|

市場調査レポート

商品コード

1644404

美術館・博物館用照明:市場シェア分析、産業動向と統計、成長予測(2025~2030年)Art & Museum Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 美術館・博物館用照明:市場シェア分析、産業動向と統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

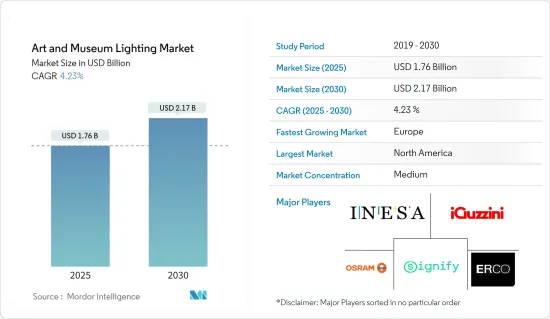

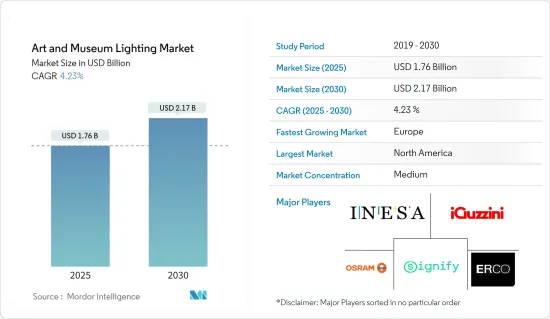

美術館・博物館用照明の市場規模は2025年に17億6,000万米ドルと推定・予測され、2030年には21億7,000万米ドルに達すると予測され、予測期間(2025-2030年)のCAGRは4.23%です。

美術館の照明デザインにおいて、アンビエント、タスク、フォーカル、装飾はすべて、空間全体の美観に貢献するレイヤーです。アンビエントレイヤーとは、部屋の一般的な照明のことです。このタイプの照明は、人が空間を移動することを可能にし、タスクライトのレベルよりもかなり低いです。世界中で都市人口が増加しているため、手頃な価格のエネルギーの安定供給、温室効果ガスの排出、気候変動、生物多様性の損失といった環境への影響に対する懸念が高まっており、その結果、住宅だけでなく都市の商業ビルでも効率的な照明の採用が進んでいます。

主なハイライト

- エネルギー削減と継続的なメンテナンスコスト削減の両面で大幅なコスト削減を達成するため、美術館や博物館内の電気照明システムの改修やアップグレードへの投資が増加していること、また、占有率やユーザーの好みに対応できるスマート制御システムを備えた照明システムへの需要が高まっていることが、美術館・博物館用照明市場の成長を促進する主な要因となっています。

- 美術館やギャラリーは、コレクションを保護・保存するための内部環境を維持するために多大なエネルギーを消費しています。Arupの報告書によると、展示室と展示室裏の照明がエネルギー消費量の20%を占めることがあり、コストを削減するため、ほとんどの美術館が効率的な照明器具を使用しています。

- さらに、LEDランプが投射する光には赤外線がほとんど含まれず、紫外線もほとんどないことも、美術館の照明システムにLEDランプを使用する利点です。壊れやすい美術品を赤外線や紫外線から守るフィルターが不要になり、来館者の視覚体験が向上します。

- また、マンチェスター博物館で実施された調査では、エネルギー消費総コストの50%が博物館の照明システムに起因していることが明らかになった。同博物館では、蛍光管をLEDランプに交換し、施設内の照明器具に人感センサーを取り付けることにしたところ、消費電力が約89%削減されました。

- さらに、美術館や博物館の最も重要な課題は、省エネとアーティストが期待する展示の照明品質のバランスをとることです。たいていの場合、大幅な省エネの誘惑は、時として照明の質を損なうことにつながります。そのため、ほとんどの市場ベンダーは、最初の戦略的アドバイスやコンセプト開拓から、施工書類や現場サポートに至るまで、包括的な照明設計サービスを提供しています。

- さらに、ロシアとウクライナの紛争は、余計な混乱を引き起こし、半導体のサプライチェーンに影響を与え、電子機器のさらなる価格上昇につながるかもしれないです。全体として、紛争がエレクトロニクス産業に与える影響は大きいと予想されます。これにより、スマート照明製品の生産が妨げられることになります。

美術館・博物館用照明市場動向

LEDセグメントが市場成長を牽引する見込み

- 美術館や博物館の照明は重要です。光は作品への注目を集めると同時に、作品自体の損傷を防ぐ。美術品を強い光源にさらすと、定期的にその品質に影響を与える可能性があるため、この2つの要請はしばしば相反します。IEAによると、より多くの国が従来の電球を廃止しようとしている中、LEDは市場のトップへの道を歩み続けています。世界の照明市場におけるLEDの普及率は、2025年には76%、2030年にはさらに87.4%に達すると予想されています。

- その結果、芸術作品の視覚的鑑賞を最適化し、その特性を損なわない照明ソリューションが必要とされています。その結果、LED照明器具が美術館や博物館の照明ソリューションとして採用されるようになった。発光ダイオード(LED)ランプは、美術館や博物館で数十年にわたって使用されてきた白熱灯や蛍光灯に取って代わりつつあります。LEDの利点の中でも、その持続時間は最も大きいです。LEDの寿命は、従来のものと比べて25,000時間以上であり、美術館や博物館の来館時間の約10年に相当します。

- 環境と電灯の耐久性に対する消費者の意識の高まりと、エネルギー効率に対する政府の義務付けが、LEDの採用増加の原動力となっています。最新のLED照明ソリューションは、大幅な省エネの可能性をもたらすため、急速に進歩しています。有効性の向上、最適化された照明器具設計、柔軟な照明制御により、さまざまな照明条件や交通条件において、低コストで性能の向上が可能になっています。

- 美術館や博物館の内部人工光源には、白熱灯、ハロゲン、光ファイバー、蛍光灯、冷陰極管、LEDなどがあります。白熱灯は一般的に、トラック照明器具を使ったアンビエント照明やアクセント照明に使われています。しかし、ほとんどのアートギャラリーは、ほとんどのハロゲン光源を廃止することで、既存の電気インフラや照明制御を変更することなく、現在のギャラリー照明器具の在庫を新しいLED照明器具に交換しました。LED照明器具は電気代も大幅に削減しました。

- さらに、LED照明技術はエネルギー効率が非常に高く、米国の照明の将来に劇的な影響を与える可能性があります。LED照明の普及は、アメリカの省エネに大きな影響を与える可能性があります。2035年までに、ほとんどの照明設備がLEDベースになると予測されています。米国DOEによると、LED照明による省エネ効果は2035年までに年間569TWhに達する可能性があり、これは921,000メガワット以上の発電所の年間エネルギー生産量に相当します。

欧州は大幅な成長が見込まれる

- 環境問題への関心の高まりと、産業界全体における発光ダイオード(LED)照明システムの採用により、EU市場がLED照明市場で大きなシェアを占めると予想されています。LEDベースの照明は、従来の照明技術よりもエネルギー効率が高く、寿命が長く、運転に必要な電力が少なくて済むためです。欧州は、照明産業が固体照明やLED光源に移行する中で、世界で最も独創的な照明マーケットプレースのひとつです。

- 消費者によるLED製品の採用を促進し、旧式の効率の悪い技術を段階的に廃止するため、各地域政府も補助金や奨励金を提供しています。これにより、欧州の照明産業全体の効率が向上します。例えば、EU Green Lightsは2022年10月、イタリアのオリーブ工場に1億ユーロの補助金を提供しました。イタリアの農業・食品・林業省によると、この新しい補助金は、エネルギー使用量が少なく、環境への影響が軽微な取り組みに資金を提供します。

- COP26でEUは、2030年までに少なくとも55%の排出量削減を約束し、2050年までに気候中立を達成する最初の地域になることを約束しました。その結果、蛍光灯を段階的に廃止する動きは重要性を増しており、直接的な社会的利益のために行うことができます。国連の水銀に関する水俣条約により、このような決定は、EUがエネルギー効率の高いクリーンなLED照明への切り替えを加速させるのに役立つと思われます。

- LED照明は、鑑賞の楽しみや美術品の保存を犠牲にすることなく、運用の最適化を可能にします。欧州には世界最大級の美術館が17館あり、そのうちの7館がロンドン、3館がパリ、マドリード、バルセロナ、2館がローマ、1館がフィレンツェとローマにあります。このような要因は、美術館や博物館のような公共の場におけるLED照明の需要を生み出す可能性があります。

- LEDの使用量の増加と、海洋産業における安全灯に関する規則の厳格化により、エネルギー効率の高い照明に対する需要の高まりが市場を牽引します。例えば、2022年11月、欧州委員会はCOP27の余波を受け、国際海運からの温室効果ガス(GHG)排出量を削減するプロジェクトに1,000万ユーロを追加すると発表しました。

- さらに、欧州で販売されるほぼすべてのランプについて、電球の寿命やウォームアップ時間など、エネルギー効率要件などに関する規制が変化していることも、同市場の活性化につながると予想されます。最新の規制によると、ほとんどのハロゲンランプと従来の蛍光管照明は2023年9月以降段階的に廃止されます。

美術館・博物館用照明産業概要

美術館・博物館用照明市場は競争が激しく、Signify NV、Osram Licht AG、ERCO GmbH、Inesa Lighting(Pty)Ltd、iGuzzini illuminazione S.p.A.などの大手企業が市場を独占しています。これらの企業は、市場シェアと収益性を高めるために、戦略的な共同イニシアティブを活用しています。

2022年11月、Nanoleaf社は、同社のEssential Smart Lightingラインの製品群に、新たに4種類のMatter対応スマート電球と照明器具を追加すると発表しました。これらの新製品のうち、2023年第1四半期に発売されたThread対応LED照明には、ライトストリップとA 19、BR 30、GU 10電球が含まれ、ブリッジなしでMatterを直接サポートする最初の製品の一部となっています。

2022年6月、Cree LEDはXlampElement G(XE-G)LEDを発売しました。XE-G LEDは、小型のフォームファクターで対にならない光出力と効率で新しいパフォーマンスクラスを実現します。XE-G LEDファミリーは、EdisonReportasによって「LightFair Top 10 MUST SEE」製品として認識されており、Cree LEDのブース3007に展示されているのは、包括的なXE-G LEDファミリーで利用可能な全17色と3つの白色オプションを紹介する8フィートの見事な周期表です。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- マクロ経済動向の影響

第5章 市場力学

- 市場促進要因

- 博物館・美術館におけるLED照明器具の採用増加

- スマート制御システムを備えた電飾照明システムに対する需要の高まり

- 市場抑制要因

- LED照明の利点に関する認識不足

第6章 市場セグメンテーション

- タイプ別

- LED

- 非LED

- 用途別

- 屋内

- 屋外

- 地域別

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

第7章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Signify NV

- OSRAM Licht AG

- ERCO GmbH

- Inesa Lighting(Pty)Ltd.

- iGuzzini illuminazione S.p.A

- BEGA Gantenbrink-Leuchten

- Lumenpulse Group

- Acuity Brands Inc.

- Targetti Sankey S.p.A.

- Feilo Sylvania Group

第8章 投資分析

第9章 市場の将来

The Art & Museum Lighting Market size is estimated at USD 1.76 billion in 2025, and is expected to reach USD 2.17 billion by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

In museum lighting design, the ambient, task, focal, and decorative are all layers that contribute to the overall aesthetic of a space. Ambient layering is the general lighting of a room. This type of lighting allows one to move through space and is significantly lower than task light levels. The growing urban population across the globe has heightened concerns about the secure, reliable supply of affordable energy, environmental impacts such as greenhouse gas emissions, climate change, and loss of biodiversity, which in turn has driven the adoption of efficient sources of lighting in residential as well as in commercial buildings in cities, which is further propelling the studied market growth.

Key Highlights

- The increasing investment to refurbish or upgrade the electric lighting systems within museums and art galleries to attain significant cost savings, both in terms of energy reduction and reducing ongoing maintenance costs and growing demand for electing lighting systems with a smart control system that can respond to occupancy or user preference are the major factors driving the growth of the art & museum lighting market.

- Museums and galleries consume significant energy to maintain an internal environment to protect and preserve their collections. As per the Arup report, lighting within both exhibitions and back-of-house areas can account for 20% of the energy consumption, and to reduce the cost, most museums are using efficient luminaires.

- Furthermore, the light cast by LED lamps contains very few infrared rays and almost no ultraviolet rays, which is another advantage of using LED lamps for the museum's lighting system. The fragile artwork no longer requires filters to preserve it from damaging infrared or ultraviolet beams, which enhances the visitor's visual experience.

- Also, a survey conducted at the Manchester Museum revealed that 50% of the total cost of energy consumption was attributable to the museum's lighting system. When the museum decided to replace its fluorescent tubes with LED lamps and affix motion sensors to the luminaires throughout its establishment, it reduced its consumption by around 89%.

- Moreover, the museums and art galleries' most significant challenge is to balance the energy savings and lighting quality of the displays as expected by the artist. Most of the time, the lure of substantial energy savings can sometimes lead to compromised lighting quality. Hence, most market vendors provide comprehensive lighting design services, from initial strategic advice and concept development to construction documents and on-site support.

- Additionally, the Russia-Ukraine conflict might cause extra disruptions and affect the supply chains of semiconductors, leading to further increases in the prices of electronics. Overall, the impact of the conflict on the electronics industry is expected to be significant. This would hamper the production of smart lighting products.

Art and Museum Lighting Market Trends

LED Segment is Expected to Drive the Growth of the Market

- Lighting up museums and art galleries well is crucial. Light helps draw attention to artwork while preventing damage to the work itself. These two imperatives often conflict, as exposing artwork to a source of intense light can periodically affect its quality. According to IEA, as more and more countries are getting close to phasing out conventional bulbs, LEDs are continuing their march to the top of the Market. The penetration rate of LEDs into the global lighting market is expected to reach a penetration of 76% in 2025 and a further 87.4% in 2030.

- Consequently, there is a need for a lighting solution that enables optimal visual appreciation of the art and ensures that its characteristics are not tainted. As a result, LED luminaires have emerged as the preferred lighting solution in museums and art galleries. Light-emitting diode (LED) lamps are increasingly replacing the incandescent and fluorescent lamps used by museums and art galleries for decades. Of all the advantages of the LED, its duration is the most significant. LEDs can have a 25,000+ hours lifetime compared to their traditional counterparts, translating to approximately ten years of museum and art gallery visiting hours.

- The growing consumer awareness about the environment and the durability of electric lights, along with the government mandates for energy efficiency, are the drivers for the increasing adoption of LEDs. Modern LED lighting solutions are advancing rapidly as they deliver significant energy-saving potential. Increasing efficacy, optimized luminaire design, and flexible lighting control enable enhanced performance at a lower cost for different lighting and traffic conditions.

- The interior artificial light sources of the museum and art galleries include incandescent, halogen, fiber optics, fluorescent, cold cathode, and LEDs. Incandescent lamps are generally used for ambient and accent lighting with track luminaires. However, by discontinuing most halogen light sources, most art galleries replaced their current stock of gallery luminaires with new LED luminaires without the need to change their existing electrical infrastructure and lighting controls. LED luminaires have also reduced electric costs significantly.

- Moreover, LED lighting technology is very energy-efficient and can drastically impact the future of lighting in the United States. The widespread adoption of LED lighting has a significant potential impact on American energy savings. By 2035, it's predicted that most lighting installations will be LED-based. According to US DOE, Energy savings from LED lighting might reach 569 TWh annually by 2035, equivalent to the yearly energy production of over 921,000-megawatt power plants.

Europe is Expected to Experience Significant Growth

- Due to growing environmental concerns and the adoption of light-emitting diode (LED) lighting systems across industries, the EU market is anticipated to dominate the LED lighting market with a sizeable share. LED-based lights are preferable to conventional lighting technologies because they are more energy-efficient, have a longer lifespan, and require less electricity to operate. Europe is one of the world's most inventive lighting marketplaces as the lighting industry transitions to solid-state lighting and LED sources.

- In order to boost consumer adoption of LED products and phase out older, less efficient technologies, the regional governments are also offering subsidies and incentives. This will enhance the overall efficiency of the European lighting industry. For instance, EU Green Lights funded a EUR100M Subsidy for Italian Olive Millers in October 2022. According to the Italian Ministry of Agriculture, Food, and Forestry, the new subsidies will fund initiatives that use less energy and have a minor environmental impact.

- At COP 26, the EU committed to reducing emissions by at least 55% by 2030 to become the first area to achieve climate neutrality by 2050. As a result, the move to phase out fluorescent lamps is growing in importance and can be done for a direct societal benefit. With the United Nations Minamata Convention on Mercury, such decisions will assist the EU in accelerating the switch to energy-efficient, clean LED lighting.

- LED illumination enables operating optimization without sacrificing viewing pleasure or art preservation. Since Europe is home to seventeen of the largest museums in the world-seven of them are in London, three are in Paris, Madrid, and Barcelona, two are in Rome, and one in each in Florence and Rome-it presents a substantial growth opportunity for the LED market. Such factors can create a demand for LED lighting in public places such as Art and Museums.

- With The rise in the usage of LEDs and the stricter rules for the marine industry concerning safety lights, the growing demand for energy-efficient lighting will drive the Market. For instance, in November 2022, the European Commission recently announced an additional EUR 10 million for a project to lower the greenhouse gas (GHG) emissions from international shipping in the margins of COP27.

- Additionally, the changing regulations for energy efficiency requirements and other factors for almost all lamps sold in Europe, such as bulb lifetime and warm-up time, are anticipated to fuel the Market. According to the latest regulation, most halogen lamps and traditional fluorescent tube lighting will be phased out from September 2023 onwards.

Art and Museum Lighting Industry Overview

The art and museum lighting market is competitive and is dominated by a few significant players like Signify NV, Osram Licht AG, ERCO GmbH, Inesa Lighting (Pty) Ltd, and iGuzzini illuminazione S.p.A. These significant players, with a prominent share in the market, are concentrating on expanding their customer base across foreign countries. These corporations leverage strategic collaborative initiatives to increase their market share and profitability.

In November 2022, Nanoleaf announced the addition of four new Matter-compatible smart bulbs and light strips under its Essential Smart Lighting line product range. Among these new products, the Thread-enabled LED lights launched in Q1 of 2023 and include a light strip and A 19, BR 30, and GU 10 bulbs, making them some of the first to support Matter directly without a bridge.

In June 2022, Cree LED launched XlampElement G (XE-G) LEDs that deliver a new performance class with unpaired light output and efficiency in a small form factor. The XE-G LED family of products has been recognized by EdisonReportas a "LightFair Top 10 MUST SEE" product on display at Cree LED's booth 3007 is a stunning, 8-foot periodic table showcasing all 17 colors and three white options available in the comprehensive XE-G LED family.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of LED Luminaires in Museum and Art Galleries

- 5.1.2 Growing Demand for Electing Lighting System with a Smart Control System

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness about the Advantages of the LED Lights

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 LED

- 6.1.2 Non-LED

- 6.2 By Application

- 6.2.1 Indoor

- 6.2.2 Outdoor

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Asia Pacific

- 6.3.3 Europe

- 6.3.4 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Company Profiles

- 7.2.1 Signify NV

- 7.2.2 OSRAM Licht AG

- 7.2.3 ERCO GmbH

- 7.2.4 Inesa Lighting (Pty) Ltd.

- 7.2.5 iGuzzini illuminazione S.p.A

- 7.2.6 BEGA Gantenbrink-Leuchten

- 7.2.7 Lumenpulse Group

- 7.2.8 Acuity Brands Inc.

- 7.2.9 Targetti Sankey S.p.A.

- 7.2.10 Feilo Sylvania Group