|

|

市場調査レポート

商品コード

1402444

バイオマスガス化の世界市場の評価:原料別、ガス化技術別、用途別、地域別、機会、予測(2017年~2031年)Biomass Gasification Market Assessment, By Source, By Gasifier Technology, By Application, By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| バイオマスガス化の世界市場の評価:原料別、ガス化技術別、用途別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年01月08日

発行: Markets & Data

ページ情報: 英文 224 Pages

納期: 3~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のバイオマスガス化の市場規模は、2023年に526億米ドル、2031年に945億1,000万米ドルに達し、2024年~2031年の予測期間にCAGRで7.6%の成長が見込まれています。

市場は複数の要因によって大きな成長を示しています。バイオマスガス化には、温室効果ガス(GHG)排出の削減、廃棄物管理、分散型エネルギー生産の可能性など、さまざまな利点があります。主に、再生可能エネルギーに対する需要の増加、環境問題への懸念、支持的な規制枠組みが市場を牽引しています。さらに、再生可能エネルギーに対する政府の支援、エネルギー安全保障と農村開発の必要性、ネットゼロ目標を達成するためのクリーンエネルギーソリューションに対するニーズの高まりが、市場の拡大に寄与しています。さらに、官民部門からの投資が増加しており、市場の成長をさらに後押ししています。

バイオマスガス化は、ネットゼロ炭素排出の達成に向けた有望なソリューションとして勢いを増しています。例えば、英国政府は2023年8月、Biomass Strategy 2023を策定しました。Biomass Strategy 2023はネットゼロ達成における持続可能なバイオマスの役割、その目標を実現するための政府の取り組み、さらなる対策が必要な分野を概説しています。さらに同戦略は、バイオマスの持続可能性を強化し、英国のネットゼロ目標を達成するため、経済の複数の部門にわたって持続可能なバイオマスの利用を促進することを目指しています。

流動床技術が市場成長を加速

流動床技術は市場の主な促進要因の1つとみなされています。流動床式ガス化炉は固定床式ガス化炉に比べ、均一な温度分布、高い炭素転換率、低いタール生成、幅広いバイオマスの種類、サイズ、供給速度などの利点があり、燃料の柔軟性、適度な酸化剤と蒸気の要件、優れた気固接触をもたらします。

発電におけるバイオマス利用の増加

発電におけるバイオマス利用の増加は、バイオマスガス化市場に数多くの機会を生み出しています。持続可能で環境にやさしいエネルギーソリューションが世界中で注目される中、バイオマスガス化は従来の化石燃料に代わるカーボンニュートラルまたはカーボンネガティブな選択肢を提供します。さらに、技術開発とバイオエネルギープロジェクトへの投資の増加に後押しされ、市場は急拡大すると予測されます。

マーケットリーダーとしての欧州の台頭

欧州は複数の要因により、バイオマスガス化市場でもっとも支配的な地域となっています。この地域の優位性は、業界の大手企業のプレゼンスと、一次エネルギー生産に向けた再生可能エネルギー源へのエネルギーシフトの積極的な追求に起因しています。さらに同市場は、農業残渣、林業廃棄物、専用のエネルギー作物などの多様なバイオマス原料を特徴としており、これが市場における欧州のリーダーシップにさらに寄与しています。

政府の取り組み

世界のバイオマスガス化市場の成長を促進する上で、政府の取り組みは極めて重要です。市場が持続可能なエネルギーソリューションを求める中、支援政策とインセンティブがバイオマスガス化技術の研究開発と採用を促進しています。さらに、政府は投資家にとって有利な環境を作ることで技術革新を促進し、バイオマスガス化の利用を促進する規制枠組みを確保する上で極めて重要な役割を果たしています。

COVID-19の影響

COVID-19パンデミックは、世界のバイオマスガス化市場に大きな影響を与え、COVID-19前と現在のシナリオに明確な変化をもたらしました。COVID-19前は、環境問題への関心の高まりと持続可能なエネルギー源への注目により、市場は安定した成長を示していました。しかし、パンデミックによってサプライチェーンに混乱が生じ、プロジェクトの遅延や効果的な市場力学が生じました。COVID-19後あるいは現在の状況は、混在した情勢を反映しています。再生可能エネルギーに対する認識が高まり、投資が促進される一方で、経済の不確実性やサプライチェーンの課題は依然として残っています。さらに、技術の統合、強靭なサプライチェーン、政府の取り組みが重視されるようになり、市場は適応しつつあります。全体として、課題が残る中、市場の成長と革新への機会が現代に生まれつつあります。

当レポートでは、世界のバイオマスガス化市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢と見通しなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 世界のバイオマスガス化市場に対するCOVID-19の影響

第4章 エグゼクティブサマリー

第5章 顧客の声

- 製品と市場のインテリジェンス

- 購入決定において考慮される要素

第6章 世界のバイオマスガス化市場の見通し(2017年~2031年)

- 市場規模と予測

- 金額

- 原料別

- 農業廃棄物

- 森林廃棄物

- 都市廃棄物

- 動物廃棄物

- その他

- ガス化技術別

- 固定床

- 流動床

- その他

- 用途別

- 発電

- 化学品

- 輸送用燃料

- エタノール

- 水素生成

- その他

- 地域別

- 北米

- アジア太平洋

- 欧州

- 南米

- 中東・アフリカ

- 市場シェア:企業別(2023年)

第7章 世界のバイオマスガス化市場の見通し:地域別(2017年~2031年)

- 北米

- 市場規模と予測

- 原料別

- ガス化技術別

- 用途別

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- 南米

- ブラジル

- アルゼンチン

- アジア太平洋

- インド

- 中国

- 日本

- オーストラリア

- 韓国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第8章 市場マッピング(2023年)

- 原料別

- ガス化技術別

- 用途別

- 地域別

第9章 マクロ環境と産業構造

- 需給分析

- 輸出入の分析

- バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第10章 市場力学

- 成長促進要因

- 成長抑制要因(課題、抑制要因)

第11章 主要企業情勢

- マーケットリーダー上位5社の競合マトリクス

- マーケットリーダー上位5社の市場収益分析(2023年)

- 合併と買収/合弁事業(該当する場合)

- SWOT分析(市場参入企業5社)

- 特許分析(該当する場合)

第12章 価格分析

第13章 ケーススタディ

第14章 主要企業の見通し

- Mitsubishi Heavy Industries (MHI) Group

- GP Green Energy Systems Pvt. Ltd

- EQTEC PLC

- Valmet Corporation

- Enersol Biopower Pvt. Ltd

- Nexterra Systems Corp.

- Ankur Scientific Energy Technologies Pvt Ltd

- PRM Energy Systems Inc.

- All Power Labs

- DP Clean Tech

第15章 戦略的推奨事項

第16章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 2. Global Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 3. Global Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 4. Global Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 5. Global Biomass Gasification Market Share (%), By Region, 2017-2031F

- Figure 6. North America Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 7. North America Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 8. North America Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 9. North America Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 10. North America Biomass Gasification Market Share (%), By Country, 2017-2031F

- Figure 11. United States Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

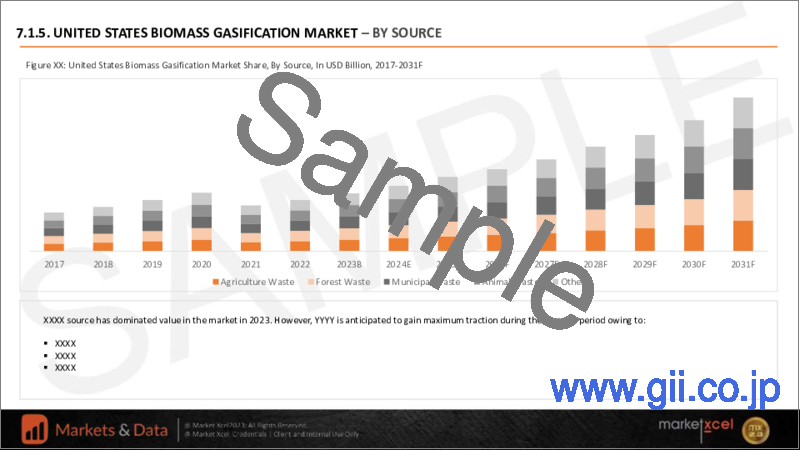

- Figure 12. United States Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 13. United States Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 14. United States Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 15. Canada Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 16. Canada Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 17. Canada Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 18. Canada Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 19. Mexico Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 20. Mexico Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 21. Mexico Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 22. Mexico Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 23. Europe Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 24. Europe Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 25. Europe Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 26. Europe Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 27. Europe Biomass Gasification Market Share (%), By Country, 2017-2031F

- Figure 28. Germany Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 29. Germany Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 30. Germany Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 31. Germany Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 32. France Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 33. France Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 34. France Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 35. France Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 36. Italy Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 37. Italy Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 38. Italy Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 39. Italy Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 40. United Kingdom Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 41. United Kingdom Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 42. United Kingdom Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 43. United Kingdom Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 44. Russia Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 45. Russia Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 46. Russia Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 47. Russia Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 48. Netherlands Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 49. Netherlands Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 50. Netherlands Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 51. Netherlands Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 52. Spain Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 53. Spain Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 54. Spain Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 55. Spain Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 56. Turkey Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 57. Turkey Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 58. Turkey Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 59. Turkey Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 60. Poland Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 61. Poland Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 62. Poland Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 63. Poland Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 64. South America Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 65. South America Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 66. South America Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 67. South America Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 68. South America Biomass Gasification Market Share (%), By Country, 2017-2031F

- Figure 69. Brazil Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 70. Brazil Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 71. Brazil Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 72. Brazil Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 73. Argentina Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 74. Argentina Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 75. Argentina Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 76. Argentina Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 77. Asia-Pacific Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 78. Asia-Pacific Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 79. Asia-Pacific Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 80. Asia-Pacific Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 81. Asia-Pacific Biomass Gasification Market Share (%), By End-use Industry, 2017-2031F

- Figure 82. Asia-Pacific Biomass Gasification Market Share (%), By Country, 2017-2031F

- Figure 83. India Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 84. India Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 85. India Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 86. India Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 87. China Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 88. China Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 89. China Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 90. China Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 91. Japan Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 92. Japan Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 93. Japan Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 94. Japan Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 95. Australia Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 96. Australia Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 97. Australia Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 98. Australia Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 99. Vietnam Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 100. Vietnam Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 101. Vietnam Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 102. Vietnam Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 103. South Korea Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 104. South Korea Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 105. South Korea Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 106. South Korea Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 107. Indonesia Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 108. Indonesia Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 109. Indonesia Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 110. Indonesia Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 111. Philippines Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 112. Philippines Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 113. Philippines Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 114. Philippines Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 115. Middle East & Africa Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 116. Middle East & Africa Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 117. Middle East & Africa Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 118. Middle East & Africa Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 119. Middle East & Africa Biomass Gasification Market Share (%), By Country, 2017-2031F

- Figure 120. Saudi Arabia Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 121. Saudi Arabia Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 122. Saudi Arabia Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 123. Saudi Arabia Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 124. UAE Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 125. UAE Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 126. UAE Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 127. UAE Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 128. South Africa Biomass Gasification Market, By Value, In USD Billion, 2017-2031F

- Figure 129. South Africa Biomass Gasification Market Share (%), By Source, 2017-2031F

- Figure 130. South Africa Biomass Gasification Market Share (%), By Gasifier Technology, 2017-2031F

- Figure 131. South Africa Biomass Gasification Market Share (%), By Application, 2017-2031F

- Figure 132. By Source Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 133. By Gasifier Technology Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 134. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 135. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Biomass gasification market size was valued at USD 52.6 billion in 2023, which is expected to reach USD 94.51 billion in 2031, with a CAGR of 7.6% for the forecasted period between 2024 and 2031.

The biomass gasification market is experiencing significant growth due to several factors. Biomass gasification offers various benefits, including reduced greenhouse gas (GHG) emissions, waste management, and the potential for decentralized energy production. The increasing demand for renewable energy, environmental concerns, and supportive regulatory frameworks primarily drive the market. Additionally, government support for renewable energy, the need for energy security and rural development, and the growing need for clean energy solutions to achieve the net zero target are contributing to the market's expansion. Moreover, the market is witnessing increased investments from both public and private sectors, further fueling its growth.

Biomass gasification is gaining momentum as a promising solution for achieving net-zero carbon emissions. For example, in August 2023, the government of the United Kingdom framed a strategy named as Biomass Strategy 2023. The Biomass Strategy 2023 outlines the role of sustainable biomass in achieving net-zero, the government's efforts to enable that objective, and areas where further action is required. Moreover, the strategy aims to strengthen biomass sustainability and promote the use of sustainable biomass across multiple sectors of the economy to achieve the UK's net-zero target.

Utilization of Agriculture Waste

The market is extensively amplified by the continuously increasing utilization of agricultural waste, including crop residues and organic matter, to produce valuable energy resources. It aligns with the principles of a circular economy, minimizing environmental impact. The market is segmented by source, gasifier technology, and application, with agricultural waste being a significant driver of market expansion.

In February 2023, Southeast Asia Development Solutions (SEADS) adopted the green technology as driving force for agriculture in Vietnam. The organization stated that in Vietnam, agricultural residues are currently being discarded and burned, thereby leading to environmental pollution and resource wastage. It has created an urgent need for agri-micro and small enterprises to transition to a more sustainable and cost-effective energy source. The adoption of proper biomass-based energy technology, such as volumetric continuous biomass gasification (VCBG), can help convert agricultural residues into fuel for heating and processing, and addressing the need for cleaner energy.

Fluidized Bed Technology is Accelerating the Market Growth

The Fluidized Bed Technology is regarded as one of the key drivers of the market. Fluidized-bed gasifiers have several advantages over fixed-bed gasifiers, including uniform temperature distribution, high carbon conversion, low tar production, and a wide range of biomass types, sizes, and feed rates. They offer fuel flexibility, moderate oxidant and steam requirements, and excellent gas-solid contact.

For instance, in May 2022, Sumitomo SHI FW (SFW) was chosen as the preferred gasifier supplier for Protos Biofuels Ltd's first municipal waste advanced biofuels project, which entered the front-end engineering design (FEED) phase. The project, developed by Advanced Biofuel Solutions Ltd (ABSL) and Greenergy, would divert 150,000 tonnes of household waste annually and avoid 160,000 tonnes of carbon dioxide emissions each year by using waste as a feedstock. The plant would replace fossil fuel with waste-based fuel alternatives and capture carbon dioxide. The project is expected to be completed by 2025.

Increasing Utilization of Biomass in Power Generation

The increasing utilization of biomass in power generation is creating numerous opportunities in the biomass gasification market. With the global focus on sustainable and eco-friendly energy solutions, biomass gasification offers a carbon-neutral or carbon-negative alternative to conventional fossil fuels. Moreover, the market is expected to expand rapidly, propelled by technological developments, and increased investment in bioenergy projects.

For instance, in August 2022, the Government of India announced that Haryana is the only state in the country to have installed a biomass gasifier plants with a capacity of 6,463 kWeq (kilowatt equivalent) for power generation from stubble and biomass. To develop a biomass supply chain infrastructure and encourage investors to participate in this sector, the ministry issued a long-term contract with a minimum tenure of 7 years for biomass supply in March 2022.

Europe's Emergence as a Market Leader

Europe has emerged as the most dominant region in the biomass gasification market due to several factors. The region's dominance is attributed to the presence of major industry players and its active pursuit of energy shift towards renewable sources for primary energy production. Additionally, the market is characterized by a diverse range of biomass feedstocks, including agricultural residues, forestry waste, and dedicated energy crops, which has further contributed to Europe's leadership in the market.

For instance, in May 2022, Cortus Energy AB (Cortus), a Swedish developer of biomass gasification technology, announced that it has secured two orders for biomass gasifiers, one from the German businesses blueFLUX Energy AG and the other from Holzner Druckbehalter GmbH along with burners and gas coolers/boilers. Moreover, Cortus stated that the total value of these two projects might be worth up to USD 7.74 million depending on the ultimate scope of delivery.

Government Initiatives

Government initiatives are crucial in fostering growth of the global biomass gasification market. As the market seek sustainable energy solutions, the supportive policies and incentives are driving R&D and adoption of biomass gasification technologies. Moreover, governments are playing a pivotal role in creating a favorable environment for investors, thereby promoting innovation, and ensuring regulatory frameworks that encourage the utilization of biomass gasification.

For instance, in November 2022, the Ministry of New and Renewable Energy (MNRE), i.e., the Government of India, launched the National Bioenergy Programme, which will run from FY 2021-22 to 2025-26 in two phases. Phase-I of the program has a budget outlay of USD 102.88 million and comprises three sub-schemes out of which the "Biomass Programme" aims to support the manufacturing of briquettes and pellets, and the promotion of biomass-based cogeneration in industries within the country.

Impact of COVID-19

The COVID-19 pandemic significantly impacted the global biomass gasification market causing distinct shifts in both pre-COVID and present scenarios. Pre-COVID, the market witnessed steady growth due to increasing environmental concerns and a focus on sustainable energy sources. However, the pandemic induced disruptions in the supply chain, delaying projects and effective market dynamics. The post-COVID or the present situation reflects a mixed landscape. It includes a rising awareness of renewable energy and driving investments, on the contrary, economic uncertainties and supply chain challenges persisting. Moreover, the market is adapting with increased emphasis on technology integration, resilient supply chains, and government initiatives. Overall, amid challenges, opportunities for growth and innovation for the market are emerging in the present era.

Key Players Landscape and Outlook

Major firms are focused on the development of biomass power plants, resulting in rapid advancements in the biomass gasification sector. Furthermore, these organizations are engaging in numerous collaborations to produce highly sophisticated technologies to increase their respective revenues.

In January 2023, DP Clean Tech, received a big contract to provide the boiler islands for the West Africa's largest biomass complex. The 46MW biomass plant situated in southeast Cote d'Ivoire is DP's third significant project on the continent, as well as a high-profile project for the area. Moreover, Biovea Energie S.A., a joint venture between Electricite De France (EDF), Biokala (a subsidiary of the agro-industrial company SIFCA), and French corporation Meridiam, is funding the project and China Energy Engineering Corp. (CEEC) is in charge of delivering it. The project is expected to run on roughly 480,000 tpa of locally supplied palm wastes.

In October 2023, Valmet, one of the Finnish market leaders in biomass gasification announced the supplying of biomass power plant to Goteborg Energi located in Sweden. Valmet's supply will contain a 140 MWth Valmet BFB Boiler plant using bubbling fluidized bed technology, as well as a flue gas cleaning and condensing system. Moreover, forest leftovers and recovered wood chips will be used as major fuels.

Table of Contents

1. Research Methodology

2. Project Scope & Definitions

3. Impact of COVID-19 on Global Biomass Gasification Market

4. Executive Summary

5. Voice of Customer

- 5.1. Product and Market Intelligence

- 5.2. Factors Considered in Purchase Decisions

- 5.2.1. Overall Expenses

- 5.2.2. Facility Requirement

- 5.2.3. Type of gasifier

- 5.2.4. Feedstock

- 5.2.5. Equivalence ratio

- 5.2.6. Syngas impurities

- 5.2.7. Efficiency

- 5.2.8. After-Sales Support

6. Global Biomass Gasification Market Outlook, 2017-2031F

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. By Source

- 6.2.1. Agriculture Waste

- 6.2.2. Forest Waste

- 6.2.3. Municipal Waste

- 6.2.4. Animal Waste

- 6.2.5. Others

- 6.3. By Gasifier Technology

- 6.3.1. Fixed Bed

- 6.3.2. Fluidized Bed

- 6.3.3. Others

- 6.4. By Application

- 6.4.1. Power Generation

- 6.4.2. Chemicals

- 6.4.3. Transportation Fuels

- 6.4.4. Ethanol

- 6.4.5. Hydrogen Generation

- 6.4.6. Others

- 6.5. By Region

- 6.5.1. North America

- 6.5.2. Asia-Pacific

- 6.5.3. Europe

- 6.5.4. South America

- 6.5.5. Middle East and Africa

- 6.6. By Company Market Share (%), 2023

7. Global Biomass Gasification Market Outlook, By Region, 2017-2031F

- 7.1. North America*

- 7.1.1. Market Size & Forecast

- 7.1.1.1. By Value

- 7.1.2. By Source

- 7.1.2.1. Agriculture Waste

- 7.1.2.2. Forest Waste

- 7.1.2.3. Municipal Waste

- 7.1.2.4. Animal Waste

- 7.1.2.5. Others

- 7.1.3. By Gasifier Technology

- 7.1.3.1. Fixed Bed

- 7.1.3.2. Fluidized Bed

- 7.1.3.3. Others

- 7.1.4. By Application

- 7.1.4.1. Power Generation

- 7.1.4.2. Chemicals

- 7.1.4.3. Transportation Fuels

- 7.1.4.4. Ethanol

- 7.1.4.5. Hydrogen Generation

- 7.1.4.6. Others

- 7.1.5. United States*

- 7.1.5.1. Market Size & Forecast

- 7.1.5.1.1. By Value

- 7.1.5.2. By Source

- 7.1.5.2.1. Agriculture Waste

- 7.1.5.2.2. Forest Waste

- 7.1.5.2.3. Municipal Waste

- 7.1.5.2.4. Animal Waste

- 7.1.5.2.5. Others

- 7.1.5.3. By Gasifier Technology

- 7.1.5.3.1. Fixed Bed

- 7.1.5.3.2. Fluidized Bed

- 7.1.5.3.3. Others

- 7.1.5.4. By Application

- 7.1.5.4.1. Power Generation

- 7.1.5.4.2. Chemicals

- 7.1.5.4.3. Transportation Fuels

- 7.1.5.4.4. Ethanol

- 7.1.5.4.5. Hydrogen Generation

- 7.1.5.4.6. Others

- 7.1.6. Canada

- 7.1.7. Mexico

- 7.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered:

- 7.2. Europe

- 7.2.1. Germany

- 7.2.2. France

- 7.2.3. Italy

- 7.2.4. United Kingdom

- 7.2.5. Russia

- 7.2.6. Netherlands

- 7.2.7. Spain

- 7.3. South America

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.4. Asia-Pacific

- 7.4.1. India

- 7.4.2. China

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.5. Middle East & Africa

- 7.5.1. Saudi Arabia

- 7.5.2. UAE

- 7.5.3. South Africa

8. Market Mapping, 2023

- 8.1. By Source

- 8.2. By Gasifier Technology

- 8.3. By Application

- 8.4. By Region

9. Macro Environment and Industry Structure

- 9.1. Supply Demand Analysis

- 9.2. Import Export Analysis

- 9.3. Value Chain Analysis

- 9.4. PESTEL Analysis

- 9.4.1. Political Factors

- 9.4.2. Economic System

- 9.4.3. Social Implications

- 9.4.4. Technological Advancements

- 9.4.5. Environmental Impacts

- 9.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 9.5. Porter's Five Forces Analysis

- 9.5.1. Supplier Power

- 9.5.2. Buyer Power

- 9.5.3. Substitution Threat

- 9.5.4. Threat from New Entrant

- 9.5.5. Competitive Rivalry

10. Market Dynamics

- 10.1. Growth Drivers

- 10.2. Growth Inhibitors (Challenges and Restraints)

11. Key Players Landscape

- 11.1. Competition Matrix of Top Five Market Leaders

- 11.2. Market Revenue Analysis of Top Five Market Leaders (in %, 2023)

- 11.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 11.4. SWOT Analysis (For Five Market Players)

- 11.5. Patent Analysis (If Applicable)

12. Pricing Analysis

13. Case Studies

14. Key Players Outlook

- 14.1. Mitsubishi Heavy Industries (MHI) Group

- 14.1.1. Company Details

- 14.1.2. Key Management Personnel

- 14.1.3. Products & Services

- 14.1.4. Financials (As reported)

- 14.1.5. Key Market Focus & Geographical Presence

- 14.1.6. Recent Developments

- 14.2. GP Green Energy Systems Pvt. Ltd

- 14.3. EQTEC PLC

- 14.4. Valmet Corporation

- 14.5. Enersol Biopower Pvt. Ltd

- 14.6. Nexterra Systems Corp.

- 14.7. Ankur Scientific Energy Technologies Pvt Ltd

- 14.8. PRM Energy Systems Inc.

- 14.9. All Power Labs

- 14.10. DP Clean Tech

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.