|

市場調査レポート

商品コード

1910717

本人確認(ID):市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Identity (ID) Verification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 本人確認(ID):市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 136 Pages

納期: 2~3営業日

|

概要

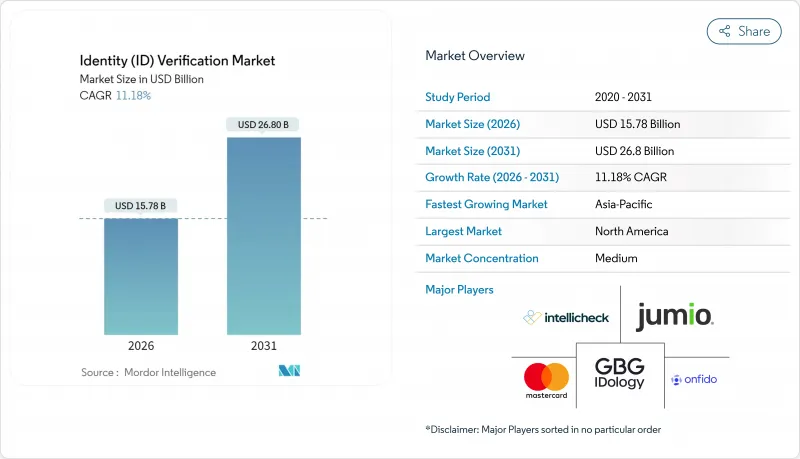

本人確認市場は、2025年の141億9,000万米ドルから2026年には157億8,000万米ドルへ成長し、2026年から2031年にかけてCAGR11.18%で推移し、2031年までに268億米ドルに達すると予測されています。

この拡大は、企業がAI生成詐欺、ディープフェイク攻撃、増加する規制罰金に直面する中で、チェックボックス式のコンプライアンスから戦略的なセキュリティ投資への決定的な転換を反映しています。ディープフェイク単独でも3,000%急増し、ベンダーは受動的な生体認証と行動分析をオンボーディングワークフローに直接組み込むことを迫られています。クラウドネイティブ展開は、現在ほとんどの新規導入におけるデフォルトの選択肢となっており、モデル更新を世界のテナント全体に即時プッシュできるため、イノベーションを加速させます。一方、ポータブルでプライバシー保護機能を備えた認証情報の需要が高まり、政府発行のモバイル運転免許証、検証可能認証情報、Web3ウォレットを単一のユーザージャーニーに統合するパイロット事業が推進されています。フルスタックセキュリティ企業がAI文書フォレンジック技術を獲得するためニッチ専門企業を買収する動きが活発化する中、市場統合が進んでおります。しかしながら、いずれのプロバイダーも収益の15%以上を支配しておらず、エッジケースリスクや業界固有の規制を解決する特化型新規参入企業にとって十分な成長余地が残されております。

世界のID検証市場の動向と洞察

サイバー詐欺と規制罰金の増加

不正な口座開設は2024年に金融取引の2.1%に達し、2年前の1.27%から急増しました。検出された不正事象の約42.5%が生成AIを活用していると推定され、銀行は合成IDやディープフェイク音声などをリアルタイムで検知する多層防御システムの導入を迫られています。規制当局も同様に厳しい姿勢を示しており、2023年には世界中の金融機関がKYC関連で66億米ドルの罰金を支払いました。リスクの高まりと罰金の増加という二重の圧力により、購入者は文書フォレンジック、生体認証による生体確認、継続的な行動監視を単一のAPIで統合するエンタープライズグレードのオーケストレーションプラットフォームへと向かっています。

リモートオンボーディングと電子KYC義務化の急増

アジア太平洋地域の消費者の78%が、新たな金融アプリ利用前にデジタル本人確認が不可欠と認識しています。規制当局はこの傾向を法制度化しつつあります。EUは加盟国に対し24ヶ月以内のデジタルIDウォレット発行を義務付け、電子KYCを実質的に制度化しました。検証を自動化した組織では、サービスデスクの処理時間が最大45秒短縮されました。これは米国トップ10銀行が音声認証導入後に確認した事実です。検証済み認証情報がプロバイダー間で転送可能になるとネットワーク効果が生まれ、再オンボーディングの摩擦が半減し、プラットフォーム規模の優位性が強化されます。

分断された世界の規制基準

KYC規則は国ごとに異なるだけでなく、同一地域内でも監督当局によって異なる場合があり、プラットフォームは並行した認証フローとデータ居住地アーキテクチャを運用せざるを得ません。米国はポータビリティを重視する一方、EUのGDPRはローカライゼーションを推進しており、統一的なクラウド展開を複雑化させています。アジアでは、日本は金融庁のライセンスを要求する一方、韓国は仮想通貨取引所に銀行との提携を義務付けています。コンプライアンスチームがこのパッチワークを処理する中で、事業拡大のスケジュールは長期化し、運営コストは上昇しています。

セグメント分析

クラウド導入は2025年に本人確認市場の65.12%を占め、企業が資本集約的なサーバーよりも弾力的な利用を好むことから、12.72%のCAGRで拡大しています。クラウド導入に関連する本人確認市場規模は、デジタル銀行やギグエコノミープラットフォームにおけるAPIの急速な採用を反映し、2031年までに187億米ドルに達すると予測されています。継続的なモデル更新、集中型脅威インテリジェンス共有、ダウンタイムゼロのパッチ適用により、クラウドは標準アーキテクチャとしての地位を確立しています。オンプレミス導入が義務付けられるのは、法令でローカルデータ処理が要求される場合のみですが、プロバイダーが認定地域センターを開設すれば、そうした管轄区域でもクラウド導入が認められる傾向にあります。

回復力も促進要因です。マスターカードは年間1,430億件の取引を分析し、異常検知スコアリングルーチンを更新することで、すべてのテナントに即時的な利益をもたらしています。クラウドハブは検証可能クレデンシャルやモバイル運転免許証との統合も簡素化し、プロジェクト期間を数ヶ月から数週間に短縮します。エッジデータセンターの普及に伴い、遅延懸念は薄れ、1秒未満の往復時間を要求する生体認証ビデオストリームにおいてもクラウド導入が可能となっています。

生体認証エンジンは2025年に本人確認市場シェアの35.84%を占め、2031年までCAGR12.86%を維持し、文書認証のみの方法を上回ると予測されています。生体認証モダリティに関連する本人確認市場規模は、背景動画フレーム内で目に見えない形で動作するパッシブ・ライブネス技術に牽引され、2031年までに101億米ドルを超えると予測されています。ベンダー各社は顔・音声・行動信号を融合し、継続的な認証を実現することで、アカウント乗っ取りの攻撃対象領域を縮小しています。

文書確認は継続されますが、次第に二次的な手順として位置づけられるでしょう。Aware社などのプロバイダーは、肉眼では識別できないGPUレンダリングによるアーティファクトを検出するリアルタイム合成メディア検知技術をリリースしています。金融機関がマルチモーダル生体認証を導入した結果、精度が250%向上し、手動審査コストの削減と顧客コンバージョンの向上を実現しています。知識ベースの質問や静的データベース照合は、低リスクの年齢制限など特定の使用事例に限定される傾向にあります。

本人確認市場は、導入形態(オンプレミス、クラウド)、ソリューションタイプ(書類/身分証明書確認、生体認証など)、エンドユーザー業界(金融サービス(BFSI)、小売・Eコマースなど)、組織規模(大企業、中小企業(SME))、および地域別にセグメント化されています。市場予測は金額(米ドル)ベースで提供されます。

地域別分析

北米は、積極的な不正対策と生体認証の早期導入に支えられ、2025年に32.43%の本人確認市場シェアを維持しました。米国は2025年5月より、TSA(運輸保安庁)チェックポイントでの全国的なモバイル運転免許証の受入れを計画しており、デジタル認証に対する連邦政府の信頼を示すものです。カナダのオープンバンキングロードマップは、クロスプラットフォームでの本人確認情報の移植性をさらに加速させます。

アジア太平洋地域は11.52%のCAGRで顕著な成長を示しており、シンガポールのフィンテックサンドボックス、インドのAadhaar連携決済基盤、日本の金融庁による暗号資産規制が牽引しています。Truliooはシンガポール拠点開設後、企業認証率90%を達成し、地域向けKYC APIへの需要の高さを示しています。スマートフォン普及率の上昇とリアルタイム決済スキームの進展により、APAC地域は予測期間において最大の増分収益源となる見込みです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストサポート(3ヶ月間)

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- サイバー詐欺の増加と規制罰金の増加

- リモートオンボーディングおよび電子KYC義務化の急増

- 文書鑑識におけるAI駆動の精度向上

- 国境を越えたデジタルID相互運用性パイロット事業

- 新興市場におけるフィンテック包摂プログラム

- 検証可能なクレデンシャルとWeb3アイデンティティウォレットの台頭

- 市場抑制要因

- 分断された世界の規制基準

- ディープフェイクおよび生成AIによる偽装脅威

- レガシー基幹システムの高い統合コスト

- クラウド導入を制限するデータ主権の障壁

- サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

- 市場におけるマクロ経済要因の評価

第5章 市場規模と成長予測

- 展開別

- オンプレミス

- クラウド

- ソリューションタイプ別

- 書類/身分証明書の確認

- 生体認証

- 認証と生体検知

- その他

- エンドユーザー産業別

- 金融サービス(BFSI)

- 小売業・電子商取引

- 政府・公共部門

- ヘルスケア

- 通信・IT

- その他

- 組織規模別

- 大企業

- 中小企業(SMEs)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 東南アジア

- その他アジア太平洋

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- エジプト

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Mastercard

- Onfido

- GBG(Idology)

- Intellicheck

- Jumio

- Trulioo

- Mitek Systems

- Veriff

- IBM

- AuthenticID

- Experian

- TransUnion

- LexisNexis Risk Solutions

- Pindrop

- ComplyCube

- Nuance Communications

- Thales Group

- IDEMIA

- Okta

- Ping Identity

- Equifax

- NEC Corporation

- Acuant

- Persona