|

市場調査レポート

商品コード

1437613

航空用スマート兵器の世界市場:市場シェア分析、産業動向・統計、成長予測(2024年~2029年)Aerial Smart Weapons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空用スマート兵器の世界市場:市場シェア分析、産業動向・統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

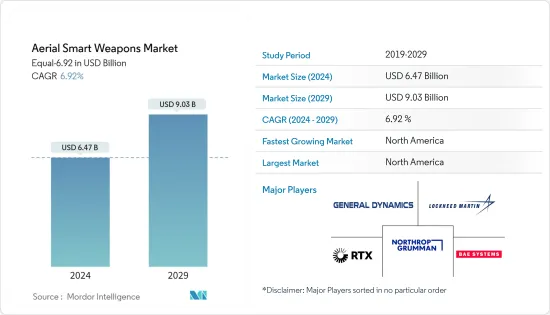

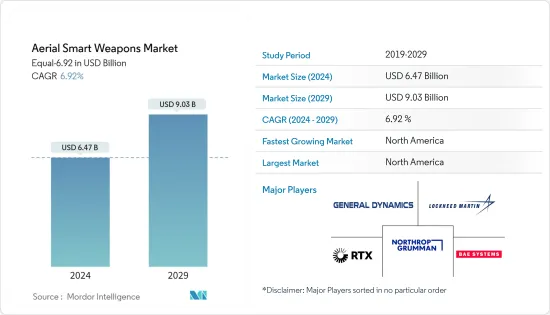

世界の航空用スマート武器の市場規模は、2024年に64億7,000万米ドルと推定され、2029年には90億3,000万米ドルに達し、予測期間中(2024年~2029年)にCAGR6.92%で成長すると予測されています。

航空用スマート兵器市場は、多様なエンドユーザーや地域からの需要の高まりにより、今後数年間で大幅な成長が見込まれています。航空戦の性質の変化と、軍用機用の先進兵器システムの開発と調達に向けた国防支出の増加により、予測期間中に航空用スマート兵器市場が牽引されると予想されます。

企業が先進的で費用対効果の高いスマート兵器システムを提供するために競合する中、市場ではさまざまな革新と発展が起こることが予想されます。エレクトロニクス、材料技術、推進システム、誘導システムの小型化に関する技術の進歩は、予測期間中の航空用スマート兵器システム市場の成長を促進すると予想されます。

調査対象の市場は、政府の規制、輸出規制、倫理上の問題など、市場の成長を制限する可能性のあるいくつかの課題に直面すると予想されます。ただし、市場機会は市場の課題を上回り、航空用スマート兵器市場は予測期間中にプラスに成長すると予測されています。

航空用スマート兵器市場動向

ミサイルセグメントは最高の成長が見込まれる

国防軍からの高度な誘導ミサイルに対する需要の増加により、ミサイルセグメントは予測期間中に最大の市場シェアを占めると予想されます。ミサイル分野の成長を促進する主な要因は、先進国と発展途上国の両方による防衛予算の大幅な増加、先進兵器の使用率の増加、そして世界中の航空戦の変化です。たとえば、2022年の世界の軍事支出は2兆2,400億米ドルに達し、2021年から6%増加しました。

ネットワーク対応兵器、極超音速ミサイル、人工知能ベースの兵器の開発は、軍の作戦を変革すると予想されるミサイルセグメントの最新動向の一部です。さまざまな国が航空兵器システムメーカーと提携して、将来の脅威に対抗するための高度なスマートミサイルを開発しています。例えば、2023年11月、MBDAはアラブ首長国連邦と提携してスマート兵器を共同開発し、初期生産日を2030年とすることを発表しました。この提携は、AI を組み込んだ機能を備えた将来の戦闘に特化したスマート グライダーおよびクルーザー空対地ミサイルを開発するために設立されました。

また、さまざまな国が、進化する脅威に対抗するため、また戦争の性質の変化に対する近代化の取り組みとして、スマート兵器システムを搭載した先進的な軍用ドローンを調達しています。例えば、2023年5月にオランダは、1億700万~2億6,800万米ドルの改造と兵器調達のもと、偵察用無人機MQ-9リーパーにレーザー誘導GBU爆弾と空対地ヘルファイアミサイルを装備し始めると発表しました。武装無人機の初期配備は2025年までに予定されており、完全配備は3年後となります。全体として、このような先進兵器システムの開発と調達注文により、予測期間中にこの部門の成長が加速すると予想されます。

予測期間中に北米が市場を独占すると予測される

米国による市場の大規模開発により、北米は航空用スマート兵器市場で最大の市場シェアを占めると予想されています。たとえば、2022年の米国の軍事防衛支出は8,770億米ドルに増加し、2021年と比較して9%増加しました。技術的に先進的な兵器への投資の増加は、戦場での中国とロシアの能力向上による米国への脅威の増大によるものです。同国は、スマート弾丸から核搭載可能な極超音速誘導兵器に至るまで、先進的なスマート兵器システムの開発と導入のために巨額の資金を投資しています。同国は、今後数年間に調査対象となる市場を牽引すると予想される、いくつかの航空用スマート兵器調達プログラムに参加しています。

たとえば、2023年1月、米国海軍はRTXコーポレーションに対し、海軍のジェット戦闘機やその他の戦闘機用の408発のAIM-9X高精度短距離赤外線誘導空対空ミサイルを開発する3億1,700万米ドルの契約を締結しました。同様に、2023年3月、米国空軍はRTX Corporationに対し、1,500個のStormBreakerスマート兵器を製造および納入する3億2,000万米ドルの契約を締結しました。これは空対地でネットワーク対応の兵器であり、マルチエフェクト弾頭とトライモードシーカーを使用してあらゆる気象条件下で移動目標を攻撃することができます。 ストームブレイカーはF-15Eストライクイーグルに搭載されており、F-35BとF/A-18でテストが進行中です。このような発展は、予測期間中にこの地域の市場の見通しを強化すると予想されます。

航空用スマート兵器業界の概要

航空用スマート兵器市場は半統合化されており、国内外の企業がさまざまな種類のミサイル、弾薬、誘導ロケット弾、誘導発射体を世界中の航空部隊に提供しています。国際的な企業以外にも、いくつかの国営企業が輸出機会も視野に入れながら、それぞれの国向けにスマート兵器の開発と製造を行っています。

市場における著名企業としては、BAE Systems PLC、RTX Corporation、Lockheed Martin Corporation、General Dynamics Corporation、Northrop Grumman Corporationなどがあります。航空戦の性質の変化に伴い、いくつかの国が自国の軍隊向けに次世代の航空用スマート兵器を開発、導入することを計画しています。国産スマート兵器の開発への注目が高まる中、地元メーカーは研究開発投資の増加を通じて市場シェアを拡大する機会を掴むことができ、それが予測期間中の成長につながると思われます。企業は他企業と合弁事業やパートナーシップを確立して技術移転を可能にすることもでき、これによりイノベーションが促進され、予測期間中の高度に洗練された航空用スマート兵器の開発が促進されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 製品

- ミサイル

- 弾薬およびその他の製品

- 技術

- 衛星誘導

- レーダー誘導

- 赤外線誘導

- レーザー誘導

- 地域

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州

- アジア太平洋

- インド

- 中国

- 日本

- 韓国

- その他アジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- イスラエル

- その他中東・アフリカ

- 北米

第6章 競合情勢

- ベンダーの市場シェア

- 企業プロファイル

- BAE Systems PLC

- General Dynamics Corporation

- Lockheed Martin Corporation

- RTX Corporation

- Northrop Grumman Corporation

- MBDA

- Saab AB

- The Boeing Company

- Rafael Advanced Defense Systems Ltd

- Safran SA

- IAI

第7章 市場機会と将来の動向

The Aerial Smart Weapons Market size is estimated at USD 6.47 billion in 2024, and is expected to reach USD 9.03 billion by 2029, growing at a CAGR of 6.92% during the forecast period (2024-2029).

The aerial smart weapons market is expected to witness significant growth in the coming years, owing to the rising demand from diverse end users and regions. The changing nature of aerial warfare and the growth in defense spending toward developing and procuring advanced weapon systems for military aircraft are expected to drive the aerial smart weapons market during the forecast period.

The market is expected to undergo various innovations and developments as the players compete to offer advanced and cost-effective smart weapon systems. Technological advancements, in terms of miniaturization of electronics, material technologies, propulsion, and guidance systems, are expected to aid the growth of the aerial smart weapon systems market during the forecast period.

The market studied is also expected to face some challenges, such as government regulations, export controls, and ethical issues, which may limit the market growth. However, the market opportunities outweigh the market challenges, and the aerial smart weapons market is projected to grow positively during the forecast period.

Aerial Smart Weapons Market Trends

Missile Segment is Expected to Witness Highest Growth

The missile segment is anticipated to occupy the largest market share over the forecast period due to the increasing demand for advanced guided missiles from the defense forces. The key factors driving the growth of the missile segment are significant increases in defense budgets by both developed and developing nations, an increased use rate of advanced weapons, and changing aerial warfare worldwide. For instance, in 2022, the global military expenditure reached USD 2,240 billion, a growth of 6% from 2021.

The development of network-enabled weapons, hypersonic missiles, and artificial intelligence-based weapons are some of the latest trends in the missile segment that are expected to transform armed force operations. Various countries are partnering with aerial weapon system manufacturers to develop advanced smart missiles to counter future threats. For instance, in November 2023, MBDA announced that it partnered with the United Arab Emirates to co-develop smart weapons with an initial production date of 2030. The partnership was established to develop the Smart Glider and Cruiser air-to-ground missiles dedicated to future combat with AI-embedded capabilities.

Various countries are also procuring advanced military drones equipped with smart weapon systems to counter evolving threats and as a modernization effort to the changing nature of warfare. For instance, in May 2023, the Netherlands announced that it would begin arming its reconnaissance MQ-9 Reaper drones with laser-guided GBU bombs and air-to-surface Hellfire missiles under a modification and weapons procurement of USD 107-268 million. The initial deployment of the armed drones is expected by 2025, and the full deployment will be three years later. Overall, such developments and procurement orders of advanced weapons systems are expected to accelerate the growth of this segment during the forecast period.

North America is Projected to Dominate the Market During the Forecast Period

North America is expected to occupy the largest market share in the aerial smart weapons market due to large-scale developments in the market by the United States. For instance, in 2022, the US military defense expenditure rose to USD 877 billion, a growth of 9% compared to 2021. The increased investments toward technologically advanced weaponry are due to the growing threat to the country from the enhanced capabilities of China and Russia on the battlefield. The country is divesting huge amounts for the development and induction of advanced smart weapon systems ranging from smart bullets to nuclear-capable hypersonic-guided weapons. The country has been involved in several aerial smart weapon procurement programs that are expected to drive the market studied in the years to come.

For instance, in January 2023, the US Navy awarded RTX Corporation a USD 317 million contract to develop 408 AIM-9X precision short-range infrared-guided air-to-air missiles for the navy's jet fighters and other combat aircraft. Similarly, in March 2023, the US Air Force awarded RTX Corporation a USD 320 million contract to produce and deliver 1500 StormBreaker smart weapons, which are air-to-surface, network-enabled weapons that can engage moving targets in all weather conditions using its multi-effects warhead and tri-mode seeker. The StormBreaker is fielded on the F-15E Strike Eagle, with testing underway on the F-35B and F/A-18. Such developments are expected to bolster the market prospects in the region during the forecast period.

Aerial Smart Weapons Industry Overview

The aerial smart weapons market is semi-consolidated, with local as well as international players providing various types of missiles, munitions, guided rockets, and guided projectiles for aerial forces across the world. Other than international players, several state-owned companies have been developing and manufacturing smart weapons for their respective countries while also looking at export opportunities.

Some of the prominent players in the market are BAE Systems PLC, RTX Corporation, Lockheed Martin Corporation, General Dynamics Corporation, and Northrop Grumman Corporation. Due to the changing nature of aerial warfare, several nations are planning to develop and induct next-generation aerial smart weapons for their militaries. As the focus is increasing on developing indigenous smart weapons, local manufacturers can grab the opportunity to increase their market share through higher R&D investments, which will help their growth during the forecast period. Players can also establish joint ventures and partnerships with other players to enable technology transfer, which will facilitate innovations and aid the development of highly sophisticated aerial smart weapons during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Missiles

- 5.1.2 Ammunition and Other Products

- 5.2 Technology

- 5.2.1 Satellite Guidance

- 5.2.2 Radar Guidance

- 5.2.3 Infrared Guidance

- 5.2.4 Laser Guidance

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Israel

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BAE Systems PLC

- 6.2.2 General Dynamics Corporation

- 6.2.3 Lockheed Martin Corporation

- 6.2.4 RTX Corporation

- 6.2.5 Northrop Grumman Corporation

- 6.2.6 MBDA

- 6.2.7 Saab AB

- 6.2.8 The Boeing Company

- 6.2.9 Rafael Advanced Defense Systems Ltd

- 6.2.10 Safran SA

- 6.2.11 IAI