|

市場調査レポート

商品コード

1910827

ドライビングシミュレーター:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Driving Simulator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ドライビングシミュレーター:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

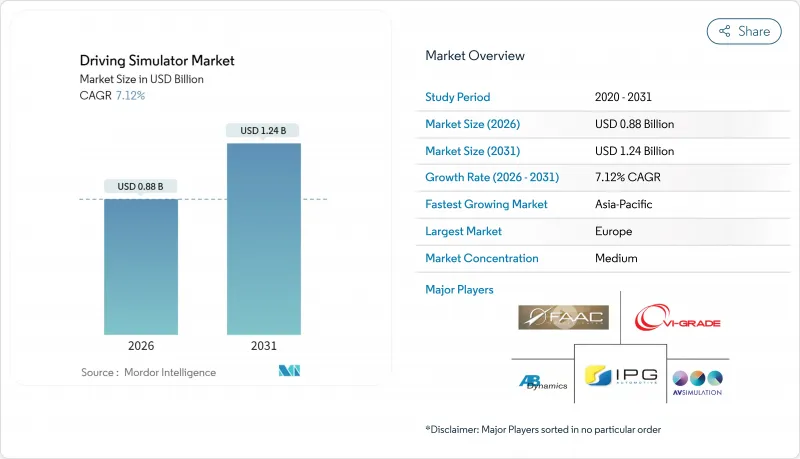

ドライビングシミュレーター市場は、2025年に8億2,000万米ドルと評価され、2026年の8億8,000万米ドルから2031年までに12億4,000万米ドルに達すると予測されています。

予測期間(2026年~2031年)におけるCAGRは7.12%と見込まれます。

この着実な成長は、より安全な運転者認定を求める規制圧力、プロトタイプ試験コスト削減の必要性、自動運転車のロードマップと仮想検証義務の整合性から生じています。商用車両は採用サイクル短縮のため高度なシミュレーターを採用し、自動車メーカーは実走行試験を補完するソフトウェア・イン・ザ・ループ試験装置へ研究予算を振り向けています。サブスクリプション型クラウドプラットフォームはコスト重視地域でのアクセスを拡大し、新たなユーザー層を育成しています。欧州は成熟した自動車エコシステムにより主導権を維持していますが、中国とインドの物流ネットワーク拡大に伴い、アジア太平洋地域が最大の増収分を担っています。競争優位性は現在、デジタルツインマップ、無線ソフトウェア検証、ハードウェア非依存型モーションキューイングを融合するプロバイダーに流れつつあります。ただし、高額な初期投資、モーションシックネスリスク、高まるサイバーセキュリティ警報が、小規模導入者の足かせとなっています。

世界のドライビングシミュレーター市場の動向と洞察

ADAS/AV検証ニーズの急増

より厳格な認証規則により、自動運転機能が公道に導入される前に数十億マイルに及ぶ仮想テスト走行が必須となりました。2024年に発表されたEuro NCAPおよびNHTSAのプロトコルでは、実走行試験とシミュレーションを組み合わせ、高精度試験装置を適合性の関門と位置付けています。IEEEは2030年までに10億米ドル規模の自動運転シミュレーション市場を予測しており、自動車メーカーが公道では検証不可能なエッジケースを調査するためにデジタルツインに依存している実態を浮き彫りにしています。実世界のセンサーログと拡張可能なシナリオエンジンを統合したプラットフォームにより、エンジニアは反復サイクルを短縮し、プロトタイプ車両群を削減できます。ソフトウェア更新が無線経由で行われるにつれ、仮想回帰テストが必須となり、ドライビングシミュレーター市場への安定した需要を支えています。シナリオライブラリ、物理エンジン、データ融合インターフェースを単一スタックに統合するベンダーは、現在、ティア1サプライヤーからの見積依頼(RFQ)をより多く獲得しています。

Eコマースの急成長がトラック運転手育成需要を喚起

オンライン小売の拡大により小包取扱量が増加し、貨物輸送能力が逼迫しています。UPSやフレモント・コントラクト・キャリアーズなどの運送会社は、教室にモーションベースのシミュレーターを導入し、事故削減と新人ドライバーの早期戦力化を報告しています。ネブラスカ州トラック協会が提供する移動式訓練ユニットは、遠隔地のカレッジへ訓練を届けることで地方の人材不足を緩和しています。再現可能な危険シナリオにより、運送会社は保険監査への対応が可能となり、数週間で新人の資格認定が完了するため、導入が促進されています。この商業分野での需要が、消費者向け運転教育プログラムの伸び悩みを相殺し、短期的には運転シミュレーター市場の成長率を10%台前半に維持しています。

フルモーションシステムの高い設備投資額

8軸モーションベース、パノラミックドーム、専用ホールは、多くの職業訓練センターにとって導入コストが高額すぎます。欧州のシュトゥットガルト運転シミュレーターは、こうした設備が要求する不動産と維持管理の負担を如実に示しています。資金調達の障壁は、特に授業料が規制されている地域において、投資回収期間を長期化させます。新興市場の購入者は購入を延期するか、静的コックピットで妥協することが多く、運転シミュレーター市場における高価格帯ハードウェアの販売数量成長を抑制しています。

セグメント分析

乗用車シミュレーターは2025年においても運転シミュレーター市場シェアの59.88%を占め、初心者ドライバー教育とOEM研究開発の両分野で主導的地位を維持しています。ただし、消費者免許試験機関によるシミュレーター代替の制限により成長は鈍化傾向にあります。導入動向の分岐は、物流のデジタル化がシミュレーター需要パターンを再構築している実態を示しています。商用車は2025年時点で収益基盤は小規模ながら、7.14%のCAGRにより、運転シミュレーター市場の将来的な拡大を牽引する主要エンジンとなります。フリート管理者は、ドライバー1人あたりの訓練コスト削減、車両稼働率維持、厳格化する運転時間規制監査への対応を目的にシミュレーターを導入。テレマティクス統合により、車内行動と教室での復習訓練がさらに連携されます。

商用車向け需要の拡大は、危険物輸送ルート向けシナリオライブラリのカスタマイズ、多言語UIオーバーレイ、遠隔指導ステーションといった周辺サービスを促進します。モジュール式コックピットとクラウドレンダリングを活用するベンダーは、従来は価格面で参入が困難だった中小規模の輸送事業者に進出しています。一方、乗用車向けプログラムは次世代インフォテインメント向けヒューマンマシンインターフェース試験に注力しており、このニッチ市場は利益率は高いもの市場規模は限定的です。デュアルパーパスアーキテクチャ、交換可能なダッシュボード、適応型ソフトウェアスタックを開発するサプライヤーは、運転シミュレーター市場においてセグメント横断的な柔軟性を維持しています。

2025年時点で、運転訓練分野は確立された教習カリキュラムと企業のコンプライアンス需要により、ドライビングシミュレーター市場規模の50.72%を占めました。しかし、試験・調査分野が記録した7.21%のCAGRは構造的な転換を示唆しています。リリースサイクル短縮を目指す自動車メーカーは、予算をソフトウェア主導の検証プロセスへ振り向けており、仮想走行距離は実走行距離よりもコスト効率に優れています。規制機関による衝突回避検証を、制御された再現性のある環境で実施するラボの需要も成長要因です。

訓練需要は堅調に推移しており、特に道路渋滞や燃料価格の高騰により実地訓練の効率性が低下している地域で顕著です。仮想現実ヘッドセットと適応型AIチューターによるモジュールの個別化が学習者の定着率向上に寄与しています。ただし、予算に敏感な教育機関では従来型車両の全車両更新について様子見の姿勢を続けています。プロバイダーは、テスト自動化スクリプトと教室用コンテンツを切り替え可能な混合利用ライセンスを提供することでリスクを分散。これにより座席稼働率の向上と運転シミュレーター市場における収益の多様化を図っています。

地域別分析

欧州は2025年、密集したテストコース網、統一された安全基準、研究開発税制優遇策を背景に、運転シミュレーター市場で36.22%のシェアを維持しました。ドイツ、フランス、スウェーデンの自動車メーカーは、規制申請書類作成に活用される統合シミュレーションパイプラインを運用し、ハードウェアの更新サイクルを安定させています。各国の運輸省はシミュレーターを活用したライセンシング制度の試験運用を進めており、民間予算が変動する中でも公共調達プログラムが継続されています。

アジア太平洋地域は7.17%のCAGRで成長し、新規席数を最も多く追加しています。中国はスマートシティ予算を自動運転シャトルのパイロット事業に投入し、インドは慢性的な労働力不足を解消するためトラック運転手養成アカデミーを拡大しています。クラウドレンダリングソリューションはインフラのボトルネックを回避し、教育機関がノートパソコン制御のコックピットを仮設教室に導入することを可能にしています。日本の確立された自動車産業は、複雑な都市交差点を再現するシナリオライブラリに注力し、ドライビングシミュレーター市場における上流ソフトウェア需要を強化しています。

北米では、商用ドライバー資格を規定する連邦ガイドラインの整備と、航空・防衛分野におけるシミュレーター導入の早期文化が利点となっています。大型貨物輸送業者は地域ハブ間をネットワーク化した車両群に投資し、集中型コンテンツ配信を活用しています。ラテンアメリカと中東は依然として小規模な消費地域ですが、湾岸地域の石油・ガス輸送コンボイ事業者の関心が高まっており、今後の地理的拡大を示唆しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- ADAS/自動運転車の検証ニーズ急増

- 電子商取引の急成長がトラック運転手育成需要を喚起

- 道路安全規制及び運転免許制度の改革

- クラウド型「サービスとしてのシミュレーター」による設備投資の削減

- シミュレーター認定艦隊向け保険連動型保険料割引

- OTAソフトウェア回帰のためのデジタルツイン統合

- 市場抑制要因

- フルモーションシステムの高い設備投資額

- モーションシックネス及び忠実度の制限

- シナリオコンテンツ開発者の不足

- ネットワーク接続型シミュレーターのサイバーセキュリティリスク

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測(金額(米ドル))

- 車両タイプ別

- 乗用車

- 商用車

- 用途別

- トレーニング

- 試験・調査

- シミュレータの種類別

- コンパクトシミュレーター

- フルスケールシミュレーター

- 高度シミュレーター

- エンドユーザー別

- 自動車教習所・訓練センター

- 自動車メーカー

- フリートオペレーター&ロジスティクス

- 学術・研究機関

- 地域別

- 北米

- 米国

- カナダ

- その他北米地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- トルコ

- エジプト

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- AB Dynamics plc

- VI-grade GmbH

- IPG Automotive GmbH

- Ansible Motion Ltd

- Cruden BV

- AutoSim AS

- AVSimulation

- Virage Simulation Inc.

- Tecknotrove Simulator Systems Pvt Ltd

- XPI Simulation

- FAAC Incorporated

- Moog Inc.

- Mechanical Simulation Corp.

- CAE Inc.

- Thales Group

- Bosch Rexroth AG

- Dassault Systemes SE

- Applied Intuition Inc.

- Exail Technologies SA