|

市場調査レポート

商品コード

1440161

年金基金業界:世界市場シェア分析、業界動向と統計、成長予測(2024-2029)Global Pension Funds Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 年金基金業界:世界市場シェア分析、業界動向と統計、成長予測(2024-2029) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 130 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

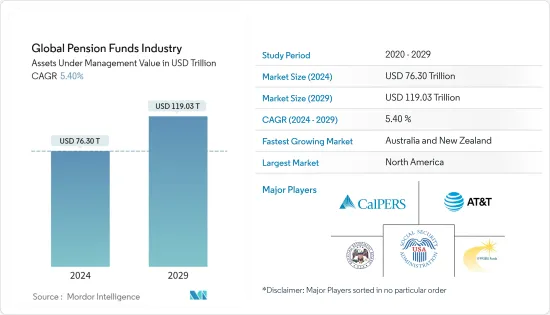

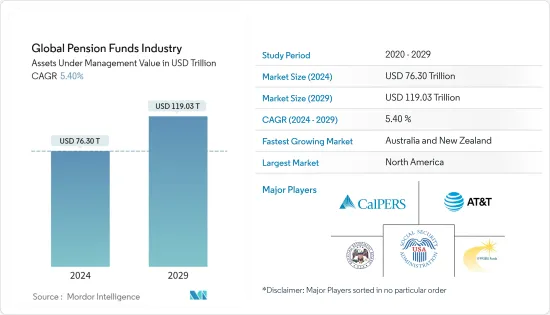

世界の年金基金業界の運用資産額は、予測期間(2024年から2029年)中に5.40%のCAGRで、2024年の76兆3,000億米ドルから2029年までに119兆300億米ドルに成長すると予想されています。

年金基金制度は、負債の存続期間に応じて長期的な運用の観点から運用を行っています。年金基金は、現在の複雑で厳しい環境で成功するために、投資戦略を適応させています。

COVID-19感染症のパンデミックは、投資市場、政府歳入、公的年金制度の見通しに大きな影響を与えました。ワクチン開発にもかかわらず、パンデミックの影響は依然として非常に不確実であり、その結果、さまざまな予測が行われました。さまざまな時期に、国内のさまざまな地域でパンデミックの深刻度はさまざまであり、パンデミックが産業に与える経済的影響も大きく異なりました。

伝統的に、年金基金は長期投資期間を持つ債券や株式に投資されています。市場のボラティリティを考慮して、ヘッジファンド、プライベートエクイティ、不動産などの代替投資に資金を配分することでポートフォリオを多様化しました。近年、世界中の国々で熱心な年金改革の取り組みが行われており、多くの場合、民間部門が管理する積立型年金プログラムの利用が増加しています。これらの資金提供による取り決めは、多くの国で退職後の収入を提供する上でますます重要な役割を果たすことが期待されています。私的に運用される年金資産は、特に長期貯蓄の源として、金融市場においてますます重要な役割を果たす可能性があります。

年金基金市場の動向

分散型拠出プランは世界的に有力なモデルとして定着しつつある

2021年、世界6大年金市場の合計における確定拠出(DC)資産の総額が初めて確定給付(DB)資産を上回った。 2021年までの10年間、DC資産はDBよりも速いペースで成長し続けました(年率8.4%対年率4.8%)。これは、会員対象範囲の拡大と一部の市場での拠出額の増加を反映しています。

分散型拠出資産の増加に伴い、雇用主にとっては会員のエンゲージメントなどの課題も生じています。対象を絞ったエンゲージメントはより優れた洞察を提供しますが、実行時には課題に直面します。テクノロジーの進歩により、カスタマイズの新たな可能性が開かれ、メンバー間のやり取りの性質が変わり、メンバーの期待が再設定されています。 DCの将来は、個々の参加者に重点が置かれ、非常にカスタマイズされることが予想されますが、雇用主はこれを受け入れるためにガバナンスを改善する必要があるかもしれません。

年金基金の資産配分の主な動向

20年間で不動産、プライベートエクイティ、インフラへの資産配分は6%から23%に増加しました。代替案は収益上の理由から魅力的であり、ガバナンスの困難を相殺しています。

リスク分散の需要を反映して、株式や債券を犠牲にしてプライベート市場やその他の代替手段への配分が増加していることが観察されています。投資家は、民間市場の代理店、測定、統合、複雑さの課題を管理するという使命を進化させる革新的な方法を模索し続けています。

年金基金業界の概要

この報告書には、世界最大の年金基金と年金制度を運営するいくつかの企業基金の概要が含まれています。社会保障信託基金、AT&T企業年金基金、カリフォルニア公務員退職金制度などの主要企業の一部は、資産規模の観点から調査対象の市場を独占しており、レポートで詳細に説明されています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 市場の範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 年金情勢の特徴と適用範囲

- 年金基金の運用資産とその成長率の推移

- 年金資産が世界経済に与える影響

- 規模別の年金資産の分布

- 年金基金の運用パターン

- 財政安定の実現における年金基金の役割

- 年金基金とその他の金融仲介業者の相互接続性

- 信用仲介・融資活動における年金基金の役割

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

- 規制および立法の情勢が年金基金に与える影響

- 各資産カテゴリーへの年金基金投資のポートフォリオ制限

- 特定の海外資産カテゴリーへの年金基金投資に対するポートフォリオ制限

- 年金積立金運用規程の最近の変更点

- COVID-19による基金スキームへの影響

第5章 市場セグメンテーション

- プランタイプ別

- 分散型貢献

- 分配利益

- 積立金

- ハイブリッド

- 地域別

- 北米

- 米国

- カナダ

- 北米のその他の地域

- 欧州

- 英国

- スイス

- オランダ

- その他欧州

- アジア太平洋

- オーストラリア

- 日本

- その他アジア太平洋地域

- 世界のその他の地域

- 北米

第6章 競合情勢

- 基金プロファイル

- Social Security Trust Funds

- National RailRoad Retirement Investment Trust

- California Public Employees'Retirement System

- AT&T Corporate Pension Fund

- 1199SEIU Pension and Retirement Funds

- National Eletrical Benefit Fund

- Government Pension Investment Fund Japan

- Caisse des Depots

- Military Retirement Fund

- Federal Retirement Thrift Investment Board*

第7章 市場機会と将来の動向

第8章 免責事項と出版社について

The Global Pension Funds Industry in terms of assets under management value is expected to grow from USD 76.30 trillion in 2024 to USD 119.03 trillion by 2029, at a CAGR of 5.40% during the forecast period (2024-2029).

Pension fund schemes invest with a long-term investment perspective in line with the duration of their liabilities. Pension funds are adapting their investment strategies to succeed in the current complex and demanding environment.

The COVID-19 pandemic had a significant impact on investment markets, government revenues, and the outlook for public pension plans. Despite vaccine development, the effect of the pandemic remained highly uncertain, resulting in varying forecasts. At different times, different parts of the country experienced varying degrees of pandemic severity, and the economic impact of the pandemic on industries varied greatly.

Traditionally, pension funds are invested in bonds and equities with long-term investment horizons. Given the market volatility, they diversified their portfolios by allocating funds to alternatives like hedge funds, private equity, real estate, and others. Recent years have witnessed intense pension reform efforts in countries around the world, often involving increased use of funded pension programs managed by the private sector. These funded arrangements are expected to play an increasingly important role in delivering retirement income in many countries. Privately managed pension assets may play an increasing role in financial markets, notably as a source of long-term savings.

Pension Fund Market Trends

Distributed Contribution Plans are Settling as a Dominant Global Model

In 2021, the total defined contribution (DC) assets across the aggregate of the six largest pension markets in the world exceeded defined benefit (DB) assets for the first time. Over the decade to 2021, DC assets continued to grow at a faster rate than DB (8.4% pa vs. 4.8% pa), reflecting increased member coverage and higher contributions in some markets.

Along with a rise in the distributed contribution assets, there are challenges like member engagement for employers. Targeted engagement provides better insights but faces challenges in execution. Advances in technology are opening up new possibilities for customization, changing the nature of member interactions, and re-setting member expectations. The future of DC is anticipated to be hyper-customized, with an increased focus on individual participants, but employers may need to improve governance to embrace this.

Key Trends in Asset Allocation of Pension Funds

The asset allocation to real estate, private equity, and infrastructure in the 20-year period grew from 6% to 23%. Alternatives have been attractive for return reasons, offsetting their governance difficulties.

A rise in allocations to private markets and other alternatives at the expense of equities and bonds has been observed, reflecting the demand for risk diversification. Investors continue looking for innovative ways to evolve their mandates to manage the agency, measurement, integration, and complexity challenges of private markets.

Pension Fund Industry Overview

The report includes an overview of the largest pension funds and a few corporate funds operating pension schemes worldwide. Some of the major players, such as Social Security Trust Funds, AT&T Corporate Pension Fund, and California Public Employees' Retirement System, are dominating the market studied in terms of asset size and are discussed in detail in the report.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Market

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.1.1 Features and Coverage of Pension Plans Landscape

- 4.1.2 Assets Under Management by Pension Funds and Growth Rates, Over the Years

- 4.1.3 Impact of Pension Assets to the Economies Worldwide

- 4.1.4 Distribution of Pension Assets by Size Segment

- 4.1.5 Investment Patterns of Pension Funds

- 4.2 Role of Pension Funds in Achieving Financial Stability

- 4.2.1 Interconnectedness of Pension funds and Other Financial Intermediaries

- 4.2.2 Role of Pension Funds in Credit Intermediation and Lending Activities

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Regulatory and Legislative Landscape on Pension Funds

- 4.6.1 Portfolio Limits on Pension Fund Investment in Selected Asset Categories

- 4.6.2 Portfolio Limits on Pension Fund Investment in Selected Foreign Asset Categories

- 4.6.3 Recent Changes to the Pension Fund Investment Regulations

- 4.7 Impact of COVID-19 on Fund Schemes

5 MARKET SEGMENTATION

- 5.1 By Plan Type

- 5.1.1 Distributed Contribution

- 5.1.2 Distributed Benefit

- 5.1.3 Reserved Fund

- 5.1.4 Hybrid

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Switzerland

- 5.2.2.3 Netherlands

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 Australia

- 5.2.3.2 Japan

- 5.2.3.3 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Fund Profiles

- 6.2.1 Social Security Trust Funds

- 6.2.2 National RailRoad Retirement Investment Trust

- 6.2.3 California Public Employees' Retirement System

- 6.2.4 AT&T Corporate Pension Fund

- 6.2.5 1199SEIU Pension and Retirement Funds

- 6.2.6 National Eletrical Benefit Fund

- 6.2.7 Government Pension Investment Fund Japan

- 6.2.8 Caisse des Depots

- 6.2.9 Military Retirement Fund

- 6.2.10 Federal Retirement Thrift Investment Board*