|

市場調査レポート

商品コード

1643123

クリーンルーム用消耗品:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Cleanroom Consumables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| クリーンルーム用消耗品:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

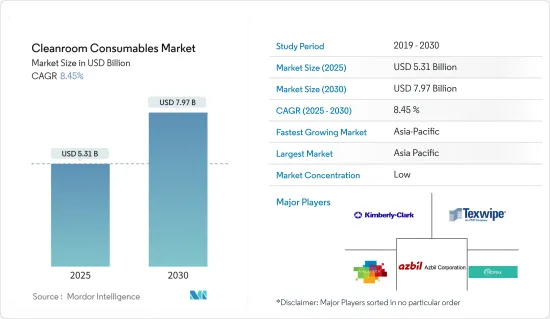

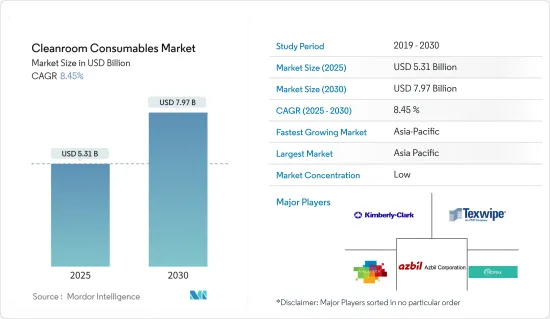

クリーンルーム用消耗品市場規模は2025年に53億1,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは8.45%で、2030年には79億7,000万米ドルに達すると予測されます。

世界のクリーンルーム用消耗品市場の成長は、ナノ技術の出現とモジュール型クリーンルームシステムに対する需要の増加によって促進されると予想されます。様々な企業が予測期間中に世界の市場シェアを拡大するために納入契約を結ぶ可能性があります。今後数年間、新技術、合併、買収により市場は成長すると予想されます。

主要ハイライト

- クリーンルーム施設は、半導体やマイクロエレクトロニクスのような様々な用途において、製品の繊細な性質のために不可欠です。これらのクリーンルームには、エッチング装置、フォトリソグラフィー装置、ドーピング装置、洗浄装置、ダイシング装置など、高価で精密な装置も含まれます。そのため、清浄度基準から逸脱すると、生産プロセス全体に影響を及ぼす可能性があります。

- 市場には、バイオテクノロジー、エレクトロニクス、ナノ技術、製薬セグメントの企業をはじめ、多くの購入者がいます。クリーンルーム用消耗品の重要性は多くのバイヤーを惹きつけ、これらの商品の需要増加に貢献しています。ゴム、セルロース、アルコール、ポリマーを製造する企業のように、市場には多くの原料サプライヤーが存在します。そのため、産業は価格交渉が難しくなっています。

- サージカルマスク、ガウン、手袋、ゴーグルなどの製品に対する需要の増加は、世界のクリーンルーム用消耗品産業の市場参入企業の収益源に変わりつつあります。コロナウイルス株は常に変化しているため、医療専門家は抗ウイルス薬や予防接種を積極的に探しています。クリーンルームで働く専門家は現在、環境汚染から身を守ることに注力しています。病院、ラボ、製薬産業の最終消費者は、信頼性の高いサプライチェーンを維持するサプライヤーに支えられています。

- 製薬産業やバイオテクノロジー産業では、医薬品の品質向上のためにクリーンルーム用消耗品の採用が進んでいます。クリーンルーム用消耗品市場は、製品の品質と検証を確実にするために規制当局が設けた厳格な規則も後押ししています。

- 2023年8月、Thomas Scientificは、マサチューセッツ州を拠点とするクリーンルーム、包装、工業製品のプロバイダー、Quintana Supplyを買収しました。Thomas Scientificの全国的な事業展開と同時に、制御された産業環境を持つ先端技術や産業セグメントの企業への製品・サービス提供能力を強化しました。

- 人工知能技術の開発により電子機器の需要が増加しており、これらの消耗品の売上を牽引しています。同様に、医療産業においても、新しい治療法の開発により、これらの消耗品のニーズが高まっています。人々のライフスタイルの変化も、より長持ちし、より清潔で、より使いやすい包装食品を求めるようになっています。

- しかし、使い捨てクリーンルーム用消耗品がもたらす厳しい規制要件や環境バイオハザードの複雑さは、市場拡大の妨げになる可能性があります。また、クリーンルームの使用や手入れは大変で、原料費の高騰も市場の成長を難しくしています。

- 医療産業のワークフローは、COVID-19の流行によって世界的に影響を受けています。医療の多くの部門を含むいくつかの部門が、パンデミックのために一時的な業務閉鎖を余儀なくされています。しかし、COVID-19感染症の流行は好影響をもたらし、手袋、カバーオール、靴カバー、フェイスマスクなどのクリーンルーム用品を含む様々なサービスに対する需要を増加させています。さらに、COVID-19に対するワクチンを開発するための研究開発努力が増加していることから、製薬会社やバイオ医薬品会社は、汚染のない環境を維持するためにこの市場に多額の投資を行うようになりました。

クリーンルーム用消耗品市場の動向

安全で高品質な医薬品への需要の高まりが市場成長を牽引する見込み

- クリーンルームの重要性は、生産品の汚染を防ぐという役割に起因していると考えられます。医薬品のクリーンルーム仕様は、成功した製品が市場に出続けることができるように慎重に計画されます。

- 湿度、ほこり、気圧、細菌、温度さえも管理できるクリーンルームは、製薬産業において必要不可欠です。クリーンルームのおかげで、市販品であれ医師から配合されたものであれ、人々が購入する健康食品に害がないことを確認することができるのです。

- 座りっぱなしのライフスタイルが、世界中で慢性疾患が多発している主要原因です。そのため、慢性疾患の診断や治療に役立つ電子機器(糖尿病治療器など)やシステム、医薬品が生み出されています。

- ある報告書によると、慢性疾患は米国で最も蔓延し、費用のかかる健康状態のひとつです。全アメリカ人の半数近く(約45%、1億3,300万人)が少なくとも一つの慢性疾患に苦しんでおり、その数は増え続けています。最も一般的な慢性疾患は、HIV、がん、糖尿病、高血圧、脳卒中、心臓病、呼吸器疾患、関節炎、肥満です。米国疾病管理センターによれば、慢性疾患は医療費総額の75%近くを占め、1人当たり年間5,300米ドルに上ると推定されています。

- 欧州製薬団体連合会(EFPIA)によると、2007~2022年までの欧州、中国、米国の医薬品研究開発費の年間成長率は以下の通りです。欧州の製薬産業の研究開発費は、2018~2022年にかけて年率4.6%成長しました。

- 製薬会社は、臨床検査を実施し、慢性疾患の治療に効果的な医薬品を開発するため、研究開発能力を拡大しています。例えば、ECの合同調査委員会によると、Ventyx Biosciencesは2021年に819%という大幅な成長率を記録しました。これに続くのがClover Biopharmaceuticalsで、研究開発費の成長率は777%を記録しました。このような大きな支出には、職場におけるクリーンルーム用消耗品の成長も含まれると考えられます。

アジア太平洋が大きな市場シェアを占める

- アジア太平洋は大幅な市場成長が見込まれており、その主要要因は、世界中で電子機器の導入が進んでいることと、人件費や原料費の低下により企業が製造工場設立への投資を増やしていることです。また、製薬産業やバイオテクノロジー産業の成長の高まり、医療や研究セグメントでのクリーンルーム用消耗品のニーズの高まりは、製造される製品の品質を維持するために非常に重要です。

- アジア諸国は、手頃なコストで研究や医薬品開発を行うためのインフラが整っています。そのため、ほとんどの外資系企業は共同で治療を生み出し、大量生産することに取り組んでいます。Serum Institute、Biological E、Bharat BIoTech、Indian Immunologicals、Mynvaxというインド企業6社ほどがCOVID-19ワクチンの開発に取り組んでおり、世界中に急速に広がっている致死的な感染症の迅速な予防治療法を見つけるための世界の取り組みに参加していました。さらに、Cipla、Glenmark、Dr. Reddy's(インドを拠点とする製薬会社)は、Gilead Sciencesと協力して、当初はエボラ出血熱の治療として開発されたが、現在ではCOVID-19に対する最良の選択肢として推測されている実験薬、レムデシビルの開発を開始する予定です。

- クリーンルームは、戦闘機、ヘリコプター、捜索救助用飛行艇、エンジンなどに使用される部品の品質を維持し、国際的な要件や基準を満たす製品やサービスを開発するために、航空宇宙産業や防衛産業では不可欠です。アジア太平洋諸国には、自国の軍事をアップグレードし、新しい防衛装備を購入する多くの理由があります。台頭する大国、新たな脅威、安全保障上の困難、軍事的コミットメントなど、この地域は間違いなく、安全保障上の力学が絶えず変化する地域です。これらは、新しいクリーンルーム製品の能力を必要とし、地域の軍事近代化を推進しています。

- アジア太平洋は、飲食品、加工、製薬、バイオテクノロジー、医療機器産業の成長により、調査期間中、世界のクリーンルーム用消耗品市場のかなりの部分を占めました。予測期間中、アジア太平洋のクリーンルーム用消耗品市場は、伝染病数の増加と国内参入企業の台頭によって牽引されると予想されます。

クリーンルーム用消耗品産業概要

クリーンルーム用消耗品市場はセグメント化されており、Kimberly-Clark Corporation、Texwipe、Nitritex Ltd.、Valuetek Inc.、Azbil Corporationのような少数の大手企業が独占しています。市場で圧倒的なシェアを誇るこれらの大手企業は、海外における顧客基盤の拡大に注力しています。これらの企業は、市場シェアと収益性を高めるために戦略的な共同イニシアティブを活用しています。しかし、技術の進歩や製品の革新に伴い、中堅・中小企業は新規契約の獲得や新市場の開拓によって市場での存在感を高めています。

欧州の大手鉄鋼会社であるBritish Steelは、英国全土の現場で働く4,000人以上の労働者に特殊な衣服を提供し続けるため、マイクロンクリーンと契約を結びました。

Kimberly-Clark Professionalは、作業員の安全性を犠牲にすることなく、長時間の着用でも快適性を高め、確かな触感を実現したキムテック・オパール・ニトリル手袋を発売しました。この新しい手袋は、無菌医薬品製造、研究開発施設、ライフサイエンスセグメントでの使用に適しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- 安全で高品質な医薬品への需要の高まり

- 規制当局による医薬品の製造包装に関する強制規制

- 市場抑制要因

- 高い原料と製造コスト

- 複雑で多様なクリーンルーム規制

第6章 市場セグメンテーション

- 製品

- 安全用品

- フロック

- ブーツカバー

- シューズカバー

- ブーファン

- パンツ&フェイスマスク

- その他

- 清掃用品

- モップ

- バケット

- ワッシャ

- スクイージー

- 検証用綿棒

- その他

- クリーンルーム用消耗品

- ペーパー類

- ノート

- 粘着パッド

- 結合剤

- クリップボード

- ラベル

- その他

- 安全用品

- 用途

- エレクトロニクス

- 製薬・バイオテクノロジー

- 飲食品

- 航空宇宙・防衛

- 大学研究

- 自動車

- 医療機器

- 地域

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Kimberly-Clark Corporation

- The Texwipe Company, LLC(Illinois Tool Works, Inc.)

- Nitritex Ltd.(Ansell Limited)

- Valutek Inc.

- DuPont de Nemours, Inc.

- Azbil Corporation

- Clean Air Products

- Micronova Manufacturing Inc.

- Micronclean Ltd.

- Contec Inc.

第8章 投資分析

第9章 市場の将来展望

The Cleanroom Consumables Market size is estimated at USD 5.31 billion in 2025, and is expected to reach USD 7.97 billion by 2030, at a CAGR of 8.45% during the forecast period (2025-2030).

Global cleanroom consumables market growth is expected to be fueled by the emergence of nanotechnology and increased demand for modular cleanroom systems. Various companies may establish delivery agreements to increase their market share globally during the predicted period. Over the next few years, the market is expected to grow because of new technologies, mergers, and acquisitions.

Key Highlights

- Clean room facilities are essential across various applications, such as semiconductor and microelectronic purposes, due to the sensitive nature of their products. These clean rooms also include expensive and precise equipment, including etching, photolithography, doping, cleaning, and dicing machines. Therefore, any departures from the cleanliness standards may affect the entire production process.

- There are a lot of purchasers in the market, including companies in the biotechnology, electronics, nanotechnology, and pharmaceutical sectors. The significance of cleanroom consumables attracts many buyers, contributing to the rising demand for these goods. There are a lot of raw material suppliers on the market, like companies that make rubber, cellulose, alcohol, and polymers. This makes it harder for the industry to negotiate prices.

- The increased demand for products like surgical masks, gowns, gloves, and goggles is converting into revenue streams for market participants in the worldwide cleanroom consumables industry. Medical specialists have been actively searching for antiviral medications and vaccinations since coronavirus strains are constantly changing. Professionals working in cleanrooms now focus on protecting themselves from environmental pollution. Hospitals, research labs, and the pharmaceutical industry's end consumers are served by suppliers who maintain reliable supply chains.

- The pharmaceutical and biotechnology industries are increasingly adopting cleanroom consumables for improved pharmaceutical drug quality. The cleanroom consumables market is also driven by strict rules put in place by regulatory authorities to ensure product quality and validation.

- In August 2023, Thomas Scientific acquired the Massachusetts-based cleanroom, packaging, and industrial products provider Quintana Supply. Thomas Scientific's national footprint while enhancing its ability to provide products and services to companies in advanced technology and industrial segments with controlled and industrial environments.

- There is an increase in demand for electronic devices due to the developments in artificial intelligence technology, which drives the sales of these consumables. Similarly, the need for these consumables in the healthcare industry has increased due to the development of new and improved treatments. People's changing lifestyles are also making them want packaged foods that last longer, are cleaner, and are easier to use.

- However, the complexity of stringent regulatory requirements and environmental biohazards brought on by disposable cleanroom consumables might hamper market expansion. Also, using and taking care of a cleanroom is hard, and rising raw material costs also make it hard for the market to grow.

- Workflows in the healthcare industry have been affected globally by the COVID-19 epidemic. Several sectors, including numerous branches of healthcare, have been forced to temporarily close their operations due to the pandemic. The prevalence of COVID-19 infectious disease has, however, had a positive effect and increased demand for a variety of services, including cleanroom supplies like gloves, coveralls, shoe covers, face masks, and others, as there is an increasing need to maintain a contamination-free environment while sampling, collecting, and testing suspected COVID-19 cases. Additionally, increasing R&D efforts to create vaccines against COVID-19 prompted pharmaceutical and biopharmaceutical firms to invest significantly in the market to maintain a contaminant-free environment.

Cleanroom Consumables Market Trends

Increasing Demand for Safe and Better-Quality Pharmaceutical Drugs is Expected to Drives the Market Growth

- The importance of cleanrooms may be attributed to their role in preventing contamination of produced goods. Cleanroom specifications for medicines are carefully planned so that a successful product can stay on the market.

- The capacity to manage humidity, dust, air pressure, germs, and even temperature makes cleanrooms essential in the pharmaceutical industry. This helps make sure that the health products people buy, whether they get them over-the-counter or from their doctor, won't hurt them.

- The adoption of a sedentary lifestyle is the main reason why there are so many chronic diseases around the world. This has led to the creation of electronic devices (like diabetes devices), systems, and medicines that can help diagnose and treat chronic diseases.

- According to a report, chronic disease is among the most prevalent and costly health conditions in the United States. Nearly half (approximately 45%, or 133 million) of all Americans suffer from at least one chronic disease, and the number is growing. The most common chronic diseases are HIV, cancer, diabetes, hypertension, stroke, heart disease, respiratory diseases, arthritis, and obesity. And as per the Centers for Disease Control in the United States, chronic disease accounts for nearly 75% of aggregate healthcare spending, or an estimated USD 5300 per person annually.

- According to EFPIA, The pharmaceutical research and development spending annual growth rate in Europe, China, and the United States in selected periods between 2007 and 2022. The European pharmaceutical industry's expenditure on R&D grew 4.6 percent annually between 2018 and 2022.

- Pharmaceutical companies are expanding their research and development capacity to conduct trials and develop effective drugs to treat chronic diseases. For instance, according to the Joint Research Commission of the EC, Ventyx Biosciences recorded a significant growth rate of 819 percent in 2021. This was followed by Clover Biopharmaceuticals, which recorded a 777% growth rate in R&D spending. Such significant expenditures would include the growth in cleanroom consumables in the workplace.

Asia-Pacific to Hold a Significant Market Share

- Asia-Pacific is anticipated to experience significant market growth, primarily driven by the high adoption of electronic gadgets across the world and companies' increased investment in setting up manufacturing plants due to lower labor and raw material costs. Also, the rising growth of the pharmaceutical and biotechnology industries and the growing need for cleanroom consumables in the healthcare and research fields will be very important for keeping the quality of the products that are made.

- Asian countries have better research and pharmaceutical infrastructure to conduct research and develop medicine at an affordable cost. So most foreign companies are working jointly to create and mass-produce the treatment. Around six Indian companies named Serum Institute, Biological E, Bharat Biotech, Indian Immunologicals, and Mynvax were working to develop COVID-19 vaccines and had joined the global efforts to find a quick preventive cure for the deadly infection spreading rapidly across the world. Further, Cipla, Glenmark, and Dr. Reddy's (India-based pharmaceutical companies) would start working with Gilead Sciences to develop Remdesivir, an experimental drug initially developed to cure Ebola but now being speculated as the best option against COVID-19.

- Cleanrooms are critical in the aerospace and defense industries for developing products and services that maintain the quality of components used in fighter jets, helicopters, search and rescue flying boats, engines, and so on, while meeting international requirements and standards. Asia-Pacific nations have many reasons to upgrade their militaries and buy new defense equipment. With emerging great powers, new threats, security difficulties, and military commitments, the area is undoubtedly one with continually changing security dynamics. These necessitate new cleanroom product capabilities, propelling regional military modernization.

- Asia-Pacific held a sizable portion of the global cleanroom consumables market during the study period due to growth in the food and beverage, processing, pharmaceutical, biotechnology, and medical device industries. During the forecast period, the cleanroom consumables market in Asia-Pacific is expected to be driven by a rise in the number of contagious diseases and the rise of domestic players.

Cleanroom Consumables Industry Overview

The cleanroom consumables market is fragmented and dominated by a few significant players like Kimberly-Clark Corporation, Texwipe, Nitritex Ltd., Valuetek Inc., and Azbil Corporation. These notable players, with a prominent share of the market, are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, midsize to smaller companies are growing their market presence by securing new contracts and tapping new markets.

British Steel, a big steel company in Europe, signed a contract with Micronclean to keep getting specialized clothing for more than 4,000 of its workers at sites all over the UK.

Kimberly-Clark Professional launched Kimtech Opal Nitrile Gloves for increased comfort during prolonged wear and solid tactile sensitivity without sacrificing worker safety. The new gloves are suitable for use in non-sterile medicine manufacturing, research and development facilities, and life sciences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Safe and Better-Quality Pharmaceutical Drugs

- 5.1.2 Compulsory Regulations by Regulatory Authorities for Production and Packaging of Medical Products

- 5.2 Market Restraints

- 5.2.1 High Raw Materials and Manufacturing Cost

- 5.2.2 Complicated and Variable Regulations of Cleanroom

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Safety Consumables

- 6.1.1.1 Frocks

- 6.1.1.2 Boot Covers

- 6.1.1.3 Shoe Covers

- 6.1.1.4 Bouffants

- 6.1.1.5 Pants and Face Masks

- 6.1.1.6 Other Safety Consumables

- 6.1.2 Cleaning Consumables

- 6.1.2.1 Mops

- 6.1.2.2 Buckets

- 6.1.2.3 Wringers

- 6.1.2.4 Squeegees

- 6.1.2.5 Validation Swabs

- 6.1.2.6 Other Cleaning Consumables

- 6.1.3 Cleanroom Stationery

- 6.1.3.1 Papers

- 6.1.3.2 Notebooks

- 6.1.3.3 Adhesive Pads

- 6.1.3.4 Binder

- 6.1.3.5 Clipboards

- 6.1.3.6 Labels

- 6.1.3.7 Other Cleanroom Stationeries

- 6.1.1 Safety Consumables

- 6.2 Application

- 6.2.1 Electronics

- 6.2.2 Pharmaceutical and Biotechnology

- 6.2.3 Food and Beverage

- 6.2.4 Aerospace and Defense

- 6.2.5 University Research

- 6.2.6 Automotive

- 6.2.7 Medical Device

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kimberly-Clark Corporation

- 7.1.2 The Texwipe Company, LLC (Illinois Tool Works, Inc.)

- 7.1.3 Nitritex Ltd. (Ansell Limited)

- 7.1.4 Valutek Inc.

- 7.1.5 DuPont de Nemours, Inc.

- 7.1.6 Azbil Corporation

- 7.1.7 Clean Air Products

- 7.1.8 Micronova Manufacturing Inc.

- 7.1.9 Micronclean Ltd.

- 7.1.10 Contec Inc.