

- 翼タイプ別

- クラス別

- 用途別

- 動作方式別

- 最大離陸重量別

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- 欧州

- 英国

- ドイツ

- ロシア

- フランス

- イタリア

- スペイン

- オランダ

- 南米

- ブラジル

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

第9章 市場マッピング(2022年)

- 翼タイプ別

- クラス別

- 用途別

- 動作方式別

- 最大離陸重量別

- 地域別

第10章 マクロ環境と産業構造

- 需給分析

- 輸入輸出分析 - 価値

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第11章 市場力学

- 成長促進要因

- 成長抑制要因

第12章 主要企業情勢

- マーケットリーダー上位5社の競合マトリクス

- マーケットリーダー上位5社の市場収益分析(2022年)

- 合併・買収/合弁事業

- SWOT分析(市場参入企業5社)

- 特許分析

第13章 価格分析

第14章 ケーススタディ

第15章 主要企業の見通し

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- General Atomics Aeronautical Systems

- Israel Aerospace Industries Limited

- Airbus Defence And Space Limited

- Baykar Makina A.S.

- Boeing Company

- Parrot SA

- SZ DJI Technology Co. Ltd.

- AeroVironment Inc.

第16章 戦略的推奨事項

第17章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 01: Respondents, By Region

- Figure 02: Respondents, By Type of Industries

- Figure 03: Respondents, By Position

- Figure 04: Primary Applications Of UAVs (%)

- Figure 05: Organization Integrated UAV Technology (%)

- Figure 06: Primary Opportunities For The Organization (%)

- Figure 07: Factors Commonly Considered During Purchase Decision (%)

- Figure 08: Barriers The Organization Faced While Adoption (%)

- Figure 09: Key Trends Shaping The UAV Market (%)

- Figure 10: Primary Focus (%)

- Figure 11: Platforms The Organization Specialize In (%)

- Figure 12: Technological Areas Which the Organizations Currently Focus On (%)

- Figure 13: Current Investment In Research and Development (%)

- Figure 14: Global Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 15: Global Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 16: Global Unmanned Aerial Vehicle Market Share, By Wing Type, % share, 2018-2030F

- Figure 17: Global Unmanned Aerial Vehicle Market Share, By Class, % share, 2018-2030F

- Figure 18: Global Unmanned Aerial Vehicle Market Share, By Application, % share, 2018-2030F

- Figure 19: Global Unmanned Aerial Vehicle Market Share, By Mode Of Operation, % share, 2018-2030F

- Figure 20: Global Unmanned Aerial Vehicle Market Share, By Maximum Take off Weight, % share, 2018-2030F

- Figure 21: Global Unmanned Aerial Vehicle Market Share, By Region, % share, 2018-2030F

- Figure 22: Market Share of Top 5 Companies (IN %, 2022)

- Figure 23: North America Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 24: North America Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 25: North America Unmanned Aerial Vehicle Market Share, By Wing Type, % share, 2018-2030F

- Figure 26: North America Unmanned Aerial Vehicle Market Share, By Class, % share, 2018-2030F

- Figure 27: North America Unmanned Aerial Vehicle Market Share, By Application, % share, 2018-2030F

- Figure 28: North America Unmanned Aerial Vehicle Market Share, By Mode Of Operation, % share, 2018-2030F

- Figure 29: North America Unmanned Aerial Vehicle Market Share, By Maximum Take off Weight, % share, 2018-2030F

- Figure 30: North America Unmanned Aerial Vehicle Market Share, By Countries, % share, 2018-2030F

- Figure 31: United States Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 32: United States Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 33: Canada Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 34: Canada Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 35: Mexico Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 36: Mexico Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 37: Asia-Pacific Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F 89

- Figure 38: Asia-Pacific Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 39: Asia-Pacific Unmanned Aerial Vehicle Market Share, By Wing Type, % share, 2018-2030F

- Figure 40: Asia-Pacific Unmanned Aerial Vehicle Market Share, By Class, In % share, 2018-2030F

- Figure 41: Asia-Pacific Unmanned Aerial Vehicle Market Share, By Application, % share, 2018-2030F

- Figure 42: Asia-Pacific Unmanned Aerial Vehicle Market Share, By Mode Of Operation, % share, 2018-2030F

- Figure 43: Asia-Pacific Unmanned Aerial Vehicle Market Share, By Maximum Take off Weight, % share, 2018-2030F

- Figure 44: Asia-Pacific Unmanned Aerial Vehicle Market Share, By Countries, % share, 2018-2030F

- Figure 45: China Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 46: China Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 47: Japan Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 48: Japan Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 49: India Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 50: India Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 51: South Korea Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 52: South Korea Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 53: Australia Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 54: Australia Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 55: Europe Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 56: Europe Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 57: Europe Unmanned Aerial Vehicle Market Share, By Wing Type, % share, 2018-2030F

- Figure 58: Europe Unmanned Aerial Vehicle Market Share, By Class, % share, 2018-2030F

- Figure 59: Europe Unmanned Aerial Vehicle Market Share, By Application, % share, 2018-2030F

- Figure 60: Europe Unmanned Aerial Vehicle Market Share, By Mode Of Operation, % share, 2018-2030F

- Figure 61: Europe Unmanned Aerial Vehicle Market Share, By Maximum Take off Weight, % share, 2018-2030F

- Figure 62: Europe Unmanned Aerial Vehicle Market Share, By Countries, % share, 2018-2030F

- Figure 63: United Kingdom Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 64: United Kingdom Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 65: Germany Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 66: Germany Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 67: Russia Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 68: Russia Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 69: France Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 70: France Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 71: Italy Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 72: Italy Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 73: Spain Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 74: Spain Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 75: Netherlands Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 76: Netherlands Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 77: South America Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 78: South America Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 79: South America Unmanned Aerial Vehicle Market Share, By Wing Type, % share, 2018-2030F

- Figure 80: South America Unmanned Aerial Vehicle Market Share, By Class, % share, 2018-2030F

- Figure 81: South America Unmanned Aerial Vehicle Market Share, By Application, % share, 2018-2030F

- Figure 82: South America Unmanned Aerial Vehicle Market Share, By Mode Of Operation, % share, 2018-2030F

- Figure 83: South America Unmanned Aerial Vehicle Market Share, By Maximum Take off Weight, % share, 2018-2030F

- Figure 84: South America Unmanned Aerial Vehicle Market Share, By Countries, % share, 2018-2030F

- Figure 85: Brazil Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 86: Brazil Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 87: Argentina Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 88: Argentina Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 89: Middle East & Africa Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 90: Middle East & Africa Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 91: Middle East & Africa Unmanned Aerial Vehicle Market Share, By Wing Type, % share, 2018-2030F

- Figure 92: Middle East & Africa Unmanned Aerial Vehicle Market Share, By Class, % share, 2018-2030F

- Figure 93: Middle East & Africa Unmanned Aerial Vehicle Market Share, By Application, % share, 2018-2030F

- Figure 94: Middle East & Africa Unmanned Aerial Vehicle Market Share, By Mode Of Operation, % share, 2018-2030F

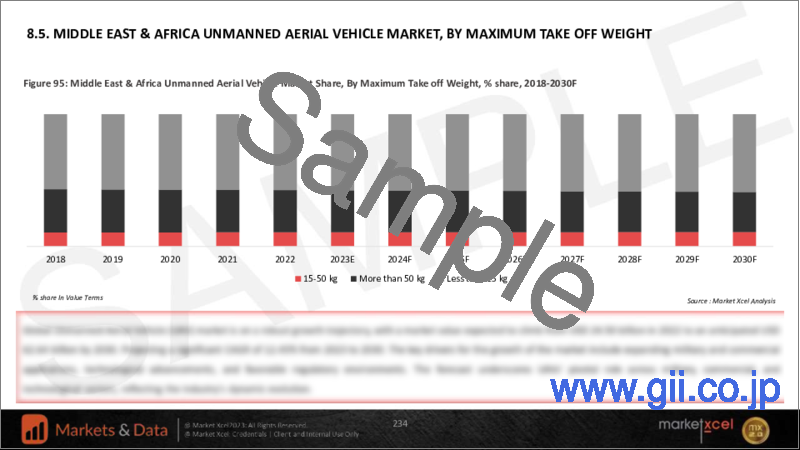

- Figure 95: Middle East & Africa Unmanned Aerial Vehicle Market Share, By Maximum Take off Weight, % share, 2018-2030F

- Figure 96: Middle East & Africa Unmanned Aerial Vehicle Market Share, By Countries, % share, 2018-2030F

- Figure 97: South Africa Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 98: South Africa Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 99: Saudi Arabia Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 100: Saudi Arabia Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 101: UAE Unmanned Aerial Vehicle Market, By Value, In USD Billion, 2018-2030F

- Figure 102: UAE Unmanned Aerial Vehicle Market, By Volume, In Thousand Units, 2018-2030F

- Figure 103: Wing Type Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 104: Class Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 105: Application Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 106: Mode of Operation Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 107: Maximum Take-Off Weight Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 108: Region Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 109: Top Ten Importer, By Value Share (%) 2022

- Figure 110: Top Ten Exporter, By Value Share (%) 2022

- Figure 111: South Asia & Middle East Countries, GDP Growth (%), 2022

- Figure 112: Total Group Revenues of Top Five Players, in USD Billion, 2022

- Figure 113: Number of Drone Patents (2015-2022)

Global unmanned aerial vehicles market size was valued at USD 24.50 billion in 2022, which is expected to reach USD 62.64 billion in 2030, with a CAGR of 12.45% for the forecast period between 2023 and 2030. The fascination with vertical travel has been an enduring aspect of human interest. Advancements in technology have enabled expert air travel, and subsequent developments in unmanned aerial vehicles have granted humans the flexibility to navigate for various purposes. Unmanned Aerial Vehicles, as the name implies, are aircraft designed to travel and explore the skies without onboard human pilots or passengers. These UAVs can operate autonomously to varying degrees and are typically under remote control by a human operator. Their applications include logistics, surveillance, rapid emergency response, aerial photography, wildlife monitoring, agricultural assessment, and expand to military applications.

Initially, UAVs were primarily developed for military applications to reduce risks to pilots during combat missions. Nevertheless, technological advancements such as lightweight materials, improved long-distance communication systems, and enhanced battery technology, leading to extended flight durations, have made UAVs increasingly cost-effective for various tasks like data collection, monitoring, and inspections. Currently, it provides compelling alternatives to traditional methods. However, the expanding utilization of drones in the corporate sector faces regulatory challenges. Yet, ongoing progress in drone technology and industry-specific software promises improved operational efficiency. As drones become more autonomous, coupled with simplified licensing and registration processes, the costs associated with drone adoption are expected to decrease, fostering their utilization across diverse industries, and propelling the global UAV market.

Military Requirements Propel Combat UAVs Market

Combat UAVs are popular due to their adaptability for intelligence, surveillance, reconnaissance, and precision strikes employing missiles and bombs. Over 100 countries deployed these remotely operated aircraft for missions that eliminate the risk to human lives. Their swift deployment addresses emerging threats, carrying a range of payloads, including sensors and missiles. These UAVs boast advanced surveillance capabilities, capturing real-time high-resolution data crucial for military intelligence. Ensuring precision strikes significantly reduces collateral damage compared to manned aircraft, while offering cost-effective operation and maintenance. Some models are known for their extended endurance, facilitating prolonged surveillance missions. The widespread adoption underscores their immense potential in modern warfare, emphasizing their pivotal role on the battlefield.

In March 2023, the United States Air Force's Air Combat Command, having relied on the MQ-9A Reaper drone for over 14 years, which was sufficiently impressed by General Atomics Aeronautical Systems to award them a contract for three of their latest MQ-9B SkyGuardian remotely piloted aircraft systems (RPAS). This marked the United States military's first order for the SkyGuardian. The MQ-9B is envisioned to provide air support, surveillance, targeting, and effects in various air environments. Recent tests have confirmed its operational capabilities, including cold-weather validation and low-earth orbit satellite control.

Increasing Commercial Applications

The commercial sector widely deploys a diverse fleet of small, micro, and mini drones, which, when equipped with various sensors, electronics, and software systems, serve a multitude of purposes. For instance, commercial drones excel in photography and videography, featuring state-of-the-art cameras such as the DJI Mavic 2 Pro and the DJI Mavic 3 with extended battery life and an updated O3+ transmission system, allowing for flights up to 15km away. Enterprises harness UAVs for specialized tasks like mapping and surveillance, enhancing them with technology like LiDAR sensors. These sensors are indispensable tools for creating highly detailed 3D models applicable in various industries, from surveying forests to assessing car accidents and mapping eroded shorelines. Mapping drones are essential for geospatial professionals who conduct aerial surveys for large-scale projects. As the range of commercial applications grows, the UAV market continues to prosper.

In August 2023, JOUAV showcased its CW-15 VTOL drone and VTOL hangar system at the 2023 Intelligent Mining & Coal Mining Technology Conference. The drone solution integrates various UAVs with a mobile ground data collection system, enhancing 3D data collection for mining and coal production management. JOUAV presented intelligent inspection and mapping technologies innovations, improving mining facility assessments and resource management. Thus, displaying the extending reach of UAV technology across domains.

Governments Regulations

Governments are responsible for ensuring citizens' safety and supporting private enterprise growth, particularly in the rapidly evolving Unmanned Aerial Vehicles (UAVs) field. Regulations are crucial in ensuring safe drone operation, minimizing accidents and collisions, and mitigating security threats. They manage shared airspace, allowing safe coexistence of commercial aviation and recreational drone operators. Regulations address privacy and data protection concerns, imposing restrictions on surveillance and data collection practices. Well-defined regulations provide a clear framework for businesses and investors, promoting growth and innovation in the UAV industry.

In North America, the United States government's 2023 budget request for Defense Department stood at USD 773 billion. This budget represents a USD 30.7 billion or 4.1 percent increase over the 2022 enacted base level of USD 742.3 billion and an 8.1 percent increase from the 2022 requested level. Notably, out of this, the government has allocated budget of USD 2.4 billion in 2023 exclusively for replacement or repair of unmanned aerial vehicles, helicopters, tactical vehicles, and various combat support equipment.

AI and Machine Learning Enhancements Revolutionize UAV Autonomy and Intelligence

Artificial Intelligence and Machine Learning advancements have significantly improved the autonomy and intelligence of Unmanned Aerial Vehicles (UAVs), enabling real-time decision-making, improved obstacle detection, and adaptive weather responses. These technologies are crucial for surveillance, reconnaissance, and disaster management, enabling simultaneous object identification, selection, and tracking. AI-driven UAV swarming ensures synchronized mission execution, and their applications span across sectors like agriculture, environmental monitoring, and security, fostering growth and innovation in the UAV industry.

In April 2023, Israel Aerospace Industries Ltd and Windward Ltd entered into a collaborative agreement to equip its heron UAV with advanced autonomy and Artificial Intelligence (AI) capabilities systems. This integrated capability will leverage Windward's AI technology in conjunction with the Heron system. The partnership aims to empower users with the capacity to enrich open-source maritime data with AI-driven insights, enabling the rapid detection of anomalies in vessel behavior and patterns of life, as well as risk assessment. The collaboration facilitates more efficient target identification and reduces the personnel and assets required for these tasks, optimizing maritime operations.

Impact of COVID-19

The COVID-19 pandemic had a profound impact on the global unmanned aerial vehicle (UAV) market in 2020 and 2021, reshaping dynamics in production, supply, and demand. The pandemic led to disruptions in manufacturing and supply chains worldwide, affecting UAV production. One significant challenge was the semiconductor chip shortage, which hampered the production of various electronic components crucial for UAVs. This shortage had a cascading effect, causing delays and increased costs for UAV manufacturers. The impact was felt globally, with certain regions facing more severe disruptions due to their dependence on specific suppliers or manufacturing hubs. Despite these challenges, the demand for UAVs surged during the pandemic. Governments, industries, and organizations turned to UAVs for various applications, including surveillance, monitoring, and delivery services. The need for contactless and remote solutions increased the adoption of UAVs, particularly in sectors such as healthcare, agriculture, and logistics. The demand for specific types of UAVs, such as delivery drones and surveillance drones, saw a significant uptick during this period. Industries like healthcare utilized UAVs for medical supply delivery and monitoring compliance with safety protocols. For instance, in 2021, Zipline, a prominent drone delivery company, played a pivotal role in deploying its autonomous drones to transport light-weight medical supplies in Rwanda and Ghana. In Ghana, Zipline collaborated with Pfizer, the Health Ministry, UPS, and other partners to establish a robust drone delivery infrastructure, facilitating the distribution of over 2.6 million COVID-19 vaccine doses by June 2021. The company aimed to deliver an additional 2.4 million doses, particularly focusing on remote areas. In Rwanda, Zipline focused on delivering blood, medical supplies, and personal protective equipment.

Impact of Russia-Ukraine War

The Russia-Ukraine War in 2022 marked a significant shift in geopolitical dynamics, transforming the traditional war into a modern, digital-age battle marked by the extensive use of drones. Both sides employed reconnaissance and attack drones in every phase of the conflict, contributing to a new era in military tactics. Ukraine embraced a diverse range of drones, including commercial ones like the Mavic quadcopter and military-grade options like the Bayraktar TB2, providing unprecedented visibility on the battlefield, enabling more accurate artillery strikes and real-time monitoring of operations. The use of combat drones has played a crucial role in the success of Ukrainian offensives, leading to significant setbacks for Russian forces. The extensive application of UAVs in the Russia-Ukraine war has encouraged governments worldwide to significantly invest in procuring these technologies and integrate them into their military power. Countries bordering Russia and Ukraine significantly hiked their annual military budgets in CY2022, leading them to invest in UAVs. The war also impacted the global unmanned aerial vehicle market growth, with countries like the US, China, Russia, and India investing in advanced military technologies like UAVs.

Key Developments

In August 2023, IAF (Indian Air Force) inducts Heron Mark 2 drones for enhanced strike capabilities marking a significant advancement in the realm of aerial defense and positioned at a forward air base within the northern sector, these cutting-edge drones represent a potent addition to the nation's security apparatus. Equipped with long-range missiles and a sophisticated weapons system, they confer a distinctive advantage to the armed forces in executing targeted strikes against potential adversaries from a considerable distance.

Key Players Landscape and Outlook

The market for UAVs is fragmented due to numerous manufacturing companies operating in both developed and emerging markets. Advanced technical companies are expected to drive technological advancements in propulsion systems and payload characteristics, accelerating the development cycle of mini-UAVs and enhancing their operational capabilities. The introduction of alternative fuel-powered UAVs is expected to change the competitive landscape. At the same time, the use of composite-based materials in UAV components could enhance their capabilities and drive widespread adoption across various industries. This fragmentation is expected to drive mini-UAV development and operational capabilities.

For instance, in November 2023, South Korea's Defense Acquisition Program Administration (DAPA) and Boeing agreed to jointly research high-altitude, long-endurance unmanned aerial vehicles (UAVs) to manufacture South Korean-made "advanced aircraft" with Boeing design. The collaboration aims to strengthen South Korea's drone capabilities in response to North Korea's recent drone threat. The two sides also agreed to cooperate on the maintenance, repair, overhaul, and upgradation of Boeing aircraft used by the South Korean military.

For instance, in March 2023, The Finnish Army announced a USD 2.81 million deal for Parrot ANAFI USA drones. The Finnish Army views the acquisition of Parrot's training flight equipment as the cornerstone for improving performance and expanding deployment. The small drone would be used by Finnish personnel for surveillance and reconnaissance missions, with a production entirely developed in France and the US. This collaboration highlighted the growing interest in UAVs for military applications and the potential for further international partnerships in this field.

For instance, in February 2022, Northrop Grumman and Echodyne signed a strategic agreement to integrate Echodyne's commercially priced radars into Northrop Grumman's advanced counter-unmanned aircraft system (C-UAS) solutions. The agreement aimed to expand upon existing efforts to integrate Echodyne radars into Northrop Grumman's C-UAS systems, which are used for border security, base security, and other applications. The collaboration was seen as a significant step towards enhancing C-UAS capabilities, leveraging the strengths of both companies to provide effective solutions for countering unmanned aerial threats.

Table of Contents

1. Research Methodology

2. Project Scope & Definitions

3. Impact of COVID-19 on the Global Unmanned Aerial Vehicle Market

4. Impact of Russia-Ukraine War

5. Executive Summary

6. Voice of Customer

- 6.1. Executives and Senior Management Respondent's Demographics

- 6.2. Primary Applications of UAVs

- 6.3. Organization Integrated UAV Technology

- 6.4. Primary Opportunities for the Organization

- 6.5. Factors Commonly Considered During Purchase Decision

- 6.6. Barriers the Organization Faced While Adoption

- 6.7. Key Trends Shaping the UAV Market

- 6.8. Primary Focus of Organization's Involvement in the UAV Industry

- 6.9. Platforms the Organizations Specialize in

- 6.10. Technological Areas Which the Organization Currently Focused on

- 6.11. Current Investments in Research and Development

7. Global Unmanned Aerial Vehicle Market Outlook, 2018-2030F

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.1.2. By Volume

- 7.2. By Wing Type

- 7.2.1. Fixed Wing

- 7.2.2. Rotary Wing

- 7.2.3. Others

- 7.3. By Class

- 7.3.1. Micro/Mini UAVs

- 7.3.2. Tactical UAVs

- 7.3.3. Strategic UAVs

- 7.3.4. Others

- 7.4. By Application

- 7.4.1. Commercial

- 7.4.2. Defense

- 7.4.3. Civil

- 7.4.4. Others

- 7.5. By Mode of Operation

- 7.5.1. Remotely Operated

- 7.5.2. Semi-Autonomous

- 7.5.3. Fully Autonomous

- 7.6. By Maximum Take off Weight

- 7.6.1. Less than 15 kg

- 7.6.2. 15-50 kg

- 7.6.3. More than 50 kg

- 7.7. By Region

- 7.7.1. Asia Pacific

- 7.7.2. Europe

- 7.7.3. North America

- 7.7.4. South America

- 7.7.5. Middle East & Africa

- 7.8. By Company Market Share (%), 2022

8. Global Unmanned Aerial Vehicle Market Outlook, By Region, 2018-2030F

- 8.1. North America*

- 8.1.1. Market Size & Forecast

- 8.1.1.1. By Value

- 8.1.1.2. By Volume

- 8.1.2. By Wing Type

- 8.1.2.1. Fixed Wing

- 8.1.2.2. Rotary Wing

- 8.1.2.3. Others

- 8.1.3. By Class

- 8.1.3.1. Micro/Mini UAVs

- 8.1.3.2. Tactical UAVs

- 8.1.3.3. Strategic UAVs

- 8.1.3.4. Others

- 8.1.4. By Application

- 8.1.4.1. Commercial

- 8.1.4.2. Defense

- 8.1.4.3. Civil

- 8.1.4.4. Others

- 8.1.5. By Mode of Operation

- 8.1.5.1. Remotely Operated

- 8.1.5.2. Semi-Autonomous

- 8.1.5.3. Fully Autonomous

- 8.1.6. By Maximum Take off Weight

- 8.1.6.1. Less than 15 kg

- 8.1.6.2. 15-50 kg

- 8.1.6.3. More than 50 kg

- 8.1.7. United States*

- 8.1.7.1. Market Size & Forecast

- 8.1.7.1.1. By Value

- 8.1.7.1.2. By Volume

- 8.1.7.2. By Wing Type

- 8.1.7.2.1. Fixed Wing

- 8.1.7.2.2. Rotary Wing

- 8.1.7.2.3. Others

- 8.1.7.3. By Class

- 8.1.7.3.1. Micro/Mini UAVs

- 8.1.7.3.2. Tactical UAVs

- 8.1.7.3.3. Strategic UAVs

- 8.1.7.3.4. Others

- 8.1.7.4. By Application

- 8.1.7.4.1. Commercial

- 8.1.7.4.2. Defense

- 8.1.7.4.3. Civil

- 8.1.7.4.4. Others

- 8.1.7.5. By Mode of Operation

- 8.1.7.5.1. Remotely Operated

- 8.1.7.5.2. Semi-Autonomous

- 8.1.7.5.3. Fully Autonomous

- 8.1.7.6. By Maximum Take off Weight

- 8.1.7.6.1. Less than 15 kg

- 8.1.7.6.2. 15-50 kg

- 8.1.7.6.3. More than 50 kg

- 8.1.8. Canada

- 8.1.9. Mexico

- 8.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered:

- 8.2. Asia-Pacific

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. South Korea

- 8.2.5. Australia

- 8.3. Europe

- 8.3.1. United Kingdom

- 8.3.2. Germany

- 8.3.3. Russia

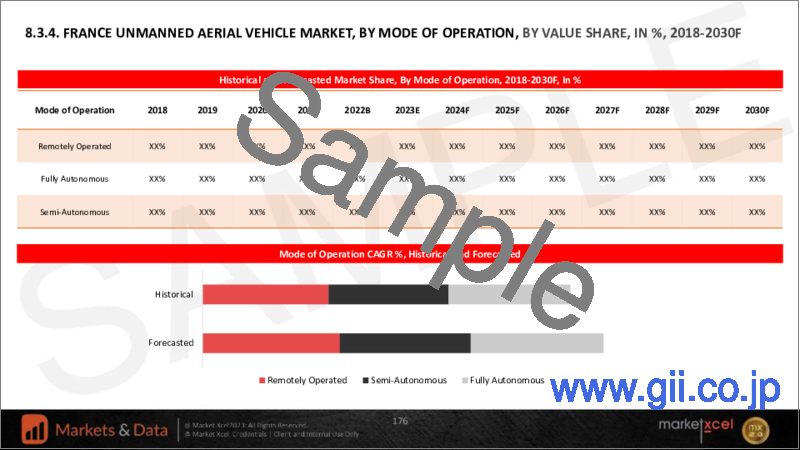

- 8.3.4. France

- 8.3.5. Italy

- 8.3.6. Spain

- 8.3.7. Netherlands

- 8.4. South America

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.5. Middle East & Africa

- 8.5.1. South Africa

- 8.5.2. Saudi Arabia

- 8.5.3. UAE

9. Market Mapping, 2022

- 9.1. By Wing Type

- 9.2. By Class

- 9.3. By Application

- 9.4. By Mode of Operation

- 9.5. By Maximum Take off Weight

- 9.6. By Region

10. Macro Environment and Industry Structure

- 10.1. Supply Demand Analysis

- 10.2. Import Export Analysis - Value

- 10.3. Value Chain Analysis

- 10.4. PESTEL Analysis

- 10.4.1. Political Factors

- 10.4.2. Economic System

- 10.4.3. Social Implications

- 10.4.4. Technological Advancements

- 10.4.5. Environmental Impacts

- 10.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 10.5. Porter's Five Forces Analysis

- 10.5.1. Supplier Power

- 10.5.2. Buyer Power

- 10.5.3. Substitution Threat

- 10.5.4. Threat from New Entrant

- 10.5.5. Competitive Rivalry

11. Market Dynamics

- 11.1. Growth Drivers

- 11.2. Growth Inhibitors

12. Key Players Landscape

- 12.1. Competition Matrix of Top Five Market Leaders

- 12.2. Market Revenue Analysis of Top Five Market Leaders (in %, 2022)

- 12.3. Mergers and Acquisitions/Joint Ventures

- 12.4. SWOT Analysis (For Five Market Players)

- 12.5. Patent Analysis

13. Pricing Analysis

14. Case Studies

15. Key Players Outlook

- 15.1. Lockheed Martin Corporation

- 15.1.1. Company Details

- 15.1.2. Key Management Personnel

- 15.1.3. Key Market Focus & Geographical Presence

- 15.1.4. Products & Services

- 15.1.5. Financials (As reported)

- 15.1.6. Recent Developments

- 15.2. Northrop Grumman Corporation

- 15.3. General Atomics Aeronautical Systems

- 15.4. Israel Aerospace Industries Limited

- 15.5. Airbus Defence And Space Limited

- 15.6. Baykar Makina A.S.

- 15.7. Boeing Company

- 15.8. Parrot SA

- 15.9. SZ DJI Technology Co. Ltd.

- 15.10. AeroVironment Inc.