|

|

市場調査レポート

商品コード

1643150

教育分野におけるバーチャルリアリティ(VR)-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Virtual Reality (VR) in Education - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 教育分野におけるバーチャルリアリティ(VR)-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

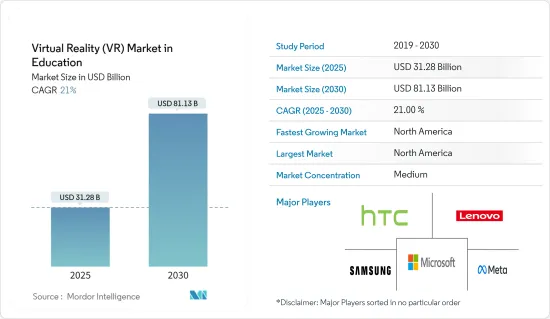

教育産業におけるバーチャルリアリティ市場は、2025年の312億8,000万米ドルから2030年には811億3,000万米ドルに成長し、予測期間中(2025~2030年)のCAGRは21%になると予測されています。

VR技術はここ数年で広く認知され、採用されるようになりました。このセグメントにおける最近の技術的進歩により、先進的な学習体験のために主要な大学、カレッジ、学校の間で新たな企業と採用が明らかになりました。さらに、この市場は今後数年間で、企業向け学習プログラムに対する企業からの大きな需要を獲得すると予想されます。

主要ハイライト

- バーチャルリアリティは、ここ数年、教育の世界で大きな支持を得ています。学習者は、現実を模倣した仮想世界に入り込むことで、複雑な主題を学習することができ、そこでは移動、会話、意思決定、周囲の世界との相互作用が可能です。このような事例が、教育におけるバーチャルリアリティの需要の高まりにつながりました。

- 教育機関は、遠足、実験室での実験、グループ活動、プロジェクトなどを通して実践的な学習を取り入れるようになりました。教育におけるバーチャルリアリティの採用は、学習をまったく新しい次元に引き上げました。バーチャルリアリティによる没入型学習は、知識を広げる効果的なツールであることが証明されています。バーチャルリアリティは、従来の学校環境では学習者がほとんどアクセスできないような、現実の体験を反映したデジタル的に作成された情報や状況を記載しています。

- 多くの企業が、教科書教材にゲーム要素を加えることで、VR技術を通じて学習をインタラクティブで魅力的なものにしています。例えば、CuriscopeのVirtuali-teeは、人体について学べるTシャツとアプリです。一人がTシャツを着用し、もう一人がスマートフォンのバーチャルリアリティアプリを使って、体内のさまざまな層をバーチャルに明らかにして探索します。

- さらに、VRは生物学の分野でも幅広く応用されており、世界中の大学やカレッジが没入型学習のためにバーチャルリアリティヘッドセットを使用しています。例えば昨年、アリゾナ州立大学の学生たちは、ユニークなバーチャルリアリティ体験の中で生物学を学んでいた。宇宙空間を疾走し、小さな都市ほどの大きさの銀河系野生生物保護区の生物たちと触れ合い、動物たちが死んでいく理由の謎を解き明かすのです。

- COVID-19の封鎖期間中、AR、VR、MRのような技術は、これらの没入型プラットフォームを使って人々が買い物をしたり、話をしたり、社交したりすることを可能にし、大きな需要を目の当たりにしました。COVID-19のパンデミックは、学習者や若い学生を教室から遠隔教育のバーチャルな世界に移動させました。現在、多くの大学や学校が、学習困難や障害のある生徒を支援する意味でも、また学習が場所に依存しないようにする意味でも、教育へのアクセスを改善するためにバーチャルリアリティ技術を活用しています。

教育分野におけるバーチャルリアリティ(VR)市場動向

インタラクティブでパーソナライズされた学習体験への需要の高まり

- オンライン教育の採用が増加し、柔軟なスケジュール、より個人的な説明責任、機動性、生徒中心の学習など、仮想学習環境の利点が市場の成長を促進しています。VRは、物理的な紙の模型、ポスター、教科書、印刷された手動に取って代わることができます。より安価で持ち運び可能な教材を提供し、教育をより身近で機動的なものにします。

- 過去数年間で、VRの導入コストは急落し、この技術はフォーチュン500に入るような企業でより一般的に使用されるようになり、小売、物流、カスタマーサービスで働く従業員がVRヘッドセットを使って練習し、より良い仕事ができるようになっています。

- 世界中の様々な企業がVR技術を利用して従業員に個別学習体験を提供しており、市場の成長を牽引しています。例えば米国では、WalmartがSTRIVR技術を使って従業員のスキルアップを図っており、Visa、Bank of America、BMW、Google、ABCなどの企業でも採用されています。トレーニングシミュレータは、従業員を現実的な環境に置き、職場のさまざまな状況に対処する能力をテストします。

- 幼稚園から高校までの学習では、バーチャルリアリティと拡張現実が、教師が生徒をコンテンツに引き込み、知識の定着を支援するのに役立っています。ウェブベースのポータルを使うことで、教師はヘッドセットを制御・管理し、授業を計画し、生徒の進歩をモニターすることができます。教師は生徒のヘッドセットに興味のあるポイントを設定し、レッスンの特定の部分に誘導したり、各生徒が見ているものサムネイル画像を見ることができます。

さらに、VRシステムの価格が下がり、より多くの人がこの新技術に興味を持つようになれば、教育セグメントでの採用が進むと予想されます。例えば、Perkins CoieとXR Associationが160人以上の専門家を対象に行った調査によると、回答者の63%が、没入型技術が今後5年間で教育を大きく発展させることに強く同意しています。

北米が主要シェアを占める見込み

- 世界のソフトウェア市場における米国の優位性に加え、市場革新に多額の投資を行っている多数のベンダーの存在により、調査対象市場の北米セグメントは予測期間中に大きく成長すると予想されます。

- 世界的に見て、米国は最も革新的なVR市場の1つになると予想されます。この技術を推進している企業のほとんどは米国に拠点を置いています。高い技術露出度とスマートデバイスの入手のしやすさが、この地域の強力なVR市場を作り出しています。

- さらに、この地域は、革新的なVR技術を様々な産業にもたらすことに注力している新興企業の数が最も多いです。Tracxn Technologiesのデータによると、2022年9月現在、米国には約1,348のバーチャルリアリティ新興企業があります。

- GSMAによると、北米のスマートフォン加入者数は2025年までに3億2,800万人に達すると予想されています。さらに2025年までに、この地域はモバイル加入者(86%)とインターネットの普及率(80%)が上昇する可能性があり、これは世界で2番目に高いです。デバイスの普及率の増加は、この地域の教育用バーチャルリアリティ市場にプラスの影響を与えると考えられます。

同地域の通信事業者は、5Gネットワークの利用を顧客に呼び込もうと積極的に取り組んでいます。そのため、これらの地域のベンダーは、今後登場する5G技術を活用してVRアプリケーションを開発するためのソフトウェアやプラットフォームに投資し、技術革新を行っています。このようなイベントは、同地域の市場成長を後押しすると期待されています。

教育分野におけるバーチャルリアリティ(VR)産業概要

教育分野におけるバーチャルリアリティ(VR)市場は中程度の競合関係にあります。さらに、没入型バーチャル環境の品質、性能、効果の向上を目指した研究開発の取り組みが、今後数年間の市場需要を促進し、主要ベンダー間の競争を激化させると予測されます。

インドでは2022年1月、Central Board of Secondary Education(CBSE)が技術大手のMetaと提携し、今後3年間で1万人の教師と1,000万人の生徒を対象に仮想現実(VR)と拡張現実(AR)のトレーニングを実施しました。この提携の一環として、Metaはデジタルセーフティ、オンラインウェルビーイング、VR、ARに関するカリキュラムを提供しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- エコシステム分析

- ハードウェア

- ソフトウェアとアプリ開発

- コンテンツクリエーター

- サービスプロバイダー

- ネットワークプロバイダー

- エンドユーザー

- 市場促進要因

- インタラクティブでパーソナライズされた学習体験に対する需要の高まり

- ブレンデッド・ラーニング技術の高いエンゲージメントと適用範囲により、利害関係者の間でより高い受容性

- VRベースの技術は、教育・企業向けカテゴリーで最初の参入者であることから利益を享受できます。

- デジタルエンゲージメントと魅力的なコンテンツの増加により、企業における教育・研修の役割が変化

- 市場抑制要因

- コンシューマー・グレードのアプリケーションのコンテンツとコスト効率の限界

- 最適な体験を確保するための帯域幅やネットワークなどの外部要因への依存

- 市場機会

- 教育機関や企業によるインタラクティブ学習への予算配分の増加

- より多くの人々がコンテンツにアクセスできるようにする技術の進歩

- 教育セグメントにおけるVRアプリ配信と価格モデル分析

- 主要使用事例と導入事例

- 中国の教室におけるVR導入

- サービス標準化のためのVR研修に向けた企業部門の取り組み

- Googleが提供するバーチャル遠足の実施

- 技術スナップショット

- COVID-19の産業への影響評価

第5章 市場セグメンテーション

- タイプ

- ハードウェア

- ソフトウェア

- サービス(トレーニングとコンサルティング、マネージドサービス)

- エンドユーザー

- 教育機関

- 幼稚園から高校までの教育機関

- 高等教育機関

- 企業研修

- ITと電気通信

- 医療

- 小売・eコマース

- その他

- 教育機関

- 地域

- 北米

- 欧州

- アジア太平洋

- その他

第6章 競合情勢

- 企業プロファイル

- HTC Corporation

- Lenovo Group Limited

- Samsung Electronics Co. Ltd

- Microsoft Corporation

- Meta Platforms, Inc.

- Avantis Systems Limited

- Unity Teach

- Nearpod Inc

- zSpace Inc

- Virtalis Holdings Limited

- EON Reality

- Veative Labs

- Alchemy VR Limited

- VR Education Holdings

第7章 投資分析

第8章 市場機会と今後の動向

The Virtual Reality Market in Education Industry is expected to grow from USD 31.28 billion in 2025 to USD 81.13 billion by 2030, at a CAGR of 21% during the forecast period (2025-2030).

VR technology has gained widespread recognition and adoption over the past few years. Recent technological advancements in this field have revealed new enterprises and adoption among major universities, colleges, and schools for advanced learning experiences. In addition, the market is expected to gain significant demand from corporations for corporate learning programs in the coming years.

Key Highlights

- Virtual reality has gained significant traction in the education world over the past few years. It offers learners an immersive experience: they can learn complicated subject matters by entering a reality-imitating virtual world where they can move, talk, make decisions, and interact with the world around them. Such an instance led to increased demand for virtual reality in education.

- Educational institutions have started incorporating practical learning through excursions, lab experiments, group activities, and projects. The introduction of virtual reality in education has taken learning to an entirely new dimension. Immersive learning through Virtual Reality has proven to be an effective tool for expanding knowledge. It delivers digitally created information and situations that mirror real-life experiences that are mostly inaccessible to learners in traditional school settings.

- Many companies are making learning interactive and more engaging through VR technologies by adding gaming elements to textbook material. For instance, Curiscope's Virtuali-tee is a t-shirt and app that lets users learn about the human body. One person puts on the t-shirt while the other uses a virtual reality app on a smartphone to virtually reveal and explore the various layers inside the body.

- Further, VR is finding extensive applications in biology, with universities and colleges worldwide using virtual reality headsets for immersive learning. For instance, last year, students at Arizona State University were learning biology in a unique virtual reality experience, hurtling through space to interact with creatures in an intergalactic wildlife sanctuary the size of a small city and to solve the mystery of why the animals are dying.

- During the COVID-19 lockdown, technologies like AR, VR, and MR witnessed significant demand as they allowed people to shop, talk, and socialize using these immersive platforms. The COVID-19 pandemic moved learners and young students out of the classroom and into the virtual world of remote education. Many universities and schools are now taking advantage of virtual reality technology to improve access to education, both in terms of helping pupils with learning difficulties or disabilities and making learning less location-dependent.

Virtual Reality (VR) in Education Market Trends

Increasing Demand For Interactive and Personalized Learning Experience

- Increasing adoption of online education and the benefits of a virtual learning environment, such as flexible schedules, more individual accountability, mobility, student-centered learning, and others, are driving the market's growth. VR can replace physical paper models, posters, textbooks, and printed manuals. It offers less expensive and portable learning materials, making education more accessible and mobile.

- Over the past few years, the cost of deploying VR has plunged, and the technology has expanded into more general use at almost Fortune 500 corporations, where employees working in retail, logistics, and customer service are practicing with VR headsets to get better at their jobs.

- Various businesses worldwide use VR technology to provide their employees with a personalized learning experience, thus driving the market's growth. For instance, across the U.S., Walmart is training its employees to improve their skills using STRIVR technology, which has also worked for companies like Visa, Bank of America, BMW, Google, ABC, and more. The training simulators place the employee in a realistic setting, which tests their ability to handle different situations at the workplace.

- In K-12 learning, virtual and augmented reality help teachers engage students in content to assist them in retaining knowledge. By using a web-based portal, teachers can control and manage the headsets, plan lessons, and monitor student progress. Teachers can set points of interest on students' headsets to direct them to certain parts of the lesson and may view thumbnail images of what each student is seeing.

Further, as the prices of VR systems drop and more people become interested in this new technology, adoption in the education sector is expected to grow. For instance, a Perkins Coie and XR Association survey of over 160 professionals found that 63% of respondents strongly agreed that immersive technology will significantly advance education over the next five years.

North America is Expected to Hold Major Share

- The North American segment of the market studied is expected to grow significantly during the forecast period, owing to the presence of a large number of vendors, who are also investing heavily in market innovation, coupled with the dominance of the United States in the global software market.

- Globally, it is expected that the United States will be one of the most innovative VR markets. Most of the companies advancing this technology are based in the United States. High technology exposure and the ease of availability of smart devices have created a strong VR market in the region.

- Further, the region has the highest number of emerging startups focusing on bringing innovative VR technologies to various industries. According to data from Tracxn Technologies, as of September 2022, there were approximately 1,348 Virtual Reality startups in the United States.

- According to the GSMA, the number of smartphone subscribers in North America is expected to reach 328 million by 2025. Moreover, by 2025, the region may witness an increase in the penetration rates of mobile subscribers (86%) and the internet (80%), the second-highest in the world. Increased device penetration will positively impact the region's virtual reality market for education.

The telecom companies in the region are aggressively making efforts to attract customers to use their 5G network. Hence, these regional vendors are investing in and innovating the software and platform for the development of VR applications by leveraging the upcoming 5G technology. Such events are expected to boost the growth of the market in the region.

Virtual Reality (VR) in Education Industry Overview

The virtual reality market in education is moderately competitive. Furthermore, research and development initiatives aimed at improving immersive virtual environments' quality, performance, and effectiveness are projected to propel market demand in the coming years, increasing competition among the key vendors.

India in January 2022, had the Central Board of Secondary Education (CBSE) collaborate with the tech giant, Meta, to train 10 lakh teachers and one crore students in Virtual Reality (VR) and Augmented Reality (AR) for the next three years. As part of this partnership, Meta provided a curriculum on digital safety, online well-being, VR, and AR.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.3.1 Hardware

- 4.3.2 Software and App Development

- 4.3.3 Content Creators

- 4.3.4 Service Providers

- 4.3.5 Network Providers

- 4.3.6 End Users

- 4.4 Market Drivers

- 4.4.1 Increasing demand for interactive and personalized learning experience

- 4.4.2 Higher acceptance among stakeholders owing to higher engagement and scope for blended learning technology

- 4.4.3 VR-based technology benefits from being the first entrant in the education & corporate category

- 4.4.4 The role of education and training among corporates has transformed with the growth in digital engagement and compelling content

- 4.5 Market Restraints

- 4.5.1 Limited content and cost efficiency of consumer-grade applications

- 4.5.2 Dependence on external factors, such as bandwidth and network, for ensuring optimal experience

- 4.6 Market Opportunities

- 4.6.1 Growth in budget allocation on interactive learning by education bodies and the corporate sector

- 4.6.2 Technological advancements to make content accessible to a wider audience

- 4.7 VR App Distribution and Pricing Model Analysis in the Education Sector

- 4.8 Key-use cases and Implementation case studies

- 4.8.1 China's implementation of VR in classrooms

- 4.8.2 The Corporate sector initiatives toward VR training for service standardization

- 4.8.3 Implementation of virtual field trips through Google's offering

- 4.9 Technology Snapshot

- 4.10 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services (Training and Consulting and Managed Services)

- 5.2 End User

- 5.2.1 Academic Institutions

- 5.2.1.1 K-12 Learning

- 5.2.1.2 Higher Education

- 5.2.2 Corporate Training

- 5.2.2.1 IT and Telecom

- 5.2.2.2 Healthcare

- 5.2.2.3 Retail and E-commerce

- 5.2.2.4 Other End users

- 5.2.1 Academic Institutions

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 HTC Corporation

- 6.1.2 Lenovo Group Limited

- 6.1.3 Samsung Electronics Co. Ltd

- 6.1.4 Microsoft Corporation

- 6.1.5 Meta Platforms, Inc.

- 6.1.6 Avantis Systems Limited

- 6.1.7 Unity Teach

- 6.1.8 Nearpod Inc

- 6.1.9 zSpace Inc

- 6.1.10 Virtalis Holdings Limited

- 6.1.11 EON Reality

- 6.1.12 Veative Labs

- 6.1.13 Alchemy VR Limited

- 6.1.14 VR Education Holdings