|

市場調査レポート

商品コード

1435947

ワイヤレスインフラ監視:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Wireless Infrastructure Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ワイヤレスインフラ監視:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

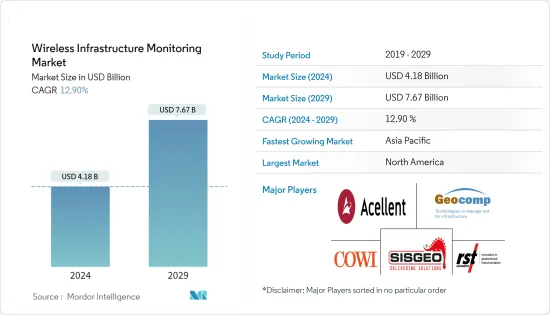

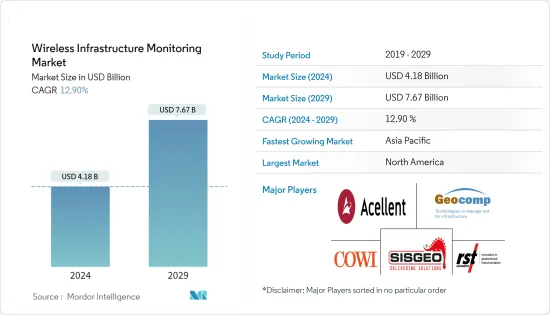

ワイヤレスインフラ監視市場規模は、2024年に41億8,000万米ドルと推定され、2029年までに76億7,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に12.90%のCAGRで成長します。

インフラの構造状態や健全性に関するリアルタイムの情報を提供するセンサー技術、ワイヤレス技術、IoTなどの技術の急速な進歩が市場を牽引しています。

主なハイライト

- 経済の強化により、ほとんどの国は工業化のプラスの影響を経験しており、道路、幹線道路、橋、工業用倉庫、エネルギープラント、無線通信の普及が期待されている鉱山地帯などの民間インフラの群衆が爆発的に成長しているのを目の当たりにしています。インフラ監視市場。

- 例えば、2019年、中国は高速鉄道網の建設に1,250億米ドル以上を投資しました。中国鉄路総公司は、4,100kmの高速インフラを含む6,800kmの新線を開設する予定で、これは2018年に稼働した総走行距離より45%多いです。2018年末までに、29,000kmの高速インフラを運行していました。この路線は世界の3分の2を占め、2018年には4000路線キロ以上が追加されました。これにより中国の主要都市間の移動時間が短縮され、当局は国内の僻地への新路線の延長を検討しています。

- さらに、老朽化により崩壊するインフラの数が増加しているため、インフラの健全性をリアルタイムでチェックして持続的なインフラの故障の状況を回避するためのインフラ監視市場が活発化しています。 2017年、米国のインフラは、インフラの品質の低下を反映する、エンジニアリング協会によってほぼ不合格のグレード D+を与えられました。 ASCEは、米国がインフラを適切なBグレードにするには2025年までに4兆5,900億米ドルを投資する必要があると推定しており、この数字は現在の資金水準より約2兆米ドル高いです。このインフラへの資金調達の増加により、ワイヤレスインフラ監視市場も押し上げられると予想されます。

ワイヤレスインフラ監視市場動向

構造監視セグメントは大幅な成長が見込まれる

- 構造監視装置を使用して、インフラの健全性をリアルタイムで継続的に監視し、気づかれずに発生し、時間の経過とともに悪化する可能性のある亀裂を検出します。 IOGPの2019年世界生産報告書によると、石油・ガスの需要はピークに達し、これまで以上に大きくなり、アフリカ、アジア太平洋、中東、南北アメリカで劇的な成長を遂げています。これにより、需要と供給を満たすために石油の探査と生産への投資が促進されました。多くの中堅企業が、型破りな資源の開発に向けて戦略的提携を結んでいます。

- 例えば、2019年、エコペトロールとオクシデンタル・ペトロリアム・コーポレーションは、米国で最大かつ最も活発な石油貯留地の一つであるテキサス州のパーミアン盆地の約97,000エーカーに非在来型貯留層の開発のための合弁事業を設立することに合意しました。州、米国の総石油生産量の約30パーセントを占めます。これにより、石油・ガス部門における構造監視装置の需要が高まることが予想されます。

- さらに、スマートシティのメガ動向が続いていることにより、インフラ監視システム市場の成長が加速しています。都市に移住する人が増えており、都市中心部のリソースやサービスに対する需要が急増しています。 2025年までに、世界中の35の都市の人口は1,000万人を超えることになります。都市はすでに世界のエネルギーの2/3と、水、住宅設備、エネルギーと電力の信頼性、大気の質、交通の流れなどのその他の資源の大部分を消費しており、これらが生活の質に影響を及ぼします。そのため、都市部のほとんどは、増大する需要に対応し、都市がリソースをより効率的に利用するために必要な最先端のインテリジェンスと柔軟性を求めて、モノのインターネット(IoT)テクノロジーに注目しています。

- たとえば、インテルとカリフォルニア州サンノゼ市は官民パートナーシッププロジェクトで協力し、インテルのIoTスマートシティデモンストレーションプラットフォームを実装し、IoTテクノロジーを使用して空気中の微粒子、騒音公害、環境汚染などの特性を測定することで環境の持続可能性を生み出しました。交通の流れを改善し、大気の質、騒音、輸送効率、健康、エネルギー効率を提供します。

北米は大幅な成長を遂げ、市場を牽引する

- ワイヤレスインフラ監視システムのアプリケーションに大きな機会を提供するエンドユーザー産業の急速な拡大が市場の拡大につながっています。例えば、米国には30の州に98基の原子炉が稼働しており、2001年以来、これらの発電所は90%以上の平均設備利用率を達成し、年間最大807 TWhを発電し、総発電量の約20%を占めています。平均設備利用率は1970年代初頭の50%から1991年には70%に上昇し、2002年には90%を超えました。業界はプラントのメンテナンスとアップグレードに年間約75億米ドルを投資しており、この投資額は今後さらに増加すると予想されています。今後数年間は市場を牽引すると予想されています。

- この地域で事業を展開している企業は、生産能力を高めるための新製品開発に注力しています。たとえば、2019年 10月に、米国に本拠を置く地中レーダー(GPR)機器メーカーのGSSIは、アプリケーション向けに設計された次世代高性能GSシリーズの最初の新しい200 MHz(200 HS)アンテナを発表しました。より深い深さの浸透が必要な場合。困難な調査条件下で高い信頼性を必要とする地球物理学、地盤工学、または環境アプリケーションに最適です。

- しかし、最近の新型コロナウイルス感染症(COVID-19)のパンデミックの発生により、市場は影響を受けることが予想されます。経済の減速によりインフラへの支出が減少し、それによってポストコロナ経済における市場の成長率が低下すると予想されます。しかし、企業は将来同様の状況を避けるために、遠隔監視機能を開発するためにITシステムに投資することが期待されています。これは中長期的に市場にとって大きな刺激となることが期待されます。

ワイヤレスインフラ監視業界の概要

ワイヤレスインフラ監視市場は競争が激しく、Acellent Technologies, Inc.、Geocomp Corporation、COWI A/S、Sisgeo Srl、RST Instruments Ltd(Vance Street Capital)などのいくつかの主要企業で構成されています。市場で卓越したシェアを誇るこれらの大手企業は、海外への顧客ベースの拡大に注力しています。これらの企業は、市場シェアを拡大し、収益性を高めるために、戦略的な協力イニシアチブを活用しています。しかし、技術の進歩と製品の革新に伴い、中規模から中小企業は新たな契約を獲得し、新たな市場を開拓することで市場での存在感を高めています。

- 2020年 6月-COWI A/Sは、ノルウェー最大の下水処理プラントであるVEASに関する2つの枠組み協定を獲得しました。 1つは、建設技術、防火、機械設備、屋外環境、水、廃水、雨水、計画、環境、アーキテクチャ、HSEなどの建築取引をカバーします。もう1つは、電気設備と自動化を対象とした別個の枠組み協定です。

- 2020年5月- シスジオ。 Srlは、地質工学モニタリング向けの主要ワイヤレスソリューションであるWorldsensingと協力し、顧客がSisgeoバージョン3デジタルプロトコルセンサーをWorldsensingのロードセンシングと組み合わせて使用するときに自動読み取りを楽しめるようにしました。特に、Sisgeoボアホールプロファイルインプレイス傾斜計、傾斜計、レール変形システム、伸び計プローブ、伸び傾斜計プローブ、液体沈降システム、ロードセル、および多点ボアホール伸び計との相互運用性を保証します。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

- 業界のバリューチェーン分析

- COVID-19症が世界のインフラ監視市場に与える影響の評価

第5章 市場力学

- 市場促進要因

- 構造物の持続可能性に関する政府の厳しい規制

- コスト効率と柔軟性に優れた情報取得と保守効率と安全性の向上

- 市場の課題

- 新興諸国全体でシステムの設置と校正を行う熟練技術者が不足

第6章 市場セグメンテーション

- タイプ別

- ハードウェア

- ソフトウェアとサービス

- 用途別

- 地盤工学モニタリング

- 構造モニタリング

- 環境モニタリング

- その他の用途(空間監視、交通流監視など)

- エンドユーザー業界別

- 土木インフラ

- 石油と製油所

- 交通機関

- マイニング

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- 世界のその他の地域

第7章 競合情勢

- 企業プロファイル

- Acellent Technologies, Inc.

- Geocomp Corporation

- COWI A/S

- Sisgeo Srl

- RST Instruments Ltd.(Vance Street Capital)

- Campbell Scientific, Inc.

- Geokon, Inc.

- Nova Metrix LLC

- WorldSensing SL

- Ackcio Pte Ltd.

第8章 投資分析

第9章 市場機会と将来の動向

The Wireless Infrastructure Monitoring Market size is estimated at USD 4.18 billion in 2024, and is expected to reach USD 7.67 billion by 2029, growing at a CAGR of 12.90% during the forecast period (2024-2029).

The rapid advancements in technologies such as sensor technology, wireless technology, and IoT, which provide real-time information on structural conditions and health of infrastructures is driving the market.

Key Highlights

- Owing to the strengthening economy, most of the countries are experiencing positive influence of industrialization and witnessing exuberant growth in their convoy of civil infrastructures such as roadways, highways, bridges, industrial warehouses, energy plants, and mining areas which are expected to boost the wireless infrastructure monitoring market.

- For instance, in 2019, China invested more than USD 125 billion for the construction of a high-speed rail network. China Railway Corporation is set to open 6,800 km of new lines, including 4,100 km of high-speed infrastructure, which is 45% more than the total mileage commissioned in 2018. By the end of 2018, it was operating 29,000 km of high-speed lines, two-thirds of the world, and had added more than 4000 route-km in 2018. It has reduced the travel time between major Chinese cities, and authorities are looking to extend new lines into some of the remote corners of the country.

- Moreocer, an increasing number of collapsing infrastructures due to deterioration has fueled the infrastructure monitoring market in order to check its health in real-time to avoid any situations of persistent infrastructure breakdown. In 2017, the United States infrastructure was given a near-failing grade of D+ by an engineering association, that reflects light on the degrading quality of its infrastructure. The ASCE estimated that the United States needed to invest USD 4.59 trillion by 2025 to bring its infrastructure to an adequate B- grade, a figure about USD 2 trillion higher than current funding levels. This increasing funding on its infrastructure is also expected to boost the wireless infrastructure monitoring market.

Wireless Infrastructure Monitoring Market Trends

Structural Monitoring Segment is Expected To Grow Significantly

- Structural monitoring equipment is employed to provides continuous, real-time monitoring of the health of the infrastructure and detects any cracks that can develop unnoticed and worsen over time. As per the IOGP's Global Production Report 2019, demand for oil and gas is at the peak, greater than ever before, with dramatic growth in Africa, Asia Pacific, the Middle East, and the Americas. This has fueled the investment in exploration and production of oil to meet the demand and supply. Many mid-sized players are forming a strategic alliance for the development of unconventional resources.

- For instance, In 2019, Ecopetrol and Occidental Petroleum Corp agreed to form a joint venture for the development of unconventional reservoirs in approximately 97,000 acres of the Permian Basin in the State of Texas which is one of the largest and most active oil basins in the United States, accounting for approximately 30 percent of the total U.S. oil production. It is expected to boost the demand for structural monitoring equipment in the oil and gas sector.

- Moreover, the growth of infrastructure monitoring system market is boosting due to the ongoing mega-trend of smart cities. An increasing number of people are moving to cities, spurring skyrocketing demand for resources and services in these urban centers. By 2025, 35 cities across the world will have a population of greater than 10 million people. Cities already consume 2/3 of the world's energy and the majority of other resources such as water, housing facilities, reliability of energy and power, the quality of the air, and the flow of traffic, which will impact the quality of living. So, most of the urban cities are addressing the escalating demands and are looking over the Internet of Things (IoT) technology for the cutting-edge intelligence and flexibility necessary to help cities use resources more efficiently.

- For instance, Intel and The City of San Jose, CA collaborated on a public-private partnership project which implements Intel's IoT Smart City Demonstration Platform to create environmental sustainability by using IoT technology to measure characteristics such as particulates in the air, noise pollution, and traffic flow and offer air quality, noise, transportation efficiency, health, and energy efficiency.

North America Will Experience Significant Growth and Drive the Market

- The rapid expansion of the end-user industries that offer a major opportunity for the application of wireless infrastructure monitoring systems is leading to the expansion of the market. For instance, United States has 98 operating nuclear power reactors in 30 states, and since 2001 these plants have achieved an average capacity factor of over 90%, generating up to 807 TWh per year and accounting for about 20% of the total electricity generated. The average capacity factor had risen from 50% in the early 1970s to 70% in 1991, and it passed 90% in 2002. The industry invests about USD 7.5 billion per year in maintenance and upgrades of the plants, which is expected to increase in upcoming years and is expected to drive the market.

- The players operating in the region are focusing on new product developments to increase their production capabilities. For instance, in October 2019, GSSI, United States-based ground penetrating radar (GPR) equipment manufacturer has introduced the new 200 MHz (200 HS) antenna, the first of the next-generation high-performance GS Series that is designed for applications that require deeper depth penetration. It is ideal for geophysical, geotechnical, or environmental applications that require high reliability under challenging survey conditions.

- However, the market is expected to be affected by the recent outbreak of the COVID-19 pandemic. The slowing down of the economy is expected to reduce expenditure on infrastructure and thereby to reduce growth figures for the market in a post-corona economy. However, the companies are expected to invest in their IT systems to develop remote monitoring capabilities in order to avoid a similar situation in the future. This is expected to act as a big stimulus for the market in the medium to long run.

Wireless Infrastructure Monitoring Industry Overview

The wireless infrastructure monitoring market is highly competitive and consists of a few major players such as Acellent Technologies, Inc., Geocomp Corporation, COWI A/S, Sisgeo S.r.l. and RST Instruments Ltd (Vance Street Capital). These major players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

- June 2020 - COWI A/S won two framework agreements for VEAS, Norway's largest wastewater treatment plant. One covers building trades, including construction technology, fire safety, mechanical installations, outdoor environment, water, wastewater, stormwater, planning, environment, architecture, and HSE. The other is a separate framework agreement covering electrical installations and automation.

- May 2020 - Sisgeo. S.r.l. collaborated with Worldsensing leading wireless solution for geotechnical monitoring, so that its customers can enjoy automated readings when using Sisgeo's version 3 digital protocol sensors in combination with Worldsensing's, Loadsensing. It guarantees interoperability with Sisgeo borehole-profile in-place inclinometers, tiltmeters, rail deformation systems, extensometer probes, extenso-inclinometer probes, liquid settlement systems, load cells, and multipoint borehole extensometers, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Global Infrastructure Monitoring Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Government Regulations Pertaining to Sustainability of Structures

- 5.1.2 Cost-effective and Flexible Nature for Information Acquisition and Improving Maintenance Efficiency and Safety

- 5.2 Market Challenges

- 5.2.1 Shortage of Skilled Technicians for Installation and Calibration of Systems across Developing countries

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.2 Software and Services

- 6.2 By Application

- 6.2.1 Geotechnical Monitoring

- 6.2.2 Structural Monitoring

- 6.2.3 Environmental Monitoring

- 6.2.4 Other Applications (Spatial Monitoring, Traffic Flow Monitoring, etc.)

- 6.3 By End-user Industry

- 6.3.1 Civil Infrastructure

- 6.3.2 Oil and Refineries

- 6.3.3 Transportation

- 6.3.4 Mining

- 6.3.5 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Acellent Technologies, Inc.

- 7.1.2 Geocomp Corporation

- 7.1.3 COWI A/S

- 7.1.4 Sisgeo S.r.l.

- 7.1.5 RST Instruments Ltd.(Vance Street Capital)

- 7.1.6 Campbell Scientific, Inc.

- 7.1.7 Geokon, Inc.

- 7.1.8 Nova Metrix LLC

- 7.1.9 WorldSensing SL

- 7.1.10 Ackcio Pte Ltd.