|

市場調査レポート

商品コード

1435805

電動LCV:市場シェア分析、産業動向と統計、成長予測(2024~2029年)Electric LCV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電動LCV:市場シェア分析、産業動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 70 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

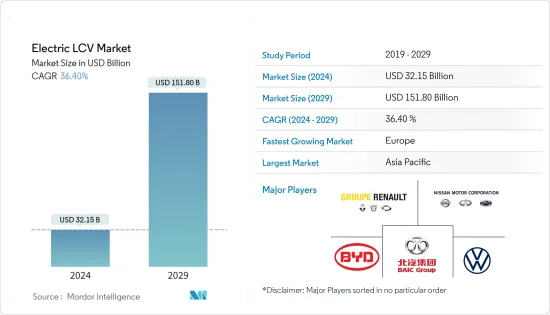

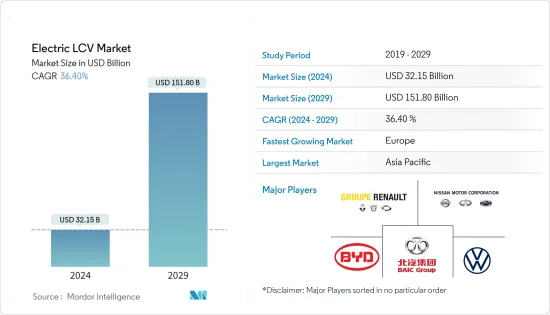

電動LCV市場規模は2024年に321億5,000万米ドルと推定され、2029年までに1,518億米ドルに達すると予測されており、予測期間(2024年から2029年)中に36.40%のCAGRで成長します。

主なハイライト

- 急速な都市化、厳しい排出規制、バッテリー技術の進歩により、予測期間中に電動LCVの需要が高まると予想されます。先進国市場ではすでに電気乗用車の導入が進んでおり、LCV市場の新興企業や大手企業は今後数年以内に新しい電気モデルを投入する予定です。

- 都市は超低排出ガスゾーンの導入によりディーゼル車の通行を制限しています。さらに、政府の助成金、ランニングコストとメンテナンスコストの削減、超低排出ゾーンへのアクセスにより、電気商用車は将来的にビジネスにとって魅力的な選択肢となる可能性があります。

- EVバッテリーのラインナップは急速に拡大しています。現在、最大600マイルの航続距離を備えた新しいモデルが市場に発売されています。トラックやバンのボディサイズは乗用車に比べて大きいため、より多くのバッテリーを搭載して長距離を走行できます。大型の電気モーターは、牽引および運搬能力に応じて膨大な量のトルクを生み出すことができます。たとえば、NikolaのBadgerピックアップトラックは、燃料電池技術とバッテリーのおかげで、航続距離600マイルを実現しています。

電動LCV市場動向

電動バンが電動LCV市場をリード

都市部の人口は急速に増加しているため、世界中の政府がディーゼル車やバンの禁止を計画しています。例えば、

- 英国は2040年までにあらゆる種類のガソリンおよびディーゼルエンジン車の販売を禁止する予定です。インドは2030年までにあらゆる種類のディーゼルエンジン車の道路走行を禁止する予定です。

- ノルウェーは時代を先取りしており、2025年までにすべての新車をゼロエミッション車にする計画です。

電気自動車の需要の高まりに伴い、事業主は既存の車両を電気自動車に置き換え始めており、市場関係者は新しい電気自動車モデルの発売予定を発表しています。 2019年、フォードは、量販用商用バン「トランジットEV」の電気バージョンを2021年までに欧州市場に投入する計画を発表しました。バンは、欧州における小型商用車の総販売台数の80%を占めています。

バンは、建設、郵便および宅配サービス、救急車サービス、警察および救助活動、移動作業場、旅客輸送など、幅広い商業活動に使用されています。

アジア太平洋が電動LCV市場をリードすると予想される

アジア太平洋地域は、安価な原材料の入手可能性、低い人件費、多数の業界関係者の存在、人口の多さ、政府の参加などの理由から、電気自動車産業の中心地となっています。例えば、中国政府は電気自動車産業を支援するために、研究開発資金、税金の免除、バッテリー充電ステーションへの融資など、約600億米ドルを費やしました。

中国企業は自国の市場で好成績を収めた後、他国でも市場での存在感を拡大しようとしています。たとえば、2019年、中国最大の電気自動車メーカーであるBYDグループは、インドに2台の純粋電気商用車、すなわちT3純粋電気商用物流ミニバンとT3純粋電気乗用MPVを導入しました。

欧州では電気バンのおかげで市場の牽引力が高まっており、市場の大手企業がこの地域で新しい電気バンを発売しています。例えば、

2019年、Renault Groupは、MASTER ZE HydrogenとKANGOO ZE Hydrogenという2台の水素電気商用車を発売しました。同社はまた、車両の航続距離を120 kmから最大350 kmまで延長しています。

電動LCV業界の概要

電動LCV市場は適度に統合されており、アクティブなプレーヤーの数は限られています。市場では、新興企業や既存のプレーヤーによるさまざまな新しい電気モデルの発売が見られます。市場の主要企業には、BYDグループ、日産自動車、Renault Group、フォルクスワーゲンAGなどがあります。両社は、市場の他のプレーヤーと戦略的提携を結び、新しい電動小型商用車を発売することで存在感を拡大しています。例えば、

- 2020年、電気バンメーカーのArrivalは、United Parcel Service(UPS)から4億2,800万米ドルで1万台の車両を受注しました。 UPSはまた、この新興企業の株式を購入することも計画しています。ArrivalはすでにヒュンダイとKIAから1億米ドル以上の資金提供を受けています。

- 2019年、Rivian Automotiveはさまざまな資金源から総額 13億米ドルの資金を受けました。また、この新興企業は2019年9月にAmazonと協力して電動配送バンを開発する計画を発表し、合計10万台の電動バンがAmazonから注文され、2021年までに配達が開始される予定です。

- 2019年、テスラはサイバートラックと名付けられた初の電動ピックアップトラックをカリフォルニア州ロサンゼルスで発売しました。 Cybertruckには最大航続距離200マイル、300マイル、500マイルの3つのバリエーションがあり、最初の納入は2021年までに予定されています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 推進タイプ別

- BEV

- HEV

- FCEV

- 車両タイプ別

- バン

- ピックアップトラック

- 出力別

- 100 kW未満

- 100~250 kW

- 250 kW以上

- 地域別

- 北米

- 米国

- カナダ

- その他北米

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州

- アジア太平洋

- インド

- 中国

- 日本

- 韓国

- その他アジア太平洋

- 世界のその他の地域

- ブラジル

- メキシコ

- アラブ首長国連邦

- その他

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- BYD Group

- Nissan Motor Co.

- BAIC Group

- Rivian Automotive

- Renault Group

- Tesla Inc.

- Volkswagen AG

- Groupe PSA

- Arrival Ltd

- Mahindra and Mahindra Ltd

- Tata Motors Limited

第7章 市場機会と今後の動向

The Electric LCV Market size is estimated at USD 32.15 billion in 2024, and is expected to reach USD 151.80 billion by 2029, growing at a CAGR of 36.40% during the forecast period (2024-2029).

Key Highlights

- The rapid urbanization, stringent emission regulations, and advancements in battery technology are expected to fuel the demand for electric LCVs during the forecast period. The market is already witnessing the adaptation of electric passenger vehicles in developed countries, and the start-ups and major players in the LCV market are planning to introduce their new electric models in the coming years.

- Cities are restricting the access of diesel vehicles through the implementation of ultra-low emissions zones. Additionally, government grants, lower running and servicing costs, and access to ultra-low emissions zones can make electric commercial vehicles an attractive choice for business in the future.

- The EV battery range is growing rapidly. Presently, new models are being launched in the market witha range of up to 600 miles. Trucks and vans' body sizes are bigger compared to passenger cars, thus, they can accommodate more batteries for a longer range. Big electric motors can create enormous amounts of torque for towing and hauling capacities. For instance, Nikola's Badger pickup truck has a range of 600 miles, owing to its fuel cell technology and batteries.

Electric LCV Market Trends

Electric Van is Leading the Electric LCV Market

The population in urban areas is growing rapidly, owing to which, governments across the world are planning to ban diesel cars and vans. For instance,

- The United Kingdom is planning to ban sales of all types of gasoline and diesel engine cars by 2040. India is planning to ban all types of diesel-engine cars on the roads by 2030.

- Norway is way ahead of the curve, and it plans to make every new car a zero-emission car by 2025.

With the growing demand for electric vehicles, business owners have started replacing their existing fleets to electric vehicles, and market players are announcing the expected launch of their new electric models. In 2019, Ford announced its plans to launch its mass-selling Transit commercial van in an electric variant, named as Transit EV, in the European market by 2021. Vans contribute 80% of the total light commercial vehicle sales in Europe.

Vans are used for a wide range of commercial activities, such as construction, postal and courier services, ambulance services, policing and rescue operations, mobile workshops, and passenger transportation.

Asia-Pacific is Expected to Lead the Electric LCV Market

Asia-Pacific is the hub of the electric vehicle industry, owing to the availability of cheap raw materials, low labor cost, presence of numerous industry players, large population, and government participation. For instance, the Chinese government spent around USD 60 billion to support the electric-vehicle industry, including R&D funding, tax exemptions, and financing for battery-charging stations.

Chinese players, after performing well in their local markets, are trying to expand their market presence in other countries. For instance, in 2019, BYD Group, China's largest electric vehicle manufacturer, introduced its two pure electric commercial vehicles in India, namely, T3 pure electric commercial logistics minivan and T3 pure electric passenger MPV.

Europe is gaining traction in the market with the help of electric vans, and major players in the market are launching new electric vans in the region. For instance,

In 2019, Renault Group launched two hydrogen-electric commercial vehicles, namely, MASTER Z.E. Hydrogen and KANGOO Z.E. Hydrogen. The company is also increasing its range of vehicles from 120 km to up to 350 km.

Electric LCV Industry Overview

The electric LCV market is moderately consolidated, and it has a limited number of active players. The market is witnessing the launch of various new electric models by start-ups and established players. Some of the major players in the market are BYD Group, Nissan Motor Co., Renault Group, and Volkswagen AG, among others. The companies are expanding their presence by forming strategic alliances with other players in the market and launching new electric LCVs. For instance,

- In 2020, Arrival, an electric van manufacturer, won a USD 428 million order from United Parcel Service (UPS) for 10,000 vehicles. UPS is also planning to buy an equity stake in the start-up. Arrival already received over USD 100 million in funding from Hyundai and KIA.

- In 2019, Rivian Automotive received a total of USD 1.3 billion in funding from different sources. Also, in September 2019, this start-up announced its plans to collaborate with Amazon for an electric delivery van, and a total of 100,000 of these electric vans have been ordered by Amazon, with deliveries expected to start by 2021.

- In 2019, Tesla launched its first electric pickup truck named Cybertruck, in Los Angeles, California. Cybertruck comes in three variants with a maximum range of 200 miles, 300 miles, and 500 miles, with the first delivery expected by 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Propulsion Type

- 5.1.1 BEV

- 5.1.2 HEV

- 5.1.3 FCEV

- 5.2 By Vehicle Type

- 5.2.1 Van

- 5.2.2 Pick-up Truck

- 5.3 By Power Output

- 5.3.1 Less Than 100 kW

- 5.3.2 100 -250 kW

- 5.3.3 More Than 250 kW

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BYD Group

- 6.2.2 Nissan Motor Co.

- 6.2.3 BAIC Group

- 6.2.4 Rivian Automotive

- 6.2.5 Renault Group

- 6.2.6 Tesla Inc.

- 6.2.7 Volkswagen AG

- 6.2.8 Groupe PSA

- 6.2.9 Arrival Ltd

- 6.2.10 Mahindra and Mahindra Ltd

- 6.2.11 Tata Motors Limited