|

市場調査レポート

商品コード

1406230

アメリカの航空機エンジン:市場シェア分析、産業動向・統計、成長予測、2024年~2029年America Aircraft Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アメリカの航空機エンジン:市場シェア分析、産業動向・統計、成長予測、2024年~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 80 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

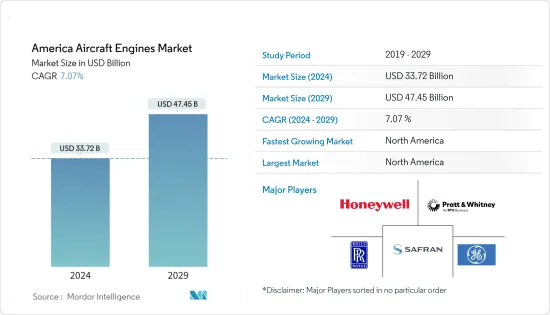

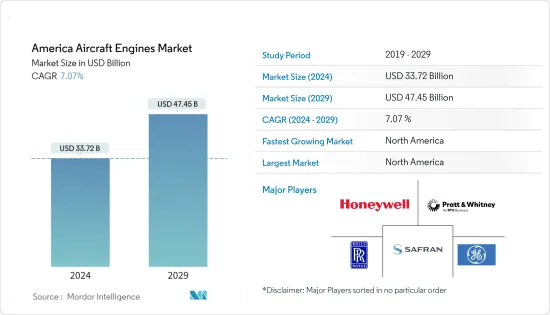

アメリカの航空機エンジン市場規模は2024年に337億2,000万米ドルと推定され、2029年には474億5,000万米ドルに達し、予測期間中(2024-2029年)のCAGRは7.07%で成長すると予測されます。

主なハイライト

- 航空機エンジンの需要は、主に北米とラテンアメリカにおける航空機受注(ビジネスジェット機、商用機、軍用機を含む)の増加と既存航空機のエンジン交換という2つの要因によってもたらされます。連邦航空局(FAA)、国際民間航空機関、国際航空運送協会(IATA)などの規制機関は、航空機からの排出ガスの削減に重点を置いています。

- この焦点は、新世代航空機エンジンの需要を生み出しています。航空機OEMとエンジンメーカーは、性能向上と航続距離延長に向けた取り組みを集中的に統合しています。こうした技術の研究開発への投資が見込まれることから、予測期間中の市場見通しは強化されると予想されます。

- 航空機エンジンのOEM(相手先商標製品製造会社)の製造サイクルは、重要なエンジン部品の製造における3Dプリンティングとセラミックマトリックス複合材の利用の増加により、急速に変化すると予想されます。さらに、ハイブリッド電気ジェットエンジンのような技術の出現は、市場プレイヤーの現在のビジネスチャンスを拡大すると予想されます。

アメリカの航空機エンジン市場動向

ターボファンセグメントが予測期間中に最も高いCAGRで成長する見込み

- ターボファンセグメントが市場の主要シェアを占めており、予測期間中に最も高いCAGRが見込まれます。これは主に、民間、軍事、一般航空部門にわたる主要なターボファン航空機プログラムの受注と納入によるものです。ラテンアメリカと北米地域の軍事近代化計画、および同地域の航空会社の機体拡大計画が、このセグメントの成長を大きく後押ししています。

- 各国は軍事力の強化に努めており、優れた性能、信頼性、汎用性を提供する最先端のタービンエンジンの獲得に多大な資源を割いています。例えば、2023年6月、TEISASとGEエアロスペースは、F16およびF15戦闘機を運用する数カ国にF110のデポレベルメンテナンスサービスを提供するため、TEISASのライセンスを延長することで合意しました。この提携により、TEIと長期的パートナーであるGEエアロスペース社との軍用エンジンサービス分野における関係はさらに強化されることになります。TEIとGEエアロスペースは長年にわたり協力関係を成功させており、現在ではF110エンジンのサポートを世界にサポートする上で重要な役割を果たす態勢を整えています。

- さらに、エンジンに課される厳しい規制とコンプライアンス基準は、他のセグメントにとって独自の参入障壁となります。これらのエンジンは、過酷な条件下でも作動し、並外れたパワーを発揮し、厳格なセキュリティー対策を維持できるよう、非常に厳しい基準を満たさなければなりません。

- このような要件を満たすには、研究開発および製造に多額の投資を行う必要があり、多くの場合、既存のエンジンメーカーだけがこれを行うことができます。このようなターボファンエンジン技術への投資は、予測期間中の同分野の成長を後押しすると予想されます。

北米が引き続き市場シェアを独占

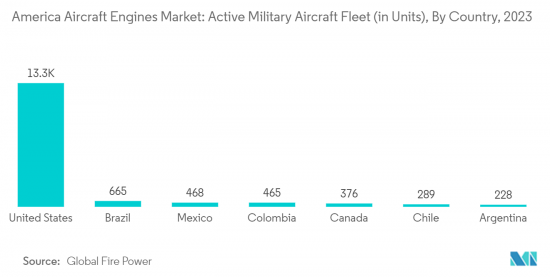

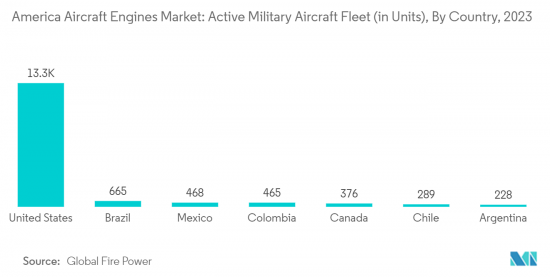

- 北米地域は現在市場を独占しており、予測期間中もその支配が続くと予想されます。これは主に米国とカナダにおける旅客輸送量の増加によるものです。旅客輸送量の増加は、航空会社の機材や路線の拡大計画を後押ししています。さらに、米国の軍事予算が莫大であるため、米軍による新型ヘリコプターの調達が可能になっています。このため、ヘリコプター用エンジンサプライヤーによる新型ヘリコプター用エンジンの生産も促進される可能性があります。

- 米国とカナダにおける軍用ヘリコプターと民間ヘリコプターの需要の増加は、この地域における航空機エンジン市場の成長を加速させると予想されます。例えば、2023年5月には、米国海兵隊の大型ヘリコプターであるSikorsky CH-53K King StallionTMに搭載されるT408エンジンの3つの追加バッチについて、6億8,370万米ドル相当の契約がGE AerospaceとNAVAIRに発注されました。

- これらのエンジンの最終組立はマサチューセッツ州リンのGEエアロスペース施設で行われ、納入は2024年から2027年にかけて行われる予定です。同様に、2023年1月、イエローヘッド・ヘリコプターズとサフラン・ヘリコプター・エンジンは、アリエルのAS350およびH125フリートの動力源としてアリエルをサポートする契約を締結しました。このサポート・バイ・ザ・アワー(SBHツォ)契約により、21基のエンジンをカバーする長期的なメンテナンス、修理、オーバーホール(MRO)およびサービス契約が正式に締結されました。

アメリカの航空機エンジン産業の概要

アメリカの航空機エンジン市場は統合されており、Honeywell International Inc.、General Electric Company、Pratt &Whitney(RTX Corporation)、Rolls-Royce plc、Safranなどの大手企業が市場シェアを独占しています。これらの主要企業は、可用性、品質、価格、技術の面で競争しています。技術的な問題による航空機の着陸、高い製造コスト、エンジン納入の遅れ、関税や輸入関税の変動などが、市場の成長を脅かす主な要因となっています。

ベンダーは、激しい市場競争の中で生き残り成功するために、先進的で高品質のガスタービンエンジンを提供しなければならないです。自社製造能力、世界な拠点網、製品提供、研究開発投資、強力な顧客基盤は、競合他社に対して優位に立つための重要な分野です。世界の経済状況の改善は、予測期間中の市場成長を促進すると予想されるため、新世代の航空機とエンジンを採用する理想的な時期となります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- エンジンタイプ

- ターボファン

- ターボプロップ

- ターボシャフト

- ピストン

- 地域

- 北米

- 米国

- カナダ

- ラテンアメリカ

- メキシコ

- ブラジル

- その他ラテンアメリカ

- 北米

第6章 競合情勢

- 企業プロファイル

- General Electric Company

- Rolls-Royce plc

- Safran

- Pratt & Whitney(RTX Corporation)

- Honeywell International Inc.

- BRP-Rotax GmbH & Co KG

- Textron Systems Corporation

- Continental Aerospace Technologies, Inc.

- Rostec

第7章 市場機会と今後の動向

The America Aircraft Engines Market size is estimated at USD 33.72 billion in 2024, and is expected to reach USD 47.45 billion by 2029, growing at a CAGR of 7.07% during the forecast period (2024-2029).

Key Highlights

- The demand for aircraft engines is primarily driven by two factors: an increase in aircraft orders (including business jets, commercial, or military aircraft) and the replacement of engines within the existing aircraft fleet in North America and Latin America. Regulatory bodies such as the Federal Aviation Administration (FAA), International Civil Aviation Organization, and International Air Transport Association (IATA), among others, are placing a growing emphasis on reducing emissions from aircraft.

- This focus is generating demand for new-generation aircraft engines. Aircraft OEMs and engine manufacturers are intensively integrating efforts to enhance performance and extend aircraft range. Anticipated investments in the research and development of these technologies are expected to bolster market prospects during the forecast period.

- The manufacturing cycle of aircraft engine original equipment manufacturers (OEMs) is expected to transform rapidly due to the increased utilization of 3D printing and ceramic matrix composites in constructing critical engine components. Additionally, the emergence of technologies like hybrid-electric jet engines is anticipated to expand current business opportunities for market players.

America Aircraft Engines Market Trends

Turbofan Segment is Expected to Grow with the Highest CAGR During the Forecast Period

- The turbofan segment accounts for a major share of the market and is expected to witness the highest CAGR during the forecast period. This is majorly due to the orders and deliveries of major turbofan aircraft programs across commercial, military, and general aviation sectors. The military modernization plans in Latin America and North America regions, as well as fleet expansion plans of airlines in the region, are majorly driving the growth of the segment.

- As countries strive to bolster their military capabilities, they allocate substantial resources to acquiring state-of-the-art turbine engines that provide superior performance, reliability, and versatility. For instance, in June 2023, TEISAS and GE Aerospace agreed to extend the license of TEISAS to provide F110 depot-level maintenance services for several countries operating F16 and F15 fighter aircraft. The collaboration will further strengthen the relationship between TEI and its long-term partner, GE Aerospace, in the field of military engine services. TEI and GE Aerospace have successfully collaborated for many years and are now poised to play a critical role in supporting F110 engine support globally.

- Additionally, the stringent regulatory and compliance standards imposed on engines create a unique barrier to entry for other segments. These engines must meet exceptionally rigorous criteria, ensuring they can operate in extreme conditions, deliver exceptional power, and maintain strict security measures.

- Meeting these requirements necessitates substantial investments in research, development, and manufacturing, which often only established engine manufacturers can undertake. Such investments in turbofan engine technology are anticipated to bolster the growth of the segment during the forecast period.

North America to Continue Market Share Domination

- The North American region currently dominates the market and is expected to continue its domination during the forecast period. This is mainly due to increasing passenger traffic in the US and Canada. The increasing passenger traffic is propelling the fleet and route expansion plans of the airlines. Moreover, the huge budgets of the United States toward the military are enabling the procurement of new helicopters by the US military. This may also drive the production of new helicopter engines by the engine suppliers for these helicopters.

- The increasing demand for military helicopters and private helicopter fleets in the United States and Canada is anticipated to accelerate the growth of the aircraft engines market in the region. For instance, in May 2023, a contract worth USD 683.7 million was awarded to GE Aerospace and NAVAIR for three additional batches of T408 engines that will power the Sikorsky CH-53K King StallionTM, the US Marine Corps' heavy-lift helicopter.

- These engines' final assembly will take place at the GE Aerospace Lynn, Massachusetts, facility, and delivery is anticipated to occur between 2024 and 2027. Similarly, in January 2023, Yellowhead Helicopters and Safran Helicopter Engines signed a contract to support Arriel in powering Arriel's AS350 and H125 fleets. A long-term Maintenance, Repair, and Overhaul (MRO) and services agreement covering 21 engines is formalized by this Support-By-the-Hour (SBH®) contract.

America Aircraft Engines Industry Overview

The American aircraft engines market is consolidated, and major players such as Honeywell International Inc., General Electric Company, Pratt & Whitney (RTX Corporation), Rolls-Royce plc, and Safran dominate the market share. These key players compete in terms of availability, quality, price, and technology. Grounding of fleets due to technical issues, high production costs, delays in engine deliveries, and fluctuations in customs and import duties are the key factors posing a threat to the growth of the market.

Vendors must provide advanced and high-quality gas turbine engines to survive and succeed in the intensely competitive market environment. In-house manufacturing capabilities, a global footprint network, product offerings, R&D investments, and a strong client base are the key areas to have the edge over competitors. Improving global economic conditions is expected to fuel market growth during the forecast period, thereby making it an ideal time to adopt new-generation aircraft and engines.

The competitive environment in the market is likely to intensify further due to an increase in product and service extensions, technological innovations, and mergers and acquisitions. For instance, in November 2021, Materialize and Proponent announced a partnership to expand the profile of 3D printing in aerospace aftermarket supply chains.

Proponent offers traditional distribution services to airlines, MROs, Original Equipment Manufacturers, and Innovative Product Portfolios. Through its global coverage, the firm delivers 54 million parts a year to approximately 6,000 aircraft clients in more than 100 countries. These companies offer aftermarket parts, such as engines, airframes, cabin interiors, and cockpits. Similarly, in March 2021, Honeywell was awarded a four-year indefinite delivery indefinite quantity (IDIQ) contract worth USD 476 million to Honeywell for new production and spare T55-GA-714A engines that power the US Army's CH-47 Chinook helicopters.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Engine Type

- 5.1.1 Turbofan

- 5.1.2 Turboprop

- 5.1.3 Turboshaft

- 5.1.4 Piston

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Latin America

- 5.2.2.1 Mexico

- 5.2.2.2 Brazil

- 5.2.2.3 Rest of Latin America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 General Electric Company

- 6.1.2 Rolls-Royce plc

- 6.1.3 Safran

- 6.1.4 Pratt & Whitney (RTX Corporation)

- 6.1.5 Honeywell International Inc.

- 6.1.6 BRP-Rotax GmbH & Co KG

- 6.1.7 Textron Systems Corporation

- 6.1.8 Continental Aerospace Technologies, Inc.

- 6.1.9 Rostec