|

市場調査レポート

商品コード

1643235

エンタープライズWLAN-市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Enterprise WLAN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| エンタープライズWLAN-市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

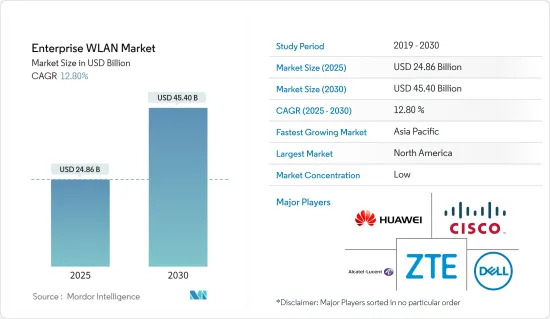

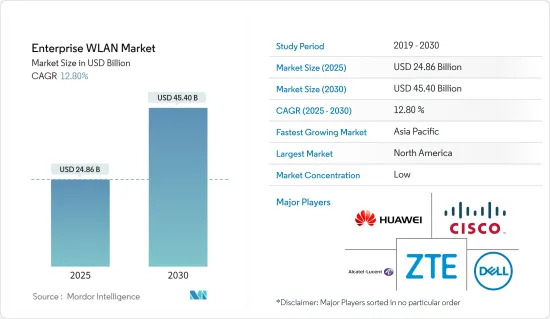

エンタープライズWLAN市場規模は、2025年に248億6,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは12.8%で、2030年には454億米ドルに達すると予測されています。

エンタープライズWLAN市場は急成長を続けており、世界中の組織のネットワークとデジタルトランスフォーメーションの目標における無線技術の重要性が強調されています。

主要ハイライト

- エンタープライズWLAN市場の成長は、職場で増加する接続デバイスをサポートできる、信頼性が高く、高速で安全な無線ネットワークに対する需要の高まりに起因しています。

- 多くの組織がアプリケーションやデータをクラウドに移行しているため、増加するトラフィックや帯域幅の需要に対応できる堅牢な無線ネットワークの要件が高まっています。また、無線ネットワークに接続されるデバイスの数が増加するにつれて、企業のWLANソリューションが提供する先進的セキュリティ機能を使用して保護できるセキュリティ侵害のリスクも増加します。

- ネットワークインフラの継続的な成長、高速インターネット需要の増加、802.11axとしても知られるWIFI6という新しい無線規格の採用は、市場にプラスの影響を与えると予想されます。また、規格が定期的に更新されることで、最大速度やトランスミッション能力といったネットワークのスループットが向上

- 中小企業向けのエンタープライズWLANの展開と維持に関連する高コストは、エンタープライズWLAN市場の成長にとって難題です。

- COVID-19はエンタープライズWLANの使用と展開に影響を与えました。パンデミックは、リモートワークをサポートし、より高い柔軟性と拡大性を提供するエンタープライズWLANソリューションの採用を加速させました。また、WLANのセキュリティと、変化するトラフィックパターンに適応できる組織の必要性も浮き彫りになりました。しかし、パンデミックはWLAN導入プロジェクトの遅延と課題も引き起こし、WLANの採用と利用に長期的な影響を与えました。

エンタープライズWLAN市場の動向

データトラフィックの増加と高速データ接続の需要が市場の成長を促進

- クラウドベースのアプリケーションの導入が進むにつれ、データトラフィックの需要が大幅に増加しています。より多くの企業がアプリケーションをクラウドに移行するにつれ、業務を円滑に進めるために信頼性の高い高速インターネット接続が必要となります。エンタープライズWLANソリューションは、高速データ伝送・レートを提供することでこの接続性を実現し、迅速かつ効率的なデータ転送を可能にします。

- より多くの企業が業務にデジタル技術を採用するにつれて、ビジネスインターネットデータトラフィックは増加しています。2022年、米国のビジネスインターネットデータトラフィックは、2021年の1,417億3,000万ギガバイトから1,782億1,000万ギガバイトに達しました。

- また、企業ネットワークに接続されるデバイス数の増加により、高速データに対する需要は近年大幅に増加しています。従業員は現在、会社のデータやアプリケーションにアクセスするために複数のデバイスを使用しているため、エンタープライズWLANソリューションで実現できる堅牢かつ高速なデータ伝送機能が必要とされています。

- さらに、企業内モビリティの中で、デジタルでワイヤレスな職場作りを重視する傾向が強まっていることも、市場成長の主要促進要因となっています。また、BYODやデジタルトランスフォーメーションの動向の高まりにより、企業はより広範なエンタープライズキャンパスを検討するようになっており、これが来年の市場の成長を後押しすることになると考えられます。

- 需要の増加により、複数のメディア企業や通信企業が高速データサービスに投資しています。例えば、2022年12月、ソーシャルメディア大手のMetaとBharti Airtelは、顧客と企業の新たな要件をサポートするために、インドにおける高速データとデジタルサービスの需要増に対応するための通信インフラに投資するために協力しました。

北米が最大の市場シェアを占める見込み

- 北米はスマートフォン、タブレット、ノートパソコンなどのモバイル機器の普及率が高く、無線接続に対する需要が高まっています。このため、企業は信頼性の高い高速無線接続を従業員や顧客に提供しようとしており、エンタープライズWLAN市場の成長を牽引しています。また、インターネット普及率が高く、人口の大部分がインターネットにアクセスできることから、無線接続に対する需要が高まり、市場の成長を支えています。

- スマートフォンの継続的な消費の増加により、この地域の組織はBYODを大規模に導入しています。これはビル内オフィスプロバイダーにとって潜在的な機会となり、予測期間中の市場の成長を後押しします。

- 北米では5Gの導入が拡大しており、ネットワーク容量の増加、速度の向上、信頼性の向上、セキュリティの強化、IoT機能の向上により、エンタープライズWLAN市場の成長を後押ししています。このことは、エンタープライズWLANベンダーに新たな機会を創出し、その製品やサービスに対する需要を促進しています。

- CTIAの2022年ワイヤレス産業年次調査によると、米国のワイヤレス産業は2021年にネットワークの成長、改善、運用に約350億米ドルを投資しました。この投資は、3億1,500万人以上の米国人をカバーする5Gネットワークという比類ない成果をもたらしています。また、この調査では、無線設備投資が5Gの展開を加速させているとしています。

- さらに、北米ではクラウドコンピューティングの採用が急増しています。企業はクラウドベースのアプリケーションやサービスに依存しており、信頼性の高い高速ワイヤレス接続が必要なため、クラウドベースのアプリケーションをサポートするWLANソリューションの需要が高まっている

エンタープライズWLAN産業概要

エンタープライズWLAN市場は競争が激しく、複数の大手企業で構成されています。市場シェアでは、現在、少数の大手企業が市場を独占しています。市場で突出したシェアを持つこれらの大手企業は、世界の顧客基盤の拡大に注力しています。

Huaweiは2023年9月、高品質な接続を構築するために、Huaweiのゼロ・ローミング分散型Wi-Fiソリューション、Huaweiの高品質簡易データセンター・ネットワークソリューション、経済発展に不可欠な中小企業が多数存在するため、高品質中小企業オフィスなど、新興国市場向けの3つの製品ポートフォリオを発表しました。Huaweiは、パートナーがより多くの顧客を獲得し、商業市場で成功できるよう、より市場性の高い製品とポートフォリオを開発します。

2022年10月、IO by HFCLはWi-Fi 7エンタープライズグレードWi-Fiアクセスポイントを発表し、インドのモバイルコングレスで2つの新しいデバイス(屋内版と屋外版)を公開しました。この新しいアクセスポイントは、オープンソースネットワーキング向けに設計され、OpenWiFiに対応し、QualcommのNetworking Proプラットフォームを搭載しています。

2022年8月、クラウドネットワーキングのリーダーの1つであるExtreme Networks Inc.は、Extreme AP5050を発表しました。これは、屋外会場、コンベンションセンター、病院や大学のキャンパス、大規模スタジアムなどへの設置に最適化された、産業初の屋外Wi-Fi 6Eアクセスポイント(AP)です。ワイヤレス体験の向上、通信速度の高速化、干渉の低減を実現します。大規模な屋外会場では、旧世代のWi-Fiと比較して最大3倍の周波数帯での運用が可能になります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の産業への影響評価

第5章 市場力学

- 市場促進要因

- BYODの急速な普及

- データトラフィックの増加と高速データ接続への需要

- 市場抑制要因

- エンタープライズWLAN技術の標準化の欠如

第6章 市場セグメンテーション

- コンポーネント別

- ハードウェア別

- アクセスポイント

- WLANコントローラ

- ワイヤレスホットスポットゲートウェイ

- ソフトウェア別

- WLANセキュリティ

- WLAN管理

- WLAN分析

- その他のソフトウェア

- サービス別

- プロフェッショナルサービス

- ハードウェア別

- 組織規模別

- 大企業

- 中小企業

- エンドユーザー産業別

- 銀行、金融サービス、保険

- 医療

- 小売

- IT・通信

- その他産業別

- 地域

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Cisco Systems Inc.

- Juniper Networks Inc.

- Huawei Technologies Co. Ltd.

- Alcatel Lucent Enterprises(ALE International)

- Aruba Networks(Hewlett Packard Enterprise Development LP)

- Ruckus Wireless, Inc.

- Aerohive Networks Ltd.

- Dell Inc.

- Extreme Networks Inc.

- ZTE Corporation

- Fortinet Inc.

第8章 投資分析

第9章 市場の将来

The Enterprise WLAN Market size is estimated at USD 24.86 billion in 2025, and is expected to reach USD 45.40 billion by 2030, at a CAGR of 12.8% during the forecast period (2025-2030).

The Enterprise WLAN market continues to grow rapidly, emphasizing the importance of wireless technology in the network and digital transformation goals of organizations across the globe.

Key Highlights

- The growth of the Enterprise WLAN market is attributed to the increasing demand for reliable, high-speed, and secure wireless networks that can support the growing number of connected devices in the workplace.

- As many organizations are moving their applications and data to the cloud, the requirement for a robust wireless network that can handle the increased traffic and bandwidth demands is increased. Also, as the number of devices connected to a wireless network increases, so does the risk of security breaches that can be protected using advanced security features provided by Enterprises' WLAN solutions.

- The continuous growth of network infrastructure, increased demand for high-speed internet, and introduction of new wireless standards named WIFI6, also known as 802.11ax, is expected to impact the market positively. Also, regularly updating standards improves network throughput in terms of maximum speeds and transmission capabilities.

- The high cost associated with the deployment and maintaining Enterprise WLAN for small and medium-sized businesses is challenging for the growth of the Enterprise WLAN market.

- COVID-19 impacted Enterprise WLAN usage and deployment. The pandemic accelerated the adoption of enterprise WLAN solutions that support remote work and provide greater flexibility and scalability. It also highlighted WLAN security and the need for organizations to be able to adapt to changing traffic patterns. However, the pandemic also caused delays and challenges for WLAN deployment projects, which long-term impacted WLAN adoption and usage.

Enterprise WLAN Market Trends

Increasing Data Traffic and Demand for High Speed Data Connectivity to Drive the Growth of the Market

- With the growing adoption of cloud-based applications, the demand for data traffic has increased tremendously. As more and more businesses move their applications to the cloud, they require reliable and fast internet connectivity to ensure their operation runs smoothly. Enterprise WLAN solutions provide this connectivity by offering high-speed data transmission rates, which allow businesses to transfer data quickly and efficiently.

- Business internet data traffic is growing as more businesses adopt digital technologies in their operations. In 2022, the business internet data traffic in the United States reached 178.21 billion gigabytes from 141.73 billion gigabytes in 2021.

- In addition, the demand for high-speed data has increased substantially in recent years due to the growing number of devices connected to enterprise networks. Employees now use multiple devices to access company data and applications, which requires robust and high-speed data transmission capabilities that can be achieved with enterprise WLAN solutions.

- Moreover, the increased emphasis of organizations on creating a digital and wireless workplace within premise mobility has become a major driving factor for the market's growth. Also, the increasing trend of BYOD and digital transformation is making enterprises consider broader enterprise campuses, which will fuel the market's growth in the coming year.

- Due to increased demand, several media and telecom companies are investing in high-speed data services. For instance, in December 2022, Social media giant Meta and Bharti Airtel collaborated to invest in telecom infrastructure to cater to the rising demand for high-speed data and digital services in India to support the emerging requirements of customers and enterprises.

North America is Expected to Hold the Largest Market Share

- North America has a high adoption rate of mobile devices such as smartphones, tablets, and laptops, which has led to an increased demand for wireless connectivity. This has driven the growth of the enterprise WLAN market as businesses seek to provide reliable, high-speed wireless connectivity to their employees and customers. Also, the high level of internet penetration, with a large percentage of the population having access to the internet, led to higher demand for wireless connectivity, supporting the market's growth.

- The continuously increasing consumption of smartphones has led organizations in the region to adopt BYOD on a large scale; therefore, good coverage inside office spaces becomes essential. This represents a potential opportunity for the in-building office providers, fueling the market's growth over the forecast period.

- The growing deployment of 5G in North America is helping to drive the growth of the Enterprise WLAN market by providing increased network capacity, faster speed, improved reliability, enhanced security, and improved IoT capabilities. This creates new opportunities for Enterprise WLAN vendors and drives demand for their products and services.

- According to CTIA's 2022 Annual Wireless Industry Survey, The United States wireless industry invested nearly USD 35 billion to grow, improve and run their networks in 2021. This investment drives unparalleled results of 5G networks covering over 315 million Americans. Also, the survey states that wireless capital investment is speeding up 5G deployment.

- Moreover, the growing adoption of cloud computing in North America is increasing rapidly. Businesses rely on cloud-based applications and services, which need reliable and high-speed wireless connectivity, leading to increased demand for WLAN solutions to support cloud-based applications.

Enterprise WLAN Industry Overview

The enterprise WLAN market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base worldwide.

In September 2023 - Huawei announced to launch of three Product Portfolios for the Commercial Market to Build High-Quality Connections, including Huawei Zero-Roaming Distributed Wi-Fi solution, Huawei High-Quality Simplified Data Center Network Solution, High-Quality SME Office as there are a large number of SMEs, which are critical to economic development. Huawei will develop more marketable products and portfolios to help partners win more customers and succeed in the commercial market.

In October 2022, IO by HFCL launched the Wi-Fi 7 enterprise-grade Wi-Fi access points revealing the two new devices (indoor and outdoor versions) at the India Mobile Congress. The new access points are designed for open-source networking, are OpenWiFi-ready, and are powered by Qualcomm's Networking Pro platform.

In August 2022, Extreme Networks Inc., one of the leaders in cloud networking, introduced the Extreme AP5050: the industry's first outdoor Wi-Fi 6E Outdoor Access Point (AP) optimized for installation at outdoor venues, convention centers, hospital and university campuses, and large stadiums, among others. It delivers enhanced wireless experiences, faster speeds, and reduced interference. It enables large outdoor venues to operate across up to three times as much spectrum as previous generations of Wi-Fi.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of BYOD

- 5.1.2 Increasing Data Traffic and Demand for High Speed Data Connectivity

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization in Enterprise WLAN Technology

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 By Hardware

- 6.1.1.1 Access points

- 6.1.1.2 WLAN Controllers

- 6.1.1.3 Wireless Hotspot Gateways

- 6.1.2 By Software

- 6.1.2.1 WLAN Security

- 6.1.2.2 WLAN Management

- 6.1.2.3 WLAN Analytics

- 6.1.2.4 Other Softwares

- 6.1.3 By Services

- 6.1.3.1 Professional Services

- 6.1.1 By Hardware

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium-Sized Enterprises

- 6.3 By End-user Verticals

- 6.3.1 Banking, Financial Services and Insurance

- 6.3.2 Healthcare

- 6.3.3 Retail

- 6.3.4 IT and Telecommunications

- 6.3.5 Other End-user Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Juniper Networks Inc.

- 7.1.3 Huawei Technologies Co. Ltd.

- 7.1.4 Alcatel Lucent Enterprises (ALE International)

- 7.1.5 Aruba Networks (Hewlett Packard Enterprise Development LP)

- 7.1.6 Ruckus Wireless, Inc.

- 7.1.7 Aerohive Networks Ltd.

- 7.1.8 Dell Inc.

- 7.1.9 Extreme Networks Inc.

- 7.1.10 ZTE Corporation

- 7.1.11 Fortinet Inc.