|

市場調査レポート

商品コード

1642129

ロボットソフトウェア:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Robot Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ロボットソフトウェア:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

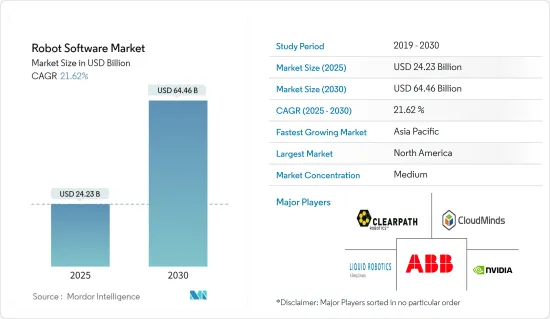

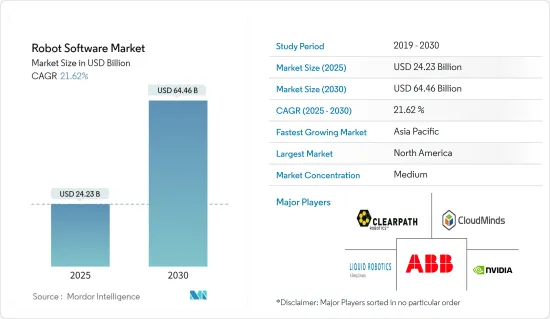

ロボットソフトウェアの市場規模は2025年に242億3,000万米ドルと推計され、2030年には644億6,000万米ドルに達すると予測され、予測期間中(2025-2030年)のCAGRは21.62%です。

ロボットソフトウェアは、知能、動作、安全性、生産性のための機能を実現し、ロボットに視覚、感覚、学習、セキュリティ維持をさせる力を与えます。これらの特徴と利点により、ユーザーは即座に簡単にロボットを立ち上げ、最適な生産性で稼働させることができます。

主なハイライト

- ロボットソフトウェア市場を牽引する主な要因は、人工知能の採用、スピードの向上、品質の改善、人件費の削減、精度の向上、生産の拡張性です。

- 製造、電気・電子、自動車、飲食品、プロセス制御など、さまざまなエンドユーザー産業でロボットの導入が増加していることが、ロボットソフトウェア・プラットフォーム市場の主要な成長要因と見られています。さまざまなエンドユーザー産業でロボットの利用が拡大していることは、カスタマイズされた需要に対応すると同時に、人件費の削減にも貢献しています。

- ロボットが発明されて以来、ソフトウェアはロボット工学の分野で重要な役割を果たしてきました。ロボットのより良い制御、シーケンスの迅速なカスタマイズ、使いやすさを可能にする新しいソフトウェア機能のイントロダクションより、ソフトウェアは今後数年間でロボット工学の採用をさらに促進すると予想されます。

- しかし、データ・セキュリティとサイバー攻撃の増加が市場の成長を妨げています。また、ロボット犯罪の増加が様々な分野でのロボット採用を妨げているため、ロボットソフトウェアの採用見通しが低下しています。また、熟練した専門知識の不足もこの市場の大きな抑制要因となっています。

- COVID-19は、ロボットソフトウェアの利用を拡大し、ロボット研究を改善するための強固な後押しとなった。パンデミックの間、様々な企業が地域の消毒や隔離された人々に食料を届けるためにロボットを導入しました。COVID-19を地域社会で追跡できるようにロボットソフトウェアを設計した企業もあります。

ロボットソフトウェアの市場動向

産業用ロボットが主要用途に

- インダストリー4.0と相まってスマートファクトリーのコンセプトに不可欠なモノのインターネット(IIoT)のような技術の出現により、産業用ロボットの採用は製造業全体で増加しています。産業用ロボットは一般的に、危険な作業や反復作業を高い精度で行うために、人間の労働者の代わりに使用されます。IFRによると、2024年までにアジア/オーストラリアにおける産業用ロボットの設置台数は37万台に達すると予測されています。

- ロボットを効率的に稼働させるためには、メーカーのニーズに合わせてロボットを操作するためのロボットソフトウェアが不可欠です。このソフトウェアは人間の能力の延長です。それは、世代や技術の飛躍ごとに鋭くなる人間のビジョンを反映しています。産業部門におけるロボット工学の著しい成長とともに、ロボットソフトウェアのニーズも大幅に高まっています。

- さらに、人工知能と機械学習機能が産業用ロボット技術に急速に浸透しています。ロボット工学とAI技術の融合から得られる最も大きなメリットの1つは、予知保全による稼働時間と生産性の向上です。

- 産業用ロボット技術にAIが統合されることで、ロボットは自身の精度や性能を監視することができ、メンテナンスが必要なときにシグナルを提供することで、高価なダウンタイムを回避することができます。

- さらに、アルファベットは2023年5月、産業用ロボット事業部門であるイントリンシックの最初の製品であるFlowstateを発表しました。Flowstateは、企業がロボットのワークフローを作成できる直感的なウェブベースの開発環境であり、ユーザーにロボットシステムの構築を開始するための基盤と、設計をテストするためのシミュレーション機能を提供します。特にこのソフトウェアは、専門家でなくてもロボットシステムを理解し、活用できるようにすることを目的としています。

大きな成長が期待されるアジア太平洋地域

- アジア太平洋地域は、予測期間中に大きな成長機会を示すと予想されます。この地域のロボットソフトウェア市場の成長に貢献している主な国は、中国、日本、シンガポール、韓国、インドです。この地域の国々は、産業全般にわたってロボット工学の採用を増やしています。

- 中国市場は、第13次5ヵ年計画でAIとロボット工学への重点的な取り組みを明確に打ち出していることから、AIとロボット工学への支出が増加すると予想されます。中国の国家開発改革委員会は、2030年までに同国が超大国になるために先端技術の採用を加速させることが期待されるAI3カ年実施プログラムを発表しました。

- 化学プラントなどの危険な作業を行う組織における自動化と安全性に対する需要の高まりが、市場の成長を促進しています。さらに、インダストリー4.0と相まってスマートファクトリー構想に不可欠なモノの産業インターネット(IIoT)のような最先端技術の採用が増加しており、産業用ロボットが市場の成長を牽引しています。

- 加えて、ロボットの作業セルのコストは数年前から毎年5-10%低下しており、ロボットのスピードとスループットは大幅に向上しています。

ロボットソフトウェア産業概要

ロボットソフトウェア市場は、様々な産業への応用による世界のロボット工学の浸透により、半複合化しています。ロボットソフトウェア企業は、ロボットプロセスを強化し、製造業のプロセス強化を支援する先進技術の開発に絶えず注力しています。同市場の著名ベンダーには、ABB Ltd、Clearpath Robotics、NVIDIA Corporation、CloudMinds Technology Inc.などがあります。

- 2023年12月-ABB Ltdは、ボルボ・カーズとの長年にわたるパートナーシップを強化し、次世代の電気自動車を製造するために1,300台以上のロボットと機能パッケージを供給すると発表しました。これにより、スウェーデンの自動車メーカーは、野心的な持続可能性目標の達成を支援します。

- 2023年10月-NVIDIAは、エッジAIとロボティクスのためのジェストンプラットフォーム上の2つのフレームワーク、NVIDIA Isaac ROSロボティクスフレームワークを発表しました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- 組織における自動化と安全性へのニーズの高まり

- 人件費とエネルギーコストの削減を目的とした中小企業によるロボットソフトウェアの急速な採用

- 市場の課題

- 導入コストの高騰とソフトウェアに対するマルウェア攻撃の増加

第6章 市場セグメンテーション

- ソフトウェアタイプ別

- 認識ソフトウェア

- シミュレーション・ソフトウェア

- 予知保全ソフトウェア

- データ管理・分析ソフトウェア

- 通信管理ソフトウェア

- ロボットタイプ別

- 産業用ロボット

- サービスロボット

- 展開別

- オンプレミス

- オンデマンド

- 企業規模別

- 中小企業

- 大企業

- 業界別

- 自動車

- 小売・eコマース

- 政府・防衛

- ヘルスケア

- 運輸・物流

- 製造業

- IT・通信

- その他エンドユーザー業界別

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- ABB Ltd

- Clearpath Robotics

- NVIDIA Corporation

- CloudMinds Technology Inc.

- Liquid Robotics Inc.

- Brain Corporation

- AIBrain Inc.

- Furhat Corporation

- Neurala Inc.

第8章 投資分析

第9章 市場機会と今後の動向

The Robot Software Market size is estimated at USD 24.23 billion in 2025, and is expected to reach USD 64.46 billion by 2030, at a CAGR of 21.62% during the forecast period (2025-2030).

Robot software enables functions for intelligence, motion, safety, and productivity and gives the power to get the robots to see, feel, learn, and maintain security. These characteristics and benefits allow users to instantly and easily get their robots up and running at optimum productivity.

Key Highlights

- The major factors driving the robot software market are the adoption of artificial intelligence, enhanced speed, improved quality, reduced labor cost, increased accuracy, and production scalability.

- Rising adoption of robots across various end-user industries such as manufacturing, electrical and electronics, automotive, food and beverage, and process controls are seen as primary growth drivers for the robotics software platforms market. The growing utilization of robots in varied end-user industries helps meet customized demand while simultaneously helping lower labor costs.

- Since the invention of robots, software has played a key role in the field of robotics. With the introduction of new software features that enable better control of the robot, quick customization of sequences, and ease of use, the software is expected to further boost the adoption of robotics in the coming years.

- However, data security and increasing cyberattacks are hindering market growth. Also, increasing robot crimes are impeding the adoption of robots in various sectors, thus, reducing the robot software adoption prospects. Also, the lack of skilled expertise is another major restraining factor for this market.

- COVID-19 provided a solid push to expand the usage of robot software and improve robotics research. During the pandemic, various companies have installed robots to disinfect areas and deliver food to quarantined people. Some companies designed robot software to help people track COVID-19 in their communities.

Robot Software Market Trends

Industrial Robots to Have the Majority Application

- With the advent of technologies like the Industrial Internet of Things (IIoT), vital to the smart factory concept coupled with Industry 4.0, industrial robot adoption is increasing across the manufacturing industries. An industrial robot is generally used in place of human laborers to perform dangerous or repetitive tasks with high accuracy. and According to IFR It is projected that by 2024, industrial robot installations in Asia/Australia will reach 370,000 units.

- In order to make the robots perform efficiently, robot software is essential to operate the robots according to the needs of the manufacturers. This software is an extension of human capability. It reflects the human vision that gets keener with every generation and every technological leap. With the enormous growth of robotics in the industrial sector, the need for robotic software is also increasing substantially.

- Moreover, Artificial Intelligence and machine learning capabilities have been rapidly making their way into industrial robotics technology. One of the most significant benefits derived from the merging of robotics and AI technology is increased uptime and productivity from predictive maintenance.

- With AI integrated with industrial robotics technology, robots are able to monitor their own accuracy and performance, providing signals when maintenance is required to avoid expensive downtime.

- Furthermore, in May 2023, Alphabet launched the first product under its industrial robotics business unit Intrinsic, called Flowstate, which is an intuitive, web-based developer environment where companies can create robotic workflows, offering users the foundation to begin building robotic systems, as well as simulation capabilities to test designs. In particular, the software is aimed at helping non-experts understand and leverage robotic systems.

The Asia-Pacific Region Expected to Register Significant Growth

- The Asia-Pacific region is expected to exhibit significant growth opportunities over the forecast period. The major economies contributing to the growth of the robot software market in this region are China, Japan, Singapore, South Korea, and India. The countries in this region are increasingly adopting robotics across industries.

- The Chinese market is expected to increase its expenditure on AI and robotics, as the country has categorically prioritized its focus on AI and robotics in its 13th five-year plans. China's National Development and Reform Commission has announced an AI three-year implementation program expected to accelerate the adoption of advanced technologies to help the country become a superpower by 2030.

- Rise in demand for automation and safety in organization for hazardous works like chemical plants and others, is driving the growth of the market. Furthermore, with the rising adoption of cutting-edge technologies like the Industrial Internet of Things (IIoT) vital to the smart factory concept coupled with Industry 4.0, and industrial robot is driving the growth of the market

- In addition, the cost of robot work cells has decreased by 5-10% per year since few years and the speed and throughput of robot has increased significantly; due to which there is an increase in adoption of robots, which in turns drives the growth of the market across the region.

Robot Software Industry Overview

The Robot Software Market is semi-conslodiated owing to the penetration of robotics globally with applications in various industries. Robotic software companies are constantly focusing on developing advanced technologies that would enhance the robotic processes and help the manufacturing industries to intensify their process. Some of the prominent vendors in the market include ABB Ltd, Clearpath Robotics, NVIDIA Corporation, and CloudMinds Technology Inc.

- December 2023 - ABB Ltd has announced the strengthening of its long-standing partnership with Volvo Cars to supply more than 1,300 robots and functional packages to build the next generation of electric vehicles. This will support the Swedish car manufacturer to achieve its ambitious sustainability targets.

- October 2023 - NVIDIA announced launch of its to two frameworks on the Jeston Platform for edge AI and robotics the NVIDIA Isaac ROS robotics framework for Robotics Platform to Meet the Rise of Generative AI, More than 10,000 companies building on the NVIDIA Jetson platform can now use new generative AI, APIs and microservices to accelerate industrial digitalization.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in need for automation and safety in organizations

- 5.1.2 Rapid adoption of robot software by SMEs to reduce labor and energy costs

- 5.2 Market Challenges

- 5.2.1 High cost of implementation and rise in malware attacks on the software

6 MARKET SEGMENTATION

- 6.1 By Software Type

- 6.1.1 Recognition Software

- 6.1.2 Simulation Software

- 6.1.3 Predictive Maintenance Software

- 6.1.4 Data Management and Analysis Software

- 6.1.5 Communication Management Software

- 6.2 By Robot Type

- 6.2.1 Industrial Robots

- 6.2.2 Service Robots

- 6.3 By Deployment

- 6.3.1 On-Premise

- 6.3.2 On-Demand

- 6.4 By Enterprise Size

- 6.4.1 Small and Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 By End-user Vertical

- 6.5.1 Automotive

- 6.5.2 Retail and E-commerce

- 6.5.3 Government and Defense

- 6.5.4 Healthcare

- 6.5.5 Transportation and Logistics

- 6.5.6 Manufacturing

- 6.5.7 IT and Telecommunications

- 6.5.8 Other End-user Verticals

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Clearpath Robotics

- 7.1.3 NVIDIA Corporation

- 7.1.4 CloudMinds Technology Inc.

- 7.1.5 Liquid Robotics Inc.

- 7.1.6 Brain Corporation

- 7.1.7 AIBrain Inc.

- 7.1.8 Furhat Corporation

- 7.1.9 Neurala Inc.