|

市場調査レポート

商品コード

1644306

暗号資産管理-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Crypto Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 暗号資産管理-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

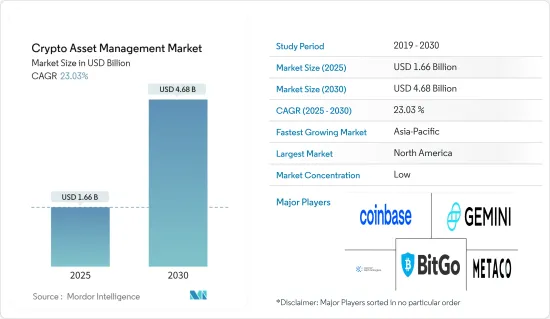

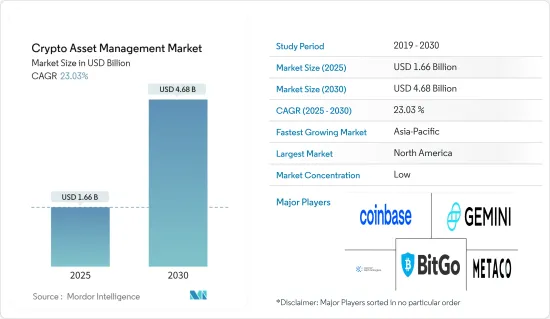

暗号資産管理市場規模は2025年に16億6,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは23.03%で、2030年には46億8,000万米ドルに達すると予測されます。

資産運用産業の進化は、暗号ファンドへの投資の増加と相まって、今後数年間の暗号資産運用市場の成長に影響を与えると分析されています。

主要ハイライト

- ブロックチェーン技術の進歩により、ここ数年、暗号通貨に大きな関心が集まっています。暗号が勢いを増すにつれ、暗号市場では信頼性の高い投資オプションに対する需要が高まっています。さらに、台頭しつつあるブロックチェーン技術は、デジタル資産の膨大な成長にわたってサービスを拡大し、いくつかのエンドユーザー産業にわたって多目的ビジネスアプリケーションを提供する可能性を秘めています。そのため、予測期間中、暗号資産管理に対する需要を大きく牽引しています。

- さらに、暗号通貨への投資を開始する機関投資家やウェルスマネージャーの増加に加え、消費者やBFSIや小売などの様々なエンドユーザー機関による暗号通貨の採用が増加しています。暗号資産管理プラットフォームの採用は、暗号通貨、デジタル資産、ブロックチェーン技術の既存と将来の開発によって、予測期間中にさらに促進されます。

- さらに、多くの資産管理プラットフォームは、ユーザーの投資目標に従ってポートフォリオを作成するAI/MLプログラムを活用しています。また、多数の資産を追跡・管理するのにも役立ちます。このような要因は、暗号産業や新しいデジタル資産の人気の高まりとともに、暗号資産管理プラットフォームの需要をさらに押し上げます。

- しかし、暗号通貨に関する認識や技術的理解の不足に加え、セキュリティ問題や各国の厳しい規制状況が、予測期間における暗号資産管理市場の成長を制限する可能性があります。

- COVID-19の大流行は、従来の投資シナリオを大きく混乱させました。これにより、デジタル暗号通貨市場はますます魅力的になりました。パンデミックは世界の経済危機を引き起こし、暗号はそのハードでデフレ的な性質から、経済の混乱に対抗するための魅力的な選択肢となりました。さらに、この大流行は、クラウドベースの暗号資産管理の需要を促進し、より深いデジタル化への推進を促し、市場成長にプラスの影響を与えました。

暗号資産管理市場の動向

BFSI産業が大きな市場シェアを占める見込み

- 同セグメントにおけるブロックチェーンまたは分散型台帳技術の採用が拡大していることから、BFSI部門による暗号通貨への投資が増加すると予想されます。例えば、分散型決済台帳(ビットコインなど)を確立することで、銀行ソリューションは従来のシステムよりも低い手数料で迅速な決済を促進することができます。

- 近年、モバイルバンキングのようなデジタル化主導のビジネスモデルへの移行に伴い、ブロックチェーン技術の採用が世界中の銀行や金融機関で急速に大きな牽引力となっています。さらに、暗号トランザクションの増加も、銀行セクターにおける資産管理プラットフォームの需要を高めています。例えば、BitInfoChartsのデータによると、ブロックチェーン上の1日当たりのビットコイン取引数は、2021年12月の26万9,390件に対し、2022年9月には28万6,500件に達しています。

- 暗号資産とブロックチェーンに関与する金融機関は世界的に増えています。例えば、2022年9月、時価総額でフランス第3位の銀行であるSociete Generale(GLE)は、暗号通貨に対する投資家の需要増に対応しようとする資産運用会社の顧客向けに新サービスを導入しました。新たに開始されたサービスにより、資産運用会社は欧州の規制に準拠した枠組みの中で、シンプルかつ適応した方法で暗号ファンドを提供できるようになります。このような取り組みや事例は、BFSI産業における暗号資産管理ソリューションの採用を後押しすると予想されます。

- さらに、暗号通貨の人気の高まりは、機関投資家に効果的にサービスを提供するために、銀行セクターにおける暗号資産管理プラットフォームの高い採用につながりました。例えば、2023年2月、資産規模でドイツ第2位のDZ銀行は、デジタル資産会社Metacoと提携し、デジタル通貨を資産管理サービスに完全に統合すると発表しました。同銀行は、デジタル資産会社MetacoのカストディプラットフォームHarmonizeを選択し、機関投資家顧客にデジタル通貨を記載しています。

北米が市場を独占する見込み

- 北米は、米国とカナダがビットコインや暗号通貨を採用していることから、暗号資産管理市場を世界的に支配すると予想されています。さらに、米国は暗号取引とトランザクションの著名な市場の1つであるため、資産管理ソリューションの採用が急速に進んでいます。

- また、北米はエンドユーザー産業におけるブロックチェーンの採用が顕著で、技術的な適応が早いです。さらに、著名な市場ベンダーの存在も市場を大きく牽引しています。先進技術の早期導入とデジタル化は、同地域の暗号資産管理市場の成長を促進すると予想されます。

- さらに、米国ではさまざまなエンドユーザー層で導入が進んでいることから、予測期間中に同国の資産管理プラットフォーム市場を牽引すると期待されています。例えば、2022年10月、米国銀行のBNY Mellonは、デジタル資産カストディプラットフォームが米国で稼動し、一部の顧客はビットコインとイーサーの送金と保有が可能になったと発表しました。このサービスは、信頼できる伝統的デジタル資産サービシングプロバイダーに対する顧客の要望をサポートするというBNY Mellonのコミットメントを強化するものです。

- さらに、米国では暗号通貨やその他のデジタル資産を運用、投資、取引の目的で利用する企業が増えており、資産管理市場のベンダーにとって今後数年間で大きなビジネス機会が生まれている

暗号資産管理産業概要

暗号資産管理市場の競合情勢は、世界中で暗号通貨の導入が進んでいることから、徐々に細分化に向かっていくと予想されます。また、中小規模の世界参入企業が複数出現していることも、市場の成長を後押しすると予想されます。既存の市場参入企業は、市場での存在感を高めるために、新製品の発売やいくつかのイノベーションを行うことが増えています。

2022年10月、暗号に特化した資産運用会社BlockTowerはベンチャーキャピタル部門を立ち上げ、分散型金融(DeFi)とブロックチェーンインフラのプロジェクトを支援するため、新たに1億5,000万米ドルのファンドを設立しました。

2022年5月、個人・機関投資家向け暗号通貨プラットフォームのBlockchain.comは、ジャージー州を拠点とする投資マネージャーのAltis Partnersと共同で、新たな暗号資産管理プラットフォームを立ち上げると発表しました。新しいプラットフォームはBlockchain.com Asset Management(BCAM)と呼ばれ、ファミリーオフィス、機関投資家、富裕層個人向けに規制された投資商品を記載しています。Altis Partnersが投資を管理し、Blockchain.comが暗号取引インフラ、セキュリティ、調査、ソフトウェアサービスを記載しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- エンドユーザー産業全体におけるブロックチェーン技術の採用の増加

- 暗号通貨資産のセキュリティへの注目の高まり

- 送金や取引目的での暗号通貨の採用拡大

- 市場抑制要因

- 一元的な規制枠組みの欠如

- 技術的知識と技術に対する認識の欠如

第6章 市場セグメンテーション

- タイプ別

- ソリューション

- カストディソリューション

- トークン化ソリューション

- 送金ソリューション

- トレーディングソリューション

- サービス

- ソリューション

- 展開モード別

- クラウド

- オンプレミス

- エンドユーザー産業別

- BFSI

- 小売・eコマース

- メディア&エンターテイメント

- その他のエンドユーザー産業(医療、旅行、ホスピタリティ)

- 地域別

- 北米

- 欧州

- アジア太平洋

- その他

第7章 競合情勢

- 企業プロファイル

- BitGo, Inc.

- Coinbase, Inc.

- Gemini Trust Company, LLC

- Cipher Technologies Management LP

- Metaco SA

- Amberdata Inc.

- Paxos Trust Company, LLC

- Crypto Finance Group

- Bakkt

- ICONOMI Limited

第8章 投資分析

第9章 市場機会と今後の動向

The Crypto Asset Management Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 4.68 billion by 2030, at a CAGR of 23.03% during the forecast period (2025-2030).

The evolution of the asset management industry, coupled with increasing investments in crypto funds, is analyzed to influence the crypto asset management market growth in the coming years.

Key Highlights

- Blockchain technology advances have generated significant interest in cryptocurrencies over the past few years. As crypto gains momentum, there is a growing demand for reliable investment options in the crypto market. In addition, emerging blockchain technology has the potential to offer multipurpose business applications across several end-user industries, extending its services across the enormous growth of digital assets. Thus significantly driving the demand for crypto asset management over the forecast period.

- Further, an increasing number of institutional investors and wealth managers started investing in cryptocurrencies, coupled with growth in cryptocurrency adoption by consumers and various end-user institutions such as BFSI and retail. The adoption of a crypto asset management platform will be further fostered during the forecast period by the existing and future developments in cryptocurrencies, digital assets, and blockchain technology.

- Moreover, many asset management platforms utilize AI/ML programs that create portfolios according to the investment goals of the users. They also help to track and manage a large number of assets. Such factors further boost the demand for crypto asset management platforms with the increasing popularity of the crypto industry and new digital assets.

- However, a lack of awareness and technical understanding regarding cryptocurrency coupled with security issues and a stringent regulatory landscape in various countries may limit the growth of the crypto asset management market over the forecast period.

- The COVID-19 pandemic largely disrupted the traditional investment scenario. This further made the digital cryptocurrency space increasingly attractive. The pandemic led to a global economic crisis, which made crypto an attractive option to combat economic disruption due to its hard, deflationary nature. Additionally, the outbreak fostered the demand for cloud-based crypto asset management and pushed the drive toward deeper digitalization, thus positively impacting the market growth.

Crypto Asset Management Market Trends

BFSI Industry Expected to Hold Significant Market Share

- The growing adoption of blockchain or distributed ledger technologies in the sector is expected to increase investment by the BFSI sector in cryptocurrency. For instance, by establishing a decentralized payment ledger (e.g., Bitcoin), banking solutions could facilitate faster payments at lower fees than traditional systems.

- In recent years, the adoption of blockchain technology is rapidly gaining significant traction in banking and institutions across the globe owing to the move towards digitalization-driven business models like mobile banking. Further, the growth in crypto transactions is also enhancing the demand for asset management platforms in the banking sector. For instance, according to the data from BitInfoCharts, the number of Bitcoin transactions per day on blockchain reached 286.5 thousand in September 2022 compared to 269.39 thousand in December 2021.

- More and more financial institutions worldwide are getting involved in crypto assets and blockchain. For instance, in September 2022, Societe Generale (GLE), the third-largest French bank by market cap, introduced new services for asset manager clients looking to respond to the increased demand from investors for cryptocurrencies. The newly launched services will enable asset managers to offer crypto funds in a simple and adapted way within a framework compliant with European regulations. Such initiatives and instances are expected to boost crypto asset management solutions adoption in the BFSI industry.

- Further, the rising popularity of cryptocurrency led to the high adoption of crypto asset management platforms in the banking sector to effectively serve institutional investors. For instance, in February 2023, DZ Bank, Germany's second-largest bank regarding asset size, announced to fully integrate of digital currencies into its asset management services in partnership with the digital asset firm Metaco. The bank selected the digital asset firm Metaco's custody platform Harmonize to provide digital currencies to its institutional clients.

North America Expected to Dominate the Market

- North America is expected to dominate the crypto asset management market globally, owing to the dominance of the United States and Canada in adopting Bitcoin or Cryptocurrencies. In addition, the US is one of the prominent markets for crypto trading and transactions, thus driving the adoption of asset management solutions rapidly.

- Also, North America is an early technological adaptor with significant blockchain adoption in end-user industries. In addition, the presence of prominent market vendors also drives the market at a significant pace. The early adoption of advanced technologies and digitization is expected to fuel the growth of the crypto asset management market in the region.

- Moreover, the growing adoption in various end-user segments across the United States is expected to drive the asset management platform market in the country over the forecast period. For instance, in October 2022, American Bank, BNY Mellon, announced that its Digital Asset Custody Platform is live in the United States, With select clients now able to transfer and hold bitcoin and ether. This offering reinforces BNY Mellon's commitment to supporting its client demand for a trusted traditional and digital asset servicing provider.

- Moreover, an increasing number of businesses in the United States are using cryptocurrencies and other digital assets for a host of operational, investment, and transactional purposes, thus creating significant opportunities for asset management market vendors in the coming years.

Crypto Asset Management Industry Overview

The competitive landscape of the Crypto Asset Management Market is expected to gradually move towards fragmentation, owing to the increasing adoption of cryptocurrency across the globe. Also, the emergence of several small and medium-sized global players is expected to help the market grow. The existing market players are increasingly making new product launches or several innovations to boost their market presence.

In October 2022, Crypto-focused asset-management company BlockTower launched a venture capital arm with a new USD 150 million fund to back decentralized finance (DeFi) and blockchain-infrastructure projects.

In May 2022, Blockchain.com, a cryptocurrency platform for individuals and institutions, announced the launch of a new crypto asset management platform with Altis Partners, a Jersey-based investment Manager. The new platform is called Blockchain.com Asset Management (BCAM) and offers regulated investment products for family offices, institutional investors, and high-net-worth individuals. Altis Partners will manage the investments, and Blockchain.com will provide the crypto trading infrastructure, security, research, and software services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Blockchain Technology Across End-user Industries

- 5.1.2 Increasing Focus on the Security of Cryptocurrency Assets

- 5.1.3 Growing Adoption of Cryptocurrency for Remittances and Trading Purposes

- 5.2 Market Restraints

- 5.2.1 Lack of a Centralized Regulatory Framework

- 5.2.2 Lack of Technical Knowledge and Awareness of the Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions**

- 6.1.1.1 Custody Solutions

- 6.1.1.2 Tokenization Solutions

- 6.1.1.3 Transfer & Remittance Solutions

- 6.1.1.4 Trading Solutions

- 6.1.2 Services

- 6.1.1 Solutions**

- 6.2 By Deployment Mode

- 6.2.1 Cloud

- 6.2.2 On-Premise

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Retail & E-commerce

- 6.3.3 Media & Entertainment

- 6.3.4 Other End-user Industries (Healthcare, Travel & Hospitality)

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BitGo, Inc.

- 7.1.2 Coinbase, Inc.

- 7.1.3 Gemini Trust Company, LLC

- 7.1.4 Cipher Technologies Management LP

- 7.1.5 Metaco SA

- 7.1.6 Amberdata Inc.

- 7.1.7 Paxos Trust Company, LLC

- 7.1.8 Crypto Finance Group

- 7.1.9 Bakkt

- 7.1.10 ICONOMI Limited