|

|

市場調査レポート

商品コード

1336061

成形コンパウンド市場:成形タイプ別、コンパウンドタイプ別、エンドユーザー別、地域別、機会、予測、2016年~2030年Molding Compound Market Assessment by Molding Type By Compound Type, By End-user By Region, Opportunities, and Forecast, 2016-2030F |

||||||

カスタマイズ可能

|

|||||||

| 成形コンパウンド市場:成形タイプ別、コンパウンドタイプ別、エンドユーザー別、地域別、機会、予測、2016年~2030年 |

|

出版日: 2023年08月22日

発行: Markets & Data

ページ情報: 英文 121 Pages

納期: 3~5営業日

|

- 全表示

- 概要

- 図表

- 目次

成形コンパウンドの市場規模は、2022年に121億米ドルとなりました。同市場は、2023年から2030年の予測期間に6.2%のCAGRで拡大し、2030年には195億8,000万米ドルに達すると予測されています。成形コンパウンドは、フィルム、シート、パイプ、ロッド、チューブ、プロファイルの製造に広く使用され、数多くの用途に使用されています。フィルムやラップの製造に成形コンパウンドが広く使用されているため、人口の増加と相まって、さまざまな自動車用品、半導体分野、運輸産業の需要が増加しています。フェノールやエポキシのような有機フィラーの需要増加に伴い、最終用途産業における成形コンパウンドは、予測期間中に大きな牽引力を獲得すると予想されます。

今後10年間で、成形コンパウンドの需要は、自動車や航空宇宙分野を含む様々な最終用途産業で高まると思われます。加えて、耐熱性と難燃性の適用範囲の拡大は、今後数年間の世界市場の収益成長を押し上げると予想される重要な要素です。耐熱性、難燃性、高い絶縁耐力、耐腐食性など、成形コンパウンドの優れた物理的特性は、予測期間中、市場の需要に拍車をかけると予想されます。

SMC/BMCを使用して、さまざまな電気・電子・家電製品が製造されています。これらの製品には、ヒューズ、開閉装置、テレビ、冷蔵庫、コーヒーメーカー、トースター、アイロン、エアコンなどが含まれます。予測期間中、都市化の進展と人口の大幅な増加が市場の需要を促進すると思われます。さらに、中国政府は国内のエレクトロニクス産業に投資しており、予測期間を通じて同部門からのSMC/BMC需要が増加すると予想されます。

中国は世界最大の製造拠点であり、スマートフォン、コンピュータ、クラウドサーバ、通信インフラなど、世界のエレクトロニクスの36%を生産しています。さらに中国は、半導体を組み込んだ電子機器の最終消費市場として、米国に次いで2番目に大きいです。このように、これらの要因から、今後数年間は成形コンパウンド市場に大きな需要が見込まれます。

この分野は、原材料の輸送、労働力不足、サプライチェーンの問題など、いくつかの問題に対処しなければならなかっています。さらに、サプライチェーンの混乱や操業上の制約のために、いくつかの国の生産拠点が閉鎖されました。例えば、中国は世界で3番目に交通量の多い寧波・舟山港のターミナル業務を一時停止しました。サプライチェーンの中断は、ポリエステル樹脂、ガラス繊維強化材、フィラーなどの原材料の輸出入に大きな影響を与えます。COVID-19期間中、いくつかのシート成形用コンパウンドメーカーは流動性、信用回復、金利の問題に見舞われました。さらに、特に発展途上国における流動性の問題と十分な資金の不足は、COVID後の業界の存続を脅かし、いくつかの組織は破産に追い込まれました。しかし、需要と経済成長が急速に加速しているため、シート成形用コンパウンドの需要は増加しています。

当レポートでは、世界の成形コンパウンド市場について調査し、市場の概要とともに、成形タイプ別、コンパウンドタイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 COVID-19が世界の成形コンパウンド市場に与える影響

第4章 ロシア・ウクライナ戦争の影響

第5章 エグゼクティブサマリー

第6章 お客様の声

第7章 世界の成形コンパウンド市場の見通し、2016年~2030年

- 市場規模と予測

- 成形タイプ別

- コンパウンドタイプ別

- エンドユーザー別

- 地域別

- 企業別市場シェア(%)、2022年

第8章 世界の成形コンパウンド市場の見通し、地域別、2016年~2030年

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

第9章 供給サイド分析

第10章 市場マッピング、2022年

- 成形タイプ別

- コンパウンドタイプ別

- エンドユーザー別

- 地域別

第11章 マクロ環境と産業構造

- 需給分析

- 輸出入分析- 量と金額

- サプライ/バリューチェーン分析

- PESTEL分析

- ポーターのファイブフォース分析

第12章 市場力学

第13章 主要企業の情勢

第14章 価格分析

第15章 ケーススタディ

第16章 主要企業の見通し

- Toray Advanced Composites

- Huntsman International LLC

- Showa Denko Materials Co. Ltd

- KYOCERA Corporation

- BASF SE

- Eastman Chemical Company

- Hexion

- Hitachi, Ltd.

- Sumitomo Bakelite Co., Ltd.

- Henkel AG & Co. KGaA

第17章 戦略的推奨事項

第18章 お問合せと免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 2. Global Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 3. Global Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 4. Global Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 5. Global Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 6. Global Molding Compound Market Share, By Region, in USD Billion, 2016-2030F

- Figure 7. North America Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 8. North America Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 9. North America Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 10. North America Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 11. North America Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 12. North America Molding Compound Market Share, By Country, in USD Billion, 2016-2030F

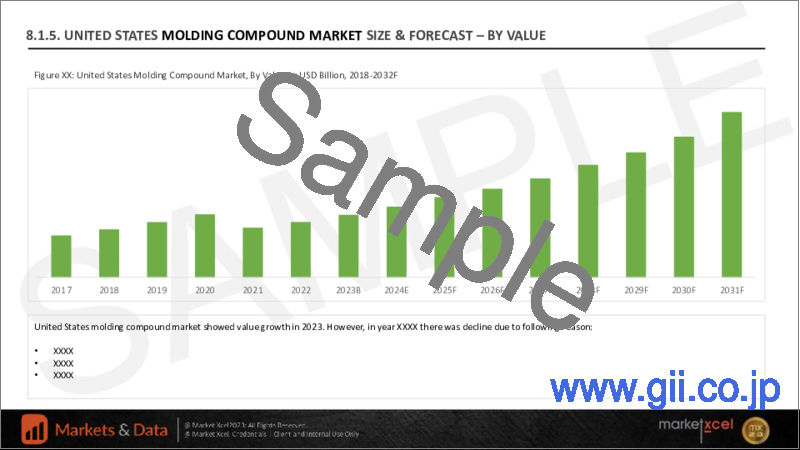

- Figure 13. United States Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 14. United States Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 15. United States Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 16. United States Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 17. United States Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 18. Canada Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 19. Canada Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 20. Canada Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 21. Canada Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 22. Canada Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 23. Mexico Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 24. Mexico Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 25. Mexico Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 26. Mexico Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 27. Mexico Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 28. Europe Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 29. Europe Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 30. Europe Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 31. Europe Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 32. Europe Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 33. Europe Molding Compound Market Share, By Country, in USD Billion, 2016-2030F

- Figure 34. Germany Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 35. Germany Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 36. Germany Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 37. Germany Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 38. Germany Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 39. France Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 40. France Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 41. France Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 42. France Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 43. France Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 44. Italy Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 45. Italy Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 46. Italy Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 47. Italy Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 48. Italy Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 49. United Kingdom Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 50. United Kingdom Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 51. United Kingdom Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 52. United Kingdom Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 53. United Kingdom Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 54. Russia Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 55. Russia Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 56. Russia Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 57. Russia Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 58. Russia Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 59. Netherlands Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 60. Netherlands Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 61. Netherlands Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 62. Netherlands Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 63. Netherlands Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 64. Market, By Value, in USD Billion, 2016-2030F

- Figure 65. Spain Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 66. Spain Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 67. Spain Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 68. Spain Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 69. Turkey Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 70. Turkey Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 71. Turkey Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 72. Turkey Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 73. Turkey Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 74. Poland Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 75. Poland Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 76. Poland Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 77. Poland Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 78. Poland Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 79. South America Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 80. South America Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 81. South America Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 82. South America Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 83. South America Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 84. South America Molding Compound Market Share, By Country, in USD Billion, 2016-2030F

- Figure 85. Brazil Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 86. Brazil Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 87. Brazil Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 88. Brazil Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 89. Brazil Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 90. Argentina Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 91. Argentina Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 92. Argentina Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 93. Argentina Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 94. Argentina Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 95. Asia-Pacific Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 96. Asia-Pacific Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 97. Asia-Pacific Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 98. Asia-Pacific Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 99. Asia-Pacific Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 100. Asia-Pacific Molding Compound Market Share, By Country, in USD Billion, 2016-2030F

- Figure 101. India Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 102. India Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 103. India Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 104. India Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 105. India Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 106. China Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 107. China Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 108. China Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 109. China Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 110. China Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 111. Japan Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 112. Japan Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 113. Japan Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 114. Japan Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 115. Japan Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 116. Australia Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 117. Australia Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 118. Australia Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 119. Australia Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 120. Australia Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 121. Vietnam Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 122. Vietnam Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 123. Vietnam Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 124. Vietnam Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 125. Vietnam Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 126. South Korea Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 127. South Korea Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 128. South Korea Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 129. South Korea Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 130. South Korea Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 131. Indonesia Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 132. Indonesia Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 133. Indonesia Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 134. Indonesia Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 135. Indonesia Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 136. Philippines Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 137. Philippines Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 138. Philippines Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 139. Philippines Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 140. Philippines Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 141. Middle East & Africa Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 142. Middle East & Africa Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 143. Middle East & Africa Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 144. Middle East & Africa Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 145. Middle East & Africa Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 146. Middle East & Africa Molding Compound Market Share, By Country, in USD Billion, 2016-2030F

- Figure 147. Saudi Arabia Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 148. Saudi Arabia Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 149. Saudi Arabia Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 150. Saudi Arabia Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 151. Saudi Arabia Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 152. UAE Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 153. UAE Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 154. UAE Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 155. UAE Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 156. UAE Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 157. South Africa Molding Compound Market, By Value, in USD Billion, 2016-2030F

- Figure 158. South Africa Molding Compound Market, By Volume, in Unit Thousand, 2016-2030F

- Figure 159. South Africa Molding Compound Market Share, By Molding Type, in USD Billion, 2016-2030F

- Figure 160. South Africa Molding Compound Market Share, By Compound Type, in USD Billion, 2016-2030F

- Figure 161. South Africa Molding Compound Market Share, By End-user, in USD Billion, 2016-2030F

- Figure 162. By Molding Type Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 163. By Compound Type Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 164. By End-user Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 165. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2022

Molding Compound Market size was valued at USD 12.1 billion in 2022, expected to reach USD 19.58 billion in 2030 with a CAGR of 6.2% for the forecast period between 2023 and 2030. Molding compounds are extensively used in producing films, sheets, pipes, rods, tubes, and profiles for numerous applications. Owing to the widespread use of molding compounds in the production of films and wraps, coupled with the increase in population, has increased the demand for a variety of automotive goods, semiconductor sectors, and the transportation industry. With the rise in demand for organic fillers such as phenolic and epoxy, molding compounds in the end-use industries are expected to gain significant traction during the forecast period.

Over the next ten years, the demand for molding compounds will rise across various end-use industries, including the automotive and aerospace sectors. In addition, expanding the application scope for heat and flame resistance is a crucial element anticipated to boost the global market revenue growth over the coming years. The superior physical properties of molding compounds, such as heat resistance, flame resistance, high dielectric strength, and corrosion resistance, are anticipated to spur the demand for the market over the forecast period.

Demand from the Electrical & Electronics Industry

Various electrical, electronic, and home appliance goods are produced using SMC/BMC. These goods include fuses, switchgear, televisions, refrigerators, coffee makers, toasters, irons, and air conditioners. Over the projection period, increasing urbanization and strong population growth will likely fuel market demand. Additionally, the Chinese government has invested in the nation's electronics industry, which is anticipated to increase the demand for SMC/BMC from the sector throughout the projection period.

China is the world's largest manufacturing hub, producing 36% of the world's electronics, including smartphones, computers, cloud servers, and telecom infrastructure. In addition, China is the second-largest final consumption market, after the United States, for electronic devices embedded with semiconductors. Thus, these factors are expected to project a significant demand for the molding compound market in the coming years.

Sheet Molding Compound (SMC): Wide Usage in the Automotive and Transportation Sectors

Sheet molding compounds are used by Original Equipment Manufacturers (OEM) of automobiles to cut weight and fuel consumption. Compared to aluminum sheets, sheet molding materials are lightweight and robustly resistant. Automobile manufacturers utilize SMC compounds to protect against dents, impact dings, and corrosion compared to conventional steel decks. The number of motor cars manufactured globally in 2021 was USD 79.1 million, up 1.3% from 2020, according to the European Automobile Manufacturers' Association (ACEA). Compounds for sheet molding are being purchased to make battery casings for electric vehicles (EV). These elements have a substantial impact on the market for sheet molding compound growth. In addition, several top automakers emphasize using eco-friendly materials and bio-based sheet composition to create prototype cars.

Increasing Use in Construction Industry

During the projected period, the market is expected to rise due to rising demand in the construction sector. A wide range of activities are included in the construction sector, including building and infrastructure construction, product manufacturing and supply, as well as repair, maintenance, and disposal. Plastics, paints, varnishes, floors, primers and sealants, adhesives, and other building materials and components are all made with specialty resin. Owing to their exceptional resistance towards blistering, stains, cracks, chemicals, and harsh temperatures these specialty resins are often used across the commercial and residential buildings, marine industry, automotive, and wastewater treatment facilities among other places. They provide outstanding adhesion, high anti-corrosion, and low volatile organic compound performance.

Impact of COVID-19

The sector has had to deal with several issues, including the transportation of raw materials, a labor shortage, and supply chain issues. Additionally, production locations throughout several nations have closed due to supply chain disruptions and operational constraints. For instance, China briefly suspended terminal operations at the third busiest port in the world, Ningbo-Zhoushan. Supply chain interruptions significantly influence the import and export of raw materials such as polyester resin, glass fiber reinforcement, and filler. During COVID-19, several sheet molding compound producers experienced problems with liquidity, credit recovery, and interest rates. Additionally, liquidity problems and a lack of adequate finance, particularly in developing nations, threatened the industry's viability after post-covid, and several organizations were forced into bankruptcy. The demand for sheet molding compounds is increasing, though, as demand and economic growth are accelerating swiftly.

Impact of Russia-Ukraine War

Impacts on semiconductor output in the short term are anticipated to be moderate. However, chipmakers and consumers will be impacted by the war's implications on raw material pricing, supply-chain restrictions, and general uncertainty. The war constantly impacted the semiconductor business, which is expected to impact the expanding chip utilization sector. The chip demand and supply moved at vastly divergent rates due to root problems that are challenging to solve. Demand changes quickly and frequently, whether it is in terms of volume or chip designs.

However, as it takes time to adapt in the manufacturing lines or increase capacity, efforts to adjust supply almost invariably lag changes in demand. For instance, the number of chips used in cars scaled by 40% on average between 2019 and 2021, and this trend is expected to continue with the growth of electric vehicles. Thus, the war between Russia and Ukraine majorly impacted the electronics and automotive industry and its application of molding compounds.

Key Players Landscape and Outlook

The molding compound market is highly competitive, with a few major players dominating the market. These players are Toray Advanced Composites, Huntsman International LLC, Showa Denko Materials Co. Ltd, KYOCERA Corporation, and BASF SE. These companies have a strong brand presence, a vast distribution network, and a focus on innovation. They are constantly investing in research and development to develop new technologies and products that meet the needs of their customers. The global molding compound market is expected to grow, driven by the increasing demand for passenger cars, light commercial vehicles, and heavy-duty vehicles.

For instance, in August 2022, Ford Motors and John Deer collaborated to develop the gator UTV concept-the bio-based sheet molding compound used to make sustainable roofing components. Over the projection period, several product improvements are anticipated to fuel the market expansion.

Table of Contents

1. Research Methodology

2. Project Scope & Definitions

3. Impact of COVID-19 on the Global Molding Compound Market

4. Impact of Russia-Ukraine War

5. Executive Summary

6. Voice of Customer

- 6.1. Market Awareness and Product Information

- 6.2. Brand Awareness and Loyalty

- 6.3. Factors Considered in Purchase Decision

- 6.3.1. Brand Name

- 6.3.2. Quality

- 6.3.3. Quantity

- 6.3.4. Price

- 6.3.5. Product Specification

- 6.3.6. Application Specification

- 6.3.7. Shelf-Life

- 6.3.8. Availability of Product

- 6.4. Frequency of Purchase

- 6.5. Medium of Purchase

7. Global Molding Compound Market Outlook, 2016-2030F

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.1.2. By Volume

- 7.2. By Molding Type

- 7.2.1. Sheet molding compound (SMC)

- 7.2.2. Bulk molding compound (BMC)

- 7.2.3. Thick molding compound (TMC)

- 7.3. By Compound Type

- 7.3.1. Thermoset Plastic Molding Compounds

- 7.3.1.1. Phenolic

- 7.3.1.2. Epoxy

- 7.3.1.3. Silicone

- 7.3.1.4. Unsaturated Polyester

- 7.3.1.5. Diallyl Phthalate

- 7.3.1.6. Others

- 7.3.2. Long Fiber Reinforced Composites

- 7.3.3. Thermoplastic Molding Compounds

- 7.3.3.1. Polyphenylene Sulfide (PPS)

- 7.3.3.2. Polycarbonate (PC)

- 7.3.3.3. Polyamide (PA)

- 7.3.1. Thermoset Plastic Molding Compounds

- 7.4. By End-user

- 7.4.1. Aerospace

- 7.4.1.1. Passenger

- 7.4.1.2. Commercial

- 7.4.1.3. Defense

- 7.4.2. Automotive

- 7.4.2.1. Passenger Cars

- 7.4.2.2. Light Commercial Vehicles (LCVs)

- 7.4.2.3. Heavy Commercial Vehicles (HCVs)

- 7.4.3. Semiconductors/Electronics Industry

- 7.4.4. Oil, Gas, & Energy Industry

- 7.4.5. Others

- 7.4.1. Aerospace

- 7.5. By Region

- 7.5.1. North America

- 7.5.2. Europe

- 7.5.3. South America

- 7.5.4. Asia-Pacific

- 7.5.5. Middle East and Africa

- 7.6. By Company Market Share (%), 2022

8. Global Molding Compound Market Outlook, By Region, 2016-2030F

- 8.1. North America*

- 8.1.1. By Molding Type

- 8.1.1.1. Sheet molding compound (SMC)

- 8.1.1.2. Bulk molding compound (BMC)

- 8.1.1.3. Thick molding compound (TMC)

- 8.1.2. By Compound Type

- 8.1.2.1. Thermoset Plastic Molding Compounds

- 8.1.2.1.1. Phenolic

- 8.1.2.1.2. Epoxy

- 8.1.2.1.3. Silicone

- 8.1.2.1.4. Unsaturated Polyester

- 8.1.2.1.5. Diallyl Phthalate

- 8.1.2.1.6. Others

- 8.1.2.2. Long Fiber Reinforced Composites

- 8.1.2.3. Thermoplastic Molding Compounds

- 8.1.2.3.1. Polyphenylene Sulfide (PPS)

- 8.1.2.3.2. Polycarbonate (PC)

- 8.1.2.3.3. Polyamide (PA)

- 8.1.3. By End-user

- 8.1.3.1. Aerospace

- 8.1.3.1.1. Passenger

- 8.1.3.1.2. Commercial

- 8.1.3.1.3. Defense

- 8.1.3.2. Automotive

- 8.1.3.2.1. Passenger Cars

- 8.1.3.2.2. Light Commercial Vehicles (LCVs)

- 8.1.3.2.3. Heavy Commercial Vehicles (HCVs)

- 8.1.3.3. Semiconductors/Electronics Industry

- 8.1.3.4. Oil, Gas, & Energy Industry

- 8.1.3.5. Others

- 8.1.4. United States*

- 8.1.4.1. By Molding Type

- 8.1.4.1.1. Sheet molding compound (SMC)

- 8.1.4.1.2. Bulk molding compound (BMC)

- 8.1.4.1.3. Thick molding compound (TMC)

- 8.1.4.2. By Compound Type

- 8.1.4.2.1. Thermoset Plastic Molding Compounds

- 8.1.4.2.1.1. Phenolic

- 8.1.4.2.1.2. Epoxy

- 8.1.4.2.1.3. Silicone

- 8.1.4.2.1.4. Unsaturated Polyester

- 8.1.4.2.1.5. Diallyl Phthalate

- 8.1.4.2.1.6. Others

- 8.1.4.2.2. Long Fiber Reinforced Composites

- 8.1.4.2.3. Thermoplastic Molding Compounds

- 8.1.4.2.3.1. Polyphenylene Sulfide (PPS)

- 8.1.4.2.3.2. Polycarbonate (PC)

- 8.1.4.2.3.3. Polyamide (PA)

- 8.1.4.3. By End-user

- 8.1.4.3.1. Aerospace

- 8.1.4.3.1.1. Passenger

- 8.1.4.3.1.2. Commercial

- 8.1.4.3.1.3. Defense

- 8.1.4.3.2. Automotive

- 8.1.4.3.2.1. Passenger Cars

- 8.1.4.3.2.2. Light Commercial Vehicles (LCVs)

- 8.1.4.3.2.3. Heavy Commercial Vehicles (HCVs)

- 8.1.4.3.3. Semiconductors/Electronics Industry

- 8.1.4.3.4. Oil, Gas, & Energy Industry

- 8.1.4.3.5. Others

- 8.1.5. Canada

- 8.1.6. Mexico

- 8.1.1. By Molding Type

All segments will be provided for all regions and countries covered

- 8.2. Europe

- 8.2.1. Germany

- 8.2.2. France

- 8.2.3. Italy

- 8.2.4. United Kingdom

- 8.2.5. Russia

- 8.2.6. Netherlands

- 8.2.7. Spain

- 8.2.8. Turkey

- 8.2.9. Poland

- 8.3. South America

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.4. Asia-Pacific

- 8.4.1. India

- 8.4.2. China

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. Vietnam

- 8.4.6. South Korea

- 8.4.7. Indonesia

- 8.4.8. Philippines

- 8.5. Middle East & Africa

- 8.5.1. Saudi Arabia

- 8.5.2. UAE

- 8.5.3. South Africa

9. Supply Side Analysis

- 9.1. Capacity, By Company

- 9.2. Production, By Company

- 9.3. Operating Efficiency, By Company

- 9.4. Key Plant Locations (Up to 25)

10. Market Mapping, 2022

- 10.1. By Molding Type

- 10.2. By Compound Type

- 10.3. By End-user

- 10.4. By Region

11. Macro Environment and Industry Structure

- 11.1. Supply Demand Analysis

- 11.2. Import Export Analysis - Volume and Value

- 11.3. Supply/Value Chain Analysis

- 11.4. PESTEL Analysis

- 11.4.1. Political Factors

- 11.4.2. Economic System

- 11.4.3. Social Implications

- 11.4.4. Technological Advancements

- 11.4.5. Environmental Impacts

- 11.4.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 11.5. Porter's Five Forces Analysis

- 11.5.1. Supplier Power

- 11.5.2. Buyer Power

- 11.5.3. Substitution Threat

- 11.5.4. Threat from New Entrant

- 11.5.5. Competitive Rivalry

12. Market Dynamics

- 12.1. Growth Drivers

- 12.2. Growth Inhibitors (Challenges, Restraints)

13. Key Players Landscape

- 13.1. Competition Matrix of Top Five Market Leaders

- 13.2. Market Revenue Analysis of Top Five Market Leaders (in %, 2022)

- 13.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 13.4. SWOT Analysis (For Five Market Players)

- 13.5. Patent Analysis (If Applicable)

14. Pricing Analysis

15. Case Studies

16. Key Players Outlook

- 16.1. Toray Advanced Composites

- 16.1.1. Company Details

- 16.1.2. Key Management Personnel

- 16.1.3. Products & Services

- 16.1.4. Financials (As reported)

- 16.1.5. Key Market Focus & Geographical Presence

- 16.1.6. Recent Developments

- 16.2. Huntsman International LLC

- 16.3. Showa Denko Materials Co. Ltd

- 16.4. KYOCERA Corporation

- 16.5. BASF SE

- 16.6. Eastman Chemical Company

- 16.7. Hexion

- 16.8. Hitachi, Ltd.

- 16.9. Sumitomo Bakelite Co., Ltd.

- 16.10. Henkel AG & Co. KGaA

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work