|

|

市場調査レポート

商品コード

1690182

マネーロンダリング対策ソリューション:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Anti-Money Laundering Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| マネーロンダリング対策ソリューション:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 171 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

マネーロンダリング対策ソリューション市場規模は、2025年に34億3,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは15.06%で、2030年には69億1,000万米ドルに達すると予測されます。

マネーロンダリング対策(AML)とは、犯罪者が違法行為によって収入を得るのを阻止するために設計された一連の法律、規制、手続きを指します。AMLソリューションには、金融機関、マネーサービス事業者、保険会社などの組織がAML規制に準拠するのを支援するために作成されたソフトウェアとサービスが含まれます。

主要ハイライト

- マネーロンダリングやテロ資金供与と闘うという道徳的な要請とは別に、金融機関はAML戦術を利用して、顧客や取引を継続的にモニタリングし、疑わしい行動を報告することを義務付ける規制を遵守し、コンプライアンス違反や過失によって課される可能性のある民事・刑事上の罰則とともに同意命令を回避し、罰金、ITコスト、従業員コスト、リスクエクスポージャーに備えて確保した資本を削減します。

- マネーロンダリング、詐欺、サイバー攻撃、贈収賄、汚職はすべて、COVID-19の流行によって増加しました。多くの組織、特にBFSIセクタの組織は、よりデジタル化された未来へと変化していたため、金融サイバー犯罪のリスクは大きかりました。多くの人々がインターネットプラットフォームに精通していないため、リスクは悪化しています。これらの要因は、サイバー犯罪者が悪用するのに適した雰囲気を生み出し、すでに金融産業に壊滅的な影響を及ぼしています。

- デジタルプラットフォームの多用によりネットワーク上のデータ量が増加し、銀行や金融機関のインフラセキュリティへの負荷が高まっています。銀行はいくつかの予防策を講じているにもかかわらず、ハッカーに攻撃され、莫大な損失を被っています。そのため、マネーロンダリング対策ソリューションへの需要が高まり、市場の成長に影響を与えています。

- マネーロンダリングの巧妙化に伴い、AMLソリューションプロバイダにとって、先進的技術への投資や、疑わしい活動を特定するためのAMLソリューションの使用に関する従業員の教育が課題となっています。常に進化し続けるAMLコンプライアンスの複雑さは、中小企業や新興企業にとって課題となる可能性があります。

- COVID-19以降、マネーロンダリング事件は依然として増加しており、その結果、企業はそれを防止するための戦略的開発に取り組んでいます。主要技術プロバイダやモバイルバンキングソリューション企業は、クロスボーダー決済をモニタリングし、決済プラットフォームにおける金融犯罪やマネーロンダリングを防止するために、クラウドベースのAMLソリューションを導入するために提携しています。

マネーロンダリング対策ソリューション市場の動向

顧客情報(KYC)システムセグメントが大きな成長を遂げる見込み

- 顧客の特定と確認、すなわちKYC(Know Your Customer)プロセスは、金融機関のマネーロンダリング対策(AML)活動にとって不可欠な要素であり、その開発は過去10年間増加の一途をたどっています。KYCプロセスは、金融機関の顧客に対する銀行業務の一部でもあります。KYCプロセスの機能性は顧客満足度に大きく影響するため、その重要性はさらに高まっています。

- 法人や機関投資家の顧客には、複雑な所有形態、異なるビジネスライン、大手銀行内の子会社があります。データの正確性を高め、冗長性を排除するためには、銀行全体で顧客のKYC情報を共有することが不可欠となります。そのため、銀行は業務効率を高めるため、技術や自動化されたKYCソリューションを採用するケースが増えています。例えば、BNP Paribas Bankは、FenergoのCLMとKYC技術をグループ全体で活用するため、One KYCと呼ばれる世界的KYCサービスを開発しました。その結果、標準化された、信頼性の高い、完全な顧客データと文書のリポジトリが作成され、グループ全体のすべての取引先と共有できるようになりました。

- 金融機関にとって顧客の行動をモニタリングすることが必要になるにつれ、KYC検証の必要性は過去10年間で急速に高まってきました。そのため、KYCツールの一部としてスキャンベースのデジタルID検証(IDV)ソリューションなどの先進的ソリューションを採用することは、リアルタイムの本人確認、十分なKYCプロセスの保証、不正行為の可能性の回避に役立つため、市場の新しい動向となっています。

- マネーロンダリング、詐欺、テロ資金供与を防止するため、規制遵守への関心が高まっていることから、KYCシステムに対する需要が高まっています。政府や金融機関は透明性と説明責任を確保するため、厳格なKYC規制を実施しています。

- インド準備銀行によると、2023年度にはインド全土で1万3,000件以上の銀行詐欺事件が記録されました。これは前年比約48%増で、過去10年間の傾向を覆すものでした。

アジア太平洋は大幅な成長が見込まれる

- 中国は、地域の参入企業による技術革新と、地域の金融環境のセキュリティを高めるために政府によって取られたイニシアチブのため、予測期間中にマネーロンダリング対策ソリューション市場で大きな成長を記録すると予想されます。

- 日本では金融取引量が増加し続けているため、取引モニタリングソリューションは今後数年間で大きな需要を生み出すと予想されます。さらに、政府の暗号通貨関連の取り組みが成長を後押しする可能性が高いです。

- インドでは、マネーロンダリング対策案件の増加に対応して、さまざまな金融機関や銀行などがAMLソリューションを導入しています。例えば、最近、BFSIバーティカルへの技術ソリューションプロバイダであるIDBI Intech Ltd(Intech)は、インドの主要保険会社の1つであるLife Insurance Corporation of India(LIC)にi-AML(マネーロンダリング対策)ソリューションを導入しました。このソリューションは、先進的分析、ワークフロー、人工知能を活用し、事前に構築されたルールとシナリオの包括的なセットで、取引と顧客レベルでのリスクとコンプライアンスの企業全体のビューを記載しています。

- 企業における金融犯罪に対する意識の高まりと、金融詐欺に対する金融機関の警戒責任に伴い、東南アジアの対象国の政府が課す規制は、市場の調査をさらに促進すると予想されます。

- マネーロンダリング対策ソリューション市場は、金融機関や企業が規制を遵守し、マネーロンダリング行為と戦う必要性が高まっているため、大幅な成長を観察しています。市場は、技術の進歩、金融犯罪の増加、世界の規制枠組みの厳格化によって牽引されています。

マネーロンダリング対策ソリューション産業概要

マネーロンダリング対策ソリューション市場は細分化されており、SAS Institute Inc.、NICE Actimize(Nice Ltd)、Experian Information Solutions Inc.(Experian Ltd)、Symphony Innovation LLC、Fair Isaac Corporation(FICO)などの大手企業が存在します。同市場の参入企業は、製品提供を強化し、サステイナブル競争優位性を獲得するために、提携や買収などの戦略を採用しています。

- 2023年7月、金融ソリューションプロバイダであるProfileは、Allica Bankとの契約期間を延長しました。Allica Bankは最近、25億3,000万米ドルの預金残高と12億6,000万米ドルを超える貸出残高をプラットフォーム上で達成し、2022年に黒字化を達成する英国の主要フィンテックのひとつとなりました。

- 2023年6月、Google Cloudがマネーロンダリング対策AI(AML AI)を発表。人工知能(AI)を活用した製品で、世界の金融機関のマネーロンダリング検知を支援します。Google CloudのAML AIは、機械学習(ML)により生成された統合的な顧客リスクスコアを記載しています。同製品は正確な結果を提供できるため、プログラム全体の有効性が高まり、業務効率が向上

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

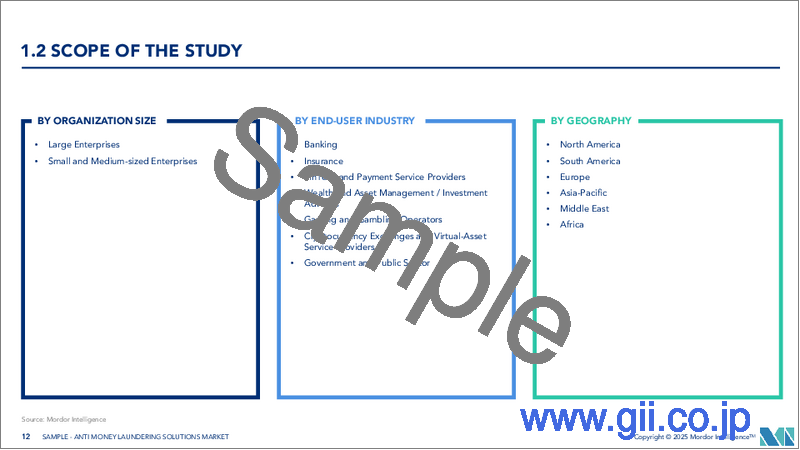

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19パンデミックがマネーロンダリング対策市場に与える影響の詳細評価

第5章 市場力学

- 市場の促進要因

- デジタル/モバイル決済ソリューションの採用拡大

- コンプライアンス管理に対する政府の厳しい規制

- 市場抑制要因

- 熟練した専門家の不足

第6章 市場セグメンテーション

- ソリューション別

- 顧客情報(KYC)システム

- コンプライアンス・レポーティング

- 取引モニタリング

- 監査とレポーティング

- その他のソリューション

- タイプ別

- ソフトウェア

- サービス別

- 展開モデル別

- オンクラウド

- オンプレミス

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 東南アジア

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- SAS Institute Inc.

- NICE Actimize(Nice Ltd)

- Experian Information Solutions Inc.(Experian Ltd)

- Symphony Innovation LLC

- Fair Isaac Corporation(FICO)

- ACI Worldwide Inc.

- Fiserv Inc.

- Oracle Corporation

- Tata Consultancy Services Limited

- Refinitiv Ltd

- Ltimindtree Limited

- Profile Systems & Software SA

- Temenos

- Fidelity National Information Services Inc.(FIS)

- Wolters Kluwer NV

- Intellect Design Arena

第8章 投資分析

第9章 将来展望

The Anti-Money Laundering Solutions Market size is estimated at USD 3.43 billion in 2025, and is expected to reach USD 6.91 billion by 2030, at a CAGR of 15.06% during the forecast period (2025-2030).

Anti-money laundering (AML) refers to a set of laws, regulations, and procedures designed to stop criminals from making income through illegal actions. AML solutions encompass software and services created to help organizations such as financial institutions, money-service businesses, and insurance companies comply with AML regulations.

Key Highlights

- Apart from the moral imperative to fight money laundering and terrorist financing, financial institutions also use AML tactics to comply with regulations that require them to monitor customers and transactions continually and report suspicious activity to avoid consent orders along with civil and criminal penalties that could be levied due to non-compliance or negligence, and for reduction of fines, IT and employee costs, and capital reserved for risk exposure.

- Money laundering, fraud, cyberattacks, bribery, and corruption all increased due to the COVID-19 pandemic. Since many organizations, particularly those in the BFSI sector, were transforming to a more digital future, the risk of financial cybercrime was significant. The risk is worsened because of most people's lack of familiarity with internet platforms. These factors generate an atmosphere suitable for cybercriminals to exploit, and they already had a devastating impact on the financial industry.

- The increasing amount of data on networks due to the high usage of digital platforms has increased the load on the infrastructure security of banks and financial institutes. Banks are being attacked by hackers despite taking several precautions, resulting in huge losses. Hence, the demand for anti-money laundering solutions is increasing, impacting the market's growth.

- With the increasing sophistication of money launderers, it becomes challenging for AML solution providers to invest in advanced technology and train their employees on using AML solutions to identify suspicious activities. The complexity of constantly evolving AML compliance could be challenging for small and emerging businesses.

- Post-COVID-19, money laundering cases are still growing, and as a result, companies are getting involved in strategic developments to prevent them. Key technology providers and mobile banking solution companies are partnering to implement a cloud-based AML solution to monitor cross-border payments and prevent financial crimes and money laundering on payment platforms.

Anti-Money Laundering Solutions Market Trends

The Know Your Customer (KYC) Systems Segment is Expected to Witness Major Growth

- Identification and verification of customers or knowing your customer (KYC) process is a vital part of financial institutions' anti-money laundering (AML) activities, the development of which has been on the rise for the past decade. The KYC process is also a part of banking operations for financial institutions' customers. The functionality of the KYC process significantly impacts customer satisfaction, further increasing its importance.

- Corporate and institutional clients have complicated ownership arrangements, different business lines, and subsidiaries within large banking institutions. To increase data accuracy and eliminate redundancy, it becomes essential for them to share clients' KYC information across the bank. Thus, banks increasingly embrace technology and automated KYC solutions to enhance operational efficiency. For instance, in order to leverage Fenergo's CLM and KYC technologies across the group, BNP Paribas Bank developed a global KYC service called One KYC. This resulted in the creation of a repository for standardized, reliable, and fully know your customer data and documents that could be shared with all its business clients across the group.

- As monitoring customer activities becomes necessary for financial institutions, the need for KYC verification has increased rapidly during the last decade. Thus, adopting advanced solutions such as scan-based digital identity verification (IDV) solutions as a part of KYC tools has become a new trend in the market, as it helps in real-time identification, assuring sufficient KYC processes and avoiding possible fraud activities.

- The demand for KYC systems is growing due to increased focus on regulatory compliance to prevent money laundering, fraud, and terrorist financing. The government and financial institutions are enforcing stringent KYC regulations to ensure transparency and accountability.

- According to the Reserve Bank of India, in FY2023, more than 13 thousand bank fraud cases were recorded across India. This was an increase compared to the previous year by about 48% and turned around the trend of the last decade.

Asia-Pacific is Expected to Witness Significant Growth

- China is anticipated to register significant growth in the anti-money laundering solutions market during the projected period due to innovations by the regional players and initiatives taken by the government to heighten the security of the regional financial landscape.

- Transaction monitoring solutions are expected to create considerable demand in Japan in the coming years as the volume of financial transactions continues to increase. Further, the government's cryptocurrency-related initiatives are likely to boost growth.

- Various financial institutions, banks, and other organizations are implementing AML solutions in response to rising anti-money laundering cases in India. For instance, recently, IDBI Intech Ltd, (Intech) a technology solutions provider to the BFSI verticals, implemented an i-AML (Anti Money Laundering) solution at one of the key insurance players of India, the Life Insurance Corporation of India (LIC). This solution provides an enterprise-wide view of risk and compliance at the transactions and customer level, harnessing advanced analytics, workflow, and artificial intelligence with a comprehensive set of pre-built rules and scenarios.

- With the rising awareness of financial crimes among businesses and the responsibility of financial institutions to be vigilant against financial frauds, the regulations imposed by the governments of countries covered under Southeast Asia are expected to further drive the market studied.

- The anti-money laundering solutions market is observing substantial growth due to the rising need for financial institutions and businesses to comply with regulations and combat money laundering activities. The market was being driven by technological advancements, the rise in financial crimes, and stricter regulatory frameworks globally.

Anti-Money Laundering Solutions Industry Overview

The anti money laundering solutions market is fragmented, with the presence of major players like SAS Institute Inc., NICE Actimize (Nice Ltd), Experian Information Solutions Inc. (Experian Ltd), Symphony Innovation LLC, and Fair Isaac Corporation (FICO). Players in the market are adopting strategies, such as partnerships and acquisitions, to enhance their product offerings and gain sustainable competitive advantage.

- July 2023: Profile, a financial solutions provider, extended the term of its contract with Allica Bank, which has been based on a strong relationship and fruitful collaboration between the two parties. Allica Bank recently exceeded ~USD 2.53 billion in deposits alongside more than ~USD 1.26 billion in lending on the platform, becoming one of the major UK fintechs to achieve profitability in 2022.

- June 2023: Google Cloud launched its anti-money laundering AI (AML AI), an artificial intelligence (AI)-powered product to help global financial institutions detect money laundering. Google Cloud's AML AI provides a consolidated machine learning (ML)-generated customer risk score. The product can deliver accurate results, which increases overall program effectiveness and improves operational efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Detailed Assessment of the Impact of the COVID-19 Pandemic on the Anti Money Laundering Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Digital/Mobile Payment Solutions

- 5.1.2 Stringent Government Regulations for Compliance Management

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals

6 MARKET SEGMENTATION

- 6.1 By Solutions

- 6.1.1 Know Your Customer (KYC) Systems

- 6.1.2 Compliance Reporting

- 6.1.3 Transaction Monitoring

- 6.1.4 Auditing and Reporting

- 6.1.5 Other Solutions

- 6.2 By Type

- 6.2.1 Software

- 6.2.2 Services

- 6.3 By Deployment Model

- 6.3.1 On-cloud

- 6.3.2 On-premise

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Southeast Asia

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAS Institute Inc.

- 7.1.2 NICE Actimize (Nice Ltd)

- 7.1.3 Experian Information Solutions Inc. (Experian Ltd)

- 7.1.4 Symphony Innovation LLC

- 7.1.5 Fair Isaac Corporation (FICO)

- 7.1.6 ACI Worldwide Inc.

- 7.1.7 Fiserv Inc.

- 7.1.8 Oracle Corporation

- 7.1.9 Tata Consultancy Services Limited

- 7.1.10 Refinitiv Ltd

- 7.1.11 Ltimindtree Limited

- 7.1.12 Profile Systems & Software SA

- 7.1.13 Temenos

- 7.1.14 Fidelity National Information Services Inc. (FIS)

- 7.1.15 Wolters Kluwer NV

- 7.1.16 Intellect Design Arena